Key Insights

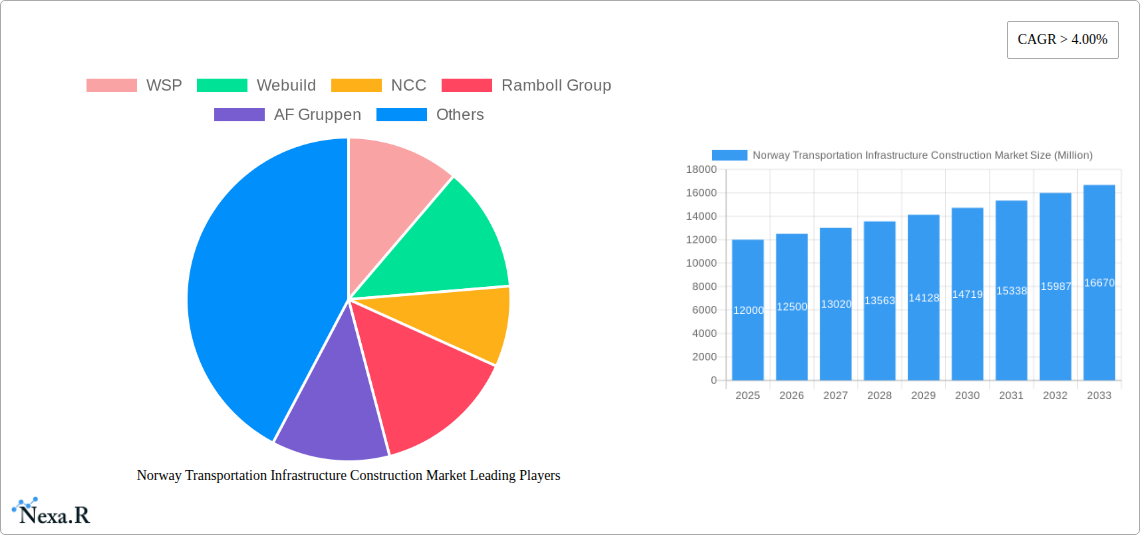

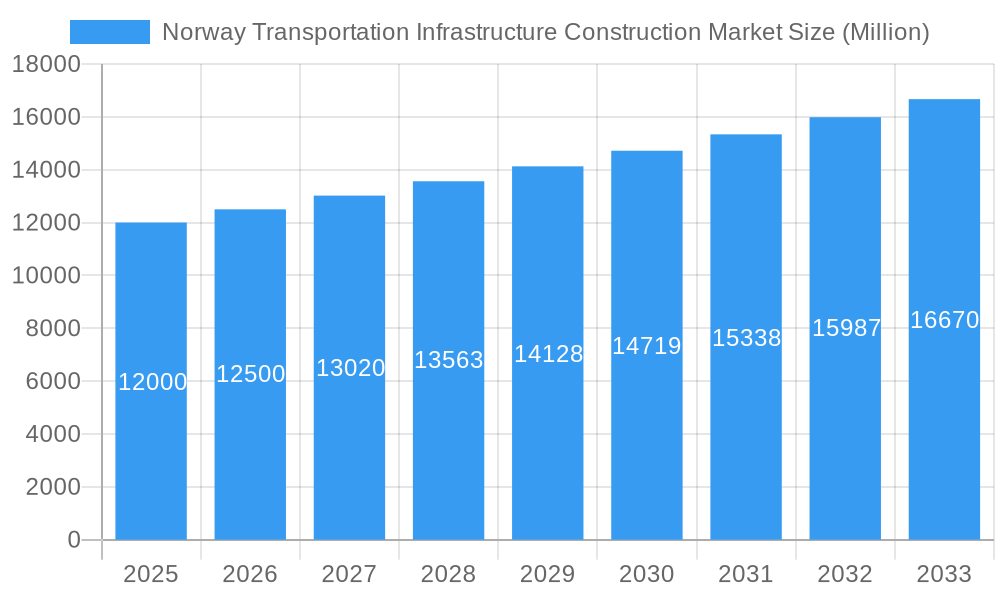

The Norway Transportation Infrastructure Construction Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. With a current market size estimated in the range of USD 12,000 million (derived from the high CAGR and considering the substantial infrastructure investments in a developed nation like Norway), the sector is driven by a confluence of strategic government initiatives, a commitment to sustainable development, and the ongoing need to upgrade and expand its extensive network. Key drivers include substantial public investment in modernizing existing transportation arteries and developing new ones to support economic activity and enhance connectivity. Furthermore, Norway's focus on green transitions is spurring investment in electric vehicle charging infrastructure, public transport upgrades, and the development of more efficient and environmentally friendly logistics networks, particularly in the ports and inland waterways segments. The burgeoning oil and gas sector, coupled with a growing tourism industry, also necessitates continuous improvements in road, rail, and airport facilities to facilitate the movement of goods and people.

Norway Transportation Infrastructure Construction Market Market Size (In Billion)

The market is segmented across various modes of transport, with Roadways and Railways likely dominating due to ongoing large-scale projects and maintenance requirements. Airports and Ports and Inland Waterways are also critical segments, reflecting Norway's importance as a maritime nation and a key gateway for international trade and tourism. Major cities like Oslo, Stavanger, and Bergen are focal points for significant infrastructure development, receiving substantial investment to manage growing populations and economic activity. Key players such as WSP, Webuild, NCC, Ramboll Group, AF Gruppen, ACCIONA, Bane NOR, Iterina, FCC Construccion, Veidekke, Skanska, and Implenia AG are actively involved, showcasing a competitive landscape. While the market is characterized by strong growth drivers, potential restraints could include stringent environmental regulations, the high cost of labor and materials in Norway, and the complexities of developing infrastructure in challenging geographical terrains. Nevertheless, the sustained demand for efficient, sustainable, and modern transportation links positions the Norway Transportation Infrastructure Construction Market for continued expansion and innovation.

Norway Transportation Infrastructure Construction Market Company Market Share

This in-depth report provides a strategic analysis of the Norway transportation infrastructure construction market, covering key segments, drivers, challenges, and the competitive landscape from 2019 to 2033. We delve into the market dynamics, growth trends, and emerging opportunities, offering actionable insights for industry stakeholders. The report focuses on roadways, railways, airports, and ports and inland waterways construction, with particular attention to key cities like Oslo, Stavanger, and Bergen.

Norway Transportation Infrastructure Construction Market Market Dynamics & Structure

The Norway transportation infrastructure construction market is characterized by a moderately consolidated structure, driven by a mix of large, established players and specialized regional contractors. Technological innovation is a significant driver, with advancements in sustainable construction materials, smart infrastructure solutions, and digital project management tools rapidly being adopted. Regulatory frameworks, primarily guided by national infrastructure plans and environmental regulations, play a crucial role in shaping project approvals and investment. Competitive product substitutes are limited within core construction services, but the emphasis on efficiency and sustainability can lead to the adoption of alternative construction methodologies. End-user demographics, including a growing population and increasing demand for efficient freight and passenger transport, underpin market growth. Mergers and acquisitions (M&A) trends, while not rampant, are evident as companies seek to expand their capabilities, geographical reach, or secure strategic project pipelines. For instance, the acquisition of smaller engineering firms by larger construction conglomerates aims to consolidate expertise. Barriers to innovation often stem from the high capital investment required for new technologies and the stringent safety and quality standards inherent in public infrastructure projects.

- Market Concentration: Moderate, with key players holding significant shares in major projects.

- Technological Innovation: Focus on BIM, prefabrication, and sustainable construction.

- Regulatory Framework: Driven by national infrastructure development plans and environmental directives.

- End-User Demographics: Increasing demand for efficient and sustainable transport solutions.

- M&A Trends: Strategic acquisitions for capability enhancement and market penetration.

- Innovation Barriers: High capital expenditure and rigorous quality control demands.

Norway Transportation Infrastructure Construction Market Growth Trends & Insights

The Norway transportation infrastructure construction market is poised for robust growth, projected to expand significantly over the forecast period. This expansion is fueled by a sustained commitment from the Norwegian government to upgrade and expand its national transportation network, recognizing its critical role in economic development and connectivity. The market size is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, with an estimated market value of XX Million in the base year 2025. Adoption rates for advanced construction techniques, such as Building Information Modeling (BIM) and modular construction, are steadily increasing, enhancing project efficiency and reducing timelines. Technological disruptions are primarily centered around the integration of digital technologies for real-time project monitoring, predictive maintenance of infrastructure, and the development of intelligent transportation systems. Consumer behavior shifts are evident in the growing demand for multimodal transport options, electric vehicle charging infrastructure integration, and the prioritization of environmentally friendly construction practices. Market penetration of sustainable materials and energy-efficient construction methods is expected to accelerate. Furthermore, the increasing emphasis on climate resilience and the adaptation of infrastructure to changing environmental conditions will necessitate significant investment in new construction and upgrades. The government's long-term infrastructure investment plans, coupled with private sector participation, are key pillars supporting this positive growth trajectory. The evolving needs of industries such as oil and gas, tourism, and fisheries also contribute to the demand for enhanced logistics and transportation capabilities, further stimulating market expansion.

Dominant Regions, Countries, or Segments in Norway Transportation Infrastructure Construction Market

The roadways segment is anticipated to be the dominant force driving growth within the Norway transportation infrastructure construction market. This dominance is largely attributable to the continuous need for maintenance, expansion, and modernization of the extensive road network across the country, facilitating both domestic and international trade, as well as inter-city and intra-city travel. Key cities such as Oslo, the capital and economic hub, are experiencing significant investment in road infrastructure development, including new bypasses, tunnel projects, and urban road enhancements aimed at easing congestion and improving traffic flow. Stavanger, a crucial center for the oil and gas industry, also sees substantial investment in road networks to support industrial activities and connect to ports and offshore facilities. Similarly, Bergen, a major port city and tourist destination, requires continuous upgrades to its road infrastructure to manage growing freight volumes and tourist traffic. Economic policies favoring regional development and connectivity further bolster investments in road construction outside major urban centers. The market share of the roadways segment is estimated to be around 45% of the total transportation infrastructure construction market.

- Roadways Segment Dominance: Driven by continuous demand for upgrades, expansion, and maintenance of the national road network.

- Oslo's Role: Capital city, experiencing extensive investment in urban road improvements and connectivity projects.

- Stavanger's Significance: Critical for supporting the oil and gas industry, requiring robust road links to industrial sites and ports.

- Bergen's Importance: A key port and tourist hub, necessitating improved road access for logistics and tourism.

- Economic Policies: Government initiatives supporting regional connectivity and infrastructure development contribute significantly.

- Growth Potential: Continued urbanization and industrial growth will sustain high demand for road construction.

The railways segment is also a significant contributor to market growth, with ongoing projects focused on high-speed rail expansion, freight line upgrades, and the modernization of existing networks. The Norwegian National Rail Administration (Bane NOR) is actively involved in projects that enhance efficiency and capacity, particularly for freight transport and intercity passenger services. The ports and inland waterways segment is crucial for Norway's extensive coastline and its reliance on maritime trade. Investments here focus on deepening harbors, expanding terminal capacities, and improving intermodal connections to inland logistics networks. The airports segment, while smaller in terms of overall project volume, sees continuous investment in terminal expansions, runway maintenance, and the adoption of new air traffic control technologies to accommodate increasing passenger and cargo demands.

Norway Transportation Infrastructure Construction Market Product Landscape

The Norway transportation infrastructure construction market product landscape is defined by a focus on robust, durable, and increasingly sustainable construction materials and technologies. Innovations in concrete mixes offering enhanced durability and reduced environmental impact, advanced asphalt formulations for longer-lasting road surfaces, and specialized geotechnical solutions for challenging terrain are prominent. The application of Building Information Modeling (BIM) is revolutionizing project design, execution, and lifecycle management, enabling greater precision and cost-effectiveness. Performance metrics are increasingly tied to longevity, reduced maintenance needs, and environmental sustainability certifications. Unique selling propositions often revolve around companies' expertise in extreme weather construction, their commitment to low-carbon footprint solutions, and their ability to integrate smart technology into infrastructure for enhanced operational efficiency. Technological advancements include the development of self-healing materials for roads and bridges, advanced sensor integration for real-time structural health monitoring, and the increased use of precast and modular construction components to accelerate project delivery.

Key Drivers, Barriers & Challenges in Norway Transportation Infrastructure Construction Market

Key Drivers:

- Government Investment: Sustained national infrastructure development plans and dedicated funding are primary growth catalysts.

- Economic Growth: A strong economy necessitates improved connectivity for trade, tourism, and industry.

- Technological Advancements: Adoption of BIM, smart infrastructure, and sustainable construction methods drives efficiency and innovation.

- Environmental Concerns: Increasing demand for green infrastructure and climate-resilient solutions.

- Urbanization: Growing urban populations require expanded and improved transportation networks.

Barriers & Challenges:

- Supply Chain Disruptions: Global and local supply chain volatility can impact material availability and costs.

- Regulatory Hurdles: Stringent environmental impact assessments and permitting processes can cause project delays.

- Skilled Labor Shortages: A persistent challenge in attracting and retaining qualified construction professionals.

- Geographical Complexities: Norway's challenging terrain and climate add to construction costs and complexity.

- Cost Overruns: Managing large-scale infrastructure projects within budget remains a significant concern.

- Competitive Pressures: Intense competition among major construction firms for lucrative contracts.

Emerging Opportunities in Norway Transportation Infrastructure Construction Market

Emerging opportunities in the Norway transportation infrastructure construction market lie in the burgeoning demand for electrification of transport infrastructure, including widespread charging networks for electric vehicles along roadways and at transportation hubs. The development of green ports and sustainable shipping infrastructure, focusing on reducing emissions and improving efficiency, presents a significant avenue for growth. The increasing focus on digitalization and smart city initiatives will drive demand for integrated intelligent transportation systems, including sensor networks, data analytics platforms, and smart traffic management solutions. Furthermore, the expansion of renewable energy infrastructure, such as offshore wind farms, will necessitate the development and upgrading of associated port facilities and transportation links. Opportunities also exist in infrastructure resilience projects aimed at adapting to climate change impacts, such as flood defenses and coastal protection measures.

Growth Accelerators in the Norway Transportation Infrastructure Construction Market Industry

Growth accelerators in the Norway transportation infrastructure construction market industry are primarily driven by the government's long-term vision for a modern, sustainable, and interconnected nation. Strategic partnerships between public entities and private sector innovators are crucial for bringing cutting-edge technologies to fruition and ensuring efficient project delivery. The increasing adoption of circular economy principles in construction, focusing on material reuse and waste reduction, presents a significant opportunity for companies that can demonstrate environmental leadership. Market expansion strategies, including international collaboration on large-scale projects and the exploration of new business models such as public-private partnerships (PPPs) for financing and operating infrastructure, will further propel growth. The continuous push for decarbonization of the transport sector will create sustained demand for infrastructure that supports cleaner mobility.

Key Players Shaping the Norway Transportation Infrastructure Construction Market Market

- WSP

- Webuild

- NCC

- Ramboll Group

- AF Gruppen

- ACCIONA

- Bane NOR

- Iterina

- FCC Construccion

- Veidekke

- Skanska

- Implenia AG

Notable Milestones in Norway Transportation Infrastructure Construction Market Sector

- 2019: Launch of the National Transport Plan, outlining long-term infrastructure investment priorities.

- 2020: Significant progress on the Follobanen railway project, a major undertaking for Bane NOR.

- 2021: Increased focus on sustainable construction materials and practices across major projects.

- 2022: Announcement of new initiatives to expand electric vehicle charging infrastructure.

- 2023: Major advancements in tunnel construction technologies for complex geological conditions.

- 2024: Growing emphasis on the integration of digital twins for infrastructure management.

In-Depth Norway Transportation Infrastructure Construction Market Market Outlook

The future outlook for the Norway transportation infrastructure construction market remains exceptionally bright, driven by a confluence of strong government commitment, technological innovation, and a growing societal emphasis on sustainability. Growth accelerators, including strategic partnerships in developing smart infrastructure and the widespread adoption of circular economy principles in construction, will continue to shape the market. The sustained investment in electrifying transportation networks and decarbonizing the sector will create a predictable and expanding demand for construction services. Companies that can adeptly navigate regulatory landscapes, embrace digital transformation, and offer sustainable, cost-effective solutions are best positioned for success. The market's trajectory is set for continued expansion, presenting significant strategic opportunities for both domestic and international players aiming to contribute to Norway's advanced and resilient transportation future.

Norway Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airports

- 1.4. Ports and Inland Waterways

-

2. Key Cities

- 2.1. Oslo

- 2.2. Stavanger

- 2.3. Bergen

Norway Transportation Infrastructure Construction Market Segmentation By Geography

- 1. Norway

Norway Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of Norway Transportation Infrastructure Construction Market

Norway Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Remote and Hybrid Work Model

- 3.3. Market Restrains

- 3.3.1. Lack of Privacy

- 3.4. Market Trends

- 3.4.1. Increasing Construction of Large-Scale Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Oslo

- 5.2.2. Stavanger

- 5.2.3. Bergen

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WSP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Webuild

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NCC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ramboll Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AF Gruppen

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ACCIONA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bane NOR

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Iterina**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FCC Construccion

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Veidekke

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Skanska

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Implenia AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 WSP

List of Figures

- Figure 1: Norway Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Norway Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Norway Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 2: Norway Transportation Infrastructure Construction Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Norway Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Norway Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 5: Norway Transportation Infrastructure Construction Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Norway Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Transportation Infrastructure Construction Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Norway Transportation Infrastructure Construction Market?

Key companies in the market include WSP, Webuild, NCC, Ramboll Group, AF Gruppen, ACCIONA, Bane NOR, Iterina**List Not Exhaustive, FCC Construccion, Veidekke, Skanska, Implenia AG.

3. What are the main segments of the Norway Transportation Infrastructure Construction Market?

The market segments include Mode, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Remote and Hybrid Work Model.

6. What are the notable trends driving market growth?

Increasing Construction of Large-Scale Projects.

7. Are there any restraints impacting market growth?

Lack of Privacy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Norway Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence