Key Insights

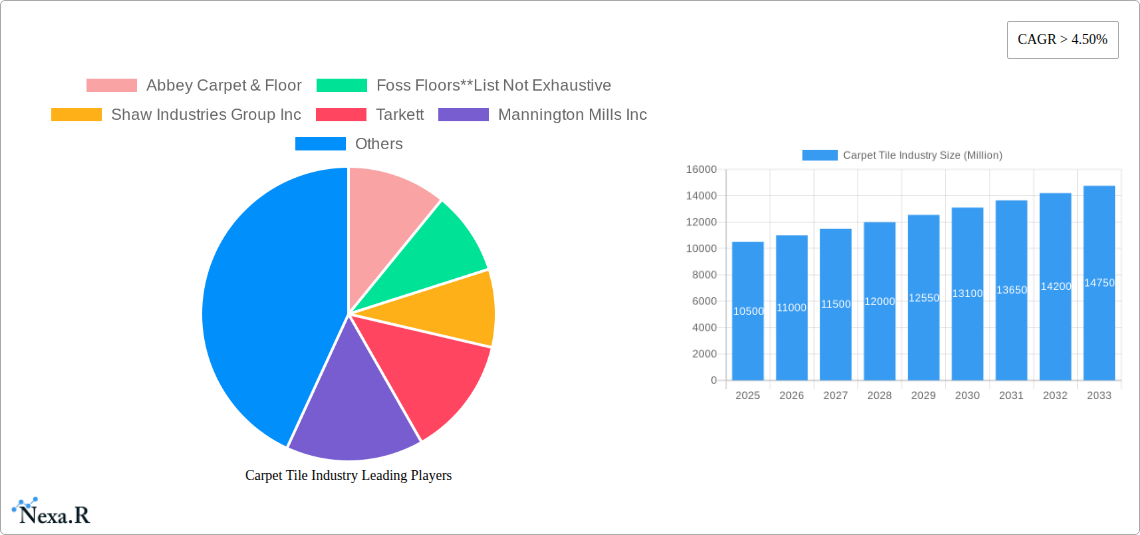

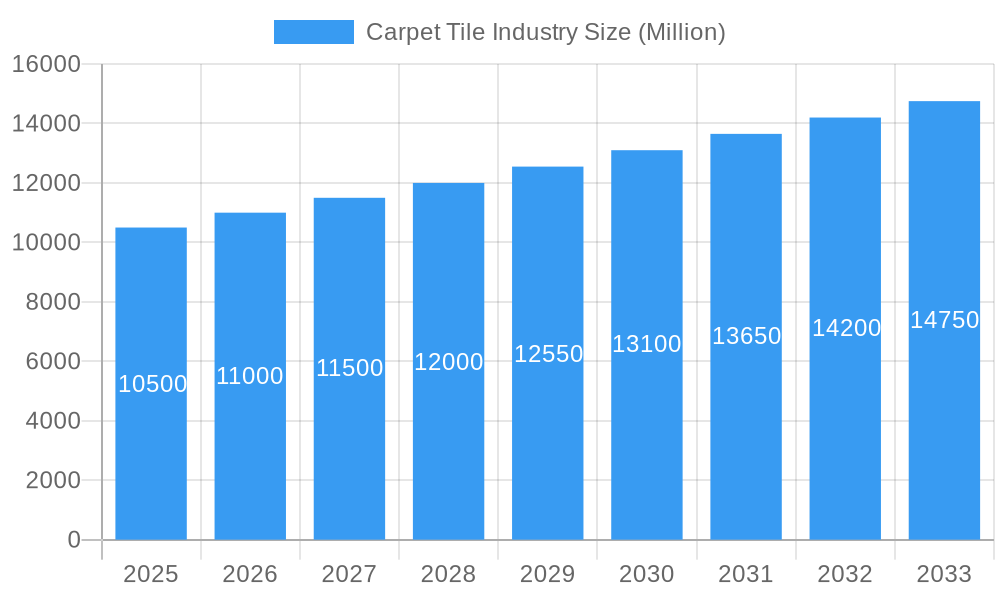

The global carpet tile market is experiencing robust expansion, projected to reach a substantial market size exceeding \$10,000 million by 2025, with a compound annual growth rate (CAGR) of over 4.50% throughout the forecast period of 2025-2033. This impressive growth is fueled by a confluence of factors, including escalating demand from the commercial sector, particularly for office spaces, hospitality, and retail environments. The inherent advantages of carpet tiles – their modularity, ease of installation and replacement, design flexibility, and excellent acoustic and underfoot comfort properties – make them a preferred choice for modern interior design and functionality. Furthermore, increasing urbanization and a focus on sustainable building practices are bolstering market penetration, as manufacturers increasingly offer eco-friendly options with recycled content and lower environmental impact.

Carpet Tile Industry Market Size (In Billion)

Key market drivers for this upward trajectory include the continuous innovation in material science, leading to enhanced durability, stain resistance, and a wider array of aesthetic choices. The growing adoption of modular flooring solutions in the residential sector, driven by a desire for customizable and easy-to-maintain interiors, also contributes significantly. However, the market faces certain restraints, such as the fluctuating raw material costs, particularly for synthetic fibers, and intense competition among a diverse range of manufacturers. Emerging trends like the integration of smart technologies for enhanced building performance and a rising preference for visually appealing, patterned carpet tiles are shaping future market dynamics. Geographically, North America and Europe currently hold dominant positions, but the Asia Pacific region, with its rapidly developing economies and expanding construction industry, presents significant untapped growth potential.

Carpet Tile Industry Company Market Share

Comprehensive Carpet Tile Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the global carpet tile industry, covering market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, emerging opportunities, and the strategic landscape. With extensive coverage from the historical period (2019-2024) through the forecast period (2025-2033), this report offers critical insights for industry professionals, investors, and stakeholders. The report is structured to deliver maximum value, presenting all monetary and volume figures in Million units for clarity and comparability.

Carpet Tile Industry Market Dynamics & Structure

The carpet tile industry is characterized by a moderately consolidated market structure, with key players like Mohawk Industries, Interface, and Tarkett holding significant market shares. Technological innovation, particularly in sustainable materials, advanced manufacturing techniques, and design versatility, acts as a primary driver for market growth. Regulatory frameworks concerning environmental impact, fire safety, and material sourcing also play a crucial role in shaping industry practices. Competitive product substitutes, such as LVT (Luxury Vinyl Tile) and engineered wood, present a continuous challenge, necessitating ongoing innovation in carpet tile performance and aesthetics. End-user demographics, including a growing demand from the commercial sector (offices, hospitality, healthcare) and a resurgence in residential applications, influence product development and marketing strategies. Mergers and acquisitions (M&A) remain a significant trend, as companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, recent M&A activities indicate a strategic consolidation aimed at enhancing market presence and efficiency. The industry is also influenced by global economic conditions, construction spending, and evolving interior design preferences.

- Market Concentration: Dominated by a few major global players, but with a growing number of regional and niche manufacturers.

- Technological Innovation: Focus on sustainability (recycled content, recyclability), durability, ease of installation, and enhanced aesthetics.

- Regulatory Frameworks: Strict adherence to environmental standards, VOC emissions, and safety certifications is paramount.

- Competitive Substitutes: Ongoing competition from LVT, SPC, and other hard flooring solutions drives innovation in carpet tile performance.

- End-User Demographics: Strong demand from commercial sectors; growing interest in residential applications due to design flexibility and comfort.

- M&A Trends: Strategic acquisitions to gain market share, expand product lines, and acquire technological expertise.

Carpet Tile Industry Growth Trends & Insights

The global carpet tile market is poised for robust growth, driven by a confluence of factors including increasing commercial construction activities, a rising demand for aesthetic and functional flooring solutions, and a strong emphasis on sustainability. The market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025-2033, escalating from an estimated xx Million units in 2025 to xx Million units by 2033. Adoption rates are steadily increasing across various end-use segments, propelled by the inherent advantages of carpet tiles, such as ease of installation, replacement, and maintenance, which translate into lower lifecycle costs for businesses. Technological disruptions are continuously reshaping the product landscape, with advancements in material science leading to the development of more durable, stain-resistant, and eco-friendly carpet tiles. For example, the incorporation of recycled PET bottles and other post-consumer waste materials into carpet tile manufacturing is gaining significant traction, aligning with the growing consumer and corporate focus on environmental responsibility. Consumer behavior shifts are also playing a vital role; there's a discernible move towards customizable flooring solutions that allow for creative design expressions, especially in office spaces aiming to foster collaborative and dynamic work environments. The integration of smart technologies, though nascent, also presents a future avenue for growth, potentially leading to carpet tiles with integrated sensor capabilities or enhanced performance monitoring. The residential sector, often influenced by commercial trends, is also showing increased interest in carpet tiles for their versatility and ability to create distinct zones within a home. The ongoing evolution of design aesthetics, favoring comfort, acoustic properties, and visual appeal, further bolsters the market's expansion.

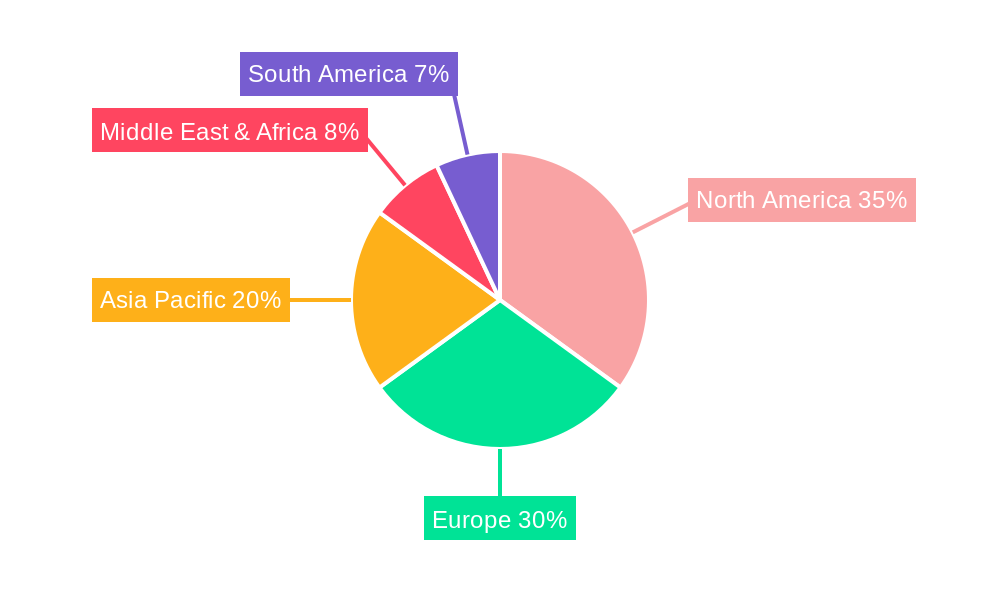

Dominant Regions, Countries, or Segments in Carpet Tile Industry

The North America region is currently the dominant force in the global carpet tile industry, driven by a robust commercial construction sector and a high level of consumer and corporate spending on interior renovations and new builds. Within North America, the United States stands out as the largest market, accounting for a significant share of global production and consumption.

Production Analysis: The United States leads in carpet tile production, supported by established manufacturers and advanced manufacturing capabilities. Countries like China also play a substantial role, particularly in the mass production of cost-effective options. The parent market, encompassing all types of flooring, sees carpet tiles as a significant segment, with its share influenced by economic cycles and competition from other flooring types.

- Key Drivers in Production: Access to raw materials, technological advancements in manufacturing, and a strong domestic demand.

Consumption Analysis: North America, especially the United States, exhibits the highest consumption of carpet tiles, primarily due to its extensive commercial real estate market. Offices, educational institutions, healthcare facilities, and retail spaces are major consumers. Europe, with countries like Germany and the UK, also represents a significant consumption hub. The child market, focusing on specific types of carpet tiles (e.g., luxury or sustainable), shows varying growth rates depending on regional trends.

- Dominance Factors in Consumption: High density of commercial buildings, corporate spending on office redesign, and awareness of the benefits of carpet tiles.

Import Market Analysis (Value & Volume): The United States is also a major importer, particularly for specialized or niche carpet tiles, although it is also a net exporter. China is a significant exporter of carpet tiles, serving global markets with competitively priced products. The import market volume is substantial, reflecting global trade flows.

- Import Volume: xx Million units

- Import Value: xx Million USD

- Key Import Drivers: Price competitiveness, specialized product availability, and demand from regions with less domestic manufacturing capacity.

Export Market Analysis (Value & Volume): The United States and European nations are significant exporters of high-value, innovative carpet tiles. China is a dominant exporter in terms of volume. The export market is driven by demand for quality, design, and sustainable products.

- Export Volume: xx Million units

- Export Value: xx Million USD

- Key Export Drivers: Product quality, brand reputation, technological innovation, and competitive pricing.

Price Trend Analysis: Prices for carpet tiles are influenced by raw material costs (nylon, polypropylene), manufacturing efficiency, design complexity, and brand positioning. Prices can range from $1.00 per square foot for basic commercial tiles to over $10.00 per square foot for high-end, designer options. The price trend is generally stable with slight fluctuations tied to commodity prices and market demand.

- Average Price Range: xx - xx USD per square foot

Segment Dominance: The commercial segment, particularly office spaces, is the most dominant segment for carpet tiles. However, the hospitality and healthcare sectors are showing accelerated growth due to their specific requirements for durability, hygiene, and design flexibility.

- Dominant Segment: Commercial (Offices)

- High Growth Segments: Hospitality, Healthcare

Carpet Tile Industry Product Landscape

Carpet tile product innovation is primarily focused on enhancing durability, improving aesthetic appeal, and increasing sustainability. Manufacturers are developing advanced fiber technologies and backing systems that offer superior stain resistance, wearability, and ease of maintenance, crucial for high-traffic commercial environments. The introduction of modular carpet tiles with interlocking or advanced adhesive systems simplifies installation and replacement, reducing downtime and labor costs. Design versatility remains a key selling point, with a growing array of patterns, textures, and color palettes that allow for creative floor designs, contributing to improved interior aesthetics and space functionality. The use of recycled content, such as post-consumer recycled plastic bottles and reclaimed carpet fibers, is a significant technological advancement, appealing to environmentally conscious consumers and businesses. Performance metrics such as VOC emissions, acoustic dampening capabilities, and fire retardancy are critical differentiators.

Key Drivers, Barriers & Challenges in Carpet Tile Industry

The carpet tile industry is propelled by several key drivers: a booming global construction sector, particularly in commercial real estate; an increasing demand for aesthetically pleasing and functional flooring solutions; and a growing emphasis on sustainability and eco-friendly products. Technological advancements in manufacturing, leading to more durable and easily maintainable carpet tiles, also contribute significantly.

- Key Drivers:

- Strong commercial construction activity.

- Demand for design flexibility and customization.

- Focus on sustainable and recycled materials.

- Technological improvements in performance and installation.

Conversely, the industry faces significant barriers and challenges. The intense competition from alternative flooring solutions like Luxury Vinyl Tile (LVT) and engineered wood poses a constant threat, requiring continuous innovation and competitive pricing. Volatile raw material prices, particularly for petroleum-based fibers, can impact profitability. Furthermore, stringent environmental regulations and the need for product certification can add to production costs and complexity. Supply chain disruptions and logistics challenges can also affect market stability and product availability.

- Key Barriers & Challenges:

- Intense competition from alternative flooring.

- Fluctuating raw material costs.

- Stringent environmental regulations.

- Supply chain vulnerabilities.

- Economic downturns impacting construction spending.

Emerging Opportunities in Carpet Tile Industry

Emerging opportunities in the carpet tile industry lie in the growing demand for smart flooring solutions that integrate technology for enhanced functionality. The expansion into underserved emerging markets, particularly in Asia and Latin America, presents significant untapped potential. Furthermore, the development of specialized carpet tiles for niche applications, such as acoustic flooring for noise reduction in offices and healthcare settings, and antimicrobial treatments for hygiene-sensitive environments, offers avenues for growth. The circular economy model, focusing on product lifecycle management, recycling, and upcycling, is also an emerging opportunity, appealing to both manufacturers and end-users committed to sustainability.

Growth Accelerators in the Carpet Tile Industry Industry

Long-term growth in the carpet tile industry will be accelerated by ongoing technological breakthroughs, particularly in the development of bio-based and fully recyclable materials, significantly enhancing sustainability credentials. Strategic partnerships between carpet tile manufacturers and designers, architects, and technology providers will foster innovation and the creation of unique, high-performance products. Market expansion strategies, including increased penetration into the residential sector and the development of specialized products for sectors like education and data centers, will also act as crucial growth catalysts. The increasing global focus on green building certifications will further drive demand for sustainable carpet tile solutions.

Key Players Shaping the Carpet Tile Industry Market

- Mohawk Industries

- Interface

- Tarkett

- Mannington Mills Inc

- Beaulieu International Group

- Bentley Mills Inc

- The Dixie Group Inc

- Shaw Industries Group Inc

- Foss Floors

- Abbey Carpet & Floor

Notable Milestones in Carpet Tile Industry Sector

- March 2023: America's Best Carpet & Tile (ABCT), a provider of full-service flooring solutions, was acquired by Kansas City-based private equity firm Great Range Capital (GRC). This partnership is expected to bolster ABCT's growth and expansion efforts.

- February 2023: Tarkett launched DESSO X RENS, a collection developed in collaboration with Studio RENS, showcasing innovative material reuse of discarded carpet tiles and promoting sustainability.

In-Depth Carpet Tile Industry Market Outlook

The carpet tile industry is poised for sustained growth, driven by a strong commitment to sustainability, continuous product innovation, and increasing demand from the commercial sector. The future market potential is significant, with opportunities arising from the integration of smart technologies, the expansion into developing economies, and the development of highly specialized flooring solutions. Strategic collaborations and a focus on circular economy principles will be crucial for manufacturers to capitalize on evolving consumer preferences and regulatory landscapes. The industry's ability to adapt to these trends will determine its trajectory in the coming years.

Carpet Tile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Carpet Tile Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Carpet Tile Industry Regional Market Share

Geographic Coverage of Carpet Tile Industry

Carpet Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand in the Commercial Sector

- 3.3. Market Restrains

- 3.3.1. Competition from Other Flooring Options

- 3.4. Market Trends

- 3.4.1. North America Region is Dominant in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Carpet Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Carpet Tile Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Carpet Tile Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Carpet Tile Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Carpet Tile Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Carpet Tile Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Abbey Carpet & Floor

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Foss Floors**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shaw Industries Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tarkett

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mannington Mills Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Beaulieu International Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bentley Mills Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Dixie Group Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mohawk Industries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Interface

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Abbey Carpet & Floor

List of Figures

- Figure 1: Global Carpet Tile Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Carpet Tile Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Carpet Tile Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Carpet Tile Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Carpet Tile Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Carpet Tile Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Carpet Tile Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Carpet Tile Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Carpet Tile Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Carpet Tile Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Carpet Tile Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Carpet Tile Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Carpet Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Carpet Tile Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Carpet Tile Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Carpet Tile Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Carpet Tile Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Carpet Tile Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Carpet Tile Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Carpet Tile Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Carpet Tile Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Carpet Tile Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Carpet Tile Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Carpet Tile Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Carpet Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Carpet Tile Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Carpet Tile Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Carpet Tile Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Carpet Tile Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Carpet Tile Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Carpet Tile Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Carpet Tile Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Carpet Tile Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Carpet Tile Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Carpet Tile Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Carpet Tile Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Carpet Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Carpet Tile Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Carpet Tile Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Carpet Tile Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Carpet Tile Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Carpet Tile Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Carpet Tile Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Carpet Tile Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Carpet Tile Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Carpet Tile Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Carpet Tile Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Carpet Tile Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Carpet Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Carpet Tile Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Carpet Tile Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Carpet Tile Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Carpet Tile Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Carpet Tile Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Carpet Tile Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Carpet Tile Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Carpet Tile Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Carpet Tile Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Carpet Tile Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Carpet Tile Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Carpet Tile Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Carpet Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Carpet Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Carpet Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Carpet Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Carpet Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Carpet Tile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Carpet Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Carpet Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Carpet Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Carpet Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Carpet Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Carpet Tile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Carpet Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Carpet Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Carpet Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Carpet Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Carpet Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Carpet Tile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Carpet Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Carpet Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Carpet Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Carpet Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Carpet Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Carpet Tile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Carpet Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Carpet Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Carpet Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Carpet Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Carpet Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Carpet Tile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Carpet Tile Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Carpet Tile Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Carpet Tile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Carpet Tile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Carpet Tile Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Carpet Tile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Carpet Tile Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Carpet Tile Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Carpet Tile Industry?

Key companies in the market include Abbey Carpet & Floor, Foss Floors**List Not Exhaustive, Shaw Industries Group Inc, Tarkett, Mannington Mills Inc, Beaulieu International Group, Bentley Mills Inc, The Dixie Group Inc, Mohawk Industries, Interface.

3. What are the main segments of the Carpet Tile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand in the Commercial Sector.

6. What are the notable trends driving market growth?

North America Region is Dominant in the Market.

7. Are there any restraints impacting market growth?

Competition from Other Flooring Options.

8. Can you provide examples of recent developments in the market?

March 2023: America's Best Carpet & Tile (ABCT), which provides full-service flooring solutions, has been acquired by Kansas City-based private equity firm Great Range Capital (GRC). The partnership will support ABCT's continued growth and expansion in both new and existing markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Carpet Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Carpet Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Carpet Tile Industry?

To stay informed about further developments, trends, and reports in the Carpet Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence