Key Insights

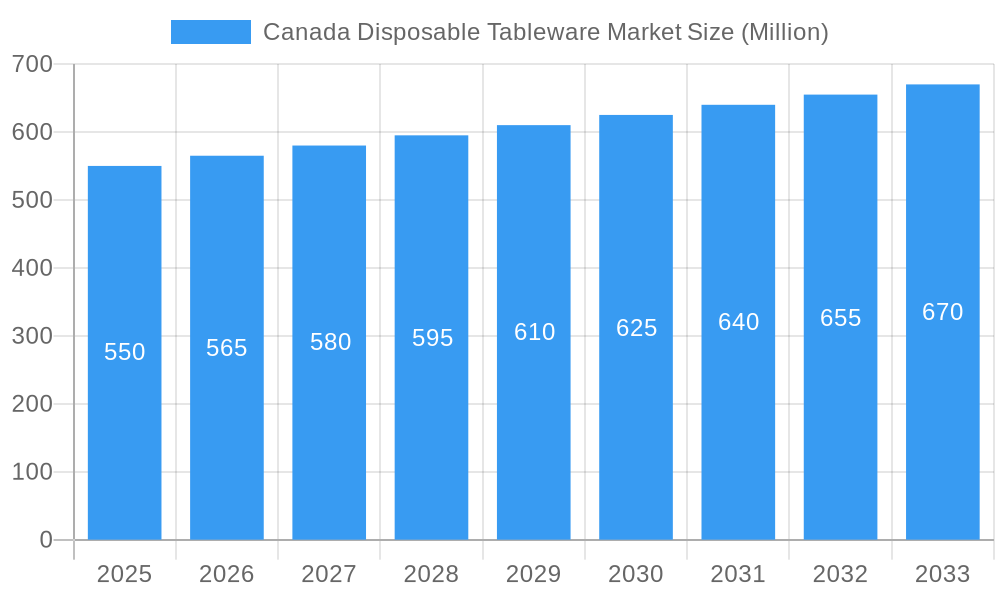

The Canadian disposable tableware market is projected for robust expansion, anticipating a Compound Annual Growth Rate (CAGR) of 4.3%. While precise Canadian market size data is unavailable, industry analysis suggests a substantial market value, estimated at 12.7 billion. This growth, based on the 2025 base year, is predominantly driven by escalating demand for convenience in the residential sector and the operational efficiency and hygiene benefits sought by commercial entities, including food service providers, caterers, and event planners. The increasing adoption of convenience-oriented lifestyles and the thriving food delivery and takeout culture are significant growth catalysts. Furthermore, distribution channels are diversifying, with a notable increase in online sales complementing traditional retail outlets, reflecting evolving consumer purchasing behaviors.

Canada Disposable Tableware Market Market Size (In Billion)

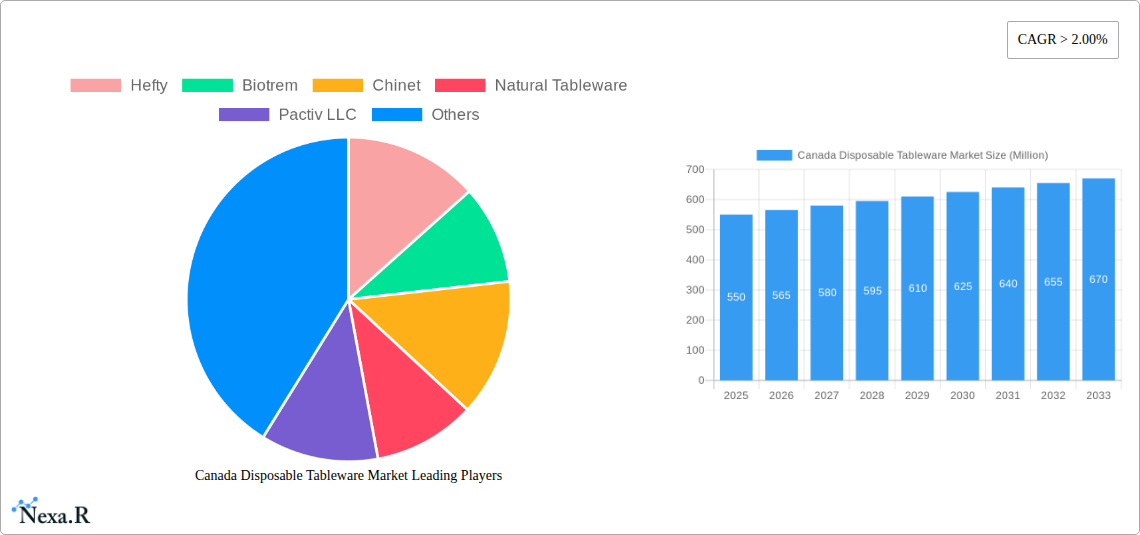

While the market exhibits positive growth, environmental concerns and rising consumer awareness of the ecological impact of single-use plastics present a key challenge. This trend is spurring innovation towards sustainable alternatives, including biodegradable and compostable materials, influencing product development and segmentation. Disposable cups continue to lead the market, followed by plates and bowls, supported by the growth in ready-to-eat meals and takeout. The "Other Product Types" segment, encompassing cutlery and specialized containers, is also expected to grow as businesses seek comprehensive disposable solutions. Leading companies such as Hefty, Chinet, Huhtamaki Oyj, and Dart Container Corporation are actively innovating and strategically expanding their market presence to address these evolving dynamics.

Canada Disposable Tableware Market Company Market Share

This report offers a comprehensive, SEO-optimized analysis of the Canada Disposable Tableware Market, detailing its size, growth trajectory, and future forecasts.

Canada Disposable Tableware Market Market Dynamics & Structure

The Canada disposable tableware market exhibits a moderate to high concentration, with key players like Hefty, Chinet, Pactiv LLC, Dixie, and Dart Container Corporation holding significant market share. Technological innovation is a key driver, with advancements in biodegradable and compostable materials significantly influencing product development and consumer adoption. Regulatory frameworks, particularly those surrounding single-use plastics and waste management, are increasingly shaping market dynamics, encouraging a shift towards sustainable alternatives. Competitive product substitutes, ranging from reusable tableware to eco-friendly disposable options, present a dynamic competitive landscape. End-user demographics are evolving, with a growing segment of environmentally conscious consumers and increased demand from commercial sectors such as food service and hospitality. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and expansion. For instance, the past few years have seen several strategic acquisitions aimed at expanding product portfolios and distribution networks. Barriers to innovation include the cost of developing and scaling new sustainable materials, along with consumer price sensitivity for certain segments. The market is anticipated to witness a strategic acquisition volume of approximately 3-5 deals annually over the forecast period, indicating continued consolidation.

- Market Concentration: Moderate to High.

- Technological Innovation Drivers: Biodegradable & Compostable Materials, Enhanced Durability, Aesthetic Appeal.

- Regulatory Frameworks: Single-use Plastic Bans, Waste Reduction Initiatives, Sustainable Sourcing Mandates.

- Competitive Product Substitutes: Reusable Tableware, Bamboo Tableware, Palm Leaf Plates.

- End-User Demographics: Environmentally Conscious Consumers, Busy Households, Foodservice Establishments, Event Organizers.

- M&A Trends: Consolidation for Market Share, Portfolio Diversification, Supply Chain Integration.

Canada Disposable Tableware Market Growth Trends & Insights

The Canada disposable tableware market is poised for robust growth, driven by a confluence of evolving consumer preferences, expanding end-use applications, and ongoing technological advancements. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2025 to 2033, reflecting a sustained upward trajectory. This growth is underpinned by increasing adoption rates of convenient and hygienic disposable solutions across residential and commercial sectors. The base year 2025 is estimated to see a market value of around $XXX Million units, with a projected increase to over $YYY Million units by 2033. Technological disruptions, particularly in the development of novel, eco-friendly materials like sugarcane bagasse, bamboo, and polylactic acid (PLA), are significantly influencing market penetration. These innovations are not only addressing environmental concerns but also offering superior performance characteristics, such as heat resistance and durability. Consumer behavior shifts are pivotal, with a growing emphasis on convenience and hygiene, especially in the post-pandemic era. This is evident in the rising demand for individually packaged disposable tableware and an increasing willingness among consumers to pay a premium for sustainable options. The foodservice industry, including restaurants, cafes, and catering services, represents a significant driver of this growth, with an escalating need for efficient and hygienic serving solutions. Furthermore, the convenience of online distribution channels is facilitating wider market access and catering to the demand for on-demand purchasing. The market penetration of compostable and biodegradable tableware is expected to surge from an estimated 25% in 2025 to over 45% by 2033. The influence of social media and public awareness campaigns on environmental sustainability is also playing a crucial role in shaping purchasing decisions, further accelerating the adoption of eco-friendly disposable tableware. The increasing frequency of outdoor events, picnics, and gatherings further fuels the demand for single-use tableware, emphasizing its role in modern lifestyles.

Dominant Regions, Countries, or Segments in Canada Disposable Tableware Market

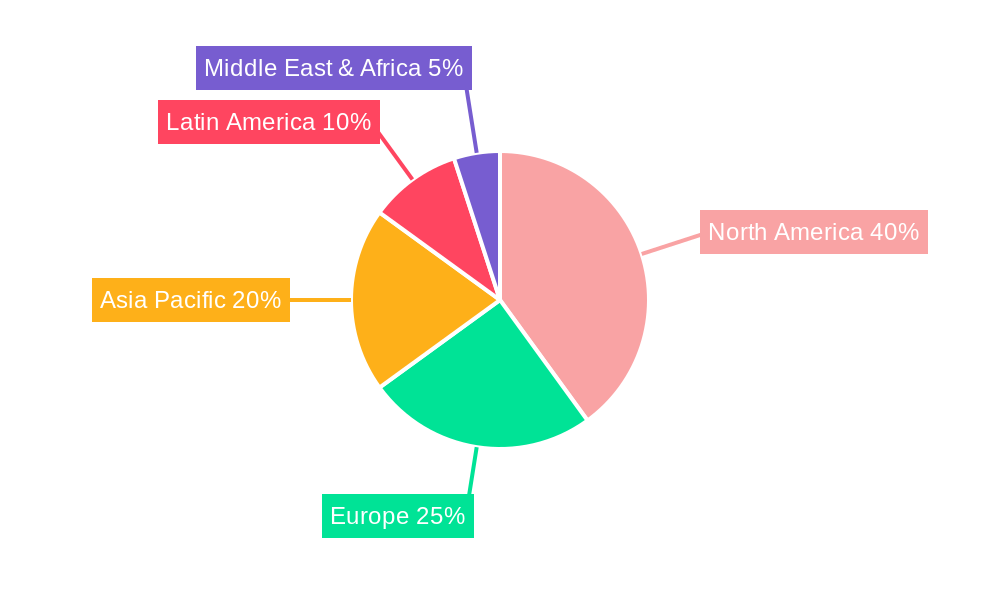

The Commercial Application segment is anticipated to be the dominant force driving growth within the Canada disposable tableware market. This dominance is propelled by a multifaceted set of factors, including escalating demand from the foodservice industry, burgeoning event management sector, and the increasing adoption of disposable tableware in healthcare and institutional settings. For instance, the Canadian foodservice industry, encompassing restaurants, fast-food chains, cafes, and catering services, relies heavily on disposable tableware for operational efficiency, hygiene, and cost-effectiveness. With an estimated 45% share of the overall market in 2025, the commercial application segment is projected to grow at a CAGR of 5.5% over the forecast period. Economic policies and infrastructure supporting a robust food service sector directly translate into sustained demand for disposable tableware. Furthermore, the growing trend of outdoor dining and the proliferation of food trucks and pop-up eateries further amplify this demand.

Within Product Type, Disposable Cups are expected to hold the largest market share, estimated at 30% in 2025, due to their ubiquitous use in beverages and their role in takeaway services. However, Disposable Plates are anticipated to exhibit the highest growth rate, driven by an increasing preference for convenient meal solutions and the rise of ready-to-eat meals.

In terms of Distribution Channels, Hypermarkets and Supermarkets are projected to maintain their lead, accounting for approximately 40% of sales in 2025, owing to their widespread reach and ability to cater to both residential and commercial bulk purchases. The Online distribution channel, however, is poised for the most significant expansion, with an estimated CAGR of 8.0%, driven by increasing e-commerce penetration and the convenience of home delivery for both consumers and businesses.

- Dominant Application: Commercial, driven by foodservice, events, and institutional needs.

- Leading Product Type (by share): Disposable Cups.

- Fastest Growing Product Type: Disposable Plates.

- Dominant Distribution Channel: Hypermarkets and Supermarkets.

- Fastest Growing Distribution Channel: Online.

- Key Drivers for Commercial Dominance: Operational efficiency, hygiene standards, cost-effectiveness, event catering demand, takeaway services.

Canada Disposable Tableware Market Product Landscape

The product landscape of the Canada disposable tableware market is characterized by continuous innovation aimed at enhancing sustainability, functionality, and aesthetic appeal. Leading companies are actively investing in the development of compostable and biodegradable materials derived from renewable resources such as bamboo, sugarcane bagasse, cornstarch, and palm leaves. These materials offer comparable or superior performance to traditional plastic and paper-based products in terms of durability, heat resistance, and leak-proof capabilities. Unique selling propositions now often center on eco-certifications and the ability to biodegrade or compost within a specified timeframe. Technological advancements are also focusing on improving the visual appeal of disposable tableware, with a growing range of designs, colors, and finishes catering to diverse consumer and commercial needs.

Key Drivers, Barriers & Challenges in Canada Disposable Tableware Market

Key Drivers:

- Growing Environmental Consciousness: Increasing consumer and governmental awareness regarding the environmental impact of single-use plastics is a primary driver, pushing demand for sustainable alternatives.

- Convenience and Hygiene Demands: The fast-paced lifestyle and heightened focus on hygiene, particularly post-pandemic, continue to fuel the demand for disposable tableware in both residential and commercial settings.

- Growth in Foodservice and HoReCa Sector: The expansion of the food and beverage industry, including restaurants, cafes, and catering services, necessitates a steady supply of disposable tableware.

- Technological Advancements in Sustainable Materials: Innovations in biodegradable and compostable materials are making eco-friendly options more viable and appealing.

Key Barriers & Challenges:

- Cost Competitiveness: Sustainable disposable tableware can often be more expensive than traditional plastic alternatives, posing a challenge for price-sensitive consumers and businesses.

- Infrastructure for Composting/Recycling: Inadequate public infrastructure for composting and effective recycling of certain biodegradable materials can hinder their widespread adoption.

- Consumer Perception and Education: Misconceptions about the environmental benefits and disposal methods of certain biodegradable products can create barriers.

- Regulatory Uncertainty and Varying Policies: Evolving regulations across different Canadian municipalities and provinces regarding single-use items can create complexity for manufacturers and distributors. Supply chain disruptions and fluctuations in raw material prices also present ongoing challenges.

Emerging Opportunities in Canada Disposable Tableware Market

Emerging opportunities in the Canada disposable tableware market lie in the innovation of truly circular economy solutions, such as compostable tableware designed for industrial composting facilities that are becoming more prevalent. Untapped markets include specialized event catering for eco-conscious weddings and corporate events, as well as supplying durable, attractive disposable options for remote workforces and extended stay accommodations. Evolving consumer preferences are also creating opportunities for niche product lines, such as premium, aesthetically pleasing disposable tableware made from recycled materials for home entertaining.

Growth Accelerators in the Canada Disposable Tableware Market Industry

Growth accelerators for the Canada disposable tableware market are primarily technology-driven and market-expansion focused. The ongoing development of advanced bioplastics and plant-based composites with enhanced performance characteristics, such as heat resistance and water repellency, will significantly broaden their applicability. Strategic partnerships between tableware manufacturers and raw material suppliers are crucial for ensuring a stable and cost-effective supply of sustainable inputs. Furthermore, market expansion through targeted marketing campaigns that highlight the environmental benefits and convenience of eco-friendly disposable tableware to both consumers and businesses will be a key catalyst for sustained growth.

Key Players Shaping the Canada Disposable Tableware Market Market

- Hefty

- Biotrem

- Chinet

- Natural Tableware

- Pactiv LLC

- Dixie

- Huhtamaki Oyj

- Dart Container Corporation

- Solo

Notable Milestones in Canada Disposable Tableware Market Sector

- 2022 March: Introduction of stricter single-use plastic regulations by several Canadian provinces, significantly impacting the market for conventional plastic tableware and boosting demand for alternatives.

- 2021 September: Key players like Pactiv LLC and Dart Container Corporation invest heavily in R&D for compostable and plant-based disposable tableware materials.

- 2020 April: Increased demand for single-use food service items due to the COVID-19 pandemic, highlighting hygiene concerns and the need for disposable solutions.

- 2019 December: Growing consumer awareness campaigns about plastic pollution lead to a noticeable shift in purchasing preferences towards eco-friendly disposable tableware.

In-Depth Canada Disposable Tableware Market Market Outlook

The Canada disposable tableware market is set for a transformative growth trajectory, fueled by a strong commitment to sustainability and evolving consumer habits. Growth accelerators will largely stem from advancements in biodegradable and compostable materials, alongside strategic collaborations that enhance supply chain resilience and cost-effectiveness. The market outlook points towards a significant rise in the adoption of eco-friendly alternatives, driven by robust regulatory support and increasing consumer demand for responsible consumption. This presents lucrative opportunities for innovation and market penetration for companies aligning with these critical trends.

Canada Disposable Tableware Market Segmentation

-

1. Product Type

- 1.1. Disposable Cups

- 1.2. Disposable Plates

- 1.3. Disposable Bowls

- 1.4. Disposable Silverware

- 1.5. Other Product Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Hypermarkets and Supermarkets

- 3.2. Convenience Stores

- 3.3. Online

- 3.4. Others

Canada Disposable Tableware Market Segmentation By Geography

- 1. Canada

Canada Disposable Tableware Market Regional Market Share

Geographic Coverage of Canada Disposable Tableware Market

Canada Disposable Tableware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Population is Expected to Drive the Growth of this Market4.; Increased Demand for Modern Kitchen Design

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Costs

- 3.4. Market Trends

- 3.4.1. Rising consumer preference for bio-degradable tableware

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Disposable Tableware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Disposable Cups

- 5.1.2. Disposable Plates

- 5.1.3. Disposable Bowls

- 5.1.4. Disposable Silverware

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets and Supermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hefty

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Biotrem

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chinet

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Natural Tableware

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pactiv LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dixie

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Huhtamaki Oyj

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dart Container Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hefty

List of Figures

- Figure 1: Canada Disposable Tableware Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Disposable Tableware Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Disposable Tableware Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Canada Disposable Tableware Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Canada Disposable Tableware Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Canada Disposable Tableware Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Canada Disposable Tableware Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Canada Disposable Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Canada Disposable Tableware Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Canada Disposable Tableware Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Canada Disposable Tableware Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Canada Disposable Tableware Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Canada Disposable Tableware Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Canada Disposable Tableware Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Canada Disposable Tableware Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Canada Disposable Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Canada Disposable Tableware Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Canada Disposable Tableware Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Disposable Tableware Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Canada Disposable Tableware Market?

Key companies in the market include Hefty, Biotrem, Chinet, Natural Tableware, Pactiv LLC, Dixie, Huhtamaki Oyj, Dart Container Corporation, Solo.

3. What are the main segments of the Canada Disposable Tableware Market?

The market segments include Product Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.7 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Population is Expected to Drive the Growth of this Market4.; Increased Demand for Modern Kitchen Design.

6. What are the notable trends driving market growth?

Rising consumer preference for bio-degradable tableware.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Disposable Tableware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Disposable Tableware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Disposable Tableware Market?

To stay informed about further developments, trends, and reports in the Canada Disposable Tableware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence