Key Insights

The Brazilian life and non-life insurance sector demonstrates significant growth potential, propelled by a growing middle class, increasing urbanization, enhanced risk management awareness, and government initiatives fostering financial inclusion. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.2%, reaching a market size of $233.7 billion by 2024. This expansion is driven by diverse product portfolios, including innovative digital insurance solutions and bundled packages addressing comprehensive protection needs. Despite potential challenges from economic volatility and regulatory shifts, the market's resilience and ongoing diversification indicate sustained growth. Leading entities such as Bradesco Seguros, MAPFRE VIDA, and Porto Seguro are capitalizing on technological advancements and strategic alliances to strengthen their market standing and meet evolving consumer demands. Both life and non-life segments are expected to contribute robustly, with life insurance likely experiencing heightened demand for retirement and health solutions.

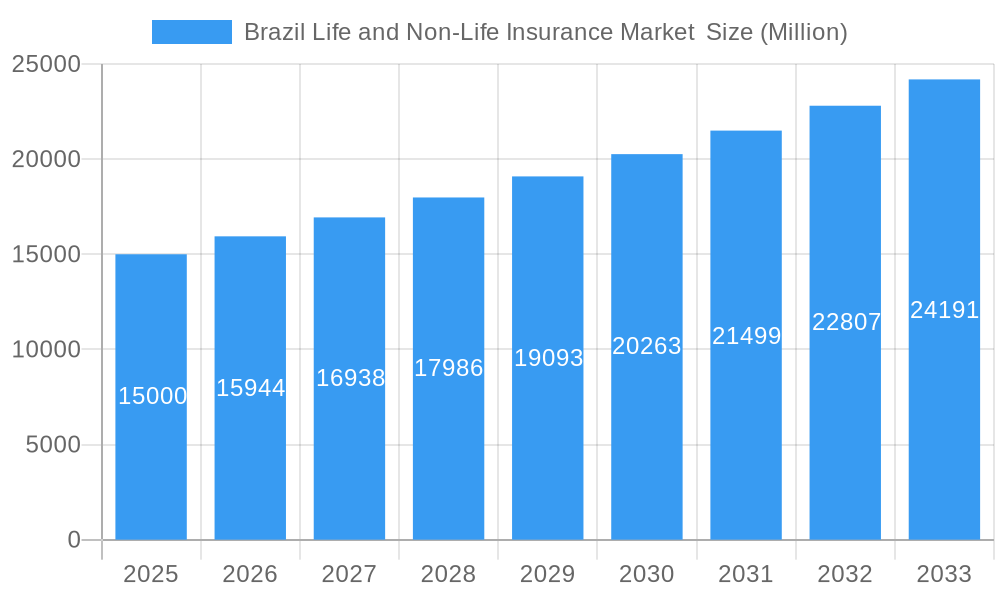

Brazil Life and Non-Life Insurance Market Market Size (In Billion)

The forecast period (2025-2033) anticipates accelerated market growth, with the CAGR potentially surpassing historical rates due to anticipated economic recovery and increasing insurance penetration. This optimistic outlook is further supported by ongoing efforts to improve financial literacy and greater business adoption of insurance for operational risk mitigation. Key considerations include monitoring inflation and competitive pressures from new entrants. Insurer success will hinge on adaptability to market dynamics and the provision of tailored solutions. Continuous focus on customer service, technological innovation, and regulatory adherence will be paramount for sustained market leadership.

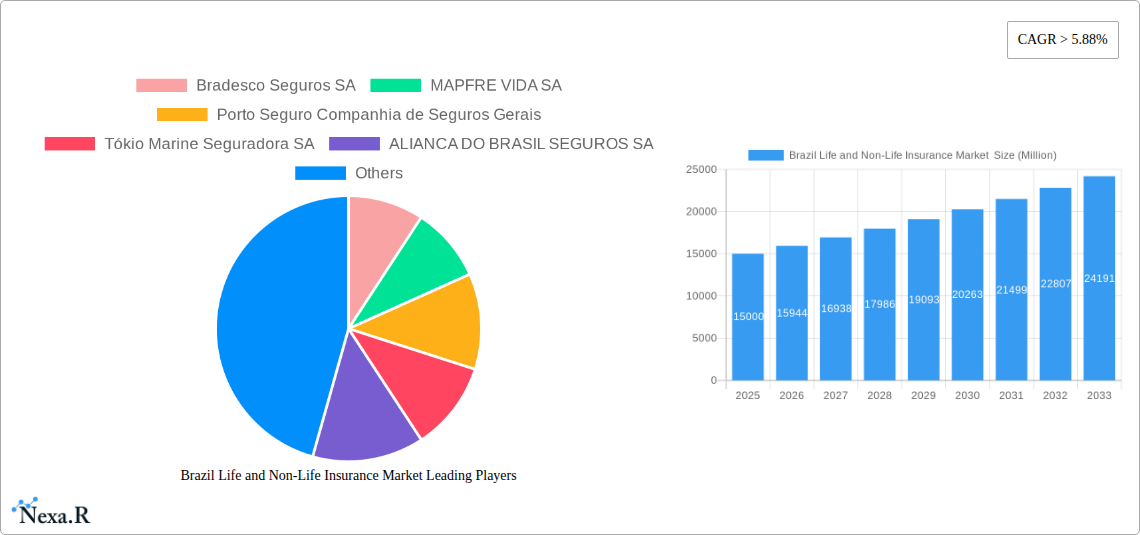

Brazil Life and Non-Life Insurance Market Company Market Share

Brazil Life and Non-Life Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil Life and Non-Life Insurance Market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report delves into market dynamics, growth trends, competitive landscapes, and future opportunities within the Brazilian insurance sector. The report segments the market into Life and Non-Life insurance, providing granular analysis of each. Expected market size (in millions) is provided throughout the report, with a base year of 2025 and a forecast period of 2025-2033.

Brazil Life and Non-Life Insurance Market Dynamics & Structure

This section analyzes the structure and dynamics of the Brazilian life and non-life insurance market, considering market concentration, technological advancements, regulatory influences, competitive dynamics, and demographic shifts. The analysis incorporates both quantitative data (market share, M&A activity) and qualitative assessments (innovation barriers).

Market Concentration: The Brazilian insurance market exhibits a moderately concentrated structure, with key players like Bradesco Seguros SA and Porto Seguro Companhia de Seguros Gerais holding significant market share. However, smaller players and Insurtech startups are also emerging. Analysis includes market share breakdown by player and segment. xx% is held by the top 5 players in the Life Insurance sector and yy% in the Non-Life Insurance sector as of 2024.

Technological Innovation: Technological advancements, such as Insurtech solutions and digital distribution channels, are reshaping the market. Adoption rates are increasing, particularly among younger demographics. However, challenges remain in terms of digital literacy and infrastructure in certain regions. Technological innovation CAGR is estimated to be at zz% from 2025 to 2033.

Regulatory Framework: The regulatory environment plays a significant role. Recent policy changes and potential upcoming regulations are assessed for their impact on market growth and competition.

Competitive Landscape: This section details the competitive dynamics among major players like Bradesco Seguros SA, MAPFRE VIDA SA, Porto Seguro Companhia de Seguros Gerais, Tokio Marine Seguradora SA, ALIANCA DO BRASIL SEGUROS SA, Sompo Seguros SA, BRADESCO VIDA E PREVIDENCIA SA, Liberty Seguros SA, ITAU VIDA E PREVIDENCIA SA, and Allianz Seguros SA, along with the impact of both established and emerging players and M&A activities. The number of M&A deals in the period 2019-2024 is recorded as xx, with a predicted xx deals for 2025-2033.

End-User Demographics: Analysis of demographic trends – including age, income levels, and urban/rural distribution – and their impact on insurance demand.

Brazil Life and Non-Life Insurance Market Growth Trends & Insights

This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and evolving consumer behavior. Utilizing various methodologies, including statistical modeling and qualitative insights, the report projects market growth trends across different segments.

The Brazilian Life and Non-Life Insurance market demonstrated consistent growth throughout the historical period (2019-2024). The market is expected to grow at a CAGR of xx% from 2025 to 2033, driven by factors such as rising disposable incomes, increased awareness of insurance products, and government initiatives to promote financial inclusion. Market penetration is expected to reach yy% by 2033, compared to xx% in 2024. Specific metrics for various segments will be included, highlighting adoption rates across different demographics and geographic locations. The impact of technological disruptions, such as the rise of Insurtech companies and digital distribution channels will also be addressed. The changing consumer behaviour will be analyzed, focusing on the increasing demand for customized products, greater transparency and digital convenience.

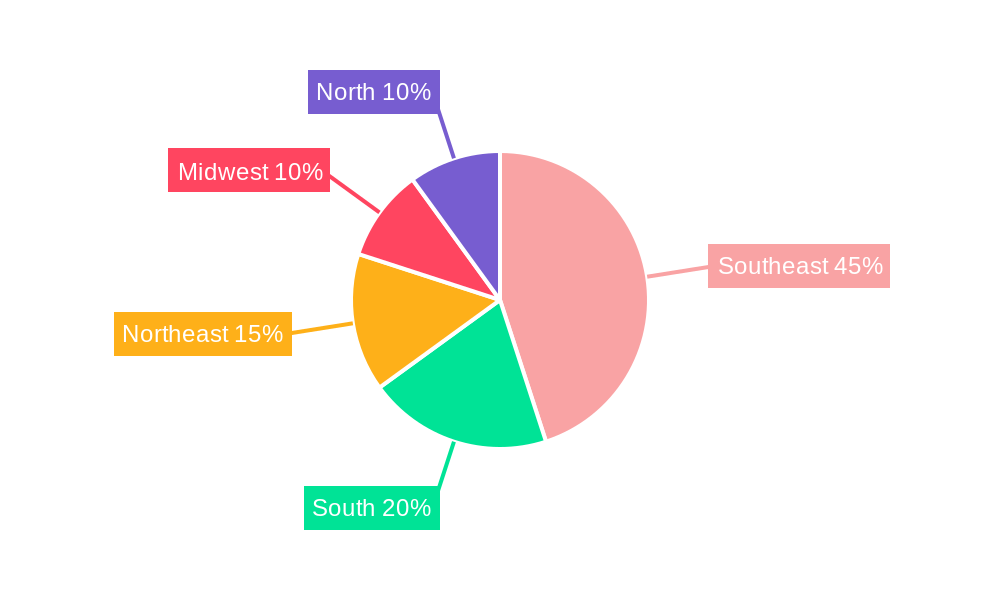

Dominant Regions, Countries, or Segments in Brazil Life and Non-Life Insurance Market

This section identifies the key regions, countries, or segments driving market growth within Brazil. The analysis will include a breakdown of market share and growth potential by region, emphasizing the factors contributing to their dominance.

Southeast Region Dominance: The Southeast region of Brazil is expected to remain the dominant market for life and non-life insurance, due to its higher concentration of population, economic activity and income levels. The detailed analysis will include the growth rate and market share of various regions, along with factors driving their performance. For example, factors such as favourable economic conditions and supportive government policies are expected to fuel growth in the Southeast.

Growth in other regions: While the Southeast leads, significant growth potential exists in other regions as economic development progresses and insurance penetration increases. The report will discuss the potential for growth in regions such as the South and Northeast of Brazil and the contributing factors.

Brazil Life and Non-Life Insurance Market Product Landscape

This section details the product innovations, applications, and performance metrics within the Brazilian life and non-life insurance market. It will highlight unique selling propositions and technological advancements contributing to product differentiation and market penetration.

The product landscape includes a wide range of traditional and innovative insurance products catering to diverse customer needs. Recent technological advancements have led to the development of digital insurance platforms and mobile applications simplifying purchasing, claims management, and customer service. Personalized products tailored to specific needs, risk profiles, and lifestyles are increasingly popular. This section analyses the market share of various products within both life and non-life categories, comparing growth rates, along with unique selling propositions of key players.

Key Drivers, Barriers & Challenges in Brazil Life and Non-Life Insurance Market

This section identifies the key drivers and challenges influencing the market's trajectory.

Key Drivers:

- Rising disposable incomes and expanding middle class.

- Increasing awareness of insurance products.

- Government initiatives promoting financial inclusion.

- Technological advancements in digital distribution and Insurtech solutions.

Key Challenges & Restraints:

- Economic volatility and inflation can impact consumer spending on insurance.

- High levels of informality and lack of financial literacy can restrict market penetration.

- Regulatory complexities and bureaucratic procedures.

- Intense competition from established players and new market entrants.

Emerging Opportunities in Brazil Life and Non-Life Insurance Market

This section highlights emerging trends and opportunities for growth in the Brazilian insurance sector.

- Untapped Markets: Expanding insurance penetration in under-served segments, such as low-income populations and rural communities.

- Product Innovation: Development of innovative products tailored to specific customer needs, such as micro-insurance and parametric insurance.

- Digital Transformation: Leveraging technology to enhance customer experience, streamline operations and increase efficiency.

Growth Accelerators in the Brazil Life and Non-Life Insurance Market Industry

Long-term growth will be driven by sustained economic expansion, government support for financial inclusion, and the continuous adoption of technology. Strategic partnerships between traditional insurers and Insurtech companies will further accelerate market expansion, opening access to broader customer segments and delivering superior service.

Key Players Shaping the Brazil Life and Non-Life Insurance Market Market

- Bradesco Seguros SA

- MAPFRE VIDA SA

- Porto Seguro Companhia de Seguros Gerais

- Tókio Marine Seguradora SA

- ALIANCA DO BRASIL SEGUROS SA

- Sompo Seguros SA

- BRADESCO VIDA E PREVIDENCIA SA

- Liberty Seguros SA

- ITAU VIDA E PREVIDENCIA SA

- Allianz Seguros SA (List Not Exhaustive)

Notable Milestones in Brazil Life and Non-Life Insurance Market Sector

September 2022: MAPFRE and Swiss Life Asset Managers revitalized their real estate collaboration, with a pan-European co-investment organization acquiring a building in Madrid. This signifies a strategic move by MAPFRE, enhancing its investment portfolio and potentially impacting its financial strength within the insurance sector.

July 2022: Bradesco Seguros launched updated versions of its Bradesco Sade programs, enhancing user experience and expanding its service offerings. This showcases Bradesco's commitment to customer service and innovation in the health insurance segment.

In-Depth Brazil Life and Non-Life Insurance Market Market Outlook

The Brazilian Life and Non-Life Insurance Market is poised for substantial growth over the forecast period. Continued economic development, coupled with rising consumer awareness and the accelerating adoption of digital technologies, will create numerous opportunities for insurers. Strategic partnerships, product innovation, and expansion into underserved markets will be key factors in capturing this market potential. The market's future trajectory is optimistic, with significant potential for growth and innovation.

Brazil Life and Non-Life Insurance Market Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Other Non-life Insurances

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Brazil Life and Non-Life Insurance Market Segmentation By Geography

- 1. Brazil

Brazil Life and Non-Life Insurance Market Regional Market Share

Geographic Coverage of Brazil Life and Non-Life Insurance Market

Brazil Life and Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Awareness About The Importance of Insurance; Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Rising Awareness About The Importance of Insurance; Increasing Disposable Incomes

- 3.4. Market Trends

- 3.4.1. Low Penetration of Life and Non-Life Insurance Turns Out to be an Opportunity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Life and Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Other Non-life Insurances

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bradesco Seguros SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MAPFRE VIDA SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Porto Seguro Companhia de Seguros Gerais

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tókio Marine Seguradora SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALIANCA DO BRASIL SEGUROS SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sompo Seguros SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BRADESCO VIDA E PREVIDENCIA SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Liberty Seguros SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ITAU VIDA E PREVIDENCIA SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allianz Seguros SA**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bradesco Seguros SA

List of Figures

- Figure 1: Brazil Life and Non-Life Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Life and Non-Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 2: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 5: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Life and Non-Life Insurance Market ?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Brazil Life and Non-Life Insurance Market ?

Key companies in the market include Bradesco Seguros SA, MAPFRE VIDA SA, Porto Seguro Companhia de Seguros Gerais, Tókio Marine Seguradora SA, ALIANCA DO BRASIL SEGUROS SA, Sompo Seguros SA, BRADESCO VIDA E PREVIDENCIA SA, Liberty Seguros SA, ITAU VIDA E PREVIDENCIA SA, Allianz Seguros SA**List Not Exhaustive.

3. What are the main segments of the Brazil Life and Non-Life Insurance Market ?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 233.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness About The Importance of Insurance; Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Low Penetration of Life and Non-Life Insurance Turns Out to be an Opportunity.

7. Are there any restraints impacting market growth?

Rising Awareness About The Importance of Insurance; Increasing Disposable Incomes.

8. Can you provide examples of recent developments in the market?

September 2022 - By selling a fresh package of assets to the pan-European co-investment entity they established in April of last year, MAPFRE and Swiss Life Asset Managers have revitalized their real estate collaboration for investing in outstanding European workplaces. A pan-European co-investment organization purchased a building from El Corte Inglés in Madrid at 13 Calle Alberto Bosch as part of this new package. This structure was formerly the Royal Spanish Football Federation's headquarters and is just a few meters from Retiro Park.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Life and Non-Life Insurance Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Life and Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Life and Non-Life Insurance Market ?

To stay informed about further developments, trends, and reports in the Brazil Life and Non-Life Insurance Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence