Key Insights

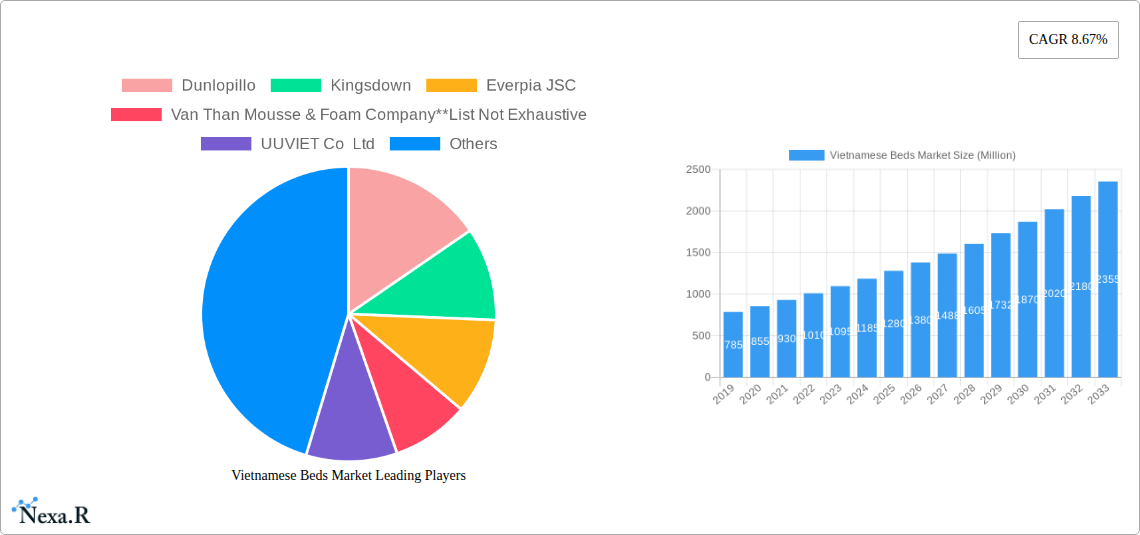

The Vietnamese beds market is poised for significant expansion, projected to reach an estimated market size of $1.18 billion by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 8.67% through 2033. This impressive trajectory is fueled by a confluence of key drivers, including a burgeoning middle class with increasing disposable incomes, a growing awareness of sleep health and its impact on overall well-being, and a sustained demand for comfortable and aesthetically pleasing bedroom furniture. The market is witnessing a distinct shift towards premium and specialized mattress types, with memory foam and latex segments showing considerable promise due to their perceived health benefits and enhanced comfort features. Furthermore, the increasing urbanization and the rise of nuclear families contribute to a steady demand for new bed purchases and replacements. The residential application segment remains the dominant force, reflecting the fundamental need for quality sleep within households.

Vietnamese Beds Market Market Size (In Million)

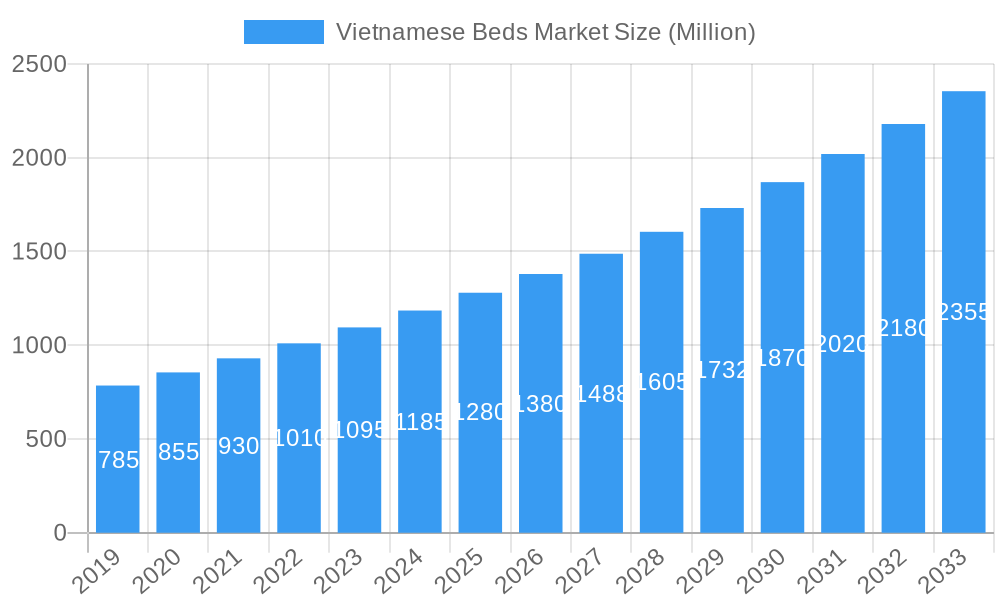

Several prevailing trends are shaping the Vietnamese beds market landscape. The online distribution channel is experiencing rapid growth, driven by the convenience of e-commerce and the increasing digital penetration in Vietnam. This allows consumers to easily compare options and access a wider range of products. Simultaneously, the offline channel continues to hold its ground, with consumers often preferring to physically test mattresses before making a purchase, especially for higher-value items. Innovations in mattress technology, such as cooling gels, adaptive support systems, and eco-friendly materials, are also becoming key differentiators. While the market enjoys strong growth, potential restraints include intense competition from both local and international players, fluctuations in raw material prices, and evolving consumer preferences that necessitate continuous product development and marketing efforts. Key players like Dunlopillo, Kingsdown, and Everpia JSC are actively investing in product innovation and expanding their distribution networks to capture a larger market share within this dynamic environment.

Vietnamese Beds Market Company Market Share

This comprehensive report offers an in-depth analysis of the Vietnamese Beds Market, providing critical insights into its dynamics, growth trajectory, and competitive environment. Spanning from 2019 to 2033, with a focus on the Base Year 2025 and a Forecast Period of 2025–2033, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this burgeoning sector. We cover key segments including Innerspring, Memory Foam, Latex, and Others beds, across Residential and Commercial applications, and analyze the impact of Online and Offline distribution channels. The report meticulously examines market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends. It also delves into market size evolution, adoption rates, technological disruptions, consumer behavior shifts, dominant regions, product innovations, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and the influential role of key players.

Vietnamese Beds Market Market Dynamics & Structure

The Vietnamese Beds Market is characterized by a growing demand for enhanced sleep solutions, driven by increasing disposable incomes and a rising awareness of the importance of quality sleep. Market concentration is moderately fragmented, with both established international brands and strong domestic players vying for market share. Technological innovation is a significant driver, with advancements in materials science leading to the development of more comfortable, durable, and health-conscious bedding options, such as advanced memory foam and sustainable latex materials. Regulatory frameworks are evolving to ensure product safety and quality standards, impacting manufacturing processes and material sourcing. Competitive product substitutes include traditional mattresses, futons, and even customized sleep solutions, though branded beds with specialized features are gaining prominence. End-user demographics are shifting towards younger, urbanized populations with a greater propensity to invest in premium home furnishings, including advanced bedding. Merger and acquisition (M&A) trends are anticipated to pick up as larger players seek to consolidate their market presence and acquire innovative technologies or distribution networks. The overall market is poised for dynamic shifts, influenced by evolving consumer preferences and strategic corporate actions.

- Market Concentration: Moderately fragmented with a mix of global and local manufacturers.

- Technological Innovation: Driven by advancements in memory foam, latex, and hybrid mattress technologies, focusing on comfort, support, and temperature regulation.

- Regulatory Frameworks: Increasing focus on product safety, material certifications, and environmental sustainability in bedding production.

- Competitive Product Substitutes: Traditional spring mattresses, futons, and emerging sleep aids.

- End-User Demographics: Growing demand from middle to upper-income households, urban dwellers, and younger consumers prioritizing health and wellness.

- M&A Trends: Potential for consolidation through acquisitions of smaller domestic players by larger entities or strategic alliances for market expansion.

Vietnamese Beds Market Growth Trends & Insights

The Vietnamese Beds Market is experiencing robust growth, fueled by a confluence of economic prosperity, urbanization, and a growing consumer consciousness regarding the significance of quality sleep for overall well-being. The market size is projected to expand at a significant Compound Annual Growth Rate (CAGR) throughout the forecast period, reflecting sustained consumer spending on home furnishings. Adoption rates for advanced bedding types, such as memory foam and latex mattresses, are steadily increasing as consumers move away from traditional innerspring options in pursuit of superior comfort and ergonomic support. Technological disruptions are playing a pivotal role, with innovations in material science, such as gel-infused memory foam for enhanced cooling and natural latex for breathability and hypoallergenic properties, driving product differentiation. Furthermore, the rise of direct-to-consumer (DTC) models and sophisticated online retail platforms is revolutionizing the distribution landscape, offering greater accessibility and convenience to a wider consumer base. Consumer behavior shifts are evident, with a discernible trend towards prioritizing health and wellness, leading to a greater willingness to invest in high-quality beds that promise restorative sleep. This increased demand is further bolstered by a growing middle class with higher disposable incomes, capable of affording premium bedding solutions. The market penetration of specialized bedding products is expected to deepen as awareness and availability continue to grow. The influence of global sleep trends and the increasing availability of information on sleep hygiene are also contributing to the market's upward trajectory.

Dominant Regions, Countries, or Segments in Vietnamese Beds Market

The Residential application segment is the dominant force driving the Vietnamese Beds Market, significantly outpacing the Commercial application sector. This dominance is primarily attributed to the burgeoning middle and upper-middle-class population, increased disposable incomes, and a growing emphasis on home comfort and personal well-being across Vietnam. The rising trend of home renovation and upgrading, coupled with a young demographic prioritizing modern living spaces, further propels demand for quality beds in households. Within the Type segment, Memory Foam beds are experiencing substantial growth due to their superior contouring, pressure relief, and durability, aligning with consumer demand for enhanced comfort and pain reduction. Latex beds are also gaining traction, appealing to health-conscious consumers seeking natural, hypoallergenic, and breathable options. While Innerspring beds retain a significant share due to their affordability and familiarity, their growth is outpaced by the innovative materials of memory foam and latex. The Offline distribution channel, encompassing furniture stores, specialty bedding retailers, and department stores, continues to hold a significant market share. However, the Online distribution channel is rapidly expanding its footprint, driven by e-commerce growth, digital marketing initiatives, and the convenience offered to consumers, particularly in urban centers. Economic policies supporting domestic manufacturing and trade, along with advancements in logistics and supply chain infrastructure, are crucial enablers of market expansion in key regions. Market share within residential application is substantial, estimated to be around 85% of the total market value. The growth potential for memory foam and latex segments is projected at a CAGR of over 10% in the coming years.

- Dominant Segment (Application): Residential application commands the largest market share.

- Drivers: Rising disposable incomes, increasing homeownership, and a growing focus on home comfort and sleep quality.

- Market Share: Estimated to be approximately 85% of the overall market value.

- Leading Segment (Type): Memory Foam and Latex segments are experiencing the fastest growth.

- Drivers: Consumer preference for enhanced comfort, ergonomic support, and health benefits (hypoallergenic, natural materials).

- Growth Potential: Projected CAGR exceeding 10% for Memory Foam and Latex.

- Distribution Channel Evolution: Offline channels remain dominant, but Online channels are exhibiting rapid expansion.

- Drivers: Convenience, wider product selection, and competitive pricing offered through e-commerce platforms.

Vietnamese Beds Market Product Landscape

The Vietnamese Beds Market product landscape is characterized by a growing emphasis on innovation aimed at enhancing sleep quality and addressing specific consumer needs. Manufacturers are increasingly integrating advanced materials and design features to differentiate their offerings. This includes the development of hybrid beds combining the support of innerspring systems with the comfort layers of memory foam and latex, offering a balanced sleeping experience. Temperature-regulating technologies, such as gel-infused foams and breathable covers, are becoming standard in premium models to combat heat retention. Ergonomic designs that promote spinal alignment and pressure point relief are also key selling points. Furthermore, there is a growing segment focused on eco-friendly and sustainable bedding, utilizing natural latex, organic cotton, and recycled materials, appealing to environmentally conscious consumers. The performance metrics being highlighted include durability, motion isolation, edge support, and breathability, with many brands investing in clinical studies and certifications to validate their claims.

Key Drivers, Barriers & Challenges in Vietnamese Beds Market

Key Drivers:

- Rising Disposable Incomes: A growing middle class with increased purchasing power is investing in higher-quality home furnishings, including premium beds.

- Health and Wellness Trend: Increased consumer awareness regarding the importance of quality sleep for overall health is driving demand for advanced bedding solutions.

- Urbanization and Modernization: Urban dwellers often seek comfortable and aesthetically pleasing home environments, leading to greater expenditure on beds.

- Product Innovation: Manufacturers are continuously introducing new materials and technologies (e.g., cooling gels, advanced memory foam) that appeal to consumers seeking comfort and specialized features.

- E-commerce Growth: The expansion of online retail channels provides wider accessibility and convenient purchasing options for a diverse range of bedding products.

Barriers & Challenges:

- Price Sensitivity: A significant portion of the population remains price-sensitive, limiting the adoption of high-end, premium beds.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of raw materials, affecting production timelines and pricing.

- Counterfeit Products: The presence of counterfeit or low-quality imitations can erode consumer trust and affect the market for genuine products.

- Limited Consumer Education: While awareness is growing, comprehensive understanding of the benefits of different mattress types and technologies is still developing in some segments.

- Logistical Challenges: Efficient delivery and installation of bulky items like mattresses can be challenging, particularly in less developed regions.

Emerging Opportunities in Vietnamese Beds Market

Emerging opportunities in the Vietnamese Beds Market lie in the burgeoning demand for personalized sleep solutions, catering to specific health conditions and individual preferences. The development of smart beds with integrated sleep tracking technology, adjustable firmness, and temperature control presents a significant growth avenue. The expansion of the commercial segment, particularly within the hospitality industry (hotels, resorts) and healthcare facilities (hospitals, elder care homes), offers untapped potential for bulk orders and specialized bedding requirements. Furthermore, a growing focus on sustainable and eco-friendly products, including mattresses made from natural and recycled materials, appeals to an increasingly environmentally conscious consumer base. The development of hybrid mattress models that combine the benefits of different materials to offer a versatile sleep experience also presents a compelling opportunity.

Growth Accelerators in the Vietnamese Beds Market Industry

Several catalysts are accelerating the growth of the Vietnamese Beds Market. Technological breakthroughs in material science, leading to more comfortable, durable, and health-beneficial mattresses, are a primary driver. Strategic partnerships between international brands and local manufacturers are facilitating market penetration and wider product availability. The increasing adoption of direct-to-consumer (DTC) sales models and the robust growth of e-commerce platforms are enhancing accessibility and driving sales volume. Furthermore, a heightened consumer awareness campaign by industry players and healthcare professionals highlighting the importance of quality sleep for physical and mental well-being is significantly boosting demand for premium bedding products.

Key Players Shaping the Vietnamese Beds Market Market

- Dunlopillo

- Kingsdown

- Everpia JSC

- Van Than Mousse & Foam Company

- UUVIET Co Ltd

- Catherine Denoual Maison

- Hava's Mattress

- Far East Foam

- Lien A Mattress

- KYMDAN

Notable Milestones in Vietnamese Beds Market Sector

- August 2022: Luxury bedding manufacturer Kingsdown, Inc. partnered with a new Malaysian licensee, Luxury Sleep Products Sdn. Bhd, a subsidiary of Rossi Design Marketing, Sdn. Bhd. The new partnership will manufacture and distribute several Kingsdown luxury collections throughout the region.

- May 2022: Luxury bedding manufacturer Kingsdown, the leading authority in sleep diagnostics, partnered with a physician, board-certified sleep specialist, and sleep coach, Dr. Angela Holliday-Bell, to bring the Kingsdown message—Sleep to Live—to life on social media.

In-Depth Vietnamese Beds Market Market Outlook

The Vietnamese Beds Market is poised for sustained and accelerated growth, driven by a combination of macro-economic factors and evolving consumer priorities. The increasing disposable incomes of a growing middle class, coupled with a heightened emphasis on health and wellness, will continue to fuel demand for premium and technologically advanced bedding solutions. Innovations in materials, such as advanced memory foams and natural latex, alongside the integration of smart sleep technologies, will further differentiate products and attract a wider consumer base. The expansion of both online and offline distribution channels will ensure greater market accessibility, while strategic partnerships and potential M&A activities will consolidate market presence and foster further innovation. The outlook for the Vietnamese Beds Market is exceptionally strong, indicating significant opportunities for market players to capitalize on the nation's evolving sleep culture.

Vietnamese Beds Market Segmentation

-

1. Type

- 1.1. Innerspring

- 1.2. Memory Foam

- 1.3. Latex

- 1.4. Others

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Vietnamese Beds Market Segmentation By Geography

- 1. Vietnam

Vietnamese Beds Market Regional Market Share

Geographic Coverage of Vietnamese Beds Market

Vietnamese Beds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Number of E-Commerce Users is Driving the Market; Increase in Residential Construction is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Low Replacement Demand

- 3.4. Market Trends

- 3.4.1. Growth in the Number of E-Commerce Users is Increasing the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnamese Beds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Innerspring

- 5.1.2. Memory Foam

- 5.1.3. Latex

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dunlopillo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kingsdown

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Everpia JSC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Van Than Mousse & Foam Company**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UUVIET Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Catherine Denoual Maison

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hava's Mattress

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Far East Foam

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lien A Mattress

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 KYMDAN

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dunlopillo

List of Figures

- Figure 1: Vietnamese Beds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnamese Beds Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnamese Beds Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Vietnamese Beds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Vietnamese Beds Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Vietnamese Beds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Vietnamese Beds Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Vietnamese Beds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Vietnamese Beds Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Vietnamese Beds Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnamese Beds Market?

The projected CAGR is approximately 8.67%.

2. Which companies are prominent players in the Vietnamese Beds Market?

Key companies in the market include Dunlopillo, Kingsdown, Everpia JSC, Van Than Mousse & Foam Company**List Not Exhaustive, UUVIET Co Ltd, Catherine Denoual Maison, Hava's Mattress, Far East Foam, Lien A Mattress, KYMDAN.

3. What are the main segments of the Vietnamese Beds Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Number of E-Commerce Users is Driving the Market; Increase in Residential Construction is Driving the Market.

6. What are the notable trends driving market growth?

Growth in the Number of E-Commerce Users is Increasing the Demand.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Low Replacement Demand.

8. Can you provide examples of recent developments in the market?

August 2022: Luxury bedding manufacturer Kingsdown, Inc. partnered with a new Malaysian licensee, Luxury Sleep Products Sdn. Bhd, a subsidiary of Rossi Design Marketing, Sdn. Bhd. The new partnership will manufacture and distribute several Kingsdown luxury collections throughout the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnamese Beds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnamese Beds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnamese Beds Market?

To stay informed about further developments, trends, and reports in the Vietnamese Beds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence