Key Insights

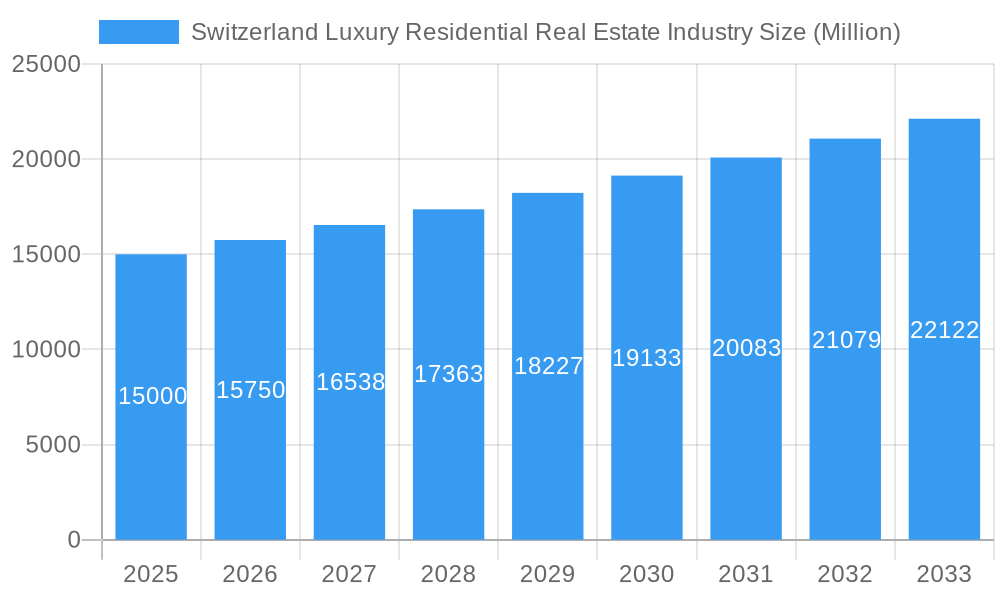

The Switzerland luxury residential real estate market, valued at approximately CHF 10 billion in 2024, is poised for significant expansion. Projections indicate a Compound Annual Growth Rate (CAGR) of 4.8%, leading to a robust market size of 10 billion by 2033. This growth trajectory is underpinned by Switzerland's inherent appeal as a stable, secure, and high-quality investment destination for High-Net-Worth Individuals (HNWIs). Factors such as economic stability, political security, and an elevated quality of life, coupled with breathtaking natural landscapes and superior infrastructure, continuously attract discerning domestic and international buyers, particularly from Europe and Asia. Limited supply of prime luxury properties in sought-after locations like Zurich, Geneva, and Bern, further constrained by stringent building regulations, inherently supports sustained price appreciation. The market is segmented by property type, including villas, landed houses, apartments, and condominiums, with Zurich, Geneva, and Bern consistently leading in property valuations. Established industry leaders such as UM Real Estate Investment AG, CMG Immobilien, and Sotheby's International Realty actively compete, driving innovation in tailored marketing and bespoke services for affluent clientele.

Switzerland Luxury Residential Real Estate Industry Market Size (In Billion)

While the market demonstrates considerable strength, potential headwinds exist. Fluctuations in interest rates and global economic uncertainties could temper buyer confidence and investment volumes. Additionally, regulations concerning foreign property ownership and taxation policies may influence market dynamics for international investors. Nevertheless, the long-term outlook remains exceptionally positive, driven by Switzerland's established reputation as a global nexus for finance, technology, and luxury living. Future market expansion will likely emphasize innovative sustainable construction practices and adaptive strategies to meet evolving buyer preferences, ensuring continued growth and opportunity. The burgeoning tech sector and its associated influx of high-earning professionals further bolster this optimistic forecast.

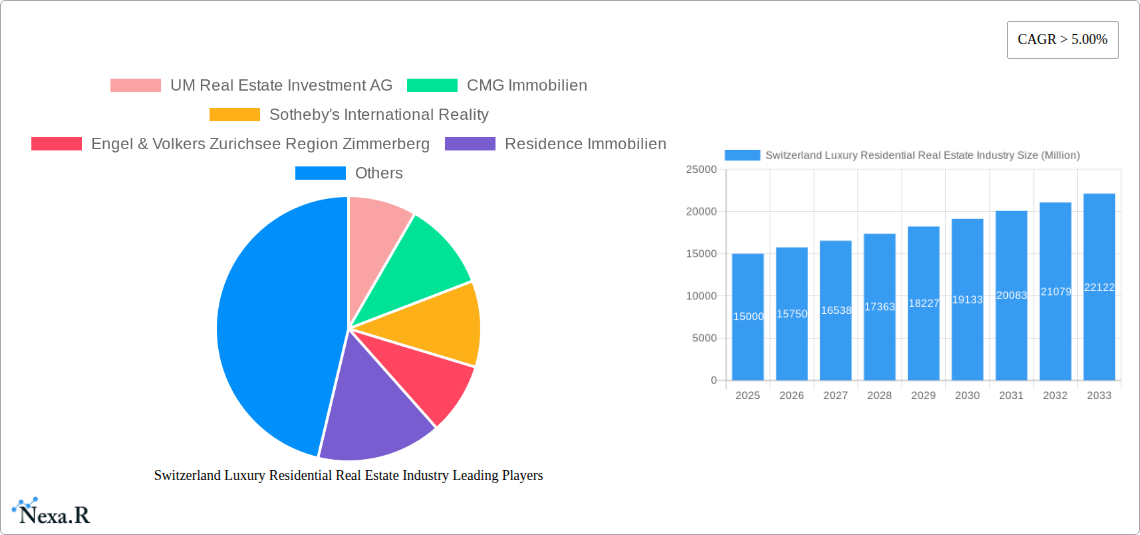

Switzerland Luxury Residential Real Estate Industry Company Market Share

Switzerland Luxury Residential Real Estate Industry: Market Report 2019-2033

This comprehensive report delivers an in-depth analysis of the Switzerland luxury residential real estate market, covering the period 2019-2033, with a focus on 2025. It provides valuable insights for investors, developers, real estate professionals, and anyone interested in this lucrative sector. The report examines market dynamics, growth trends, dominant segments, key players, and future opportunities within the parent market of Swiss real estate and the child market of luxury residential properties.

Keywords: Switzerland Luxury Real Estate, Swiss Luxury Property Market, Luxury Villas Switzerland, Luxury Apartments Switzerland, Zurich Luxury Real Estate, Geneva Luxury Property, Bern Real Estate, Basel Luxury Homes, Lausanne Luxury Properties, Real Estate Investment Switzerland, Swiss Real Estate Market Analysis, High-Net-Worth Individuals (HNWI) Switzerland, Swiss Property Market Trends, UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Realty, Engel & Volkers, Residence Immobilien, Honeywell Immobilier, SJS ImmoArch AG, Swiss Capital Property, Luxury Places SA, La Roche Residential.

Switzerland Luxury Residential Real Estate Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the Swiss luxury residential real estate market, encompassing market concentration, technological advancements, regulatory frameworks, competitive substitutions, end-user demographics, and M&A activity. The market exhibits a moderately concentrated structure with several prominent players holding significant shares. However, the market also sees the presence of several niche players catering to specific luxury segments and locations.

- Market Concentration: The top 5 players command approximately xx% of the market share in 2025 (estimated). This indicates a somewhat fragmented yet competitive market environment.

- Technological Innovation: Technological innovations like virtual tours, 3D modeling, and online property platforms are transforming the way luxury properties are marketed and sold. However, high initial investment costs and resistance to change among traditional players act as barriers.

- Regulatory Framework: Stringent regulations regarding building permits, environmental standards, and property taxes significantly influence the development and pricing of luxury residential properties.

- Competitive Substitutes: While luxury properties possess unique characteristics, high-end rental properties and alternative investments can act as substitutes, particularly for investors.

- End-User Demographics: The primary end-users are High-Net-Worth Individuals (HNWIs), both domestic and international, seeking premium properties for primary residences or investment purposes.

- M&A Trends: The historical period (2019-2024) witnessed xx M&A deals in the luxury residential segment, with an estimated xx million value. This suggests consolidation is occurring in the market.

Switzerland Luxury Residential Real Estate Industry Growth Trends & Insights

The Swiss luxury residential real estate market has exhibited steady growth throughout the historical period (2019-2024). The market size, estimated at xx million in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated xx million by 2033. This growth is attributed to several factors, including an increase in HNWIs, sustained economic stability, and attractive investment opportunities. Demand remains strong, particularly for properties in prime locations like Zurich, Geneva, and the surrounding areas. The market has seen increased adoption of digital tools in marketing and sales. However, the impact of global economic uncertainty and potential interest rate hikes on consumer behavior should be monitored.

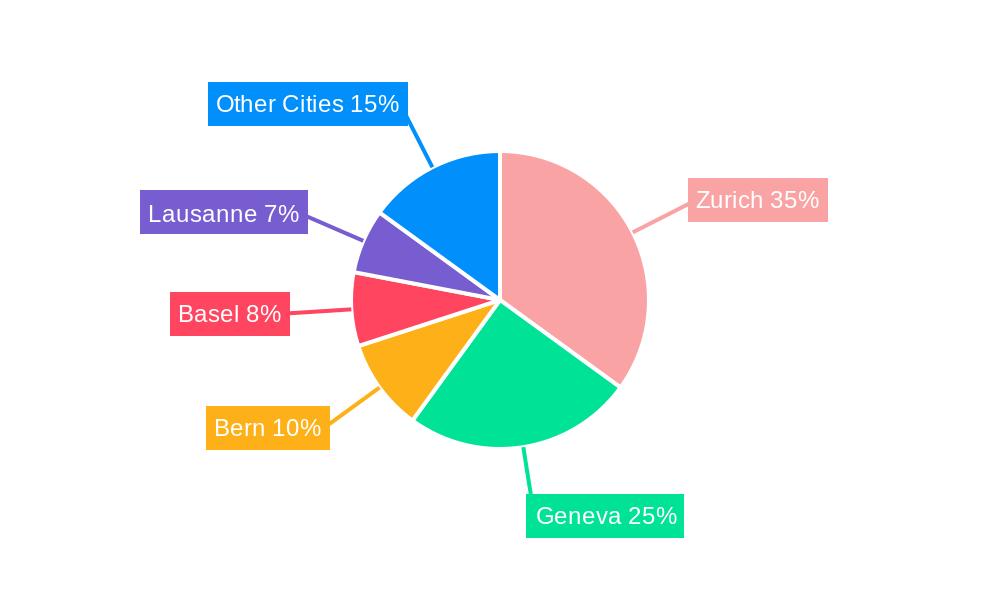

Dominant Regions, Countries, or Segments in Switzerland Luxury Residential Real Estate Industry

Zurich and Geneva consistently dominate the Swiss luxury residential real estate market, accounting for approximately xx% of the total market value in 2025. The high demand in these cities is driven by factors such as established infrastructure, proximity to international organizations, and a high quality of life. Villas and landed houses represent a larger share of the luxury segment compared to apartments and condominiums.

- Key Drivers for Zurich & Geneva:

- Strong local and international demand.

- Well-developed infrastructure and amenities.

- Strong economies and employment opportunities.

- High quality of life.

- Villas and Landed Houses: This segment benefits from the appeal of spacious living and privacy, which are especially valued among HNWIs.

- Apartments and Condominiums: Though smaller in market share within the luxury sector, this segment experiences steady growth due to the convenience and upscale amenities offered in many new developments.

Switzerland Luxury Residential Real Estate Industry Product Landscape

The Swiss luxury residential real estate market showcases a diverse range of high-end properties, including bespoke villas, exclusive penthouses, and luxury apartments with state-of-the-art amenities. Innovation in the sector focuses on sustainable building practices, smart home technology integration, and the enhancement of security features. Unique selling propositions often involve prime locations, exceptional views, bespoke architectural design, and high-quality finishes. Technological advancements are significantly impacting customer experience via virtual tours and augmented reality applications.

Key Drivers, Barriers & Challenges in Switzerland Luxury Residential Real Estate Industry

Key Drivers:

- Strong economic fundamentals and high purchasing power of HNWIs.

- Favorable government policies promoting investment in real estate.

- Consistent demand for luxury properties driven by a desirable lifestyle and prestigious image.

Key Challenges:

- Limited land availability in prime locations drives higher prices.

- Strict building regulations and lengthy approval processes can hinder development.

- Increasing competition from other investment classes. Competition impacts market share and profit margins.

Emerging Opportunities in Switzerland Luxury Residential Real Estate Industry

Emerging opportunities include leveraging smart home technology and sustainable building practices to increase property value and appeal. Further tapping into the growing segment of eco-conscious HNWIs seeking sustainable luxury living presents an opportunity. Exploring niche markets such as wellness retreats and luxury chalets offers further potential.

Growth Accelerators in the Switzerland Luxury Residential Real Estate Industry Industry

Long-term growth is accelerated by strategic partnerships between developers and luxury brands, introducing new design concepts and innovative amenities. Technological adoption, especially the implementation of proptech solutions to improve efficiency and customer experience, is a key driver. Continued foreign investment and the influx of HNWIs also fuel future growth.

Key Players Shaping the Switzerland Luxury Residential Real Estate Industry Market

- UM Real Estate Investment AG

- CMG Immobilien

- Sotheby's International Realty

- Engel & Volkers Zurichsee Region Zimmerberg

- Residence Immobilien

- Honeywell Immobilier

- SJS ImmoArch AG

- Swiss Capital Property

- Luxury Places SA

- La Roche Residential

Notable Milestones in Switzerland Luxury Residential Real Estate Industry Sector

- March 2023: Honeywell Immobilier partnered with Watershed Organization Trust (WOTR) for soil and water conservation, enhancing its sustainability profile and potentially attracting environmentally conscious buyers.

- January 2022: Engel & Volkers Zurichsee Region Zimmerberg expanded to over 50 locations in Switzerland, increasing its market reach and brand recognition.

In-Depth Switzerland Luxury Residential Real Estate Industry Market Outlook

The Swiss luxury residential real estate market is poised for continued growth, driven by the factors outlined above. Strategic acquisitions, innovative development projects, and a focus on sustainability will be key to capturing market share and achieving long-term success. The future potential lies in catering to evolving consumer preferences, leveraging technology to enhance the customer journey, and maintaining a strong focus on environmental responsibility.

Switzerland Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Cities

- 2.1. Bern

- 2.2. Zurich

- 2.3. Geneva

- 2.4. Basel

- 2.5. Lausanne

- 2.6. Other Cities

Switzerland Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Switzerland

Switzerland Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Switzerland Luxury Residential Real Estate Industry

Switzerland Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Bern

- 5.2.2. Zurich

- 5.2.3. Geneva

- 5.2.4. Basel

- 5.2.5. Lausanne

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UM Real Estate Investment AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CMG Immobilien

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sotheby's International Reality

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engel & Volkers Zurichsee Region Zimmerberg

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Residence Immobilien

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell Immobilier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SJS ImmoArch AG**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Swiss Capital Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Luxury places SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 La Roche Residential

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UM Real Estate Investment AG

List of Figures

- Figure 1: Switzerland Luxury Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Switzerland Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 3: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 6: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Luxury Residential Real Estate Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Switzerland Luxury Residential Real Estate Industry?

Key companies in the market include UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Reality, Engel & Volkers Zurichsee Region Zimmerberg, Residence Immobilien, Honeywell Immobilier, SJS ImmoArch AG**List Not Exhaustive, Swiss Capital Property, Luxury places SA, La Roche Residential.

3. What are the main segments of the Switzerland Luxury Residential Real Estate Industry?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 10 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

March 2023: Honeywell Immobilier recently entered into a partnership with Watershed Organization Trust (WOTR) to focus on soil and water conservation in rural ecosystems. WOTR is involved in restoring rural water bodies, boosting the water table and helping farmers and women with livelihood opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Switzerland Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence