Key Insights

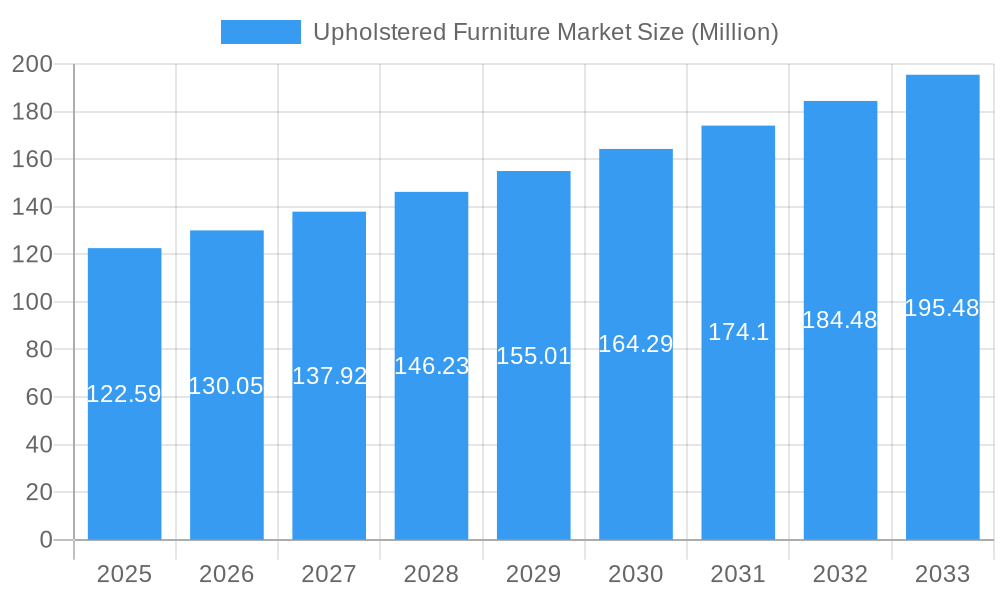

The global upholstered furniture market is projected for robust growth, driven by evolving consumer preferences and a rising disposable income, particularly in emerging economies. With a current market size of approximately $122.59 million, the sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 5.78% through 2033. This sustained expansion is fueled by increasing urbanization, a growing demand for aesthetically pleasing and comfortable home furnishings, and a significant trend towards home renovation and interior design upgrades. The market is characterized by a dynamic interplay of production and consumption patterns, with key regions like North America and Europe currently holding substantial market shares, while Asia Pacific exhibits the highest growth potential due to its expanding middle class and rapid infrastructure development. The furniture industry is witnessing a surge in demand for sustainable and eco-friendly materials, innovative designs that cater to smaller living spaces, and customizable options, all contributing to the market's upward trajectory.

Upholstered Furniture Market Market Size (In Million)

Despite the optimistic outlook, certain factors could influence the pace of growth. Fluctuations in raw material prices, such as the cost of textiles and lumber, along with increasing logistics and transportation expenses, present potential restraints. Furthermore, intense competition among established players and the emergence of new entrants, especially from low-cost manufacturing regions, will necessitate continuous innovation and strategic pricing. The market segments, including production analysis, consumption analysis, import/export dynamics, and price trends, all offer distinct opportunities and challenges. For instance, import and export analyses reveal shifting global trade flows, with significant volumes being exchanged between key manufacturing hubs and consumer markets. The forecast period from 2025 to 2033 is expected to see a gradual increase in market value, driven by these underlying economic and social factors, with companies focusing on product differentiation and expanding their distribution networks to capture a larger market share.

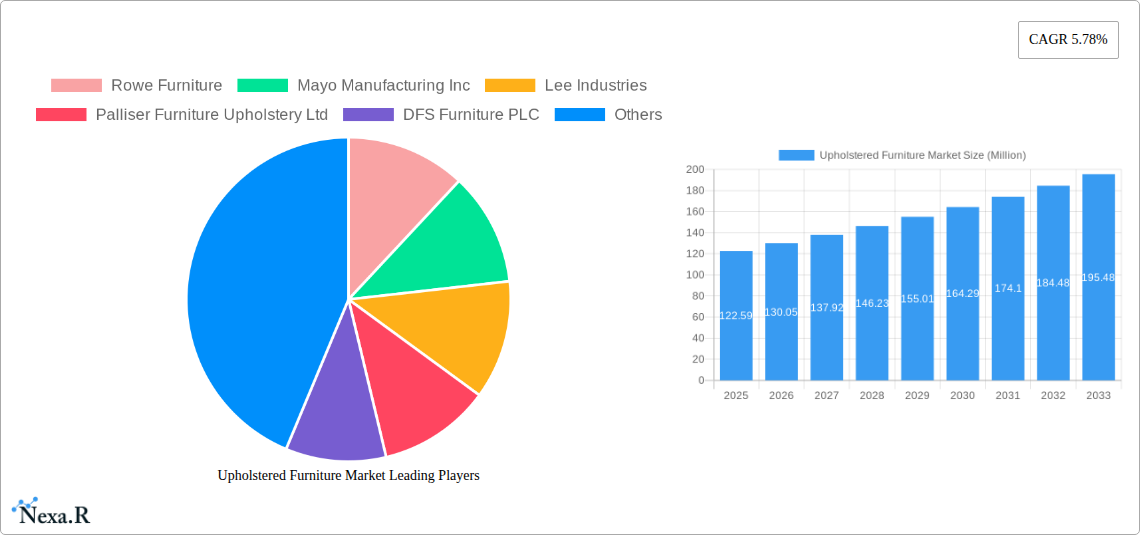

Upholstered Furniture Market Company Market Share

Comprehensive Upholstered Furniture Market Analysis: 2019–2033

This in-depth report provides a panoramic view of the global Upholstered Furniture Market, meticulously analyzing its dynamics, growth trajectory, and future potential from 2019 to 2033. With the base year set at 2025, the report delves into historical trends, current estimations, and robust forecasts, offering unparalleled insights for industry stakeholders. Covering key segments such as Production Analysis, Consumption Analysis, Import/Export Market Analysis (Value & Volume), and Price Trend Analysis, this report is an indispensable resource for manufacturers, suppliers, retailers, and investors navigating the evolving landscape of upholstered furniture. We explore the intricate parent and child market structures, providing a granular understanding of the industry's interconnectedness.

Upholstered Furniture Market Market Dynamics & Structure

The global upholstered furniture market is characterized by a moderately concentrated structure, with a mix of large multinational corporations and numerous smaller, regional players. Technological innovation is a significant driver, particularly in material science, sustainable manufacturing processes, and the integration of smart features in furniture. Regulatory frameworks, encompassing environmental standards, import/export duties, and product safety regulations, play a crucial role in shaping market entry and operational strategies. Competitive product substitutes, ranging from alternative seating solutions to DIY furniture kits, present ongoing challenges. End-user demographics, including rising disposable incomes, urbanization, and a growing preference for aesthetically pleasing and comfortable living spaces, are key demand determinants. Mergers and acquisitions (M&A) activity is notable, with companies seeking to expand their market reach, acquire proprietary technologies, or consolidate their positions. For instance, the acquisition volume in the parent Upholstered Furniture Market has seen consistent activity, with approximately 15-20 significant M&A deals annually over the past five years. Innovation barriers, such as the high cost of R&D for novel materials and the long product development cycles for upholstered goods, also influence market evolution.

- Market Concentration: A blend of large players and niche manufacturers, indicating room for both consolidation and specialized growth.

- Technological Innovation Drivers: Focus on sustainable materials, ergonomic design, and smart furniture integration.

- Regulatory Frameworks: Adherence to environmental certifications (e.g., FSC, Greenguard) and evolving safety standards.

- Competitive Substitutes: Competition from mass-produced furniture, adaptable modular systems, and growing second-hand markets.

- End-User Demographics: Driven by millennials and Gen Z preferences for customization, sustainability, and smart home integration.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and diversify product portfolios.

- Innovation Barriers: High capital investment for advanced manufacturing and material research.

Upholstered Furniture Market Growth Trends & Insights

The global upholstered furniture market is poised for robust growth, driven by an increasing global population, rising disposable incomes, and a sustained demand for home furnishings. The market size is projected to expand from approximately USD 145,000 million in 2023 to an estimated USD 210,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period (2025–2033). Adoption rates of contemporary designs and customizable options are on an upward trajectory, reflecting shifting consumer preferences towards personalized living spaces. Technological disruptions, such as advancements in 3D printing for intricate designs and the increasing use of recycled and bio-based materials, are revolutionizing production processes and product offerings. Consumer behavior shifts are evident, with a growing emphasis on durability, comfort, and the aesthetic appeal of furniture. The demand for eco-friendly and ethically sourced upholstered furniture is also gaining significant traction, prompting manufacturers to invest in sustainable practices. Furthermore, the expansion of online retail channels and the rise of direct-to-consumer (DTC) models are reshaping purchasing habits, making upholstered furniture more accessible to a wider consumer base. The influence of social media and interior design trends continues to play a pivotal role in shaping consumer choices and driving demand for specific styles and functionalities. The market penetration of premium and luxury upholstered furniture segments is also expected to witness steady growth, catering to an affluent consumer base that prioritizes quality and exclusivity. The integration of augmented reality (AR) in online furniture shopping platforms is further enhancing the customer experience, allowing consumers to visualize products in their own homes before making a purchase, thereby reducing return rates and boosting sales. The growing trend of home renovation and interior decoration projects, particularly in emerging economies, is also a significant contributor to market expansion. The average CAGR for the upholstered furniture market globally stands at an estimated 4.2% for the historical period 2019-2024, indicating a stable and upward growth trajectory.

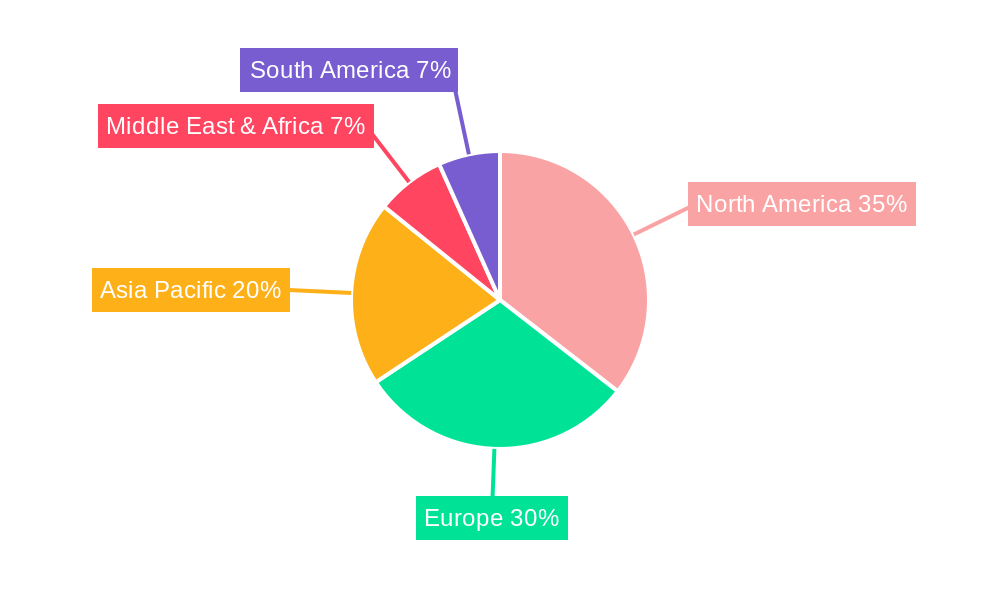

Dominant Regions, Countries, or Segments in Upholstered Furniture Market

The global upholstered furniture market is significantly influenced by regional economic conditions, consumer preferences, and manufacturing capabilities. North America currently holds a dominant position in the upholstered furniture market, driven by high disposable incomes, a strong consumer appetite for premium and custom-designed furniture, and a well-established retail infrastructure. Within North America, the United States stands out as the largest consumer and producer.

- Production Analysis: The United States and European countries are major production hubs, leveraging advanced manufacturing technologies and skilled labor. Production in the U.S. is estimated at around 35,000 million units annually, with significant output also coming from China and Vietnam for the global market.

- Consumption Analysis: North America, particularly the U.S., leads in consumption, with an estimated 40,000 million units consumed annually. Europe follows closely, with strong demand from countries like Germany, the UK, and France. Asia Pacific, driven by China and India, is a rapidly growing consumption market.

- Import Market Analysis (Value & Volume): The United States is the largest importer of upholstered furniture globally, with import volumes reaching approximately 8,500 million units in 2024, valued at an estimated USD 15,000 million. Germany and the UK are significant importers within Europe. Key exporting nations for these markets include China, Vietnam, and Mexico.

- Export Market Analysis (Value & Volume): China and Vietnam are the leading exporters of upholstered furniture, capitalizing on cost-effective manufacturing and large production capacities. China’s export volume in 2024 was estimated at around 15,000 million units, with a value of approximately USD 22,000 million. The United States also has a significant export market for high-end, luxury upholstered furniture.

- Price Trend Analysis: Prices in North America and Western Europe tend to be higher due to premium materials, intricate designs, and brand value. Emerging economies offer more competitive price points, driving volume growth. The average price per unit across the global market is estimated to hover around USD 150-200 in 2025.

- Dominant Segments: The sofa and sectional segment consistently dominates the market, accounting for over 60% of global sales. This is followed by accent chairs and recliners.

The dominance of North America is underpinned by robust economic policies that support consumer spending on home furnishings, advanced logistics and distribution networks, and a cultural emphasis on home comfort and interior aesthetics. The strong presence of major retailers and online platforms also facilitates market penetration.

Upholstered Furniture Market Product Landscape

The upholstered furniture market is witnessing a surge in product innovations focused on enhancing comfort, durability, and aesthetic appeal. Key advancements include the development of sustainable and eco-friendly upholstery fabrics, such as recycled polyester, organic cotton, and innovative plant-based leathers, which appeal to environmentally conscious consumers. Ergonomic designs are increasingly being integrated, offering advanced lumbar support, adjustable features, and modular configurations that adapt to various living spaces. Smart furniture, incorporating features like built-in charging ports, ambient lighting, and integrated sound systems, is also gaining traction, catering to the modern connected lifestyle. Performance metrics are driven by fabric wear resistance (e.g., Martindale cycles), stain repellency, and frame structural integrity. Unique selling propositions often revolve around customization options, bespoke designs, and the use of premium, handcrafted materials.

Key Drivers, Barriers & Challenges in Upholstered Furniture Market

Key Drivers:

- Rising Disposable Incomes: Increasing global wealth fuels consumer spending on home furnishings, particularly premium upholstered pieces.

- Urbanization and Smaller Living Spaces: Demand for versatile, space-saving, and multi-functional upholstered furniture designed for modern urban living.

- Home Renovation and Decor Trends: A persistent interest in interior design and home improvement drives the replacement and purchase of new furniture.

- E-commerce Expansion: Online platforms offer wider accessibility and convenience, broadening the market reach for upholstered furniture.

- Sustainability and Ethical Sourcing: Growing consumer demand for eco-friendly materials and transparent production processes.

Key Barriers & Challenges:

- Supply Chain Disruptions: Volatility in raw material prices (e.g., lumber, foam, textiles) and logistical challenges can impact production costs and timelines. In 2024, supply chain disruptions led to an estimated 5-7% increase in raw material costs for many manufacturers.

- Intense Competition: The market is highly competitive, with numerous players vying for market share, leading to price pressures.

- Economic Downturns and Recessions: Consumer spending on discretionary items like furniture can decrease significantly during economic slowdowns.

- Stringent Environmental Regulations: Compliance with evolving environmental standards can increase production costs and necessitate investment in new technologies.

- Counterfeiting and Intellectual Property Infringement: Particularly in higher-end segments, protecting design originality can be challenging.

Emerging Opportunities in Upholstered Furniture Market

Emerging opportunities lie in catering to niche markets, such as the growing demand for pet-friendly and kid-friendly upholstered furniture with enhanced durability and stain resistance. The expansion of the rental furniture market and the rise of subscription-based models for furniture offer new revenue streams. Furthermore, there's a significant opportunity in developing smart upholstered furniture that seamlessly integrates technology for enhanced user experience, such as adjustable firmness, built-in heating/cooling, and connectivity features. The increasing focus on circular economy principles also presents an opportunity for manufacturers to explore furniture leasing, repair services, and the use of recycled materials, appealing to a growing segment of conscious consumers.

Growth Accelerators in the Upholstered Furniture Market Industry

Long-term growth in the upholstered furniture market will be significantly accelerated by continued investment in sustainable material research and development, leading to innovative, eco-friendly product lines. Strategic partnerships between furniture manufacturers and technology companies will drive the integration of smart home features and enhanced digital customer experiences. Market expansion into developing economies, coupled with localized product offerings that cater to specific cultural preferences, will unlock new growth avenues. Furthermore, the adoption of advanced manufacturing techniques, such as robotics and AI-driven design, will improve efficiency and allow for greater customization, meeting evolving consumer demands for personalized and high-quality upholstered furniture.

Key Players Shaping the Upholstered Furniture Market Market

- Rowe Furniture

- Mayo Manufacturing Inc

- Lee Industries

- Palliser Furniture Upholstery Ltd

- DFS Furniture PLC

- Lazar

- Ekornes ASA

- Flexsteel Industries Inc

- Zoy Furniture

- American Furniture Manufacturing

- Ashley HomeStores Ltd

- Norwalk Furniture

- United Furniture Industries Inc

- England Furniture

- Hooker Furniture

- Sherrill Furniture

- Marge Carson (now part of Linly Designs)

Notable Milestones in Upholstered Furniture Market Sector

- October 2022: Marge Carson, a manufacturer of handcrafted furniture based in California, was purchased by Linly Designs, an interior design and retail business in Chicago. The Marge Carson furniture line is famous not just in the United States but also around the world for its high quality, proportional forms, and textiles in the industry. This acquisition signifies a consolidation trend and the expansion of premium brands.

- January 2022: The Furniture Practice (TFP) acquired Bermondsey-based furniture consultants Operandum. The acquisition of Operandum was considered an extremely good fit for TFP as it continues to expand its national and international reach. This highlights strategic expansion and diversification within the furniture industry consultancy sector, impacting how furniture is designed and marketed.

In-Depth Upholstered Furniture Market Market Outlook

The upholstered furniture market is set for a period of sustained expansion, driven by a confluence of factors including evolving consumer lifestyles, technological advancements, and a growing emphasis on sustainable living. The market's future potential is significantly shaped by the ongoing digital transformation, enabling enhanced customer engagement through virtual showrooms and personalized online shopping experiences. Strategic collaborations and acquisitions will continue to be pivotal in consolidating market positions and accessing new technologies and consumer segments. The increasing demand for customization, coupled with innovations in material science and manufacturing processes, will empower manufacturers to offer diverse and high-quality products. The market outlook is overwhelmingly positive, with significant opportunities in emerging economies and a continued strong performance in developed markets, particularly for premium, sustainable, and technologically integrated upholstered furniture solutions.

Upholstered Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Upholstered Furniture Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Upholstered Furniture Market Regional Market Share

Geographic Coverage of Upholstered Furniture Market

Upholstered Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. An Increase in the Building or Renovating of Homes Frequently Results in a Rise in the Demand for Furniture; Rising Demand for Sustainable and Eco-friendly Varieties

- 3.3. Market Restrains

- 3.3.1. High Maintenance Costs; Lack of Affordability

- 3.4. Market Trends

- 3.4.1. Growth in International Trade of Upholstered Furniture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Upholstered Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rowe Furniture

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mayo Manufacturing Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lee Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Palliser Furniture Upholstery Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DFS Furniture PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Other Companies (Lazar Ekornes ASA Flexsteel Industries Inc Zoy Furniture and American Furniture Manufacturing)**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ashley HomeStores Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Norwalk Furniture

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 United Furniture Industries Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 England Furniture

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hooker Furniture

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sherrill Furniture

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Rowe Furniture

List of Figures

- Figure 1: Global Upholstered Furniture Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Upholstered Furniture Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Upholstered Furniture Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Upholstered Furniture Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Upholstered Furniture Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Upholstered Furniture Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Upholstered Furniture Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Upholstered Furniture Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Upholstered Furniture Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Upholstered Furniture Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Upholstered Furniture Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Upholstered Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Upholstered Furniture Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Upholstered Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Upholstered Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Upholstered Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Upholstered Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Upholstered Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Upholstered Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Upholstered Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Upholstered Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Upholstered Furniture Market?

The projected CAGR is approximately 5.78%.

2. Which companies are prominent players in the Upholstered Furniture Market?

Key companies in the market include Rowe Furniture, Mayo Manufacturing Inc, Lee Industries, Palliser Furniture Upholstery Ltd, DFS Furniture PLC, Other Companies (Lazar Ekornes ASA Flexsteel Industries Inc Zoy Furniture and American Furniture Manufacturing)**List Not Exhaustive, Ashley HomeStores Ltd, Norwalk Furniture, United Furniture Industries Inc, England Furniture, Hooker Furniture, Sherrill Furniture.

3. What are the main segments of the Upholstered Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 122.59 Million as of 2022.

5. What are some drivers contributing to market growth?

An Increase in the Building or Renovating of Homes Frequently Results in a Rise in the Demand for Furniture; Rising Demand for Sustainable and Eco-friendly Varieties.

6. What are the notable trends driving market growth?

Growth in International Trade of Upholstered Furniture Products.

7. Are there any restraints impacting market growth?

High Maintenance Costs; Lack of Affordability.

8. Can you provide examples of recent developments in the market?

October 2022: Marge Carson, a manufacturer of handcrafted furniture based in California, was purchased by Linly Designs, an interior design and retail business in Chicago. The Marge Carson furniture line is famous not just in the United States but also around the world for its high quality, proportional forms, and textiles in the industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Upholstered Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Upholstered Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Upholstered Furniture Market?

To stay informed about further developments, trends, and reports in the Upholstered Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence