Key Insights

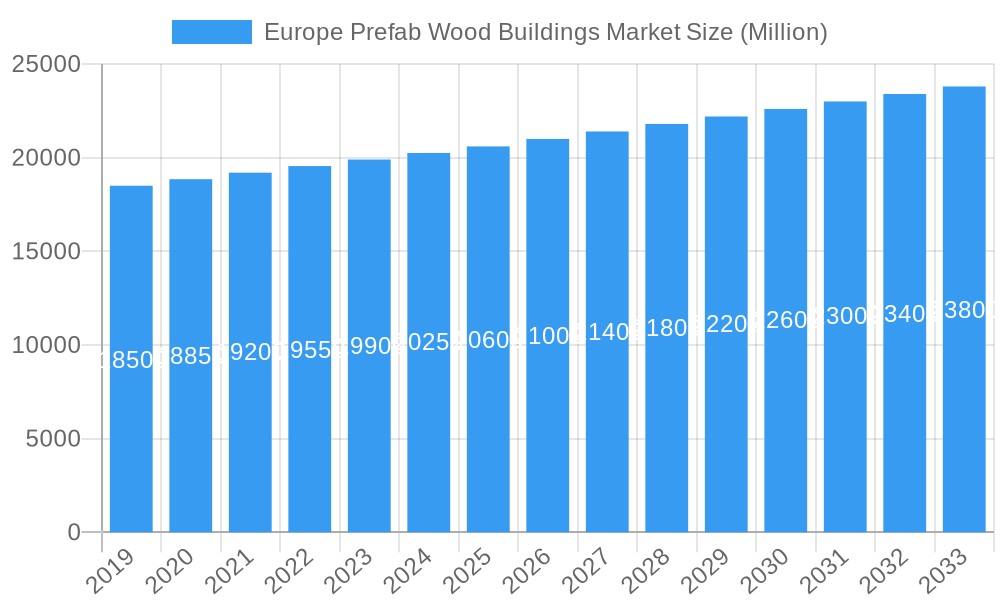

The Europe Prefab Wood Buildings Market is projected for significant expansion, anticipated to reach $61 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.5% through 2033. Growth is propelled by escalating demand for sustainable, eco-friendly construction driven by environmental regulations and consumer preference. Advantages such as accelerated build times, reduced labor costs, and enhanced thermal insulation further boost adoption. Key segments include Residential, Commercial (Office, Hospitality), and Other Applications (Infrastructure, Industrial), with Residential expected to lead. Panel systems, notably Cross-Laminated Timber (CLT), are gaining prominence, alongside established Glue-Laminated Timber (GLT) for structural components.

Europe Prefab Wood Buildings Market Market Size (In Billion)

Market drivers include government support for sustainable construction, rising urbanization necessitating efficient housing, and technological advancements improving quality and customization. Potential restraints involve perceived design limitations (though diminishing) and supply chain vulnerabilities for specialized wood products. The competitive landscape features established innovators like Moelven Byggmodul AB, Peab AB, and Laing O'Rourke. Europe, with its strong sustainability focus and advanced construction, is set to lead, with Germany, Sweden, and Finland at the forefront.

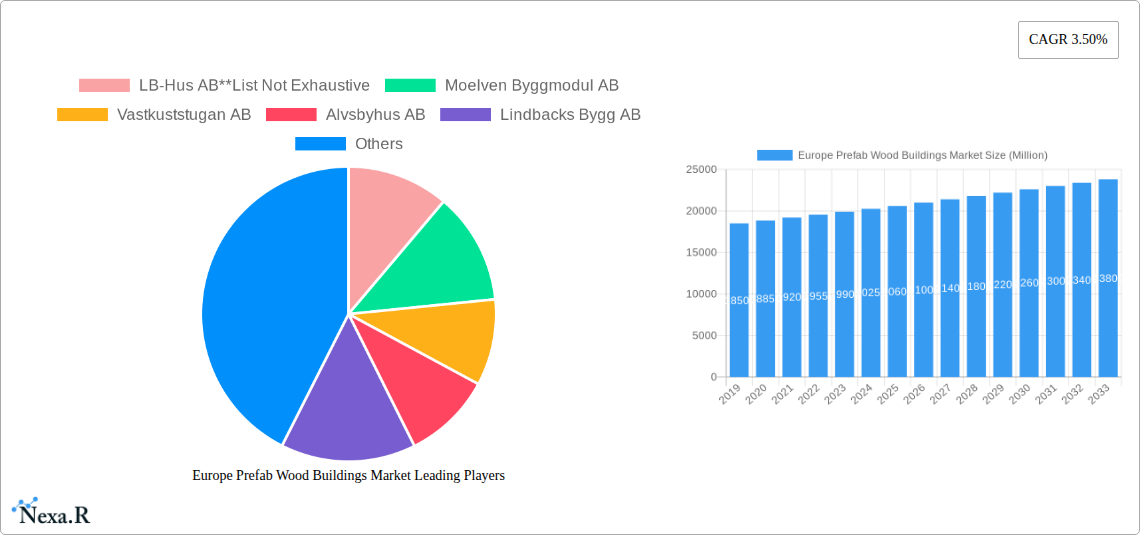

Europe Prefab Wood Buildings Market Company Market Share

This report offers a comprehensive analysis of the Europe Prefab Wood Buildings Market, detailing market dynamics, growth trends, dominant segments, product innovations, key players, and future opportunities. The report covers the Study Period: 2019–2033, with a Base Year: 2025, and Forecast Period: 2025–2033, utilizing Historical Data: 2019–2024. Market values are presented in billions.

Europe Prefab Wood Buildings Market Dynamics & Structure

The Europe Prefab Wood Buildings Market is characterized by increasing market concentration, driven by strategic mergers and acquisitions aimed at enhancing production capacity and technological capabilities. Technological innovation, particularly in mass timber construction techniques and advanced manufacturing processes, acts as a significant driver. Stringent environmental regulations promoting sustainable building practices and government incentives for green construction further bolster market growth. The competitive landscape features a mix of established players and emerging innovators, with product substitution primarily stemming from other prefabricated construction methods and traditional building materials, albeit with wood's growing appeal. End-user demographics are increasingly favoring sustainable and cost-effective housing solutions, especially in urban areas.

- Market Concentration: Growing consolidation through M&A activities.

- Technological Innovation Drivers: Advancements in mass timber, automation, and digital design.

- Regulatory Frameworks: Supportive policies for sustainable construction and energy efficiency.

- Competitive Product Substitutes: Other offsite construction methods, traditional materials.

- End-User Demographics: Rising demand for affordable, sustainable, and fast housing.

- M&A Trends: Companies are acquiring smaller players to expand market reach and product portfolios. For instance, recent acquisitions signal a trend towards increased modular assembly prevalence.

Europe Prefab Wood Buildings Market Growth Trends & Insights

The Europe Prefab Wood Buildings Market is poised for substantial expansion, fueled by an escalating demand for sustainable and efficient construction solutions. Market size evolution indicates a consistent upward trajectory, with adoption rates of prefabricated wood buildings accelerating across residential, commercial, and industrial sectors. Technological disruptions, such as the rise of Cross-Laminated Timber (CLT) and advanced prefabrication techniques, are redefining construction timelines and cost-effectiveness. Consumer behavior is shifting towards environmentally conscious choices, with prefabricated wood structures offering lower carbon footprints and faster project completion times. This evolution is supported by a growing awareness of the long-term economic benefits, including reduced labor costs and improved energy performance.

The market's robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) that reflects the increasing acceptance and integration of these modern building solutions. Market penetration is deepening as more developers and consumers recognize the advantages of offsite construction, including enhanced quality control and reduced waste. The shift towards digitalization in the construction industry further facilitates the adoption of prefabricated wood buildings through Building Information Modeling (BIM) and other advanced design and project management tools. These trends collectively contribute to a dynamic market environment where innovation and sustainability are key differentiators. The market is anticipated to witness a significant increase in its overall value, driven by both volume growth and rising average selling prices due to enhanced product offerings and specialized applications. The integration of smart technologies within prefabricated structures also presents a growing segment, catering to modern living and working environments.

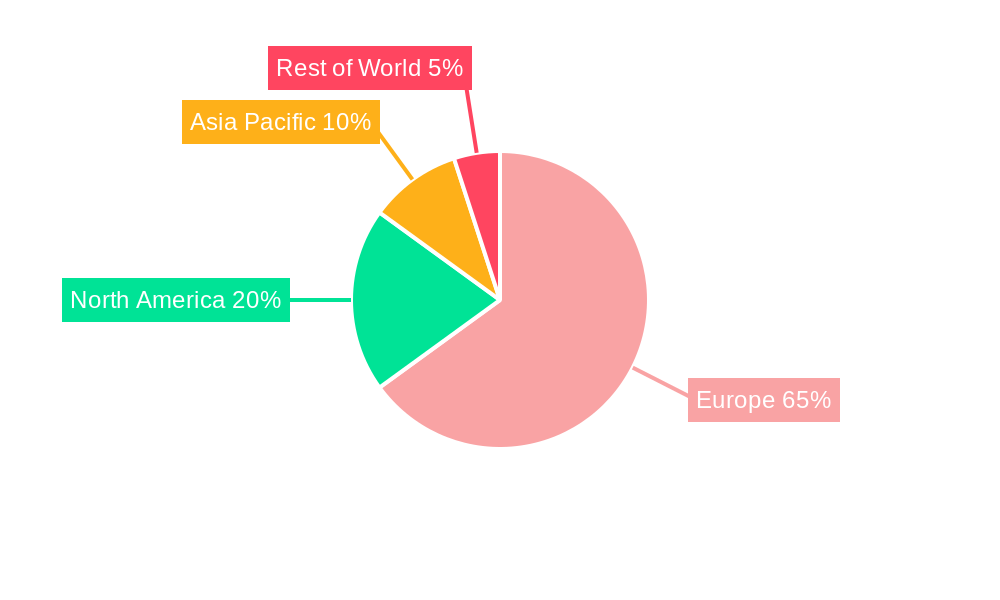

Dominant Regions, Countries, or Segments in Europe Prefab Wood Buildings Market

The Residential application segment stands as the dominant force in the Europe Prefab Wood Buildings Market, driven by an acute need for affordable, energy-efficient, and rapidly deployable housing solutions across the continent. Countries such as Germany, Sweden, Norway, and France are leading the charge, propelled by supportive government policies, a strong commitment to sustainability targets, and a well-established timber construction heritage. The increasing urbanization and subsequent housing shortages in major European cities further amplify the demand for prefabricated residential units.

Cross-Laminated Timber (CLT) Panels are emerging as a highly significant panel system, revolutionizing the structural capabilities of prefabricated wood buildings. CLT's superior strength, fire resistance, and design flexibility allow for taller and more complex structures, extending the applicability of wood construction beyond traditional low-rise buildings. This technological advancement is crucial in enabling the growth of prefabricated solutions in the commercial sector, including office spaces and hospitality projects, where demanding structural requirements are common.

- Leading Region/Country: Germany and the Nordic countries (Sweden, Norway) are at the forefront due to favorable government initiatives, established wood industries, and high consumer acceptance.

- Dominant Application Segment: Residential construction, driven by housing demand and affordability.

- Key Drivers: Growing populations, urbanization, need for faster housing delivery, energy efficiency mandates.

- Market Share: Expected to account for a substantial portion of the total market value.

- Dominant Panel System: Cross-Laminated Timber (CLT) Panels.

- Key Drivers: Enhanced structural performance, fire resistance, design versatility, sustainability credentials, ability to support taller buildings.

- Growth Potential: Significant potential to capture market share from conventional materials in various applications.

- Commercial Segment Growth: The Commercial segment, encompassing office and hospitality, is showing robust growth, facilitated by the advancements in panel systems like CLT, enabling larger-scale projects.

- Infrastructure and Industrial Applications: While currently a smaller segment, Other Applications like infrastructure (e.g., bridges, temporary structures) and industrial buildings are gaining traction due to the speed and cost-effectiveness of prefabricated wood solutions.

- Economic Policies: Government subsidies, tax incentives for sustainable building, and carbon emission reduction targets are crucial for market expansion.

- Infrastructure Development: Investment in new housing projects and urban regeneration initiatives directly benefits the prefabricated wood buildings market.

Europe Prefab Wood Buildings Market Product Landscape

The product landscape of the Europe Prefab Wood Buildings Market is marked by continuous innovation in panel systems and modular designs. Cross-Laminated Timber (CLT) Panels are at the forefront, enabling the construction of high-performance, aesthetically pleasing, and structurally sound buildings across various applications, from residential homes to multi-story commercial structures. Nail-Laminated Timber (NLT) Panels and Dowel-Laminated Timber (DLT) Panels offer cost-effective and versatile solutions for floor, roof, and wall systems, particularly suited for residential and smaller commercial projects. Glue-Laminated Timber (GLT) Columns and Beams provide essential structural components for larger spans and complex architectural designs. Unique selling propositions include superior thermal insulation, reduced construction time, lower embodied carbon, and design flexibility. Technological advancements focus on optimizing manufacturing processes for greater precision and efficiency, integrating smart technologies, and developing advanced fire-retardant treatments.

Key Drivers, Barriers & Challenges in Europe Prefab Wood Buildings Market

Key Drivers:

- Sustainability Mandates: Increasing environmental regulations and consumer demand for eco-friendly construction materials and methods are primary drivers. Prefabricated wood buildings offer a lower carbon footprint compared to concrete and steel.

- Construction Efficiency: The demand for faster project completion times and reduced on-site labor costs due to skilled labor shortages significantly boosts the adoption of prefabricated solutions.

- Technological Advancements: Innovations in mass timber construction, particularly CLT, NLT, and DLT, are expanding the structural possibilities and applications for wood buildings.

- Government Incentives: Supportive policies, subsidies, and tax credits for green building and affordable housing projects indirectly promote the use of prefabricated wood structures.

- Energy Efficiency: Prefabricated wood buildings often offer superior thermal performance, leading to lower energy consumption and operational costs, appealing to end-users.

Barriers & Challenges:

- Perception and Acceptance: Lingering perceptions of wood as less durable or prone to fire hazards, especially for larger structures, can hinder widespread adoption. Overcoming these misconceptions through education and demonstration projects is crucial.

- Supply Chain Disruptions: Fluctuations in timber prices and availability, along with potential logistical challenges for transporting large prefabricated components, can impact project timelines and costs.

- Skilled Workforce Requirements: While reducing on-site labor, the manufacturing of prefabricated components requires a skilled workforce in factories, which can be a challenge to source and train.

- Regulatory Hurdles and Standardization: Harmonizing building codes and standards across different European countries for prefabricated wood structures can be complex, creating compliance challenges for manufacturers.

- Initial Capital Investment: Setting up advanced manufacturing facilities for prefabricated wood buildings requires significant upfront investment, which can be a barrier for smaller companies.

- Competitive Pressures: Competition from established traditional construction methods and other offsite construction sectors, like steel or concrete modular systems, remains a significant challenge.

Emerging Opportunities in Europe Prefab Wood Buildings Market

Emerging opportunities in the Europe Prefab Wood Buildings Market are primarily centered around the increasing demand for sustainable urban development and innovative housing solutions. The expansion of prefabricated wood construction into larger commercial projects, including hotels, schools, and healthcare facilities, presents a significant growth avenue. Furthermore, the integration of smart home technologies and sustainable energy systems (solar panels, advanced insulation) within prefabricated modules offers a compelling value proposition for environmentally conscious consumers and businesses. Untapped markets in Eastern Europe, with growing economies and a need for modern housing, also represent a substantial opportunity for market players. The development of hybrid construction models, combining prefabricated wood elements with other sustainable materials, is another area ripe for innovation.

Growth Accelerators in the Europe Prefab Wood Buildings Market Industry

Long-term growth in the Europe Prefab Wood Buildings Market is being accelerated by breakthroughs in material science and manufacturing technologies. The ongoing development of advanced mass timber products, offering enhanced structural integrity and fire resistance, is enabling wood to compete in applications previously dominated by steel and concrete. Strategic partnerships between timber producers, manufacturers, and construction firms are streamlining the supply chain and fostering collaborative innovation, leading to more integrated and efficient project delivery. Market expansion strategies focusing on developing standardized modular systems for specific building types, such as affordable housing or student accommodation, are also critical growth catalysts. The increasing focus on circular economy principles within the construction industry further favors wood as a renewable and recyclable material, bolstering its long-term growth prospects.

Key Players Shaping the Europe Prefab Wood Buildings Market Market

- LB-Hus AB

- Moelven Byggmodul AB

- Vastkuststugan AB

- Alvsbyhus AB

- Lindbacks Bygg AB

- Anebyhusgruppen AB

- DFH Group

- Moelven Byggmodul AS

- Swietelsky AG

- Romakowski GmbH & Co KG

- Peab AB

- Laing O'Rourke

- OBOS Bostadsutveckling AB

- Trivselhus AB

- ELK Fertighaus GmbH Zweigniederlassung Dtl

- Gotenehus AB

- Derome Husproduktion AB

- Fertighaus Weiss GmbH

Notable Milestones in Europe Prefab Wood Buildings Market Sector

- June 2022: Ardmac, a leader in modular building, has purchased Cental. Modular assembly and full modular buildings will be considerably more prevalent in the future construction environment, which will have a more standardized, consolidated, and integrated construction process. This acquisition takes Ardmac one step closer to that goal. Ardmac's strengths as a top provider of offsite modular solutions to its clients in the data centre, pharmaceutical, healthcare, and advanced manufacturing sectors are enhanced by the combined experience and resources, and new options are now available to clients in the commercial fit out sector.

- April 2022: HusCompagniet A/S has signed a contract to purchase a prefabricated factory from NVV GmbH and JAWS Holding ApS, along with an order book worth about DKK 200 million (USD 291 Million). Esbjerg, Denmark is home to the factory. The facility is one of the most automated in the Nordic region, and HusCompagniet's strategic goals will be further strengthened by its entry into this area of the Danish supply chain. With the newly acquired facility, HusCompagniet can assure production in their expanding semi-detached segment and avoid supply chain difficulties involving both subcontractors and specific materials.

In-Depth Europe Prefab Wood Buildings Market Market Outlook

The future market outlook for Europe Prefab Wood Buildings is exceptionally promising, driven by a confluence of economic, environmental, and technological factors. Continued investment in sustainable construction practices and supportive government policies will act as significant growth accelerators, fostering innovation and adoption across all application segments. The increasing maturity of mass timber technologies, such as CLT, NLT, and DLT, will unlock new architectural possibilities and expand the market's reach into larger and more complex projects. Strategic partnerships and industry consolidation are expected to further streamline production and enhance market efficiency. Emerging opportunities in urban regeneration, affordable housing, and the integration of smart building technologies present substantial untapped potential. The overall market trajectory indicates sustained growth, positioning prefabricated wood buildings as a cornerstone of future European construction.

Europe Prefab Wood Buildings Market Segmentation

-

1. Application

- 1.1. Resident

- 1.2. Commercial (Office, Hospitality, etc.)

- 1.3. Other Applications (Infrastructure and Industrial)

-

2. Panel Systems

- 2.1. Cross-Laminated Timber (CLT) Panels

- 2.2. Nail-Laminated Timber (NLT) Panels

- 2.3. Dowel-Laminated Timber (DLT) Panels

- 2.4. Glue-Laminated Timber (GLT) Columns and Beams

Europe Prefab Wood Buildings Market Segmentation By Geography

- 1. Belgium

- 2. Finland

- 3. France

- 4. Germany

- 5. Italy

- 6. Russia

- 7. Spain

- 8. Sweden

- 9. United Kingdom

- 10. Rest Of Europe

Europe Prefab Wood Buildings Market Regional Market Share

Geographic Coverage of Europe Prefab Wood Buildings Market

Europe Prefab Wood Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land Availability4.; Economic Uncertainties

- 3.4. Market Trends

- 3.4.1. National Urban Redevelopment Projects in Ukraine and Turkey

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Resident

- 5.1.2. Commercial (Office, Hospitality, etc.)

- 5.1.3. Other Applications (Infrastructure and Industrial)

- 5.2. Market Analysis, Insights and Forecast - by Panel Systems

- 5.2.1. Cross-Laminated Timber (CLT) Panels

- 5.2.2. Nail-Laminated Timber (NLT) Panels

- 5.2.3. Dowel-Laminated Timber (DLT) Panels

- 5.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Belgium

- 5.3.2. Finland

- 5.3.3. France

- 5.3.4. Germany

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Spain

- 5.3.8. Sweden

- 5.3.9. United Kingdom

- 5.3.10. Rest Of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Belgium Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Resident

- 6.1.2. Commercial (Office, Hospitality, etc.)

- 6.1.3. Other Applications (Infrastructure and Industrial)

- 6.2. Market Analysis, Insights and Forecast - by Panel Systems

- 6.2.1. Cross-Laminated Timber (CLT) Panels

- 6.2.2. Nail-Laminated Timber (NLT) Panels

- 6.2.3. Dowel-Laminated Timber (DLT) Panels

- 6.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Finland Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Resident

- 7.1.2. Commercial (Office, Hospitality, etc.)

- 7.1.3. Other Applications (Infrastructure and Industrial)

- 7.2. Market Analysis, Insights and Forecast - by Panel Systems

- 7.2.1. Cross-Laminated Timber (CLT) Panels

- 7.2.2. Nail-Laminated Timber (NLT) Panels

- 7.2.3. Dowel-Laminated Timber (DLT) Panels

- 7.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. France Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Resident

- 8.1.2. Commercial (Office, Hospitality, etc.)

- 8.1.3. Other Applications (Infrastructure and Industrial)

- 8.2. Market Analysis, Insights and Forecast - by Panel Systems

- 8.2.1. Cross-Laminated Timber (CLT) Panels

- 8.2.2. Nail-Laminated Timber (NLT) Panels

- 8.2.3. Dowel-Laminated Timber (DLT) Panels

- 8.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Germany Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Resident

- 9.1.2. Commercial (Office, Hospitality, etc.)

- 9.1.3. Other Applications (Infrastructure and Industrial)

- 9.2. Market Analysis, Insights and Forecast - by Panel Systems

- 9.2.1. Cross-Laminated Timber (CLT) Panels

- 9.2.2. Nail-Laminated Timber (NLT) Panels

- 9.2.3. Dowel-Laminated Timber (DLT) Panels

- 9.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Italy Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Resident

- 10.1.2. Commercial (Office, Hospitality, etc.)

- 10.1.3. Other Applications (Infrastructure and Industrial)

- 10.2. Market Analysis, Insights and Forecast - by Panel Systems

- 10.2.1. Cross-Laminated Timber (CLT) Panels

- 10.2.2. Nail-Laminated Timber (NLT) Panels

- 10.2.3. Dowel-Laminated Timber (DLT) Panels

- 10.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Russia Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Resident

- 11.1.2. Commercial (Office, Hospitality, etc.)

- 11.1.3. Other Applications (Infrastructure and Industrial)

- 11.2. Market Analysis, Insights and Forecast - by Panel Systems

- 11.2.1. Cross-Laminated Timber (CLT) Panels

- 11.2.2. Nail-Laminated Timber (NLT) Panels

- 11.2.3. Dowel-Laminated Timber (DLT) Panels

- 11.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Spain Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Resident

- 12.1.2. Commercial (Office, Hospitality, etc.)

- 12.1.3. Other Applications (Infrastructure and Industrial)

- 12.2. Market Analysis, Insights and Forecast - by Panel Systems

- 12.2.1. Cross-Laminated Timber (CLT) Panels

- 12.2.2. Nail-Laminated Timber (NLT) Panels

- 12.2.3. Dowel-Laminated Timber (DLT) Panels

- 12.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Sweden Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application

- 13.1.1. Resident

- 13.1.2. Commercial (Office, Hospitality, etc.)

- 13.1.3. Other Applications (Infrastructure and Industrial)

- 13.2. Market Analysis, Insights and Forecast - by Panel Systems

- 13.2.1. Cross-Laminated Timber (CLT) Panels

- 13.2.2. Nail-Laminated Timber (NLT) Panels

- 13.2.3. Dowel-Laminated Timber (DLT) Panels

- 13.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 13.1. Market Analysis, Insights and Forecast - by Application

- 14. United Kingdom Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Application

- 14.1.1. Resident

- 14.1.2. Commercial (Office, Hospitality, etc.)

- 14.1.3. Other Applications (Infrastructure and Industrial)

- 14.2. Market Analysis, Insights and Forecast - by Panel Systems

- 14.2.1. Cross-Laminated Timber (CLT) Panels

- 14.2.2. Nail-Laminated Timber (NLT) Panels

- 14.2.3. Dowel-Laminated Timber (DLT) Panels

- 14.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 14.1. Market Analysis, Insights and Forecast - by Application

- 15. Rest Of Europe Europe Prefab Wood Buildings Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Application

- 15.1.1. Resident

- 15.1.2. Commercial (Office, Hospitality, etc.)

- 15.1.3. Other Applications (Infrastructure and Industrial)

- 15.2. Market Analysis, Insights and Forecast - by Panel Systems

- 15.2.1. Cross-Laminated Timber (CLT) Panels

- 15.2.2. Nail-Laminated Timber (NLT) Panels

- 15.2.3. Dowel-Laminated Timber (DLT) Panels

- 15.2.4. Glue-Laminated Timber (GLT) Columns and Beams

- 15.1. Market Analysis, Insights and Forecast - by Application

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 LB-Hus AB**List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Moelven Byggmodul AB

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Vastkuststugan AB

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Alvsbyhus AB

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Lindbacks Bygg AB

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Anebyhusgruppen AB

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 DFH Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Moelven Byggmodul AS

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Swietelsky AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Romakowski GmbH & Co KG

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Peab AB

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Laing O'Rourke

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 OBOS Bostadsutveckling AB

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Trivselhus AB

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 ELK Fertighaus GmbH Zweigniederlassung Dtl

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Gotenehus AB

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 Derome Husproduktion AB

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.18 Fertighaus Weiss GmbH

- 16.2.18.1. Overview

- 16.2.18.2. Products

- 16.2.18.3. SWOT Analysis

- 16.2.18.4. Recent Developments

- 16.2.18.5. Financials (Based on Availability)

- 16.2.1 LB-Hus AB**List Not Exhaustive

List of Figures

- Figure 1: Europe Prefab Wood Buildings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Prefab Wood Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 3: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 6: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 9: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 12: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 15: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 18: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 21: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 24: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 27: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 30: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Panel Systems 2020 & 2033

- Table 33: Europe Prefab Wood Buildings Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Prefab Wood Buildings Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Europe Prefab Wood Buildings Market?

Key companies in the market include LB-Hus AB**List Not Exhaustive, Moelven Byggmodul AB, Vastkuststugan AB, Alvsbyhus AB, Lindbacks Bygg AB, Anebyhusgruppen AB, DFH Group, Moelven Byggmodul AS, Swietelsky AG, Romakowski GmbH & Co KG, Peab AB, Laing O'Rourke, OBOS Bostadsutveckling AB, Trivselhus AB, ELK Fertighaus GmbH Zweigniederlassung Dtl, Gotenehus AB, Derome Husproduktion AB, Fertighaus Weiss GmbH.

3. What are the main segments of the Europe Prefab Wood Buildings Market?

The market segments include Application, Panel Systems.

4. Can you provide details about the market size?

The market size is estimated to be USD 61 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy.

6. What are the notable trends driving market growth?

National Urban Redevelopment Projects in Ukraine and Turkey.

7. Are there any restraints impacting market growth?

4.; Limited Land Availability4.; Economic Uncertainties.

8. Can you provide examples of recent developments in the market?

June 2022: Ardmac, a leader in modular building, has purchased Cental. Modular assembly and full modular buildings will be considerably more prevalent in the future construction environment, which will have a more standardised, consolidated, and integrated construction process.This acquisition takes Ardmac one step closer to that goal. Ardmac's strengths as a top provider of offsite modular solutions to its clients in the data centre, pharmaceutical, healthcare, and advanced manufacturing sectors are enhanced by the combined experience and resources, and new options are now available to clients in the commercial fit out sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Prefab Wood Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Prefab Wood Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Prefab Wood Buildings Market?

To stay informed about further developments, trends, and reports in the Europe Prefab Wood Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence