Key Insights

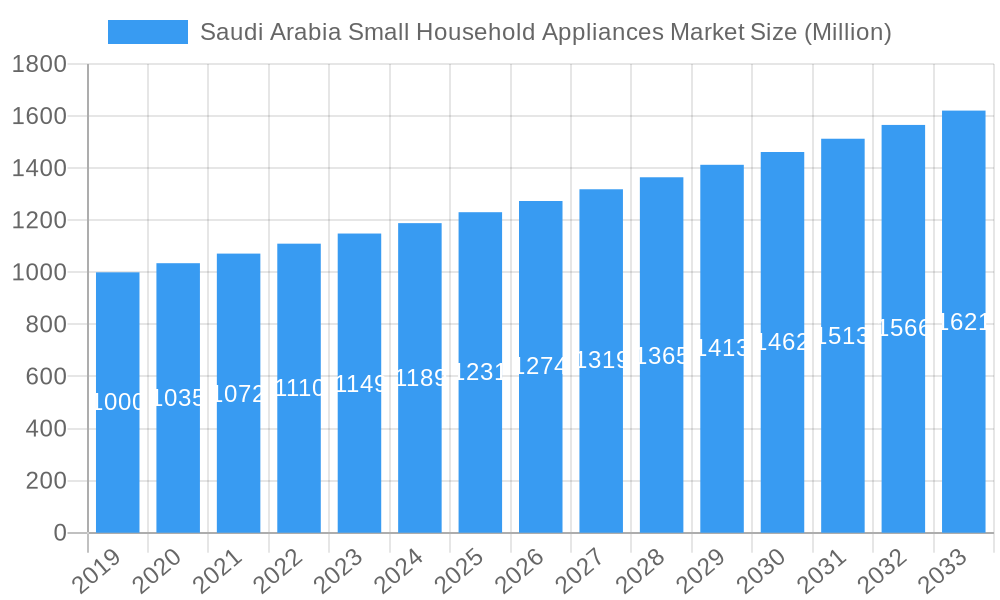

The Saudi Arabia Small Household Appliances Market is poised for robust expansion, projected to reach approximately $1.24 billion in 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.87%, indicating sustained demand and innovation within the sector. A significant driver for this market is the increasing disposable income and rising consumer spending power within the Kingdom, fueled by economic diversification initiatives and a growing young population with a penchant for modern conveniences. Furthermore, a strong emphasis on enhancing living standards and the adoption of smart home technologies are propelling the demand for sophisticated and energy-efficient small household appliances. The market is witnessing a growing preference for premium and technologically advanced products across all segments, reflecting a consumer shift towards convenience, durability, and aesthetic appeal.

Saudi Arabia Small Household Appliances Market Market Size (In Billion)

The market's trajectory is further shaped by key trends such as the burgeoning online retail sector, offering greater accessibility and convenience for consumers to explore and purchase a wide array of small household appliances. This digital shift is complemented by the continued importance of multi-branded and specialty stores, which provide curated selections and expert advice. While the market benefits from strong purchasing power and a desire for upgraded home environments, potential restraints could include fluctuating raw material costs and intense competition among established global and emerging local players. However, the overall outlook remains positive, driven by continuous product innovation, strategic marketing efforts by leading companies like Samsung Electronics, LG Electronics, and Philips, and a persistent consumer demand for appliances that simplify daily routines and enhance home comfort.

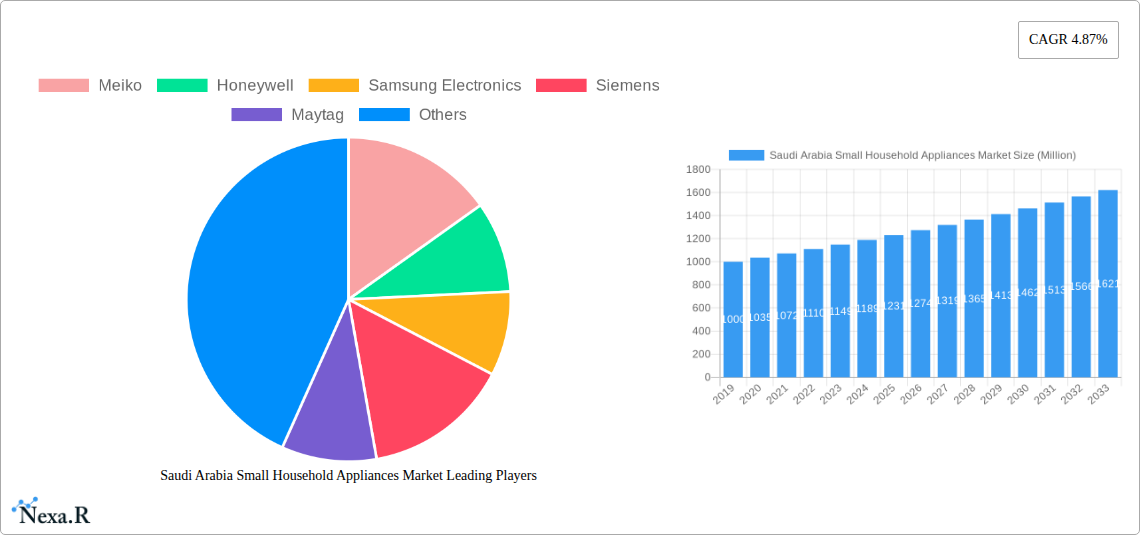

Saudi Arabia Small Household Appliances Market Company Market Share

Saudi Arabia Small Household Appliances Market: Market Dynamics & Structure

The Saudi Arabia small household appliances market is characterized by a moderately concentrated landscape, with key global players and emerging regional brands vying for market share. Technological innovation is a significant driver, with a growing demand for smart appliances, energy-efficient models, and multi-functional devices. Regulatory frameworks, while generally supportive of consumer goods, can influence import duties and product safety standards. Competitive product substitutes are abundant, particularly in categories like kitchen appliances, where a wide array of options exists to cater to diverse price points and functional needs. End-user demographics are shifting, with a growing middle-class population, increasing disposable income, and a preference for convenience and modern living driving demand for sophisticated household solutions. Mergers and acquisitions (M&A) trends are relatively nascent but are expected to gain traction as larger players seek to consolidate their presence and acquire innovative technologies or distribution networks.

- Market Concentration: Dominated by a few multinational corporations, but with increasing participation from local and regional distributors.

- Technological Innovation Drivers: Demand for smart home integration, energy efficiency (e.g., AAA-rated appliances), and advanced features in kitchen gadgets and cleaning devices.

- Regulatory Frameworks: Focus on consumer safety standards, import regulations, and potential incentives for local manufacturing.

- Competitive Product Substitutes: Wide variety of brands offering similar functionalities across all product categories.

- End-User Demographics: Young population, increasing urbanization, and a rising female workforce seeking time-saving home solutions.

- M&A Trends: Potential for consolidation as established brands acquire smaller, innovative startups or expand their distribution footprint through strategic alliances.

Saudi Arabia Small Household Appliances Market Growth Trends & Insights

The Saudi Arabia small household appliances market is poised for robust expansion, driven by a confluence of economic, social, and technological factors throughout the study period of 2019–2033. The base year of 2025 represents a significant point for current market valuation, with projected growth anticipated through the forecast period of 2025–2033. This growth trajectory is underpinned by Saudi Arabia's ambitious Vision 2030, which aims to diversify the economy and improve the quality of life for its citizens, directly translating into increased consumer spending on home improvement and modernization. The historical period of 2019–2024 has already witnessed a steady rise in the adoption of small household appliances, fueled by an expanding expatriate population, a young demographic with a penchant for adopting new technologies, and increasing household incomes.

The market size evolution is expected to be significant, with CAGRs projected to be healthy, reflecting sustained consumer interest. Adoption rates for both essential and premium small appliances are on the rise. Smart appliances, in particular, are experiencing accelerated adoption as consumers become more digitally integrated and seek greater convenience and control in their homes. Technological disruptions, such as the integration of AI and IoT in appliances, are creating new product categories and enhancing the functionality of existing ones, thereby stimulating demand. Consumer behavior shifts are paramount to this growth; there's a discernible move towards products that offer time-saving benefits, enhance culinary experiences, and contribute to a healthier and more sustainable lifestyle. The market penetration of small household appliances is still growing, especially in emerging urban centers and for more specialized product categories, indicating ample room for continued expansion. The increasing participation of e-commerce platforms has further democratized access to a wider range of products and brands, contributing to market accessibility and growth. The ongoing development of smart cities and residential infrastructure will also create sustained demand for advanced and integrated household solutions, further solidifying the positive growth outlook for the Saudi Arabian small household appliances market.

Dominant Regions, Countries, or Segments in Saudi Arabia Small Household Appliances Market

The Saudi Arabia small household appliances market is experiencing significant growth and evolution, with several key segments and regions contributing to its expansion. Within the product landscape, Coffee Makers have emerged as a dominant segment, driven by a burgeoning coffee culture, an increasing number of cafes and a growing preference for at-home brewing solutions among consumers. This segment is further propelled by premiumization trends, with consumers willing to invest in advanced espresso machines and specialized coffee makers that offer convenience and superior taste. The Food Processors segment also commands substantial market share, reflecting the growing interest in home cooking and healthy eating, particularly among the younger, health-conscious demographic. As consumers increasingly seek to prepare meals from scratch, the demand for versatile and efficient food processors continues to surge.

The Distribution Channel analysis reveals that Multi Branded Stores currently hold a significant market presence, acting as traditional retail hubs for a wide array of appliance brands. However, the rapid growth of Online Stores is a defining trend, capturing an ever-increasing share of the market. This shift is attributed to the convenience of online shopping, the wider product selection available, competitive pricing, and the growing digital literacy of Saudi consumers. The ease of comparison, customer reviews, and doorstep delivery further bolster the appeal of online channels.

Geographically, major urban centers like Riyadh, Jeddah, and Dammam represent the dominant regions for small household appliance sales. These cities boast a higher concentration of disposable income, a larger expatriate population, and a greater adoption rate of new technologies and lifestyle trends. Economic policies promoting consumer spending and infrastructure development in these urban hubs further facilitate market growth. The increasing disposable income, coupled with a growing preference for Westernized lifestyles and culinary habits, fuels the demand for a diverse range of small household appliances.

- Dominant Product Segment: Coffee Makers, driven by evolving consumer habits and a desire for premium at-home brewing experiences.

- Key Drivers for Coffee Makers: Growth of coffee culture, increasing café penetration, and demand for advanced brewing technologies.

- Strong Performing Product Segment: Food Processors, fueled by healthy eating trends and a preference for home-cooked meals.

- Dominant Distribution Channel: Multi Branded Stores, offering extensive product variety and traditional retail experience.

- Rapidly Growing Distribution Channel: Online Stores, characterized by convenience, wider selection, and competitive pricing.

- Dominant Geographical Regions: Riyadh, Jeddah, and Dammam, benefiting from high population density, disposable income, and urbanization.

- Key Drivers in Dominant Regions: High disposable income, Western lifestyle influences, and advanced retail infrastructure.

Saudi Arabia Small Household Appliances Market Product Landscape

The Saudi Arabia small household appliances market is witnessing a dynamic product landscape characterized by a focus on enhanced functionality, user convenience, and aesthetic appeal. Innovations in the Coffee Makers segment are pushing boundaries with integrated grinding capabilities, programmable brewing cycles, and smart connectivity for personalized beverage creation. Food Processors are becoming more powerful and versatile, offering multiple attachments for chopping, blending, kneading, and even spiralizing, catering to diverse culinary needs. The Grills and Roasters category is evolving with indoor electric options that mimic outdoor grilling, featuring precise temperature controls and non-stick surfaces for healthier and more convenient cooking. Vacuum Cleaners are increasingly embracing smart technology, with robotic models offering autonomous navigation and advanced suction power, alongside cordless stick vacuums that prioritize portability and ease of use. "Other Small Appliances" encompass a broad spectrum of innovations, including air fryers that provide a healthier alternative to deep-frying, multi-functional blenders for smoothies and soups, and advanced juicers that maximize nutrient extraction. The unique selling propositions revolve around energy efficiency, intuitive interfaces, and sleek, modern designs that complement contemporary kitchen aesthetics.

Key Drivers, Barriers & Challenges in Saudi Arabia Small Household Appliances Market

The Saudi Arabia small household appliances market is propelled by several key drivers. Growing disposable income and a young, aspirational population with a strong inclination towards adopting modern lifestyles are primary economic catalysts. Increasing urbanization and a rising female workforce create a demand for time-saving and convenient home solutions. Technological advancements, such as smart home integration and energy efficiency, are driving consumer preference for advanced appliances. Government initiatives like Vision 2030, aimed at improving living standards and diversifying the economy, also indirectly support market growth by fostering consumer confidence and spending.

However, the market faces certain barriers and challenges. Intense competition from both global and local brands, often leading to price wars, can impact profit margins for manufacturers and retailers. Supply chain disruptions, particularly those related to global logistics and component sourcing, can lead to stockouts and increased costs. Evolving consumer preferences require continuous product innovation and adaptation, posing a challenge for companies to stay ahead of trends. Regulatory hurdles, including import duties and product certification requirements, can also present complexities for market entry and operations.

Emerging Opportunities in Saudi Arabia Small Household Appliances Market

Emerging opportunities in the Saudi Arabia small household appliances market are centered around the growing demand for smart and connected appliances. The integration of IoT and AI in everyday household devices presents a significant avenue for innovation, offering consumers enhanced convenience, energy management, and personalized experiences. The health and wellness trend is another strong opportunity, driving demand for kitchen appliances that promote healthy cooking, such as air fryers, blenders for nutrient-rich smoothies, and advanced juicers. Furthermore, the eco-conscious consumer is gaining traction, creating demand for energy-efficient and sustainable appliance options. Untapped markets in smaller cities and towns, coupled with the increasing penetration of e-commerce, offer potential for expansion and reaching a wider consumer base. The development of innovative applications within existing product categories, like specialized coffee makers catering to specific brewing methods or food processors with unique attachments, can also unlock new market niches.

Growth Accelerators in the Saudi Arabia Small Household Appliances Market Industry

Several catalysts are accelerating the growth of the Saudi Arabia small household appliances industry. Technological breakthroughs, particularly in areas of artificial intelligence and the Internet of Things (IoT), are enabling the development of more sophisticated and user-friendly smart appliances, appealing to a tech-savvy consumer base. Strategic partnerships, such as distribution agreements and co-marketing initiatives between international manufacturers and local entities, are crucial for expanding market reach and understanding regional consumer preferences. For instance, Hisense's partnership with United Matbouli Group and Panasonic's collaboration with Ahmed Abdulwahed Trading Co are prime examples of how such alliances can bolster operations and distribution networks. Market expansion strategies, including targeted marketing campaigns and the introduction of product lines tailored to local tastes and needs, are also key growth drivers. The ongoing development of infrastructure and residential projects across the Kingdom further creates a sustained demand for these essential household items.

Key Players Shaping the Saudi Arabia Small Household Appliances Market Market

Meiko, Honeywell, Samsung Electronics, Siemens, Maytag, Philips, Electrolux Arabia, Haier, Bosch, LG Electronics, Panasonic Corporation

Notable Milestones in Saudi Arabia Small Household Appliances Market Sector

- December 2022: Hisense entered into a partnership agreement with Saudi Arabia's United Matbouli Group to enhance and broaden its operations in the Kingdom.

- December 2022: Panasonic Marketing Middle East & Africa (PMMAF) established a partnership with Ahmed Abdulwahed Trading Co (AAW) as its new distributor in Saudi Arabia for small domestic appliances.

In-Depth Saudi Arabia Small Household Appliances Market Market Outlook

The future outlook for the Saudi Arabia small household appliances market is exceptionally bright, fueled by a dynamic interplay of economic prosperity, evolving consumer lifestyles, and rapid technological integration. Growth accelerators, including the nation's commitment to economic diversification and improving living standards, will continue to stimulate consumer spending on home enhancements. The increasing adoption of smart home technologies and the growing demand for energy-efficient, convenience-oriented appliances are expected to drive significant market penetration. Strategic partnerships and a focus on localized product offerings will be crucial for brands seeking to capture substantial market share. The expanding e-commerce ecosystem further democratizes access, opening new avenues for growth beyond traditional retail channels. Overall, the market is positioned for sustained expansion, presenting lucrative opportunities for innovation, strategic market entry, and brand development within this vibrant sector.

Saudi Arabia Small Household Appliances Market Segmentation

-

1. Product

- 1.1. Coffee Makers

- 1.2. Food Processors

- 1.3. Grills and Roasters

- 1.4. Vacuum Cleaners

- 1.5. Other Small Appliances

-

2. Distribution Channel

- 2.1. Multi Branded Stores

- 2.2. Specialty Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

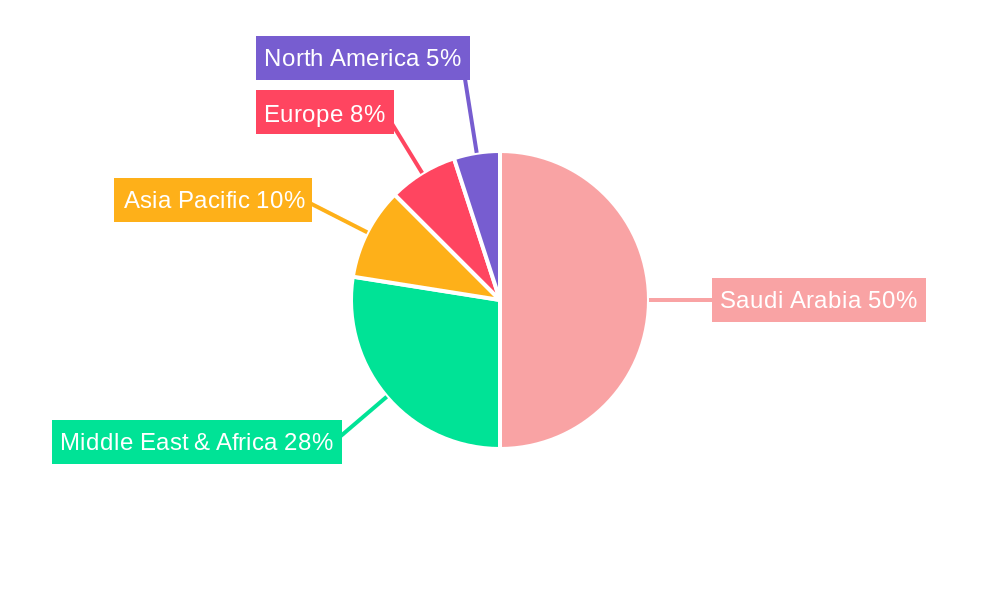

Saudi Arabia Small Household Appliances Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Small Household Appliances Market Regional Market Share

Geographic Coverage of Saudi Arabia Small Household Appliances Market

Saudi Arabia Small Household Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Competition in the Industry is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Smart Homes in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Small Household Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Coffee Makers

- 5.1.2. Food Processors

- 5.1.3. Grills and Roasters

- 5.1.4. Vacuum Cleaners

- 5.1.5. Other Small Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi Branded Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Meiko

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maytag

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Philips

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Electrolux Arabia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Haier

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bosch

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Meiko

List of Figures

- Figure 1: Saudi Arabia Small Household Appliances Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Small Household Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Small Household Appliances Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Saudi Arabia Small Household Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Saudi Arabia Small Household Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Saudi Arabia Small Household Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Saudi Arabia Small Household Appliances Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Small Household Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Small Household Appliances Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Saudi Arabia Small Household Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Saudi Arabia Small Household Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Saudi Arabia Small Household Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Saudi Arabia Small Household Appliances Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Small Household Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Small Household Appliances Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Saudi Arabia Small Household Appliances Market?

Key companies in the market include Meiko, Honeywell, Samsung Electronics, Siemens, Maytag, Philips, Electrolux Arabia, Haier, Bosch, LG Electronics, Panasonic Corporation.

3. What are the main segments of the Saudi Arabia Small Household Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Smart Homes in Saudi Arabia.

7. Are there any restraints impacting market growth?

High Competition in the Industry is Restraining the Market.

8. Can you provide examples of recent developments in the market?

December 2022: Hisense entered into a partnership agreement with Saudi Arabia's United Matbouli Group to enhance and broaden its operations in the Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Small Household Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Small Household Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Small Household Appliances Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Small Household Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence