Key Insights

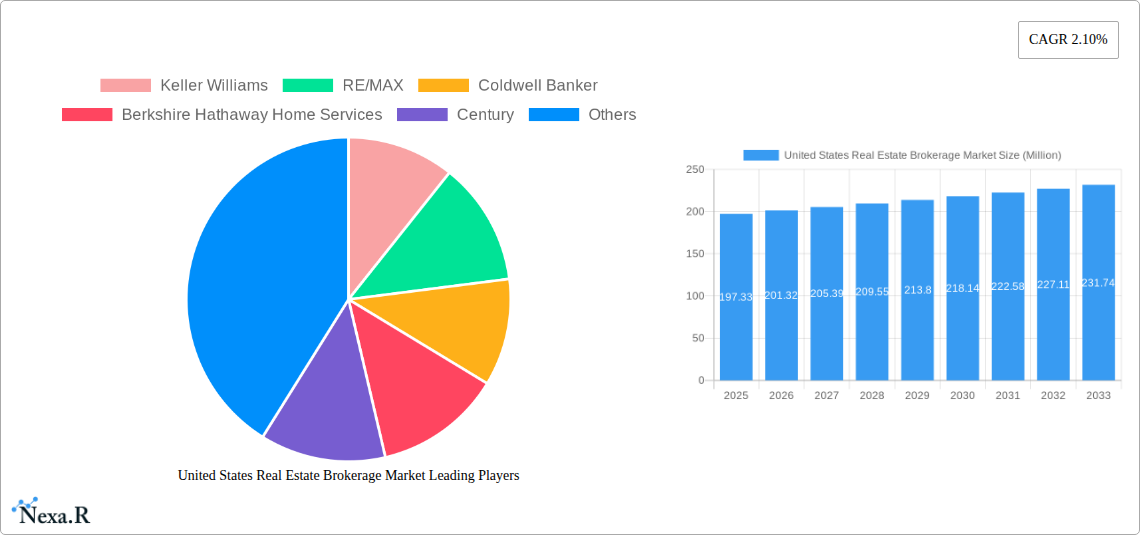

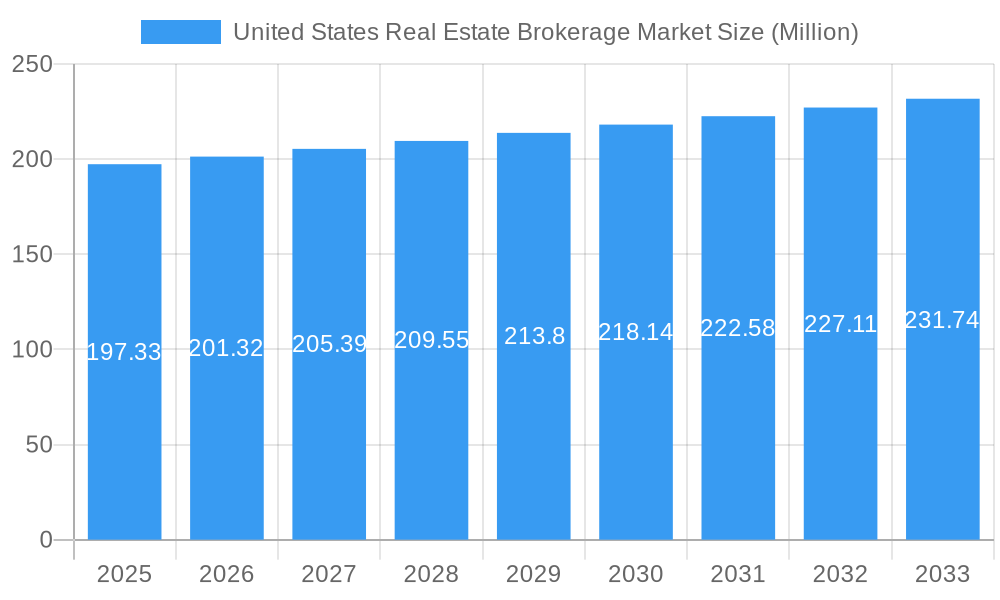

The United States Real Estate Brokerage Market is poised for steady expansion, currently valued at approximately $197.33 million. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 2.10% from 2025 to 2033. The market's trajectory is significantly influenced by a robust demand for both residential and non-residential properties, alongside a thriving rental sector. Key drivers include increasing urbanization, a growing population, and favorable economic conditions that encourage real estate investment. Furthermore, technological advancements are revolutionizing brokerage services, with online platforms and virtual tours enhancing the buying and selling experience. The market is segmented into residential and non-residential categories, with services encompassing sales and rentals, catering to a diverse clientele seeking to buy, sell, or lease properties. The increasing adoption of innovative business models and proptech solutions by leading companies such as Keller Williams, RE/MAX, and Compass is further stimulating market activity and driving efficiency.

United States Real Estate Brokerage Market Market Size (In Million)

Navigating the evolving landscape, the market faces certain restraints. Rising interest rates, although a natural part of economic cycles, can temper buyer enthusiasm and slow transaction volumes. Additionally, regulatory changes and increased competition from discount brokerages and iBuyers present ongoing challenges. However, the overarching trend favors continued growth, with market participants actively adapting to these dynamics. The emphasis on personalized client services, data-driven insights, and the integration of digital tools are becoming paramount for success. As the nation continues to experience population shifts and economic development, the demand for professional real estate brokerage services is expected to remain strong, with an estimated market size projected to grow significantly by 2033, reflecting sustained interest in property transactions and a dynamic housing market.

United States Real Estate Brokerage Market Company Market Share

Gain unparalleled insights into the dynamic United States real estate brokerage market with this comprehensive report. Analyzing the US residential real estate market and US commercial real estate brokerage sectors, this study covers the real estate services market from 2019 to 2033, with a deep dive into the 2025 market estimate and 2025-2033 forecast period. Discover key real estate industry trends, real estate brokerage technology, and real estate agent services. This report is essential for real estate investors, real estate developers, and real estate professionals seeking to understand market drivers, challenges, and emerging opportunities.

United States Real Estate Brokerage Market Market Dynamics & Structure

The United States real estate brokerage market is characterized by a moderate level of concentration, with leading players like Keller Williams, RE/MAX, and Coldwell Banker holding significant market share, estimated to be around 45% among the top 10 companies. Technological innovation, particularly in areas like virtual tours, AI-powered lead generation, and digital transaction management, is a key driver, with an estimated XX% of brokerages investing in new technologies in the past year. Regulatory frameworks, including state licensing laws and federal fair housing regulations, provide a stable operating environment, though compliance remains a crucial consideration. Competitive product substitutes, such as direct-to-consumer FSBO platforms and iBuyers, exert pressure, though the value of professional brokerage services continues to be recognized by a majority of consumers. End-user demographics are shifting, with an increasing demand for personalized services and a preference for tech-savvy agents among millennial and Gen Z buyers and sellers. Mergers and acquisitions (M&A) remain a significant trend, with approximately 150-200 smaller brokerages being acquired annually by larger entities, aiming to consolidate market share and leverage operational efficiencies.

- Market Concentration: Top 10 brokerages command an estimated 45% market share.

- Technological Innovation: XX% of brokerages invested in new technologies in the last year, focusing on AI, virtual tours, and digital platforms.

- Regulatory Landscape: State licensing and federal fair housing laws shape operations.

- Competitive Landscape: FSBO platforms and iBuyers present alternative options.

- End-User Demographics: Growing demand for personalized and tech-enabled services.

- M&A Activity: Approximately 150-200 small brokerage acquisitions per year.

United States Real Estate Brokerage Market Growth Trends & Insights

The United States real estate brokerage market is projected to experience robust growth, driven by a combination of macroeconomic factors and evolving consumer behaviors. The market size, valued at an estimated $XXX billion in 2024, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period from 2025 to 2033. This growth is underpinned by increasing homeownership rates, particularly among first-time homebuyers, and a steady demand for rental properties across major metropolitan areas. Technological adoption is accelerating, with an estimated XX% of real estate transactions now involving digital platforms for marketing, communication, and closing processes. Consumer behavior is shifting towards a greater reliance on online research and virtual showings, necessitating brokerages to enhance their digital presence and offer seamless online experiences. Furthermore, the increasing complexity of real estate transactions, coupled with evolving market conditions, continues to highlight the value proposition of experienced and well-equipped real estate professionals. The market penetration of tech-enabled brokerages is expected to reach XX% by 2033.

- Market Size Evolution: Estimated $XXX billion in 2024, with a projected CAGR of XX% from 2025-2033.

- Adoption Rates: XX% of transactions involve digital platforms; XX% tech-enabled brokerage penetration by 2033.

- Technological Disruptions: AI, virtual reality, and data analytics are transforming brokerage operations.

- Consumer Behavior Shifts: Increased reliance on online research, virtual tours, and digital convenience.

- Market Penetration: Growing demand from first-time homebuyers and renters.

Dominant Regions, Countries, or Segments in United States Real Estate Brokerage Market

The Residential segment of the United States real estate brokerage market is the dominant force, accounting for an estimated 78% of the total market value in 2024. This dominance is driven by persistent demand for homeownership, fueled by favorable demographic trends and economic conditions. Within the residential segment, the Sales service is particularly strong, representing approximately 70% of all residential transactions. Key drivers for the residential sales market include low interest rates (historically), population growth in suburban and exurban areas, and increasing household formation. Regions such as the South Atlantic (including Florida, Georgia, and North Carolina) and the Sun Belt states are experiencing significant growth due to their affordability, job opportunities, and attractive lifestyles.

The Non-Residential segment, encompassing commercial properties like office spaces, retail, industrial, and multi-family dwellings, constitutes the remaining 22% of the market. While smaller in overall market share, the multi-family rental sub-segment within non-residential is experiencing substantial growth, driven by urbanization and a rising preference for rental accommodations. Key drivers in the non-residential sector include business expansion, e-commerce growth necessitating industrial space, and the increasing institutional investment in real estate. The Rental service across both residential and non-residential sectors is also a significant contributor, with an estimated XX% of the total brokerage market value, reflecting the sustained demand for flexible housing and commercial space solutions.

- Dominant Segment: Residential (78% market share).

- Key Residential Sub-segment: Sales (70% of residential transactions).

- Leading Residential Drivers: Homeownership demand, population growth, job opportunities.

- Prominent Regions: South Atlantic, Sun Belt states.

- Non-Residential Segment: Commercial properties (22% market share).

- Growing Non-Residential Sub-segment: Multi-family rentals.

- Rental Service Contribution: XX% of total brokerage market value.

United States Real Estate Brokerage Market Product Landscape

The product landscape of the United States real estate brokerage market is rapidly evolving, driven by technological innovation and a focus on enhancing client experience. Brokerages are increasingly offering integrated platforms that combine property listings, virtual tours, digital document signing, and AI-powered communication tools. For instance, Compass's recent acquisitions highlight a strategy to bolster its technology offerings and agent support systems. These innovations aim to streamline the transaction process, improve agent productivity, and provide clients with greater transparency and convenience. Performance metrics are shifting towards digital engagement, lead conversion rates, and client satisfaction scores, reflecting the value placed on efficiency and personalized service. The integration of data analytics is enabling brokerages to provide more accurate market valuations and targeted property recommendations, setting them apart from traditional service providers.

Key Drivers, Barriers & Challenges in United States Real Estate Brokerage Market

The United States real estate brokerage market is propelled by several key drivers. Technological advancements, including AI-powered lead generation and virtual reality property tours, are enhancing efficiency and client engagement. Economic factors such as interest rate fluctuations, employment growth, and consumer confidence directly impact housing demand and transaction volumes. Regulatory frameworks, while providing structure, also offer opportunities for specialized service providers.

However, the market faces significant barriers and challenges. Intense competition from established players and emerging tech-focused disruptors puts pressure on commission rates and service offerings. Regulatory hurdles and compliance requirements add to operational costs. Supply chain issues, particularly in new construction, can indirectly affect the resale market. Furthermore, the challenge of attracting and retaining top talent amidst a dynamic and demanding industry remains a constant concern for brokerage firms. The need for continuous investment in technology and agent training to stay competitive represents a significant financial hurdle.

- Key Drivers: Technological innovation, economic growth, favorable demographics, evolving consumer needs.

- Barriers & Challenges: Intense competition, regulatory compliance, talent acquisition and retention, high operational costs, need for continuous technological investment.

Emerging Opportunities in United States Real Estate Brokerage Market

Emerging opportunities in the United States real estate brokerage market lie in the growing demand for specialized services and the adoption of advanced technologies. The increasing interest in sustainable and eco-friendly properties presents an untapped market for brokerages focusing on green real estate. Furthermore, the aging population and the need for downsizing or senior living solutions are creating a niche for agents specializing in these transitions. The continued evolution of proptech, including blockchain for secure property transactions and advanced data analytics for predictive market insights, offers significant potential for innovation and differentiation. The expansion into underserved or emerging geographic markets also presents considerable growth prospects for agile and adaptable brokerage firms.

Growth Accelerators in the United States Real Estate Brokerage Market Industry

Several growth accelerators are propelling the United States real estate brokerage market forward. The ongoing digital transformation within the industry, encompassing everything from virtual showings to AI-driven client relationship management, is enhancing efficiency and expanding reach. Strategic partnerships between brokerages and proptech companies are fostering innovation and offering integrated solutions that appeal to a wider client base. Market expansion strategies, including aggressive M&A activities and the establishment of franchises in new territories, are crucial for increasing market share and consolidating influence. Furthermore, the increasing demand for data-driven insights and personalized services by both buyers and sellers is pushing brokerages to invest in advanced analytics and customer-centric approaches.

Key Players Shaping the United States Real Estate Brokerage Market Market

- Keller Williams

- RE/MAX

- Coldwell Banker

- Berkshire Hathaway Home Services

- Century

- Sotheby's International Realty

- Compass

- eXp Realty

- Realogy Holdings Corp

- Redfin

- 6 3 Other Companies

Notable Milestones in United States Real Estate Brokerage Market Sector

- May 2024: Compass Inc. acquired Parks Real Estate, Tennessee's top residential real estate firm, integrating over 1,500 agents and expanding Compass's reach with cutting-edge technology and a national referral network.

- April 2024: Compass finalized its acquisition of Latter & Blum, a prominent New Orleans-based brokerage, significantly strengthening Compass's market share in Louisiana and Gulf Coast metros, estimated at 15% in New Orleans.

In-Depth United States Real Estate Brokerage Market Market Outlook

The future outlook for the United States real estate brokerage market is characterized by sustained growth, driven by technological integration and evolving consumer demands. Catalysts such as advancements in AI for personalized client experiences and virtual reality for immersive property viewing will continue to reshape brokerage operations. Strategic partnerships with proptech firms and expansion into niche markets, like sustainable or senior living real estate, represent key opportunities. The ongoing consolidation through mergers and acquisitions will likely lead to a more streamlined and efficient market landscape. Brokerages that effectively leverage data analytics, embrace digital innovation, and prioritize client-centric services are poised to capture significant market share and drive the industry's evolution in the coming years. The market is expected to witness continued innovation and a focus on providing seamless, technology-enabled real estate experiences.

United States Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-Residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

United States Real Estate Brokerage Market Segmentation By Geography

- 1. United States

United States Real Estate Brokerage Market Regional Market Share

Geographic Coverage of United States Real Estate Brokerage Market

United States Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market

- 3.4. Market Trends

- 3.4.1 Industrial Sector Leads Real Estate Absorption

- 3.4.2 Retail Tightens Vacancy Rates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-Residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Keller Williams

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RE/MAX

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coldwell Banker

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Berkshire Hathaway Home Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Century

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sotheby's International Realty

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Compass

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 eXp Realty

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Realogy Holdings Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Redfin**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Keller Williams

List of Figures

- Figure 1: United States Real Estate Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Real Estate Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: United States Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: United States Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: United States Real Estate Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Real Estate Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: United States Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: United States Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: United States Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: United States Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Real Estate Brokerage Market?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the United States Real Estate Brokerage Market?

Key companies in the market include Keller Williams, RE/MAX, Coldwell Banker, Berkshire Hathaway Home Services, Century, Sotheby's International Realty, Compass, eXp Realty, Realogy Holdings Corp, Redfin**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the United States Real Estate Brokerage Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 197.33 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market.

6. What are the notable trends driving market growth?

Industrial Sector Leads Real Estate Absorption. Retail Tightens Vacancy Rates.

7. Are there any restraints impacting market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market.

8. Can you provide examples of recent developments in the market?

May 2024: Compass Inc., the leading residential real estate brokerage by sales volume in the United States, acquired Parks Real Estate, Tennessee's top residential real estate firm that boasts over 1,500 agents. Known for its strategic acquisitions and organic growth, Compass's collaboration with Parks Real Estate not only enriches its agent pool but also grants these agents access to Compass's cutting-edge technology and a vast national referral network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the United States Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence