Key Insights

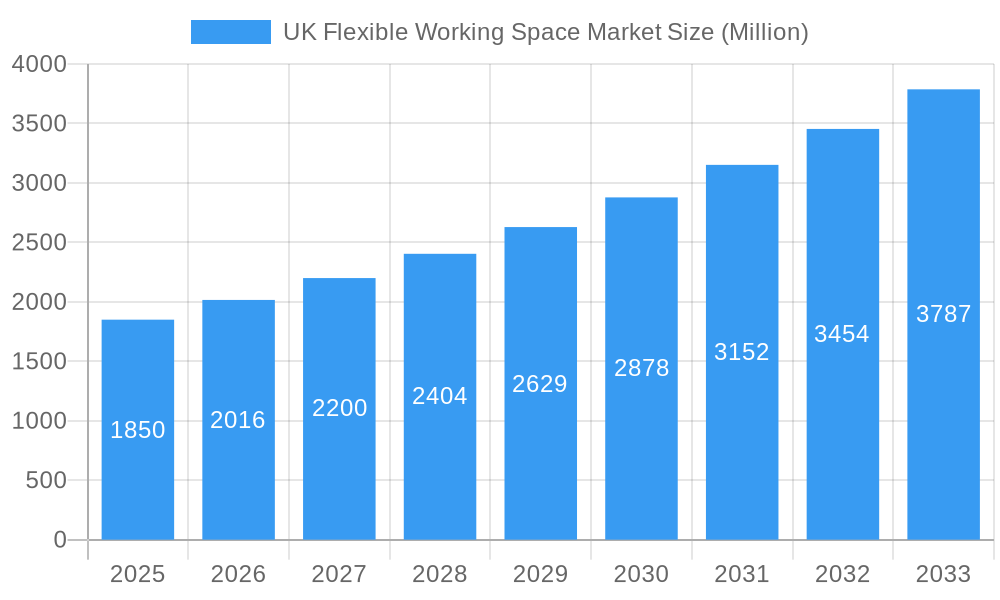

The UK flexible workspace market, valued at £1.85 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.95% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of hybrid work models following the pandemic has significantly boosted demand for flexible office solutions, allowing businesses to optimize costs and enhance employee satisfaction. Furthermore, the rise of the gig economy and the increasing number of startups and small to medium-sized enterprises (SMEs) contribute to the market's growth. London, Manchester, and Birmingham remain the leading cities, reflecting their established business hubs and strong economic activity. The market segmentation reveals a preference for co-working spaces, driven by their cost-effectiveness and networking opportunities. However, private offices continue to hold a significant share, particularly among larger established companies valuing privacy and dedicated workspaces. The IT and Telecommunications sector dominates end-user demand, followed closely by Media and Entertainment and Retail and Consumer Goods. While the market faces some constraints, including economic uncertainty and potential competition from traditional office spaces, the overall growth trajectory remains positive. The presence of established players like IWG, WeWork, and local providers like Workspace and The Office Group ensures a competitive yet dynamic market landscape. The continued digital transformation and the evolving preferences of the modern workforce will likely further fuel the expansion of the flexible workspace sector in the UK over the forecast period.

UK Flexible Working Space Market Market Size (In Billion)

The diverse range of flexible workspace options, including private offices, co-working spaces, and virtual offices, caters to a wide spectrum of business needs and budgets. This adaptability is a crucial factor contributing to market growth. Regional variations exist, with London and other major cities experiencing the highest demand. However, growth is expected across the UK, reflecting a wider adoption of flexible working arrangements across England, Wales, Scotland, and Northern Ireland. The continued focus on sustainability and the incorporation of technological advancements within flexible workspaces will further shape the market's evolution. Companies are increasingly focusing on enhancing the overall employee experience within these spaces, driving further innovation and investment in the sector. The ongoing evolution of the flexible workspace market will be influenced by evolving technologies, changing work patterns, and economic conditions, which may lead to the emergence of new business models and service offerings.

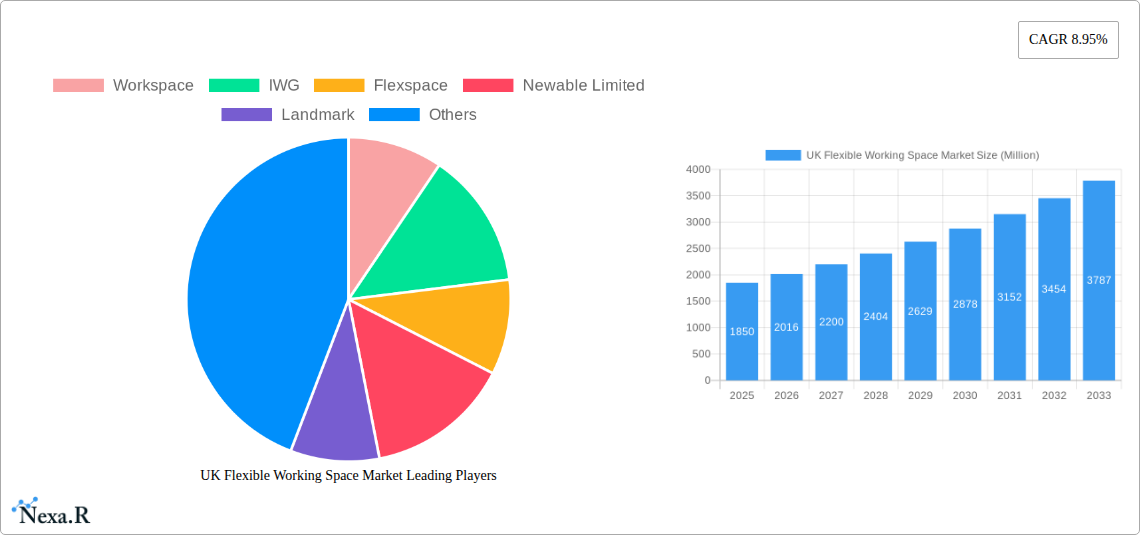

UK Flexible Working Space Market Company Market Share

UK Flexible Working Space Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK flexible working space market, encompassing its dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for businesses operating in or considering entry into this rapidly evolving sector, offering valuable insights for strategic decision-making. The report segments the market by city (London, Manchester, Birmingham, Leeds, Rest of UK), type (private offices, co-working space, virtual office), and end-user (IT & Telecommunications, Media & Entertainment, Retail & Consumer Goods), providing granular data for informed analysis. The market size is projected to reach xx Million by 2033.

UK Flexible Working Space Market Dynamics & Structure

The UK flexible workspace market is characterized by a dynamic interplay of factors. Market concentration is moderate, with key players like IWG, Workspace, WeWork Management LLC, and others vying for market share. Technological innovation, including smart building technologies and booking platforms, is a significant driver. Regulatory frameworks, such as building codes and employment laws, influence market operations. Competitive substitutes, like traditional office leasing, exert pressure, while the growing preference for flexible work arrangements fuels market growth. M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, signaling consolidation within the sector.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Smart building technologies, online booking platforms, and virtual office solutions are driving efficiency and attracting new users.

- Regulatory Framework: Building regulations and employment laws impact space availability and operational costs.

- Competitive Substitutes: Traditional office leasing remains a significant competitor.

- End-User Demographics: A shift towards younger demographics and smaller businesses fuels demand for flexible spaces.

- M&A Trends: Moderate M&A activity observed, driven by expansion and consolidation strategies.

UK Flexible Working Space Market Growth Trends & Insights

The UK flexible workspace market experienced significant growth from 2019 to 2024, expanding at a CAGR of xx%. This growth is driven by several factors, including the rising adoption of hybrid work models, increasing demand for flexible and cost-effective office solutions from startups and SMEs, and technological advancements improving the user experience. Consumer behavior shifts towards remote and hybrid work are accelerating market penetration. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, demonstrating considerable future potential. The continued adoption of flexible work models and technological innovations will be key drivers of market expansion throughout the forecast period.

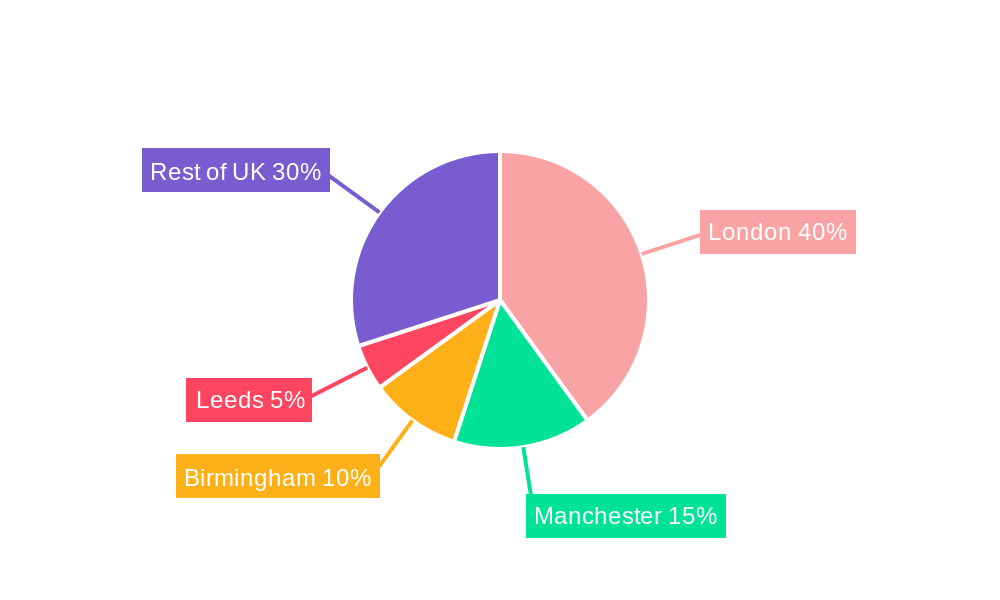

Dominant Regions, Countries, or Segments in UK Flexible Working Space Market

London remains the dominant region, accounting for xx% of the market in 2024 due to its large concentration of businesses and high demand for flexible workspaces. Co-working spaces represent the largest segment by type, driven by the popularity of collaborative work environments. The IT and Telecommunications sector is the leading end-user, reflecting the industry's adaptability to remote and hybrid work.

- London's Dominance: High business density, strong infrastructure, and a large pool of talent contribute to its leading position.

- Co-working Space Growth: Popularity of collaborative work environments and cost-effectiveness fuel this segment's dominance.

- IT & Telecoms Leadership: Industry's early adoption of flexible work practices drives demand for flexible spaces.

- Manchester & Birmingham: Significant growth potential due to increasing business activity and infrastructure development.

UK Flexible Working Space Market Product Landscape

The market offers a diverse range of products, from private offices and co-working spaces to virtual office solutions. Key features include flexible lease terms, high-speed internet connectivity, meeting room facilities, and technological integrations for seamless work management. Innovations focus on enhancing user experience, offering customized solutions and integrating technologies to improve efficiency and collaboration. Unique selling propositions include flexible contract terms, technology-driven service offerings, and a focus on community building.

Key Drivers, Barriers & Challenges in UK Flexible Working Space Market

Key Drivers:

- The rise of hybrid and remote work models.

- Increasing demand from startups and SMEs.

- Technological advancements improving the user experience.

- Government policies promoting flexible work.

Key Challenges:

- Competition from traditional office spaces.

- Economic uncertainty impacting business investment.

- Supply chain disruptions affecting construction and fit-out.

- Regulatory hurdles impacting expansion and operations (e.g., planning permissions).

Emerging Opportunities in UK Flexible Working Space Market

Untapped markets in smaller cities and towns present significant growth opportunities. The integration of sustainable practices and technologies into flexible workspace designs presents a new market niche. The development of specialized co-working spaces catering to specific industries (e.g., creative, tech) can drive growth. Expansion into underserved markets and offering bespoke solutions for specific business needs presents further opportunities.

Growth Accelerators in the UK Flexible Working Space Market Industry

Technological advancements in smart building technologies, virtual office solutions, and online booking platforms will drive further growth. Strategic partnerships between flexible workspace providers and technology companies will enhance service offerings. Expansion into new geographic markets and targeting new customer segments will create significant growth opportunities. Further consolidation through mergers and acquisitions could also boost market growth.

Notable Milestones in UK Flexible Working Space Market Sector

- May 2022: Flexspace secured a USD 6 million seed round to fund product development and expansion.

- October 2022: WeWork partnered with Foundervine to offer flexible workspace solutions to diverse entrepreneurs.

In-Depth UK Flexible Working Space Market Market Outlook

The UK flexible workspace market is poised for sustained growth over the forecast period, driven by the enduring shift towards hybrid and remote work models. Technological innovation, strategic partnerships, and market expansion into new regions will shape the market landscape. Companies that embrace innovation, adapt to evolving consumer preferences, and effectively manage operational challenges will be best positioned for success. The long-term outlook for the market remains positive, with continued growth anticipated throughout the forecast period.

UK Flexible Working Space Market Segmentation

-

1. Type

- 1.1. Private offices

- 1.2. Co-working space

- 1.3. Virtual Office

-

2. End User

- 2.1. IT and Telecommunications

- 2.2. Business Consulting & Professional Services

- 2.3. BFSI

- 2.4. Others

-

3. City

- 3.1. London

- 3.2. Manchester

- 3.3. Birmingham

- 3.4. Leeds

- 3.5. Rest of United Kingdom

UK Flexible Working Space Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Flexible Working Space Market Regional Market Share

Geographic Coverage of UK Flexible Working Space Market

UK Flexible Working Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Demand for Larger Spaces driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Flexible Working Space Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Private offices

- 5.1.2. Co-working space

- 5.1.3. Virtual Office

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunications

- 5.2.2. Business Consulting & Professional Services

- 5.2.3. BFSI

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. London

- 5.3.2. Manchester

- 5.3.3. Birmingham

- 5.3.4. Leeds

- 5.3.5. Rest of United Kingdom

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Flexible Working Space Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Private offices

- 6.1.2. Co-working space

- 6.1.3. Virtual Office

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. IT and Telecommunications

- 6.2.2. Business Consulting & Professional Services

- 6.2.3. BFSI

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by City

- 6.3.1. London

- 6.3.2. Manchester

- 6.3.3. Birmingham

- 6.3.4. Leeds

- 6.3.5. Rest of United Kingdom

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Flexible Working Space Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Private offices

- 7.1.2. Co-working space

- 7.1.3. Virtual Office

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. IT and Telecommunications

- 7.2.2. Business Consulting & Professional Services

- 7.2.3. BFSI

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by City

- 7.3.1. London

- 7.3.2. Manchester

- 7.3.3. Birmingham

- 7.3.4. Leeds

- 7.3.5. Rest of United Kingdom

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Flexible Working Space Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Private offices

- 8.1.2. Co-working space

- 8.1.3. Virtual Office

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. IT and Telecommunications

- 8.2.2. Business Consulting & Professional Services

- 8.2.3. BFSI

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by City

- 8.3.1. London

- 8.3.2. Manchester

- 8.3.3. Birmingham

- 8.3.4. Leeds

- 8.3.5. Rest of United Kingdom

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Flexible Working Space Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Private offices

- 9.1.2. Co-working space

- 9.1.3. Virtual Office

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. IT and Telecommunications

- 9.2.2. Business Consulting & Professional Services

- 9.2.3. BFSI

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by City

- 9.3.1. London

- 9.3.2. Manchester

- 9.3.3. Birmingham

- 9.3.4. Leeds

- 9.3.5. Rest of United Kingdom

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Flexible Working Space Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Private offices

- 10.1.2. Co-working space

- 10.1.3. Virtual Office

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. IT and Telecommunications

- 10.2.2. Business Consulting & Professional Services

- 10.2.3. BFSI

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by City

- 10.3.1. London

- 10.3.2. Manchester

- 10.3.3. Birmingham

- 10.3.4. Leeds

- 10.3.5. Rest of United Kingdom

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Workspace

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IWG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Flexspace

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Newable Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Landmark

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TheOfficeGroup

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 WeWork Management LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BizSpace

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Office Providers

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Instant Group**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Workspace

List of Figures

- Figure 1: Global UK Flexible Working Space Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Flexible Working Space Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UK Flexible Working Space Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UK Flexible Working Space Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America UK Flexible Working Space Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America UK Flexible Working Space Market Revenue (Million), by City 2025 & 2033

- Figure 7: North America UK Flexible Working Space Market Revenue Share (%), by City 2025 & 2033

- Figure 8: North America UK Flexible Working Space Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America UK Flexible Working Space Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Flexible Working Space Market Revenue (Million), by Type 2025 & 2033

- Figure 11: South America UK Flexible Working Space Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America UK Flexible Working Space Market Revenue (Million), by End User 2025 & 2033

- Figure 13: South America UK Flexible Working Space Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: South America UK Flexible Working Space Market Revenue (Million), by City 2025 & 2033

- Figure 15: South America UK Flexible Working Space Market Revenue Share (%), by City 2025 & 2033

- Figure 16: South America UK Flexible Working Space Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America UK Flexible Working Space Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Flexible Working Space Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe UK Flexible Working Space Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe UK Flexible Working Space Market Revenue (Million), by End User 2025 & 2033

- Figure 21: Europe UK Flexible Working Space Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe UK Flexible Working Space Market Revenue (Million), by City 2025 & 2033

- Figure 23: Europe UK Flexible Working Space Market Revenue Share (%), by City 2025 & 2033

- Figure 24: Europe UK Flexible Working Space Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe UK Flexible Working Space Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Flexible Working Space Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East & Africa UK Flexible Working Space Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa UK Flexible Working Space Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East & Africa UK Flexible Working Space Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East & Africa UK Flexible Working Space Market Revenue (Million), by City 2025 & 2033

- Figure 31: Middle East & Africa UK Flexible Working Space Market Revenue Share (%), by City 2025 & 2033

- Figure 32: Middle East & Africa UK Flexible Working Space Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Flexible Working Space Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Flexible Working Space Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific UK Flexible Working Space Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific UK Flexible Working Space Market Revenue (Million), by End User 2025 & 2033

- Figure 37: Asia Pacific UK Flexible Working Space Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Asia Pacific UK Flexible Working Space Market Revenue (Million), by City 2025 & 2033

- Figure 39: Asia Pacific UK Flexible Working Space Market Revenue Share (%), by City 2025 & 2033

- Figure 40: Asia Pacific UK Flexible Working Space Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Flexible Working Space Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Flexible Working Space Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Flexible Working Space Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global UK Flexible Working Space Market Revenue Million Forecast, by City 2020 & 2033

- Table 4: Global UK Flexible Working Space Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global UK Flexible Working Space Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global UK Flexible Working Space Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global UK Flexible Working Space Market Revenue Million Forecast, by City 2020 & 2033

- Table 8: Global UK Flexible Working Space Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global UK Flexible Working Space Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global UK Flexible Working Space Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global UK Flexible Working Space Market Revenue Million Forecast, by City 2020 & 2033

- Table 15: Global UK Flexible Working Space Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global UK Flexible Working Space Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global UK Flexible Working Space Market Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global UK Flexible Working Space Market Revenue Million Forecast, by City 2020 & 2033

- Table 22: Global UK Flexible Working Space Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UK Flexible Working Space Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global UK Flexible Working Space Market Revenue Million Forecast, by End User 2020 & 2033

- Table 34: Global UK Flexible Working Space Market Revenue Million Forecast, by City 2020 & 2033

- Table 35: Global UK Flexible Working Space Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global UK Flexible Working Space Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global UK Flexible Working Space Market Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Global UK Flexible Working Space Market Revenue Million Forecast, by City 2020 & 2033

- Table 45: Global UK Flexible Working Space Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Flexible Working Space Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Flexible Working Space Market?

The projected CAGR is approximately 8.95%.

2. Which companies are prominent players in the UK Flexible Working Space Market?

Key companies in the market include Workspace, IWG, Flexspace, Newable Limited, Landmark, TheOfficeGroup, WeWork Management LLC, BizSpace, The Office Providers, Instant Group**List Not Exhaustive.

3. What are the main segments of the UK Flexible Working Space Market?

The market segments include Type, End User, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.85 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Demand for Larger Spaces driving the market.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

October 2022: WeWork has announced its partnership with Foundervine, to offer 12 months of flexible workspace solutions, starting from January 2023 to early-stage entrepreneurs from ethnically diverse backgrounds across the UK and Ireland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Flexible Working Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Flexible Working Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Flexible Working Space Market?

To stay informed about further developments, trends, and reports in the UK Flexible Working Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence