Key Insights

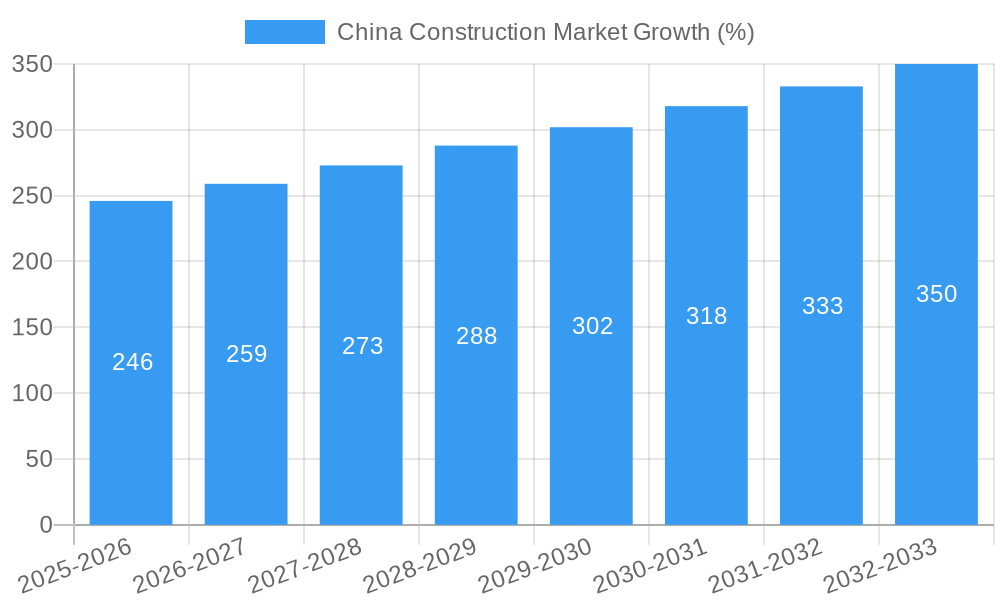

The China construction market, valued at $4.59 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.07% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant government investment in infrastructure projects, particularly in transportation networks (high-speed rail, roads, and ports) and energy infrastructure (renewable energy projects and power grids), is a major catalyst. Secondly, rapid urbanization and a growing middle class are driving demand for residential and commercial construction. The ongoing development of smart cities further fuels this demand, necessitating innovative and sustainable construction practices. Finally, China's commitment to sustainable development initiatives, including green building standards and energy-efficient technologies, presents lucrative opportunities for environmentally conscious construction companies. However, the market faces certain challenges. Fluctuations in the global economy, potential material price increases, and the need for skilled labor can impact project timelines and profitability.

Despite these restraints, the segmentation of the market offers promising insights. The infrastructure sector, encompassing transportation and energy, is anticipated to dominate market share due to ongoing government investments. However, the residential and commercial sectors are expected to witness significant growth driven by urbanization and rising disposable incomes. Key players such as China National Chemical Engineering, China Metallurgical Group, and China State Construction Engineering are well-positioned to capitalize on these opportunities, leveraging their experience and expertise to secure prominent positions in major projects. The competitive landscape is dynamic, with both state-owned enterprises and private companies vying for market share. The forecast period (2025-2033) presents a period of sustained growth, although careful management of risks and adaptation to evolving market dynamics will be crucial for long-term success.

China Construction Market: 2019-2033 Report - Unlocking Growth in a Thriving Sector

This comprehensive report provides an in-depth analysis of the China construction market, covering market dynamics, growth trends, key players, and future opportunities. With a study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is an essential resource for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The report delves into parent markets (Infrastructure Development) and child markets (Residential, Commercial, Industrial construction) to provide a granular view of market segmentation.

Market size is estimated at xx Million units in 2025 and projected to reach xx Million units by 2033.

Keywords: China Construction Market, Construction Industry China, Infrastructure Development China, Residential Construction China, Commercial Construction China, Industrial Construction China, China Construction Market Size, China Construction Market Growth, China Construction Market Trends, China Construction Companies, Construction Market Analysis China.

China Construction Market Dynamics & Structure

The Chinese construction market is characterized by a high level of concentration amongst a few dominant players, intense competition, and significant government influence. The market's structure reflects a complex interplay of technological innovation, stringent regulatory frameworks, and the ever-present pressure from substitute products and materials. Mergers and acquisitions (M&A) activity plays a key role in shaping market dynamics.

- Market Concentration: The top 10 players account for approximately 60% of the market share in 2025, with China State Construction Engineering holding the largest share (approximately 15%). Smaller firms operate largely in niche segments.

- Technological Innovation: While adoption of Building Information Modeling (BIM) and other advanced technologies is increasing, the pace is hindered by cost considerations, skill gaps, and reluctance to embrace change amongst some players.

- Regulatory Framework: Stringent building codes, environmental regulations, and safety standards significantly impact project timelines and costs. Government policies promoting sustainable construction practices influence material choices and project designs.

- Competitive Product Substitutes: The emergence of prefabricated construction methods and innovative materials presents a challenge to traditional construction methods, impacting material suppliers and labor demand.

- End-User Demographics: The increasing urbanization and middle-class growth drives demand for residential and commercial construction. Government investment in infrastructure projects significantly impacts the industrial and transportation sectors.

- M&A Trends: Consolidation is prevalent, with larger firms acquiring smaller players to expand their market share and geographical reach. The number of M&A deals is estimated to be around 150 in 2025, valued at approximately xx Million units.

China Construction Market Growth Trends & Insights

The China construction market experienced significant growth throughout the historical period (2019-2024). This growth trajectory is expected to continue, albeit at a slightly moderated pace, during the forecast period (2025-2033). The Compound Annual Growth Rate (CAGR) is projected to be approximately 5% during the forecast period, driven by robust government spending on infrastructure development, sustained urbanization, and increasing private sector investment in real estate. Market penetration of advanced construction technologies like BIM is anticipated to increase gradually, influenced by government incentives and increasing industry awareness of the benefits. Consumer behavior is shifting toward sustainable and smart building solutions, creating new niche markets and driving innovation in design and material selection.

Dominant Regions, Countries, or Segments in China Construction Market

The coastal regions of China, including Guangdong, Jiangsu, and Zhejiang, consistently dominate the construction market, due to high population density, robust economic activity, and significant government investment in infrastructure projects. Among sectors, Infrastructure (Transportation) projects, fueled by ongoing national infrastructure programs, hold a significant share of market growth.

- Key Drivers for Infrastructure (Transportation):

- Extensive high-speed rail network expansion.

- Development of new ports and airports.

- Urban mass transit system upgrades and expansions.

- Investment in smart city infrastructure.

- Market Share & Growth Potential: Infrastructure (Transportation) constitutes approximately 30% of the overall market in 2025, showing potential for further growth exceeding 6% CAGR during the forecast period. The sector's dominance is due to its inherent importance to economic development and government prioritization.

China Construction Market Product Landscape

The product landscape is evolving rapidly with innovations in building materials, construction technologies, and project management systems. The focus is shifting towards prefabricated construction, sustainable building materials, and technologies that enhance efficiency, safety, and quality. Product innovation emphasizes reduced construction timelines, improved durability, and enhanced energy efficiency, creating unique selling propositions that cater to specific market segments.

Key Drivers, Barriers & Challenges in China Construction Market

Key Drivers:

- Government investment in infrastructure: Massive investments in transportation, energy, and urban development projects drive significant construction demand.

- Urbanization and population growth: The ongoing migration to urban centers fuels residential and commercial construction growth.

- Increasing disposable incomes: Rising living standards support higher spending on real estate and construction projects.

Key Challenges:

- Labor shortages and rising labor costs: Finding skilled labor remains a challenge, impacting project timelines and costs.

- Stringent environmental regulations: Meeting increasingly strict standards adds to project complexity and cost.

- Intense competition: The highly competitive landscape pressures profit margins and requires continuous innovation.

Emerging Opportunities in China Construction Market

- Green building technologies: Growing demand for sustainable construction solutions presents significant opportunities for environmentally friendly materials and construction methods.

- Smart building solutions: The integration of IoT, AI, and data analytics in building design and management presents considerable potential.

- Prefabrication and modular construction: These methods offer efficiency gains and cost reductions.

Growth Accelerators in the China Construction Market Industry

Technological advancements in construction methods, the rise of strategic partnerships between domestic and international firms, and expansion into new markets like renewable energy infrastructure and smart cities will propel long-term growth.

Key Players Shaping the China Construction Market Market

- China National Chemical Engineering

- China Metallurgical Group

- China State Construction Engineering

- China Communications Construction Company

- China Railway Group

- China Railway Construction

- China Energy Engineering Corporation

- Shanghai Construction Group

- China Petroleum Engineering Corporation

- Power Construction Corporation of China (Website unavailable)

Notable Milestones in China Construction Market Sector

- July 2023: Shaoxing Metro Line 2, constructed by CRCC, opened, introducing automated and driverless subway systems to Shaoxing. This boosted the "Commuting Circle" for the Hangzhou Asian Games.

- December 2023: Two Chinese construction projects won ENR's 2023 Global Best Projects Awards: Lamu Port Berth 1-3 (Airport and Port category) and the Peljesac Bridge (Bridge and Tunnel category).

In-Depth China Construction Market Market Outlook

The China construction market is poised for sustained growth driven by government initiatives, technological advancements, and evolving consumer preferences. Strategic partnerships, investments in sustainable solutions, and expansion into high-growth sectors like renewable energy will be crucial for long-term success in this dynamic and competitive environment. The continued focus on infrastructure projects, coupled with the rise of smart and green buildings, presents significant investment opportunities and promises a robust outlook for the sector throughout the forecast period.

China Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastruture (Transportation)

- 1.5. Energy and Utilities

China Construction Market Segmentation By Geography

- 1. China

China Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Oversupply in the Real Estate; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Increase in Output value of China Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastruture (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China National Chemical Engineering

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Metallurgical Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China State Construction Engineering

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Communications Construction Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Railway Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Railway Construction

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Energy Engineering Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Construction Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Petroleum Engineering Corporation**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Power Construction Corporation of China

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China National Chemical Engineering

List of Figures

- Figure 1: China Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Construction Market Share (%) by Company 2024

List of Tables

- Table 1: China Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: China Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: China Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Construction Market?

The projected CAGR is approximately 5.07%.

2. Which companies are prominent players in the China Construction Market?

Key companies in the market include China National Chemical Engineering, China Metallurgical Group, China State Construction Engineering, China Communications Construction Company, China Railway Group, China Railway Construction, China Energy Engineering Corporation, Shanghai Construction Group, China Petroleum Engineering Corporation**List Not Exhaustive, Power Construction Corporation of China.

3. What are the main segments of the China Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Increase in Output value of China Construction Industry.

7. Are there any restraints impacting market growth?

Oversupply in the Real Estate; Labor Shortages.

8. Can you provide examples of recent developments in the market?

December 2023: Recently, "Engineering News-Record" (ENR), one of the world's most authoritative academic journals in engineering and construction, announced the winners of the 2023 Global Best Projects Awards. I received awards for two projects. The Lamu Port Berth 1-3 Project was honored with the Award of Merit in the Airport and Port category, while the Peljesac Bridge and its access roads in Croatia received the Award of Merit in the Bridge and Tunnel category.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Construction Market?

To stay informed about further developments, trends, and reports in the China Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence