Key Insights

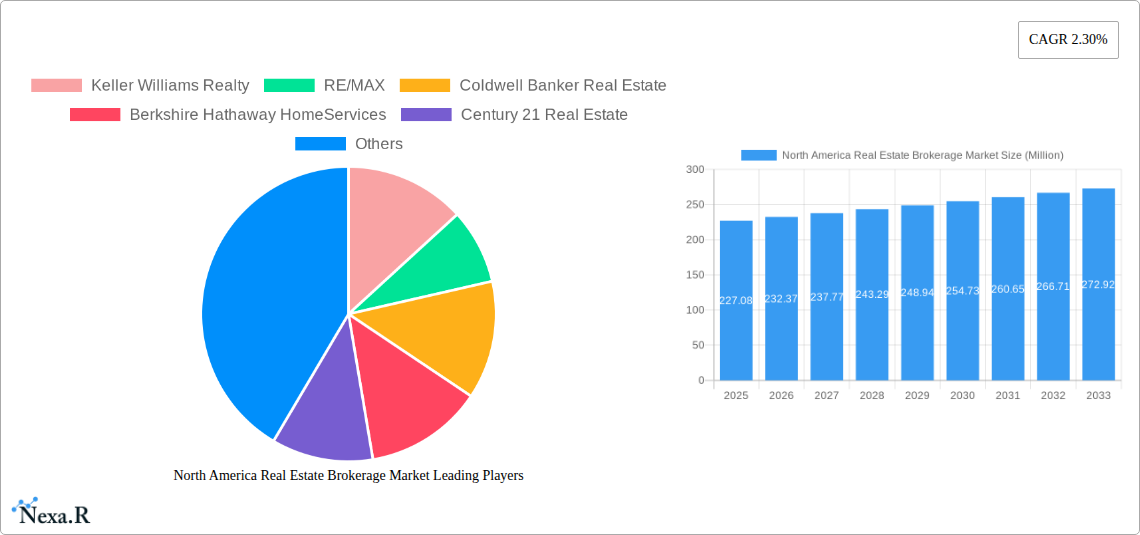

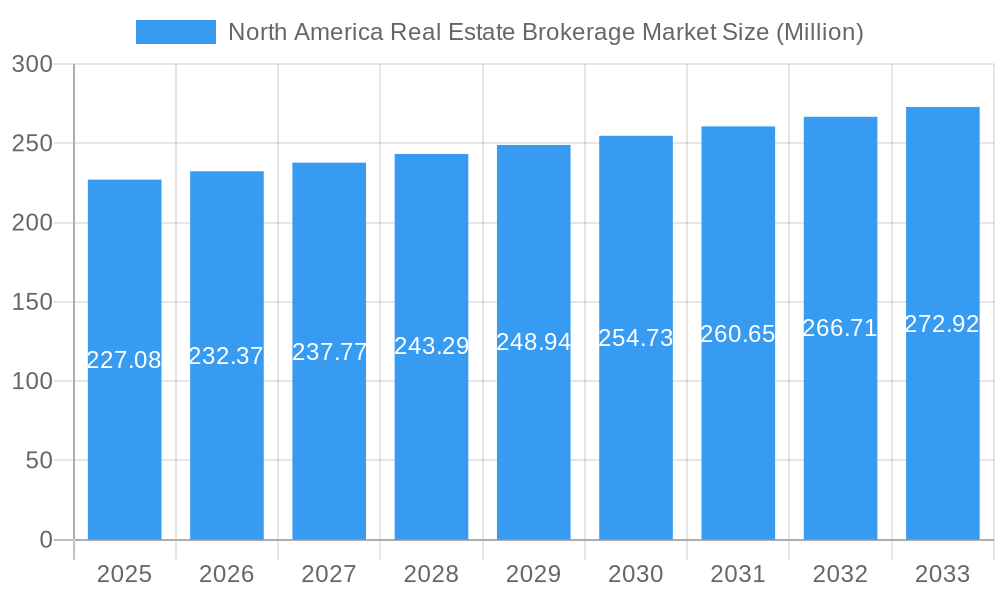

The North America Real Estate Brokerage Market is poised for steady growth, projected to reach approximately $227.08 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.30% anticipated through 2033. This sustained expansion is primarily driven by an increasing demand for both residential and non-residential properties across the United States, Canada, and Mexico. Factors fueling this demand include a growing population, urbanization trends, and ongoing economic development. The market's robustness is further supported by a dynamic mix of sales and rental services, catering to diverse client needs from homeownership aspirations to investment opportunities. Established players like Keller Williams Realty, RE/MAX, and Coldwell Banker Real Estate continue to hold significant market presence, leveraging their extensive networks and brand recognition. However, emerging technologies and evolving consumer preferences are also shaping the landscape, encouraging innovation in digital marketing, virtual tours, and data analytics to enhance client experiences and operational efficiencies.

North America Real Estate Brokerage Market Market Size (In Million)

The North America Real Estate Brokerage Market's future trajectory will be significantly influenced by its ability to adapt to shifting market dynamics. While the demand for property remains a core driver, the market is also navigating certain restraints. These could include fluctuating interest rates, regulatory changes, and the increasing competition from independent agents and online platforms. Nevertheless, the ongoing need for professional guidance in property transactions, particularly in complex commercial deals and high-value residential sales, ensures the continued relevance of brokerage services. The market's segmentation into residential and non-residential sectors, coupled with the dual service offerings of sales and rentals, provides a broad base for growth. Geographically, the United States is expected to remain the dominant market, with Canada and Mexico presenting substantial growth opportunities due to their expanding economies and real estate sectors. The forecast period of 2025-2033 indicates a commitment to sustained, albeit moderate, growth, underscoring a mature yet evolving industry.

North America Real Estate Brokerage Market Company Market Share

This comprehensive report provides an in-depth analysis of the North America Real Estate Brokerage Market, offering critical insights into market dynamics, growth trends, regional dominance, product innovations, and key player strategies. Covering the historical period from 2019-2024, the base year 2025, and a robust forecast period extending to 2033, this report is an essential resource for real estate professionals, investors, and stakeholders seeking to navigate this dynamic sector.

North America Real Estate Brokerage Market Market Dynamics & Structure

The North America Real Estate Brokerage Market exhibits a moderately concentrated structure, with a blend of large established players and agile emerging firms vying for market share. Technological innovation is a significant driver, with advancements in digital platforms, AI-powered analytics, and virtual tours revolutionizing client engagement and operational efficiency. Regulatory frameworks, while varying by jurisdiction, generally aim to ensure fair practices and consumer protection. Competitive product substitutes are primarily indirect, encompassing DIY listing platforms and direct seller-buyer negotiations. End-user demographics are increasingly influenced by a growing millennial and Gen Z homeownership aspiration, alongside a sustained demand from established demographics. Mergers and acquisitions (M&A) are a consistent feature, driven by the pursuit of market consolidation, talent acquisition, and technological integration.

- Market Concentration: Dominated by a few large brokerages, but with significant room for specialized and tech-enabled independent firms.

- Technological Innovation Drivers:

- PropTech solutions for lead generation and CRM.

- Virtual staging and augmented reality for property visualization.

- Data analytics for market insights and pricing strategies.

- Regulatory Frameworks: Licensing requirements, fair housing laws, and evolving data privacy regulations.

- Competitive Product Substitutes: Online listing portals, direct FSBO (For Sale By Owner) platforms.

- End-User Demographics: Shifting preferences towards digital-first experiences, demand for personalized service, and interest in sustainable living.

- M&A Trends: Strategic acquisitions to expand geographic reach, acquire technology, and consolidate market share. Estimated M&A deal volume in the last fiscal year: XX Million Units.

North America Real Estate Brokerage Market Growth Trends & Insights

The North America Real Estate Brokerage Market is poised for sustained growth, driven by a confluence of economic factors, demographic shifts, and technological advancements. The market size is projected to expand significantly, fueled by increasing homeownership rates and a robust rental market. Adoption rates for digital tools and services are rapidly accelerating, empowering brokers to enhance client experiences and streamline operations. Technological disruptions, such as the integration of AI in property matching and the rise of proptech startups, are fundamentally reshaping the brokerage landscape. Consumer behavior is evolving, with a greater emphasis on convenience, transparency, and personalized service. The market penetration of online services continues to climb, indicating a strong preference for integrated digital solutions. The Compound Annual Growth Rate (CAGR) for the forecast period is estimated at XX%.

The market size is expected to reach $XXX Million Units by 2033, up from an estimated $XXX Million Units in 2025. This growth is underpinned by several key trends:

- Increased Demand for Homeownership: Favorable interest rates (in certain periods), population growth, and a desire for asset accumulation continue to drive demand for residential properties.

- Evolution of Rental Market Dynamics: Strong rental demand in urban centers and for specific property types, creating consistent opportunities for rental brokerages.

- Digital Transformation: The widespread adoption of CRM systems, virtual tour technology, and online marketing tools is enhancing brokerage efficiency and reach.

- Data-Driven Decision Making: Brokers are increasingly leveraging big data analytics to provide clients with precise market valuations and investment insights.

- Focus on Client Experience: Personalization, proactive communication, and seamless transaction processes are becoming paramount for client satisfaction and retention.

The adoption rate of advanced digital tools is projected to reach XX% by 2030, indicating a profound shift in how real estate transactions are managed. Technological disruptions, including the use of blockchain for secure transactions and AI-powered predictive analytics for market forecasting, are set to further revolutionize the industry. Consumer behavior is increasingly characterized by a demand for instant gratification, personalized recommendations, and a seamless omnichannel experience, pushing brokerages to adapt their service delivery models.

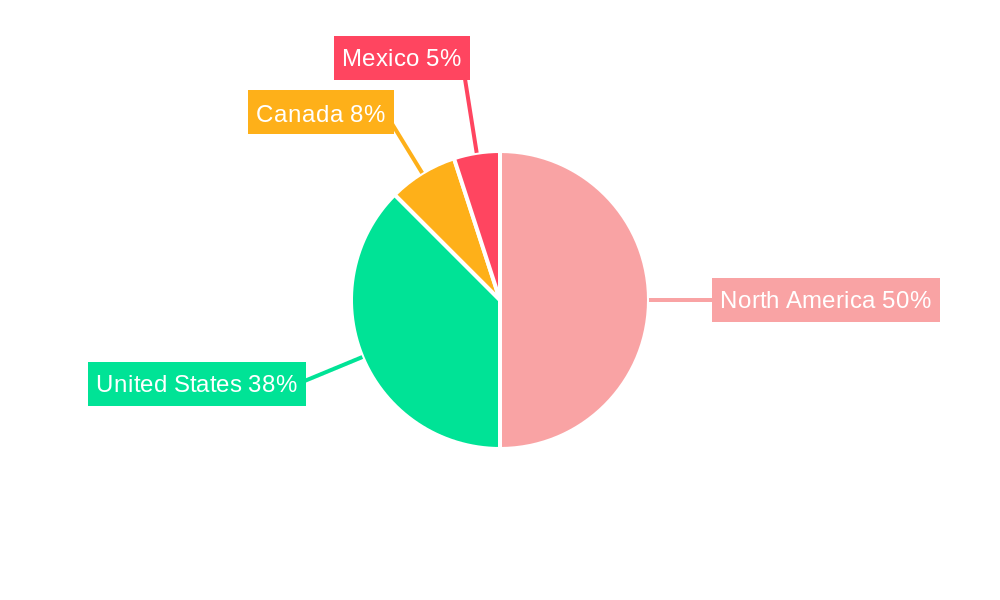

Dominant Regions, Countries, or Segments in North America Real Estate Brokerage Market

The United States stands as the dominant region within the North America Real Estate Brokerage Market, driven by its sheer market size, robust economic activity, and a deeply ingrained culture of property ownership. Within the United States, key metropolitan areas with strong job markets and population growth consistently lead in transaction volumes. Canada and Mexico also contribute significantly, with their own unique market dynamics and growth drivers.

Dominant Segment Analysis:

Geography:

- United States: Accounts for an estimated XX% of the total North American market share. Its dominance is attributed to:

- Economic Stability and Growth: A large and diversified economy that supports consistent real estate investment.

- High Homeownership Rate: A cultural emphasis on property ownership and wealth building.

- Technological Adoption: Early and widespread adoption of PropTech solutions.

- Diverse Market Conditions: Offering opportunities across various price points and property types.

- Canada: A significant contributor, with strong markets in Toronto, Vancouver, and Montreal. Its growth is influenced by immigration policies and a stable housing market. Market share estimated at XX%.

- Mexico: Experiencing a growing real estate sector, particularly in tourist destinations and emerging economic hubs. Market share estimated at XX%.

- United States: Accounts for an estimated XX% of the total North American market share. Its dominance is attributed to:

Type:

- Residential: This segment consistently represents the largest portion of the market, driven by ongoing demand for primary residences, vacation homes, and investment properties. It accounts for an estimated XX% of the market.

- Key Drivers: Population growth, urbanization, demographic shifts (e.g., millennials entering the homeownership market), and investment opportunities.

- Non-Residential: This segment includes commercial, industrial, and retail properties. While smaller than residential, it plays a crucial role in economic development and offers significant investment potential. Market share estimated at XX%.

- Key Drivers: Business expansion, e-commerce growth (impacting industrial and retail), and corporate investment.

- Residential: This segment consistently represents the largest portion of the market, driven by ongoing demand for primary residences, vacation homes, and investment properties. It accounts for an estimated XX% of the market.

Service:

- Sales: The primary service offered by real estate brokerages, encompassing the facilitation of property transactions. This segment holds the largest market share, estimated at XX%.

- Key Drivers: Transaction volumes, property values, and the complexity of real estate transactions requiring expert guidance.

- Rental: A consistently strong segment, driven by urban migration, affordability challenges in some markets, and the demand for flexible living arrangements. Market share estimated at XX%.

- Key Drivers: Rental demand in metropolitan areas, student housing needs, and investment in buy-to-let properties.

- Sales: The primary service offered by real estate brokerages, encompassing the facilitation of property transactions. This segment holds the largest market share, estimated at XX%.

The dominance of the United States is further amplified by its sophisticated financial markets, extensive infrastructure, and a mature regulatory environment that fosters investor confidence. Canada's market, though smaller, is characterized by a stable economic outlook and consistent demand. Mexico's market is showing promising growth, fueled by foreign investment and an expanding middle class.

North America Real Estate Brokerage Market Product Landscape

The product landscape within the North America Real Estate Brokerage Market is characterized by a dynamic integration of digital tools and traditional brokerage services. Innovations are focused on enhancing client acquisition, streamlining transaction management, and providing data-driven insights. Unique selling propositions often revolve around proprietary technology platforms, specialized agent training programs, and comprehensive marketing strategies. Technological advancements are increasingly centered on AI-powered lead qualification, personalized client communication tools, and virtual reality-enhanced property showings, aiming to offer unparalleled efficiency and a superior customer journey.

Key Drivers, Barriers & Challenges in North America Real Estate Brokerage Market

Key Drivers:

- Technological Advancements: PropTech solutions, AI, and digital marketing are enhancing efficiency and client reach.

- Economic Growth and Stability: Favorable interest rates (in certain periods), job creation, and a strong consumer confidence foster real estate investment.

- Demographic Shifts: Growing millennial and Gen Z populations entering the housing market, coupled with an aging population seeking to downsize or relocate.

- Urbanization and Suburbanization Trends: Shifting population patterns create demand for both urban and suburban properties.

- Investment Opportunities: Real estate continues to be viewed as a stable and attractive asset class for individual and institutional investors.

Barriers & Challenges:

- Regulatory Hurdles: Evolving data privacy laws, licensing requirements, and fair housing regulations can create compliance complexities.

- Market Saturation and Intense Competition: A crowded marketplace necessitates differentiation and innovative strategies.

- Affordability Crisis: Rising property prices in key markets can limit buyer accessibility and impact transaction volumes.

- Economic Downturns and Interest Rate Volatility: Fluctuations in the broader economy can significantly impact buyer demand and mortgage availability.

- Talent Acquisition and Retention: Attracting and retaining skilled agents in a competitive landscape remains a constant challenge. The cost of acquiring new agents can be up to $XX Million Units annually for larger brokerages.

- Cybersecurity Threats: Protecting sensitive client data from breaches is a critical and ongoing concern.

Emerging Opportunities in North America Real Estate Brokerage Market

Emerging opportunities lie in the continued development and adoption of AI-powered predictive analytics for market forecasting and client needs assessment. The growing demand for sustainable and eco-friendly properties presents a niche but expanding market segment. Furthermore, leveraging blockchain technology for secure and transparent transactions could streamline processes and build greater client trust. The untapped potential in secondary and tertiary markets, often overlooked by larger players, offers significant growth avenues for agile and technologically adept brokerages. The rise of remote work is also opening up new geographical markets for residential and commercial real estate.

Growth Accelerators in the North America Real Estate Brokerage Market Industry

Growth accelerators are predominantly driven by strategic technological integration and evolving client-centric service models. The widespread adoption of comprehensive CRM systems, coupled with advanced digital marketing tools, enables brokerages to more effectively target and engage potential clients. Partnerships with PropTech companies for innovative solutions, such as virtual staging and AI-driven property valuation, further boost efficiency and appeal. Expansion into underserved geographical areas and a focus on niche market segments, like senior living or specialized commercial properties, are also critical growth catalysts. The increasing demand for data analytics to inform investment decisions is pushing brokerages to enhance their analytical capabilities.

Key Players Shaping the North America Real Estate Brokerage Market Market

- Keller Williams Realty

- RE/MAX

- Coldwell Banker Real Estate

- Berkshire Hathaway HomeServices

- Century 21 Real Estate

- Sotheby's International Realty

- ERA Real Estate

- Corcoran Group

- Compass

- Douglas Elliman Real Estate

- 6 3 Other Companies (not exhaustive)

Notable Milestones in North America Real Estate Brokerage Market Sector

- June 2024: Real Brokerage Inc., North America's fastest-growing publicly traded real estate brokerage, reported a significant expansion, surpassing 19,000 agents after a robust month of recruitment. This marks a substantial increase in its agent network, strengthening its market presence.

- April 2024: Compass finalized its acquisition of Latter & Blum, a prominent brokerage firm based in New Orleans. Latter & Blum, known for its strong foothold in Louisiana and other Gulf Coast metros, has now become a part of Compass. This strategic move not only solidifies Compass' presence in the region but also propels it to a significant market share, estimated at around 15% in New Orleans.

In-Depth North America Real Estate Brokerage Market Market Outlook

The North America Real Estate Brokerage Market is set for continued expansion, propelled by technological innovation and evolving consumer demands. The strategic integration of AI, virtual reality, and data analytics will further refine client experiences and operational efficiencies. Growth accelerators include a strong emphasis on personalized service, the expansion into emerging geographical markets, and the development of specialized brokerage services catering to niche segments. The market's future outlook is characterized by a dynamic interplay between established players and agile, tech-forward firms, all striving to capture market share through innovation and a deep understanding of client needs, ensuring robust future market potential.

North America Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-Residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Real Estate Brokerage Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Real Estate Brokerage Market Regional Market Share

Geographic Coverage of North America Real Estate Brokerage Market

North America Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.4. Market Trends

- 3.4.1. Industrial Rental Growth Faces Challenges Amidst Changing Dynamics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-Residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Residential

- 6.1.2. Non-Residential

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Sales

- 6.2.2. Rental

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Residential

- 7.1.2. Non-Residential

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Sales

- 7.2.2. Rental

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Residential

- 8.1.2. Non-Residential

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Sales

- 8.2.2. Rental

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Keller Williams Realty

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 RE/MAX

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Coldwell Banker Real Estate

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Berkshire Hathaway HomeServices

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Century 21 Real Estate

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Sotheby's International Realty

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 ERA Real Estate

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Corcoran Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Compass

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Douglas Elliman Real Estate**List Not Exhaustive 6 3 Other Companie

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Keller Williams Realty

List of Figures

- Figure 1: Global North America Real Estate Brokerage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global North America Real Estate Brokerage Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States North America Real Estate Brokerage Market Revenue (Million), by Type 2025 & 2033

- Figure 4: United States North America Real Estate Brokerage Market Volume (Billion), by Type 2025 & 2033

- Figure 5: United States North America Real Estate Brokerage Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: United States North America Real Estate Brokerage Market Volume Share (%), by Type 2025 & 2033

- Figure 7: United States North America Real Estate Brokerage Market Revenue (Million), by Service 2025 & 2033

- Figure 8: United States North America Real Estate Brokerage Market Volume (Billion), by Service 2025 & 2033

- Figure 9: United States North America Real Estate Brokerage Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: United States North America Real Estate Brokerage Market Volume Share (%), by Service 2025 & 2033

- Figure 11: United States North America Real Estate Brokerage Market Revenue (Million), by Geography 2025 & 2033

- Figure 12: United States North America Real Estate Brokerage Market Volume (Billion), by Geography 2025 & 2033

- Figure 13: United States North America Real Estate Brokerage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 14: United States North America Real Estate Brokerage Market Volume Share (%), by Geography 2025 & 2033

- Figure 15: United States North America Real Estate Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 16: United States North America Real Estate Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 17: United States North America Real Estate Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: United States North America Real Estate Brokerage Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Canada North America Real Estate Brokerage Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Canada North America Real Estate Brokerage Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Canada North America Real Estate Brokerage Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Canada North America Real Estate Brokerage Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Canada North America Real Estate Brokerage Market Revenue (Million), by Service 2025 & 2033

- Figure 24: Canada North America Real Estate Brokerage Market Volume (Billion), by Service 2025 & 2033

- Figure 25: Canada North America Real Estate Brokerage Market Revenue Share (%), by Service 2025 & 2033

- Figure 26: Canada North America Real Estate Brokerage Market Volume Share (%), by Service 2025 & 2033

- Figure 27: Canada North America Real Estate Brokerage Market Revenue (Million), by Geography 2025 & 2033

- Figure 28: Canada North America Real Estate Brokerage Market Volume (Billion), by Geography 2025 & 2033

- Figure 29: Canada North America Real Estate Brokerage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Canada North America Real Estate Brokerage Market Volume Share (%), by Geography 2025 & 2033

- Figure 31: Canada North America Real Estate Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Canada North America Real Estate Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Canada North America Real Estate Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Canada North America Real Estate Brokerage Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Mexico North America Real Estate Brokerage Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Mexico North America Real Estate Brokerage Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Mexico North America Real Estate Brokerage Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Mexico North America Real Estate Brokerage Market Revenue (Million), by Service 2025 & 2033

- Figure 40: Mexico North America Real Estate Brokerage Market Volume (Billion), by Service 2025 & 2033

- Figure 41: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Service 2025 & 2033

- Figure 42: Mexico North America Real Estate Brokerage Market Volume Share (%), by Service 2025 & 2033

- Figure 43: Mexico North America Real Estate Brokerage Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: Mexico North America Real Estate Brokerage Market Volume (Billion), by Geography 2025 & 2033

- Figure 45: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Mexico North America Real Estate Brokerage Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: Mexico North America Real Estate Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Mexico North America Real Estate Brokerage Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Mexico North America Real Estate Brokerage Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 13: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 19: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 21: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 28: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 29: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Real Estate Brokerage Market?

The projected CAGR is approximately 2.30%.

2. Which companies are prominent players in the North America Real Estate Brokerage Market?

Key companies in the market include Keller Williams Realty, RE/MAX, Coldwell Banker Real Estate, Berkshire Hathaway HomeServices, Century 21 Real Estate, Sotheby's International Realty, ERA Real Estate, Corcoran Group, Compass, Douglas Elliman Real Estate**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the North America Real Estate Brokerage Market?

The market segments include Type, Service, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 227.08 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

6. What are the notable trends driving market growth?

Industrial Rental Growth Faces Challenges Amidst Changing Dynamics.

7. Are there any restraints impacting market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2024: Real Brokerage Inc., North America's fastest-growing publicly traded real estate brokerage, reported a significant expansion, surpassing 19,000 agents after a robust month of recruitment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the North America Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence