Key Insights

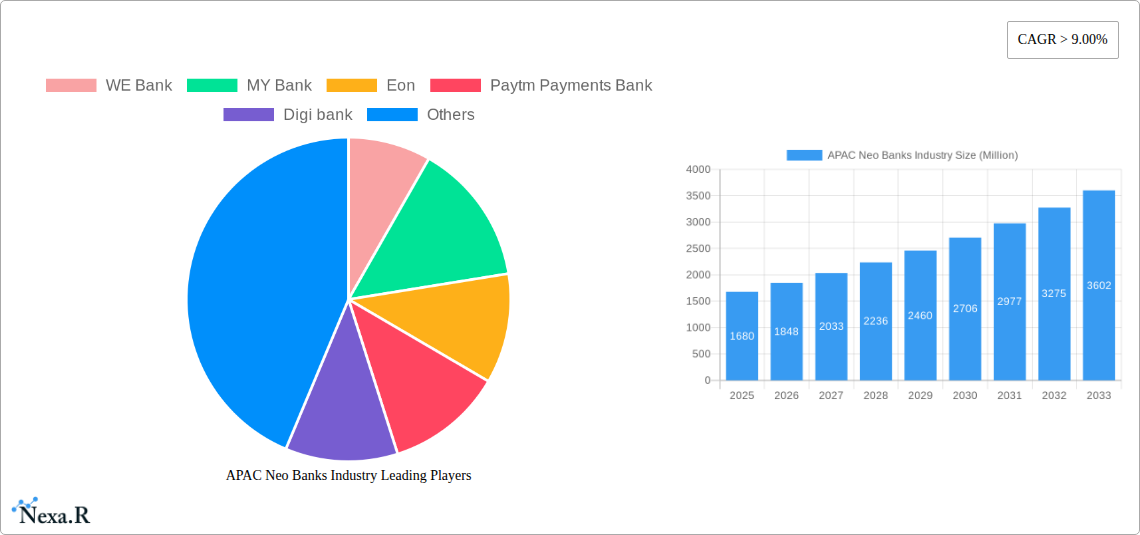

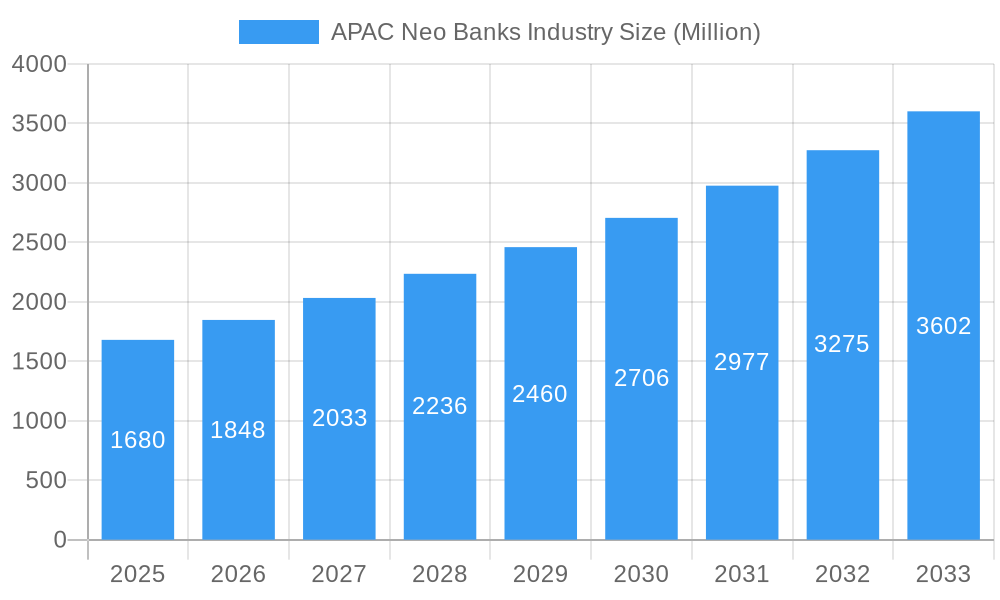

The APAC Neo Banks Industry is poised for substantial expansion, projected to reach a market size of approximately $1.68 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 9.00% throughout the forecast period extending to 2033. This growth is primarily fueled by the increasing adoption of digital banking services, a burgeoning middle class across the region, and supportive government initiatives aimed at financial inclusion and digital transformation. Key drivers include the demand for convenient and cost-effective banking solutions, particularly among younger, tech-savvy demographics, and the growing penetration of smartphones and internet services. Neo banks are effectively catering to these demands by offering user-friendly mobile interfaces, faster onboarding processes, and competitive interest rates on savings and a diverse range of loan products. The competitive landscape is dynamic, featuring established players and a steady influx of new entrants like WE Bank, MY Bank, Paytm Payments Bank, and Kakao Bank, all vying to capture market share.

APAC Neo Banks Industry Market Size (In Billion)

The market segments within APAC neo banking are experiencing varied growth trajectories. The "Payments" segment is anticipated to dominate due to the increasing volume of digital transactions. "Savings Products" and "Current Accounts" are also showing significant traction as consumers seek better returns and more accessible banking options. Consumer credit and loans are expanding as neo banks leverage data analytics to offer personalized lending solutions. Geographically, the Asia Pacific region itself is the primary focus, with China, India, and ASEAN countries leading the charge in neo bank adoption. While the industry is characterized by strong growth, potential restraints include evolving regulatory frameworks, concerns about data security and privacy, and the need for greater customer trust in purely digital banking models. However, the overall outlook remains exceptionally positive, driven by continuous innovation and a deep understanding of unmet customer needs in the digital banking space.

APAC Neo Banks Industry Company Market Share

Here is a compelling, SEO-optimized report description for the APAC Neo Banks Industry, designed for maximum visibility and engagement:

Unlocking the Future of Finance: APAC Neo Banks Industry Market Analysis and Growth Projections (2019-2033)

This comprehensive report delves into the dynamic APAC Neo Banks Industry, providing an in-depth analysis of market structure, growth trends, and future outlook. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research equips industry professionals, investors, and stakeholders with critical insights into the rapidly evolving digital banking landscape across the Asia-Pacific region. Discover the forces shaping digital banking APAC, understand neo bank market share, and identify lucrative opportunities within this burgeoning sector. We explore parent and child markets to offer a holistic view, ensuring you stay ahead of the curve in online banking trends and fintech innovation.

APAC Neo Banks Industry Market Dynamics & Structure

The APAC Neo Banks Industry is characterized by a moderately concentrated market, driven by rapid technological innovation and evolving regulatory frameworks. Key players are increasingly focusing on enhancing user experience through sophisticated digital platforms, offering competitive online banking services.

- Market Concentration: The market exhibits growth, with a few dominant players alongside a growing number of emerging fintech startups.

- Technological Innovation Drivers: AI-powered personalization, blockchain for secure transactions, and advanced mobile banking applications are key innovation drivers.

- Regulatory Frameworks: Governments across APAC are adapting regulations to foster fintech growth while ensuring consumer protection, impacting market entry and operations.

- Competitive Product Substitutes: Traditional banks are enhancing their digital offerings, creating a competitive landscape for neo banks.

- End-User Demographics: The personal segment represents the largest consumer base, with a growing adoption among the business segment seeking streamlined financial solutions.

- M&A Trends: Strategic acquisitions and mergers are occurring as established players seek to expand their digital capabilities and market reach. The volume of M&A deals is projected to increase by xx% in the forecast period.

APAC Neo Banks Industry Growth Trends & Insights

The APAC Neo Banks Industry is experiencing a period of exponential growth, fueled by increasing internet penetration, smartphone adoption, and a young, tech-savvy population eager for convenient and cost-effective banking solutions. The market size is projected to reach USD XXX Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% from 2019 to 2033. This surge is underpinned by significant shifts in consumer behavior, with a marked preference for digital-first financial services over traditional brick-and-mortar institutions.

Technological disruptions are at the forefront of this expansion. Neo banks are leveraging cutting-edge technologies such as artificial intelligence (AI) for personalized customer service and fraud detection, blockchain for enhanced security and transparency in transactions, and cloud computing for scalable and efficient operations. The integration of these technologies allows neo banks to offer a superior customer experience, characterized by speed, convenience, and lower fees compared to incumbent banks.

Adoption rates for neo banking services are steadily climbing across the region. In the personal segment, consumers are increasingly turning to neo banks for everyday banking needs, including payments, savings products, and current accounts. The business segment is also witnessing significant adoption, particularly for small and medium-sized enterprises (SMEs), which benefit from streamlined onboarding processes, accessible credit facilities, and efficient payment solutions tailored to their operational needs.

Consumer behavior is evolving rapidly. There is a growing demand for seamless, omnichannel banking experiences, with customers expecting instant access to their accounts and financial services anytime, anywhere. Neo banks are adept at meeting these expectations by offering intuitive mobile applications that provide a comprehensive suite of banking functionalities. Furthermore, the increasing financial literacy and digital savviness of the APAC population are further accelerating the adoption of digital banking platforms. The CAGR for the personal segment is estimated at XX%, while the business segment is expected to grow at XX%.

Dominant Regions, Countries, or Segments in APAC Neo Banks Industry

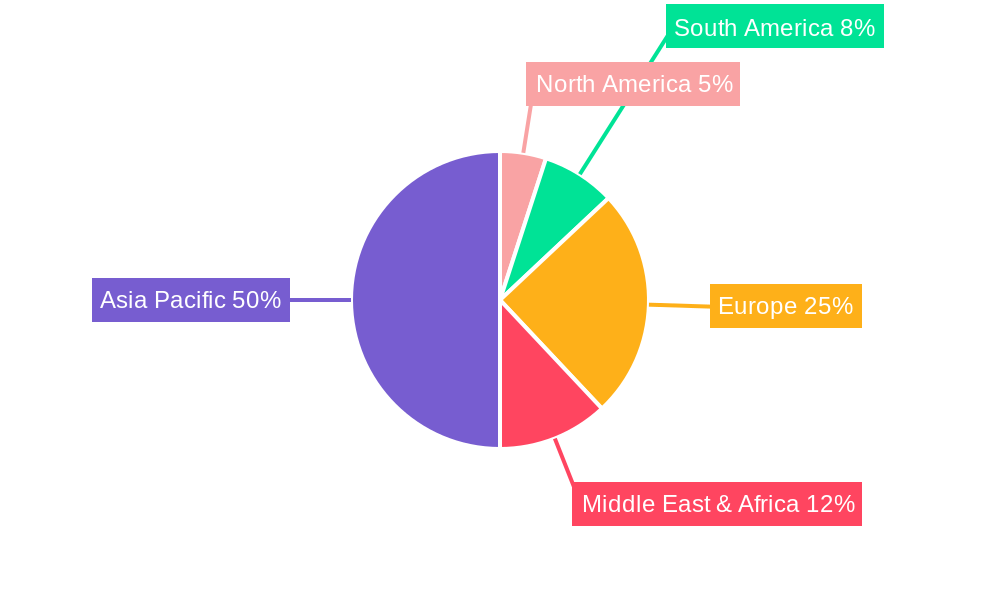

The APAC Neo Banks Industry showcases a diverse growth trajectory across its various regions and segments. While the entire Asia-Pacific region is experiencing a digital banking revolution, certain countries and segments stand out as dominant growth drivers.

- Dominant Country: India emerges as a leading force, propelled by its vast young population, widespread smartphone adoption, and supportive government initiatives for digital payments and financial inclusion. The country’s burgeoning fintech ecosystem and a significant unbanked and underbanked population provide fertile ground for neo banks to thrive.

- Dominant Region: Southeast Asia also plays a pivotal role, with countries like Singapore, Indonesia, and Vietnam demonstrating substantial growth. These regions benefit from a growing middle class, increasing disposable income, and a strong push towards digital transformation across all sectors.

- Dominant Segment (Service Type): Within the Service Type segmentation, Payments currently dominates, driven by the increasing demand for digital wallets, peer-to-peer transfers, and seamless online transaction capabilities. The market for Payments is estimated at USD XXX Million in 2025.

- Key Drivers for Payments Dominance:

- High mobile penetration enabling widespread access to digital payment apps.

- Government initiatives promoting cashless economies.

- E-commerce growth driving online transaction volumes.

- Key Drivers for Payments Dominance:

- Dominant Segment (End-User Type): The Personal Segment is the primary driver of growth in the End-User Type categorization. This is attributed to the preference of millennials and Gen Z for user-friendly, accessible, and feature-rich digital banking platforms for their daily financial needs.

- Key Drivers for Personal Segment Dominance:

- Young demographic skew eager to adopt new technologies.

- Desire for convenient banking without physical branch visits.

- Attractive interest rates and lower fees offered by neo banks.

- Key Drivers for Personal Segment Dominance:

- High Growth Potential Segments:

- Consumer Credit and Loans: As neo banks mature, their offerings in consumer credit and loans are expected to see significant expansion, tapping into the unmet credit needs of the population. The market for Consumer Credit is projected to grow at XX% CAGR.

- Business Segment: With an increasing number of SMEs embracing digital transformation, the demand for specialized business banking solutions from neo banks is on the rise, indicating strong future growth potential. The market for the Business Segment is anticipated to reach USD XXX Million by 2033.

APAC Neo Banks Industry Product Landscape

The APAC Neo Banks Industry is defined by a compelling product landscape focused on innovation and customer-centricity. Neo banks are not just replicating traditional banking products but are reimagining them for the digital age. This includes highly personalized savings products with competitive interest rates, seamless current account management with real-time transaction alerts, and accessible consumer credit and loans with simplified application processes. Unique selling propositions often revolve around fee-free transactions, budgeting tools, investment opportunities integrated within the banking app, and loyalty programs. Technological advancements such as biometrics for secure login, AI-driven financial advisory, and instant payment solutions are setting new benchmarks for user experience and functionality.

Key Drivers, Barriers & Challenges in APAC Neo Banks Industry

The APAC Neo Banks Industry is propelled by several key drivers:

- Technological Advancements: Rapid adoption of AI, blockchain, and mobile technology enhances service delivery and user experience.

- Increasing Smartphone Penetration: Widespread access to smartphones and affordable data plans fuels digital banking adoption.

- Demographic Shifts: A young, tech-savvy population in APAC is inherently inclined towards digital solutions.

- Supportive Regulatory Environment: Governments are increasingly introducing policies to foster fintech innovation and digital payments.

- Unmet Financial Needs: A significant portion of the APAC population remains underbanked, presenting a vast opportunity for neo banks.

However, the industry faces significant challenges:

- Regulatory Hurdles: Navigating diverse and evolving regulatory landscapes across different APAC countries can be complex.

- Intense Competition: The market is becoming increasingly competitive with both neo banks and traditional banks enhancing their digital offerings.

- Customer Trust and Security Concerns: Building and maintaining customer trust regarding data security and financial stability remains a paramount concern.

- Profitability and Sustainability: Achieving long-term profitability while maintaining low-cost structures is an ongoing challenge.

- Talent Acquisition: Securing skilled talent in areas like cybersecurity, AI, and data analytics is critical for growth.

Emerging Opportunities in APAC Neo Banks Industry

Emerging opportunities within the APAC Neo Banks Industry are multifaceted. The untapped potential in rural and semi-urban areas presents a significant avenue for expansion, leveraging mobile-first strategies. The growing demand for embedded finance solutions, where banking services are integrated into non-financial platforms, offers new revenue streams. Furthermore, the development of specialized offerings for niche segments like freelancers, gig economy workers, and SMEs with specific cross-border payment needs can unlock substantial market share. The increasing adoption of cryptocurrency and blockchain technology by consumers and businesses also opens doors for neo banks to explore innovative financial products and services in this domain.

Growth Accelerators in the APAC Neo Banks Industry Industry

Several catalysts are accelerating the growth of the APAC Neo Banks Industry. Technological breakthroughs, such as the advancement of AI for hyper-personalized financial advice and predictive analytics for credit scoring, are enhancing operational efficiency and customer engagement. Strategic partnerships between neo banks and established tech companies, e-commerce platforms, and telecommunication providers are crucial for expanding customer reach and offering bundled services. Market expansion strategies, including localized product offerings tailored to specific country needs and regulatory environments, are also key growth accelerators. Furthermore, ongoing investment rounds and venture capital funding are providing the necessary capital for neo banks to scale their operations, invest in technology, and acquire customers.

Key Players Shaping the APAC Neo Banks Industry Market

- WE Bank

- MY Bank

- Eon

- Paytm Payments Bank

- Digi bank

- Jenius

- SBI Sumishin Net Bank

- Kakao Bank

- K Plus

- Timo

- Volt

- Xinja

- BigPay

- Neat

(List Not Exhaustive)

Notable Milestones in APAC Neo Banks Industry Sector

- October 2023: Paytm launched the industry’s first alternate ID-based guest checkout solution for merchants, enhancing security through tokenization.

- July 2023: Paytm announced the launch of two innovative 4G-enabled payment devices: Paytm Pocket Soundbox and Paytm Music Soundbox, designed for merchants on the go.

In-Depth APAC Neo Banks Industry Market Outlook

The future outlook for the APAC Neo Banks Industry is exceptionally bright, with continued strong growth projected. Emerging opportunities in embedded finance and underserved markets will be key to expanding market penetration. Strategic partnerships and continued investment in advanced technologies like AI and blockchain will be critical for neo banks to maintain their competitive edge and drive innovation. The increasing demand for personalized financial solutions and a seamless digital banking experience will further solidify the position of neo banks as essential financial service providers across the Asia-Pacific region, significantly impacting the future of digital banking. The market is poised for continued evolution, offering substantial returns for stakeholders who can navigate its complexities and capitalize on its inherent growth potential.

APAC Neo Banks Industry Segmentation

-

1. Service Type

- 1.1. Payments

- 1.2. Savings Products

- 1.3. Current Account

- 1.4. Consumer Credit

- 1.5. Loans

- 1.6. Others

-

2. End-User Type

- 2.1. Business Segment

- 2.2. Personal Segment

APAC Neo Banks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Neo Banks Industry Regional Market Share

Geographic Coverage of APAC Neo Banks Industry

APAC Neo Banks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increase in Internet Penetration is Driving the Market

- 3.4. Market Trends

- 3.4.1. Raise in Mobile Penetration and High Unbanked Adults in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Neo Banks Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Payments

- 5.1.2. Savings Products

- 5.1.3. Current Account

- 5.1.4. Consumer Credit

- 5.1.5. Loans

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User Type

- 5.2.1. Business Segment

- 5.2.2. Personal Segment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America APAC Neo Banks Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Payments

- 6.1.2. Savings Products

- 6.1.3. Current Account

- 6.1.4. Consumer Credit

- 6.1.5. Loans

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by End-User Type

- 6.2.1. Business Segment

- 6.2.2. Personal Segment

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America APAC Neo Banks Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Payments

- 7.1.2. Savings Products

- 7.1.3. Current Account

- 7.1.4. Consumer Credit

- 7.1.5. Loans

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by End-User Type

- 7.2.1. Business Segment

- 7.2.2. Personal Segment

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe APAC Neo Banks Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Payments

- 8.1.2. Savings Products

- 8.1.3. Current Account

- 8.1.4. Consumer Credit

- 8.1.5. Loans

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by End-User Type

- 8.2.1. Business Segment

- 8.2.2. Personal Segment

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa APAC Neo Banks Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Payments

- 9.1.2. Savings Products

- 9.1.3. Current Account

- 9.1.4. Consumer Credit

- 9.1.5. Loans

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by End-User Type

- 9.2.1. Business Segment

- 9.2.2. Personal Segment

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific APAC Neo Banks Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Payments

- 10.1.2. Savings Products

- 10.1.3. Current Account

- 10.1.4. Consumer Credit

- 10.1.5. Loans

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by End-User Type

- 10.2.1. Business Segment

- 10.2.2. Personal Segment

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WE Bank

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MY Bank

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Paytm Payments Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Digi bank

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jenius

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SBI Sumishin Net Bank

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kakao Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 K Plus

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Timo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Volt

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Xinja

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BigPay

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Neat**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 WE Bank

List of Figures

- Figure 1: Global APAC Neo Banks Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global APAC Neo Banks Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America APAC Neo Banks Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 4: North America APAC Neo Banks Industry Volume (Billion), by Service Type 2025 & 2033

- Figure 5: North America APAC Neo Banks Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America APAC Neo Banks Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 7: North America APAC Neo Banks Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 8: North America APAC Neo Banks Industry Volume (Billion), by End-User Type 2025 & 2033

- Figure 9: North America APAC Neo Banks Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 10: North America APAC Neo Banks Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 11: North America APAC Neo Banks Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America APAC Neo Banks Industry Volume (Billion), by Country 2025 & 2033

- Figure 13: North America APAC Neo Banks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America APAC Neo Banks Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America APAC Neo Banks Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 16: South America APAC Neo Banks Industry Volume (Billion), by Service Type 2025 & 2033

- Figure 17: South America APAC Neo Banks Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 18: South America APAC Neo Banks Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 19: South America APAC Neo Banks Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 20: South America APAC Neo Banks Industry Volume (Billion), by End-User Type 2025 & 2033

- Figure 21: South America APAC Neo Banks Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 22: South America APAC Neo Banks Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 23: South America APAC Neo Banks Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: South America APAC Neo Banks Industry Volume (Billion), by Country 2025 & 2033

- Figure 25: South America APAC Neo Banks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America APAC Neo Banks Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe APAC Neo Banks Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 28: Europe APAC Neo Banks Industry Volume (Billion), by Service Type 2025 & 2033

- Figure 29: Europe APAC Neo Banks Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Europe APAC Neo Banks Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 31: Europe APAC Neo Banks Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 32: Europe APAC Neo Banks Industry Volume (Billion), by End-User Type 2025 & 2033

- Figure 33: Europe APAC Neo Banks Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 34: Europe APAC Neo Banks Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 35: Europe APAC Neo Banks Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe APAC Neo Banks Industry Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe APAC Neo Banks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe APAC Neo Banks Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa APAC Neo Banks Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 40: Middle East & Africa APAC Neo Banks Industry Volume (Billion), by Service Type 2025 & 2033

- Figure 41: Middle East & Africa APAC Neo Banks Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 42: Middle East & Africa APAC Neo Banks Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 43: Middle East & Africa APAC Neo Banks Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 44: Middle East & Africa APAC Neo Banks Industry Volume (Billion), by End-User Type 2025 & 2033

- Figure 45: Middle East & Africa APAC Neo Banks Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 46: Middle East & Africa APAC Neo Banks Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 47: Middle East & Africa APAC Neo Banks Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa APAC Neo Banks Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa APAC Neo Banks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa APAC Neo Banks Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific APAC Neo Banks Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 52: Asia Pacific APAC Neo Banks Industry Volume (Billion), by Service Type 2025 & 2033

- Figure 53: Asia Pacific APAC Neo Banks Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 54: Asia Pacific APAC Neo Banks Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 55: Asia Pacific APAC Neo Banks Industry Revenue (Million), by End-User Type 2025 & 2033

- Figure 56: Asia Pacific APAC Neo Banks Industry Volume (Billion), by End-User Type 2025 & 2033

- Figure 57: Asia Pacific APAC Neo Banks Industry Revenue Share (%), by End-User Type 2025 & 2033

- Figure 58: Asia Pacific APAC Neo Banks Industry Volume Share (%), by End-User Type 2025 & 2033

- Figure 59: Asia Pacific APAC Neo Banks Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific APAC Neo Banks Industry Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific APAC Neo Banks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific APAC Neo Banks Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Neo Banks Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global APAC Neo Banks Industry Volume Billion Forecast, by Service Type 2020 & 2033

- Table 3: Global APAC Neo Banks Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 4: Global APAC Neo Banks Industry Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 5: Global APAC Neo Banks Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global APAC Neo Banks Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global APAC Neo Banks Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global APAC Neo Banks Industry Volume Billion Forecast, by Service Type 2020 & 2033

- Table 9: Global APAC Neo Banks Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: Global APAC Neo Banks Industry Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 11: Global APAC Neo Banks Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global APAC Neo Banks Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Neo Banks Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 20: Global APAC Neo Banks Industry Volume Billion Forecast, by Service Type 2020 & 2033

- Table 21: Global APAC Neo Banks Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 22: Global APAC Neo Banks Industry Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 23: Global APAC Neo Banks Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global APAC Neo Banks Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global APAC Neo Banks Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 32: Global APAC Neo Banks Industry Volume Billion Forecast, by Service Type 2020 & 2033

- Table 33: Global APAC Neo Banks Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 34: Global APAC Neo Banks Industry Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 35: Global APAC Neo Banks Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global APAC Neo Banks Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global APAC Neo Banks Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 56: Global APAC Neo Banks Industry Volume Billion Forecast, by Service Type 2020 & 2033

- Table 57: Global APAC Neo Banks Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 58: Global APAC Neo Banks Industry Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 59: Global APAC Neo Banks Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global APAC Neo Banks Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global APAC Neo Banks Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 74: Global APAC Neo Banks Industry Volume Billion Forecast, by Service Type 2020 & 2033

- Table 75: Global APAC Neo Banks Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 76: Global APAC Neo Banks Industry Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 77: Global APAC Neo Banks Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global APAC Neo Banks Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific APAC Neo Banks Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific APAC Neo Banks Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Neo Banks Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the APAC Neo Banks Industry?

Key companies in the market include WE Bank, MY Bank, Eon, Paytm Payments Bank, Digi bank, Jenius, SBI Sumishin Net Bank, Kakao Bank, K Plus, Timo, Volt, Xinja, BigPay, Neat**List Not Exhaustive.

3. What are the main segments of the APAC Neo Banks Industry?

The market segments include Service Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Raise in Mobile Penetration and High Unbanked Adults in the Region.

7. Are there any restraints impacting market growth?

Increase in Internet Penetration is Driving the Market.

8. Can you provide examples of recent developments in the market?

In October 2023, Paytm launched the industry’s first alternate ID-based guest checkout solution for merchants. Tokenisation masks the 16-digit debit or credit card number with a unique token that is specific to one’s card to prevent misuse and theft from merchant websites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Neo Banks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Neo Banks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Neo Banks Industry?

To stay informed about further developments, trends, and reports in the APAC Neo Banks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence