Key Insights

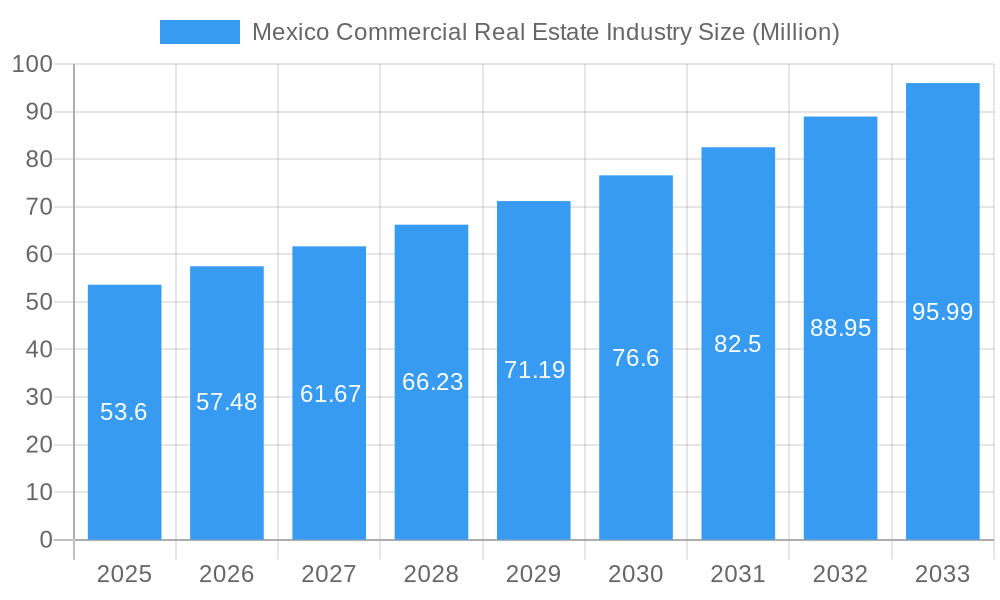

The Mexico commercial real estate market is poised for significant expansion, with an estimated market size of USD 53.60 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 7.23% through 2033. This robust growth trajectory is fueled by several key drivers, including an expanding middle class, increasing foreign direct investment in sectors like manufacturing and technology, and a growing demand for modern office spaces, retail destinations, and sophisticated logistics facilities. The ongoing development of infrastructure projects across Mexico, coupled with favorable government policies encouraging business investment, further bolsters this positive outlook. The market segmentation reveals a diverse landscape, with Offices, Retail, Industrial, Logistics, Multi-family, and Hospitality properties all contributing to the overall market dynamism. The rise of e-commerce has particularly spurred the demand for industrial and logistics spaces, while the evolving consumer preferences are reshaping the retail sector. Furthermore, a burgeoning tourism industry and the increasing demand for flexible living arrangements are driving growth in the hospitality and multi-family segments, respectively.

Mexico Commercial Real Estate Industry Market Size (In Million)

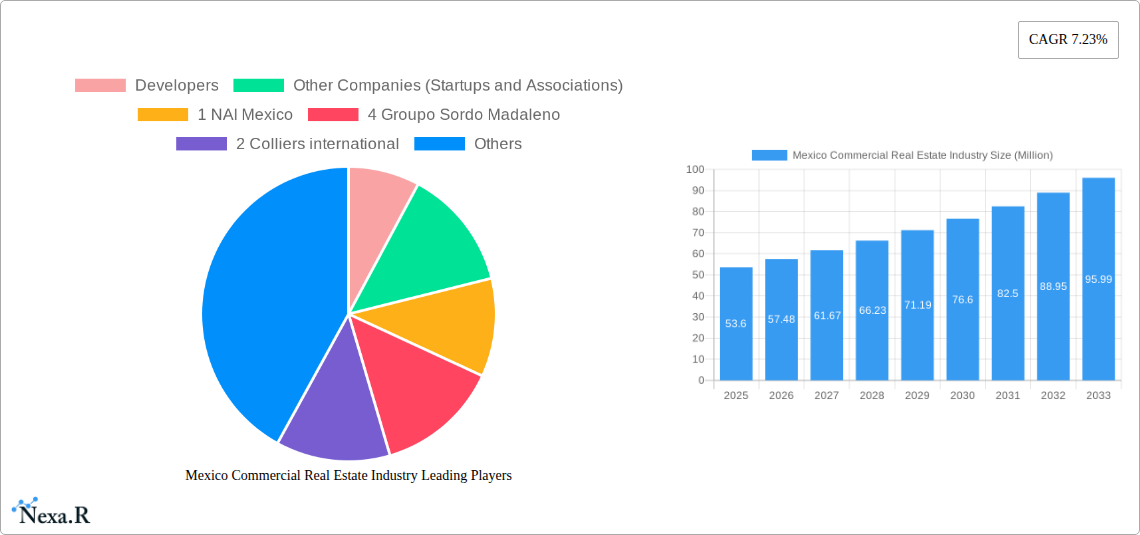

Despite the strong growth potential, the market faces certain restraints that warrant strategic consideration. These include regulatory complexities, access to financing for smaller developers, and potential economic volatility that could impact investment decisions. However, the presence of prominent companies such as NAI Mexico, Colliers International, Savills Mexico, Hines, and Lamudi, alongside a burgeoning ecosystem of startups and associations like Flat and ID8Capital, indicates a competitive yet innovative market. Real estate agencies and trusts, including Grupo Posadas and Onni Contracting Ltd, are actively participating, underscoring the established players' commitment and the emergence of new ventures. The Mexican commercial real estate landscape, characterized by its dynamic nature and attractive investment opportunities, is well-positioned to capitalize on these growth drivers while navigating potential challenges through strategic planning and agile adaptation.

Mexico Commercial Real Estate Industry Company Market Share

Mexico Commercial Real Estate Industry Report: Market Dynamics, Growth Trends, and Future Outlook

This comprehensive report delves into the dynamic Mexico Commercial Real Estate Industry, offering an in-depth analysis of market trends, growth drivers, and investment opportunities. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report is an essential resource for investors, developers, and industry professionals seeking to navigate the evolving landscape of Mexican commercial property. We provide granular insights into parent and child markets, ensuring a holistic understanding of this burgeoning sector.

Mexico Commercial Real Estate Industry Market Dynamics & Structure

The Mexico Commercial Real Estate Industry is characterized by a moderately concentrated market, with key players increasingly focusing on technological integration and sustainable development. Regulatory frameworks, particularly those impacting foreign investment and urban planning, play a significant role in shaping market access and development strategies. While established asset classes like Mexican Offices and Retail remain robust, emerging segments such as Mexican Industrial and Logistics are experiencing accelerated growth due to e-commerce expansion and nearshoring trends. Competitive product substitutes are primarily driven by the adoption of flexible office solutions and the repurposing of existing spaces. End-user demographics are shifting towards a younger, more digitally native workforce and a growing middle class demanding modern amenities and convenience. Mergers and acquisitions (M&A) activity is on the rise, signaling consolidation and strategic expansion among leading entities.

- Market Concentration: Dominated by a few large developers and real estate agencies, with increasing participation from startups offering innovative property technology solutions.

- Technological Innovation Drivers: Propelled by PropTech advancements, including AI-driven property management, virtual tours, and smart building technologies.

- Regulatory Frameworks: Influenced by government incentives for industrial development and urban regeneration projects, alongside evolving zoning laws.

- Competitive Product Substitutes: Rise of co-working spaces and adaptable multi-use properties challenging traditional leasing models.

- End-User Demographics: Growing demand from the tech sector for modern office spaces and increasing interest in sustainable, amenity-rich residential and retail developments.

- M&A Trends: Strategic acquisitions aimed at expanding portfolios in high-growth logistics hubs and prime urban centers.

Mexico Commercial Real Estate Industry Growth Trends & Insights

The Mexico Commercial Real Estate Industry is poised for significant expansion, driven by robust economic recovery, foreign direct investment, and a burgeoning domestic market. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated value of xx Million USD. Adoption rates for advanced building technologies and sustainable construction practices are steadily increasing, influenced by global ESG mandates and investor preferences. Technological disruptions, particularly in data analytics and smart building management systems, are enhancing operational efficiency and tenant experience. Consumer behavior shifts are evident, with an increasing preference for mixed-use developments offering integrated living, working, and leisure spaces. The rise of e-commerce continues to fuel demand for Mexican Logistics and Industrial facilities, reshaping the supply chain infrastructure across the country.

The Mexican commercial property market is experiencing a transformative period, marked by substantial growth and evolving investment strategies. The overall market size is projected to expand considerably, driven by a confluence of economic, demographic, and technological factors. From a historical perspective, the period between 2019 and 2024 saw steady, albeit variable, growth, influenced by global economic fluctuations and domestic policy shifts. However, the forecast period of 2025–2033 indicates a period of accelerated expansion.

Market Size Evolution: The total market value is anticipated to grow from an estimated xx Million USD in 2025 to a projected xx Million USD by 2033. This growth is underpinned by increasing demand across various segments, including offices, retail, industrial, logistics, multi-family, and hospitality. The Mexico Commercial Real Estate Industry is a key indicator of broader economic health, and its projected trajectory reflects strong confidence in the country's economic future.

Adoption Rates: The uptake of advanced technologies within the real estate sector is a significant growth catalyst. PropTech solutions, such as AI-powered property management software, virtual reality tours for property showcasing, and IoT-enabled building systems, are seeing increased adoption. This trend is not only enhancing operational efficiencies but also improving the tenant experience, making properties more attractive and valuable. The Mexican real estate technology adoption rate is expected to climb by over 15% annually throughout the forecast period.

Technological Disruptions: Beyond adoption, disruptive technologies are reshaping the very fabric of commercial real estate. Automation in construction, advanced data analytics for site selection and market forecasting, and the integration of smart grid technologies in industrial parks are creating new opportunities and driving innovation. For instance, the development of smart logistics hubs is revolutionizing supply chain management, a critical factor for the Mexican industrial property market.

Consumer Behavior Shifts: A notable shift in consumer behavior is the increasing demand for integrated and sustainable living and working environments. Millennials and Gen Z, who constitute a growing proportion of the workforce and consumer base, prioritize convenience, flexibility, and environmental consciousness. This is leading to a surge in demand for mixed-use developments that combine residential, retail, and office spaces, as well as properties with strong ESG credentials. The Mexican multi-family market is particularly benefiting from this trend, as is the demand for sustainable office solutions. The preference for experiential retail over traditional brick-and-mortar is also influencing the Mexican retail property market, pushing for more engaging and service-oriented spaces.

Market Penetration: The market penetration of modern commercial real estate concepts, such as flexible office spaces and specialized logistics facilities, is still in its growth phase. While major urban centers like Mexico City, Guadalajara, and Monterrey are leading the charge, there is significant potential for expansion into secondary and tertiary cities. The Mexican industrial real estate segment, for example, is experiencing deep penetration in border regions due to nearshoring, but also expanding inland.

The Mexico Commercial Real Estate Industry is a dynamic ecosystem where growth is propelled by a multifaceted interplay of economic vitality, strategic investment, and evolving market demands. The continued influx of foreign investment, particularly in manufacturing and logistics sectors, coupled with the expansion of domestic businesses, creates sustained demand for various commercial property types. The report forecasts a robust CAGR of approximately 6.5% for the Mexican commercial property market between 2025 and 2033, translating to an estimated market size of xx Million USD by the end of the forecast period.

The adoption of cutting-edge technologies, often referred to as PropTech, is a significant driver. This includes the implementation of AI for property management and tenant services, virtual reality for property tours, and IoT devices for energy efficiency and predictive maintenance in Mexican offices, retail spaces, and industrial facilities. These technological advancements not only enhance operational efficiencies but also contribute to a more sustainable and appealing built environment, aligning with global ESG (Environmental, Social, and Governance) standards.

Consumer behavior is also undergoing a profound transformation. The rise of e-commerce has accelerated the demand for sophisticated Mexican logistics and industrial properties, necessitating larger, more strategically located distribution centers and last-mile delivery hubs. Simultaneously, there's a growing preference for mixed-use developments that offer a blend of residential, commercial, and recreational spaces, catering to a desire for convenience and integrated lifestyles. This trend is particularly influential in the Mexican multi-family and hospitality sectors, where flexible living arrangements and experiential offerings are increasingly valued.

The report highlights a growing market penetration of modern real estate concepts. While major metropolitan areas are leading the way, there is significant untapped potential in secondary cities and emerging economic corridors. This suggests ample room for growth and diversification within the Mexico Commercial Real Estate Industry. Understanding these evolving demands and leveraging technological innovations will be critical for capitalizing on the extensive opportunities that lie ahead.

Dominant Regions, Countries, or Segments in Mexico Commercial Real Estate Industry

The Mexico Commercial Real Estate Industry is experiencing dynamic growth across several key segments, with Industrial & Logistics emerging as the dominant force driving market expansion. This dominance is fueled by Mexico's strategic position as a manufacturing hub, its integration into North American supply chains, and the significant impact of nearshoring initiatives. The proximity to the United States, coupled with favorable trade agreements, has led to an unprecedented surge in demand for modern warehouse facilities, distribution centers, and manufacturing plants. This segment alone is projected to account for over 35% of the total market value by 2025.

- Industrial & Logistics Dominance: Fueled by nearshoring, e-commerce growth, and robust manufacturing output.

- Market Share: Expected to hold approximately 35% of the total market value in 2025, with projections to reach 40% by 2033.

- Key Drivers: Proximity to the US market, established manufacturing base, favorable trade policies (USMCA), and the expansion of e-commerce logistics.

- Growth Potential: High, with significant investment in modern, technologically advanced facilities and last-mile delivery hubs.

- Geographic Focus: Northern border states (Nuevo León, Chihuahua, Tamaulipas), Bajío region (Querétaro, Guanajuato, Jalisco), and key logistics corridors around major cities.

Beyond the industrial sector, Office and Multi-family segments are also showing strong performance. The Mexican Office market is benefiting from a resurgence in demand for Class A spaces in prime urban locations, driven by technology companies, financial services, and a gradual return to hybrid work models that prioritize collaboration and amenity-rich environments. The Mexican Multi-family segment is experiencing robust growth due to urbanization, a growing middle class, and increasing demand for rental housing, particularly in cities with strong job markets.

Office Segment Performance: Steady growth driven by corporate expansion and demand for quality workspaces.

- Market Share: Anticipated to constitute around 25% of the market in 2025.

- Key Drivers: Corporate investment, demand for modern amenities, and the evolving nature of work.

- Growth Potential: Moderate to high, particularly in dynamic economic hubs.

Multi-family Segment Traction: Supported by demographic trends and housing demand.

- Market Share: Expected to capture approximately 20% of the market value in 2025.

- Key Drivers: Urbanization, young professional demographics, and a preference for rental accommodation.

- Growth Potential: High, with opportunities in both established and emerging urban centers.

The Retail segment is undergoing a transformation, with a greater emphasis on experiential retail, mixed-use developments, and convenience-oriented formats. While traditional retail faces challenges, modern shopping centers and localized retail clusters are thriving. The Hospitality sector is recovering strongly, driven by both domestic and international tourism, with significant investment in new hotel developments and renovations.

Retail Segment Evolution: Adapting to changing consumer habits towards experiential and convenience-driven formats.

- Market Share: Estimated at 10% in 2025, with a focus on quality and experience.

- Key Drivers: Growth of tourism, changing consumer preferences, and integration into mixed-use projects.

Hospitality Sector Recovery: Benefiting from a rebound in tourism and business travel.

- Market Share: Projected to be around 10% in 2025.

- Key Drivers: Increased tourist arrivals, business travel resurgence, and investment in resort and urban hotels.

Geographically, the northern border states and the Bajío region continue to be hotspots for Mexican Industrial Real Estate due to their strategic advantages. Mexico City, Guadalajara, and Monterrey remain primary hubs for Office, Retail, and Multi-family investments, attracting significant domestic and international capital. Emerging growth corridors in the south and central regions also present substantial untapped potential for diversified real estate development.

Mexico Commercial Real Estate Industry Product Landscape

The Mexico Commercial Real Estate Industry product landscape is increasingly defined by innovation and sustainability. Key product developments focus on enhancing operational efficiency, tenant experience, and environmental performance across all asset classes. In the Industrial & Logistics segment, this translates to the development of smart warehouses equipped with automated systems, advanced inventory management, and energy-efficient lighting and climate control. For Offices, the emphasis is on flexible layouts, collaborative spaces, smart building technology for occupant comfort and energy management, and a focus on biophilic design to improve well-being. The Retail sector is seeing a rise in experiential spaces, integrating technology for customer engagement and personalized shopping journeys, alongside the development of mixed-use retail centers that blend convenience and entertainment.

Key Drivers, Barriers & Challenges in Mexico Commercial Real Estate Industry

The Mexico Commercial Real Estate Industry is propelled by several key drivers, including robust economic growth, significant foreign direct investment, and the strategic advantage of nearshoring manufacturing. The growing e-commerce penetration is a major catalyst for the Industrial and Logistics sector, while urbanization and a growing middle class fuel demand in the Multi-family and Office segments. Government incentives for industrial development and infrastructure improvements further bolster market expansion.

Conversely, the industry faces notable barriers and challenges. Regulatory complexities and bureaucratic processes can sometimes hinder development timelines and increase costs. Access to financing, particularly for smaller developers or niche projects, can be a restraint. Furthermore, the need for skilled labor in specialized construction and property management can pose challenges, especially as the industry adopts more advanced technologies. Supply chain disruptions, though easing, can still impact construction timelines and material costs. Competitive pressures, particularly in prime markets, necessitate strategic planning and differentiation.

Emerging Opportunities in Mexico Commercial Real Estate Industry

Emerging opportunities within the Mexico Commercial Real Estate Industry are multifaceted. The continued expansion of e-commerce presents significant potential for the development of last-mile delivery hubs and specialized logistics facilities in urban and suburban areas. The growing demand for sustainable and ESG-compliant properties creates opportunities for green building certifications and renewable energy integration. Furthermore, the increasing popularity of mixed-use developments, blending residential, commercial, and hospitality components, offers integrated living and working solutions. Untapped markets in secondary cities with developing economies also present considerable growth potential for diversified real estate investments.

Growth Accelerators in the Mexico Commercial Real Estate Industry Industry

Several key growth accelerators are poised to propel the Mexico Commercial Real Estate Industry forward. The ongoing nearshoring trend will continue to drive substantial investment in Industrial and Logistics properties, transforming Mexico into a critical manufacturing and distribution hub for North America. Technological advancements, particularly in PropTech, will enhance operational efficiency, tenant experience, and property management across all segments. Strategic partnerships between local and international developers, alongside robust government support for infrastructure development, will facilitate large-scale projects and market expansion. The increasing focus on sustainable development and green building practices will also attract capital and cater to evolving investor and tenant demands.

Key Players Shaping the Mexico Commercial Real Estate Industry Market

- NAI Mexico

- Grupo Sordo Madaleno

- Colliers International

- Savills Mexico

- Flat

- Hines

- Lamudi

- Grupo Posadas

- Onni Contracting Ltd

- ID8Capital

- Reonomy

(List Not Exhaustive)

Notable Milestones in Mexico Commercial Real Estate Industry Sector

- 2019: Increased foreign investment in manufacturing facilities, particularly along the northern border, boosting the Mexican industrial property market.

- 2020: Accelerated adoption of e-commerce, driving demand for Mexican logistics warehousing.

- 2021: Growing interest in sustainable development and ESG-compliant properties across all segments.

- 2022: Resurgence in the Mexican hospitality sector with increased tourism and business travel.

- 2023: Significant M&A activity as larger players consolidate portfolios and expand market presence.

- 2024: Continued growth in flexible office solutions and the repurposing of commercial spaces to meet hybrid work demands.

In-Depth Mexico Commercial Real Estate Industry Market Outlook

The Mexico Commercial Real Estate Industry is set for sustained and robust growth, driven by powerful economic tailwinds and evolving market demands. The nearshoring phenomenon will continue to be a dominant force, significantly boosting investment in Mexican industrial and logistics real estate. Technological integration through PropTech will redefine property management and tenant experiences, fostering smarter, more efficient, and sustainable built environments. The diversification of urban economies and the increasing demand for integrated living and working spaces will fuel opportunities in mixed-use developments, multi-family housing, and modern office spaces. Strategic partnerships and supportive government policies are expected to further accelerate development and attract both domestic and international capital, positioning Mexico as a prime destination for commercial real estate investment in the coming years.

Mexico Commercial Real Estate Industry Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial

- 1.4. Logistics

- 1.5. Multi-family

- 1.6. Hospitality

Mexico Commercial Real Estate Industry Segmentation By Geography

- 1. Mexico

Mexico Commercial Real Estate Industry Regional Market Share

Geographic Coverage of Mexico Commercial Real Estate Industry

Mexico Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing foreign investments driving the market4.; Increasing urbanization driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Economic uncertainity affecting the growth of the market4.; Increasing cost of raw materials affecting the construction industry

- 3.4. Market Trends

- 3.4.1. The Offices Segment is Occupying the Significant Market Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Commercial Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Logistics

- 5.1.5. Multi-family

- 5.1.6. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Developers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Other Companies (Startups and Associations)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 1 NAI Mexico

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 4 Groupo Sordo Madaleno

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 2 Colliers international

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 1 Savills Mexico

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 2 Flat

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 2 Hines

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 4 Lamudi**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Real Estate Agencies and Trusts

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 5 Grupo Posadas*

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3 Onni Contracting Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 1 ID8Capital

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 3 Reonomy

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Developers

List of Figures

- Figure 1: Mexico Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Commercial Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Mexico Commercial Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Mexico Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Mexico Commercial Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Commercial Real Estate Industry?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the Mexico Commercial Real Estate Industry?

Key companies in the market include Developers, Other Companies (Startups and Associations), 1 NAI Mexico, 4 Groupo Sordo Madaleno, 2 Colliers international, 1 Savills Mexico, 2 Flat, 2 Hines, 4 Lamudi**List Not Exhaustive, Real Estate Agencies and Trusts, 5 Grupo Posadas*, 3 Onni Contracting Ltd, 1 ID8Capital, 3 Reonomy.

3. What are the main segments of the Mexico Commercial Real Estate Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.60 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing foreign investments driving the market4.; Increasing urbanization driving the market.

6. What are the notable trends driving market growth?

The Offices Segment is Occupying the Significant Market Share in the Market.

7. Are there any restraints impacting market growth?

4.; Economic uncertainity affecting the growth of the market4.; Increasing cost of raw materials affecting the construction industry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Mexico Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence