Key Insights

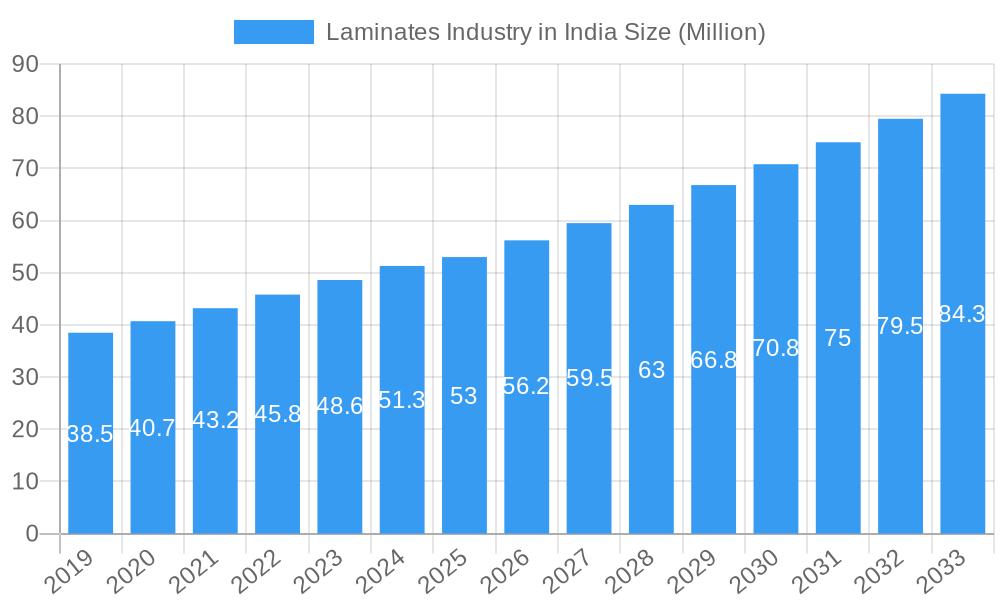

The Indian Laminates Industry is poised for significant expansion, with the market size projected to reach approximately USD 53 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 6.0% anticipated throughout the forecast period of 2025-2033. The industry's trajectory is largely propelled by escalating urbanization, a burgeoning middle class with increasing disposable incomes, and a heightened demand for aesthetically pleasing and durable interior design solutions across both residential and commercial sectors. Key drivers include the rising popularity of modular kitchens and furniture, a growing preference for cost-effective and low-maintenance alternatives to traditional materials like wood and tiles, and significant investments in infrastructure development and real estate projects, particularly in metropolitan areas. Furthermore, the increasing availability of a diverse product portfolio, encompassing high-density fiberboard (HDF) and medium-density fiberboard (MDF) laminated flooring, caters to a wide spectrum of consumer needs and preferences.

Laminates Industry in India Market Size (In Million)

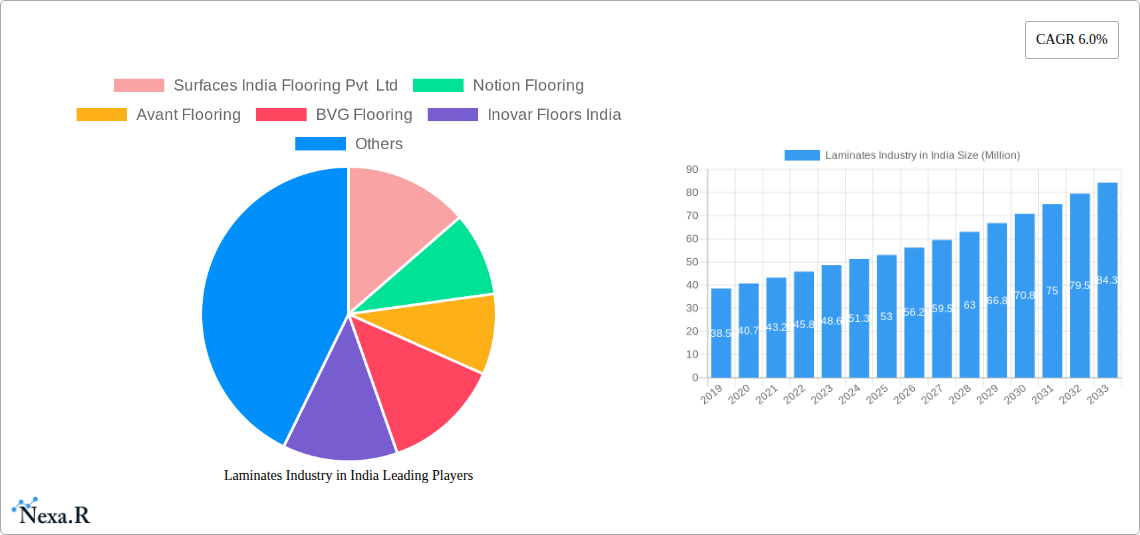

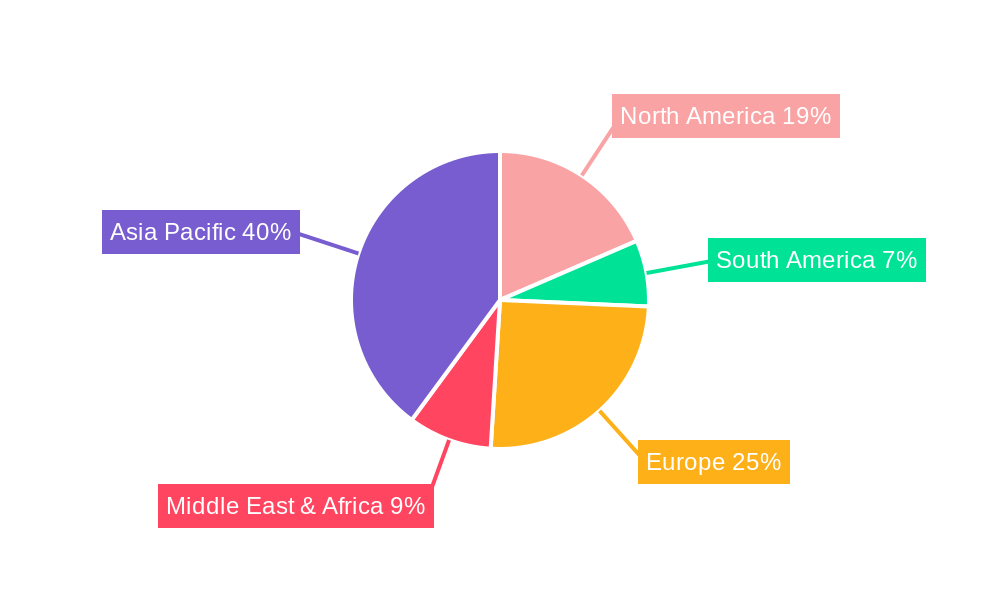

The industry is witnessing dynamic shifts driven by several key trends and presenting unique opportunities for market players. The rise of e-commerce and online distribution channels is transforming the way consumers discover and purchase laminate products, offering greater accessibility and convenience. Simultaneously, the expansion of offline retail networks, particularly in Tier 2 and Tier 3 cities, is crucial for broader market penetration. While the market is experiencing substantial growth, certain restraints warrant attention. Fluctuations in raw material prices, such as wood pulp and resins, can impact profitability. Additionally, intense competition from both domestic manufacturers and international brands necessitates continuous innovation in product design, quality, and sustainability. Companies like Surfaces India Flooring Pvt Ltd, Notion Flooring, Avant Flooring, BVG Flooring, Inovar Floors India, QuickStep, Marco Polo flooring, Pergo, Greenlam Industries, and Accord Floors are actively shaping this landscape through strategic investments in manufacturing, marketing, and product development, aiming to capture a larger share of this expanding market. The Asia Pacific region, led by China, India, and Japan, is expected to be a dominant force in the global laminates market.

Laminates Industry in India Company Market Share

This in-depth report provides a meticulous analysis of the Laminates Industry in India, offering unparalleled insights into market dynamics, growth trajectories, competitive landscapes, and future opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study is indispensable for stakeholders seeking to understand and capitalize on the burgeoning Indian laminate flooring market, residential laminate flooring, and commercial laminate flooring sectors. We delve into the nuances of High-density Fiberboard Laminated Flooring and Medium-density Fiberboard Laminated Flooring, examining their market share and adoption rates across diverse distribution channels, including offline laminate stores and online laminate sales.

Laminates Industry in India Market Dynamics & Structure

The Indian laminates industry is characterized by a moderately concentrated market, with key players actively investing in technological innovation to meet evolving consumer demands. Drivers of innovation include the development of more durable, water-resistant, and aesthetically pleasing laminate options, directly impacting the laminate flooring price and perceived value. Regulatory frameworks, primarily concerning environmental standards and product safety, are influencing manufacturing processes and material sourcing. Competitive product substitutes, such as vinyl flooring and engineered wood, present a constant challenge, necessitating continuous product differentiation and value proposition enhancement for laminate flooring manufacturers. End-user demographics are shifting, with a growing middle class driving demand for affordable yet stylish interior solutions. Mergers and acquisitions (M&A) are becoming more prevalent as larger companies seek to expand their product portfolios and market reach. For instance, the sector has witnessed X M&A deals in the historical period (2019-2024), indicating a consolidation trend.

- Market Concentration: Dominated by a few key manufacturers, but with increasing participation from smaller regional players.

- Technological Innovation: Focus on enhanced durability, water resistance, scratch resistance, and eco-friendly production methods.

- Regulatory Frameworks: Adherence to BIS standards and increasing emphasis on sustainable sourcing and manufacturing.

- Competitive Substitutes: Vinyl flooring, engineered wood, and natural stone pose significant competitive threats.

- End-User Demographics: Rising disposable incomes, urbanization, and a preference for modern interior aesthetics are key drivers.

- M&A Trends: Strategic acquisitions and partnerships are observed to gain market share and expand product offerings.

Laminates Industry in India Growth Trends & Insights

The laminates market in India is poised for significant expansion, driven by robust economic growth, increasing urbanization, and a burgeoning real estate sector. The study forecasts a Compound Annual Growth Rate (CAGR) of XX% for the Indian laminate flooring industry during the forecast period (2025-2033). Adoption rates for laminate flooring are steadily increasing, fueled by its cost-effectiveness, ease of installation, and wide variety of designs, making it a popular choice for both residential laminate flooring and commercial laminate flooring applications. Technological disruptions, such as advancements in printing techniques for realistic wood and stone patterns, along with improved wear layers, are enhancing the appeal and performance of laminate products. Consumer behavior is shifting towards seeking aesthetically pleasing, durable, and low-maintenance flooring solutions. The penetration rate of laminate flooring in the overall flooring market is projected to reach XX% by 2033, up from XX% in 2019. The increasing preference for DIY (Do-It-Yourself) installations is also boosting the adoption of click-lock laminate systems, further contributing to market growth. The laminate flooring market size in India is estimated to reach INR XXXX Million by 2033, showcasing a substantial upward trend.

Dominant Regions, Countries, or Segments in Laminates Industry in India

The Indian laminate flooring market is experiencing robust growth across various segments, with High-density Fiberboard (HDF) Laminated Flooring emerging as the dominant product type, holding an estimated XX% market share in 2025. This dominance is attributed to HDF's superior durability, moisture resistance, and dimensional stability compared to Medium-density Fiberboard (MDF) alternatives. In terms of end-user segments, Residential applications account for the largest share, estimated at XX% of the market in 2025, driven by a growing demand for affordable and aesthetically pleasing flooring solutions in new housing projects and renovations. The Commercial segment, encompassing offices, retail spaces, and hospitality, is also a significant contributor, projected to grow at a CAGR of XX% due to increasing corporate expansions and the demand for durable and low-maintenance flooring in high-traffic areas.

Geographically, Western India, particularly states like Maharashtra and Gujarat, currently leads the market, driven by strong economic activity, a high concentration of real estate development, and a significant urban population. However, the Northern Indian region, including states like Delhi NCR and Punjab, is rapidly gaining traction due to aggressive infrastructure development and a rising disposable income.

The Offline Stores distribution channel continues to dominate, accounting for approximately XX% of the market share in 2025, owing to the traditional consumer preference for in-person product evaluation and expert advice. Nevertheless, the Online Stores segment is exhibiting a faster growth rate, projected to grow at a CAGR of XX%, fueled by the increasing digital penetration and the convenience offered by e-commerce platforms. Key drivers for this segment's dominance include aggressive marketing campaigns by manufacturers and retailers, coupled with the availability of detailed product information and customer reviews online.

- Dominant Product Type: High-density Fiberboard Laminated Flooring (XX% market share in 2025).

- Superior durability and moisture resistance.

- Preferred for high-traffic areas and demanding environments.

- Dominant End User Segment: Residential (XX% market share in 2025).

- Driven by new housing construction and home renovation trends.

- Growing middle-class demand for stylish and affordable options.

- Leading Geographic Region: Western India.

- Strong economic base and extensive real estate development.

- High urban population driving demand.

- Dominant Distribution Channel: Offline Stores (XX% market share in 2025).

- Consumer preference for physical inspection and expert consultation.

- Established retail networks across cities.

Laminates Industry in India Product Landscape

The Indian laminates industry is characterized by continuous product innovation aimed at enhancing aesthetics, durability, and functionality. Manufacturers are increasingly focusing on developing laminates with superior scratch resistance, water repellency, and antimicrobial properties, catering to the diverse needs of both residential and commercial spaces. Advanced printing technologies enable highly realistic reproductions of natural materials like wood and stone, offering consumers a wider palette of design choices. The performance metrics for laminate flooring are steadily improving, with higher AC ratings (Abrasion Class) signifying enhanced wear resistance for high-traffic areas. Unique selling propositions often revolve around eco-friendly manufacturing processes and the use of sustainable materials.

Key Drivers, Barriers & Challenges in Laminates Industry in India

Key Drivers:

- Rising Disposable Incomes: Increased purchasing power of Indian households fuels demand for aesthetic and durable flooring solutions.

- Urbanization and Real Estate Boom: Rapid urbanization and a burgeoning construction sector, both residential and commercial, drive the need for flooring materials.

- Cost-Effectiveness: Laminate flooring offers a budget-friendly alternative to natural wood and stone, appealing to a broad consumer base.

- Aesthetic Versatility: A wide range of designs, patterns, and finishes allows for customization to suit diverse interior design preferences.

- Ease of Installation and Maintenance: The user-friendly click-lock systems and low maintenance requirements are attractive to consumers.

Barriers & Challenges:

- Competition from Substitutes: Vinyl flooring, engineered wood, and tiles offer stiff competition with their own unique advantages.

- Perception of Inferior Quality: Some consumers still perceive laminate as a less premium option compared to natural materials.

- Water and Moisture Sensitivity: Certain laminate products can be susceptible to damage from prolonged exposure to moisture, limiting their use in wet areas.

- Raw Material Price Volatility: Fluctuations in the prices of core raw materials like wood pulp and resins can impact manufacturing costs and final product pricing.

- Supply Chain Disruptions: Global and domestic supply chain issues can affect the availability and cost of raw materials and finished goods.

Emerging Opportunities in Laminates Industry in India

Emerging opportunities within the Indian laminates sector lie in the increasing demand for eco-friendly and sustainable flooring solutions. Manufacturers are exploring the use of recycled materials and developing products with lower VOC (Volatile Organic Compound) emissions to cater to environmentally conscious consumers. The growth of the hospitality and healthcare sectors presents significant opportunities for specialized laminate products with enhanced durability, hygiene properties, and fire-retardant features. Furthermore, the untapped potential of Tier II and Tier III cities, coupled with the growing influence of online sales channels, opens new avenues for market expansion and reaching a wider customer base. The development of innovative functionalities like integrated underlayment for enhanced sound insulation and comfort also presents a promising growth area.

Growth Accelerators in the Laminates Industry in India Industry

Long-term growth in the Indian laminates industry will be significantly accelerated by continuous technological advancements, strategic market expansion, and evolving consumer preferences. Breakthroughs in digital printing and embossing techniques are enabling the creation of hyper-realistic textures and patterns, blurring the lines between laminate and natural materials. Investments in research and development for enhanced moisture resistance and durability will further solidify laminate flooring's position in diverse applications. Strategic partnerships between manufacturers, distributors, and interior designers can create synergistic growth opportunities. Furthermore, the increasing focus on sustainable manufacturing practices and the development of formaldehyde-free laminates will resonate with a growing segment of environmentally aware consumers, driving market adoption and brand loyalty.

Key Players Shaping the Laminates Industry in India Market

- Surfaces India Flooring Pvt Ltd

- Notion Flooring

- Avant Flooring

- BVG Flooring

- Inovar Floors India

- QuickStep

- Marco Polo flooring

- Pergo

- Greenlam Industries

- Accord Floors

Notable Milestones in Laminates Industry in India Sector

- September 2022: BVG Flooring introduced Brown Laminated Sports Court Wooden Flooring for indoor use, catering to the specialized sports flooring market.

- January 2022: Notion, an India-headquartered company, launched its laminate flooring series, including the Suite, Loft, Basal, and Studio series, designed for both commercial and residential applications.

In-Depth Laminates Industry in India Market Outlook

The Indian laminates industry is set for a robust growth trajectory, driven by a confluence of favorable economic conditions, evolving consumer preferences, and ongoing technological advancements. Future market potential is immense, particularly in the residential and commercial construction sectors, where laminate flooring offers an attractive balance of aesthetics, durability, and affordability. Strategic opportunities lie in catering to the growing demand for sustainable and eco-friendly products, as well as expanding into emerging urban and semi-urban markets. The continued innovation in product design and performance, coupled with aggressive market penetration strategies by key players, will ensure sustained growth and increased market share for laminate flooring in India.

Laminates Industry in India Segmentation

-

1. Product Type

- 1.1. High-density Fiberboard Laminated Flooring

- 1.2. Medium-density Fiberboard Laminated Flooring

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Offline Stores

- 3.2. Online Stores

Laminates Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Laminates Industry in India Regional Market Share

Geographic Coverage of Laminates Industry in India

Laminates Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.0% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Urbanization and Population Growth

- 3.3. Market Restrains

- 3.3.1. Economic Uncertainty

- 3.4. Market Trends

- 3.4.1. Commercial Segment is Expected to Hold a Major Market Share in the Near Future

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laminates Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-density Fiberboard Laminated Flooring

- 5.1.2. Medium-density Fiberboard Laminated Flooring

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Stores

- 5.3.2. Online Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Laminates Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. High-density Fiberboard Laminated Flooring

- 6.1.2. Medium-density Fiberboard Laminated Flooring

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Stores

- 6.3.2. Online Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Laminates Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. High-density Fiberboard Laminated Flooring

- 7.1.2. Medium-density Fiberboard Laminated Flooring

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Stores

- 7.3.2. Online Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Laminates Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. High-density Fiberboard Laminated Flooring

- 8.1.2. Medium-density Fiberboard Laminated Flooring

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Stores

- 8.3.2. Online Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Laminates Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. High-density Fiberboard Laminated Flooring

- 9.1.2. Medium-density Fiberboard Laminated Flooring

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Stores

- 9.3.2. Online Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Laminates Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. High-density Fiberboard Laminated Flooring

- 10.1.2. Medium-density Fiberboard Laminated Flooring

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Offline Stores

- 10.3.2. Online Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Surfaces India Flooring Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Notion Flooring

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Avant Flooring

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BVG Flooring

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Inovar Floors India

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 QuickStep

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Marco Polo flooring

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pergo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Greenlam Industries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accord Floors

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Surfaces India Flooring Pvt Ltd

List of Figures

- Figure 1: Global Laminates Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Laminates Industry in India Volume Breakdown (Squar foot, %) by Region 2025 & 2033

- Figure 3: North America Laminates Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Laminates Industry in India Volume (Squar foot), by Product Type 2025 & 2033

- Figure 5: North America Laminates Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Laminates Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Laminates Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 8: North America Laminates Industry in India Volume (Squar foot), by End User 2025 & 2033

- Figure 9: North America Laminates Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Laminates Industry in India Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Laminates Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: North America Laminates Industry in India Volume (Squar foot), by Distribution Channel 2025 & 2033

- Figure 13: North America Laminates Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Laminates Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Laminates Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Laminates Industry in India Volume (Squar foot), by Country 2025 & 2033

- Figure 17: North America Laminates Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Laminates Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Laminates Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 20: South America Laminates Industry in India Volume (Squar foot), by Product Type 2025 & 2033

- Figure 21: South America Laminates Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Laminates Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 23: South America Laminates Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 24: South America Laminates Industry in India Volume (Squar foot), by End User 2025 & 2033

- Figure 25: South America Laminates Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 26: South America Laminates Industry in India Volume Share (%), by End User 2025 & 2033

- Figure 27: South America Laminates Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: South America Laminates Industry in India Volume (Squar foot), by Distribution Channel 2025 & 2033

- Figure 29: South America Laminates Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America Laminates Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America Laminates Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Laminates Industry in India Volume (Squar foot), by Country 2025 & 2033

- Figure 33: South America Laminates Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Laminates Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Laminates Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 36: Europe Laminates Industry in India Volume (Squar foot), by Product Type 2025 & 2033

- Figure 37: Europe Laminates Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Europe Laminates Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Europe Laminates Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 40: Europe Laminates Industry in India Volume (Squar foot), by End User 2025 & 2033

- Figure 41: Europe Laminates Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 42: Europe Laminates Industry in India Volume Share (%), by End User 2025 & 2033

- Figure 43: Europe Laminates Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Europe Laminates Industry in India Volume (Squar foot), by Distribution Channel 2025 & 2033

- Figure 45: Europe Laminates Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Europe Laminates Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Europe Laminates Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Laminates Industry in India Volume (Squar foot), by Country 2025 & 2033

- Figure 49: Europe Laminates Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Laminates Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Laminates Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Middle East & Africa Laminates Industry in India Volume (Squar foot), by Product Type 2025 & 2033

- Figure 53: Middle East & Africa Laminates Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East & Africa Laminates Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East & Africa Laminates Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 56: Middle East & Africa Laminates Industry in India Volume (Squar foot), by End User 2025 & 2033

- Figure 57: Middle East & Africa Laminates Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 58: Middle East & Africa Laminates Industry in India Volume Share (%), by End User 2025 & 2033

- Figure 59: Middle East & Africa Laminates Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 60: Middle East & Africa Laminates Industry in India Volume (Squar foot), by Distribution Channel 2025 & 2033

- Figure 61: Middle East & Africa Laminates Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Middle East & Africa Laminates Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa Laminates Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa Laminates Industry in India Volume (Squar foot), by Country 2025 & 2033

- Figure 65: Middle East & Africa Laminates Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Laminates Industry in India Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Laminates Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 68: Asia Pacific Laminates Industry in India Volume (Squar foot), by Product Type 2025 & 2033

- Figure 69: Asia Pacific Laminates Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Asia Pacific Laminates Industry in India Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Asia Pacific Laminates Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 72: Asia Pacific Laminates Industry in India Volume (Squar foot), by End User 2025 & 2033

- Figure 73: Asia Pacific Laminates Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 74: Asia Pacific Laminates Industry in India Volume Share (%), by End User 2025 & 2033

- Figure 75: Asia Pacific Laminates Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 76: Asia Pacific Laminates Industry in India Volume (Squar foot), by Distribution Channel 2025 & 2033

- Figure 77: Asia Pacific Laminates Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Asia Pacific Laminates Industry in India Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific Laminates Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific Laminates Industry in India Volume (Squar foot), by Country 2025 & 2033

- Figure 81: Asia Pacific Laminates Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Laminates Industry in India Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Laminates Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Laminates Industry in India Volume Squar foot Forecast, by Product Type 2020 & 2033

- Table 3: Global Laminates Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Laminates Industry in India Volume Squar foot Forecast, by End User 2020 & 2033

- Table 5: Global Laminates Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Laminates Industry in India Volume Squar foot Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Laminates Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Laminates Industry in India Volume Squar foot Forecast, by Region 2020 & 2033

- Table 9: Global Laminates Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Laminates Industry in India Volume Squar foot Forecast, by Product Type 2020 & 2033

- Table 11: Global Laminates Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Laminates Industry in India Volume Squar foot Forecast, by End User 2020 & 2033

- Table 13: Global Laminates Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Laminates Industry in India Volume Squar foot Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Laminates Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Laminates Industry in India Volume Squar foot Forecast, by Country 2020 & 2033

- Table 17: United States Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 19: Canada Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 21: Mexico Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 23: Global Laminates Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Laminates Industry in India Volume Squar foot Forecast, by Product Type 2020 & 2033

- Table 25: Global Laminates Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Laminates Industry in India Volume Squar foot Forecast, by End User 2020 & 2033

- Table 27: Global Laminates Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Laminates Industry in India Volume Squar foot Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Laminates Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Laminates Industry in India Volume Squar foot Forecast, by Country 2020 & 2033

- Table 31: Brazil Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 33: Argentina Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 37: Global Laminates Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Laminates Industry in India Volume Squar foot Forecast, by Product Type 2020 & 2033

- Table 39: Global Laminates Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 40: Global Laminates Industry in India Volume Squar foot Forecast, by End User 2020 & 2033

- Table 41: Global Laminates Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Laminates Industry in India Volume Squar foot Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Laminates Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Laminates Industry in India Volume Squar foot Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 47: Germany Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 49: France Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 51: Italy Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 53: Spain Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 55: Russia Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 57: Benelux Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 59: Nordics Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 63: Global Laminates Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 64: Global Laminates Industry in India Volume Squar foot Forecast, by Product Type 2020 & 2033

- Table 65: Global Laminates Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 66: Global Laminates Industry in India Volume Squar foot Forecast, by End User 2020 & 2033

- Table 67: Global Laminates Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 68: Global Laminates Industry in India Volume Squar foot Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global Laminates Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Laminates Industry in India Volume Squar foot Forecast, by Country 2020 & 2033

- Table 71: Turkey Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 73: Israel Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 75: GCC Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 77: North Africa Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 79: South Africa Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 83: Global Laminates Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 84: Global Laminates Industry in India Volume Squar foot Forecast, by Product Type 2020 & 2033

- Table 85: Global Laminates Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 86: Global Laminates Industry in India Volume Squar foot Forecast, by End User 2020 & 2033

- Table 87: Global Laminates Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 88: Global Laminates Industry in India Volume Squar foot Forecast, by Distribution Channel 2020 & 2033

- Table 89: Global Laminates Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global Laminates Industry in India Volume Squar foot Forecast, by Country 2020 & 2033

- Table 91: China Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 93: India Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 95: Japan Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 97: South Korea Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 101: Oceania Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Laminates Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Laminates Industry in India Volume (Squar foot) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laminates Industry in India?

The projected CAGR is approximately 6.0%.

2. Which companies are prominent players in the Laminates Industry in India?

Key companies in the market include Surfaces India Flooring Pvt Ltd, Notion Flooring, Avant Flooring, BVG Flooring, Inovar Floors India, QuickStep, Marco Polo flooring, Pergo, Greenlam Industries, Accord Floors.

3. What are the main segments of the Laminates Industry in India?

The market segments include Product Type, End User , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 53 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Urbanization and Population Growth.

6. What are the notable trends driving market growth?

Commercial Segment is Expected to Hold a Major Market Share in the Near Future.

7. Are there any restraints impacting market growth?

Economic Uncertainty.

8. Can you provide examples of recent developments in the market?

September 2022: BVG Flooring now offers Brown Laminated Sports Court Wooden Flooring For Indoor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Squar foot.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laminates Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laminates Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laminates Industry in India?

To stay informed about further developments, trends, and reports in the Laminates Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence