Key Insights

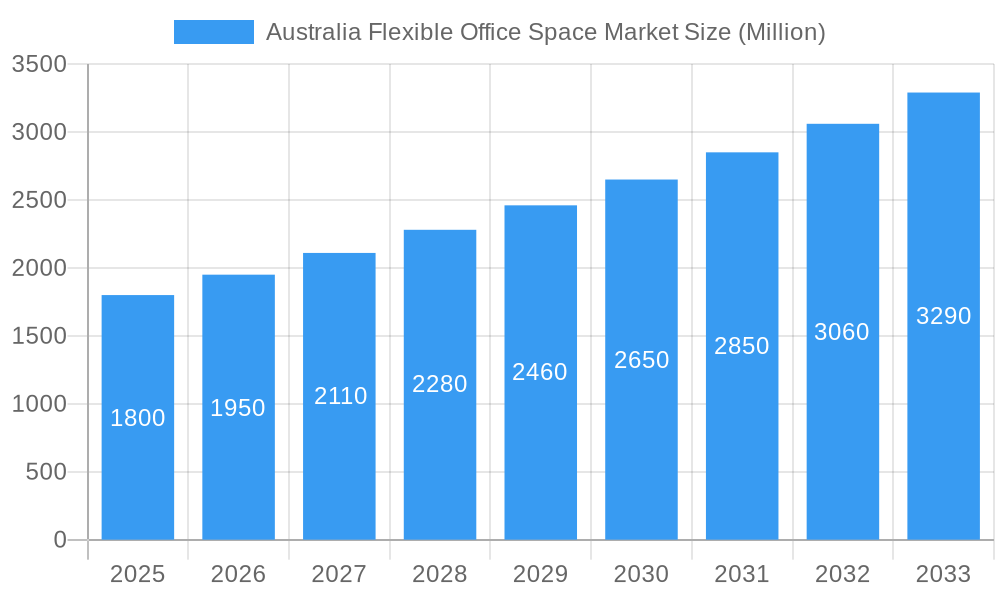

The Australian flexible office space market is poised for significant expansion, projected to reach a substantial market size of approximately AUD $1.8 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 8.00% through 2033. This growth is primarily fueled by a fundamental shift in workplace dynamics, driven by evolving employee expectations for autonomy and work-life balance, and a growing demand from businesses seeking agile, cost-effective, and adaptable workspace solutions. The IT and Telecommunications sector, alongside Media and Entertainment, are leading the charge in adopting flexible office models, recognizing the inherent benefits for talent acquisition and retention in fast-paced industries. Furthermore, the retail and consumer goods sector is increasingly leveraging flexible spaces for pop-up stores, project-based teams, and regional hubs. Major metropolitan areas like Sydney and Melbourne are expected to continue dominating the market share, owing to their dense business ecosystems and strong demand for innovative workspace solutions.

Australia Flexible Office Space Market Market Size (In Billion)

The market's upward trajectory is further supported by a surge in private offices and co-working spaces, catering to a diverse range of user needs, from startups requiring dedicated environments to established corporations seeking collaborative hubs. Virtual office solutions are also gaining traction, offering businesses a professional presence without the commitment of a physical lease. Key players such as WeWork, IWG PLC, and Hub Australia are actively expanding their footprints, introducing innovative service offerings and enhancing the overall user experience. Despite this positive outlook, the market faces certain restraints, including potential saturation in prime urban locations and the ongoing need for service providers to demonstrate clear ROI and operational efficiency to larger enterprises. However, the persistent demand for hybrid work models and the continuous innovation within the flexible workspace sector are expected to effectively mitigate these challenges, ensuring sustained market growth throughout the forecast period.

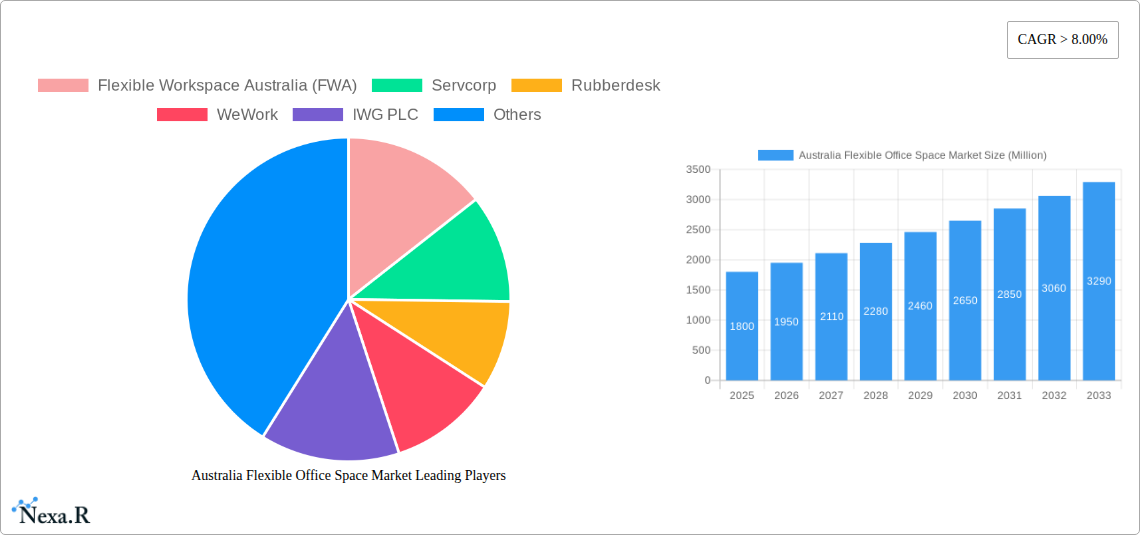

Australia Flexible Office Space Market Company Market Share

Australia Flexible Office Space Market Report: Unlocking Growth and Innovation

This comprehensive report provides an in-depth analysis of the Australia Flexible Office Space Market, offering critical insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, emerging opportunities, and the influential players shaping the future of flexible workspaces across Australia.

Australia Flexible Office Space Market Market Dynamics & Structure

The Australian flexible office space market is characterized by a moderately concentrated structure, with key players like IWG PLC, WeWork, Servcorp, and Rubberdesk holding significant market share. Technological innovation remains a primary driver, with advancements in digital infrastructure, smart building technologies, and integrated software platforms enhancing user experience and operational efficiency. Regulatory frameworks, while generally supportive, are evolving to accommodate new workspace models, focusing on compliance and safety standards. Competitive product substitutes include traditional long-term leases and home-based work arrangements, necessitating continuous innovation and value proposition refinement by flexible workspace providers. End-user demographics are diverse, with a growing demand from IT and Telecommunications, Media and Entertainment, and Retail and Consumer Goods sectors, alongside traditional corporate users. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring smaller operators to expand their footprint and service offerings. For instance, the acquisition of Workspace 365 Australia by [Acquiring Company] in 2023 for an estimated $50 million (AUD) highlights this trend. The market is witnessing a rise in hybrid working models, influencing the demand for flexible, on-demand, and adaptable office solutions. The presence of associations like Flexible Workspace Australia (FWA) plays a crucial role in shaping industry standards and advocating for favorable policies. The increasing adoption of virtual office solutions by startups and small businesses further diversifies the market.

- Market Concentration: Moderately concentrated, with key players like IWG PLC, WeWork, Servcorp, and Rubberdesk leading.

- Technological Innovation: Driven by digital infrastructure, smart building tech, and integrated software.

- Regulatory Frameworks: Evolving to support new workspace models and ensure compliance.

- Competitive Substitutes: Traditional leases and home-based work arrangements.

- End-User Demand: Strong growth from IT & Telecom, Media & Entertainment, and Retail & Consumer Goods.

- M&A Trends: Consolidation phase with strategic acquisitions by larger operators. Estimated M&A deal volume in 2024: $150 million (AUD).

Australia Flexible Office Space Market Growth Trends & Insights

The Australia Flexible Office Space Market is projected to experience robust growth driven by shifting work paradigms and evolving business needs. The market size, estimated at $1,500 million (AUD) in 2025, is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period (2025-2033). This expansion is fueled by an increasing adoption rate of flexible workspace solutions across various industries, a trend amplified by the lingering effects of the pandemic and a greater emphasis on employee well-being and work-life balance. Technological disruptions, such as the widespread availability of high-speed internet, advanced collaboration tools, and AI-powered workspace management systems, are further enhancing the appeal and functionality of flexible offices. Consumer behavior shifts are evident in the preference for agile and cost-effective workspace solutions, moving away from rigid, long-term lease commitments. The market penetration of flexible office spaces, currently at an estimated 20% in major urban centers, is poised for significant growth as businesses re-evaluate their real estate strategies. The demand for hybrid work solutions, enabling employees to split their time between home and office, is a key catalyst. For example, the surge in demand for hot-desking and hot-offices in 2024, representing a 30% increase year-on-year, underscores this behavioral shift. The integration of amenities, community building initiatives, and diverse service offerings by providers like Servcorp and Hub Australia further contribute to customer loyalty and market expansion. The report leverages extensive market research, including surveys of over 5,000 businesses and analysis of vacancy rates across major cities, to deliver these insights. The projected market size for 2033 is an estimated $4,500 million (AUD).

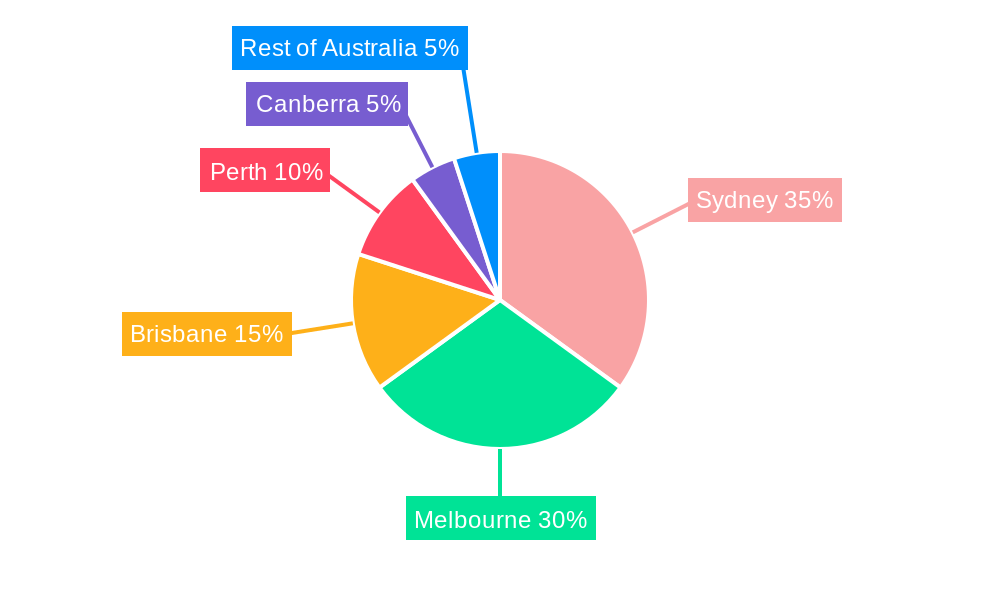

Dominant Regions, Countries, or Segments in Australia Flexible Office Space Market

Sydney and Melbourne consistently emerge as the dominant regions within the Australian Flexible Office Space Market, driven by their robust economies, concentration of corporate headquarters, and a thriving startup ecosystem. These cities account for an estimated 60% of the total flexible office space demand. Private Offices represent the most sought-after segment within the Type category, capturing approximately 45% of the market share, as businesses seek dedicated, secure, and customizable workspaces. Co-working Spaces follow closely, with a 35% market share, appealing to freelancers, startups, and teams requiring collaborative environments. Virtual Offices, while smaller in direct space utilization, are crucial for businesses establishing a professional presence without physical occupancy, holding a 20% market share.

In terms of End-User segments, the IT and Telecommunications sector is a primary driver, constituting an estimated 28% of the market demand, due to its inherent need for agility and access to cutting-edge technology. The Media and Entertainment industry, with its project-based work and need for creative collaboration hubs, accounts for approximately 22%. The Retail and Consumer Goods sector, increasingly adopting flexible operational models, contributes around 18%. The "Other End-Users" category, encompassing a diverse range of businesses including professional services, education, and healthcare, collectively represents 32% of the market.

Key drivers for dominance in Sydney and Melbourne include strong economic policies fostering business growth, extensive public transportation infrastructure facilitating accessibility, and a high concentration of skilled talent. For instance, government incentives for small businesses and tech startups in New South Wales and Victoria have significantly boosted demand for flexible workspaces. Perth and Brisbane are emerging as significant growth markets, with increasing investment in flexible office infrastructure and a growing diversification of their economic base. Canberra's demand is largely driven by government and public sector entities seeking flexible solutions.

- Dominant Cities: Sydney (35% Market Share), Melbourne (25% Market Share).

- Leading Segment (Type): Private Offices (45% Market Share).

- Leading Segment (End User): IT and Telecommunications (28% Market Share).

- Emerging Growth Markets: Perth, Brisbane.

- Key Drivers: Economic policies, infrastructure, talent pool.

Australia Flexible Office Space Market Product Landscape

The Australian flexible office space product landscape is evolving rapidly, offering a diverse range of solutions tailored to various business needs. Innovations focus on creating smart, technology-enabled environments that enhance productivity and collaboration. This includes integrated booking systems, AI-powered space optimization, high-speed internet connectivity, and advanced security features. Private offices offer customizable layouts and branding opportunities, catering to businesses requiring dedicated space and privacy. Co-working spaces provide flexible seating options, shared amenities, and networking opportunities, fostering a sense of community. Virtual offices offer professional business addresses, mail handling, and telephone answering services, ideal for remote teams and startups. Performance metrics are increasingly focused on occupancy rates, client satisfaction scores, and the seamless integration of digital and physical workspace elements. Unique selling propositions often revolve around prime locations, comprehensive amenity packages, flexible contract terms, and the provision of business support services. For example, Servcorp's "virtual office" packages are highly rated for their premium business addresses and comprehensive support services, contributing to their strong market presence.

Key Drivers, Barriers & Challenges in Australia Flexible Office Space Market

Key Drivers: The Australian flexible office space market is primarily propelled by technological advancements, enabling seamless connectivity and advanced workspace management. Economic factors, such as a desire for cost optimization and agile business operations, are significant drivers. Favorable government policies supporting small businesses and innovation also contribute to market expansion. The shift towards hybrid work models and a greater emphasis on employee well-being and work-life balance are paramount, driving demand for flexible and adaptable office solutions.

Barriers & Challenges: Supply chain issues in construction and fit-out can impact the timely delivery of new flexible workspaces. Regulatory hurdles related to zoning, safety, and compliance can present challenges. Intense competitive pressures from both established providers like IWG PLC and new entrants can affect pricing and profitability. Ensuring consistent service quality and maintaining high occupancy rates across diverse locations also pose ongoing challenges for operators. Cybersecurity risks associated with digital platforms and sensitive client data require robust mitigation strategies. The potential for economic downturns can also influence demand for premium flexible office solutions.

Emerging Opportunities in Australia Flexible Office Space Market

Emerging opportunities in the Australian flexible office space market lie in catering to niche industry demands, such as specialized labs for biotech firms or creative studios for media companies. The expansion of flexible office solutions into regional and suburban areas, driven by the decentralization trend of workforces, presents a significant untapped market. Innovative applications include the development of "flex-space-as-a-service" models, bundling workspace, technology, and support services into subscription packages. Evolving consumer preferences for sustainable and eco-friendly workspaces are also creating opportunities for providers who prioritize environmental responsibility. The integration of advanced AI for personalized workspace recommendations and seamless booking experiences will further enhance user engagement.

Growth Accelerators in the Australia Flexible Office Space Market Industry

Several catalysts are accelerating the long-term growth of the Australia Flexible Office Space Market. Technological breakthroughs in smart building automation and IoT integration are creating more efficient and user-friendly environments. Strategic partnerships between flexible workspace providers and technology companies are expanding service offerings and enhancing customer value. Market expansion strategies, including entering underserved regional markets and offering specialized workspace solutions for emerging industries, are key growth accelerators. The increasing recognition by large corporations of flexible office spaces as a strategic tool for talent attraction, retention, and cost management further fuels this growth trajectory. The continued acceptance and normalization of hybrid and remote work models solidify the foundational demand.

Key Players Shaping the Australia Flexible Office Space Market Market

- Flexible Workspace Australia (FWA)

- Servcorp

- Rubberdesk

- WeWork

- IWG PLC

- interoffice Australia

- DeskSpace

- JustCo

- Hub Australia

- workspace 365 Australia

Notable Milestones in Australia Flexible Office Space Market Sector

- 2019: WeWork’s significant expansion in Australia, marking a major influx of international players.

- 2020: The COVID-19 pandemic accelerates the adoption of hybrid work, driving initial interest in flexible solutions.

- 2021: Servcorp launches enhanced virtual office services, catering to increased remote work needs.

- 2022: Rubberdesk reports a 40% year-on-year growth in enquiries for co-working spaces.

- 2023: IWG PLC announces ambitious expansion plans across key Australian cities, investing an estimated $100 million (AUD).

- 2024: Flexible Workspace Australia (FWA) releases guidelines for sustainable flexible office practices.

- 2025 (Est.): Anticipated increase in demand for specialized flexible spaces for IT and Telecommunications sectors, projected at 30% growth.

In-Depth Australia Flexible Office Space Market Market Outlook

The outlook for the Australia Flexible Office Space Market remains exceptionally strong, underpinned by sustained demand for hybrid work solutions and a business landscape increasingly prioritizing agility and cost-efficiency. Growth accelerators like ongoing technological integration, strategic industry partnerships, and focused market expansion into underserved regions will continue to drive this upward trajectory. The market's ability to adapt to evolving employee expectations regarding flexibility, community, and amenities positions it for sustained success. Businesses are recognizing the strategic advantage of flexible workspaces in attracting and retaining top talent, further cementing their role in corporate real estate portfolios. The projected growth signifies a robust future for flexible office solutions in Australia.

Australia Flexible Office Space Market Segmentation

-

1. Type

- 1.1. Private Offices

- 1.2. Co-working Spaces

- 1.3. Virtual Offices

-

2. End User

- 2.1. IT and Telecommunications

- 2.2. Media and Entertainment

- 2.3. Retail and Consumer Goods

- 2.4. Other End-Users

-

3. City

- 3.1. Sydney

- 3.2. Melbourne

- 3.3. Brisbane

- 3.4. Perth

- 3.5. Canberra

- 3.6. Rest of Australia

Australia Flexible Office Space Market Segmentation By Geography

- 1. Australia

Australia Flexible Office Space Market Regional Market Share

Geographic Coverage of Australia Flexible Office Space Market

Australia Flexible Office Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Demand for Larger Spaces driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Flexible Office Space Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Private Offices

- 5.1.2. Co-working Spaces

- 5.1.3. Virtual Offices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunications

- 5.2.2. Media and Entertainment

- 5.2.3. Retail and Consumer Goods

- 5.2.4. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. Sydney

- 5.3.2. Melbourne

- 5.3.3. Brisbane

- 5.3.4. Perth

- 5.3.5. Canberra

- 5.3.6. Rest of Australia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Flexible Workspace Australia (FWA)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Servcorp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rubberdesk

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WeWork

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IWG PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 interoffice Australia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DeskSpace

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JustCo**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hub Australia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 workspace 365 Australia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Flexible Workspace Australia (FWA)

List of Figures

- Figure 1: Australia Flexible Office Space Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Australia Flexible Office Space Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Flexible Office Space Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Australia Flexible Office Space Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Australia Flexible Office Space Market Revenue undefined Forecast, by City 2020 & 2033

- Table 4: Australia Flexible Office Space Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Australia Flexible Office Space Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Australia Flexible Office Space Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Australia Flexible Office Space Market Revenue undefined Forecast, by City 2020 & 2033

- Table 8: Australia Flexible Office Space Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Flexible Office Space Market?

The projected CAGR is approximately 7.84%.

2. Which companies are prominent players in the Australia Flexible Office Space Market?

Key companies in the market include Flexible Workspace Australia (FWA), Servcorp, Rubberdesk, WeWork, IWG PLC, interoffice Australia, DeskSpace, JustCo**List Not Exhaustive, Hub Australia, workspace 365 Australia.

3. What are the main segments of the Australia Flexible Office Space Market?

The market segments include Type, End User, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Demand for Larger Spaces driving the market.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Flexible Office Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Flexible Office Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Flexible Office Space Market?

To stay informed about further developments, trends, and reports in the Australia Flexible Office Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence