Key Insights

The Chilean home appliances market is projected for robust expansion, anticipating a compound annual growth rate (CAGR) of 5.8% from 2024 to 2033. This growth is driven by rising disposable incomes, an expanding middle class, and increasing demand for modern, energy-efficient, and technologically advanced appliances. The market, valued at $3.34 billion in the base year 2024, is experiencing significant uplift due to government initiatives promoting energy conservation and smart home technologies. Key factors include heightened consumer awareness of the benefits of upgrading to newer models, a gradual replacement cycle, and increased adoption of innovative features like IoT integration.

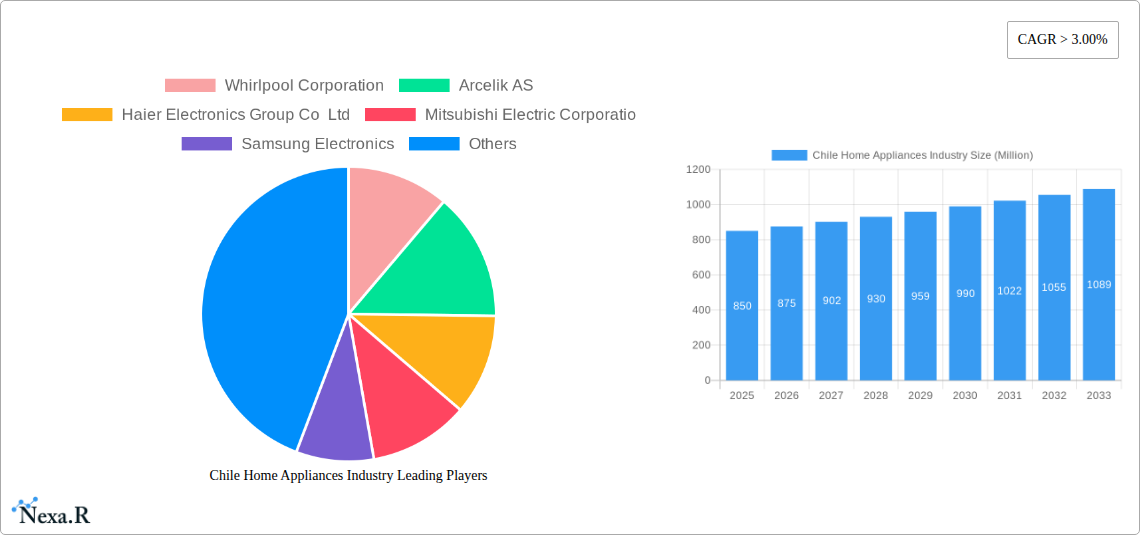

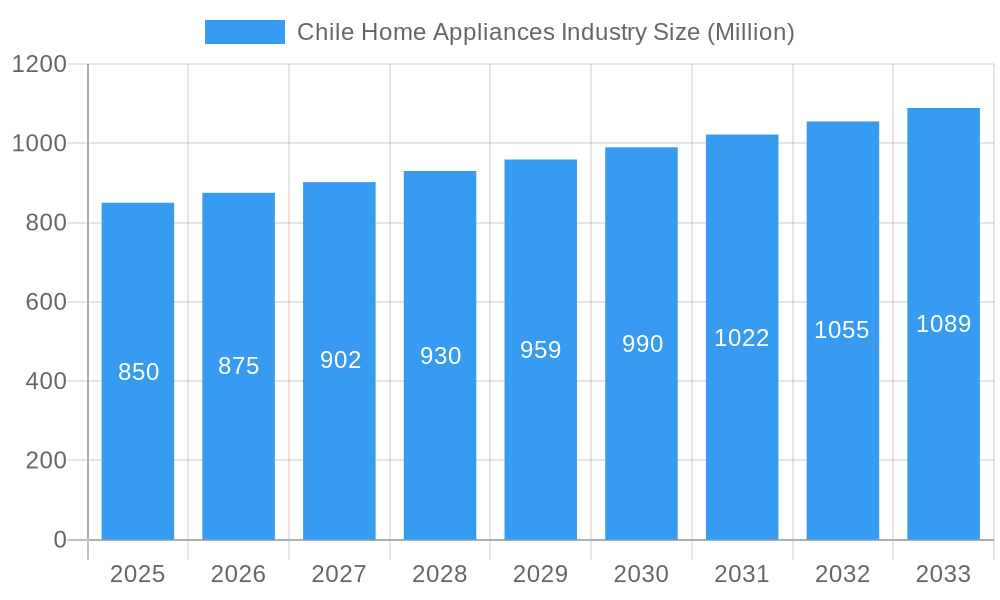

Chile Home Appliances Industry Market Size (In Billion)

Furthermore, Chile's strong construction sector, with ongoing residential and commercial projects, directly fuels sustained demand for a diverse range of home appliances. The competitive landscape features global leaders and prominent regional players focusing on product innovation, strategic partnerships, and extensive distribution networks. The market is segmented into major appliances (refrigerators, washing machines, ovens) and small domestic appliances (blenders, coffee makers, vacuum cleaners). Trends such as a growing preference for eco-friendly and energy-saving appliances are shaping product development and consumer choices. While strong demand drivers are present, potential restraints include economic volatility and fluctuating import duties. Nevertheless, the overall outlook remains positive, with companies prioritizing value-added products and tailored solutions for evolving Chilean household needs.

Chile Home Appliances Industry Company Market Share

Gain comprehensive insights into the Chilean home appliances industry with our latest market research report. Explore market size, growth forecasts, key drivers, competitive strategies, and emerging trends for the Chilean home appliance sector.

Chile Home Appliances Industry Market Dynamics & Structure

The Chilean home appliances market is characterized by a dynamic interplay of established global players and emerging local contenders, driven by evolving consumer preferences and increasing disposable incomes. Market concentration is moderately high, with a few dominant multinational corporations holding significant market share across various appliance categories. Technological innovation remains a key driver, particularly in areas like energy efficiency, smart home integration, and advanced functionalities, with companies continuously investing in R&D to differentiate their product offerings. Regulatory frameworks, primarily focusing on safety standards, energy consumption labels, and import/export regulations, play a crucial role in shaping market entry and product development. Competitive product substitutes, ranging from basic functional appliances to premium, feature-rich models, cater to diverse consumer segments. End-user demographics, marked by a growing middle class, urbanization, and a rising demand for convenience, significantly influence purchasing decisions. Mergers and acquisitions (M&A) trends, while not overtly aggressive, indicate strategic consolidations and partnerships aimed at expanding market reach and product portfolios.

- Market Concentration: Dominated by global brands with an estimated XX% market share held by the top 5 companies.

- Technological Innovation: Focus on smart appliances, IoT integration, and energy-saving features.

- Regulatory Frameworks: Emphasis on energy efficiency certifications (e.g., SEC approval) and consumer protection laws.

- Competitive Product Substitutes: Wide range from budget-friendly to high-end, feature-rich appliances.

- End-User Demographics: Driven by urban households, young professionals, and families seeking convenience and modern living.

- M&A Trends: Strategic partnerships and acquisitions to enhance distribution networks and expand product lines.

Chile Home Appliances Industry Growth Trends & Insights

The Chilean home appliances industry is poised for robust expansion, driven by a confluence of economic stability, increasing consumer spending power, and a growing adoption of modern living standards. The market size evolution reflects a steady upward trajectory, with the total value of the market projected to reach xx Million USD by 2033, up from xx Million USD in 2024. This growth is underpinned by rising household formation rates, a significant portion of which are first-time buyers entering the market for essential kitchen and laundry appliances. Adoption rates for technologically advanced appliances, such as smart refrigerators and energy-efficient washing machines, are experiencing a significant surge, propelled by heightened consumer awareness of sustainability and the convenience offered by connected devices. Technological disruptions, including advancements in artificial intelligence for appliance performance optimization and the proliferation of IoT platforms, are reshaping the product landscape and consumer expectations. Consumer behavior shifts are evident, with a discernible move towards premium products offering enhanced durability, sophisticated design, and advanced features. This segment, along with the parent market for overall home appliances, shows strong potential. The CAGR for the home appliances market in Chile is estimated at xx% during the forecast period. Market penetration for key appliance categories like refrigerators and washing machines stands at approximately xx%, with significant room for growth, particularly in smaller cities and rural areas. The increasing urbanization, coupled with a desire for enhanced home comfort and efficiency, acts as a primary catalyst for sustained market development.

Dominant Regions, Countries, or Segments in Chile Home Appliances Industry

The Consumption Analysis segment is currently the most dominant force driving the Chilean Home Appliances Industry. This is largely attributable to the high purchasing power of urban households in major metropolitan areas, particularly Santiago and its surrounding regions. These areas are home to a concentrated population with higher disposable incomes, a strong propensity for adopting new technologies, and a greater demand for modern, feature-rich appliances that enhance convenience and aesthetics. The parent market for white goods, encompassing major kitchen and laundry appliances, exhibits the highest market share within this consumption-driven landscape.

- Santiago Metropolitan Region: Accounts for an estimated xx% of total domestic consumption due to its dense population and economic activity.

- Economic Policies: Government initiatives promoting homeownership and consumer credit availability have bolstered demand for appliances.

- Infrastructure: Well-developed retail infrastructure, including large hypermarkets and specialized appliance stores, facilitates widespread product availability and accessibility.

- Consumer Behavior: A growing preference for energy-efficient models and smart home integration contributes to the dominance of technologically advanced appliance segments.

- Market Share: Major appliance categories like refrigerators, washing machines, and ovens hold a significant combined market share of over xx% in the consumption segment.

- Growth Potential: While mature, the consumption segment still presents substantial growth opportunities driven by replacement cycles and upgrades to more sophisticated models.

Within the Import Market Analysis (Volume), the parent market of major appliances from countries like China and the United States remains dominant. This is due to competitive pricing and the vast product portfolios offered by these exporting nations.

- Leading Importing Countries: China (xx% of volume), United States (xx% of volume), and Brazil (xx% of volume).

- Key Product Categories: Refrigerators, washing machines, and ovens constitute the bulk of imported volumes.

- Trade Agreements: Favorable trade agreements reduce import duties, making foreign products more competitive.

Chile Home Appliances Industry Product Landscape

The Chilean home appliances industry is witnessing a surge in product innovations focusing on enhanced user experience, energy efficiency, and smart connectivity. Product applications now extend beyond basic functionality to encompass personalized cooking settings, optimized laundry cycles based on fabric types, and intelligent cooling systems for food preservation. Performance metrics are increasingly being benchmarked against global standards for energy consumption (kWh/year) and water usage per cycle. Unique selling propositions revolve around sleek, minimalist designs, intuitive user interfaces, and seamless integration with smart home ecosystems, allowing for remote control and monitoring via mobile applications. Technological advancements such as induction cooking technology, inverter motor efficiency in washing machines, and advanced refrigeration compressors are becoming mainstream, catering to a consumer base that values both performance and sustainability.

Key Drivers, Barriers & Challenges in Chile Home Appliances Industry

The Chilean home appliances market is propelled by several key drivers. Rising disposable incomes and a growing middle class fuel increased consumer spending on durable goods. Technological advancements, particularly in energy efficiency and smart home integration, create demand for upgraded appliances. Furthermore, government initiatives promoting sustainable living and energy conservation encourage the adoption of eco-friendly models. The expansion of housing projects also contributes significantly to market growth.

- Drivers:

- Growing middle class and increasing disposable income.

- Technological innovation in energy efficiency and smart features.

- Government support for sustainability and energy conservation.

- Growth in the construction and real estate sector.

Conversely, the industry faces significant barriers and challenges. High import tariffs on certain components can impact manufacturing costs. Intense competition from both international and domestic brands puts pressure on profit margins. Fluctuations in currency exchange rates can affect the cost of imported raw materials and finished goods.

- Barriers & Challenges:

- Supply chain disruptions and rising logistics costs.

- Intense price competition among manufacturers and retailers.

- Stringent environmental regulations and compliance costs.

- Economic slowdowns impacting consumer purchasing power.

- Counterfeit products entering the market.

Emerging Opportunities in Chile Home Appliances Industry

Emerging opportunities in the Chilean home appliances sector lie in the burgeoning demand for sustainable and energy-efficient products, driven by heightened environmental consciousness among consumers and government incentives for greener technologies. The smart home appliance segment presents a significant untapped market, with increasing consumer interest in connected devices that offer convenience, automation, and enhanced functionality. Furthermore, there is an opportunity to cater to niche markets, such as compact appliances for smaller urban dwellings and specialized appliances for specific culinary needs, reflecting evolving lifestyle trends and living spaces.

Growth Accelerators in the Chile Home Appliances Industry Industry

Catalysts driving long-term growth in the Chilean Home Appliances Industry include continuous technological breakthroughs that enhance product performance, reduce energy consumption, and introduce innovative features. Strategic partnerships between appliance manufacturers and technology providers are accelerating the integration of IoT and AI capabilities, creating smarter and more user-friendly products. Market expansion strategies, particularly targeting underserved regions and developing premium product lines that appeal to affluent consumers, will also be crucial growth accelerators.

Key Players Shaping the Chile Home Appliances Industry Market

- Whirlpool Corporation

- Arcelik AS

- Haier Electronics Group Co Ltd

- Mitsubishi Electric Corporation

- Samsung Electronics

- Gorenje Group

- BSH Hausgeräte GmbH

- Electrolux AB

- Panasonic Corporation

- LG Electronics

Notable Milestones in Chile Home Appliances Industry Sector

- 2019 October: Introduction of enhanced energy efficiency labeling by the Chilean government, prompting manufacturers to focus on more sustainable product lines.

- 2020 February: Launch of smart home-enabled refrigerators by major brands, signaling a growing trend towards connected appliances.

- 2021 July: Significant increase in e-commerce sales of home appliances due to changing consumer shopping habits.

- 2022 March: A major appliance manufacturer announces expansion of its local assembly operations to meet growing demand.

- 2023 November: Introduction of advanced water-saving washing machine technologies to address growing environmental concerns.

In-Depth Chile Home Appliances Industry Market Outlook

The outlook for the Chilean Home Appliances Industry remains highly optimistic, driven by robust economic fundamentals, a young and growing population, and an increasing embrace of technology. Growth accelerators such as smart home integration, the demand for energy-efficient appliances, and expanding middle-class purchasing power will continue to fuel market expansion. Strategic opportunities for companies lie in innovating with sustainable technologies, enhancing digital customer engagement, and potentially exploring niche product segments that cater to evolving Chilean lifestyles.

Chile Home Appliances Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Chile Home Appliances Industry Segmentation By Geography

- 1. Chile

Chile Home Appliances Industry Regional Market Share

Geographic Coverage of Chile Home Appliances Industry

Chile Home Appliances Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Household Disposable Income Drives The Market; Changing Lifestyles and Time Constraints Drives The Market

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Infrastructure and Space Limitations

- 3.4. Market Trends

- 3.4.1. Innovative Kitchen Appliances Grabbing a Higher Portion of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Home Appliances Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arcelik AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Haier Electronics Group Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporatio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gorenje Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BSH Hausgeräte GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Electrolux AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Chile Home Appliances Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Chile Home Appliances Industry Share (%) by Company 2025

List of Tables

- Table 1: Chile Home Appliances Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Chile Home Appliances Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Chile Home Appliances Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Chile Home Appliances Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Chile Home Appliances Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Chile Home Appliances Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Chile Home Appliances Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Chile Home Appliances Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Chile Home Appliances Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Chile Home Appliances Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Chile Home Appliances Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Chile Home Appliances Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Home Appliances Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Chile Home Appliances Industry?

Key companies in the market include Whirlpool Corporation, Arcelik AS, Haier Electronics Group Co Ltd, Mitsubishi Electric Corporatio, Samsung Electronics, Gorenje Group, BSH Hausgeräte GmbH, Electrolux AB, Panasonic Corporation, LG Electronics.

3. What are the main segments of the Chile Home Appliances Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Household Disposable Income Drives The Market; Changing Lifestyles and Time Constraints Drives The Market.

6. What are the notable trends driving market growth?

Innovative Kitchen Appliances Grabbing a Higher Portion of the Market.

7. Are there any restraints impacting market growth?

High Initial Costs; Infrastructure and Space Limitations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Home Appliances Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Home Appliances Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Home Appliances Industry?

To stay informed about further developments, trends, and reports in the Chile Home Appliances Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence