Key Insights

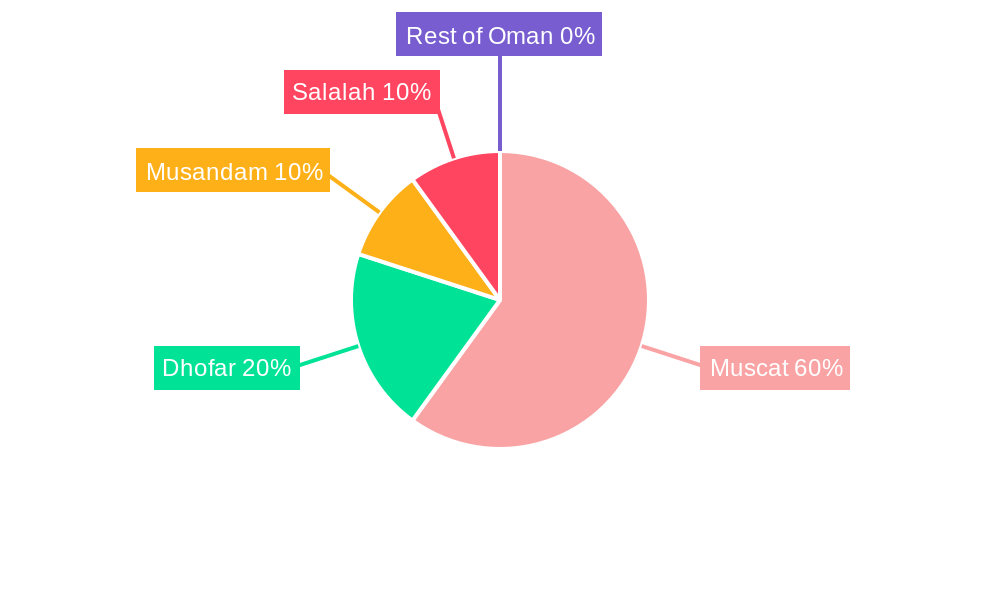

The Oman luxury residential real estate market is poised for significant expansion, projected to reach $4.78 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.19% from 2025 to 2033. This robust growth is propelled by a confluence of factors including Oman's expanding economy, particularly in tourism and energy, attracting high-net-worth individuals. Government initiatives fostering foreign investment and infrastructure development further enhance market appeal. Additionally, a growing affluent population's preference for sophisticated living and premium amenities is a key driver. Geographically, Muscat leads the market, followed by Dhofar, Musandam, and Salalah. Condominiums, apartments, villas, and landed houses represent key property segments. Despite challenges like fluctuating oil prices and potential regulatory shifts, strong investor confidence and sustained sector development ensure a positive market outlook. Leading entities such as Al Mouj Muscat, Better Homes, and Royal Estate World are instrumental in shaping the market landscape through their diverse offerings.

Oman Luxury Residential Real Estate Market Market Size (In Billion)

Beyond economic performance, the sector's growth is intrinsically linked to the rising demand for premium lifestyle experiences. This includes exclusive amenities, upscale communities, and prime locations. Oman's strategic geographic position, rich cultural heritage, and commitment to sustainable development projects also bolster the luxury real estate market's attractiveness. An increasing expatriate workforce further fuels demand for high-end residential spaces. While global economic fluctuations present potential challenges, strategic market analysis and investment by key players indicate a resilient long-term forecast. Governmental support for infrastructure and tourism initiatives reinforces this optimistic outlook.

Oman Luxury Residential Real Estate Market Company Market Share

Oman Luxury Residential Real Estate Market Analysis: 2025-2033 Outlook

This report offers a comprehensive analysis of the Oman luxury residential real estate market, focusing on the period from 2025 to 2033. It delves into market dynamics, growth trends, key stakeholders, and future opportunities, serving as an essential resource for investors, developers, and industry professionals. Utilizing extensive data analysis, the report provides critical insights into the broader Oman Real Estate market and the specialized Luxury Residential segment.

Oman Luxury Residential Real Estate Market Dynamics & Structure

This section analyzes the Oman luxury residential real estate market's competitive landscape, regulatory environment, and technological advancements. The market is characterized by a moderate level of concentration, with key players like AL Mouj Muscat and Better Homes competing alongside numerous smaller firms. Technological innovation, while present, faces barriers including high implementation costs and a relatively slower adoption rate compared to global trends. The regulatory framework, while supportive of real estate development, requires ongoing analysis for potential impacts. Substitutes for luxury residential properties include high-end rentals and luxury hotels, impacting market share. M&A activity is moderate, with xx million USD in deal volume recorded in the historical period (2019-2024), indicating consolidation potential within the segment. End-user demographics show a strong preference for villas and landed houses in prime locations like Muscat.

- Market Concentration: Moderately concentrated, with top 5 players holding an estimated 40% market share.

- Technological Innovation: Slow adoption of smart home technologies; limited use of VR/AR in marketing.

- Regulatory Framework: Relatively stable, but ongoing changes in building codes and zoning regulations need monitoring.

- Competitive Substitutes: High-end rentals and luxury hotels compete for affluent clientele.

- M&A Activity: xx million USD deal volume (2019-2024). Growth expected in the forecast period.

- End-User Demographics: High-net-worth individuals (HNWIs) and expatriates are primary buyers.

Oman Luxury Residential Real Estate Market Growth Trends & Insights

The Oman luxury residential real estate market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million USD in 2024. Market penetration for luxury residential properties is estimated at xx% in 2025, indicating considerable room for expansion. Technological disruptions such as the rise of online property platforms are transforming consumer behavior, increasing transparency and accessibility. However, traditional methods remain prevalent. The forecast period (2025-2033) projects continued growth, driven by factors such as rising HNWIs, government investments in infrastructure, and tourism expansion, resulting in a projected market size of xx million USD by 2033 and a CAGR of xx%.

Dominant Regions, Countries, or Segments in Oman Luxury Residential Real Estate Market

Muscat dominates the Oman luxury residential real estate market, accounting for approximately 70% of the market share in 2025, primarily due to its established infrastructure, proximity to key amenities, and higher concentration of HNWIs. Villas and landed houses represent a larger segment compared to condominiums and apartments, driven by cultural preferences. Dhofar, while smaller, shows significant growth potential due to increasing tourism and new developments. Musandam and Salalah present niche opportunities, with limited supply and high demand.

- Muscat: Dominant due to established infrastructure, high concentration of HNWIs, and established market.

- Dhofar: Emerging market with high growth potential driven by tourism development.

- Villas and Landed Houses: Larger segment due to cultural preferences and land availability.

- Condominiums and Apartments: Smaller segment, primarily concentrated in Muscat.

Oman Luxury Residential Real Estate Market Product Landscape

The Oman luxury residential real estate market features a range of products catering to diverse preferences, from opulent villas with private pools and gardens to high-rise apartments offering panoramic views. Key product innovations include incorporating sustainable features (solar panels, water conservation) and leveraging smart home technologies to enhance convenience and security. Luxury finishes, premium materials, and bespoke design elements are key selling propositions.

Key Drivers, Barriers & Challenges in Oman Luxury Residential Real Estate Market

Key Drivers:

- Government initiatives to improve infrastructure and attract foreign investment.

- Rising disposable incomes and an expanding HNWIs population.

- Growing tourism sector, increasing demand for luxury accommodation.

Challenges:

- High construction costs and land scarcity, particularly in prime locations.

- Relatively stringent building regulations and approval processes.

- Competition from substitute properties such as high-end rentals.

Emerging Opportunities in Oman Luxury Residential Real Estate Market

Untapped opportunities exist in developing luxury properties in secondary cities outside Muscat, leveraging the rise of domestic tourism. Further opportunities lie in developing sustainable, eco-friendly luxury housing, meeting increasing environmental consciousness amongst buyers. Customized design and build options tailored to individual needs offer another niche opportunity.

Growth Accelerators in the Oman Luxury Residential Real Estate Market Industry

Strategic partnerships between international developers and local firms will accelerate market growth. Government support through streamlined approvals and investment incentives will play a pivotal role in stimulating growth. Technological advancements (e.g. improved construction techniques, online marketing platforms) will accelerate building processes and improve consumer accessibility, boosting overall market development.

Key Players Shaping the Oman Luxury Residential Real Estate Market Market

- AL Mouj Muscat

- Better Homes

- Royal Estate World

- Al Madina Real Estate Company Muscat

- Harbor Real Estate

- Al-Taher Group

- Alfardan Heights

- Maysan properties SAOC

- Wujha Real Estate

- Noor Oman

Notable Milestones in Oman Luxury Residential Real Estate Market Sector

- April 2022: Barka Real Estate Development Company and Tibiaan Properties Company launched the Massar integrated commercial project in Barka.

- March 2023: Tibiaan Properties and Al Tamman Real Estate Company signed a contract to develop the 'Ajwaa' commercial project in Al Saada, Salalah.

In-Depth Oman Luxury Residential Real Estate Market Market Outlook

The Oman luxury residential real estate market shows strong potential for long-term growth, driven by continuous economic development and expanding tourism. Strategic investments in infrastructure and easing of regulations will further enhance the market's attractiveness to investors and developers. Targeting niche market segments (sustainable luxury, bespoke designs) and leveraging technology will be crucial for future success. The forecast period promises steady expansion, with significant opportunities for both established players and new entrants.

Oman Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Muscat

- 2.2. Dhofar

- 2.3. Musandam

- 2.4. Salalh

- 2.5. Rest of Oman

Oman Luxury Residential Real Estate Market Segmentation By Geography

- 1. Oman

Oman Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of Oman Luxury Residential Real Estate Market

Oman Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Supply of Residential Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Muscat

- 5.2.2. Dhofar

- 5.2.3. Musandam

- 5.2.4. Salalh

- 5.2.5. Rest of Oman

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AL Mouj Muscat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Better Homes**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal Estate World

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Madina Real Estate Company Muscat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harbor Real Estate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al-Taher Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alfardan Heights

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maysan properties SAOC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wujha Real Estate

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Noor Oman

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AL Mouj Muscat

List of Figures

- Figure 1: Oman Luxury Residential Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Oman Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 3: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 6: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Luxury Residential Real Estate Market?

The projected CAGR is approximately 9.19%.

2. Which companies are prominent players in the Oman Luxury Residential Real Estate Market?

Key companies in the market include AL Mouj Muscat, Better Homes**List Not Exhaustive, Royal Estate World, Al Madina Real Estate Company Muscat, Harbor Real Estate, Al-Taher Group, Alfardan Heights, Maysan properties SAOC, Wujha Real Estate, Noor Oman.

3. What are the main segments of the Oman Luxury Residential Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Supply of Residential Buildings.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

March 2023: Tibiaan Properties and Al Tamman Real Estate Company, a subsidiary of Muscat Overseas Group, signed a contract to develop and market the first commercial development of its kind in the Dhofar Governorate specifically in Al Saada area, Salalah. This project will include commercial units dedicated to various activities such as office spaces, retail spaces, restaurants, cafes, etc. This cooperation comes into place to deliver premium projects in Dhofar Governorate, where demand is rising for quality real estate projects. The project name 'Ajwaa' is an Arabic word that refers to the beautiful weather Salalah is enjoying throughout the year, thus reflecting the opportunities this project offers to investors in both corporates and individuals capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Oman Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence