Key Insights

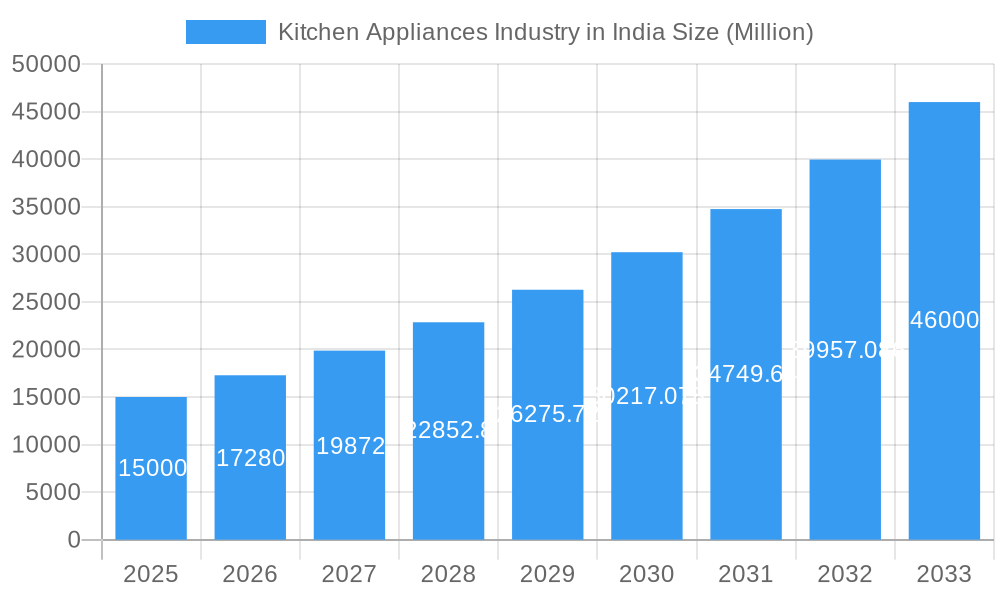

The Indian Kitchen Appliances Market is poised for remarkable expansion, projected to reach a substantial market size of approximately \$XX Million and exhibit a robust Compound Annual Growth Rate (CAGR) of 15.20% during the forecast period of 2025-2033. This impressive trajectory is fueled by a confluence of dynamic factors, primarily driven by rising disposable incomes, an increasing preference for modern and technologically advanced kitchens, and a growing awareness of convenience and energy efficiency among Indian consumers. The burgeoning middle class, coupled with rapid urbanization, has significantly boosted demand for a wide array of kitchen appliances, from essential cooking devices to sophisticated food preparation and storage solutions. Furthermore, evolving lifestyle trends, including a greater emphasis on home aesthetics and the influence of digital media showcasing modern culinary practices, are creating a fertile ground for market growth. Government initiatives promoting domestic manufacturing and smart city development also play a crucial role in stimulating the demand for innovative and sustainable kitchen appliance solutions.

Kitchen Appliances Industry in India Market Size (In Billion)

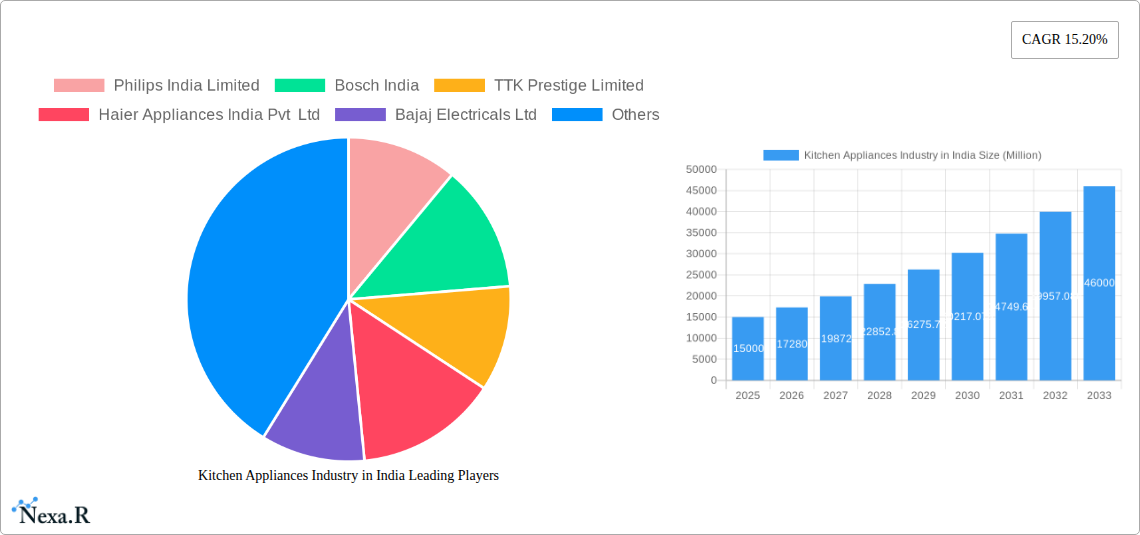

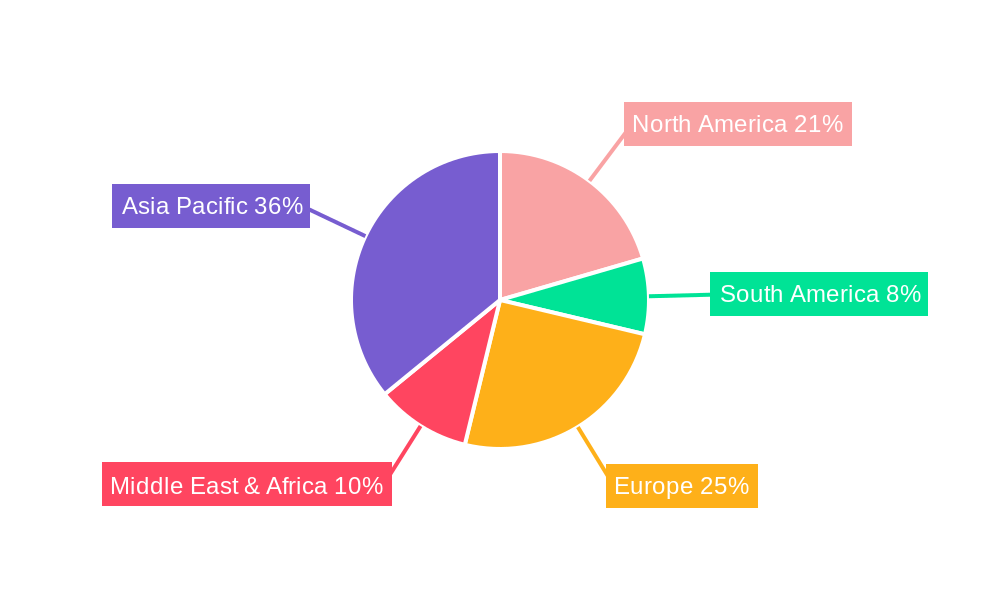

The market segmentation analysis reveals strong performance across various categories, with Production, Consumption, and Import analyses indicating substantial activity, alongside consistent growth in Export markets. While Price Trend Analysis suggests some volatility due to raw material costs and competitive pressures, the overall upward trend in value and volume signifies healthy market demand. Key restraints, such as intense competition among established domestic and international players and the initial cost barrier for premium appliances in certain segments, are being effectively navigated by manufacturers through product innovation, strategic pricing, and targeted marketing campaigns. The competitive landscape features prominent players like Philips India Limited, Bosch India, TTK Prestige Limited, and Samsung India Electronics Pvt Ltd, actively vying for market share through product diversification and technological advancements. The regional distribution highlights significant market penetration and growth opportunities across Asia Pacific, particularly in China and India, followed by Europe and North America, underscoring the global appeal and adoption of modern kitchen solutions.

Kitchen Appliances Industry in India Company Market Share

Here's a compelling, SEO-optimized report description for the Kitchen Appliances Industry in India, designed for maximum visibility and engagement.

This in-depth report offers a panoramic view of the Indian kitchen appliances market, a rapidly expanding sector fueled by rising disposable incomes, urbanization, and evolving consumer lifestyles. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this analysis delves into the intricate dynamics shaping the home kitchen appliances industry in India. We provide granular insights into kitchen appliances market size India, kitchen appliances market share India, and the crucial parent and child market segments driving growth. Whether you're a manufacturer, distributor, investor, or industry professional, this report is your essential guide to navigating the opportunities and challenges within this vibrant market.

Kitchen Appliances Industry in India Market Dynamics & Structure

The Indian kitchen appliances market is characterized by a moderately concentrated structure, with a blend of established multinational corporations and robust domestic players vying for market dominance. Key companies such as Philips India Limited, Bosch India, TTK Prestige Limited, Haier Appliances India Pvt Ltd, Bajaj Electricals Ltd, IFB Appliances, Electrolux India, Samsung India Electronics Pvt Ltd, LG Electronics India Pvt Ltd, and Whirlpool of India Ltd are continuously innovating to capture consumer attention. Technological innovation remains a paramount driver, with a focus on smart appliances, energy efficiency, and enhanced user convenience. The regulatory framework, while evolving, generally supports market growth by promoting standards and consumer safety. Competitive product substitutes are abundant, ranging from basic manual tools to highly sophisticated automated systems, influencing product development and pricing strategies. End-user demographics in India are diverse, encompassing a growing middle class in urban centers and an emerging consumer base in Tier 2 and Tier 3 cities, each with distinct preferences and purchasing power. Mergers and Acquisitions (M&A) trends indicate strategic consolidation and expansion efforts by leading companies seeking to broaden their product portfolios and market reach.

- Market Concentration: A significant share is held by the top 5-7 players, but a growing number of smaller niche players are emerging.

- Technological Innovation Drivers: Smart home integration, AI-powered features, and sustainable appliance design are key innovation areas.

- Regulatory Frameworks: BIS standardization and energy efficiency norms are influencing product design and market entry.

- Competitive Product Substitutes: Traditional cooking methods and increasingly sophisticated multi-functional appliances offer a wide range of alternatives.

- End-User Demographics: Young, tech-savvy urban dwellers and a rising affluent rural population are key consumer segments.

- M&A Trends: Strategic acquisitions to gain market share or acquire new technologies are observed, with an estimated xx M&A deals in the historical period.

Kitchen Appliances Industry in India Growth Trends & Insights

The kitchen appliances market in India has witnessed substantial growth, driven by increasing urbanization, a burgeoning middle class with higher disposable incomes, and a growing preference for modern, convenient kitchen solutions. The market size is projected to expand significantly, with a robust Compound Annual Growth Rate (CAGR) estimated at xx% during the forecast period (2025–2033). Adoption rates for various kitchen appliances, particularly in the small kitchen appliances market India and large kitchen appliances market India, are on an upward trajectory. Technological disruptions, such as the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in appliances, are transforming consumer experiences, offering enhanced functionalities and connectivity. Consumer behavior shifts are evident, with a growing demand for energy-efficient, aesthetically pleasing, and multi-functional appliances. The kitchen appliances consumption India is a key indicator of this trend, showcasing a strong preference for brands that offer both performance and style. Market penetration for premium and mid-range appliances is increasing, reflecting the evolving aspirations of Indian households. The Indian kitchen appliances industry is poised for continued expansion, supported by government initiatives promoting manufacturing and consumer spending.

Dominant Regions, Countries, or Segments in Kitchen Appliances Industry in India

The Indian kitchen appliances market exhibits distinct regional dominance, primarily driven by economic development, urbanization, and consumer purchasing power. The Northern region, encompassing states like Uttar Pradesh, Delhi, and Punjab, along with the Western region, including Maharashtra and Gujarat, consistently lead in both kitchen appliances production India and kitchen appliances consumption India. These regions boast higher per capita incomes, greater urbanization, and a well-established retail infrastructure, facilitating wider availability and adoption of a diverse range of kitchen appliances.

- Production Analysis: The Western region, particularly Maharashtra, is a manufacturing hub due to favorable industrial policies and established supply chains. The Northern region also contributes significantly, with a focus on small kitchen appliances.

- Consumption Analysis: Both Northern and Western regions exhibit the highest consumption volumes due to their large population bases and higher disposable incomes. The child market for specific appliance categories, like air fryers and smart ovens, is particularly strong in metropolitan areas within these regions.

- Import Market Analysis (Value & Volume): While domestic production is robust, imports play a crucial role in catering to specific demands for high-end or niche products. The import market for kitchen appliances in India sees significant volumes entering through major ports in the West (e.g., Nhava Sheva) and South India. Countries like China, South Korea, and Vietnam are major suppliers.

- Export Market Analysis (Value & Volume): India is increasingly becoming an export hub, particularly for small kitchen appliances. The export market for kitchen appliances from India is growing, with products finding markets in Southeast Asia, the Middle East, and Africa. This segment is expected to see steady growth in volume and value.

- Price Trend Analysis: Price trends are influenced by raw material costs, import duties, and competitive pressures. The price of kitchen appliances in India varies significantly across segments, with premium segments experiencing stable to slightly increasing prices, while the mass market sees more aggressive pricing strategies.

Kitchen Appliances Industry in India Product Landscape

The Indian kitchen appliances industry is witnessing a surge in product innovation, with a strong emphasis on smart technology, energy efficiency, and multi-functionality. From advanced induction cooktops and smart ovens to feature-rich mixer grinders and innovative air fryers, manufacturers are constantly introducing products that cater to the evolving needs of Indian consumers. Applications range from basic cooking and food preparation to sophisticated culinary experiences, with an increasing demand for appliances that offer convenience, speed, and healthier cooking options. Performance metrics are often highlighted by energy ratings, noise levels, and cooking speed, with a growing awareness among consumers regarding these aspects. Unique selling propositions often revolve around digital connectivity, app-based control, and personalized cooking presets, setting a new benchmark for household convenience and efficiency.

Key Drivers, Barriers & Challenges in Kitchen Appliances Industry in India

Key Drivers:

- Rising Disposable Income: Increased purchasing power fuels demand for modern kitchen appliances.

- Urbanization & Changing Lifestyles: Compact living spaces and busy schedules necessitate convenient, efficient solutions.

- Growing Awareness of Health & Hygiene: Demand for appliances that support healthier cooking and better hygiene.

- Technological Advancements: Smart appliances and IoT integration appeal to tech-savvy consumers.

- Government Initiatives: 'Make in India' and production-linked incentive schemes boost domestic manufacturing.

Barriers & Challenges:

- Price Sensitivity: A significant portion of the Indian market remains price-conscious, impacting adoption of premium products.

- Supply Chain Disruptions: Global and domestic supply chain issues can affect production and distribution.

- Intense Competition: A crowded market with both domestic and international players leads to price wars and margin pressures.

- Infrastructure Gaps: Inadequate cold chain and logistics in certain regions can hinder market reach.

- Consumer Education: Educating consumers about the benefits and usage of advanced appliances remains a challenge.

Emerging Opportunities in Kitchen Appliances Industry in India

The Indian kitchen appliances market presents a wealth of emerging opportunities. The rapid growth of the small kitchen appliances market India, driven by convenience-seeking consumers, offers significant potential for innovative products like multi-functional blenders and smart air fryers. Untapped markets in Tier 2 and Tier 3 cities represent a substantial growth avenue, provided products are adapted to local needs and price points. Evolving consumer preferences for sustainable and energy-efficient appliances are creating opportunities for eco-friendly product lines. Furthermore, the increasing demand for integrated smart home solutions opens doors for connectivity-enabled kitchen appliances, promising a more automated and personalized cooking experience.

Growth Accelerators in the Kitchen Appliances Industry in India Industry

Several catalysts are propelling the long-term growth of the kitchen appliances industry in India. Technological breakthroughs in areas like AI and IoT are enabling the development of highly intelligent and user-friendly appliances. Strategic partnerships between appliance manufacturers and technology providers are fostering innovation and expanding product capabilities. Market expansion strategies, including a focus on rural markets and direct-to-consumer (D2C) sales channels, are crucial for increasing penetration. The increasing adoption of modular kitchens and the rise of the millennial and Gen Z consumer base, who prioritize convenience and modern living, are significant growth accelerators.

Key Players Shaping the Kitchen Appliances Industry in India Market

- Philips India Limited

- Bosch India

- TTK Prestige Limited

- Haier Appliances India Pvt Ltd

- Bajaj Electricals Ltd

- IFB Appliances

- Electrolux India

- Samsung India Electronics Pvt Ltd

- LG Electronics India Pvt Ltd

- Whirlpool of India Ltd

Notable Milestones in Kitchen Appliances Industry in India Sector

- 2019: Launch of AI-powered smart ovens by major brands, enhancing user experience and cooking precision.

- 2020: Significant surge in demand for small kitchen appliances like air fryers and multi-cookers due to increased home cooking during lockdowns.

- 2021: Introduction of a wider range of energy-efficient appliances, aligning with growing environmental consciousness.

- 2022: Increased investment in R&D for IoT-enabled kitchen appliances, promising greater connectivity and automation.

- 2023: Expansion of domestic manufacturing capabilities, supported by government incentives, to meet rising demand.

- 2024: Growing focus on customizable and modular kitchen appliance solutions catering to diverse interior designs.

In-Depth Kitchen Appliances Industry in India Market Outlook

The Indian kitchen appliances market is poised for continued robust growth, driven by a confluence of favorable economic factors, evolving consumer aspirations, and technological advancements. The ongoing shift towards modern, convenient, and healthy living will remain a core growth accelerator. Strategic investments in product innovation, particularly in smart home integration and energy efficiency, will be crucial for market leaders. Expansion into Tier 2 and Tier 3 cities, coupled with an increasing focus on e-commerce and direct-to-consumer models, will unlock new customer segments. The Indian kitchen appliances industry is set to witness significant opportunities in the coming years, driven by a dynamic market landscape and a commitment to delivering advanced and consumer-centric solutions.

Kitchen Appliances Industry in India Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Kitchen Appliances Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Kitchen Appliances Industry in India Regional Market Share

Geographic Coverage of Kitchen Appliances Industry in India

Kitchen Appliances Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Hotel and Hotel Industry creating demand for smart bed; Rising demand for Tech enabled products

- 3.3. Market Restrains

- 3.3.1. Lack of Fully developed market structure and sales channel; Fluctuation in raw material cost of electronics products

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Kitchen Appliances Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Kitchen Appliances Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Kitchen Appliances Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Kitchen Appliances Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Kitchen Appliances Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Kitchen Appliances Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Philips India Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosch India

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TTK Prestige Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Haier Appliances India Pvt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bajaj Electricals Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IFB Appliances

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Electrolux India

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Samsung India Electronics Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LG Electronics India Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Whirlpool of India Ltd**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Philips India Limited

List of Figures

- Figure 1: Global Kitchen Appliances Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Kitchen Appliances Industry in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Kitchen Appliances Industry in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Kitchen Appliances Industry in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Kitchen Appliances Industry in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Kitchen Appliances Industry in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Kitchen Appliances Industry in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Kitchen Appliances Industry in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Kitchen Appliances Industry in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Kitchen Appliances Industry in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Kitchen Appliances Industry in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Kitchen Appliances Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Kitchen Appliances Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Kitchen Appliances Industry in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Kitchen Appliances Industry in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Kitchen Appliances Industry in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Kitchen Appliances Industry in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Kitchen Appliances Industry in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Kitchen Appliances Industry in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Kitchen Appliances Industry in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Kitchen Appliances Industry in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Kitchen Appliances Industry in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Kitchen Appliances Industry in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Kitchen Appliances Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Kitchen Appliances Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Kitchen Appliances Industry in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Kitchen Appliances Industry in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Kitchen Appliances Industry in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Kitchen Appliances Industry in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Kitchen Appliances Industry in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Kitchen Appliances Industry in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Kitchen Appliances Industry in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Kitchen Appliances Industry in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Kitchen Appliances Industry in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Kitchen Appliances Industry in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Kitchen Appliances Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Kitchen Appliances Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Kitchen Appliances Industry in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Kitchen Appliances Industry in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Kitchen Appliances Industry in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Kitchen Appliances Industry in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Kitchen Appliances Industry in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Kitchen Appliances Industry in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Kitchen Appliances Industry in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Kitchen Appliances Industry in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Kitchen Appliances Industry in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Kitchen Appliances Industry in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Kitchen Appliances Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Kitchen Appliances Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Kitchen Appliances Industry in India Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Kitchen Appliances Industry in India Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Kitchen Appliances Industry in India Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Kitchen Appliances Industry in India Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Kitchen Appliances Industry in India Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Kitchen Appliances Industry in India Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Kitchen Appliances Industry in India Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Kitchen Appliances Industry in India Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Kitchen Appliances Industry in India Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Kitchen Appliances Industry in India Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Kitchen Appliances Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Kitchen Appliances Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Kitchen Appliances Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Kitchen Appliances Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kitchen Appliances Industry in India?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the Kitchen Appliances Industry in India?

Key companies in the market include Philips India Limited, Bosch India, TTK Prestige Limited, Haier Appliances India Pvt Ltd, Bajaj Electricals Ltd, IFB Appliances, Electrolux India, Samsung India Electronics Pvt Ltd, LG Electronics India Pvt Ltd, Whirlpool of India Ltd**List Not Exhaustive.

3. What are the main segments of the Kitchen Appliances Industry in India?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Hotel and Hotel Industry creating demand for smart bed; Rising demand for Tech enabled products.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

Lack of Fully developed market structure and sales channel; Fluctuation in raw material cost of electronics products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kitchen Appliances Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kitchen Appliances Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kitchen Appliances Industry in India?

To stay informed about further developments, trends, and reports in the Kitchen Appliances Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence