Key Insights

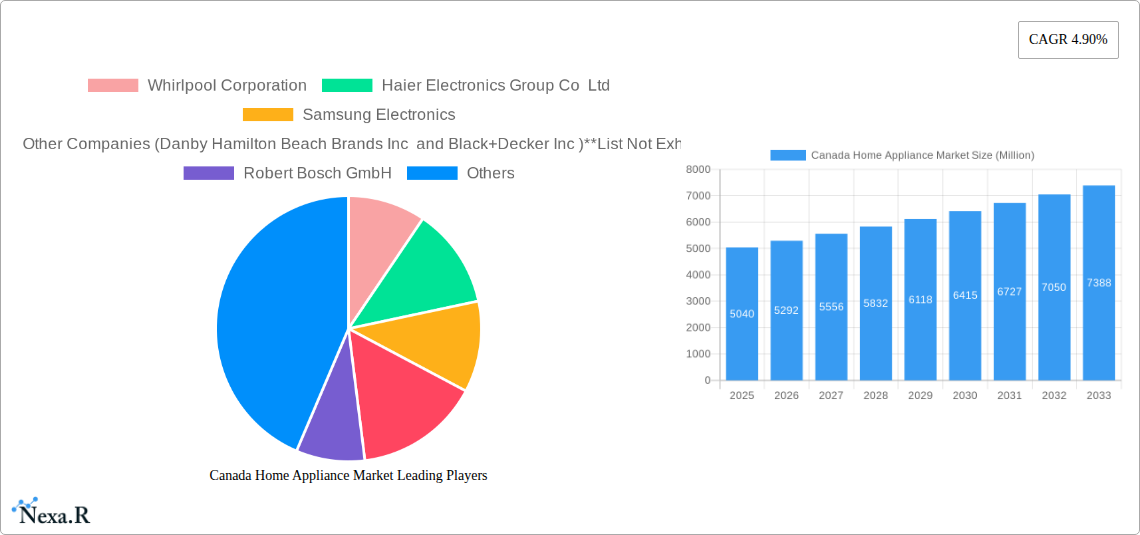

The Canadian home appliance market is poised for steady expansion, projecting a current market size of approximately USD 5.04 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 4.90% anticipated through 2033. This growth trajectory is underpinned by several key drivers, including an increasing disposable income among Canadian households, a rising demand for energy-efficient and smart appliances, and a growing trend towards home renovations and upgrades. Consumers are increasingly prioritizing appliances that offer enhanced convenience, advanced features, and a reduced environmental footprint, stimulating innovation and product development within the sector. Furthermore, government initiatives promoting energy conservation and sustainability are likely to further bolster the adoption of eco-friendly appliance models. The market is segmented across various product categories, encompassing major appliances like refrigerators, washing machines, and ovens, as well as smaller kitchen and personal care appliances. The ongoing development of smart home ecosystems and the integration of IoT capabilities into everyday appliances are significant trends shaping consumer preferences and driving market evolution.

Canada Home Appliance Market Market Size (In Billion)

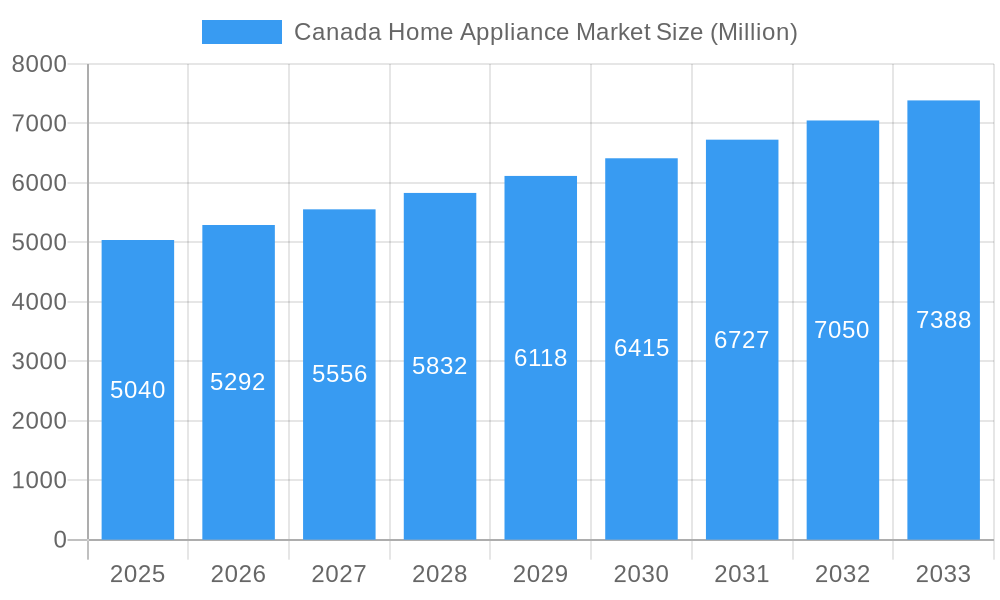

Despite the positive outlook, the Canadian home appliance market faces certain restraints. Fluctuations in raw material costs and supply chain disruptions can impact manufacturing expenses and product availability, potentially affecting pricing strategies and consumer affordability. While the market is dominated by global players like Whirlpool Corporation, Samsung Electronics, and LG Electronics, local manufacturers and brands also hold a significant presence, particularly in specific product niches. The competitive landscape is characterized by continuous product innovation, strategic partnerships, and aggressive marketing campaigns aimed at capturing market share. The analysis of production, consumption, import, and export data, alongside price trend analysis, reveals a dynamic market influenced by global economic conditions, technological advancements, and evolving consumer lifestyles. The focus on premium and technologically advanced appliances is expected to continue, aligning with the Canadian consumer's demand for quality, durability, and sophisticated functionality in their homes.

Canada Home Appliance Market Company Market Share

This comprehensive report provides an in-depth analysis of the Canada Home Appliance Market, encompassing production, consumption, import/export dynamics, price trends, and industry developments. Leveraging extensive data from 2019 to 2033, with a base year of 2025, this report offers critical insights for stakeholders navigating this dynamic sector. Discover market size evolution, technological disruptions, consumer behavior shifts, and the competitive landscape shaped by leading players like Whirlpool Corporation and Samsung Electronics. Explore dominant regions and segments, understand key growth drivers and challenges, and identify emerging opportunities within the Canadian home appliance industry.

Canada Home Appliance Market Market Dynamics & Structure

The Canada Home Appliance Market is characterized by a moderately consolidated structure, with key players like Whirlpool Corporation, Haier Electronics Group Co. Ltd, Samsung Electronics, LG Electronics, and Electrolux AB holding significant market shares. This competitive environment is driven by continuous technological innovation, focusing on smart appliances, energy efficiency, and enhanced user experience. Regulatory frameworks, particularly those pertaining to energy standards and environmental impact, play a crucial role in shaping product development and market entry. The presence of competitive product substitutes, ranging from refurbished appliances to DIY repair solutions, influences consumer purchasing decisions. End-user demographics, including a growing millennial population with a preference for connected devices and eco-friendly options, are increasingly shaping demand. Mergers and acquisitions (M&A) are a notable trend, with companies strategically acquiring complementary businesses to expand their product portfolios and market reach. For instance, Whirlpool Corporation's acquisition of InSinkErator underscores a strategic move to bolster its offering in specialized appliance segments.

- Market Concentration: Moderate, with a few dominant players and a long tail of smaller manufacturers.

- Technological Innovation Drivers: Smart home integration, AI-powered features, energy efficiency, connected diagnostics, and sustainable materials.

- Regulatory Frameworks: Energy Star certifications, provincial energy efficiency standards, and waste management regulations.

- Competitive Product Substitutes: Refurbished appliances, rental services, and DIY repair.

- End-User Demographics: Increasing demand from younger generations for smart and sustainable solutions, and a growing senior population seeking ease-of-use.

- M&A Trends: Strategic acquisitions to expand product lines, enter new market segments, and gain market share.

Canada Home Appliance Market Growth Trends & Insights

The Canada Home Appliance Market is poised for robust growth, projected to expand significantly through the forecast period. This expansion is fueled by a confluence of factors including rising disposable incomes, an increasing trend towards home renovations and upgrades, and a growing consumer preference for technologically advanced and energy-efficient appliances. The adoption rate of smart home appliances is witnessing a substantial surge, driven by the convenience and efficiency they offer. Technological disruptions, such as the integration of Artificial Intelligence (AI) for personalized user experiences and predictive maintenance, are redefining product categories and consumer expectations.

Consumer behavior shifts are also playing a pivotal role. There is a discernible move towards premium and feature-rich appliances, with consumers willing to invest in products that offer enhanced functionality and aesthetic appeal. The impact of sustainability concerns is also growing, with a rising demand for eco-friendly and energy-saving appliances. Online sales channels are becoming increasingly significant, offering consumers wider product selections and competitive pricing. The average household expenditure on home appliances is expected to rise as consumers prioritize upgrading their living spaces. The market penetration of advanced kitchen appliances, such as induction cooktops and smart ovens, is also on an upward trajectory.

Furthermore, the increasing urbanization and the development of new housing projects across Canada will continue to drive demand for essential and modern home appliances. The report highlights specific metrics such as a projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period and a market penetration rate for smart appliances reaching xx% by 2033. The influence of connected devices in everyday life is translating into a greater acceptance and desire for integrated home appliance ecosystems. The shift towards smaller, more efficient appliances for urban dwellers is also a noteworthy trend, catering to space constraints without compromising on functionality.

Dominant Regions, Countries, or Segments in Canada Home Appliance Market

The Consumption Analysis segment is a dominant driver of growth within the Canada Home Appliance Market. This dominance is primarily attributed to robust consumer spending power, a strong inclination towards modernizing living spaces, and a high degree of urbanization across major Canadian provinces. The economic policies that support home ownership and renovation, coupled with accessible financing options, further bolster consumer demand for a wide array of home appliances.

- Key Drivers in Consumption Analysis:

- High Disposable Income: Canadian households generally possess significant purchasing power, enabling investment in both essential and premium appliances.

- Home Renovation and Upgrade Trends: A persistent trend of renovating and upgrading existing homes fuels consistent demand for new appliances, particularly in kitchens and laundry rooms.

- Urbanization: Concentrated populations in urban centers lead to higher appliance sales per capita, driven by new construction and the need for efficient living solutions.

- Economic Policies: Government incentives for energy-efficient appliances and favorable mortgage rates encourage consumer spending on home improvements.

- Consumer Preferences for Technology: A growing appetite for smart and connected appliances, enhancing convenience and lifestyle.

The Import Market Analysis (Value & Volume) also plays a crucial role in shaping the market landscape. Canada relies heavily on imports for a substantial portion of its home appliances, especially from countries with advanced manufacturing capabilities and competitive pricing. This influx of imported goods contributes to product diversity and price competitiveness, benefiting consumers.

- Dominance Factors in Import Market:

- Global Supply Chains: Access to a wide range of products manufactured globally, including specialized or niche appliances not produced domestically.

- Cost-Effectiveness: Imports often offer more competitive pricing due to economies of scale and lower manufacturing costs in certain regions.

- Technological Advancements: Importing cutting-edge technologies and designs from international manufacturers keeps the Canadian market abreast of global trends.

- Market Share: Imported appliances represent a significant portion of the total market share, influencing overall market dynamics and competitive pricing strategies.

- Growth Potential: The import market is expected to continue its growth trajectory as consumer demand for diverse and technologically advanced appliances escalates.

Canada Home Appliance Market Product Landscape

The Canada Home Appliance Market is characterized by a vibrant product landscape defined by innovation and evolving consumer needs. Major manufacturers are focusing on integrating smart technologies, offering connected appliances that can be controlled remotely via smartphones and voice assistants, enhancing convenience and efficiency. Energy efficiency remains a paramount concern, with a growing emphasis on appliances that meet stringent Energy Star ratings and reduce environmental impact. Product applications are expanding beyond basic functionality to encompass personalized user experiences, with smart refrigerators offering recipe suggestions and ovens featuring pre-programmed cooking cycles. Performance metrics are increasingly focused on durability, ease of maintenance, and optimized energy consumption. Unique selling propositions often revolve around sleek designs, advanced digital interfaces, and specialized features catering to specific consumer lifestyles, such as induction cooktops for precise temperature control or high-capacity washing machines for larger households.

Key Drivers, Barriers & Challenges in Canada Home Appliance Market

Key Drivers:

- Technological Advancements: The integration of smart home technology, AI, and IoT is driving demand for connected and intelligent appliances.

- Growing Disposable Income: Rising household incomes empower consumers to invest in premium and feature-rich appliances.

- Home Renovation and New Construction: Ongoing renovation activities and the construction of new homes directly fuel appliance sales.

- Energy Efficiency Mandates: Government regulations and consumer demand for eco-friendly products incentivize the purchase of energy-efficient appliances.

- Increasing Urbanization: Higher population density in urban areas leads to greater demand for appliances that optimize space and functionality.

Barriers & Challenges:

- Supply Chain Disruptions: Global supply chain volatility can lead to component shortages, increased lead times, and higher production costs.

- Economic Downturns: Recessions or economic slowdowns can reduce consumer spending on discretionary items like high-end appliances.

- Intense Competition: A crowded market with numerous global and domestic players leads to price pressures and challenges in differentiating products.

- Rising Raw Material Costs: Fluctuations in the prices of raw materials like steel, copper, and plastic can impact manufacturing expenses and profit margins.

- Skilled Labor Shortages: A lack of skilled technicians for manufacturing, installation, and repair can pose operational challenges.

Emerging Opportunities in Canada Home Appliance Market

Emerging opportunities in the Canada Home Appliance Market lie in the increasing demand for sustainable and eco-friendly products. Consumers are actively seeking appliances with lower energy consumption, made from recycled materials, and designed for longevity. The "smart home" ecosystem continues to expand, presenting opportunities for integrated appliance solutions that enhance connectivity and automation within households. Niche market segments, such as compact appliances for smaller living spaces and specialized appliances for health-conscious consumers (e.g., air purifiers with advanced filtration), are also ripe for growth. Furthermore, the growing trend of online sales and direct-to-consumer (DTC) models offers manufacturers a chance to bypass traditional retail channels and build stronger relationships with customers.

Growth Accelerators in the Canada Home Appliance Market Industry

Several catalysts are accelerating growth in the Canada Home Appliance Market. Technological breakthroughs in AI and IoT are enabling the development of truly intelligent and intuitive appliances that offer personalized user experiences and predictive maintenance capabilities. Strategic partnerships between appliance manufacturers and smart home technology providers are creating integrated ecosystems, enhancing product appeal and fostering customer loyalty. Market expansion strategies, including the penetration of emerging urban centers and the development of innovative service models like subscription-based appliance usage, are further driving growth. The increasing focus on circular economy principles, leading to the design of more durable and repairable appliances, also contributes to long-term sustainability and market resilience.

Key Players Shaping the Canada Home Appliance Market Market

- Whirlpool Corporation

- Haier Electronics Group Co Ltd

- Samsung Electronics

- LG Electronics

- Robert Bosch GmbH

- Electrolux AB

- Panasonic Corporation

- Kenmore

- Viking Range LLC

- Other Companies (Danby Hamilton Beach Brands Inc and Black+Decker Inc)

Notable Milestones in Canada Home Appliance Market Sector

- April 2023: Samsung Electronics announced the opening of a new online store for its B2B customers in Germany, aiming to expand to 30 countries worldwide. This B2B online store provides products and solutions, along with purchase benefits specifically for small and medium-sized businesses (SMBs).

- November 2022: Whirlpool Corporation announced the completion of its acquisition of InSinkErator, the world's largest manufacturer of food waste disposers and instant hot water dispensers for home and commercial use, from Emerson.

In-Depth Canada Home Appliance Market Market Outlook

The in-depth outlook for the Canada Home Appliance Market is exceptionally positive, driven by sustained consumer demand for innovation, convenience, and sustainability. Growth accelerators such as the continued integration of smart technologies, eco-friendly product development, and expanding online sales channels will continue to shape the market. Strategic partnerships and market expansion initiatives will further solidify the competitive landscape, offering consumers a wider array of advanced and efficient home appliance solutions. The market is poised for significant expansion as manufacturers invest in research and development to meet evolving consumer preferences and environmental regulations, ensuring a dynamic and thriving future for the Canadian home appliance sector.

Canada Home Appliance Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Canada Home Appliance Market Segmentation By Geography

- 1. Canada

Canada Home Appliance Market Regional Market Share

Geographic Coverage of Canada Home Appliance Market

Canada Home Appliance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Usage of Smart Home Appliances is Increasing; Technological Innovations are Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Maintainance Costs

- 3.4. Market Trends

- 3.4.1. Small Home Appliances are Dominating the Sales Volume of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Home Appliance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haier Electronics Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Other Companies (Danby Hamilton Beach Brands Inc and Black+Decker Inc )**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Robert Bosch GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Electrolux AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kenmore

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Viking Range LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Canada Home Appliance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Home Appliance Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Home Appliance Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Canada Home Appliance Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Canada Home Appliance Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Canada Home Appliance Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Canada Home Appliance Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Canada Home Appliance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Canada Home Appliance Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Canada Home Appliance Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Canada Home Appliance Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Canada Home Appliance Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Canada Home Appliance Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Canada Home Appliance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Home Appliance Market?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Canada Home Appliance Market?

Key companies in the market include Whirlpool Corporation, Haier Electronics Group Co Ltd, Samsung Electronics, Other Companies (Danby Hamilton Beach Brands Inc and Black+Decker Inc )**List Not Exhaustive, Robert Bosch GmbH, Electrolux AB, Kenmore, Viking Range LLC, Panasonic Corporation, LG Electronics.

3. What are the main segments of the Canada Home Appliance Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Usage of Smart Home Appliances is Increasing; Technological Innovations are Driving the Market.

6. What are the notable trends driving market growth?

Small Home Appliances are Dominating the Sales Volume of the Market.

7. Are there any restraints impacting market growth?

High Maintainance Costs.

8. Can you provide examples of recent developments in the market?

April 2023: Samsung Electronics announced the opening of a new online store for its B2B customers in Germany. The new store will be added to expand to 30 countries worldwide. Samsung's B2B online store is a service within Samsung.com providing products and solutions, as well as purchase benefits - all dedicated to small and medium-sized businesses (SMBs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Home Appliance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Home Appliance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Home Appliance Market?

To stay informed about further developments, trends, and reports in the Canada Home Appliance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence