Key Insights

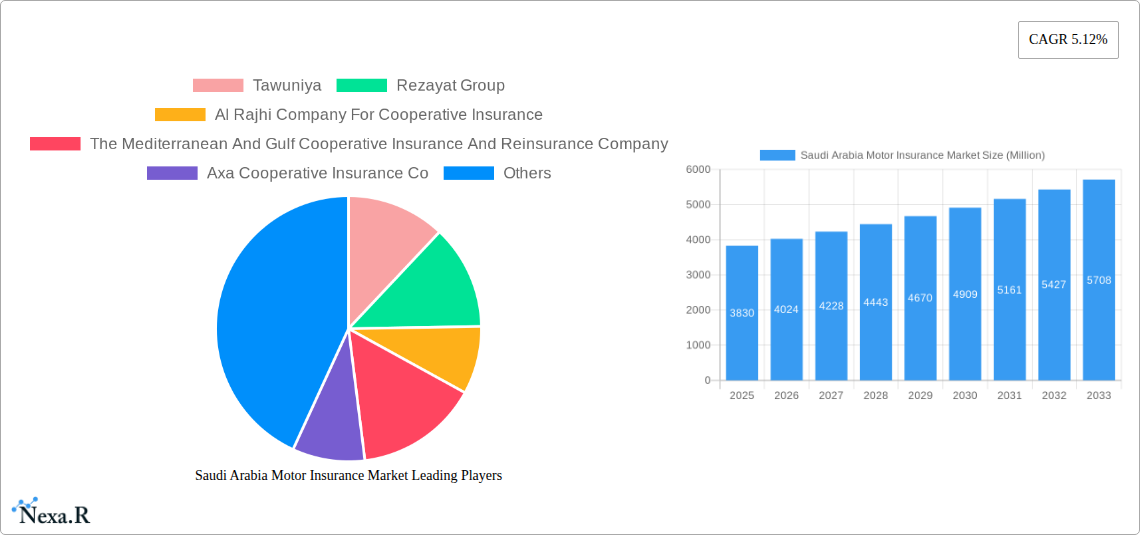

The Saudi Arabia Motor Insurance Market is poised for robust expansion, exhibiting a projected Compound Annual Growth Rate (CAGR) of 5.12% over the forecast period of 2025-2033. This growth is underpinned by a dynamic market landscape that encompasses a current market size of approximately USD 3.83 billion in 2025, with the potential to reach significantly higher valuations by 2033. A primary driver for this surge is the increasing vehicle ownership and an evolving regulatory environment that mandates comprehensive insurance coverage for all vehicles. Furthermore, rising disposable incomes and a growing middle class are contributing to a higher demand for both new and used vehicles, consequently boosting the need for motor insurance. The market is characterized by a bifurcated structure, with Third Party Liability insurance remaining a foundational segment due to its mandatory nature, while Comprehensive insurance is witnessing increasing uptake as consumers recognize the broader protection it offers against damages and theft.

Saudi Arabia Motor Insurance Market Market Size (In Billion)

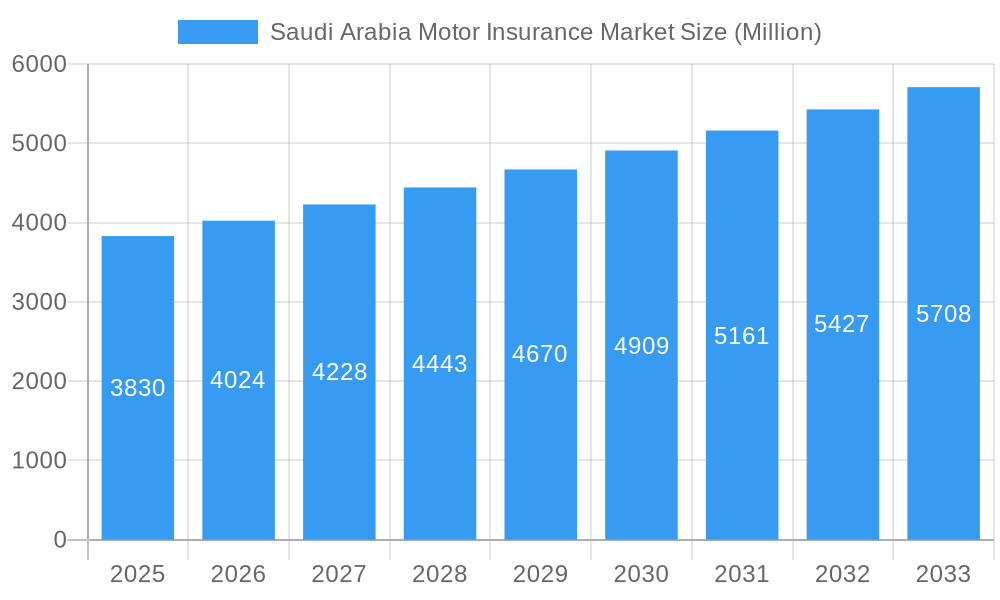

The distribution channels for motor insurance in Saudi Arabia are also undergoing a significant transformation. While traditional channels like agents and brokers continue to hold a substantial market share, the digital revolution is undeniably reshaping the landscape. Online platforms and mobile applications are rapidly gaining traction, offering consumers greater convenience, competitive pricing, and streamlined claims processes. Banks also play a crucial role, often bundling motor insurance with vehicle financing packages. Key players like Tawuniya, Al Rajhi Company For Cooperative Insurance, and Walaa Cooperative Insurance Company are actively innovating to capture market share, leveraging digital strategies and expanding their product portfolios to cater to diverse customer needs. However, the market also faces certain restraints, including intense price competition among insurers and evolving underwriting challenges driven by accident frequency and repair costs. Despite these hurdles, the overarching trend points towards a more accessible, technologically driven, and customer-centric motor insurance market in Saudi Arabia.

Saudi Arabia Motor Insurance Market Company Market Share

Saudi Arabia Motor Insurance Market Report: Growth, Trends, and Competitive Landscape (2019-2033)

Gain unparalleled insights into the dynamic Saudi Arabia motor insurance market, a sector projected for significant expansion. This comprehensive report, covering the study period of 2019–2033 with 2025 as the base and estimated year, delves into intricate market dynamics, growth trends, and the competitive landscape. Analyze key segments including Third Party Liability and Comprehensive insurance, alongside crucial distribution channels like Agents, Brokers, Banks, and Online platforms. With the forecast period from 2025–2033, this report equips industry professionals with the strategic intelligence needed to navigate this burgeoning market. Understand the impact of evolving industry developments, the influence of key players, and emerging opportunities, all presented with quantitative insights in Million units.

Saudi Arabia Motor Insurance Market Market Dynamics & Structure

The Saudi Arabia motor insurance market exhibits a moderately concentrated structure, with leading entities vying for market dominance. Technological innovation is a pivotal driver, particularly the integration of telematics and AI for risk assessment and personalized premiums. Regulatory frameworks, overseen by the Saudi Central Bank (SAMA), play a crucial role in ensuring market stability and consumer protection, influencing product development and operational standards. Competitive product substitutes are limited within the core motor insurance offering, but the evolving landscape of mobility solutions could introduce indirect competition. End-user demographics are shifting, with a growing young population and increasing vehicle ownership driving demand. Mergers and acquisitions (M&A) are becoming more prevalent as insurers seek to consolidate their market position and expand their service portfolios.

- Market Concentration: Dominated by a few key players, with opportunities for smaller insurers to carve out niche markets.

- Technological Innovation Drivers: Telematics, AI-powered claims processing, and digital underwriting are reshaping risk management.

- Regulatory Frameworks: SAMA's stringent oversight ensures solvency and fair practices, impacting pricing and product design.

- Competitive Product Substitutes: While direct substitutes are few, the rise of mobility-as-a-service platforms presents a long-term consideration.

- End-User Demographics: Growing disposable incomes and a young, tech-savvy population fuel demand for motor insurance.

- M&A Trends: Consolidation is expected to continue as companies seek economies of scale and expanded market reach.

Saudi Arabia Motor Insurance Market Growth Trends & Insights

The Saudi Arabia motor insurance market is poised for substantial growth, propelled by a confluence of economic, demographic, and technological factors. The market size is projected to witness a robust CAGR over the forecast period, fueled by increasing vehicle penetration and a heightened awareness of insurance necessity among consumers. Adoption rates for various insurance types are steadily rising, with a noticeable shift towards comprehensive policies as disposable incomes grow and consumers seek greater financial protection against vehicle damage and theft. Technological disruptions, such as the introduction of usage-based insurance (UBI) powered by telematics and advanced data analytics, are revolutionizing underwriting and claims management, leading to more accurate risk assessment and personalized customer experiences.

Consumer behavior is evolving, with a growing preference for digital channels for policy purchase and claims submission, driven by convenience and transparency. This shift necessitates insurers to invest heavily in their online platforms and mobile applications. The government's Vision 2030 initiatives, aimed at diversifying the economy and boosting private sector participation, are indirectly supporting the motor insurance market through increased economic activity and infrastructure development, leading to higher vehicle sales. Furthermore, a proactive regulatory environment by SAMA is fostering a more competitive and consumer-centric market, encouraging innovation and improving service quality. The historical period (2019-2024) has laid the groundwork for this accelerated growth, with increasing policy uptake and a gradual embrace of digital solutions by both insurers and customers. The estimated year 2025 marks a crucial juncture, reflecting current market momentum and the initial impact of emerging trends. The forecast period 2025–2033 will see these trends mature, with digital transformation and data-driven strategies becoming central to success in the Saudi Arabia auto insurance market.

Dominant Regions, Countries, or Segments in Saudi Arabia Motor Insurance Market

The Saudi Arabia motor insurance market is largely driven by segments catering to the vast majority of vehicle owners. Comprehensive insurance, offering broader coverage than Third Party Liability, is emerging as a dominant segment. This is attributed to rising disposable incomes, increasing vehicle values, and a greater consumer understanding of the financial implications of accidents. The growth potential for comprehensive policies is significantly higher as individuals and businesses seek to protect their substantial investments in vehicles.

Distribution channels are also critical to market dominance. While Agents and Brokers have historically held significant sway, the Online distribution channel is rapidly gaining traction and is poised to become a leading growth driver. The increasing internet penetration, smartphone usage, and the demand for quick, convenient transactions are fueling this shift. Banks, as a distribution channel, also play a crucial role, leveraging their existing customer relationships to offer bundled insurance products, further integrating financial services with motor insurance.

Insurance Type Dominance:

- Comprehensive: Experiencing robust growth due to increased vehicle values and consumer desire for extensive protection.

- Third Party Liability: Remains a mandatory segment, ensuring a foundational demand.

Distribution Channel Dominance:

- Online: Rapidly expanding its market share, offering competitive pricing and convenience.

- Agents & Brokers: Continue to provide personalized advice and support, especially for complex needs.

- Banks: Leverage existing customer bases for cross-selling opportunities.

Economic policies in Saudi Arabia, focused on economic diversification and encouraging private sector growth, indirectly boost vehicle sales and, consequently, motor insurance demand. Infrastructure development projects also contribute to increased vehicle usage. The market share of online channels is projected to surge, reflecting a broader digital transformation across industries. The growth potential within the online segment is immense, driven by innovative insurtech solutions and a younger, digitally native customer base. Understanding these dominant segments is crucial for insurers to strategize effectively and capture a larger share of the Saudi Arabia car insurance market.

Saudi Arabia Motor Insurance Market Product Landscape

The Saudi Arabia motor insurance market is witnessing a wave of product innovations aimed at enhancing customer value and operational efficiency. Beyond traditional Third Party Liability and Comprehensive policies, insurers are introducing usage-based insurance (UBI) programs, leveraging telematics to offer personalized premiums based on driving behavior. Applications are expanding to include value-added services such as roadside assistance, accident management support, and even integrated car maintenance tracking. Performance metrics for these new products are focused on improved customer retention, reduced claims leakage, and enhanced profitability through better risk segmentation. Unique selling propositions often revolve around digital accessibility, faster claims processing, and tailored coverage options. Technological advancements in AI and data analytics are central to developing these sophisticated and customer-centric motor insurance products.

Key Drivers, Barriers & Challenges in Saudi Arabia Motor Insurance Market

The Saudi Arabia motor insurance market is propelled by several key drivers. The nation's commitment to economic diversification under Vision 2030 is leading to increased disposable incomes and a growing vehicle fleet, directly boosting demand for motor insurance. Technological advancements, particularly in telematics and AI, are enabling insurers to offer more personalized and competitive products. Furthermore, increasing awareness of the financial risks associated with vehicle ownership, coupled with regulatory mandates, are significant drivers.

However, the market also faces considerable barriers and challenges. Intense competition among existing players can lead to price wars, impacting profitability. Regulatory hurdles, though essential for market stability, can sometimes slow down the adoption of innovative products. Supply chain issues affecting vehicle repair and parts availability can also indirectly impact the claims process and customer satisfaction. Economic downturns or unforeseen geopolitical events could also act as restraints, affecting consumer spending on insurance.

Key Drivers:

- Economic growth and rising disposable incomes.

- Increasing vehicle ownership and road usage.

- Technological advancements (telematics, AI).

- Growing consumer awareness of insurance benefits.

- Supportive regulatory environment.

Barriers & Challenges:

- Intense market competition and potential for price erosion.

- Regulatory compliance costs and adaptation to new rules.

- Fraudulent claims impacting profitability.

- Economic volatility and consumer affordability.

- Operational complexities in claims management and repair networks.

Emerging Opportunities in Saudi Arabia Motor Insurance Market

Emerging opportunities in the Saudi Arabia motor insurance market lie in the burgeoning demand for specialized insurance solutions and the widespread adoption of digital technologies. The increasing popularity of electric and hybrid vehicles presents a unique opportunity for insurers to develop tailored coverage plans that address specific risks associated with these newer technologies. Furthermore, the growth of the gig economy and ride-sharing services creates a demand for flexible, on-demand motor insurance options. Untapped markets within specific demographics, such as young drivers or small and medium-sized enterprises (SMEs) with commercial fleets, offer significant growth potential. The evolving consumer preferences for seamless digital experiences also pave the way for insurtech startups and established players to innovate with mobile-first solutions, personalized pricing, and value-added services like predictive maintenance alerts.

Growth Accelerators in the Saudi Arabia Motor Insurance Market Industry

Several catalysts are accelerating the growth of the Saudi Arabia motor insurance market industry. Strategic partnerships between insurers and automotive manufacturers are becoming increasingly important, enabling bundled offers and integrated services that enhance customer value. The continuous investment in digital transformation by insurance providers, focusing on AI-powered underwriting, automated claims processing, and user-friendly online platforms, is improving efficiency and customer satisfaction. Market expansion strategies, including potential cross-border collaborations and the development of niche product lines, are also contributing to sustained growth. Furthermore, the ongoing initiatives under Saudi Vision 2030, which promote economic diversification and infrastructure development, are indirectly stimulating higher vehicle sales and, consequently, greater demand for motor insurance.

Key Players Shaping the Saudi Arabia Motor Insurance Market Market

- Tawuniya

- Rezayat Group

- Al Rajhi Company For Cooperative Insurance

- The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company

- Axa Cooperative Insurance Co

- Walaa Cooperative Insurance Company

- Trade Union Cooperative Insurance Co

- Salama Cooperative Insurance Co

- Saudi Arabian Cooperative Insurance Co

- Allianz Saudi Fransi Cooperative Insurance Company

- Saudi Re For Cooperative Reinsurance Company

Notable Milestones in Saudi Arabia Motor Insurance Market Sector

- July 2024: Dutch firm Boskalis planned to acquire the remaining shares in Smit Lamnalco, the world’s fifth-largest towage operator, which already owns 50%. Smit Lamnalco, a joint venture with Saudi’s Rezayat Group, reported USD 275 million in revenue and USD 100 million in EBITDA for 2023. The acquisition is pending regulatory approval.

- December 2023: The Mediterranean and Gulf Cooperative Insurance and Reinsurance Company (Medgulf) announced on December 2023 that it received a notice to award the contract to provide health insurance services for Saudi Electricity Company (SEC) employees and dependents for one year.

In-Depth Saudi Arabia Motor Insurance Market Market Outlook

The Saudi Arabia motor insurance market is set for a promising future, characterized by sustained growth and increasing sophistication. Key accelerators include the ongoing digital transformation initiatives by insurers, driving operational efficiencies and enhancing customer engagement through advanced technologies like AI and telematics. Strategic collaborations between insurance providers and automotive stakeholders are expected to unlock new revenue streams and customer acquisition channels. Furthermore, the market's ability to adapt to evolving consumer preferences, such as the demand for personalized and on-demand insurance products, will be crucial for long-term success. Saudi Arabia's ongoing economic diversification and infrastructure development will continue to fuel vehicle sales, thereby underpinning a robust demand for motor insurance. This dynamic environment presents significant strategic opportunities for market players to innovate and expand their offerings.

Saudi Arabia Motor Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Third Party Liability

- 1.2. Comprehensive

-

2. Distribution Channel

- 2.1. Agents

- 2.2. Brokers

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Saudi Arabia Motor Insurance Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Motor Insurance Market Regional Market Share

Geographic Coverage of Saudi Arabia Motor Insurance Market

Saudi Arabia Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Mandatory Insurance For All Vehicles Ensures Widespread Coverage

- 3.2.2 Boosting The Motor Vehicle Insurance Market'S Growth.; Online Platforms And Mobile Apps Simplify Insurance Processes

- 3.2.3 Increasing Accessibility And Driving Higher Insurance Adoption Rates.

- 3.3. Market Restrains

- 3.3.1 Mandatory Insurance For All Vehicles Ensures Widespread Coverage

- 3.3.2 Boosting The Motor Vehicle Insurance Market'S Growth.; Online Platforms And Mobile Apps Simplify Insurance Processes

- 3.3.3 Increasing Accessibility And Driving Higher Insurance Adoption Rates.

- 3.4. Market Trends

- 3.4.1. Rising Vehicle Ownership is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Third Party Liability

- 5.1.2. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Agents

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tawuniya

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rezayat Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Rajhi Company For Cooperative Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axa Cooperative Insurance Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Walaa Cooperative Insurance Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trade Union Cooperative Insurance Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Salama Cooperative Insurance Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Arabian Cooperative Insurance Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allianz Saudi Fransi Cooperative Insurance Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Saudi Re For Cooperative Reinsurance Company**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Tawuniya

List of Figures

- Figure 1: Saudi Arabia Motor Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Motor Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Motor Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Saudi Arabia Motor Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: Saudi Arabia Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Saudi Arabia Motor Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Saudi Arabia Motor Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Motor Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Motor Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 8: Saudi Arabia Motor Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 9: Saudi Arabia Motor Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Saudi Arabia Motor Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Saudi Arabia Motor Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Motor Insurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Motor Insurance Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Saudi Arabia Motor Insurance Market?

Key companies in the market include Tawuniya, Rezayat Group, Al Rajhi Company For Cooperative Insurance, The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company, Axa Cooperative Insurance Co, Walaa Cooperative Insurance Company, Trade Union Cooperative Insurance Co, Salama Cooperative Insurance Co, Saudi Arabian Cooperative Insurance Co, Allianz Saudi Fransi Cooperative Insurance Company, Saudi Re For Cooperative Reinsurance Company**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Motor Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Mandatory Insurance For All Vehicles Ensures Widespread Coverage. Boosting The Motor Vehicle Insurance Market'S Growth.; Online Platforms And Mobile Apps Simplify Insurance Processes. Increasing Accessibility And Driving Higher Insurance Adoption Rates..

6. What are the notable trends driving market growth?

Rising Vehicle Ownership is Driving the Market.

7. Are there any restraints impacting market growth?

Mandatory Insurance For All Vehicles Ensures Widespread Coverage. Boosting The Motor Vehicle Insurance Market'S Growth.; Online Platforms And Mobile Apps Simplify Insurance Processes. Increasing Accessibility And Driving Higher Insurance Adoption Rates..

8. Can you provide examples of recent developments in the market?

July 2024: Dutch firm Boskalis planned to acquire the remaining shares in Smit Lamnalco, the world’s fifth-largest towage operator, which already owns 50%. Smit Lamnalco, a joint venture with Saudi’s Rezayat Group, reported USD 275 million in revenue and USD 100 million in EBITDA for 2023. The acquisition is pending regulatory approval.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Motor Insurance Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence