Key Insights

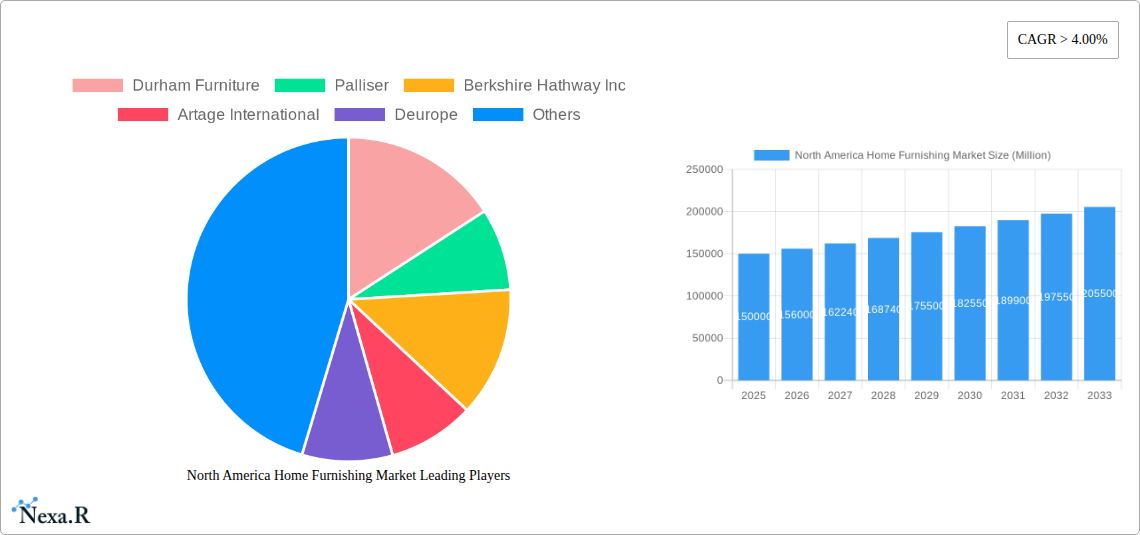

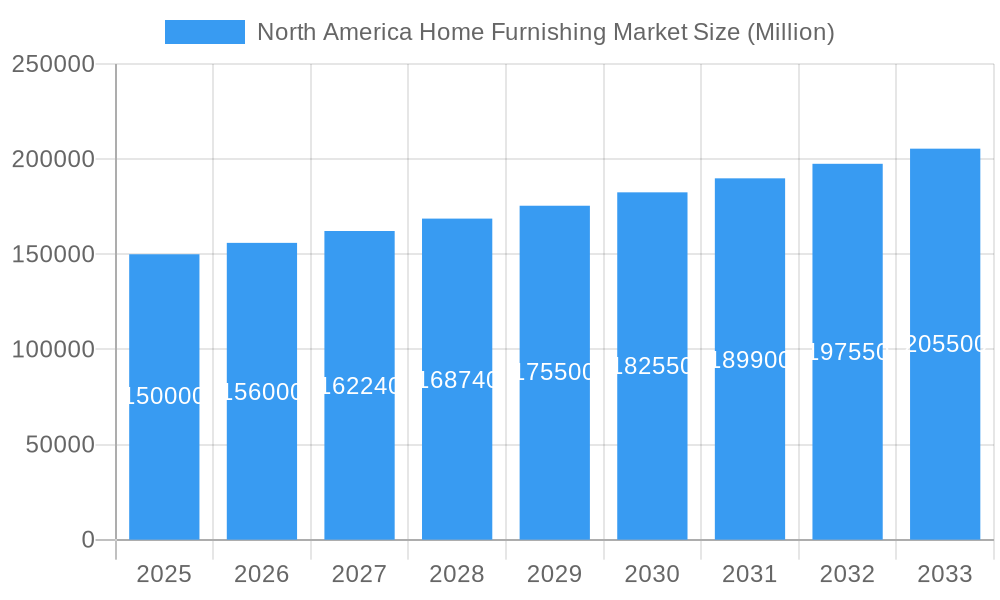

The North America Home Furnishing Market is poised for robust expansion, projecting a market size of approximately $150,000 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 4.00% through 2033. This growth is fueled by a confluence of factors, including increasing disposable incomes, a rising demand for aesthetically pleasing and functional living spaces, and a growing trend towards home renovation and personalization. The market is segmented across various furniture types, with Living Room Furniture, Dining Room Furniture, and Bedroom Furniture leading the demand. The increasing urbanization and the resultant smaller living spaces are driving innovation in multi-functional and space-saving furniture solutions. Furthermore, the growing awareness of sustainable living is prompting a shift towards eco-friendly materials like responsibly sourced wood and recycled plastics, presenting a significant opportunity for manufacturers. The distribution landscape is also evolving, with online channels witnessing substantial growth, complementing traditional retail formats like specialty stores and hypermarkets.

North America Home Furnishing Market Market Size (In Billion)

Key drivers underpinning this market growth include evolving consumer lifestyles, a heightened focus on interior design and home décor, and the sustained demand for durable and stylish furnishings. The "work from home" trend has further augmented the need for comfortable and ergonomic home office furniture, expanding the market's scope. However, the market also faces certain restraints, such as fluctuations in raw material prices, global supply chain disruptions, and intense competition among both established players and emerging brands. Despite these challenges, the North American home furnishing sector is demonstrating resilience and adaptability, with companies continually innovating to meet consumer preferences and capitalize on emerging trends. The geographical focus remains primarily on the United States and Canada, which represent the largest consumer bases and are expected to continue their strong performance in the coming years.

North America Home Furnishing Market Company Market Share

Here's a comprehensive, SEO-optimized report description for the North America Home Furnishing Market, incorporating your specific requirements:

This in-depth report provides a definitive analysis of the North America Home Furnishing Market, offering a granular look at market dynamics, growth trends, regional dominance, and key player strategies from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this research is crucial for stakeholders seeking to understand the evolution of the home furnishings market, furniture sales North America, and residential interior design trends. The report meticulously examines parent and child markets, providing insights into the broader industry and its specialized segments, with all values presented in Million units.

North America Home Furnishing Market Market Dynamics & Structure

The North America Home Furnishing Market is characterized by a dynamic interplay of factors influencing its structure and trajectory. Market concentration varies across segments, with some areas exhibiting consolidation among larger players like IKEA and Ashley Furniture Store, while others remain more fragmented. Technological innovation is a significant driver, particularly in areas like sustainable materials, smart furniture integration, and advanced manufacturing techniques. Regulatory frameworks, while generally supportive of consumer choice, can influence product safety standards and import/export policies, impacting companies like Durham Furniture and Palliser. Competitive product substitutes, ranging from DIY solutions to secondhand markets, constantly challenge established manufacturers. End-user demographics are shifting, with increasing demand for personalized, eco-friendly, and space-saving furniture solutions, particularly among millennial and Gen Z consumers. Mergers and acquisitions (M&A) trends are notable, with strategic consolidations aiming to expand market reach, diversify product portfolios, and enhance operational efficiencies for firms such as Berkshire Hathway Inc. (through its subsidiaries and investments) and Bassett Furniture.

- Market Concentration: Varies by furniture type and price point, with large retailers dominating mass-market segments.

- Technological Innovation: Focus on sustainable materials, smart home integration, and efficient production methods.

- Regulatory Frameworks: Influence product safety, environmental standards, and trade policies.

- Competitive Substitutes: DIY, upcycling, and the growing secondhand market.

- End-User Demographics: Growing demand for sustainable, personalized, and functional furniture.

- M&A Trends: Strategic acquisitions and partnerships to gain market share and competitive advantage.

North America Home Furnishing Market Growth Trends & Insights

The North America Home Furnishing Market is poised for robust growth, driven by a confluence of economic recovery, evolving consumer lifestyles, and a heightened focus on home improvement. The market size is projected to expand significantly, with adoption rates of new furniture styles and materials accelerating. Technological disruptions, such as e-commerce advancements and virtual interior design tools, are reshaping purchasing behaviors, making it easier for consumers to discover and acquire furniture from brands like La-Z-Boy and Rooms To Go. Consumer behavior shifts are particularly evident, with a growing emphasis on comfort, functionality, and aesthetic appeal in home spaces, fueled by increased remote work and a greater appreciation for domestic living. The adoption of sustainable and ethically sourced materials is also on the rise, influencing product development and marketing strategies for companies like American Eco Furniture LLC and MiseWell. The integration of smart technology into furniture is an emerging trend, offering convenience and enhanced living experiences.

- Market Size Evolution: Consistent upward trajectory driven by disposable income and housing market trends.

- Adoption Rates: Increasing acceptance of online purchasing and subscription-based furniture models.

- Technological Disruptions: E-commerce, AR/VR visualization, and smart furniture innovations.

- Consumer Behavior Shifts: Prioritization of comfort, sustainability, personalization, and well-being at home.

- Market Penetration: Deepening penetration across all segments, with online channels experiencing rapid growth.

- CAGR: Projected strong compound annual growth rate throughout the forecast period.

Dominant Regions, Countries, or Segments in North America Home Furnishing Market

The United States is the dominant region in the North America Home Furnishing Market, accounting for a substantial share of sales and demand. This dominance is driven by its large population, strong disposable income, and a mature housing market that consistently fuels demand for living room furniture, bedroom furniture, and dining room furniture. Economic policies that support consumer spending, coupled with extensive retail infrastructure, further solidify the US's leading position. Canada, while smaller in scale, represents a significant and growing market, influenced by similar consumer trends and a strong affinity for home décor.

Within segments, wood furniture continues to hold a significant share due to its durability, aesthetic appeal, and perceived value, with companies like Durham Furniture and Deurope specializing in this area. However, metal furniture is gaining traction for its modern design and versatility, particularly in urban living spaces. The specialty stores distribution channel remains crucial for high-end and customizable furniture, offering personalized service and expert advice. Simultaneously, the online & others distribution channel is experiencing exponential growth, driven by the convenience and wider selection offered by e-commerce platforms and direct-to-consumer brands like Ashley Furniture Store. The increasing demand for living room furniture, driven by evolving interior design trends and the importance of home as a central gathering space, is a key growth factor across the continent.

- Dominant Geography: United States, owing to its economic strength and consumer spending power.

- Key Market Drivers (US): High disposable income, robust housing market, and consumer preference for home improvement.

- Growing Market (Canada): Influenced by similar trends and a focus on quality home goods.

- Dominant Material: Wood, favored for its timeless appeal and durability.

- Emerging Material: Metal, gaining popularity for contemporary designs.

- Dominant Distribution Channel: Specialty Stores, offering curated selections and personalized service.

- Fastest Growing Distribution Channel: Online & Others, driven by e-commerce convenience.

- Dominant Furniture Type: Living Room Furniture, reflecting the evolving importance of home as a social and recreational hub.

North America Home Furnishing Market Product Landscape

The product landscape of the North America Home Furnishing Market is characterized by a diverse range of innovations focused on enhancing aesthetics, functionality, and sustainability. Manufacturers are increasingly incorporating eco-friendly materials and production processes, appealing to environmentally conscious consumers. Smart furniture, featuring integrated technology for charging, lighting, and connectivity, is a growing niche. Product applications span across residential, hospitality, and contract sectors, with bespoke and customizable options becoming more sought after. Performance metrics are increasingly being evaluated based on durability, ease of maintenance, and ergonomic design. Unique selling propositions often revolve around craftsmanship, design originality, and ethical sourcing. Technological advancements in material science and manufacturing are enabling lighter yet stronger furniture, as well as intricate designs previously unachievable.

Key Drivers, Barriers & Challenges in North America Home Furnishing Market

Key Drivers:

- Economic Growth and Disposable Income: Rising consumer spending power fuels demand for new furniture.

- Housing Market Activity: New home construction and renovations directly correlate with furniture purchases.

- Evolving Lifestyles: Increased time spent at home, remote work, and a focus on home comfort drive demand for functional and aesthetically pleasing furnishings.

- Technological Advancements: Innovations in materials, design software, and e-commerce enhance product offerings and accessibility.

- Sustainability Trends: Growing consumer preference for eco-friendly and ethically produced furniture.

Barriers & Challenges:

- Supply Chain Disruptions: Global logistics challenges and raw material availability can impact production timelines and costs for companies like Bermex.

- Raw Material Price Volatility: Fluctuations in the cost of wood, metal, and other materials can affect profitability.

- Intense Competition: A crowded market with both established players and emerging online retailers leads to pricing pressures.

- Changing Consumer Preferences: Rapid shifts in design trends require constant adaptation and product innovation.

- Economic Downturns: Recessions can significantly reduce discretionary spending on home furnishings.

- Regulatory Compliance: Adhering to evolving environmental and safety regulations can increase operational costs.

Emerging Opportunities in North America Home Furnishing Market

Emerging opportunities within the North America Home Furnishing Market lie in the growing demand for sustainable and circular economy furniture solutions, catering to eco-conscious consumers and businesses. The expansion of the rental and subscription furniture models presents a significant opportunity for increased market penetration, particularly among younger demographics and transient populations. Furthermore, the increasing integration of smart home technology into furniture offers a novel way to enhance user experience and create differentiated products. The aging population also presents an opportunity for furniture designed with enhanced ergonomics, comfort, and safety features. Finally, the continued growth of e-commerce and direct-to-consumer (DTC) channels allows for greater market reach and customer engagement for companies willing to adapt their business models.

Growth Accelerators in the North America Home Furnishing Market Industry

Several catalysts are accelerating long-term growth in the North America Home Furnishing Market. Technological breakthroughs in 3D printing and additive manufacturing are enabling the creation of highly customized and complex furniture designs at potentially lower costs. Strategic partnerships between furniture manufacturers and interior designers or technology companies are fostering innovation and creating unique value propositions. The expansion of off-price and discount retail channels, alongside the growing popularity of online marketplaces, is making furniture more accessible to a wider consumer base. Furthermore, a continued emphasis on home renovation and redecoration trends, spurred by media and social influences, provides a consistent demand driver. The increasing adoption of modular and multi-functional furniture is also appealing to consumers seeking to maximize space utility.

Key Players Shaping the North America Home Furnishing Market Market

- Durham Furniture

- Palliser

- Berkshire Hathway Inc.

- Artage International

- Deurope

- Ashley Furniture Store

- American Eco Furniture LLC

- MiseWell

- Bermex

- IKEA

- La-Z-Boy

- Rooms To Go

- Bassett Furniture

Notable Milestones in North America Home Furnishing Market Sector

- 2021: Berkshire Hathway Inc. disclosed a new, USD 99 million position in Floor & Decor and a USD 475 million stake in Royalty Pharma, indicating strategic investment in consumer-facing and healthcare-related sectors, which can indirectly influence home spending.

- 2021: Bassett Furniture Industries, Inc. announced a lease for a 123,000 square foot manufacturing facility in Newton, North Carolina, aimed at creating distinct production platforms for various product lines, including Everyday Value, Bench Made custom upholstery, domestic motion and reclining chairs, and outdoor furniture. This expansion signifies a commitment to domestic manufacturing and diversification of product capabilities.

In-Depth North America Home Furnishing Market Market Outlook

The North America Home Furnishing Market is set for sustained growth, propelled by resilient consumer demand and ongoing shifts in lifestyle preferences. Key growth accelerators include the increasing adoption of sustainable materials, the continued rise of e-commerce and DTC models, and innovations in smart furniture technology. The market's future potential is further bolstered by the steady demand from the housing sector and a growing consumer interest in home improvement and personalization. Strategic opportunities abound for companies that can effectively leverage digital channels, offer eco-friendly solutions, and adapt to evolving design aesthetics. The integration of advanced manufacturing techniques and a focus on customer experience will be crucial for navigating the competitive landscape and capitalizing on emerging trends in this dynamic market.

North America Home Furnishing Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Furniture

-

2. Type

- 2.1. Living Room Furniture

- 2.2. Dining Room Furniture

- 2.3. Bedroom Furniture

- 2.4. Kitchen Furniture

- 2.5. Other Furniture

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Wholesalers

- 3.4. Online & Others

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Home Furnishing Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Home Furnishing Market Regional Market Share

Geographic Coverage of North America Home Furnishing Market

North America Home Furnishing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. United States Witnessing Rising Demand for Home Furniture Due to Increased Construction Activity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Furnishing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Living Room Furniture

- 5.2.2. Dining Room Furniture

- 5.2.3. Bedroom Furniture

- 5.2.4. Kitchen Furniture

- 5.2.5. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Wholesalers

- 5.3.4. Online & Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. United States North America Home Furnishing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Wood

- 6.1.2. Metal

- 6.1.3. Plastic

- 6.1.4. Other Furniture

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Living Room Furniture

- 6.2.2. Dining Room Furniture

- 6.2.3. Bedroom Furniture

- 6.2.4. Kitchen Furniture

- 6.2.5. Other Furniture

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets & Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Wholesalers

- 6.3.4. Online & Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Canada North America Home Furnishing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Wood

- 7.1.2. Metal

- 7.1.3. Plastic

- 7.1.4. Other Furniture

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Living Room Furniture

- 7.2.2. Dining Room Furniture

- 7.2.3. Bedroom Furniture

- 7.2.4. Kitchen Furniture

- 7.2.5. Other Furniture

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets & Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Wholesalers

- 7.3.4. Online & Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Durham Furniture

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Palliser

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Berkshire Hathway Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Artage International

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Deurope

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Ashely Furniture Store

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 American Eco Furniture LLC**List Not Exhaustive

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 MiseWell

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Bermex

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 IKEA

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 La-Z-Boy

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Rooms To Go

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Bassett Furniture

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.1 Durham Furniture

List of Figures

- Figure 1: North America Home Furnishing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Home Furnishing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Home Furnishing Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: North America Home Furnishing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Home Furnishing Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Home Furnishing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Home Furnishing Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: North America Home Furnishing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Home Furnishing Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Home Furnishing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Home Furnishing Market Revenue Million Forecast, by Material 2020 & 2033

- Table 12: North America Home Furnishing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: North America Home Furnishing Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Home Furnishing Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Home Furnishing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Furnishing Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the North America Home Furnishing Market?

Key companies in the market include Durham Furniture, Palliser, Berkshire Hathway Inc, Artage International, Deurope, Ashely Furniture Store, American Eco Furniture LLC**List Not Exhaustive, MiseWell, Bermex, IKEA, La-Z-Boy, Rooms To Go, Bassett Furniture.

3. What are the main segments of the North America Home Furnishing Market?

The market segments include Material, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Activities; Increase in Demand for Luxury Vinyl Tiles is Driving the Market.

6. What are the notable trends driving market growth?

United States Witnessing Rising Demand for Home Furniture Due to Increased Construction Activity.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In 2021, Berkshire Hathway built new stakes in Floor & Decor and Royalty Pharma. It disclosed a new, USD 99 million position in Floor & Decor, a flooring retailer, and a USD 475 million stake in Royalty Pharma, which funds clinical trials in exchange for royalties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Furnishing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Furnishing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Furnishing Market?

To stay informed about further developments, trends, and reports in the North America Home Furnishing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence