Key Insights

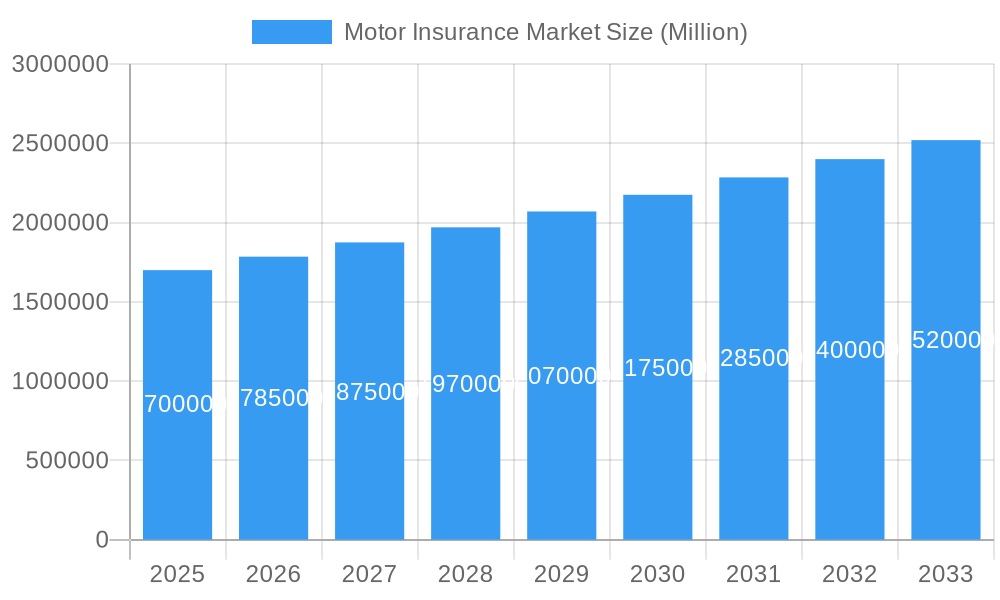

The global Motor Insurance Market is poised for robust expansion, projected to reach an estimated market size of approximately $1.7 trillion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 5.03% throughout the study period. This substantial growth is underpinned by a confluence of factors, including increasing vehicle ownership globally, a rising awareness of the financial protection offered by insurance, and the continuous evolution of regulatory frameworks mandating motor insurance for road usage. Emerging economies, particularly in the Asia Pacific region, are expected to be significant contributors to this growth, fueled by rapid urbanization and a burgeoning middle class with greater purchasing power for vehicles. The increasing adoption of telematics and Usage-Based Insurance (UBI) policies also presents a key growth driver, offering personalized premiums based on driving behavior, thereby enhancing customer engagement and encouraging safer driving practices. Furthermore, advancements in automotive technology, such as the proliferation of Advanced Driver-Assistance Systems (ADAS) and the eventual widespread adoption of autonomous vehicles, are expected to influence risk profiles and consequently shape the motor insurance landscape.

Motor Insurance Market Market Size (In Million)

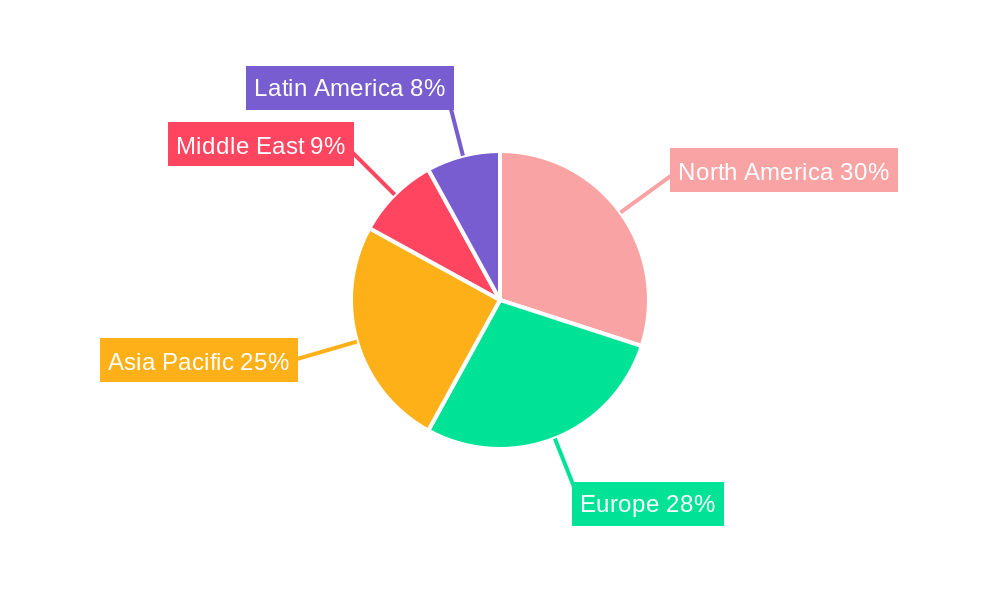

However, the market also faces certain restraints, including intense price competition among insurers, the challenge of accurately assessing and pricing risks in an increasingly dynamic environment, and the persistent issue of fraudulent claims, which can impact profitability and customer trust. Nevertheless, the overarching trend towards digitalization and the integration of Artificial Intelligence (AI) in claims processing and underwriting are expected to mitigate some of these challenges and improve operational efficiencies. The market is segmented by policy type, with Third-Party Liability, Third-Party Fire and Theft, and Comprehensive policies catering to diverse customer needs and regulatory requirements. Leading companies such as PICC Property and Casualty Co Ltd, Samsung Fire and Marine Insurance Co Ltd, Allianz SE, GEICO, and Ping An Insurance (Group) Co of China Ltd are actively shaping the market through innovation and strategic expansions. Regional variations are significant, with North America and Europe currently holding substantial market share, while Asia Pacific is demonstrating the highest growth potential.

Motor Insurance Market Company Market Share

Here is a comprehensive, SEO-optimized report description for the Motor Insurance Market, designed for maximum visibility and engagement.

This in-depth motor insurance market report provides an exhaustive analysis of the global landscape, covering critical market dynamics, growth trends, regional dominance, and key player strategies. Delve into the intricacies of auto insurance, car insurance, and vehicle insurance with detailed insights into policy types including Third-party Liability, Third-party Fire and Theft, and Comprehensive coverage. Our study, encompassing the historical period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033), leverages proprietary data and advanced analytical models to deliver actionable intelligence. We explore the impact of evolving industry developments on market concentration, technological innovation drivers, and regulatory frameworks. Understand competitive product substitutes, end-user demographics, and the influence of mergers & acquisitions (M&A) on the global motor insurance market.

This report is indispensable for insurance providers, reinsurers, brokers, automotive manufacturers, technology solution providers, investors, and regulatory bodies seeking a granular understanding of the car insurance market size, auto insurance market growth, and emerging opportunities. We present all quantitative values in Million Units for clarity and comparability.

Motor Insurance Market Market Dynamics & Structure

The global motor insurance market is characterized by a dynamic interplay of concentration, innovation, and regulation. Market concentration varies significantly by region, with developed economies often exhibiting higher consolidation among major players like PICC Property and Casualty Co Ltd, Samsung Fire and Marine Insurance Co Ltd, Allianz SE, GEICO, Ping An Insurance (Group) Co of China Ltd, ICICI Lombard General Insurance Co Ltd, Sompo Holdings Inc, State Farm Mutual Automobile Insurance Company, Aviva Plc, and Porto Seguro S A. Technological innovation acts as a primary driver, with advancements in telematics, AI-powered claims processing, and InsurTech solutions reshaping product offerings and operational efficiencies. Regulatory frameworks, including mandatory insurance laws and evolving data privacy regulations, exert substantial influence on market entry, product pricing, and consumer protection. Competitive product substitutes, such as pay-per-mile insurance and usage-based insurance (UBI), are gaining traction, compelling traditional insurers to adapt. End-user demographics, particularly the rise of younger, tech-savvy drivers and an aging population, necessitate diversified product portfolios. M&A trends are driven by a desire for market expansion, diversification of offerings, and the acquisition of technological capabilities, with an estimated XX Million Units in M&A deal volumes projected over the forecast period. Barriers to innovation include legacy IT systems, regulatory hurdles, and the challenge of data integration from diverse sources.

- Market Concentration: Varies from oligopolistic in mature markets to more fragmented in emerging economies.

- Technological Innovation Drivers: Telematics, AI, InsurTech platforms, and data analytics.

- Regulatory Frameworks: Mandatory insurance laws, data privacy (e.g., GDPR), and solvency regulations.

- Competitive Product Substitutes: Usage-Based Insurance (UBI), pay-per-mile, and mobility-as-a-service (MaaS) insurance models.

- End-User Demographics: Shifting preferences of Gen Z and Millennials, and the needs of an aging driver population.

- M&A Trends: Consolidation for scale, technology acquisition, and market entry.

Motor Insurance Market Growth Trends & Insights

The motor insurance market is poised for significant expansion, driven by an increasing global vehicle parc and evolving consumer needs. The market size is projected to grow from an estimated XX Million Units in the base year 2025 to XX Million Units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Adoption rates for digital insurance solutions, including online policy purchase and self-service claims, are accelerating, fueled by convenience and transparency. Technological disruptions, such as the integration of Advanced Driver-Assistance Systems (ADAS) and the eventual proliferation of autonomous vehicles, are creating new risk landscapes and necessitating innovative insurance products. Consumer behavior shifts are evident in the growing demand for personalized policies, flexible payment options, and a greater emphasis on proactive risk mitigation services offered by insurers. The penetration of motor insurance is steadily increasing across both developed and developing economies, as awareness of its protective benefits grows and mandatory insurance regulations are enforced. The digital transformation of the insurance value chain, from underwriting to claims settlement, is a critical factor influencing market growth, leading to enhanced customer experiences and operational efficiencies. The increasing complexity of vehicle technology also presents an opportunity for insurers to offer specialized coverage and value-added services, further driving market penetration and premium revenues. The sustained growth in vehicle sales, particularly in emerging markets, coupled with rising disposable incomes, will continue to be a fundamental growth engine for the auto insurance market.

Dominant Regions, Countries, or Segments in Motor Insurance Market

The motor insurance market is witnessing robust growth, with the Comprehensive policy segment emerging as a dominant force, driven by increasing consumer awareness of the need for all-encompassing protection and the rising value of vehicles. In terms of regions, North America and Europe currently hold significant market share, owing to well-established automotive industries, high vehicle ownership rates, and stringent regulatory environments mandating comprehensive coverage. However, the Asia Pacific region is exhibiting the fastest growth trajectory, propelled by a burgeoning middle class, rapid urbanization, and a significant increase in new vehicle registrations. Countries like China and India are pivotal to this expansion, with their massive populations and growing economies fueling demand for car insurance. Key drivers for the dominance of Comprehensive policies include the increasing complexity and cost of vehicle repairs, the desire for greater peace of mind, and the proactive risk management strategies adopted by insurers who often incentivize such coverage. Market share for Comprehensive policies is estimated at XX% in 2025, with a projected CAGR of XX% through 2033. Economic policies that promote vehicle ownership, investments in road infrastructure, and the development of advanced safety features in vehicles further bolster the adoption of comprehensive coverage. While Third-party Liability remains a fundamental requirement, the aspirational aspect of protecting one's own asset drives the demand for Comprehensive insurance. The growth potential in emerging markets for comprehensive coverage is immense, as consumers transition from basic protection to more robust insurance solutions for their increasingly valuable vehicles.

- Dominant Segment: Comprehensive Policy Type.

- Key Drivers: Increased vehicle value, demand for all-risk protection, insurer incentives.

- Market Share (2025): XX%

- CAGR (2025-2033): XX%

- Dominant Regions: North America, Europe, and rapidly growing Asia Pacific.

- North America & Europe: Mature markets, high vehicle parc, strong regulatory enforcement.

- Asia Pacific: High growth driven by rising incomes, urbanization, and vehicle sales in countries like China and India.

- Growth Potential: Significant untapped markets in developing economies.

Motor Insurance Market Product Landscape

The product landscape in the motor insurance market is evolving rapidly, driven by technological advancements and a focus on customer-centricity. Insurers are innovating beyond traditional coverage to offer tailored solutions, including telematics-based policies that reward safe driving with lower premiums. Product innovations include parametric insurance for specific weather-related risks, cyber insurance for connected vehicles, and enhanced roadside assistance packages. Applications range from basic accident repair to sophisticated data-driven risk assessment and fraud detection. Performance metrics are increasingly focused on claims settlement speed, customer satisfaction scores, and the accuracy of underwriting. Unique selling propositions often revolve around the ease of policy management through digital platforms, personalized pricing models, and the integration of value-added services like vehicle maintenance tracking. Technological advancements such as AI-powered claims assessment and predictive analytics for risk profiling are key differentiators. The auto insurance market is witnessing a surge in demand for flexible and adaptive products that cater to the diverse needs of modern drivers, moving beyond a one-size-fits-all approach.

Key Drivers, Barriers & Challenges in Motor Insurance Market

Key Drivers: The motor insurance market is propelled by several key drivers. The increasing global vehicle parc, particularly in emerging economies, forms the bedrock of demand. Mandatory insurance regulations worldwide ensure a baseline level of market penetration. Technological advancements, such as telematics and AI, enable personalized pricing, improved risk assessment, and efficient claims processing, driving innovation and customer acquisition. Rising disposable incomes in many regions boost the affordability and adoption of comprehensive coverage. Furthermore, the growing awareness of the financial implications of accidents and vehicle theft motivates consumers to seek protective insurance solutions.

Barriers & Challenges: Despite strong growth drivers, the car insurance market faces significant barriers and challenges. Intense competition from a multitude of insurers, including traditional players and InsurTech startups, leads to price wars and pressure on profit margins. Regulatory hurdles, varying by country, can complicate product development and market entry. The increasing sophistication of vehicle technology, especially in the realm of connected and autonomous vehicles, presents challenges in accurately assessing and pricing new risks. Cyber threats and data breaches are also growing concerns for insurers. Supply chain issues affecting vehicle availability and repair times can impact claims costs. Fraudulent claims remain a persistent challenge, requiring robust detection and prevention mechanisms.

Emerging Opportunities in Motor Insurance Market

Emerging opportunities in the motor insurance market lie in the burgeoning connected car ecosystem and the rise of electric vehicles (EVs). Telematics data offers immense potential for personalized pricing, proactive risk management, and the development of new value-added services, such as predictive maintenance alerts and optimized route planning. The growing adoption of EVs presents a unique opportunity for specialized insurance products that account for battery degradation, charging infrastructure risks, and higher initial vehicle costs. Untapped markets in developing economies, where vehicle ownership is still growing, represent significant growth potential for basic and increasingly comprehensive coverage. The evolving landscape of mobility, including ride-sharing and subscription-based car services, necessitates innovative insurance models that cater to shared and flexible usage patterns. Furthermore, leveraging big data analytics and AI to enhance underwriting accuracy, streamline claims processes, and personalize customer interactions will be crucial for competitive advantage.

Growth Accelerators in the Motor Insurance Market Industry

Several catalysts are accelerating growth within the motor insurance industry. The continuous advancements in vehicle safety technology, while reducing accident frequency, also lead to higher repair costs, thus justifying comprehensive coverage and increasing premium values. The proliferation of InsurTech startups is injecting innovation into the market, pushing established players to adopt digital-first strategies and enhance customer experience through user-friendly platforms and mobile applications. Strategic partnerships between insurers, automotive manufacturers, and technology providers are creating integrated solutions and new distribution channels, such as embedded insurance at the point of vehicle sale. Market expansion into underserved regions, driven by economic development and increasing vehicle penetration, offers substantial growth opportunities. The development of data analytics capabilities allows for more precise risk segmentation and personalized product offerings, improving customer retention and profitability.

Key Players Shaping the Motor Insurance Market Market

- PICC Property and Casualty Co Ltd

- Samsung Fire and Marine Insurance Co Ltd

- Allianz SE

- GEICO

- Ping An Insurance (Group) Co of China Ltd

- ICICI Lombard General Insurance Co Ltd

- Sompo Holdings Inc

- State Farm Mutual Automobile Insurance Company

- Aviva Plc

- Porto Seguro S A

Notable Milestones in Motor Insurance Market Sector

- 2019: Increased adoption of telematics for usage-based insurance (UBI) programs globally.

- 2020: Significant surge in digital adoption for policy purchases and claims processing due to the COVID-19 pandemic.

- 2021: Growing investment in AI and machine learning for enhanced fraud detection and underwriting accuracy.

- 2022: Introduction of specialized insurance products for electric vehicles (EVs) to address unique risks.

- 2023: Expansion of embedded insurance offerings within automotive sales and financing channels.

- 2024: Enhanced focus on cybersecurity insurance for connected vehicles and data protection.

In-Depth Motor Insurance Market Market Outlook

The motor insurance market outlook is exceptionally positive, driven by ongoing vehicle parc expansion, persistent demand for robust protection, and relentless technological innovation. Growth accelerators such as the integration of IoT devices in vehicles and the increasing sophistication of data analytics will enable insurers to offer hyper-personalized and proactive risk management solutions. Strategic partnerships will continue to expand distribution networks and create synergistic opportunities. The shift towards sustainable mobility, particularly the growth of EVs, presents a significant avenue for specialized product development and market leadership. Furthermore, the increasing regulatory focus on consumer protection and data privacy will shape product design and operational strategies. Companies that effectively leverage digital transformation, embrace emerging technologies, and adapt to evolving consumer preferences will be best positioned to capture significant market share and achieve sustained profitability in the coming years. The auto insurance market is set for a dynamic and expansive future.

Motor Insurance Market Segmentation

-

1. Policy Type

- 1.1. Third-party Liability

- 1.2. Third-party Fire and Theft

- 1.3. Comprehensive

Motor Insurance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. Latin America

Motor Insurance Market Regional Market Share

Geographic Coverage of Motor Insurance Market

Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claims Made; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Emerging Countries Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 5.1.1. Third-party Liability

- 5.1.2. Third-party Fire and Theft

- 5.1.3. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 6. North America Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 6.1.1. Third-party Liability

- 6.1.2. Third-party Fire and Theft

- 6.1.3. Comprehensive

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 7. Europe Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 7.1.1. Third-party Liability

- 7.1.2. Third-party Fire and Theft

- 7.1.3. Comprehensive

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 8. Asia Pacific Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 8.1.1. Third-party Liability

- 8.1.2. Third-party Fire and Theft

- 8.1.3. Comprehensive

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 9. Middle East Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 9.1.1. Third-party Liability

- 9.1.2. Third-party Fire and Theft

- 9.1.3. Comprehensive

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 10. Latin America Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 10.1.1. Third-party Liability

- 10.1.2. Third-party Fire and Theft

- 10.1.3. Comprehensive

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PICC Property and Casualty Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung Fire and Marine Insurance Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Allianz SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GEICO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ping An Insurance (Group) Co of China Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ICICI Lombard General Insurance Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sompo Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 State Farm Mutual Automobile Insurance Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aviva Plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Porto Seguro S A**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PICC Property and Casualty Co Ltd

List of Figures

- Figure 1: Global Motor Insurance Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 3: North America Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 4: North America Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 7: Europe Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 8: Europe Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 11: Asia Pacific Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 12: Asia Pacific Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 15: Middle East Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 16: Middle East Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 19: Latin America Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 20: Latin America Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Latin America Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 2: Global Motor Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 4: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 6: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 8: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 10: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 12: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motor Insurance Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Motor Insurance Market?

Key companies in the market include PICC Property and Casualty Co Ltd, Samsung Fire and Marine Insurance Co Ltd, Allianz SE, GEICO, Ping An Insurance (Group) Co of China Ltd, ICICI Lombard General Insurance Co Ltd, Sompo Holdings Inc, State Farm Mutual Automobile Insurance Company, Aviva Plc, Porto Seguro S A**List Not Exhaustive.

3. What are the main segments of the Motor Insurance Market?

The market segments include Policy Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Emerging Countries Driving the Market Growth.

7. Are there any restraints impacting market growth?

Increase in Cost of Claims Made; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motor Insurance Market?

To stay informed about further developments, trends, and reports in the Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence