Key Insights

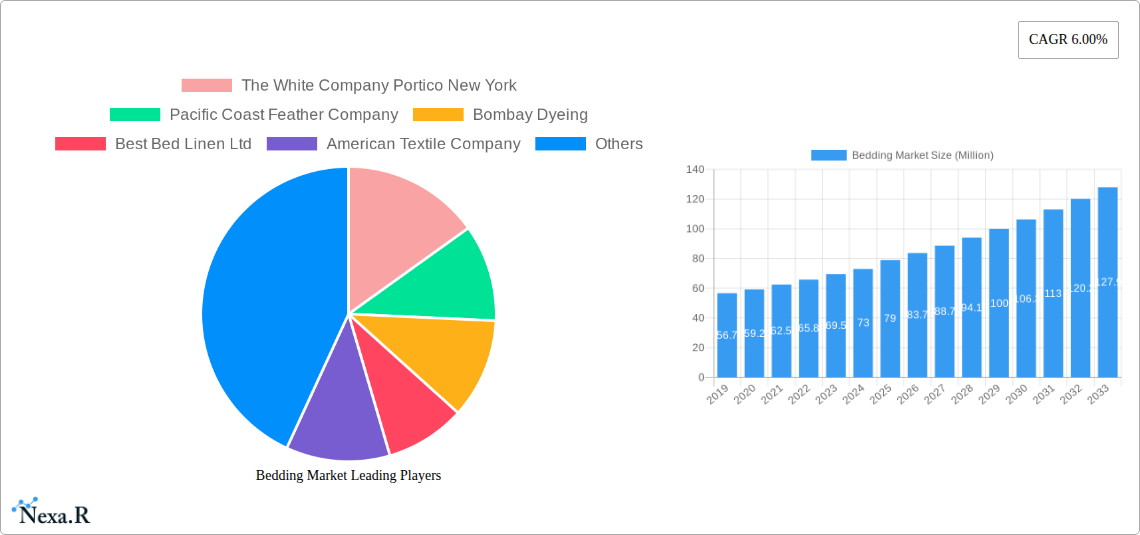

The global Bedding Market is poised for significant growth, projected to reach an estimated market size of $79 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.00% expected throughout the forecast period of 2025-2033. This expansion is fueled by a confluence of factors, including a growing emphasis on home decor and comfort, coupled with increasing disposable incomes in emerging economies. The Home Bedding segment is anticipated to be a primary driver, as consumers increasingly invest in creating comfortable and aesthetically pleasing personal sanctuaries. Furthermore, the Hotel Bedding segment is also expected to contribute substantially, driven by the recovering hospitality sector and a heightened focus on guest experience, which often translates to higher quality and more luxurious bedding choices. Technological advancements in fabric innovation, offering enhanced breathability, durability, and hypoallergenic properties, are also playing a crucial role in consumer purchasing decisions, further bolstering market expansion.

Bedding Market Market Size (In Million)

The market's trajectory will be influenced by evolving distribution channels. While traditional Supermarkets/Hypermarkets and Specialty Stores will continue to hold sway, the Online channel is experiencing a remarkable surge in popularity, driven by convenience, wider product selection, and competitive pricing. This shift necessitates a strong digital presence for market players. Key restraints, such as fluctuating raw material prices and intense competition from both established brands and new entrants, will require strategic maneuvering by companies. However, the persistent trend of urbanization and the associated rise in smaller living spaces, which often necessitate more functional and space-saving bedding solutions, present new opportunities. Emerging markets within the Asia Pacific and Middle East & Africa regions are expected to be significant growth centers, offering vast untapped potential for market penetration.

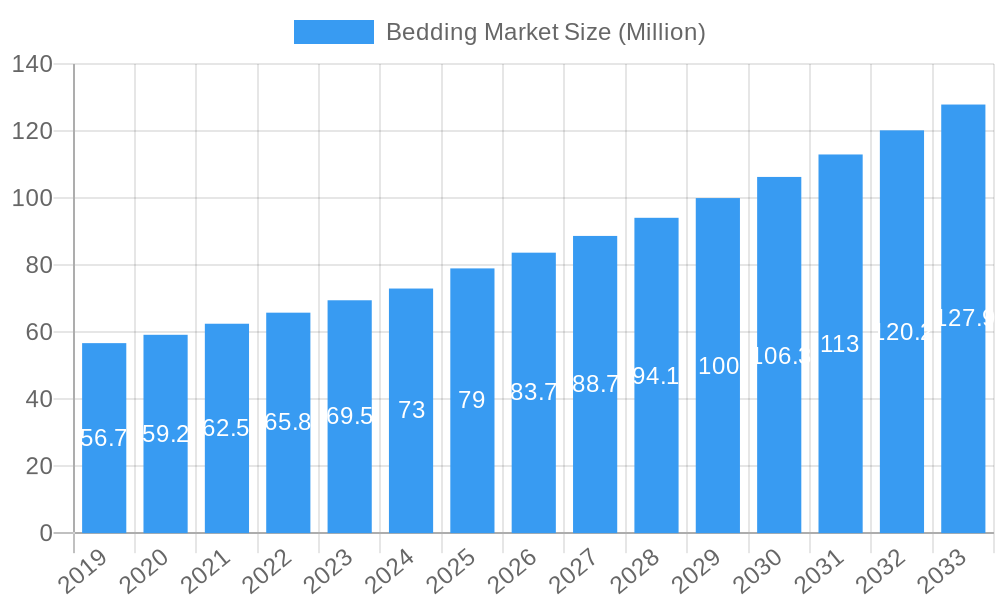

Bedding Market Company Market Share

Here is a comprehensive, SEO-optimized report description for the Bedding Market, designed for maximum visibility and engagement with industry professionals.

Bedding Market: Comprehensive Analysis and Forecast (2019-2033)

Unlock unparalleled insights into the global Bedding Market with our definitive report. Covering the expansive study period from 2019–2033, with a base year of 2025, this report offers a deep dive into market dynamics, growth trends, regional dominance, product innovation, key players, and emerging opportunities. Analyze parent and child market segments, including Home Bedding and Hotel Bedding, and explore distribution channels such as Supermarkets/Hypermarkets, Specialty Stores, and Online retail. We present all quantitative values in Million Units for clarity and direct comparison.

Bedding Market Market Dynamics & Structure

The global bedding market is characterized by a dynamic interplay of factors influencing its structure and concentration. Technological innovation remains a significant driver, with advancements in materials science leading to the development of enhanced comfort, durability, and therapeutic properties in bedding products. Regulatory frameworks, particularly concerning fire safety standards and material sourcing, shape manufacturing processes and product compliance across different regions. Competitive product substitutes, ranging from traditional mattresses and pillows to smart bedding solutions and sleep accessories, constantly challenge established market positions. End-user demographics, including an aging population, increasing disposable incomes, and a growing awareness of sleep health, significantly influence demand patterns. Mergers and acquisitions (M&A) trends are evident as larger players seek to consolidate market share, acquire innovative technologies, or expand their geographical reach.

- Market Concentration: Moderate to high in developed regions, with a growing number of smaller, niche players emerging.

- Technological Innovation Drivers: Focus on sustainable materials, cooling technologies, hypoallergenic properties, and smart sleep tracking.

- Regulatory Frameworks: Stringent safety standards in North America and Europe, evolving regulations in emerging economies.

- Competitive Product Substitutes: Growing adoption of adjustable beds, sleep trackers, and personalized sleep solutions.

- End-User Demographics: Increasing demand from millennials and Gen Z for aesthetically pleasing and health-conscious bedding.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios and market access, with a notable increase in the last three years.

Bedding Market Growth Trends & Insights

The bedding market is poised for substantial growth, driven by evolving consumer lifestyles and a heightened focus on well-being. Our analysis, leveraging comprehensive market data, forecasts a robust Compound Annual Growth Rate (CAGR) for the forecast period of 2025–2033. The adoption rates for premium and technologically advanced bedding products are steadily increasing, reflecting a consumer willingness to invest in sleep quality. Technological disruptions are at the forefront, with the integration of smart features like temperature regulation, sleep tracking, and personalized comfort settings becoming increasingly prevalent. Consumer behavior shifts are significantly impacting the market; there's a discernible move towards online purchasing for convenience and a wider selection, alongside a growing preference for eco-friendly and sustainably sourced materials. The impact of global events on supply chains has also led to an increased emphasis on localized manufacturing and resilient sourcing strategies.

The market size evolution indicates a consistent upward trajectory, fueled by both organic growth and strategic market expansions. Penetration rates for specialized bedding, such as orthopedic mattresses and hypoallergenic pillows, are rising as consumer awareness of sleep-related health issues grows. The influence of interior design trends also plays a crucial role, with consumers seeking bedding that complements their home aesthetics. The historical period (2019–2024) reveals a resilient market, demonstrating its ability to navigate economic fluctuations and adapt to changing consumer preferences. The base year (2025) serves as a critical pivot point for forecasting future market dynamics and identifying key growth vectors. The estimated year of 2025 provides an immediate outlook on the market's current standing and short-term potential.

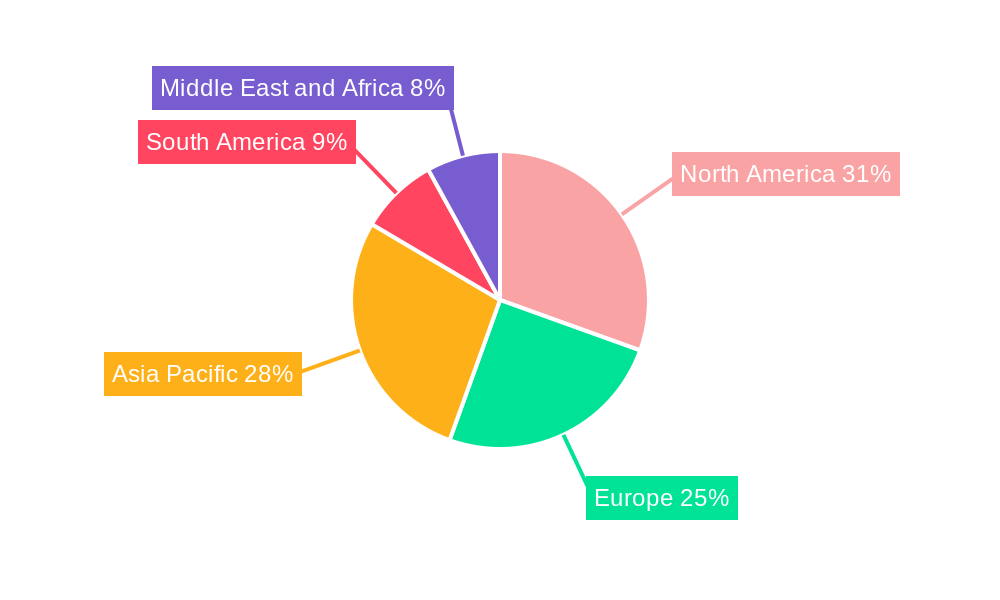

Dominant Regions, Countries, or Segments in Bedding Market

The Home Bedding segment, particularly within the Online distribution channel, is emerging as a dominant force in the global Bedding Market. This dominance is propelled by a confluence of economic policies, robust digital infrastructure, and evolving consumer purchasing habits. North America and Europe currently lead in market share due to higher disposable incomes, greater awareness of sleep health, and established e-commerce ecosystems. However, Asia Pacific is exhibiting the fastest growth potential, driven by rapid urbanization, a burgeoning middle class, and increasing penetration of online retail platforms.

- Dominant Segment (Type): Home Bedding is projected to account for approximately 75% of the total market revenue during the forecast period, driven by consumer spending on home décor and personal comfort.

- Dominant Segment (Distribution Channel): Online channels are anticipated to capture over 40% of the market share by 2033, facilitated by convenience, wider product selection, and competitive pricing strategies.

- Leading Regions: North America (approx. 30% market share in 2025), followed by Europe (approx. 25% market share), and Asia Pacific showing the highest projected CAGR.

- Key Growth Drivers in Asia Pacific: Increasing disposable incomes, rising urbanization, a growing middle class eager for comfort and luxury, and expanding internet penetration.

- Infrastructure Impact: Development of efficient logistics and delivery networks is crucial for the growth of online bedding sales in emerging economies.

- Economic Policies: Favorable trade agreements and incentives for domestic manufacturing are supporting regional market growth.

- Market Share and Growth Potential: While established markets maintain higher absolute market share, emerging economies present a significantly higher growth potential due to lower penetration rates and increasing consumer demand for quality bedding.

Bedding Market Product Landscape

The product landscape of the bedding market is rapidly evolving, marked by a strong emphasis on innovation, application, and performance. Unique selling propositions now revolve around advanced materials offering superior temperature regulation, pressure relief, and hypoallergenic properties. Applications extend beyond basic comfort to encompass therapeutic benefits, such as enhanced spinal alignment and improved sleep quality, catering to a health-conscious consumer base. Technological advancements are driving the integration of smart features, including sleep tracking sensors and customizable firmness levels, setting new benchmarks for performance and user experience. The market is witnessing a surge in demand for eco-friendly and sustainable bedding options, featuring recycled materials, organic cotton, and biodegradable components.

Key Drivers, Barriers & Challenges in Bedding Market

Key Drivers:

- Growing Health and Wellness Consciousness: Increased consumer awareness of the critical role of sleep in overall health is a primary growth catalyst.

- Rising Disposable Incomes: Particularly in emerging economies, higher disposable incomes translate to increased consumer spending on home furnishings and comfort products.

- Technological Advancements: Innovations in materials science and smart technologies are creating new product categories and enhancing existing ones.

- E-commerce Growth: The convenience and accessibility of online shopping are driving significant growth in direct-to-consumer bedding sales.

Barriers & Challenges:

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials and finished goods.

- Intense Competition: The market is highly fragmented with numerous players, leading to price pressures and challenges in differentiation.

- Economic Volatility: Recessions or economic downturns can dampen consumer discretionary spending on non-essential items like premium bedding.

- Sustainability Concerns: Balancing cost-effective production with the demand for sustainable and ethically sourced materials presents an ongoing challenge. The cost of sustainable materials can be higher, impacting final product pricing.

Emerging Opportunities in Bedding Market

Emerging opportunities in the bedding market are largely driven by evolving consumer preferences and technological integration. The demand for personalized sleep solutions, tailored to individual needs and preferences, represents a significant untapped market. Furthermore, the expansion of the "wellness at home" trend is creating opportunities for smart bedding that actively contributes to a healthier sleep environment, moving beyond passive comfort. The growing interest in sustainable and eco-friendly products, especially in developing regions, opens avenues for brands that prioritize ethical sourcing and environmentally conscious manufacturing. The integration of bedding with broader smart home ecosystems also presents a compelling opportunity for cross-functional product development and market penetration.

Growth Accelerators in the Bedding Market Industry

Several key catalysts are propelling long-term growth in the bedding market industry. The relentless pursuit of technological breakthroughs, particularly in material science and smart bedding functionalities, continues to redefine product offerings and create new market segments. Strategic partnerships between bedding manufacturers and technology companies are accelerating innovation and product development, enabling companies to offer integrated sleep solutions. Market expansion strategies, including the penetration of emerging economies and the development of direct-to-consumer (DTC) models, are vital for capturing new customer bases and increasing market share. The increasing focus on health and wellness, coupled with a growing global middle class, provides a sustained demand for comfortable and supportive bedding solutions.

Key Players Shaping the Bedding Market Market

- The White Company

- Portico New York

- Pacific Coast Feather Company

- Bombay Dyeing

- Best Bed Linen Ltd

- American Textile Company

- Serena and Lily Inc

- Hollander Sleep Products LLC

- Casper Sleep Inc

- Beaumont & Brown

- Crane & Canopy Inc

- Sleep Number Corporation

- Serta Simmons Bedding

- Tempur Sealy International Inc

- Boll and Branch LLC

Notable Milestones in Bedding Market Sector

- March 2023: VFI Group partnered with US-based Setra Simmons to manufacture high-end bedding in India, establishing two units for luxury mattress production in the Indian market.

- January 2022: Sleep Number introduced upgrades to its 360 Smart Bed range, enhancing its ability to detect potential sleep problems like insomnia and sleep apnea.

In-Depth Bedding Market Market Outlook

The future outlook for the bedding market is exceptionally bright, underpinned by a strong foundation of innovation and evolving consumer demands. Growth accelerators such as the continuous development of advanced materials and smart sleep technologies will drive product differentiation and premiumization. The expansion into emerging markets, coupled with the increasing adoption of e-commerce and direct-to-consumer strategies, will broaden market reach and accessibility. Strategic collaborations among industry players and with technology providers will foster a dynamic ecosystem of product innovation. As global awareness of the importance of quality sleep intensifies, the demand for comfortable, healthy, and personalized bedding solutions is set to surge, positioning the market for sustained robust growth and significant future potential.

Bedding Market Segmentation

-

1. Type

- 1.1. Home Bedding

- 1.2. Hotel Bedding

-

2. Distribution Channel

- 2.1. Supermarkets / Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Bedding Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of the North America

-

2. Asia Pacific

- 2.1. India

- 2.2. China

- 2.3. Australia

- 2.4. Rest of the Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of the Middle East and Africa

Bedding Market Regional Market Share

Geographic Coverage of Bedding Market

Bedding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure

- 3.3. Market Restrains

- 3.3.1. Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid

- 3.4. Market Trends

- 3.4.1. Home Bedding is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bedding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Home Bedding

- 5.1.2. Hotel Bedding

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets / Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Bedding Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Home Bedding

- 6.1.2. Hotel Bedding

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets / Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Bedding Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Home Bedding

- 7.1.2. Hotel Bedding

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets / Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Bedding Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Home Bedding

- 8.1.2. Hotel Bedding

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets / Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Bedding Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Home Bedding

- 9.1.2. Hotel Bedding

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets / Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Bedding Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Home Bedding

- 10.1.2. Hotel Bedding

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets / Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The White Company Portico New York

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pacific Coast Feather Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bombay Dyeing

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Best Bed Linen Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American Textile Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Serena and Lily Inc **List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hollander Sleep Products LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Casper Sleep Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beaumont & Brown

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Crane & Canopy Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sleep Number Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Serta Simmons Bedding

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tempur Sealy International Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Boll and Branch LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 The White Company Portico New York

List of Figures

- Figure 1: Global Bedding Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Bedding Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Asia Pacific Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Asia Pacific Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Asia Pacific Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Asia Pacific Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Bedding Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Bedding Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Bedding Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Bedding Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Bedding Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Bedding Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Bedding Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Bedding Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Bedding Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Bedding Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of the North America Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: India Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: China Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Australia Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of the Asia Pacific Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of the Europe Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of the South America Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Bedding Market Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Bedding Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 32: Global Bedding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of the Middle East and Africa Bedding Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bedding Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Bedding Market?

Key companies in the market include The White Company Portico New York, Pacific Coast Feather Company, Bombay Dyeing, Best Bed Linen Ltd, American Textile Company, Serena and Lily Inc **List Not Exhaustive, Hollander Sleep Products LLC, Casper Sleep Inc, Beaumont & Brown, Crane & Canopy Inc, Sleep Number Corporation, Serta Simmons Bedding, Tempur Sealy International Inc, Boll and Branch LLC.

3. What are the main segments of the Bedding Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure.

6. What are the notable trends driving market growth?

Home Bedding is Dominating the Market.

7. Are there any restraints impacting market growth?

Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid.

8. Can you provide examples of recent developments in the market?

March 2023: VFI Group partnered with US-based Setra Simmons to manufacture high-end bedding in India. The collaboration includes setting up two units for manufacturing high-end luxury mattresses for the Indian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bedding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bedding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bedding Market?

To stay informed about further developments, trends, and reports in the Bedding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence