Key Insights

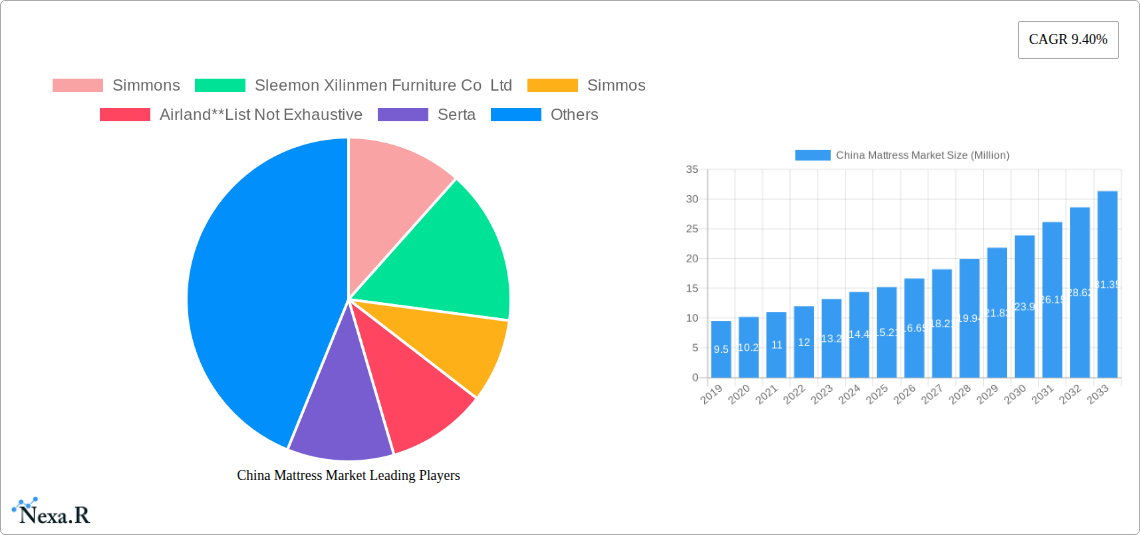

The China mattress market is poised for robust expansion, projected to reach a significant valuation of USD 15.21 million by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 9.40%, indicating sustained momentum over the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing consumer awareness regarding sleep health and the benefits of quality mattresses. As disposable incomes rise and living standards improve across China, consumers are demonstrating a greater willingness to invest in products that enhance their well-being, with mattresses being a key area of focus. Furthermore, the burgeoning e-commerce sector has democratized access to a wider array of mattress options, from traditional innerspring to innovative memory foam and hybrid designs, catering to diverse consumer preferences and price points. The "stay-at-home" economy and a growing emphasis on home comfort have also contributed to a surge in demand for superior sleep solutions, making the mattress market a dynamic and attractive segment.

China Mattress Market Market Size (In Million)

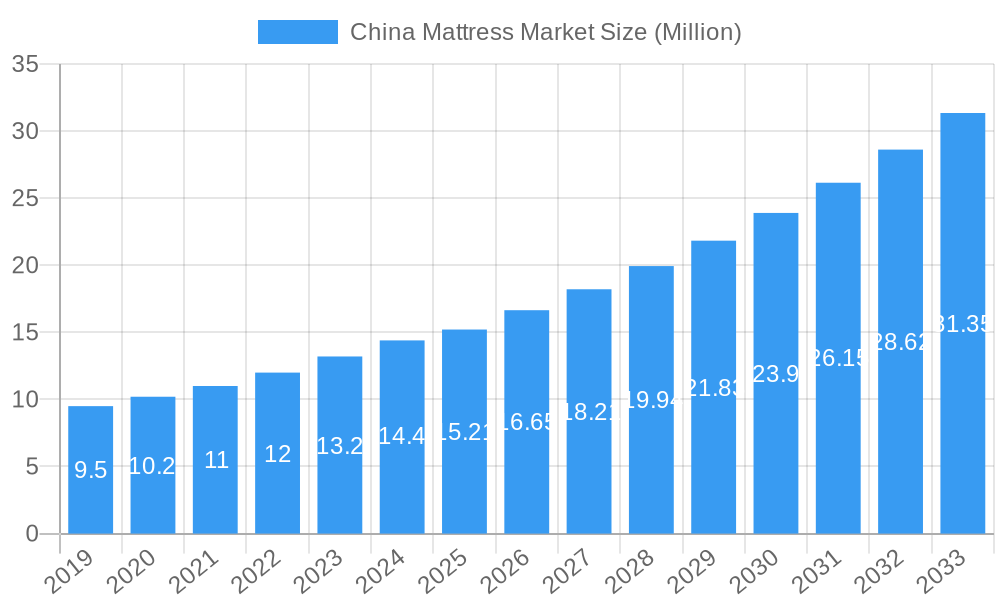

The market's expansion is further fueled by ongoing trends such as the growing preference for personalized sleep experiences, the introduction of smart mattresses with integrated technology for sleep tracking and adjustment, and a heightened demand for eco-friendly and sustainable materials. While the market experiences strong growth, potential restraints could emerge from intense price competition, especially in the lower-tier segments, and the susceptibility to fluctuations in raw material costs. However, the sheer scale of the Chinese population and the continued urbanization trend present substantial opportunities for market penetration. Key players like Simmons, Serta, and Sealy, alongside domestic giants such as Xilinmen Furniture Co. Ltd., are actively vying for market share through product innovation, strategic partnerships, and expanded distribution networks, particularly leveraging online channels to reach consumers across the vast geographical expanse of China.

China Mattress Market Company Market Share

China Mattress Market: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report provides a holistic analysis of the China Mattress Market, offering critical insights into market dynamics, growth trends, regional dominance, product landscape, and key players. Delve into production and consumption analyses, import and export market evaluations, and detailed price trend analysis. With a study period spanning from 2019 to 2033, and a base year of 2025, this report is meticulously crafted for industry professionals seeking to navigate and capitalize on the evolving Chinese mattress sector. All values are presented in million units, ensuring clarity and precision.

China Mattress Market Market Dynamics & Structure

The China Mattress Market exhibits a dynamic interplay of market concentration, technological innovation, regulatory influences, and competitive pressures. While fragmented to some extent, with numerous local manufacturers, key global and domestic brands are steadily consolidating their presence. Technological innovation is a significant driver, with advancements in material science, ergonomic design, and smart mattress features enhancing product differentiation and consumer appeal. Regulatory frameworks, particularly concerning product safety and environmental standards, are becoming increasingly stringent, influencing manufacturing processes and product development. Competitive product substitutes, including futons, sofa beds, and even sleeping on traditional bedding, present an ongoing challenge, necessitating continuous innovation in comfort and health benefits. End-user demographics are shifting, with a growing middle class, an aging population, and increased health consciousness driving demand for premium, specialized mattresses. Mergers and acquisitions (M&A) trends are observed as larger players seek to expand market share and achieve economies of scale.

- Market Concentration: Moderate fragmentation with a growing influence of established brands.

- Technological Innovation Drivers: Advancements in memory foam, latex, hybrid constructions, and smart mattress technology.

- Regulatory Frameworks: Increasing emphasis on national safety standards (e.g., GB/T 19237-2013) and environmental certifications.

- Competitive Product Substitutes: Traditional bedding, futons, sofa beds, and regional sleeping customs.

- End-User Demographics: Rising disposable incomes, urbanization, health awareness, and an aging population.

- M&A Trends: Strategic acquisitions to gain market access and product portfolios.

China Mattress Market Growth Trends & Insights

The China Mattress Market is poised for robust growth, driven by a confluence of socioeconomic factors and evolving consumer preferences. The market size has experienced steady expansion over the historical period (2019-2024), and this trajectory is projected to continue through the forecast period (2025-2033) at a significant Compound Annual Growth Rate (CAGR). Adoption rates for modern mattresses, particularly those offering enhanced comfort and health benefits, are on the rise, reflecting a growing willingness among consumers to invest in their sleep quality. Technological disruptions are playing a pivotal role, with the introduction of innovative materials like gel-infused memory foam, natural latex, and advanced pocket spring systems catering to diverse sleep needs. Furthermore, the increasing adoption of online retail channels has democratized access to a wider range of products, accelerating market penetration. Consumer behavior is shifting dramatically; from a historical preference for firmer, traditional surfaces, there is a discernible move towards customizable, supportive, and health-conscious sleep solutions. This includes a growing interest in mattresses designed for specific needs, such as orthopedic support, cooling properties, and hypoallergenic features. The urbanization trend, coupled with a burgeoning middle class possessing higher disposable incomes, further fuels demand for premium and branded mattresses. The government's focus on promoting domestic consumption and improving living standards indirectly supports the mattress market by encouraging investments in home furnishings and lifestyle upgrades. The increasing awareness of sleep's impact on overall health and well-being is a fundamental driver, pushing consumers to prioritize quality sleep and, consequently, quality mattresses. The market penetration of specialized mattresses, such as those for children or individuals with specific health conditions, is also expected to grow. The penetration of the online channel for mattress sales, already significant, is anticipated to increase further, offering consumers greater choice and convenience.

Dominant Regions, Countries, or Segments in China Mattress Market

The Consumption Analysis segment is a dominant force driving growth within the China Mattress Market, with the Eastern China region standing out as the leading geographical area. This dominance is underpinned by a robust economic infrastructure, high population density, and a concentration of disposable income, fostering a greater propensity for purchasing premium and branded mattresses. Production analysis in this region is also significant, fueled by established manufacturing hubs and a skilled workforce.

Consumption Analysis Dominance: Eastern China, including major metropolises like Shanghai, Beijing, and Guangzhou, accounts for the largest share of mattress consumption due to high urbanization and consumer spending power.

- Key Drivers: High per capita income, strong retail infrastructure (both online and offline), and a culture of prioritizing home comfort and wellness.

- Market Share: Estimated to hold over 40% of the total mattress consumption in China.

- Growth Potential: Continuous urbanization and rising living standards promise sustained growth.

Production Analysis: While Eastern China is a production powerhouse, Northern China (including regions like Hebei and Shandong) also holds significant manufacturing capacity, often focusing on cost-effective production.

- Key Drivers: Proximity to raw material sources and established industrial bases.

- Growth Potential: Focus on efficiency and scalability in production.

Import Market Analysis (Value & Volume): Imports are concentrated in Tier-1 cities within Eastern China, driven by demand for premium international brands and specialized sleep technologies.

- Key Drivers: Consumer aspiration for global brands and advanced sleep solutions not readily available domestically.

- Value & Volume: Higher value per unit is observed in imported mattresses, indicating a focus on premium segments.

Export Market Analysis (Value & Volume): While China is a major global manufacturing hub for mattresses, the export market from China is primarily driven by bulk production of more conventional mattress types for international markets, with Southeast Asia and developing economies being key destinations.

- Key Drivers: Competitive pricing and large-scale manufacturing capabilities.

- Value & Volume: Dominated by volume exports of mid-range and economy mattresses.

Price Trend Analysis: Prices in Eastern China tend to be higher, reflecting the premiumization of the market and higher operating costs. Other regions may offer more competitive pricing due to lower production costs.

- Key Drivers: Brand positioning, material quality, technological features, and regional economic disparities.

China Mattress Market Product Landscape

The China Mattress Market product landscape is characterized by a diverse array of innovations catering to evolving consumer needs. Key product categories include memory foam, latex, innerspring (particularly pocketed coil), hybrid, and increasingly, smart mattresses. Material science advancements have led to the development of gel-infused foams for enhanced cooling, adaptive support systems, and hypoallergenic treatments. Applications range from standard residential use to specialized orthopedic and therapeutic solutions, addressing specific health concerns like back pain and allergies. Performance metrics such as pressure relief, durability, breathability, and motion isolation are increasingly important selling points. Technological advancements are evident in the integration of sensors for sleep tracking, adjustable firmness levels, and even climate control features in premium smart mattresses.

Key Drivers, Barriers & Challenges in China Mattress Market

The China Mattress Market is propelled by several key drivers. The increasing urbanization rate and rising disposable incomes are significant economic drivers, enabling consumers to invest more in home furnishings and prioritize sleep quality. Technological innovation, such as the development of advanced materials like memory foam and hybrid constructions, and the integration of smart features, directly fuels demand for upgraded sleep solutions. Government initiatives promoting domestic consumption and healthy living also act as catalysts.

- Key Drivers:

- Economic Growth & Urbanization: Higher disposable incomes and a growing middle class.

- Health & Wellness Trend: Increased consumer awareness of sleep's impact on well-being.

- Technological Advancements: Innovations in materials and smart mattress technology.

- E-commerce Penetration: Wider accessibility to a variety of mattress options.

However, the market faces substantial barriers and challenges. Intense competition from both domestic and international players, coupled with a price-sensitive consumer base, can lead to price wars and pressure on profit margins. Supply chain disruptions, especially concerning raw material sourcing and logistics, can impact production costs and delivery timelines. Evolving regulatory landscapes, while beneficial for product quality, can also impose compliance costs and necessitate investment in new technologies. The prevalence of counterfeit products in some segments of the market also poses a significant challenge to brand integrity and consumer trust.

- Barriers & Challenges:

- Intense Competition & Price Sensitivity: Numerous players and a focus on value for money.

- Supply Chain Volatility: Raw material availability and logistics complexities.

- Regulatory Compliance: Adhering to evolving safety and environmental standards.

- Counterfeit Products: Risk to brand reputation and consumer trust.

- Consumer Education: Need to inform consumers about premium features and benefits.

Emerging Opportunities in China Mattress Market

Emerging opportunities within the China Mattress Market lie in the growing demand for eco-friendly and sustainable mattresses, driven by increasing environmental consciousness. The niche market for specialty mattresses catering to specific health conditions, such as allergies, back pain, and sleep apnea, presents significant untapped potential. Furthermore, the continued growth of e-commerce and direct-to-consumer (DTC) models opens avenues for innovative distribution strategies and personalized customer experiences. The integration of smart technology beyond basic sleep tracking, offering personalized sleep environment control, is another burgeoning area.

- Eco-friendly & Sustainable Mattresses: Growing demand for organic materials and reduced environmental impact.

- Specialty & Health-Focused Mattresses: Catering to specific health needs and orthopedic requirements.

- Direct-to-Consumer (DTC) & E-commerce Expansion: Innovative online sales models and personalized customer journeys.

- Advanced Smart Mattress Technology: Personalized sleep environment control and integrated wellness features.

Growth Accelerators in the China Mattress Market Industry

Several catalysts are accelerating long-term growth in the China Mattress Market industry. The continuous technological breakthroughs in materials science and sleep technology are leading to the creation of more comfortable, supportive, and healthier sleep solutions, directly stimulating consumer interest and willingness to upgrade. Strategic partnerships between mattress manufacturers, e-commerce platforms, and even healthcare providers are expanding market reach and building brand credibility. Furthermore, market expansion strategies targeting emerging Tier-2 and Tier-3 cities, where disposable incomes are rising and demand for better living standards is growing, are crucial for sustained volume growth. The increasing focus on premiumization by leading brands, offering differentiated products with enhanced features and superior customer service, is also driving higher average selling prices and overall market value.

Key Players Shaping the China Mattress Market Market

- Simmons

- Sleemon Xilinmen Furniture Co Ltd

- Simmos

- Airland

- Serta

- Silentnight

- King Koil

- Sealy

- Tempur-Pedic

- Sleep Number

Notable Milestones in China Mattress Market Sector

- April 2023: Avocado Green Mattress enters wholesale, aiming for availability in over 600 stores by year-end through expanded wholesale partnerships. This move signals a strategy to broaden market reach and accessibility for their eco-friendly products.

- May 2023: Tempur Sealy announced a definitive agreement to acquire Mattress Firm Group Inc. for approximately USD 4 billion. This acquisition represents a significant consolidation in the retail mattress sector, impacting distribution channels and market competition.

In-Depth China Mattress Market Market Outlook

The future outlook for the China Mattress Market is exceptionally promising, driven by sustained economic development, evolving consumer lifestyles, and relentless innovation. Growth accelerators, including the increasing adoption of advanced sleep technologies and a heightened focus on health and wellness, will continue to shape the market. Strategic opportunities lie in further penetrating underserved urban and rural areas, leveraging digital channels for enhanced customer engagement, and developing sustainable product lines to align with growing environmental awareness. The market's trajectory indicates a clear shift towards premiumization, customization, and integrated sleep solutions, ensuring continued expansion and profitability for agile and forward-thinking industry players.

China Mattress Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Mattress Market Segmentation By Geography

- 1. China

China Mattress Market Regional Market Share

Geographic Coverage of China Mattress Market

China Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Challenges in Distribution and Logistics

- 3.4. Market Trends

- 3.4.1. China is the Major Exporter of Mattresses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Mattress Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Simmons

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sleemon Xilinmen Furniture Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Simmos

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Airland**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Serta

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Silentnight

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 King Koil

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sealy

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tempur-Pedic

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sleep Number

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Simmons

List of Figures

- Figure 1: China Mattress Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Mattress Market Share (%) by Company 2025

List of Tables

- Table 1: China Mattress Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: China Mattress Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: China Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: China Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: China Mattress Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: China Mattress Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: China Mattress Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: China Mattress Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: China Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: China Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: China Mattress Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: China Mattress Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Mattress Market?

The projected CAGR is approximately 9.40%.

2. Which companies are prominent players in the China Mattress Market?

Key companies in the market include Simmons, Sleemon Xilinmen Furniture Co Ltd, Simmos, Airland**List Not Exhaustive, Serta, Silentnight, King Koil, Sealy, Tempur-Pedic, Sleep Number.

3. What are the main segments of the China Mattress Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

China is the Major Exporter of Mattresses.

7. Are there any restraints impacting market growth?

Challenges in Distribution and Logistics.

8. Can you provide examples of recent developments in the market?

April 2023: Avocado Green Mattress enters wholesale. Avocado Green Mattress aims to be available in more than 600 stores by the end of the year by adding more wholesale partners to its business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Mattress Market?

To stay informed about further developments, trends, and reports in the China Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence