Key Insights

The Canadian home textiles market, valued at $2.90 billion in 2025, is projected to experience robust growth, driven by several key factors. Rising disposable incomes and a growing preference for aesthetically pleasing and comfortable home environments are fueling demand for high-quality bed linen, bath linen, kitchen textiles, and upholstery fabrics. The increasing popularity of online shopping, coupled with the expansion of e-commerce platforms offering a wide variety of home textile products, is further boosting market expansion. Furthermore, the increasing awareness of eco-friendly and sustainable home textile products is creating new opportunities for manufacturers to cater to environmentally conscious consumers. This segment is expected to witness significant growth due to the growing concerns about the environmental impact of conventional textile manufacturing. The market is segmented by distribution channels (supermarkets/hypermarkets, specialty stores, online, other) and product type (bed linen, bath linen, kitchen linen, upholstery, floor coverings). The competitive landscape includes both established international and domestic players vying for market share through product innovation, strategic partnerships, and targeted marketing campaigns. Competition is expected to intensify as new entrants explore innovative materials and designs.

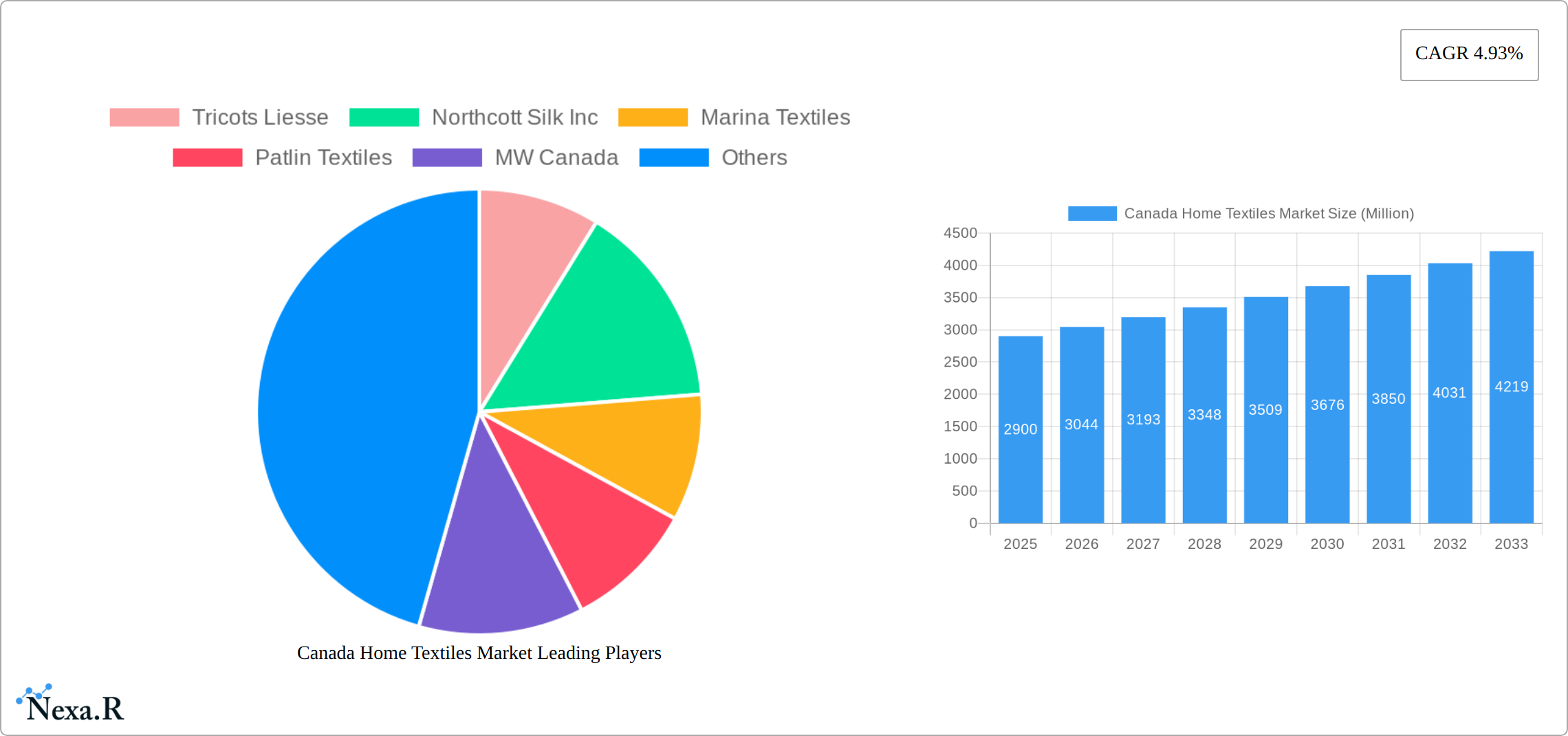

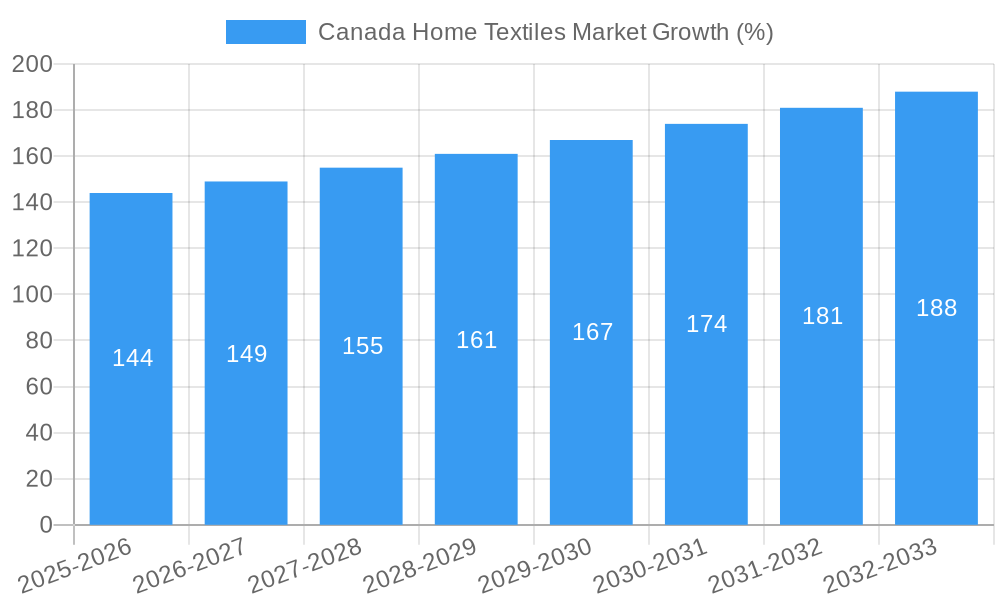

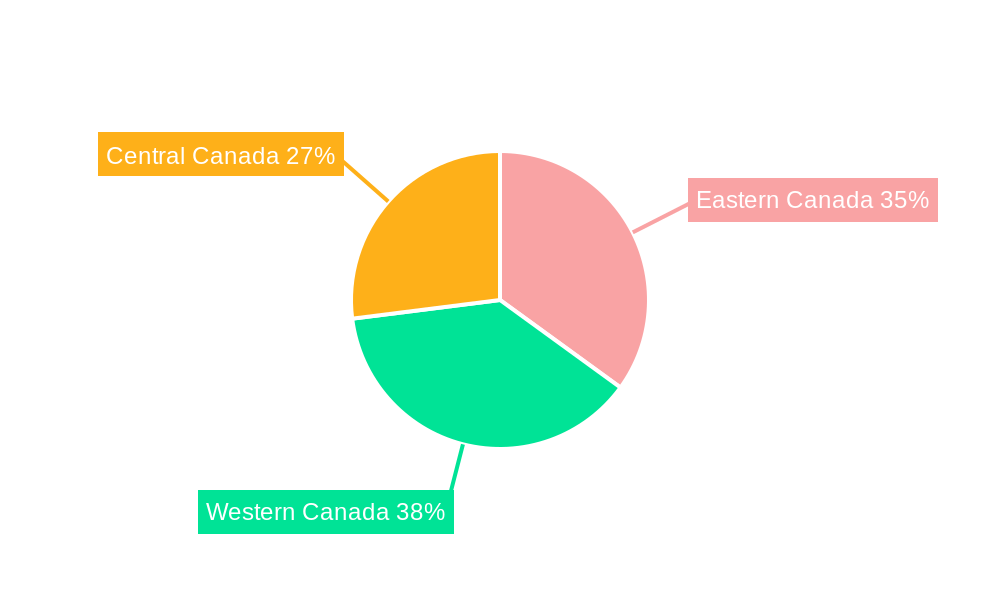

The market's Compound Annual Growth Rate (CAGR) of 4.93% from 2019 to 2024 suggests continued expansion. Considering this trend, and factoring in potential economic fluctuations and changing consumer preferences, we can project continued, albeit slightly moderated, growth in the coming years. Regional variations within Canada (Eastern, Western, Central) will exist, influenced by population density, economic activity, and consumer spending patterns. The online channel is anticipated to demonstrate the fastest growth rate, reflecting broader e-commerce trends. Growth will be partly constrained by potential economic downturns that could impact consumer spending on non-essential goods. However, the long-term outlook for the Canadian home textiles market remains positive, driven by the continuous evolution of consumer preferences and the innovation within the sector.

Canada Home Textiles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Home Textiles Market, covering market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market (Home Textiles) and its child markets (Bed Linen, Bath Linen, Kitchen Linen, Upholstery, Floor Covering) and distribution channels (Supermarkets and Hypermarkets, Specialty Stores, Online, Other Distribution Channels) to provide a holistic view of the market landscape. The market size is valued at xx Million units in 2025.

Canada Home Textiles Market Market Dynamics & Structure

The Canadian home textiles market is characterized by a moderately concentrated landscape, with key players such as Tricots Liesse, Northcott Silk Inc, Marina Textiles, and others competing for market share. Technological innovation, particularly in materials and manufacturing processes (e.g., sustainable fabrics, smart textiles), plays a significant role in shaping market dynamics. Regulatory frameworks concerning product safety and environmental sustainability also influence industry practices. The market faces competition from substitute products, such as alternative floor coverings (e.g., hardwood, vinyl) and imported goods. Consumer demographics, with a growing focus on home improvement and comfortable living, are major drivers. M&A activity, as evidenced by Sleep Country Canada’s acquisition of Hush Blankets in October 2021, demonstrates consolidation trends within the sector.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on sustainable materials (organic cotton, recycled fibers) and smart textiles (temperature regulating fabrics).

- Regulatory Framework: Compliance with safety standards (e.g., flammability regulations) and environmental regulations (e.g., textile waste management).

- Competitive Substitutes: Alternative floor coverings, imported home textiles, and DIY options.

- End-User Demographics: Growing demand driven by millennial and Gen Z homebuyers, increased disposable income, and a focus on home comfort.

- M&A Trends: Strategic acquisitions to expand market share and product portfolios, as seen in Sleep Country's acquisition of Hush Blankets. Approximately xx M&A deals were recorded between 2019 and 2024.

Canada Home Textiles Market Growth Trends & Insights

The Canadian home textiles market experienced a CAGR of xx% during the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for comfortable and stylish home environments. The market is expected to continue its growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033). The adoption rate of innovative materials and technologies is gradually increasing. Shifts in consumer behavior, including a rising preference for online shopping and personalized products, further influence the market landscape.

Dominant Regions, Countries, or Segments in Canada Home Textiles Market

The Canadian home textiles market is significantly shaped by the economic and demographic strengths of its major provinces. Ontario and Quebec, with their high population density, robust economic activity, and well-established retail infrastructure, continue to be the dominant regions. These areas exhibit the highest consumer spending on home furnishings and décor. Across distribution channels, online sales are experiencing a dynamic surge, outpacing traditional retail. This rapid growth is a direct consequence of the widespread adoption of e-commerce, enhanced online shopping experiences, and a strong consumer preference for the convenience and accessibility offered by digital platforms. In terms of product segments, the bed linen category commands the largest market share, a position it maintains due to its essential nature and frequent replacement cycles. Following closely is the bath linen segment, also a staple in most households.

- Leading Regions: Ontario and Quebec together are estimated to account for approximately 60-65% of the total market value, reflecting their significant consumer base and economic output.

- Dominant Distribution Channel: Online sales are demonstrating the highest growth trajectory, projected to expand by over 15-20% annually, driven by increasing internet penetration and digital commerce innovation.

- Largest Segment: Bed linen consistently holds the largest share, representing approximately 35-40% of the market value, owing to its status as a core home essential.

- Key Drivers: The market is propelled by a confluence of factors including rising disposable incomes, increasing urbanization leading to greater demand for new housing and furnishings, a growing emphasis on home improvement and interior design trends, and a continuous quest for enhanced home comfort and aesthetic appeal.

Canada Home Textiles Market Product Landscape

The Canadian home textile market showcases innovative products, including sustainable and eco-friendly options made from recycled materials and organic cotton. Technological advancements are focused on improving fabric performance, such as incorporating moisture-wicking and temperature-regulating properties. Unique selling propositions often center on design aesthetics, comfort, and durability.

Key Drivers, Barriers & Challenges in Canada Home Textiles Market

Key Drivers: The Canadian home textiles market is experiencing robust expansion fueled by several interconnected drivers. A consistent increase in disposable incomes empowers consumers to invest more in their homes. Growing urbanization, particularly in key metropolitan areas, drives demand for new household goods. The widespread appeal of home improvement projects and interior design, amplified by media and social platforms, encourages spending on textiles. Furthermore, the convenience and accessibility of online shopping have become a significant catalyst for market growth. Technological advancements in material science and manufacturing processes are also playing a crucial role, enabling the development of innovative, high-performance, and aesthetically pleasing textile products.

Key Challenges: Despite its growth trajectory, the market faces notable challenges. Fluctuations in the prices of raw materials, such as cotton and synthetics, can impact production costs and profitability. Intense competition, particularly from imported goods that often offer lower price points, presents a continuous hurdle for domestic manufacturers. Potential disruptions in global and domestic supply chains, exacerbated by geopolitical events or logistical issues, can affect product availability and delivery timelines. Additionally, evolving regulatory landscapes and increasing environmental consciousness necessitate adaptations in production processes, material sourcing, and packaging, which can incur additional costs and require significant investment.

Emerging Opportunities in Canada Home Textiles Market

The Canadian home textiles market is ripe with emerging opportunities, particularly for forward-thinking and adaptable businesses. The growing global and domestic emphasis on sustainability and ethical production presents a substantial opening for companies that prioritize eco-friendly materials, responsible sourcing, and transparent manufacturing processes. Consumers are increasingly willing to pay a premium for products aligned with their values. The integration of smart home technologies into everyday living opens new avenues for innovation in home textiles, such as temperature-regulating bedding or connected textiles. Furthermore, identifying and catering to niche markets, such as specialized bedding designed for individuals with specific health conditions (e.g., allergies, sleep apnea) or focusing on the growing pet-owner market with durable and stylish pet bedding, offers untapped potential for market penetration and differentiation.

Growth Accelerators in the Canada Home Textiles Market Industry

Strategic partnerships and collaborations between retailers and manufacturers, such as those established through the Apparel Textile Sourcing Canada trade show, are key growth catalysts. Investing in sustainable and technological advancements, including smart fabrics and manufacturing processes, further accelerates growth. Market expansion initiatives targeting underpenetrated regions or demographics offer further growth potential.

Key Players Shaping the Canada Home Textiles Market Market

- Tricots Liesse

- Northcott Silk Inc

- Marina Textiles

- Patlin Textiles

- MW Canada

- KenDor Textiles

- Beco Home

- Maharam

- Standard Textile

- Novo Textiles Co

Notable Milestones in Canada Home Textiles Market Sector

- November 2022: The Apparel Textile Sourcing Canada trade show, held in Toronto, successfully convened over 2,000 industry professionals. This event underscored the industry's resilience and renewed focus, attracting major Canadian retailers like Walmart Canada and fostering engagement with international suppliers, indicating strong collaborative opportunities and market interest.

- October 2021: Sleep Country Canada's strategic acquisition of Hush Blankets marked a significant consolidation move within the Canadian home textile sector. This acquisition highlights a growing trend towards the integration of digital retail capabilities and a keen interest in acquiring innovative and popular brands specializing in sleep-related home textile products, particularly those with a strong online presence.

In-Depth Canada Home Textiles Market Market Outlook

The Canadian home textiles market is projected to continue its upward trajectory, driven by a dynamic interplay of sustained consumer demand, ongoing technological advancements, and strategic industry collaborations. The market's future will be significantly shaped by the ability of businesses to capitalize on evolving consumer preferences and lifestyle trends. Opportunities for growth are abundant, particularly in the expansion of sustainable and ethically sourced product lines, the enhancement of sophisticated and user-friendly e-commerce platforms, and the exploration of innovative product applications that integrate functionality and design. A pronounced focus on sustainability, coupled with the adoption of cutting-edge technological advancements and the cultivation of strategic partnerships, will be paramount in defining the competitive landscape and ensuring long-term success in this evolving market.

Canada Home Textiles Market Segmentation

-

1. Type

- 1.1. Bed Linen

- 1.2. Bath Linen

- 1.3. Kitchen Linen

- 1.4. Upholstery

- 1.5. Floor Covering

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Canada Home Textiles Market Segmentation By Geography

- 1. Canada

Canada Home Textiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Online Sales is Driving the Market; Growing Urbanisation is Driving need for Small Appliances

- 3.3. Market Restrains

- 3.3.1. Changing Needs of Customers; Limited Usage of the Product

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Spending on Home Improvement Activities is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Home Textiles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Bed Linen

- 5.1.2. Bath Linen

- 5.1.3. Kitchen Linen

- 5.1.4. Upholstery

- 5.1.5. Floor Covering

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Eastern Canada Canada Home Textiles Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Home Textiles Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Home Textiles Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Tricots Liesse

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Northcott Silk Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Marina Textiles

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Patlin Textiles

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 MW Canada

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 KenDor Textiles

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Beco Home

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Maharam

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Standard Textile

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Novo Textiles Co

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Tricots Liesse

List of Figures

- Figure 1: Canada Home Textiles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Home Textiles Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Home Textiles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Home Textiles Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Canada Home Textiles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Canada Home Textiles Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Canada Home Textiles Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Canada Home Textiles Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Canada Home Textiles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada Home Textiles Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Canada Home Textiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Canada Home Textiles Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Eastern Canada Canada Home Textiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Canada Canada Home Textiles Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Western Canada Canada Home Textiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Western Canada Canada Home Textiles Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Central Canada Canada Home Textiles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Central Canada Canada Home Textiles Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Canada Home Textiles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Canada Home Textiles Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 19: Canada Home Textiles Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Canada Home Textiles Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 21: Canada Home Textiles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Canada Home Textiles Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Home Textiles Market?

The projected CAGR is approximately 4.93%.

2. Which companies are prominent players in the Canada Home Textiles Market?

Key companies in the market include Tricots Liesse, Northcott Silk Inc, Marina Textiles, Patlin Textiles, MW Canada, KenDor Textiles, Beco Home, Maharam, Standard Textile, Novo Textiles Co.

3. What are the main segments of the Canada Home Textiles Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Online Sales is Driving the Market; Growing Urbanisation is Driving need for Small Appliances.

6. What are the notable trends driving market growth?

Increasing Consumer Spending on Home Improvement Activities is Driving the Market.

7. Are there any restraints impacting market growth?

Changing Needs of Customers; Limited Usage of the Product.

8. Can you provide examples of recent developments in the market?

November 2022: The first live trade show on Canadian territory since 2019 was held in Toronto from November 7-9 as part of Apparel Textile Sourcing Canada. The sourcing show reintroduced its retail audience of 2,000 attendees, which included a significant number of notable Canadian brands like La Maison Simons, Walmart Canada, and Roots. In addition, it introduced its international exhibitor field of over 150 textile and garment enterprises, featuring ready-made garments, textiles, and accessories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Home Textiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Home Textiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Home Textiles Market?

To stay informed about further developments, trends, and reports in the Canada Home Textiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence