Key Insights

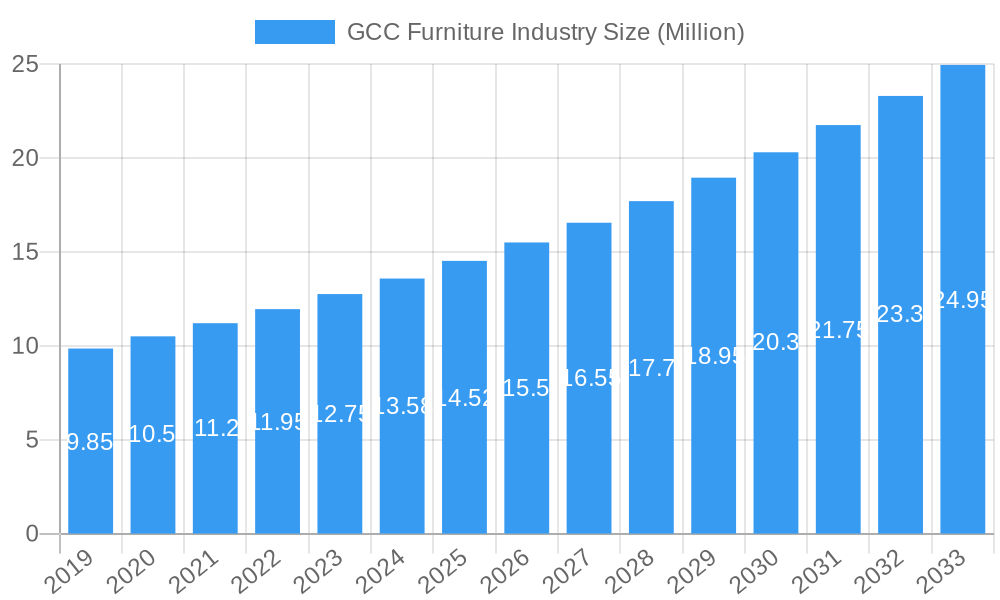

The GCC furniture market is poised for significant expansion, projected to reach a valuation of approximately USD 14.52 billion by 2025. This robust growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 7.54%, indicating sustained demand and increasing market value throughout the forecast period. A primary driver for this expansion is the booming construction sector across the GCC region, fueled by ambitious government initiatives and large-scale infrastructure projects. The ongoing development of smart cities, tourist destinations, and residential complexes necessitates substantial investment in interior furnishings. Furthermore, rising disposable incomes and an increasing preference for premium and customized furniture among the affluent population are contributing to market value. E-commerce penetration and the growing influence of online retail platforms are also reshaping consumer purchasing behavior, making furniture more accessible and diversifying product offerings. This dynamic environment presents both opportunities and challenges for manufacturers and retailers alike.

GCC Furniture Industry Market Size (In Million)

The market's trajectory is shaped by several key trends. The growing demand for sustainable and eco-friendly furniture is a prominent factor, aligning with the region's increasing focus on environmental consciousness. Consumers are actively seeking products made from recycled materials and those with minimal environmental impact. Moreover, the rise of modular and space-saving furniture solutions is a direct response to evolving housing trends and smaller living spaces in urban centers. Smart furniture, integrating technology for enhanced functionality and convenience, is also gaining traction. However, the market faces certain restraints, including fluctuations in raw material prices and supply chain disruptions, which can impact production costs and lead times. Intense competition from both local and international players necessitates continuous innovation and cost-efficiency strategies for market participants to maintain their competitive edge and capitalize on the burgeoning opportunities within the GCC furniture landscape.

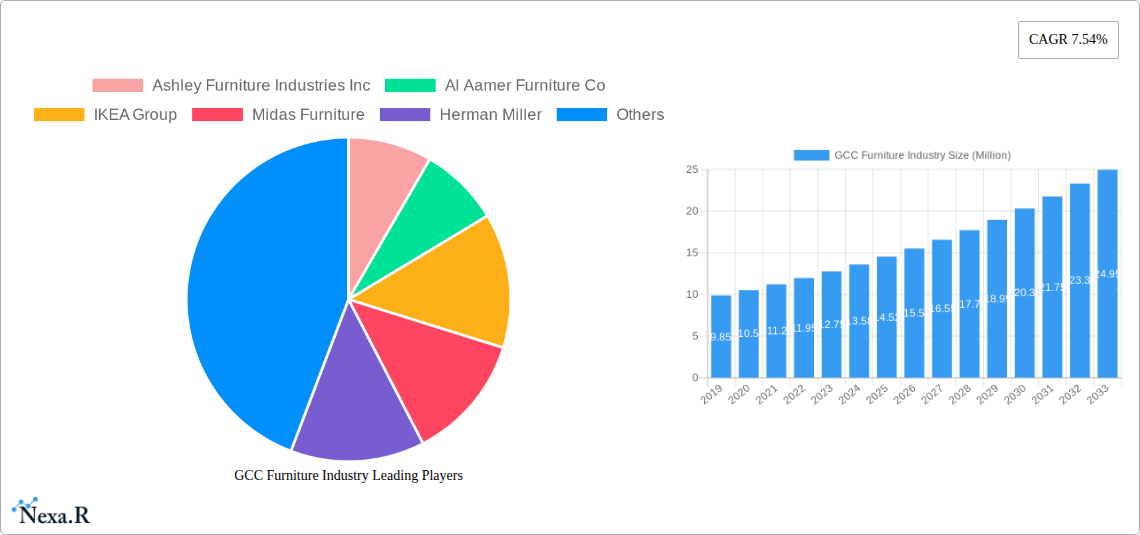

GCC Furniture Industry Company Market Share

GCC Furniture Industry Report: Market Dynamics, Growth Trends, and Key Player Analysis (2019-2033)

This comprehensive report offers an in-depth analysis of the GCC Furniture Industry, providing crucial insights for manufacturers, retailers, investors, and policymakers. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscape, and key players shaping the future of the GCC furniture market. Values are presented in Million units for clear quantitative understanding.

GCC Furniture Industry Market Dynamics & Structure

The GCC furniture industry exhibits a dynamic market structure characterized by a growing demand for both mass-produced and luxury items. Market concentration varies across segments, with established global players and local manufacturers coexisting. Technological innovation is a key driver, particularly in areas like sustainable materials, smart furniture, and advanced manufacturing techniques. Regulatory frameworks, while evolving, generally support business growth, though import/export regulations and product safety standards require careful navigation. Competitive product substitutes include readily available global brands and a burgeoning local design scene. End-user demographics are diverse, with a significant young population driving demand for modern and adaptable furniture, while a growing expatriate population and high-net-worth individuals contribute to the luxury segment. Mergers and acquisitions (M&A) trends are present, indicating consolidation and expansion strategies among key entities.

- Market Concentration: Moderate to high in specific segments (e.g., mass-market home furnishings), with emerging opportunities in niche luxury and custom furniture.

- Technological Innovation Drivers: Sustainable material sourcing, smart home integration, 3D printing for custom designs, and advanced manufacturing for efficiency.

- Regulatory Frameworks: Focus on product safety, sustainability standards, and import/export compliance.

- Competitive Product Substitutes: Global furniture giants, regional manufacturers, and artisanal furniture makers.

- End-User Demographics: Young families, expatriate professionals, and affluent households seeking premium and unique pieces.

- M&A Trends: Strategic acquisitions to expand market reach, enhance product portfolios, and secure supply chains.

GCC Furniture Industry Growth Trends & Insights

The GCC furniture industry is poised for robust growth, driven by sustained economic development, significant infrastructure projects, and a rising disposable income across the region. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025–2033. Adoption rates for modern and sustainable furniture are accelerating as consumer awareness and preferences shift towards eco-friendly and technologically advanced products. Technological disruptions, such as the increasing integration of e-commerce platforms and augmented reality (AR) for furniture visualization, are transforming the customer journey and expanding market reach. Consumer behavior is characterized by a growing appreciation for bespoke designs, premium quality, and personalized home decor solutions. The increasing focus on the parent market (overall furniture demand) and child markets (specific segments like residential, commercial, or hospitality) highlights diverse growth trajectories. The residential sector, fueled by new housing projects and renovation trends, represents a significant portion of the parent market, while the commercial segment, including offices and retail spaces, demonstrates strong growth in the child market.

- Market Size Evolution: Expected to witness substantial expansion, driven by construction booms and consumer spending.

- Adoption Rates: Increasing for smart furniture, customizable options, and sustainable materials.

- Technological Disruptions: Rise of e-commerce, AR/VR for design, and advanced manufacturing automation.

- Consumer Behavior Shifts: Growing demand for quality, aesthetics, personalization, and eco-consciousness.

- CAGR: Projected at xx% from 2025–2033.

- Market Penetration: Deepening across both traditional retail and online channels.

Dominant Regions, Countries, or Segments in GCC Furniture Industry

The United Arab Emirates (UAE) consistently emerges as a dominant force within the GCC furniture industry, demonstrating remarkable growth across all analyzed segments: Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. This dominance is fueled by its robust economic diversification, attractive investment climate, and status as a major regional hub for trade and tourism.

In Production Analysis, the UAE leads due to its advanced manufacturing capabilities, adoption of modern technologies, and the presence of key industry players investing in local production. Saudi Arabia follows closely, with significant government initiatives aimed at boosting domestic manufacturing and reducing reliance on imports.

The Consumption Analysis is heavily influenced by the UAE's rapidly growing population, high disposable incomes, and a strong culture of home improvement and interior design. Saudi Arabia also presents a substantial consumption market, driven by its large population and ongoing urban development projects. The parent market (overall furniture demand) in the UAE is particularly strong due to a vibrant real estate sector, while its child markets, such as the luxury residential segment and hospitality fit-out, are experiencing exceptional growth.

The Import Market Analysis (Value & Volume) is significantly led by the UAE, which acts as a gateway for furniture imports into the wider GCC region. Its sophisticated logistics infrastructure and consumer demand for a wide array of international brands contribute to this. Saudi Arabia also holds a considerable share in imports, catering to its large domestic market.

In terms of Export Market Analysis (Value & Volume), the UAE plays a pivotal role, exporting furniture manufactured locally or re-exporting imported goods to neighboring countries. Saudi Arabia is also increasing its export capabilities as its manufacturing sector matures.

The Price Trend Analysis in the UAE is characterized by a wide spectrum, reflecting the presence of both high-end luxury brands and more accessible options, influenced by global price fluctuations and local market dynamics. Saudi Arabia's price trends are also influenced by import costs and government policies on domestic production.

- Dominant Country: United Arab Emirates (UAE)

- Key Drivers (UAE):

- Economic Policies: Pro-business environment, foreign investment incentives.

- Infrastructure: World-class logistics, ports, and transportation networks.

- Real Estate Development: Continuous growth in residential and commercial projects.

- Consumer Demand: High purchasing power, evolving lifestyle preferences, and a strong design culture.

- Tourism & Hospitality: Significant demand from hotels, restaurants, and entertainment venues.

- Market Share (Estimated): UAE accounts for an estimated 40% of the GCC furniture market.

- Growth Potential: Continued strong growth projected due to ongoing mega-projects and population expansion.

- Segment Dominance: Residential furniture within the parent market, and luxury hospitality fit-out within child markets, are key growth areas.

GCC Furniture Industry Product Landscape

The GCC furniture industry is witnessing a surge in product innovation, with a focus on blending aesthetic appeal with functional superiority. Key product categories include contemporary residential furniture, office furniture designed for ergonomic efficiency, and bespoke luxury pieces for high-end residential and hospitality projects. Applications span across homes, offices, hotels, retail spaces, and educational institutions. Performance metrics are increasingly evaluated on durability, sustainability, and smart functionality. Unique selling propositions often revolve around high-quality materials, artisanal craftsmanship, and integration of smart technologies, such as wireless charging or adjustable lighting. Technological advancements are evident in the use of sustainable wood alternatives, recycled materials, and innovative upholstery fabrics that offer enhanced durability and ease of maintenance.

Key Drivers, Barriers & Challenges in GCC Furniture Industry

Key Drivers:

- Economic Growth & Diversification: Sustained economic development and government initiatives promoting non-oil sectors.

- Infrastructure Development: Large-scale construction projects in residential, commercial, and hospitality sectors.

- Rising Disposable Income: Increased purchasing power among the population for home furnishings.

- Growing Expatriate Population: Diverse preferences and demand for a wide range of furniture styles.

- E-commerce Penetration: Expanding online retail channels reaching a wider customer base.

- Focus on Sustainability: Growing consumer and regulatory pressure for eco-friendly products.

Barriers & Challenges:

- Supply Chain Volatility: Dependence on imports for raw materials and finished goods can lead to disruptions and cost fluctuations.

- Skilled Labor Shortage: Difficulty in sourcing and retaining skilled labor for manufacturing and craftsmanship.

- Intense Competition: Presence of established global brands and a growing number of local manufacturers.

- Regulatory Compliance: Navigating varied import/export duties, product safety standards, and labeling requirements across GCC countries.

- Economic Downturns: Potential impact of global economic slowdowns on consumer spending.

- Counterfeit Products: Challenges in combating the influx of counterfeit furniture items.

Emerging Opportunities in GCC Furniture Industry

Emerging opportunities within the GCC furniture industry lie in the burgeoning demand for sustainable and eco-friendly furniture, driven by growing environmental consciousness. The rise of the 'smart home' concept presents a significant avenue for innovative furniture with integrated technology. Untapped markets in customized and artisanal furniture cater to a niche segment seeking unique, high-quality pieces. Evolving consumer preferences for personalized living spaces also opens doors for modular and adaptable furniture solutions. Furthermore, the growing hospitality sector, with its constant need for stylish and durable furnishings, offers substantial growth potential. The increasing focus on interior design trends within the parent market, and specialized child markets like co-working spaces or boutique hotels, presents lucrative prospects for targeted product development.

Growth Accelerators in the GCC Furniture Industry Industry

Several catalysts are propelling the long-term growth of the GCC Furniture Industry. Technological breakthroughs in materials science are leading to the development of more durable, sustainable, and aesthetically pleasing furniture. Strategic partnerships between local manufacturers and international design houses are fostering innovation and enhancing product offerings. Market expansion strategies, including the penetration of underserved segments and the establishment of a strong online presence, are crucial growth accelerators. Government initiatives supporting local manufacturing and export promotion also play a vital role in accelerating industry growth. The increasing adoption of advanced manufacturing techniques, such as automation and AI, further enhances efficiency and competitiveness.

Key Players Shaping the GCC Furniture Industry Market

- Ashley Furniture Industries Inc

- Al Aamer Furniture Co

- IKEA Group

- Midas Furniture

- Herman Miller

- Jassco Furnishing

- Saudi Modern Factory Co

- Merint Furniture Factory

- Other Prominent Players**List Not Exhaustive

- AL Jabriya Furniture

- Deena Furniture Factory

Notable Milestones in GCC Furniture Industry Sector

- January 2023: Majid Al Futtaim's Lifestyle division acquired UAE rights for Poltrona Frau, marking an entry into the luxury Italian furniture space known for leather interiors and tapping into the fast-growing home interiors market.

- August 2022: Sophia Home, a prominent luxury furniture retailer in the UAE, opened its second showroom at Dubai Hills Mall, further establishing its presence and catering to demand for high-end furniture and decor in Abu Dhabi and Dubai.

In-Depth GCC Furniture Industry Market Outlook

The GCC Furniture Industry is projected for sustained and dynamic growth, underpinned by a confluence of strong economic fundamentals and evolving consumer aspirations. Key growth accelerators include the region's ongoing commitment to infrastructure development, particularly in the residential and hospitality sectors, which directly fuels demand for furniture in both parent and child markets. The increasing adoption of sustainable practices and smart furniture technologies represents a significant opportunity for companies that can innovate and cater to these emerging trends. Strategic market expansion, both geographically within the GCC and into new product segments, alongside continued investment in advanced manufacturing and digital retail platforms, will be pivotal in capturing future market potential. The industry is poised to benefit from a growing focus on interior design and home enhancement, creating fertile ground for strategic partnerships and product diversification.

GCC Furniture Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

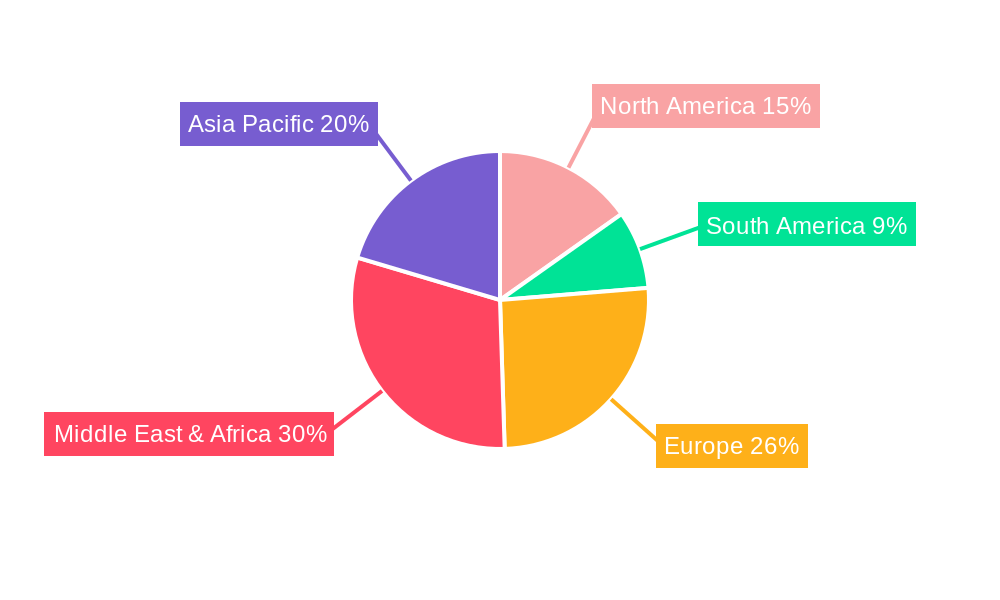

GCC Furniture Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Furniture Industry Regional Market Share

Geographic Coverage of GCC Furniture Industry

GCC Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Durable & functional Products; Boom in Real-Estate

- 3.3. Market Restrains

- 3.3.1. Continuous Change in Prefrences of Consumers

- 3.4. Market Trends

- 3.4.1. Saudi Arabia is One of the Fastest-growing Furniture Markets in the GCC Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America GCC Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America GCC Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe GCC Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa GCC Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific GCC Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ashley Furniture Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Al Aamer Furniture Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IKEA Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Midas Furniture

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Herman Miller

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jassco Furnishing

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Saudi Modern Factory Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Merint Furniture Factory

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Other Prominent Players**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AL Jabriya Furniture

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Deena Furniture Factory

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Ashley Furniture Industries Inc

List of Figures

- Figure 1: Global GCC Furniture Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Furniture Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America GCC Furniture Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America GCC Furniture Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America GCC Furniture Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America GCC Furniture Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America GCC Furniture Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America GCC Furniture Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America GCC Furniture Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America GCC Furniture Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America GCC Furniture Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America GCC Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America GCC Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America GCC Furniture Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America GCC Furniture Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America GCC Furniture Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America GCC Furniture Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America GCC Furniture Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America GCC Furniture Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America GCC Furniture Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America GCC Furniture Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America GCC Furniture Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America GCC Furniture Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America GCC Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America GCC Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe GCC Furniture Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe GCC Furniture Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe GCC Furniture Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe GCC Furniture Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe GCC Furniture Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe GCC Furniture Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe GCC Furniture Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe GCC Furniture Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe GCC Furniture Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe GCC Furniture Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe GCC Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe GCC Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa GCC Furniture Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa GCC Furniture Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa GCC Furniture Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa GCC Furniture Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa GCC Furniture Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa GCC Furniture Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa GCC Furniture Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa GCC Furniture Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa GCC Furniture Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa GCC Furniture Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa GCC Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa GCC Furniture Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific GCC Furniture Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific GCC Furniture Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific GCC Furniture Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific GCC Furniture Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific GCC Furniture Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific GCC Furniture Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific GCC Furniture Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific GCC Furniture Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific GCC Furniture Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific GCC Furniture Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific GCC Furniture Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific GCC Furniture Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Furniture Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global GCC Furniture Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global GCC Furniture Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global GCC Furniture Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global GCC Furniture Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global GCC Furniture Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global GCC Furniture Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global GCC Furniture Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global GCC Furniture Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global GCC Furniture Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global GCC Furniture Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global GCC Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global GCC Furniture Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global GCC Furniture Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global GCC Furniture Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global GCC Furniture Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global GCC Furniture Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global GCC Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global GCC Furniture Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global GCC Furniture Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global GCC Furniture Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global GCC Furniture Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global GCC Furniture Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global GCC Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global GCC Furniture Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global GCC Furniture Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global GCC Furniture Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global GCC Furniture Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global GCC Furniture Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global GCC Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global GCC Furniture Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global GCC Furniture Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global GCC Furniture Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global GCC Furniture Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global GCC Furniture Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global GCC Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific GCC Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Furniture Industry?

The projected CAGR is approximately 7.54%.

2. Which companies are prominent players in the GCC Furniture Industry?

Key companies in the market include Ashley Furniture Industries Inc, Al Aamer Furniture Co, IKEA Group, Midas Furniture, Herman Miller, Jassco Furnishing, Saudi Modern Factory Co, Merint Furniture Factory, Other Prominent Players**List Not Exhaustive, AL Jabriya Furniture, Deena Furniture Factory.

3. What are the main segments of the GCC Furniture Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Durable & functional Products; Boom in Real-Estate.

6. What are the notable trends driving market growth?

Saudi Arabia is One of the Fastest-growing Furniture Markets in the GCC Region.

7. Are there any restraints impacting market growth?

Continuous Change in Prefrences of Consumers.

8. Can you provide examples of recent developments in the market?

January 2023 - Majid Al Futtaim's Lifestyle division has taken on the UAE rights for Poltrona Frau, the luxury Italian furniture brand known for its leather interiors. This marks the UAE entity's entry into the home interiors space, which has been recording some fast-track growth in recent years in sync with developments in the wider property market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Furniture Industry?

To stay informed about further developments, trends, and reports in the GCC Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence