Key Insights

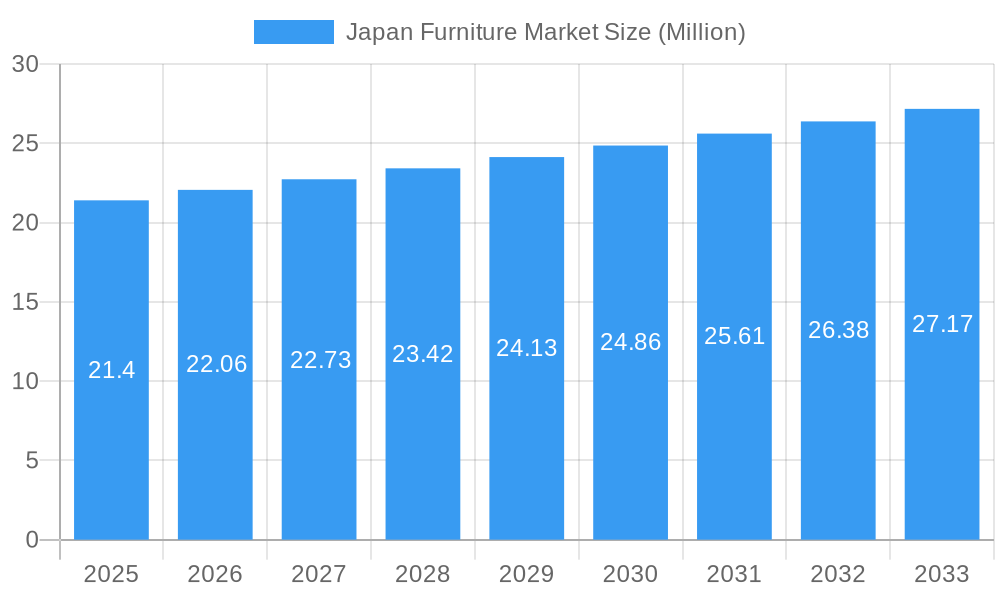

The Japan Furniture Market is projected to reach a substantial valuation of $21.40 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 3.00% from 2019 to 2033. This consistent growth is primarily fueled by evolving consumer preferences towards stylish and functional home furnishings, alongside an increasing demand for ergonomic and aesthetically pleasing office furniture. The hospitality sector also plays a significant role, with a continuous need for durable and design-forward pieces to enhance guest experiences. E-commerce platforms are rapidly emerging as a dominant distribution channel, driven by convenience and wider product accessibility, complementing the traditional presence of specialty stores. While the market demonstrates robust expansion, it is important to acknowledge the influence of economic factors and evolving design trends that shape consumer spending habits.

Japan Furniture Market Market Size (In Million)

The market landscape is characterized by a dynamic competitive environment, with both established global players and distinctive local brands vying for market share. Nitori and IKEA Kobe are prominent figures, known for their broad product ranges and accessible price points. Japanese brands such as Karimoku Furniture Co., Ltd., Muji, Cassina Ixc, Ariake, CondeHouse, Hida Sangyo, and Miyazaki Chair Factory are recognized for their commitment to quality craftsmanship, sustainable materials, and unique design philosophies. The segmentation of the market by material, including wood and metal, reflects a diverse range of product offerings catering to different aesthetic and functional requirements. Similarly, the application segmentation across home, office, and hospitality furniture highlights the varied demands within the Japanese market. The growth trajectory indicates a sustained interest in furniture that combines aesthetic appeal with practical utility, reflecting a mature yet adaptive consumer base.

Japan Furniture Market Company Market Share

Japan Furniture Market: In-depth Analysis & Future Outlook (2019-2033)

This comprehensive report provides a detailed analysis of the Japan furniture market, offering critical insights into its dynamics, growth trends, competitive landscape, and future outlook. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study is essential for stakeholders seeking to understand the evolving Japanese home furniture market, Japanese office furniture market, and Japanese hospitality furniture market. We delve into parent and child markets, presenting all values in million units for clarity and precision. Leverage our expert analysis on material segmentation (wood, metal), application-specific furniture, and distribution channels (supermarkets & hypermarkets, specialty stores, online, others). This report is designed to maximize your search engine visibility with high-traffic keywords and equip industry professionals with actionable intelligence.

Japan Furniture Market Market Dynamics & Structure

The Japan furniture market exhibits a moderate level of concentration, with a few dominant players controlling a significant share, alongside a vibrant ecosystem of smaller, specialized manufacturers. Technological innovation plays a crucial role, particularly in areas like sustainable materials, smart furniture integration, and advanced manufacturing processes, driving efficiency and product differentiation. Regulatory frameworks, including environmental standards and safety regulations, shape product development and market entry. Competitive product substitutes, ranging from DIY solutions to reconfigurable furniture systems, influence consumer choices. End-user demographics, characterized by an aging population and a growing demand for compact, multi-functional furniture, are a key driver of market evolution. Mergers and acquisitions (M&A) trends, while not as prevalent as in some other global markets, are observed as companies seek to expand their product portfolios or gain market access.

- Market Concentration: Dominated by a few large players, but with ample space for niche and bespoke manufacturers.

- Technological Innovation: Focus on sustainability, smart features, and efficient production methods.

- Regulatory Frameworks: Emphasis on environmental impact and product safety standards.

- Product Substitutes: Rise of adaptable and modular furniture solutions.

- End-User Demographics: Aging population driving demand for ergonomic and space-saving designs.

- M&A Trends: Strategic acquisitions to broaden product offerings and market reach.

Japan Furniture Market Growth Trends & Insights

The Japan furniture market is poised for sustained growth, driven by evolving consumer preferences and economic factors. The market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) over the forecast period, reflecting increased spending on home renovation and a growing demand for aesthetically pleasing and functional furniture. Adoption rates for sustainable and eco-friendly furniture are on the rise, with consumers increasingly prioritizing environmentally conscious choices. Technological disruptions, such as the integration of IoT in furniture and advancements in material science, are creating new product categories and enhancing user experience. Consumer behavior shifts, including a greater emphasis on comfort, personalization, and online purchasing convenience, are significantly influencing market trends. The rise of the online furniture market in Japan is a particularly strong indicator of these shifts.

(Note: The XXX placeholder for a specific tool is not used as per instructions. The analysis above provides a general overview of growth trends. Specific quantitative metrics like CAGR would be detailed within the full report.)

Dominant Regions, Countries, or Segments in Japan Furniture Market

Within the Japan furniture market, Home Furniture undeniably dominates, driven by consistent consumer demand for residential spaces. The Wood segment holds significant sway, owing to Japan's rich tradition of woodworking and the inherent appeal of natural materials, representing a substantial portion of the market share. The Specialty Stores distribution channel continues to be a primary avenue for furniture sales, offering curated selections and expert advice, though the Online channel is rapidly gaining traction, especially for its convenience and wider product availability.

- Dominant Application: Home Furniture commands the largest market share due to ongoing residential demand and renovation activities.

- Dominant Material: Wood remains the preferred material, favored for its aesthetic appeal, durability, and cultural significance in Japan.

- Dominant Distribution Channel: Specialty stores offer a high-touch customer experience, while online platforms are witnessing accelerated growth, catering to a digitally-savvy consumer base.

The Competitive Landscape in Japan is characterized by a mix of established domestic brands and international players. Nitori, a leading Japanese furniture and home furnishing retailer, consistently captures a significant market share with its broad product range and affordable pricing. Muji appeals to consumers seeking minimalist and functional designs, further solidifying its presence. Karimoku Furniture Co., Ltd. stands out for its premium wood furniture, renowned for exceptional craftsmanship and design, partnering with firms like Zaha Hadid Design for exclusive collections. IKEA Kobe continues to influence the market with its accessible and modern furniture solutions, with recent expansion into the North Kanto region underscoring its commitment to the Japanese market. Other key players like Cassina Ixc, Huasheng Furniture Group, Ariake, CondeHouse, Hida Sangyo, and Miyazaki Chair Factory each contribute to the market's diversity with their unique offerings in design, material, and target audience.

Japan Furniture Market Product Landscape

The product landscape in the Japan furniture market is a dynamic interplay of traditional craftsmanship and modern innovation. We are witnessing a surge in demand for multi-functional furniture that optimizes space in increasingly urbanized living environments. Sustainable materials and eco-friendly production processes are no longer niche but are becoming mainstream selling propositions. Technological advancements are leading to the integration of smart features, such as built-in charging ports and adjustable ergonomics, enhancing user comfort and convenience. The performance metrics of furniture are increasingly being evaluated not just on durability and aesthetics but also on their environmental impact and lifecycle.

Key Drivers, Barriers & Challenges in Japan Furniture Market

Key Drivers:

- Rising Disposable Income: Increased consumer spending power fuels demand for higher quality and more aesthetically pleasing furniture.

- Urbanization & Smaller Living Spaces: Drives demand for compact, multi-functional, and space-saving furniture solutions.

- Growing E-commerce Penetration: Enhances accessibility and convenience for consumers, expanding the reach of furniture brands.

- Focus on Home Improvement & Renovation: Post-pandemic trends continue to emphasize comfortable and functional living spaces, driving furniture purchases.

Barriers & Challenges:

- High Material and Production Costs: Japan's manufacturing costs can be a significant barrier, impacting price competitiveness.

- Aging Population & Shrinking Workforce: Can lead to labor shortages and impact production capacity.

- Intense Competition: Both from established domestic brands and international players, leading to price pressures.

- Logistics and Distribution Complexities: Navigating Japan's complex urban landscapes and ensuring efficient last-mile delivery can be challenging.

- Economic Slowdowns and Consumer Confidence: Fluctuations in the Japanese economy can directly impact consumer spending on discretionary items like furniture.

Emerging Opportunities in Japan Furniture Market

Emerging opportunities within the Japan furniture market lie in catering to the burgeoning demand for personalized and bespoke furniture, offering unique design solutions that align with individual tastes and living spaces. The continuous rise of the online furniture market presents a significant opportunity for brands to expand their reach and engage with a wider customer base through innovative e-commerce strategies and virtual showrooms. Furthermore, the growing consumer consciousness towards sustainability creates a substantial opening for manufacturers who prioritize eco-friendly materials and ethical production processes. The integration of smart technology into furniture, offering enhanced functionality and convenience, represents another promising avenue for innovation and market differentiation in the Japanese furniture sector.

Growth Accelerators in the Japan Furniture Market Industry

Growth in the Japan furniture market is being significantly accelerated by the ongoing digital transformation, with e-commerce platforms revolutionizing how consumers discover and purchase furniture. Strategic partnerships between traditional furniture makers and technology companies are driving the development of smart and connected furniture, enhancing user experience and creating new market segments. Furthermore, a growing emphasis on sustainable and eco-friendly furniture production is not only meeting evolving consumer demands but also opening up new avenues for innovation and brand differentiation. The expansion strategies of key players, such as IKEA's recent store openings, also play a crucial role in stimulating market growth and accessibility across different regions of Japan.

Key Players Shaping the Japan Furniture Market Market

- Nitori

- Muji

- Karimoku Furniture Co., Ltd.

- IKEA Kobe

- Cassina Ixc

- Huasheng Furniture Group

- Ariake

- CondeHouse

- Hida Sangyo

- Miyazaki Chair Factory

Notable Milestones in Japan Furniture Market Sector

- January 2024: IKEA opened a new store in the North Kanto region, marking its tenth store in Japan and its first in the region, signifying expansion and increased market presence.

- May 2023: Karimoku Furniture Inc. partnered with Zaha Hadid Design to create the SEYUN collection, showcasing a commitment to high-end design collaborations and product innovation in wooden furniture.

In-Depth Japan Furniture Market Market Outlook

The outlook for the Japan furniture market remains robust, fueled by a confluence of sustained consumer demand for home improvement, the accelerating adoption of e-commerce, and a growing preference for sustainable and smart furniture solutions. Strategic investments in innovative product development, particularly in space-saving and multi-functional designs, will continue to be crucial. The increasing integration of technology into furniture offers significant potential for growth, creating a more connected and personalized living experience. Brands that can effectively leverage digital platforms for sales and marketing, while also emphasizing eco-conscious practices, are best positioned for long-term success and expansion within this dynamic market.

Japan Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

-

2. Application

- 2.1. Home Furniture

- 2.2. Office Furniture

- 2.3. Hospitality Furniture

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Others

-

4. COMPETITIVE LANDSCAPE

- 4.1. Market Competion Overview

-

4.2. Company Profiles

- 4.2.1. Nitori

- 4.2.2. Muji

- 4.2.3. Karimoku Furniture Co., Ltd.

- 4.2.4. IKEA Kobe

- 4.2.5. Cassina Ixc

- 4.2.6. Huasheng Furniture Group

- 4.2.7. Ariake

- 4.2.8. CondeHouse

- 4.2.9. Hida Sangyo

- 4.2.10. Miyazaki Chair Factory

Japan Furniture Market Segmentation By Geography

- 1. Japan

Japan Furniture Market Regional Market Share

Geographic Coverage of Japan Furniture Market

Japan Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The integration of technology into furniture is gaining traction in Japan. Consumers are increasingly interested in smart furniture that offers convenience

- 3.2.2 such as adjustable beds

- 3.2.3 smart storage solutions

- 3.2.4 and furniture with built-in charging capabilities.

- 3.3. Market Restrains

- 3.3.1 Japan's declining population presents a long-term challenge for the furniture market. As the population shrinks and household formation slows

- 3.3.2 the overall demand for new furniture may decrease

- 3.3.3 particularly in rural areas.

- 3.4. Market Trends

- 3.4.1 The demand for eco-friendly furniture is growing

- 3.4.2 with consumers seeking products that are not only stylish but also sustainable. This includes furniture made from recycled or upcycled materials

- 3.4.3 as well as products certified for sustainability by organizations like the Forest Stewardship Council (FSC).

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Furniture

- 5.2.2. Office Furniture

- 5.2.3. Hospitality Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by COMPETITIVE LANDSCAPE

- 5.4.1. Market Competion Overview

- 5.4.2. Company Profiles

- 5.4.2.1. Nitori

- 5.4.2.2. Muji

- 5.4.2.3. Karimoku Furniture Co., Ltd.

- 5.4.2.4. IKEA Kobe

- 5.4.2.5. Cassina Ixc

- 5.4.2.6. Huasheng Furniture Group

- 5.4.2.7. Ariake

- 5.4.2.8. CondeHouse

- 5.4.2.9. Hida Sangyo

- 5.4.2.10. Miyazaki Chair Factory

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 4 IKEA Kobe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 6 Huasheng Furniture Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 2 Muji

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 8 CondeHouse

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3 Karimoku Furniture Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 10 Miyazaki Chair Factory

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 5 Cassina Ixc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1 Nitori

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 9 Hida Sangyo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 7 Ariake

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 4 IKEA Kobe

List of Figures

- Figure 1: Japan Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Japan Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Japan Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Japan Furniture Market Revenue Million Forecast, by COMPETITIVE LANDSCAPE 2020 & 2033

- Table 5: Japan Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Japan Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Japan Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Japan Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Japan Furniture Market Revenue Million Forecast, by COMPETITIVE LANDSCAPE 2020 & 2033

- Table 10: Japan Furniture Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Furniture Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Japan Furniture Market?

Key companies in the market include 4 IKEA Kobe, 6 Huasheng Furniture Group, 2 Muji, 8 CondeHouse, 3 Karimoku Furniture Co Ltd, 10 Miyazaki Chair Factory, 5 Cassina Ixc, 1 Nitori, 9 Hida Sangyo, 7 Ariake.

3. What are the main segments of the Japan Furniture Market?

The market segments include Material, Application, Distribution Channel, COMPETITIVE LANDSCAPE.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.40 Million as of 2022.

5. What are some drivers contributing to market growth?

The integration of technology into furniture is gaining traction in Japan. Consumers are increasingly interested in smart furniture that offers convenience. such as adjustable beds. smart storage solutions. and furniture with built-in charging capabilities..

6. What are the notable trends driving market growth?

The demand for eco-friendly furniture is growing. with consumers seeking products that are not only stylish but also sustainable. This includes furniture made from recycled or upcycled materials. as well as products certified for sustainability by organizations like the Forest Stewardship Council (FSC)..

7. Are there any restraints impacting market growth?

Japan's declining population presents a long-term challenge for the furniture market. As the population shrinks and household formation slows. the overall demand for new furniture may decrease. particularly in rural areas..

8. Can you provide examples of recent developments in the market?

In January 2024, as a part of its expansion, IKEA opened a new store in the North Kanto region in Japan. It is the first store in the region and the tenth store in Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Furniture Market?

To stay informed about further developments, trends, and reports in the Japan Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence