Key Insights

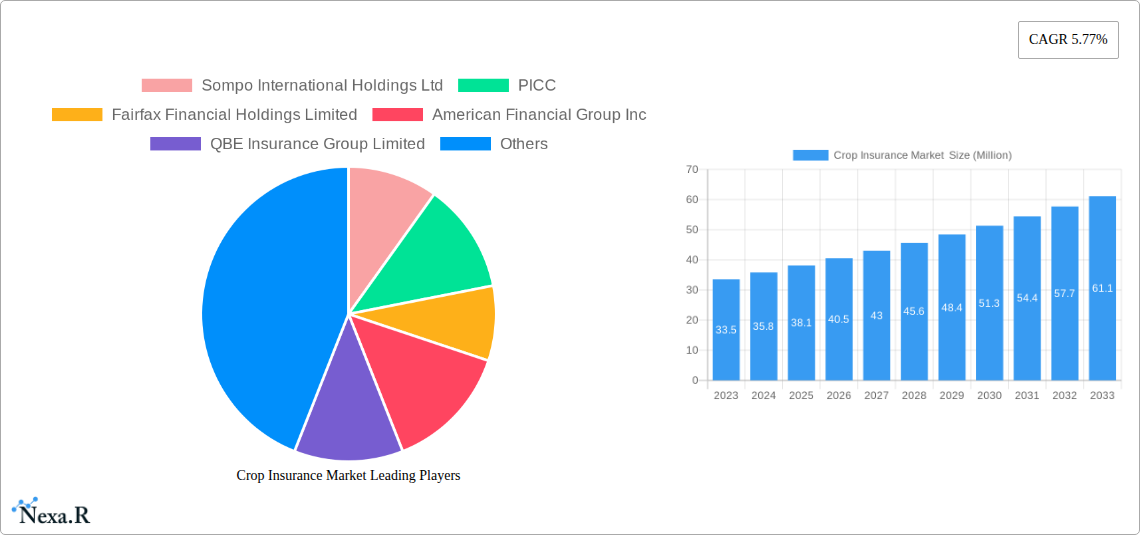

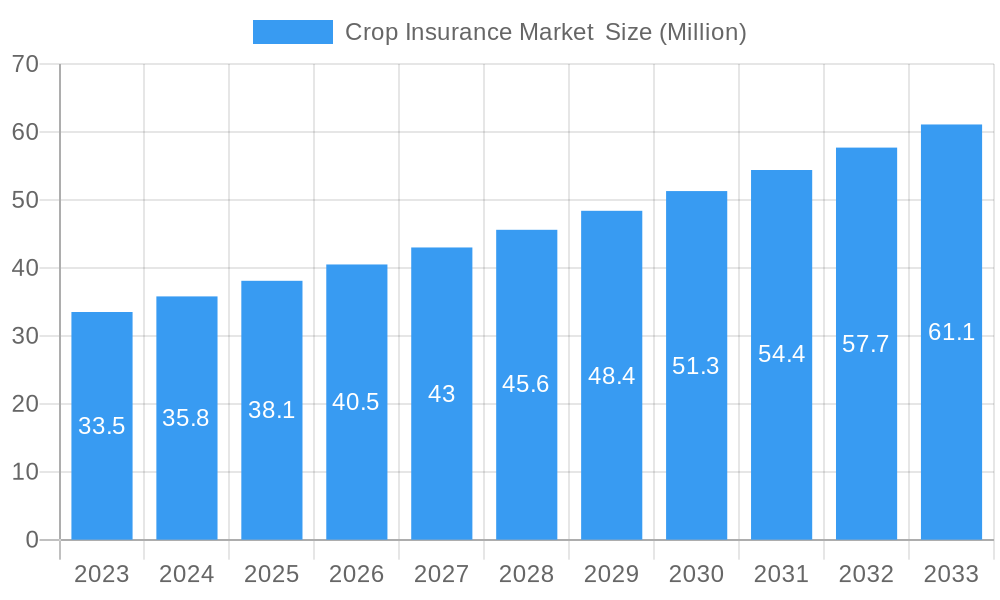

The global Crop Insurance Market is poised for significant expansion, projected to reach a substantial USD 38.10 million by 2025. This growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 5.77% during the forecast period of 2025-2033. A primary driver of this upward trajectory is the increasing frequency and severity of climate-related events, such as unpredictable weather patterns, droughts, floods, and pest infestations, which pose substantial risks to agricultural yields and farmer livelihoods. Governments worldwide are actively promoting crop insurance schemes to safeguard the agricultural sector, recognizing its critical role in food security and rural economic stability. Subsidies and incentives offered by regulatory bodies further bolster market adoption. The rising global population also necessitates enhanced agricultural productivity, making crop insurance an essential tool for risk mitigation and encouraging investment in advanced farming techniques.

Crop Insurance Market Market Size (In Million)

The market is segmented into various types, including Multiple Peril Crop Insurance, Actual Production History, and Crop Revenue Coverage, catering to diverse risk profiles. Coverage extends to localized calamities, sowing/planting/germination risks, standing crop loss, and post-harvest losses, providing comprehensive protection. Distribution channels are diverse, with Banks, Insurance Companies, Brokers, and Agents playing pivotal roles, alongside emerging "Other Distribution Channels" that likely encompass digital platforms and agricultural cooperatives. Key players like Sompo International Holdings Ltd, PICC, Fairfax Financial Holdings Limited, and American Financial Group Inc. are actively shaping the market landscape through innovation and strategic partnerships. Asia Pacific, particularly China and India, is expected to be a dominant region due to its large agrarian economies and increasing government focus on agricultural resilience.

Crop Insurance Market Company Market Share

Comprehensive Crop Insurance Market Report: Navigating Risk and Ensuring Agricultural Resilience (2019–2033)

Unlock critical insights into the dynamic crop insurance market with this in-depth report. Analyzing the global crop insurance market, agricultural insurance market, and farm insurance market, this study provides a 360-degree view of market size, growth trends, and competitive landscapes. Essential for farmers, insurers, reinsurers, agriculture companies, policymakers, and financial institutions, this report details the parent market of agriculture and its crucial child market of risk management. With a study period from 2019–2033, including a base year of 2025 and a forecast period of 2025–2033, you'll gain foresight into market evolution, driven by climate change impact on agriculture, food security initiatives, and government agricultural subsidies. The report quantifies market values in Million units, ensuring precise data-driven decision-making.

Crop Insurance Market Market Dynamics & Structure

The crop insurance market is characterized by a moderately concentrated structure, with a few key players holding significant market share, alongside a growing number of regional and specialized insurers. Technological innovation is a paramount driver, particularly in the development of parametric crop insurance, weather-based crop insurance, and digital crop insurance solutions leveraging AI and satellite imagery for more accurate risk assessment and faster claims processing. Regulatory frameworks, often government-led, play a crucial role in shaping the market by mandating certain coverages, offering subsidies, and setting capital requirements. Competitive product substitutes, such as direct government aid or informal risk-sharing mechanisms, exist but often lack the comprehensive protection and financial backing of formal insurance. End-user demographics are diverse, ranging from smallholder farmers to large agricultural conglomerates, each with varying risk appetites and coverage needs. Mergers and acquisitions (M&A) trends are evident as larger players seek to expand their geographical reach, product portfolios, and technological capabilities.

- Market Concentration: Dominated by a mix of global insurance giants and specialized agricultural insurers, with a notable presence of state-backed entities in key agricultural economies.

- Technological Innovation Drivers: Advancements in data analytics, IoT sensors, drones, and remote sensing are transforming underwriting, claims management, and risk modeling.

- Regulatory Frameworks: Government mandates, subsidies, and public-private partnerships are critical in promoting crop insurance adoption and ensuring market stability. For instance, the US Federal Crop Insurance Program significantly influences market dynamics.

- Competitive Product Substitutes: While informal mechanisms exist, their limited scope makes formal crop insurance products more attractive for comprehensive risk mitigation.

- End-User Demographics: A spectrum from smallholder farmers vulnerable to localized weather events to large agribusinesses requiring protection against systemic risks.

- M&A Trends: Driven by a desire for market consolidation, access to new technologies, and expansion into emerging agricultural markets. Deal volumes in the past year indicate a robust interest in acquiring specialized crop insurance providers and technology platforms.

Crop Insurance Market Growth Trends & Insights

The crop insurance market is projected to experience robust growth, fueled by escalating agricultural uncertainties and a growing recognition of its importance for food security and farmer livelihoods. The market size evolution is directly correlated with the increasing frequency and intensity of extreme weather events, making crop risk management a necessity rather than an option. Adoption rates are steadily rising, particularly in developing economies where agricultural insurance penetration was historically low but is now being boosted by government initiatives and increased awareness. Technological disruptions are playing a transformative role, moving the market towards more sophisticated and affordable insurance solutions. This includes the rise of index-based crop insurance, which triggers payouts based on predefined indices like rainfall or temperature, thereby reducing moral hazard and adverse selection. Consumer behavior shifts are also evident, with farmers increasingly valuing crop protection insurance as a vital financial tool for securing investments and ensuring business continuity. The CAGR is estimated to be in the range of 5-7% over the forecast period, driven by a combination of increasing cultivated land, rising crop values, and greater policy support. The market penetration, currently around 20-25% globally, is expected to climb as more farmers understand the benefits of safeguarding their yields against unforeseen losses. The integration of digital platforms for policy issuance, premium collection, and claims settlement is further enhancing accessibility and efficiency, contributing to significant growth.

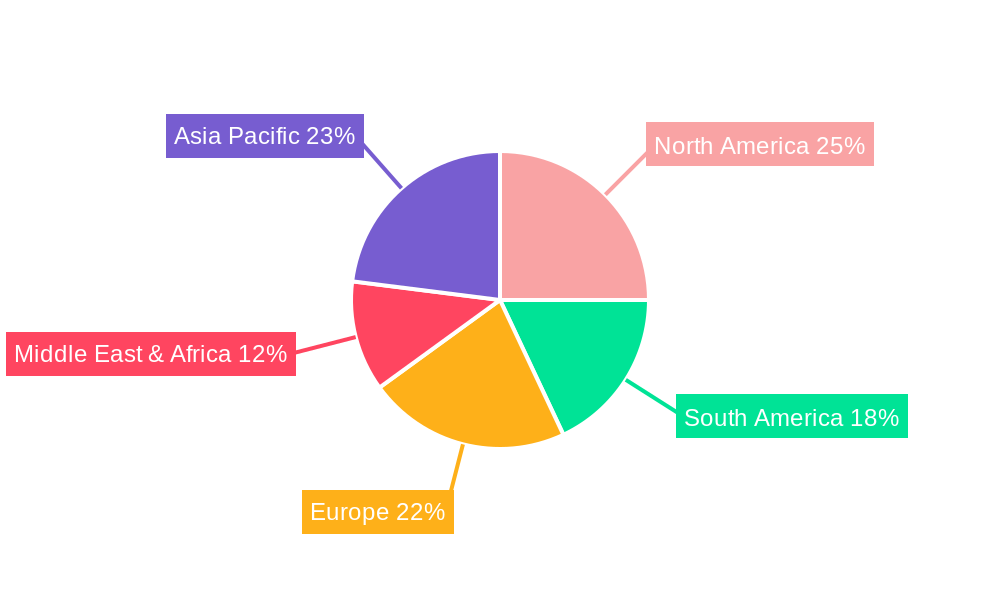

Dominant Regions, Countries, or Segments in Crop Insurance Market

The North America crop insurance market, particularly the United States crop insurance market, stands as a dominant force, driven by extensive government support, advanced agricultural practices, and a mature insurance industry. The prevalence of Multiple Peril Crop Insurance (MPCI), covering a broad spectrum of risks, is a key segment fueling this dominance. Countries like Canada also contribute significantly to this regional leadership through similar policy frameworks and a strong agricultural base. The Asia Pacific crop insurance market, especially India's crop insurance market and China's agricultural insurance market, is rapidly emerging as a significant growth engine. This expansion is propelled by the sheer volume of agricultural activity, a large farmer population, and government initiatives aimed at bolstering farm risk mitigation and rural economic development.

Key Drivers of Dominance:

- Multiple Peril Crop Insurance (MPCI): This type of insurance, offering comprehensive protection against a wide array of perils, is the cornerstone of the dominant segments, providing farmers with broad-spectrum risk mitigation.

- Localized Calamities Coverage: With increasing climate volatility, insurance products that specifically address localized weather events like droughts, floods, and hailstorms are in high demand.

- Government Support and Subsidies: Robust government backing, including premium subsidies and reinsurance programs, significantly reduces the cost burden for farmers and encourages higher adoption rates, as seen in the US and increasingly in India.

- Technological Adoption: Advanced farming techniques and the integration of technology in agriculture, from precision farming to data analytics, enable more accurate risk assessment and product development, leading to market expansion.

- Economic Policies and Infrastructure: Supportive economic policies, well-developed financial infrastructure, and efficient distribution channels (like banks) facilitate easier access to and uptake of crop insurance products.

- Standing Crop Loss Protection: Insurance solutions that cover the standing crop from planting to harvest are crucial for farmers, providing a safety net against yield reductions due to unforeseen events.

The dominance of regions like North America and the rising influence of Asia Pacific highlight the global imperative for resilient agricultural systems. Growth potential in these regions remains substantial, driven by ongoing technological advancements and a sustained focus on agricultural resilience.

Crop Insurance Market Product Landscape

The crop insurance market product landscape is evolving rapidly, driven by a demand for more tailored and responsive solutions. Innovations are centered around parametric products and digital platforms, offering efficient crop risk management. Actual Production History (APH) policies remain a staple, providing coverage based on historical farm yields, ensuring a degree of income stability for farmers. However, newer products like Crop Revenue Coverage (CRC) are gaining traction by protecting against both yield losses and price declines, offering a more holistic financial safeguard. The application of these products spans a wide range of crops and farming systems, from staple grains to high-value horticultural produce. Performance metrics are increasingly being evaluated not just on payout ratios but also on claims settlement speed and customer satisfaction, facilitated by technological advancements. The unique selling propositions of advanced products include their ability to provide rapid payouts based on objective data, thereby minimizing administrative delays and improving cash flow for farmers in times of crisis.

Key Drivers, Barriers & Challenges in Crop Insurance Market

Key Drivers:

- Climate Change and Extreme Weather Events: The escalating frequency and severity of droughts, floods, storms, and temperature fluctuations necessitate robust crop protection insurance to mitigate financial losses for farmers.

- Government Policies and Subsidies: Supportive government initiatives, including premium subsidies, reinsurance support, and regulatory frameworks, are crucial in driving crop insurance adoption and market growth.

- Technological Advancements: Innovations in data analytics, satellite imagery, IoT, and AI are enabling more accurate risk assessment, personalized product offerings, and efficient claims processing, thus enhancing market attractiveness.

- Increasing Food Demand and Volatile Commodity Prices: The growing global population and fluctuating agricultural commodity prices underscore the need for farm insurance to safeguard investments and ensure the viability of agricultural operations.

- Growing Awareness and Education: Increased farmer awareness about the benefits of crop insurance as a risk management tool, facilitated by outreach programs and digital platforms, is a significant growth driver.

Key Barriers & Challenges:

- Low Insurance Penetration in Emerging Markets: Despite growth, a significant portion of farmers, especially smallholders in developing nations, still lack access to or understanding of crop insurance, limiting market reach. This represents a substantial unrealized market potential.

- High Premiums and Affordability: For some farmers, particularly in regions with high-risk profiles, the cost of premiums can be prohibitive, even with subsidies, creating an affordability barrier.

- Basis Risk in Index-Based Insurance: While efficient, index-based insurance can suffer from basis risk, where the index payout does not perfectly match the actual farm losses, leading to farmer dissatisfaction.

- Adverse Selection and Moral Hazard: Insurers face challenges in managing adverse selection (high-risk individuals being more likely to seek insurance) and moral hazard (insured individuals taking more risks), impacting profitability and pricing.

- Regulatory Hurdles and Bureaucracy: Complex and evolving regulatory environments in different regions can create compliance challenges and administrative burdens for insurers.

- Data Availability and Quality: In many regions, accurate and reliable historical agricultural data required for effective underwriting and risk modeling is scarce, hindering product development and pricing.

Emerging Opportunities in Crop Insurance Market

Emerging opportunities in the crop insurance market lie in the development of innovative digital insurance solutions and the expansion into underpenetrated segments. The increasing adoption of parametric crop insurance, triggered by weather indices, offers a streamlined and cost-effective approach, particularly appealing in regions prone to specific climatic risks. There is a significant opportunity in developing micro-insurance products tailored for smallholder farmers, addressing their unique risk profiles and financial constraints. Furthermore, integrating blockchain technology for transparent and efficient claims processing can build greater trust and reduce fraud. The growing focus on sustainable agriculture also presents an opportunity to develop insurance products that incentivize eco-friendly farming practices, such as cover cropping and reduced pesticide use, linking insurance payouts to verifiable environmental outcomes. The untapped potential in emerging agricultural economies, coupled with government commitments to enhancing agricultural resilience, offers substantial room for market expansion and product diversification.

Growth Accelerators in the Crop Insurance Market Industry

Several catalysts are accelerating the growth of the crop insurance industry. Technological breakthroughs are at the forefront, with the application of artificial intelligence (AI) and machine learning (ML) in precision agriculture enabling highly accurate risk assessment and personalized insurance products. Advanced analytics derived from satellite imagery and IoT sensors allow for real-time monitoring of crop health and environmental conditions, leading to more dynamic and responsive crop insurance policies. Strategic partnerships between insurance providers, agricultural technology companies, and government agencies are crucial for expanding market reach, enhancing product innovation, and improving the accessibility of insurance for farmers. Market expansion strategies, particularly focusing on emerging economies with large agrarian populations and a rising need for farm risk management, are key to driving sustained growth.

Key Players Shaping the Crop Insurance Market Market

- Sompo International Holdings Ltd

- PICC

- Fairfax Financial Holdings Limited

- American Financial Group Inc

- QBE Insurance Group Limited

- ICICI Lombard General Insurance Company Limited

- Zurich

- Chubb

- Tokio Marine HCC

- Agriculture Insurance Company of India Limited (AIC)

Notable Milestones in Crop Insurance Market Sector

- September 2023: The Shrimp Crop Insurance scheme developed by the Agricultural Insurance Company was launched in India, providing comprehensive insurance cover from the initial stage to 130 days until shrimps are ready for harvest, addressing a critical need in aquaculture risk management.

- July 2023: American Financial Group (AFG) completed the purchase of Crop Risk Services (CRS) from AIG. CRS, a primary crop insurance general agent, is recognized as the seventh-largest provider of multi-peril crop insurance in the United States, indicating strategic consolidation and expansion within the US crop insurance landscape.

In-Depth Crop Insurance Market Market Outlook

The crop insurance market outlook is exceptionally positive, driven by a confluence of factors poised to accelerate growth and enhance resilience in the agricultural sector. The continued evolution of parametric insurance and the integration of advanced digital technologies are set to redefine risk management for farmers, offering more responsive and accessible solutions. Emerging markets present a significant frontier for expansion, as governments increasingly prioritize food security and farmer welfare through enhanced agricultural insurance penetration. Strategic partnerships, innovative product development targeting specific crop and regional risks, and a growing emphasis on sustainable farming insurance will be key growth accelerators. The market is expected to witness a substantial increase in farm insurance coverage, driven by the ongoing need to mitigate risks associated with climate change and market volatility, ensuring a more stable and prosperous future for global agriculture.

Crop Insurance Market Segmentation

-

1. Type

- 1.1. Multiple Peril Crop Insurance

- 1.2. Actual Production History

- 1.3. Crop Revenue Coverage

-

2. Coverage

- 2.1. Localized Calamities

- 2.2. Sowing/Planting/Germination Risk

- 2.3. Standing Crop Loss

- 2.4. Post-harvest Losses

-

3. Distribution Channel

- 3.1. Banks

- 3.2. Insurance Companies

- 3.3. Brokers and Agents

- 3.4. Other Distribution Channels

Crop Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Crop Insurance Market Regional Market Share

Geographic Coverage of Crop Insurance Market

Crop Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Government Support

- 3.2.2 Including Subsidies and Initiatives

- 3.2.3 is a Significant Driver

- 3.3. Market Restrains

- 3.3.1. Instances of Fraud or Misreporting can Impact the Integrity of the Crop Insurance System

- 3.4. Market Trends

- 3.4.1. Increasing Value Crop Protection Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crop Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Multiple Peril Crop Insurance

- 5.1.2. Actual Production History

- 5.1.3. Crop Revenue Coverage

- 5.2. Market Analysis, Insights and Forecast - by Coverage

- 5.2.1. Localized Calamities

- 5.2.2. Sowing/Planting/Germination Risk

- 5.2.3. Standing Crop Loss

- 5.2.4. Post-harvest Losses

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Banks

- 5.3.2. Insurance Companies

- 5.3.3. Brokers and Agents

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Crop Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Multiple Peril Crop Insurance

- 6.1.2. Actual Production History

- 6.1.3. Crop Revenue Coverage

- 6.2. Market Analysis, Insights and Forecast - by Coverage

- 6.2.1. Localized Calamities

- 6.2.2. Sowing/Planting/Germination Risk

- 6.2.3. Standing Crop Loss

- 6.2.4. Post-harvest Losses

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Banks

- 6.3.2. Insurance Companies

- 6.3.3. Brokers and Agents

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Crop Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Multiple Peril Crop Insurance

- 7.1.2. Actual Production History

- 7.1.3. Crop Revenue Coverage

- 7.2. Market Analysis, Insights and Forecast - by Coverage

- 7.2.1. Localized Calamities

- 7.2.2. Sowing/Planting/Germination Risk

- 7.2.3. Standing Crop Loss

- 7.2.4. Post-harvest Losses

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Banks

- 7.3.2. Insurance Companies

- 7.3.3. Brokers and Agents

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Crop Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Multiple Peril Crop Insurance

- 8.1.2. Actual Production History

- 8.1.3. Crop Revenue Coverage

- 8.2. Market Analysis, Insights and Forecast - by Coverage

- 8.2.1. Localized Calamities

- 8.2.2. Sowing/Planting/Germination Risk

- 8.2.3. Standing Crop Loss

- 8.2.4. Post-harvest Losses

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Banks

- 8.3.2. Insurance Companies

- 8.3.3. Brokers and Agents

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Crop Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Multiple Peril Crop Insurance

- 9.1.2. Actual Production History

- 9.1.3. Crop Revenue Coverage

- 9.2. Market Analysis, Insights and Forecast - by Coverage

- 9.2.1. Localized Calamities

- 9.2.2. Sowing/Planting/Germination Risk

- 9.2.3. Standing Crop Loss

- 9.2.4. Post-harvest Losses

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Banks

- 9.3.2. Insurance Companies

- 9.3.3. Brokers and Agents

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Crop Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Multiple Peril Crop Insurance

- 10.1.2. Actual Production History

- 10.1.3. Crop Revenue Coverage

- 10.2. Market Analysis, Insights and Forecast - by Coverage

- 10.2.1. Localized Calamities

- 10.2.2. Sowing/Planting/Germination Risk

- 10.2.3. Standing Crop Loss

- 10.2.4. Post-harvest Losses

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Banks

- 10.3.2. Insurance Companies

- 10.3.3. Brokers and Agents

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sompo International Holdings Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PICC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fairfax Financial Holdings Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 American Financial Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 QBE Insurance Group Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ICICI Lombard General Insurance Company Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zurich**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chubb

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tokio Marine HCC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Agriculture Insurance Company of India Limited (AIC)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sompo International Holdings Ltd

List of Figures

- Figure 1: Global Crop Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Crop Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Crop Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Crop Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 5: North America Crop Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 6: North America Crop Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Crop Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Crop Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Crop Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Crop Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 11: South America Crop Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Crop Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 13: South America Crop Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 14: South America Crop Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America Crop Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Crop Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Crop Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Crop Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe Crop Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Crop Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 21: Europe Crop Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 22: Europe Crop Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Crop Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Crop Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Crop Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Crop Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East & Africa Crop Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Crop Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 29: Middle East & Africa Crop Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 30: Middle East & Africa Crop Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Crop Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Crop Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Crop Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Crop Insurance Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific Crop Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Crop Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 37: Asia Pacific Crop Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 38: Asia Pacific Crop Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Crop Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Crop Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Crop Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Crop Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Crop Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 3: Global Crop Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Crop Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Crop Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Crop Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 7: Global Crop Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Crop Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Crop Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Crop Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 14: Global Crop Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Crop Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Crop Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Crop Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 21: Global Crop Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Crop Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Crop Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Crop Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 34: Global Crop Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Crop Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Crop Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global Crop Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 44: Global Crop Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Crop Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Crop Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crop Insurance Market ?

The projected CAGR is approximately 5.77%.

2. Which companies are prominent players in the Crop Insurance Market ?

Key companies in the market include Sompo International Holdings Ltd, PICC, Fairfax Financial Holdings Limited, American Financial Group Inc, QBE Insurance Group Limited, ICICI Lombard General Insurance Company Limited, Zurich**List Not Exhaustive, Chubb, Tokio Marine HCC, Agriculture Insurance Company of India Limited (AIC).

3. What are the main segments of the Crop Insurance Market ?

The market segments include Type, Coverage, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Support. Including Subsidies and Initiatives. is a Significant Driver.

6. What are the notable trends driving market growth?

Increasing Value Crop Protection Globally.

7. Are there any restraints impacting market growth?

Instances of Fraud or Misreporting can Impact the Integrity of the Crop Insurance System.

8. Can you provide examples of recent developments in the market?

September 2023: The Shrimp Crop Insurance scheme developed by the Agricultural Insurance Company was launched in India. The insurance cover starts from the initial stage to 130 days till the shrimps are ready.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crop Insurance Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crop Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crop Insurance Market ?

To stay informed about further developments, trends, and reports in the Crop Insurance Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence