Key Insights

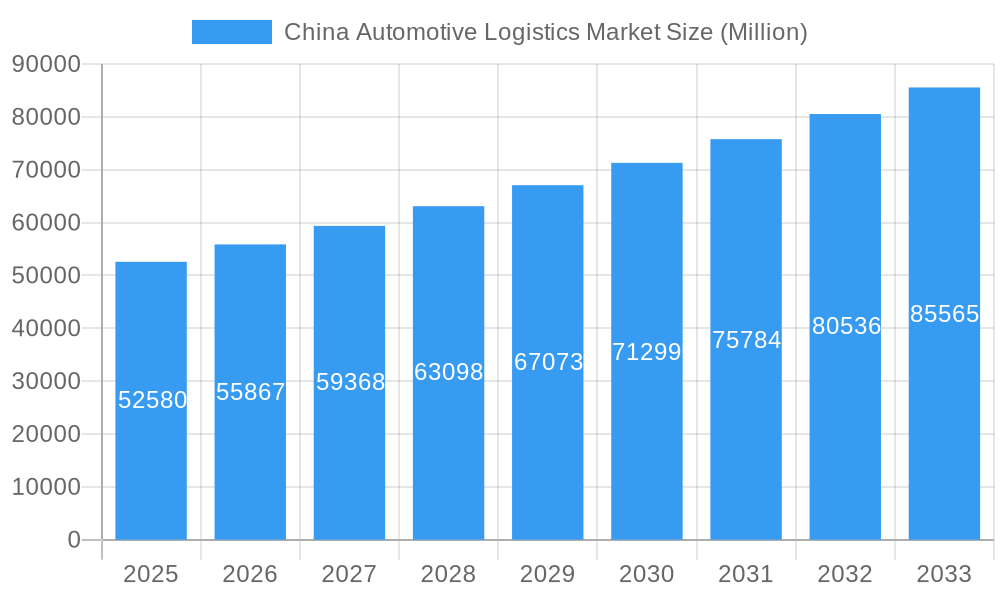

The China automotive logistics market, valued at $52.58 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.96% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning Chinese automotive industry, fueled by increasing domestic demand and government initiatives promoting electric vehicles (EVs), is a primary catalyst. Furthermore, advancements in technology, such as the adoption of sophisticated logistics management systems and the rise of autonomous vehicles, are streamlining operations and enhancing efficiency within the sector. The expanding e-commerce sector also plays a significant role, as it necessitates efficient and reliable delivery networks for automotive parts and finished vehicles. The market is segmented by type (finished vehicles and auto components) and service (transportation, warehousing, distribution, and inventory management, along with other services). Major players like Apex Group, DHL, Nippon Express, UPS, GEODIS, and others are actively shaping the market landscape through strategic partnerships and investments in infrastructure and technology. The increasing focus on sustainable logistics practices, driven by environmental concerns, is also influencing market dynamics, encouraging the adoption of eco-friendly transportation methods.

China Automotive Logistics Market Market Size (In Billion)

The market’s growth trajectory is expected to remain positive throughout the forecast period (2025-2033). While challenges such as infrastructure limitations in certain regions and fluctuations in fuel prices might present some headwinds, the overall positive outlook is reinforced by the strong growth prospects of the Chinese automotive industry and the continuous improvements in logistics technologies. China's strategic focus on improving its supply chain resilience and optimizing its logistics infrastructure will further fuel growth. The expansion of the logistics network, especially in less-developed regions, will play a crucial role in facilitating efficient distribution of automotive products across the country. The competitive landscape is characterized by a mix of both international and domestic logistics providers, leading to innovative solutions and enhanced service offerings.

China Automotive Logistics Market Company Market Share

China Automotive Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Automotive Logistics Market, encompassing market dynamics, growth trends, regional dominance, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by Type (Finished Vehicle, Auto Component) and Service (Transportation, Warehousing, Distribution & Inventory Management, Other Services), offering granular data and analysis for each segment. The total market size is projected to reach xx million units by 2033.

China Automotive Logistics Market Dynamics & Structure

This section analyzes the competitive landscape of the Chinese automotive logistics market, examining market concentration, technological innovation, regulatory frameworks, and significant M&A activities. The market is characterized by a mix of both international giants and domestic players, with varying degrees of market share.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few large players holding significant market share, but with ample space for smaller specialized firms. Further analysis reveals that the top 5 players collectively control approximately xx% of the market.

- Technological Innovation: The sector is witnessing rapid technological advancement, driven by the adoption of automation, data analytics, and sustainable practices. Innovation barriers include high initial investment costs and the need for skilled labor.

- Regulatory Framework: Government regulations related to environmental protection, safety, and efficiency significantly impact market operations. Recent policy changes are expected to further drive market consolidation and sustainable solutions.

- Competitive Product Substitutes: The emergence of new logistics technologies and alternative transportation methods pose a competitive threat.

- End-User Demographics: The growth of the automotive industry, particularly electric vehicles and new energy vehicles, directly influences the demand for automotive logistics services.

- M&A Trends: The past five years have witnessed xx M&A deals in the sector, predominantly involving smaller companies acquired by larger players aiming to expand their geographical reach and service offerings.

China Automotive Logistics Market Growth Trends & Insights

The China automotive logistics market is experiencing robust growth, driven by a confluence of factors including surging automotive production, the rapid expansion of the electric vehicle (EV) sector, and substantial government investments in infrastructure development. Historical data reveals a CAGR of [Insert Precise CAGR for 2019-2024]% during the period 2019-2024. This positive trajectory is expected to continue, with projections indicating a CAGR of [Insert Precise CAGR for 2025-2033]% during the forecast period (2025-2033). Beyond these headline figures, several key dynamics are shaping market evolution. The increasing adoption of just-in-time (JIT) inventory management strategies significantly influences efficiency and demand. Simultaneously, technological advancements, such as the introduction of autonomous vehicles and sophisticated tracking systems, are accelerating operational optimization and market expansion. The integration of advanced technologies like blockchain and AI for supply chain optimization presents further potential for market expansion. Furthermore, the evolving regulatory landscape, with a focus on sustainability and emission reduction, is reshaping logistics practices within the sector.

Dominant Regions, Countries, or Segments in China Automotive Logistics Market

Geographical dominance within the Chinese automotive logistics market is currently concentrated along the coastal regions. Provinces such as Guangdong, Zhejiang, and Jiangsu are leading the way due to their established infrastructure, proximity to major automotive manufacturing hubs, and access to key ports. In terms of market segments, the Finished Vehicle segment commands the largest market share, followed by the Auto Component segment. Within the service sector, Transportation Services constitutes the most significant portion. This dominance is further reinforced by:

Key Drivers:

- Supportive government policies aimed at fostering growth within the automotive industry, including incentives for EV adoption and infrastructure development.

- Significant investments in robust infrastructure development, encompassing improved road networks, modernized port facilities, and high-speed rail connections.

- Exponential growth in demand from the electric vehicle (EV) and new energy vehicle (NEV) segments, necessitating specialized logistics solutions.

- The continuous development and implementation of specialized logistics solutions precisely tailored to the unique requirements of EVs and NEVs.

Dominance Factors:

- Highly developed logistics networks and efficient supply chains deeply integrated into major automotive manufacturing clusters.

- Ready access to a robust transportation infrastructure and a skilled workforce proficient in automotive logistics.

- Strategically advantageous locations facilitating seamless import and export operations, minimizing transit times and costs.

China Automotive Logistics Market Product Landscape

The product landscape of the Chinese automotive logistics market is characterized by a diverse range of services and technologies. This includes specialized transportation for both finished vehicles and components, sophisticated warehousing and inventory management solutions designed to meet the stringent requirements of the automotive industry, and cutting-edge technology-driven solutions such as real-time tracking, predictive analytics, and automated warehouse systems. The increasing adoption of sustainable and environmentally friendly logistics practices, including the use of alternative fuel vehicles, is also shaping the product landscape. These advancements are crucial in ensuring the industry's adherence to stringent quality control and security protocols for vehicles and components.

Key Drivers, Barriers & Challenges in China Automotive Logistics Market

Key Drivers:

The market is propelled by increasing automotive production, the rise of e-commerce and its impact on the automotive retail landscape, the expansion of the EV sector, and supportive government policies designed to optimize supply chains and facilitate logistics efficiency.

Challenges & Restraints:

The market faces challenges including the need for infrastructure upgrades to handle increased volume, stringent regulatory compliance costs, and intense competition within the sector. Supply chain disruptions, particularly evident during the pandemic, also pose significant challenges to market growth. Labor shortages and fluctuating fuel prices further add to the complexity of the market.

Emerging Opportunities in China Automotive Logistics Market

Several key opportunities are poised to drive further growth within the China automotive logistics market. The expansion of last-mile delivery solutions for e-commerce automotive parts caters to the rising demand for online retail. The increasing focus on sustainable and environmentally friendly logistics practices presents significant opportunities for businesses adopting green technologies. Furthermore, the continued expansion of the EV industry into new regions creates considerable demand for specialized logistics solutions. This is compounded by the potential for significant efficiency gains through the wider adoption of advanced technologies, such as blockchain for improved traceability and AI for optimized route planning and resource allocation.

Growth Accelerators in the China Automotive Logistics Market Industry

Technological advancements, strategic partnerships between logistics providers and automotive manufacturers, and government initiatives promoting sustainable logistics are major catalysts for long-term growth. Expanding into less-developed regions of China and focusing on specialized logistics solutions for emerging automotive technologies further contribute to growth.

Key Players Shaping the China Automotive Logistics Market Market

- Apex Group

- DHL

- Nippon Express

- UPS

- GEODIS

- Yusen Logistics Co Ltd

- China Ocean Shipping (Group) Company

- SAIC Anji Logistics

- BLG Logistics

- Sinotrans Co Ltd

- HYCX Group

Notable Milestones in China Automotive Logistics Market Sector

- May 2023: SAIC Anji's order of four methanol-ready car carriers demonstrates a proactive commitment to reducing greenhouse gas emissions and adopting more sustainable logistics practices.

- July 2023: COSCO Shipping's launch of a comprehensive full-chain logistics service for new energy vehicle exports underscores the burgeoning demand within this rapidly growing sector. This highlights the increasing importance of efficient and reliable logistics for supporting international trade in EVs.

- [Add other notable milestones with dates and brief descriptions]

In-Depth China Automotive Logistics Market Market Outlook

The future of the China automotive logistics market appears bright, driven by continued growth in automotive production, the increasing adoption of electric vehicles, and ongoing investments in infrastructure. Strategic partnerships, technological innovation, and a focus on sustainability will be key to capturing growth opportunities in the coming years. The market is expected to experience robust growth, with significant potential for new market entrants and existing players alike.

China Automotive Logistics Market Segmentation

-

1. Type

- 1.1. Finished Vehicle

- 1.2. Auto Component

-

2. Service

- 2.1. Transportation

- 2.2. Warehous

- 2.3. Other Services

China Automotive Logistics Market Segmentation By Geography

- 1. China

China Automotive Logistics Market Regional Market Share

Geographic Coverage of China Automotive Logistics Market

China Automotive Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing New Energy Vehicles Sales

- 3.3. Market Restrains

- 3.3.1. Trade War between China and the United States

- 3.4. Market Trends

- 3.4.1. Chinese Investment in NEVs (New Energy Vehicles) Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Finished Vehicle

- 5.1.2. Auto Component

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Transportation

- 5.2.2. Warehous

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Apex Group**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippon Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UPS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GEODIS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yusen Logistics Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Ocean Shipping (Group) Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAIC Anji Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BLG Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sinotrans Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HYCX Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Apex Group**List Not Exhaustive

List of Figures

- Figure 1: China Automotive Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Automotive Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 3: China Automotive Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: China Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: China Automotive Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Logistics Market?

The projected CAGR is approximately 5.96%.

2. Which companies are prominent players in the China Automotive Logistics Market?

Key companies in the market include Apex Group**List Not Exhaustive, DHL, Nippon Express, UPS, GEODIS, Yusen Logistics Co Ltd, China Ocean Shipping (Group) Company, SAIC Anji Logistics, BLG Logistics, Sinotrans Co Ltd, HYCX Group.

3. What are the main segments of the China Automotive Logistics Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing New Energy Vehicles Sales.

6. What are the notable trends driving market growth?

Chinese Investment in NEVs (New Energy Vehicles) Driving the Market Growth.

7. Are there any restraints impacting market growth?

Trade War between China and the United States.

8. Can you provide examples of recent developments in the market?

May 2023: SAIC Anji (a wholly-owned subsidiary of China’s SAIC Motor specializing in the automotive logistics business) placed an order for four methanol-ready car carriers to reduce greenhouse gas (GHG) emissions. As informed, the 9,000 CEU vessels will be built by China Merchants Jinling Shipyard (CMJL Nanjing). They will measure 228 meters in length with a molded depth of 15.4 meters and a width of 37.8 meters. The car carriers will also be scrubber-fitted to reduce greenhouse gas (GHG) emissions additionally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Logistics Market?

To stay informed about further developments, trends, and reports in the China Automotive Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence