Key Insights

The China Residential Real Estate Market is poised for substantial expansion, driven by ongoing urbanization, a growing affluent population, and supportive government housing policies. The market is projected to reach a significant size of 986.9 billion USD by 2025, with a Compound Annual Growth Rate (CAGR) of 9.8%. This growth is underpinned by rising disposable incomes and sustained demand for quality housing, especially in major urban centers. Despite regulatory interventions focused on market stability and sustainable development, core market drivers remain robust. Historical data indicates a consistent upward trend, demonstrating industry resilience.

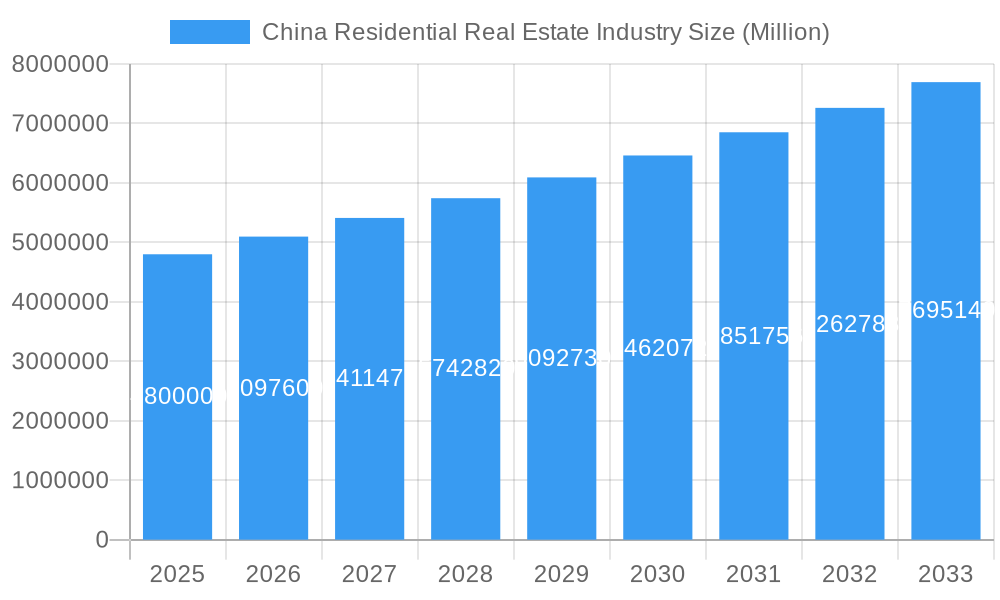

China Residential Real Estate Industry Market Size (In Billion)

Future market dynamics will be shaped by the integration of smart home technologies, eco-friendly building practices, and an increased focus on rental housing solutions to address demographic trends and affordability. Government strategies aimed at price stabilization and affordable housing promotion will continue to influence market trajectory. Coupled with economic progress and urban migration, these factors are expected to sustain positive market momentum. While Tier 1 and Tier 2 cities lead growth, secondary and tertiary cities offer emerging investment prospects. Continuous innovation and adaptability to evolving consumer demands and regulatory environments will be key to sustained success. The market is expected to experience healthy year-on-year growth, reinforcing its economic significance.

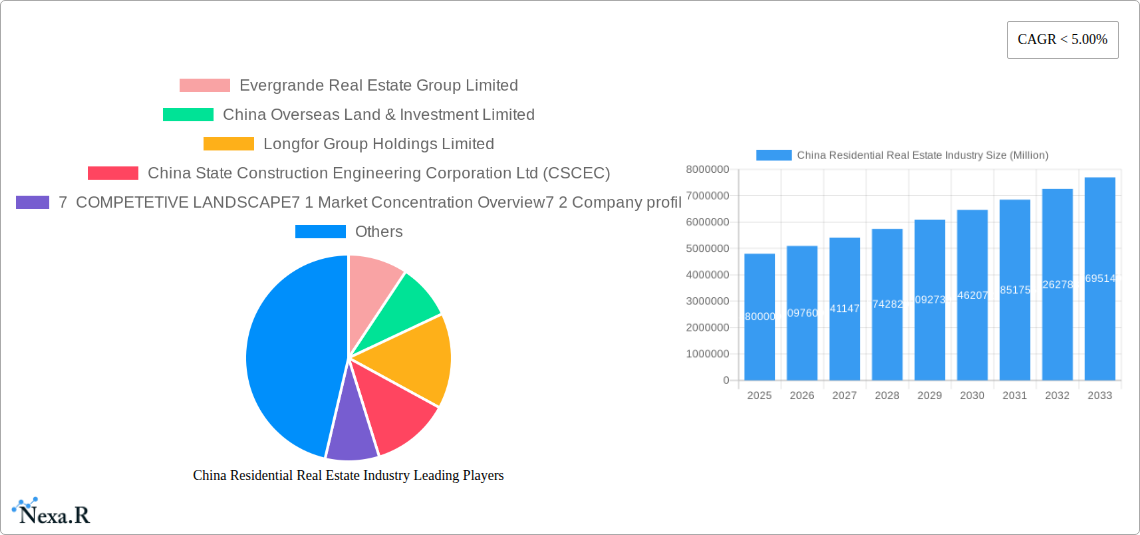

China Residential Real Estate Industry Company Market Share

China Residential Real Estate Industry: Market Dynamics, Growth Trends, and Competitive Landscape Report

This comprehensive report provides an in-depth analysis of the China Residential Real Estate Industry, offering critical insights into market dynamics, growth trajectories, and the competitive environment from 2019 to 2033, with a base year of 2025. It covers parent and child market segments, detailed company profiles, and emerging trends, making it an indispensable resource for industry professionals, investors, and policymakers navigating this dynamic sector. All values are presented in Million units.

China Residential Real Estate Industry Market Dynamics & Structure

The China Residential Real Estate Industry is characterized by a complex interplay of factors, from stringent regulatory frameworks to evolving end-user demographics. Market concentration remains a significant aspect, with a few major players dominating significant portions of the landscape. Technological innovation is increasingly influencing construction methods, sales channels, and property management, though adoption barriers persist due to cost and established practices. Regulatory policies, particularly those aimed at curbing speculation and ensuring housing affordability, heavily shape market activity. Competitive product substitutes, while nascent, include emerging rental markets and alternative housing solutions. Shifting end-user demographics, driven by urbanization and a growing middle class, are redefining demand patterns. Mergers and acquisitions (M&A) trends continue, consolidating market power and driving strategic alliances.

- Market Concentration: While dominant, the market is seeing strategic consolidation and diversification efforts by key players.

- Technological Innovation Drivers: Smart home integration, sustainable building materials, and online sales platforms are key innovation areas.

- Regulatory Frameworks: Government policies on land supply, financing, and property taxes significantly influence market stability and growth.

- Competitive Product Substitutes: Co-living spaces and build-to-rent models are beginning to emerge as alternatives.

- End-User Demographics: The demand for smaller, more efficient units in urban centers is rising, alongside a continued preference for family-sized homes in suburban areas.

- M&A Trends: Strategic acquisitions are focused on expanding geographical reach, acquiring land banks, and diversifying project portfolios.

China Residential Real Estate Industry Growth Trends & Insights

The China Residential Real Estate Industry has witnessed significant evolution throughout the historical period (2019-2024) and is poised for substantial growth during the forecast period (2025-2033). The market size has experienced fluctuations, influenced by economic cycles and policy interventions, but the underlying demand remains robust. Adoption rates for sustainable building practices and smart home technologies are on an upward trajectory. Technological disruptions are reshaping the development and sales processes, with a notable increase in digital platforms for property viewings and transactions. Consumer behavior has shifted towards a greater emphasis on quality of life, community amenities, and long-term value, moving beyond purely investment-driven purchases. The Compound Annual Growth Rate (CAGR) is projected to be significant, driven by ongoing urbanization and a sustained demand for quality housing.

- Market Size Evolution: The total market value is expected to grow from an estimated $3.5 trillion in 2024 to over $4.2 trillion by 2033.

- Adoption Rates: Smart home technology adoption is projected to reach 45% of new developments by 2030.

- Technological Disruptions: The rise of proptech solutions for property management and virtual tours is transforming customer engagement.

- Consumer Behavior Shifts: Increased demand for eco-friendly and energy-efficient homes is becoming a key purchasing factor.

- Market Penetration: The penetration of large-scale, integrated residential communities offering diverse amenities is expanding.

Dominant Regions, Countries, or Segments in China Residential Real Estate Industry

Within the China Residential Real Estate Industry, Apartments & Condominiums emerge as the dominant segment, catering to the vast majority of the urban population and reflecting the prevailing urbanization trends. This segment's dominance is fueled by its affordability, accessibility, and suitability for smaller households and young professionals.

Key Cities such as Shanghai, Beijing, and Shenzhen consistently lead market activity due to their strong economic foundations, high population densities, and continuous influx of talent. These metropolitan hubs represent the most dynamic and sought-after markets for residential real estate.

Dominant Segment - Apartments & Condominiums:

- Market Share: Constituting approximately 70% of the total residential market by volume.

- Key Drivers: Rapid urbanization, smaller household sizes, and greater affordability compared to landed properties.

- Growth Potential: Continued demand from first-time homebuyers and urban dwellers seeking convenient living.

Dominant Cities - Shanghai, Beijing, Shenzhen:

- Economic Policies: Pro-business environments and significant foreign investment foster job creation and population growth, driving housing demand.

- Infrastructure Development: Advanced transportation networks and public amenities enhance the desirability of these cities.

- Market Share: These three cities collectively account for over 35% of national residential sales value.

- Growth Potential: Continued appreciation due to limited land supply and sustained demand from high-income earners.

Hangzhou and Guangzhou: These cities are also crucial growth centers, benefiting from their economic diversification and strategic locations, contributing significantly to the overall market.

China Residential Real Estate Industry Product Landscape

The product landscape in China's residential real estate is evolving to meet sophisticated consumer demands. Innovations focus on enhancing living experiences through integrated smart home systems, energy-efficient designs, and sustainable building materials. Apartments & Condominiums often feature modular construction for faster development and customization. Villas & Landed Houses are increasingly incorporating green building certifications and advanced security features. Performance metrics are benchmarked against energy consumption, construction quality, and resident satisfaction. Unique selling propositions increasingly revolve around community-centric living, access to green spaces, and proximity to essential services.

Key Drivers, Barriers & Challenges in China Residential Real Estate Industry

Key Drivers:

- Urbanization: Continuous migration to cities fuels sustained demand for housing.

- Economic Growth: Rising disposable incomes enable more people to purchase homes.

- Government Support: Policies aimed at urbanization and affordable housing drive market activity.

- Infrastructure Development: New transport links and amenities make areas more attractive.

Barriers & Challenges:

- Regulatory Hurdles: Strict land use policies and financing regulations can constrain development.

- Affordability Concerns: Rising property prices in prime locations create affordability challenges for some segments.

- Supply Chain Disruptions: Global supply chain issues can impact the cost and availability of construction materials.

- Environmental Regulations: Increasing focus on sustainability necessitates higher construction standards and costs.

- Market Volatility: Policy shifts and economic slowdowns can lead to unpredictable market swings, with potential for a 5-10% annual price fluctuation in certain regions.

Emerging Opportunities in China Residential Real Estate Industry

Emerging opportunities lie in the development of affordable housing solutions for first-time buyers, particularly in Tier 2 and Tier 3 cities. The growing demand for senior living communities and co-living spaces presents untapped markets driven by demographic shifts. Furthermore, integrating green building technologies and smart home features into mid-range developments can unlock significant growth potential by appealing to an increasingly environmentally conscious and tech-savvy consumer base. The expansion of rental property management services also offers substantial opportunity.

Growth Accelerators in the China Residential Real Estate Industry Industry

Long-term growth in the China Residential Real Estate Industry is being accelerated by continuous technological breakthroughs in construction, such as prefabrication and 3D printing, leading to faster and more cost-effective development. Strategic partnerships between developers and technology firms are fostering innovation in smart building and property management. Market expansion strategies focused on underdeveloped urban areas and the development of integrated smart cities are crucial catalysts. The increasing adoption of digital platforms for sales and marketing is also broadening market reach and enhancing customer engagement.

Key Players Shaping the China Residential Real Estate Industry Market

- Evergrande Real Estate Group Limited

- China Overseas Land & Investment Limited

- Longfor Group Holdings Limited

- China State Construction Engineering Corporation Ltd (CSCEC)

- Shimao Group Holdings Limited

- Sunac China Holdings Limited

- China Resources Land Limited

- China Vanke Co Ltd

- China Merchants Shekou Industrial Zone Holdings Co Ltd

- Country Garden Holdings Company Limited

Notable Milestones in China Residential Real Estate Industry Sector

- February 2022: Dar Al-Arkan established a Beijing office, signaling international interest in forming joint ventures for both Chinese and Saudi markets, enhancing investment and knowledge sharing.

- February 2022: China Evergrande Group sold stakes and "right to debt" in four developments for CNY 2.13 billion (USD 0.35 billion) to state-owned trust firms, a move to ensure project completion amid its substantial liabilities. This included a residential development in Chongqing and Dongguan sold to Everbright Trust for CNY 1.03 billion (USD 0.19 billion), and a housing project in Foshan and a theme park in Guangzhou to Minmetals Trust for CNY 1.1 billion (USD 0.16 billion).

In-Depth China Residential Real Estate Industry Market Outlook

The future of the China Residential Real Estate Industry is characterized by sustainable growth, driven by urbanization, technological integration, and a focus on quality of living. Strategic opportunities abound in developing eco-friendly and smart-enabled housing in emerging urban centers and catering to the evolving needs of an aging population and young professionals. The continuous innovation in construction methodologies and property management, coupled with supportive government policies aimed at market stability, will foster a resilient and dynamic sector. Partnerships and digital transformation will be key to unlocking new market segments and enhancing customer experiences, ensuring sustained market potential.

China Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments & Condominiums

- 1.2. Villas & Landed Houses

-

2. Key Cities

- 2.1. Shenzhen

- 2.2. Beijing

- 2.3. Shanghai

- 2.4. Hangzhou

- 2.5. Guangzhou

- 2.6. Other Key Cities

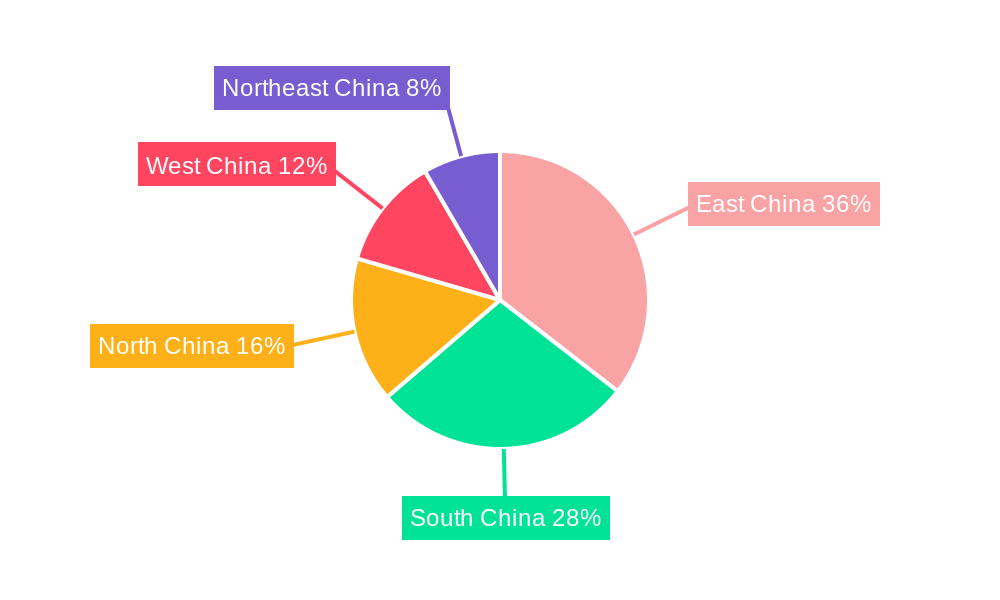

China Residential Real Estate Industry Segmentation By Geography

- 1. China

China Residential Real Estate Industry Regional Market Share

Geographic Coverage of China Residential Real Estate Industry

China Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Oversupply in the Real Estate; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Urbanization Driving the Residential Real Estate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments & Condominiums

- 5.1.2. Villas & Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Shenzhen

- 5.2.2. Beijing

- 5.2.3. Shanghai

- 5.2.4. Hangzhou

- 5.2.5. Guangzhou

- 5.2.6. Other Key Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Evergrande Real Estate Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Overseas Land & Investment Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Longfor Group Holdings Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China State Construction Engineering Corporation Ltd (CSCEC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 7 COMPETETIVE LANDSCAPE7 1 Market Concentration Overview7 2 Company profiles

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shimao Group Holdings Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunac China Holdings Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Resources Land Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Vanke Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Merchants Shekou Industrial Zone Holdings Co Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Country Garden Holdings Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Evergrande Real Estate Group Limited

List of Figures

- Figure 1: China Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: China Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Residential Real Estate Industry Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 3: China Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: China Residential Real Estate Industry Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 6: China Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Residential Real Estate Industry?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the China Residential Real Estate Industry?

Key companies in the market include Evergrande Real Estate Group Limited, China Overseas Land & Investment Limited, Longfor Group Holdings Limited, China State Construction Engineering Corporation Ltd (CSCEC), 7 COMPETETIVE LANDSCAPE7 1 Market Concentration Overview7 2 Company profiles, Shimao Group Holdings Limited, Sunac China Holdings Limited, China Resources Land Limited, China Vanke Co Ltd, China Merchants Shekou Industrial Zone Holdings Co Ltd **List Not Exhaustive, Country Garden Holdings Company Limited.

3. What are the main segments of the China Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 986.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Urbanization Driving the Residential Real Estate Market.

7. Are there any restraints impacting market growth?

Oversupply in the Real Estate; Labor Shortages.

8. Can you provide examples of recent developments in the market?

February 2022: Dar Al-Arkan, a Saudi real estate corporation, announced the creation of an office in Beijing, China. The move is in accordance with Dar Al-strategic Arkan's expansion ambitions and builds on the company's global brand development efforts. The company's Beijing office is expected to serve a variety of tasks, including establishing joint ventures between Dar Al-Arkan and renowned Chinese real estate developers for both the Chinese and Saudi markets, as well as enhancing investment and knowledge-sharing opportunities between the two countries. Dar Al-office Arkan's will serve as a hub for Chinese enterprises and investors looking to expand, start businesses, or invest in the Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the China Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence