Key Insights

Thailand's prefabricated house market is set for significant expansion, driven by the increasing demand for faster, cost-effective, and sustainable housing. The market is projected to reach $24.66 billion by 2025, with a compound annual growth rate (CAGR) of 6.5%. Key growth factors include ongoing urbanization, a growing middle class seeking modern residences, and government initiatives promoting affordable housing. Prefabricated construction's advantages—reduced on-site labor, minimized waste, and quicker project completion—are highly attractive to developers. Residential projects are expected to lead application segments, followed by commercial and industrial developments.

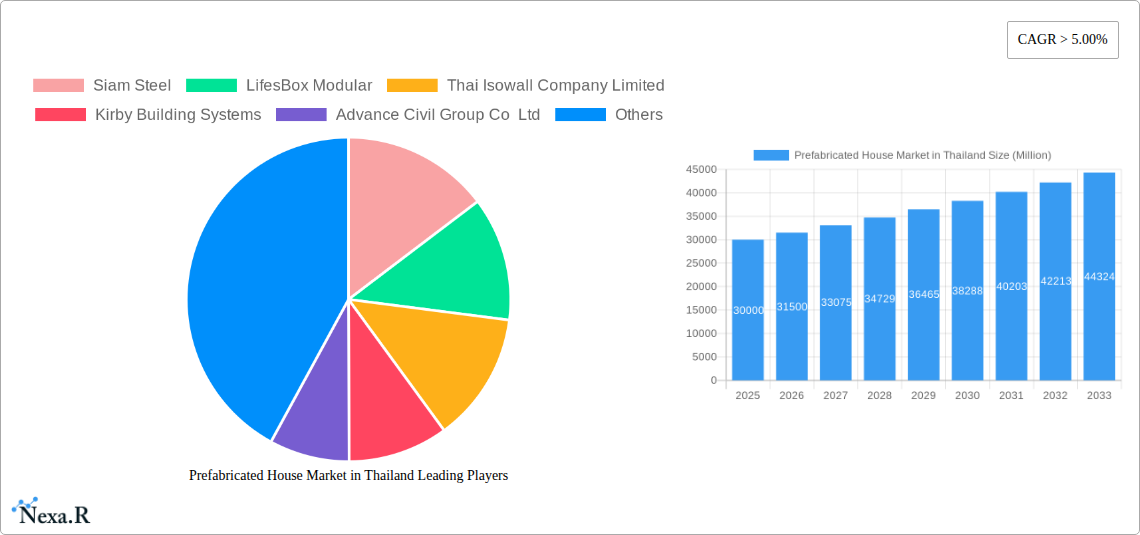

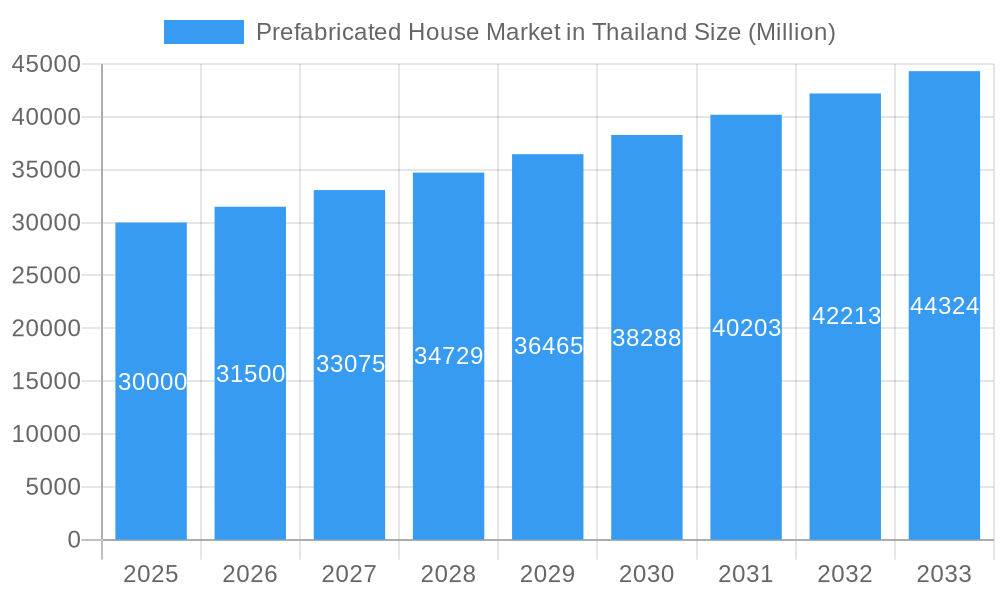

Prefabricated House Market in Thailand Market Size (In Billion)

The market features established and emerging players like Siam Steel, LifesBox Modular, Thai Isowall Company Limited, and Kirby Building Systems. These companies drive innovation through technological advancements, novel designs, and sustainable materials. Potential challenges include stringent regulations, perceived aesthetic limitations, and initial capital investment. However, rising consumer acceptance and advancements in modular design and construction technologies are expected to mitigate these concerns. The growing emphasis on eco-friendly building practices further enhances the appeal of prefabricated solutions, positioning the market for substantial and sustainable development.

Prefabricated House Market in Thailand Company Market Share

This report offers a definitive analysis of the Thailand prefabricated house market, providing critical insights for industry professionals, investors, and policymakers. It details market evolution from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The analysis covers dominant segments, key growth drivers, emerging opportunities, and the competitive landscape, making it an essential resource for understanding the modular construction Thailand sector and its prefabricated building solutions. The report focuses on quantitative data in Million units and qualitative analysis for a comprehensive market overview.

Prefabricated House Market in Thailand Market Dynamics & Structure

The Thai prefabricated house market is characterized by a moderate to high concentration, with a few key players dominating specific niches. Technological innovation is a significant driver, primarily fueled by advancements in materials science, digital design tools (BIM), and automated manufacturing processes, leading to faster construction times and enhanced quality. Regulatory frameworks are evolving, with the government increasingly recognizing the potential of offsite construction to address housing shortages and promote sustainable development. Competitive product substitutes, such as traditional construction methods, still hold a considerable share but are being challenged by the cost-effectiveness and speed of prefabricated solutions. End-user demographics are shifting, with a growing demand from the residential sector for affordable and quickly deliverable housing, and from the commercial sector for adaptable and scalable building solutions. Merger and acquisition (M&A) trends are expected to accelerate as larger construction firms seek to integrate modular capabilities and smaller, specialized firms aim for market consolidation.

- Market Concentration: Dominated by a mix of established local manufacturers and international players with a strong presence.

- Technological Innovation Drivers:

- Digitalization of design and manufacturing (BIM, automation).

- Development of sustainable and advanced building materials.

- Improvements in logistics and on-site assembly techniques.

- Regulatory Frameworks: Increasing government support for offsite construction through incentives and streamlined approval processes.

- Competitive Product Substitutes: Traditional building methods, though facing pressure, remain a benchmark for cost and established practices.

- End-User Demographics:

- Residential: Growing demand for affordable, energy-efficient, and quick-to-build homes.

- Commercial: Need for flexible, scalable, and cost-effective solutions for offices, retail spaces, and hospitality.

- Other Applications: Driven by infrastructure projects, industrial facilities, and temporary housing needs.

- M&A Trends: Anticipated increase in strategic acquisitions to expand market reach and technological capabilities.

Prefabricated House Market in Thailand Growth Trends & Insights

The Thailand prefabricated house market is on an upward trajectory, driven by a confluence of economic, social, and technological factors. Market size evolution is projected to be substantial, with an estimated Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Adoption rates are steadily increasing, as consumers and developers recognize the inherent advantages of offsite construction, including reduced waste, improved quality control, and significantly shorter project timelines. Technological disruptions, such as the integration of AI in design and manufacturing, and the use of advanced modular systems, are further enhancing the attractiveness of prefabricated housing. Consumer behavior shifts are evident, with a growing preference for sustainable and smart homes, attributes that prefabricated construction is well-positioned to deliver. The parent market, encompassing all construction in Thailand, sees prefabricated solutions gaining a larger share as efficiency and sustainability become paramount. The child market, specifically the prefabricated segment, is exhibiting robust growth, outperforming traditional construction in certain applications. Market penetration is expanding from niche applications to mainstream residential and commercial projects.

- Market Size Evolution: Significant growth anticipated, driven by increasing demand for efficient construction solutions.

- Adoption Rates: Steadily rising across residential, commercial, and infrastructure sectors.

- Technological Disruptions: Innovations in materials, digital design, and manufacturing are enhancing efficiency and sustainability.

- Consumer Behavior Shifts: Growing preference for speed, cost-effectiveness, sustainability, and smart home features.

- Market Penetration: Expansion into diverse applications, moving beyond temporary structures to permanent, high-quality buildings.

- CAGR: Projected at xx% for the forecast period.

Dominant Regions, Countries, or Segments in Prefabricated House Market in Thailand

The Residential segment is currently the dominant force in the Thailand prefabricated house market, driven by burgeoning urban populations, a growing middle class, and government initiatives aimed at affordable housing. The economic policies promoting construction and infrastructure development in key urban centers, particularly in and around Bangkok, are significant growth drivers for prefabricated residential units. Market share within the residential sector is substantial and projected to expand further as awareness of the benefits of modular construction increases. The ease of rapid deployment and cost-effectiveness makes prefabricated homes an attractive option for developers looking to meet immediate housing demands. The Commercial segment is a rapidly growing secondary market, with increasing adoption for retail outlets, office spaces, and hospitality projects due to the flexibility and scalability of prefabricated structures. The Other Applications segment, encompassing infrastructure and industrial facilities, also presents significant growth potential, particularly with large-scale government projects requiring swift construction timelines. The Eastern Economic Corridor (EEC) region, with its focus on industrial development and infrastructure, is a key area for growth in this segment.

- Dominant Segment: Residential Applications, driven by housing demand and affordability.

- Key Drivers:

- Urbanization and population growth.

- Government affordable housing initiatives.

- Demand for faster construction of homes.

- Key Drivers:

- Growing Segments:

- Commercial Applications: Driven by the need for flexible and quickly deployable retail, office, and hospitality spaces.

- Key Drivers:

- Expansion of the service sector.

- E-commerce growth requiring quick retail setups.

- Tourism industry demand for adaptable accommodations.

- Key Drivers:

- Other Applications (Infrastructure and Industrial): Supported by large-scale development projects.

- Key Drivers:

- Government infrastructure investment (e.g., transportation, utilities).

- Industrial park development and expansion.

- Need for temporary or rapidly deployable facilities for construction sites.

- Key Drivers:

- Commercial Applications: Driven by the need for flexible and quickly deployable retail, office, and hospitality spaces.

- Regional Dominance: Urban centers and special economic zones are key hubs for prefabricated construction.

Prefabricated House Market in Thailand Product Landscape

The product landscape of the Thailand prefabricated house market is evolving rapidly, with a focus on innovation and user-centric design. Manufacturers are offering a diverse range of prefabricated solutions, from single-story modular homes to multi-story commercial buildings and specialized industrial units. Key product innovations include the use of sustainable materials like recycled steel and advanced insulation technologies, enhancing energy efficiency. Performance metrics such as structural integrity, thermal resistance, and acoustic insulation are continuously being improved. Unique selling propositions often revolve around speed of construction, reduced on-site labor, and cost predictability. Technological advancements are enabling greater customization and aesthetic appeal, breaking the perception of prefabricated homes as purely utilitarian. The market is seeing the introduction of smart home integration and advanced weather-resistant materials, catering to diverse client needs.

Key Drivers, Barriers & Challenges in Prefabricated House Market in Thailand

Key Drivers:

- Government Support and Initiatives: Policies promoting affordable housing and sustainable construction practices.

- Skilled Labor Shortage in Traditional Construction: Prefabrication reduces on-site labor requirements.

- Demand for Faster Project Completion: Crucial for residential, commercial, and infrastructure projects.

- Cost-Effectiveness and Predictability: Reduced waste and controlled factory environment lead to better cost management.

- Technological Advancements: Improved design software, manufacturing processes, and material science.

- Sustainability and Environmental Concerns: Prefabricated construction generally produces less waste.

Barriers & Challenges:

- Perception and Acceptance: Lingering negative perceptions about the quality and durability of prefabricated homes compared to traditional builds.

- High Initial Investment in Manufacturing: Setting up advanced fabrication facilities requires significant capital.

- Logistics and Transportation: Moving large modules to remote or congested sites can be challenging and costly.

- Regulatory Hurdles and Building Codes: Ensuring compliance with existing, sometimes rigid, building codes and obtaining necessary permits.

- Supply Chain Disruptions: Reliance on specific materials and components can make the market vulnerable to global supply chain issues.

- Financing and Mortgage Availability: Some financial institutions may be hesitant to provide mortgages for prefabricated homes.

Emerging Opportunities in Prefabricated House Market in Thailand

Emerging opportunities in the Thailand prefabricated house market are abundant, particularly in the realm of sustainable and smart living solutions. The growing demand for eco-friendly housing presents a significant avenue for prefabricated manufacturers leveraging green building materials and energy-efficient designs. Untapped markets within rural and semi-urban areas, where land is more affordable and construction infrastructure might be less developed, offer substantial potential. Innovative applications, such as prefabricated healthcare facilities, educational institutions, and disaster relief housing, are gaining traction. Evolving consumer preferences for personalized and adaptable living spaces are driving demand for highly customizable modular designs. The integration of IoT and AI technologies into prefabricated homes, offering smart functionalities and enhanced living experiences, represents a key growth frontier.

Growth Accelerators in the Prefabricated House Market in Thailand Industry

Several catalysts are driving the long-term growth of the prefabricated house market in Thailand. Technological breakthroughs in areas like 3D printing for construction components and advanced robotics in factory assembly are poised to revolutionize production efficiency and cost-effectiveness. Strategic partnerships between prefab manufacturers and real estate developers are crucial for scaling up projects and integrating modular solutions into mainstream housing developments. Market expansion strategies, including targeting specific demographics and developing specialized product lines for various applications, will further fuel growth. The increasing awareness and acceptance of offsite construction, driven by successful projects and positive testimonials, are creating a more favorable market environment. Investment in research and development to create innovative and sustainable building materials will also act as a significant growth accelerator.

Key Players Shaping the Prefabricated House Market in Thailand Market

- Siam Steel

- LifesBox Modular

- Thai Isowall Company Limited

- Kirby Building Systems

- Advance Civil Group Co Ltd

- Unibuild

- Modern Modular Co Ltd

- Container Kings

- Karmod Prefabricated Technologies

- Maxxi Factory

(List Not Exhaustive)

Notable Milestones in Prefabricated House Market in Thailand Sector

- June 2022: Naval Facilities Engineering Systems Command (NAVFAC) Pacific Resident Officer in Charge of Construction (ROICC) Thailand completed the construction of an Unmanned Aerial System (UAS) Operations Support Facility on June 9 at U-Tapao Royal Thai Navy Airfield. This involved a 1,600 sq ft, two-story prefabricated facility with essential rooms, assembled on-site in record time.

- March 2021: Panasonic partnered with Siam Steel International to introduce modular construction housing in Thailand, the company's first foray into regional modular housing. They offered six models ranging from 200 to 370 sq m, priced at THB 35,000 (USD 1068) per sq m, targeting mid-priced housing projects between THB 5-10 million (USD 0.15-0.31 million) per unit.

In-Depth Prefabricated House Market in Thailand Market Outlook

The outlook for the Thailand prefabricated house market remains exceptionally promising, driven by sustained demand and accelerating innovation. Growth accelerators, including government backing for sustainable construction and the industry's response to skilled labor shortages, are firmly in place. Strategic partnerships between manufacturers and developers will be key to unlocking large-scale residential and commercial projects. The market is poised for significant expansion as technology continues to enhance efficiency, reduce costs, and improve the aesthetic and functional appeal of prefabricated buildings. Emerging opportunities in areas like affordable housing, sustainable urban development, and specialized infrastructure projects will provide further impetus for growth, solidifying Thailand's position as a key market for prefabricated construction solutions in Southeast Asia.

Prefabricated House Market in Thailand Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Other Applications (Infrastructure and Industrial)

Prefabricated House Market in Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

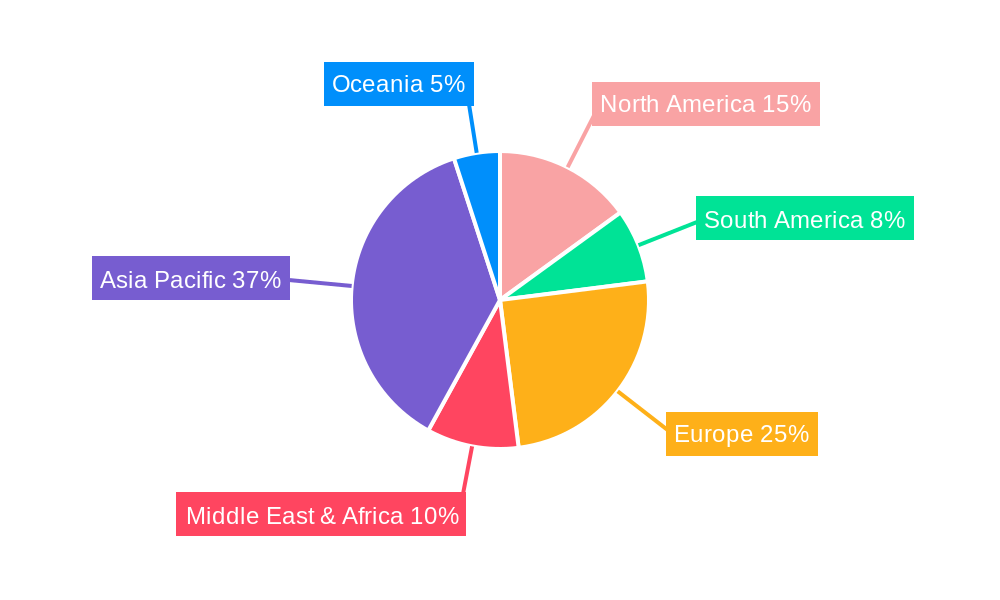

Prefabricated House Market in Thailand Regional Market Share

Geographic Coverage of Prefabricated House Market in Thailand

Prefabricated House Market in Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing number of startups

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Privacy Issues

- 3.4. Market Trends

- 3.4.1. Construction Investment to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Other Applications (Infrastructure and Industrial)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Other Applications (Infrastructure and Industrial)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Other Applications (Infrastructure and Industrial)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Other Applications (Infrastructure and Industrial)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Other Applications (Infrastructure and Industrial)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Other Applications (Infrastructure and Industrial)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Siam Steel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LifesBox Modular

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thai Isowall Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kirby Building Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advance Civil Group Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unibuild

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Modern Modular Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Container Kings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Karmod Prefabricated Technologies**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Maxxi Factory

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Siam Steel

List of Figures

- Figure 1: Global Prefabricated House Market in Thailand Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 7: South America Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 8: South America Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 15: Middle East & Africa Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 16: Middle East & Africa Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 19: Asia Pacific Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Prefabricated House Market in Thailand?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Prefabricated House Market in Thailand?

Key companies in the market include Siam Steel, LifesBox Modular, Thai Isowall Company Limited, Kirby Building Systems, Advance Civil Group Co Ltd, Unibuild, Modern Modular Co Ltd, Container Kings, Karmod Prefabricated Technologies**List Not Exhaustive, Maxxi Factory.

3. What are the main segments of the Prefabricated House Market in Thailand?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.66 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing number of startups.

6. What are the notable trends driving market growth?

Construction Investment to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Low Awareness and Privacy Issues.

8. Can you provide examples of recent developments in the market?

June 2022: Naval Facilities Engineering Systems Command (NAVFAC) Pacific Resident Officer in Charge of Construction (ROICC) Thailand completed construction of an Unmanned Aerial System (UAS) Operations Support Facility on June 9 at U-Tapao Royal Thai Navy Airfield in Thailand. ROICC Thailand awarded a 100-day construction contract to a local Thai company to provide a 1,600 square feet two-story facility with a control room, maintenance room, and storage for the launch and retrieval equipment. The prefabricated facility was assembled on-site in record time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Prefabricated House Market in Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Prefabricated House Market in Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Prefabricated House Market in Thailand?

To stay informed about further developments, trends, and reports in the Prefabricated House Market in Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence