Key Insights

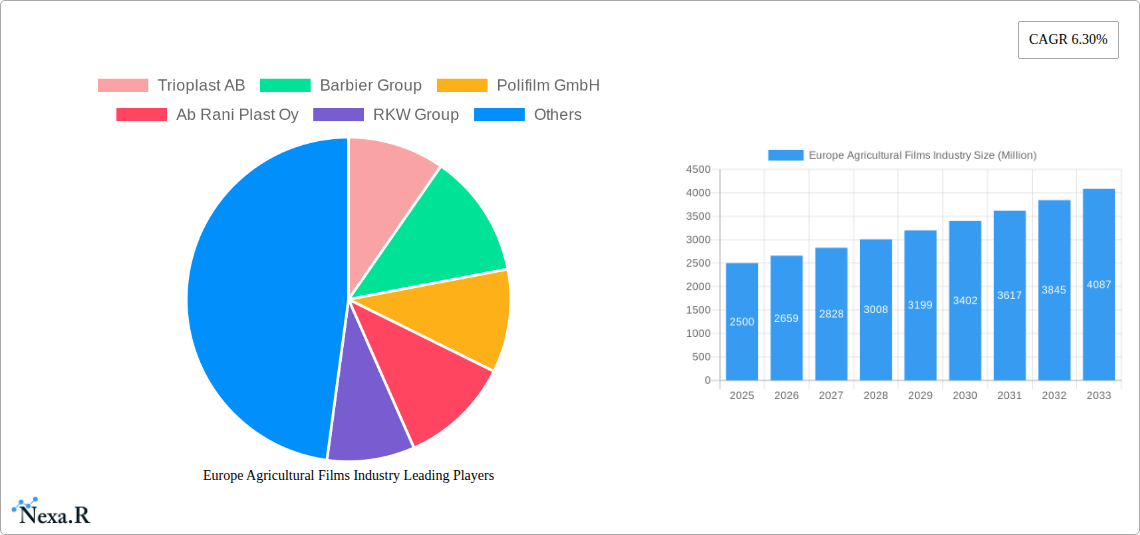

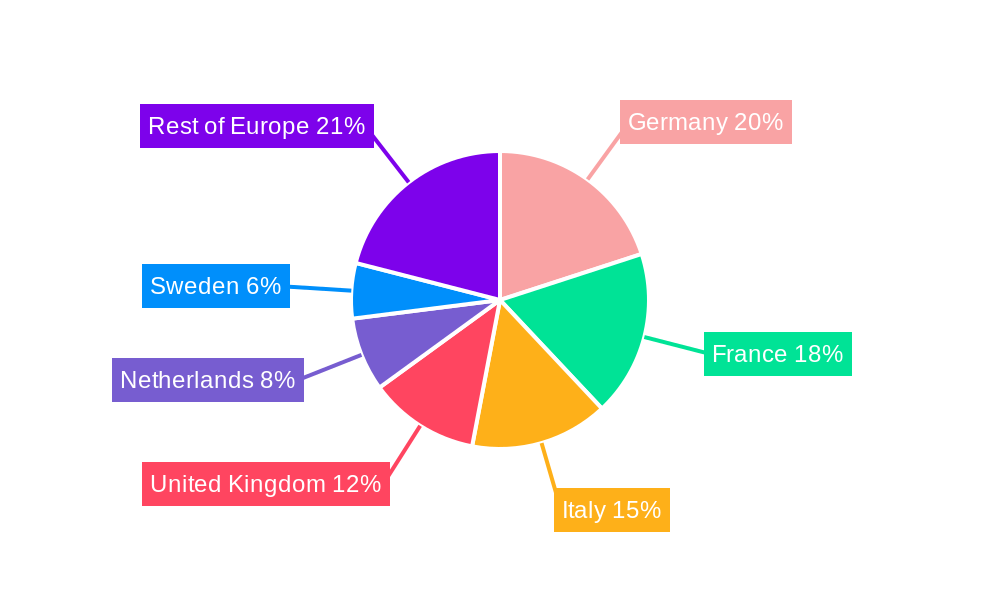

The European agricultural films market, projected to reach $2.34 billion by 2025, is forecast for substantial growth, with an anticipated Compound Annual Growth Rate (CAGR) of 6.3% from 2025 to 2033. This expansion is propelled by the escalating demand for efficient and sustainable agricultural solutions across Europe. Key drivers include the widespread adoption of agricultural films for enhanced greenhouse cultivation, effective silage preservation, and advanced soil mulching techniques. Technological innovations in film manufacturing, resulting in superior durability, UV resistance, and biodegradability, are also significantly contributing to market expansion. Moreover, supportive government initiatives promoting sustainable farming practices and increased investments in precision agriculture technologies are fostering a favorable market environment. Analysis of market segmentation indicates a strong preference for Low-Density Polyethylene (LDPE) and Linear Low-Density Polyethylene (LLDPE) films, attributed to their cost-effectiveness and adaptability. Germany, France, Italy, and the United Kingdom stand out as leading contributors to the European market, reflecting their robust agricultural sectors and sophisticated farming methodologies.

Europe Agricultural Films Industry Market Size (In Billion)

Despite positive growth trajectories, the market confronts inherent challenges. Volatile raw material prices, particularly for polyethylene, present a risk to profit margins. Additionally, environmental concerns surrounding plastic waste necessitate the development and implementation of sustainable disposal methods, driving the demand for biodegradable and compostable film alternatives. Intense competition among established industry players, such as Trioplast AB and Barbier Group, requires continuous innovation and stringent cost management. Nevertheless, the long-term outlook for the European agricultural films market remains optimistic. This optimism is underpinned by sustained growth in agricultural output and the increasing integration of advanced farming techniques, including protected cultivation and precision agriculture. The market is anticipated to witness a notable surge in the adoption of advanced materials and specialized film types, further fueling growth and diversification within the industry.

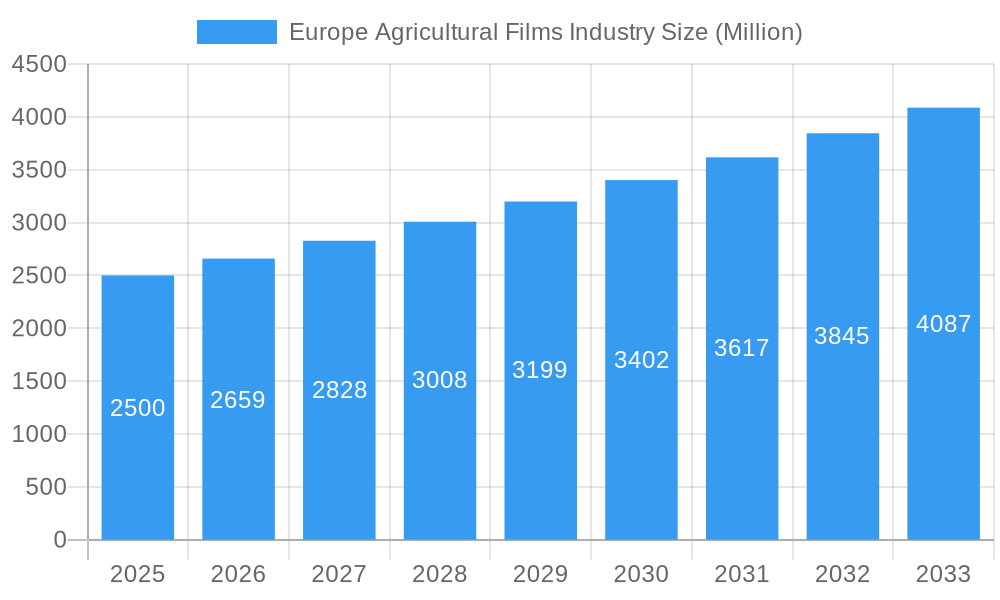

Europe Agricultural Films Industry Company Market Share

Europe Agricultural Films Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Agricultural Films market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this study meticulously examines market dynamics, growth trends, regional performance, and the competitive landscape. The report segments the market by application (Greenhouse, Silage, Mulching, Others) and type (Low-Density Polyethylene, Linear Low-Density Polyethylene, High-Density Polyethylene, Others), providing granular data and forecasts for each segment.

Europe Agricultural Films Industry Market Dynamics & Structure

This section analyzes the competitive intensity of the European agricultural films market, revealing market concentration levels and identifying key players like Trioplast AB, Barbier Group, Polifilm GmbH, Ab Rani Plast Oy, RKW Group, BASF, Berry Global, Luigi Bandera SpA, and Duo Plast AG. We examine the role of technological innovation, including advancements in film properties and manufacturing processes, and how regulatory frameworks concerning plastic waste and sustainability impact market strategies. The report also explores the influence of substitute products, end-user demographics (e.g., farm size, farming practices), and the frequency of mergers and acquisitions (M&A) activities.

- Market Concentration: xx% controlled by the top 5 players in 2025.

- M&A Activity: xx deals recorded between 2019-2024, with an average deal value of xx million.

- Innovation Barriers: High R&D costs and regulatory compliance requirements are significant hurdles.

- Substitute Products: Biodegradable films are emerging as a competitive threat, gaining xx% market share by 2033.

Europe Agricultural Films Industry Growth Trends & Insights

This section leverages comprehensive market data to analyze the historical and projected market size of the European agricultural films industry. We explore the evolution of market size, calculating the Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) and forecasting the CAGR for the period 2025-2033. The impact of technological disruptions like the introduction of smart films and automated application systems is assessed, alongside changes in consumer behavior (e.g., increased adoption of precision agriculture). The analysis provides a detailed picture of market penetration across different segments and regions, highlighting factors driving both growth and potential challenges.

- Market Size (2025): xx Million Units

- CAGR (2019-2024): xx%

- CAGR (2025-2033): xx%

- Market Penetration (Greenhouse Films in 2025): xx%

Dominant Regions, Countries, or Segments in Europe Agricultural Films Industry

This section identifies the leading regions, countries, and segments within the European agricultural films market that are driving overall growth. We examine the market share and growth potential of each application (Greenhouse, Silage, Mulching, Others) and type (Low-Density Polyethylene, Linear Low-Density Polyethylene, High-Density Polyethylene, Others). Key growth drivers are highlighted using bullet points, considering factors such as economic policies supporting agricultural modernization, existing infrastructure, and regional climate conditions favorable to specific film applications.

- Leading Region: Western Europe (Market Share in 2025: xx%)

- Fastest-Growing Segment (Application): Greenhouse films (CAGR 2025-2033: xx%)

- Fastest-Growing Segment (Type): Linear Low-Density Polyethylene (CAGR 2025-2033: xx%)

- Key Drivers: Government subsidies for sustainable agriculture, increasing adoption of protected cultivation, and favorable weather conditions in key regions.

Europe Agricultural Films Industry Product Landscape

The European agricultural films market offers a diverse range of products, each catering to specific needs within various applications. Innovations focus on enhancing film properties, such as improved UV resistance, increased strength, and better biodegradability. These advancements result in improved crop yields, reduced waste, and enhanced environmental sustainability. Unique selling propositions often revolve around specialized film formulations for particular crops or applications, ensuring optimal performance and cost-effectiveness.

Key Drivers, Barriers & Challenges in Europe Agricultural Films Industry

Key Drivers: Increased demand for food security drives the adoption of modern agricultural practices, including the widespread use of agricultural films for crop protection and yield improvement. Technological advancements lead to better-performing, more sustainable films. Government policies promoting sustainable agriculture further support market growth.

Challenges: Fluctuations in raw material prices, particularly polyethylene resins, impact production costs and profitability. Growing environmental concerns regarding plastic waste necessitate the development and adoption of more sustainable and biodegradable alternatives. Stringent regulations on plastic waste disposal pose a challenge to manufacturers and users of agricultural films.

Emerging Opportunities in Europe Agricultural Films Industry

The market presents exciting opportunities for growth through the development of biodegradable and compostable agricultural films. Expansion into emerging applications, such as smart films with integrated sensors, opens doors for enhanced precision agriculture. Meeting the demands of sustainable agriculture presents significant potential for innovation and market expansion.

Growth Accelerators in the Europe Agricultural Films Industry Industry

Long-term growth will be driven by technological advancements leading to greater efficiency, sustainability, and performance of agricultural films. Strategic collaborations between film manufacturers and agricultural technology companies will create innovative solutions for farmers. Market expansion into Eastern European countries with growing agricultural sectors represents a substantial growth opportunity.

Key Players Shaping the Europe Agricultural Films Industry Market

- Trioplast AB

- Barbier Group

- Polifilm GmbH

- Ab Rani Plast Oy

- RKW Group

- BASF

- Berry Global

- Luigi Bandera SpA

- Duo Plast AG

Notable Milestones in Europe Agricultural Films Industry Sector

- 2021: Introduction of a new biodegradable silage film by RKW Group.

- 2022: Merger between two smaller agricultural film producers in France.

- 2023: Launch of a smart film technology by Polifilm GmbH incorporating sensor integration for precision agriculture.

In-Depth Europe Agricultural Films Industry Market Outlook

The future of the European agricultural films market is bright, driven by growing demand for food security, technological advancements fostering sustainable agriculture, and increasing government support for modern farming practices. Strategic partnerships and innovation in bio-based materials will shape future growth, presenting lucrative opportunities for key players. The market is poised for significant expansion in the coming years, fueled by these positive factors.

Europe Agricultural Films Industry Segmentation

-

1. Type

- 1.1. Low-Density Polyethylene

- 1.2. Linear Low-Density Polyethylene

- 1.3. High-Density Polyethylene

- 1.4. Others

-

2. Application

- 2.1. Greenhouse

- 2.2. Silage

- 2.3. Mulching

- 2.4. Others

-

3. Type

- 3.1. Low-Density Polyethylene

- 3.2. Linear Low-Density Polyethylene

- 3.3. High-Density Polyethylene

- 3.4. Others

-

4. Application

- 4.1. Greenhouse

- 4.2. Silage

- 4.3. Mulching

- 4.4. Others

Europe Agricultural Films Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

Europe Agricultural Films Industry Regional Market Share

Geographic Coverage of Europe Agricultural Films Industry

Europe Agricultural Films Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Horticulture Industry Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Agricultural Films Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Low-Density Polyethylene

- 5.1.2. Linear Low-Density Polyethylene

- 5.1.3. High-Density Polyethylene

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Greenhouse

- 5.2.2. Silage

- 5.2.3. Mulching

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Low-Density Polyethylene

- 5.3.2. Linear Low-Density Polyethylene

- 5.3.3. High-Density Polyethylene

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Greenhouse

- 5.4.2. Silage

- 5.4.3. Mulching

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.5.2. United Kingdom

- 5.5.3. France

- 5.5.4. Spain

- 5.5.5. Italy

- 5.5.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Agricultural Films Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Low-Density Polyethylene

- 6.1.2. Linear Low-Density Polyethylene

- 6.1.3. High-Density Polyethylene

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Greenhouse

- 6.2.2. Silage

- 6.2.3. Mulching

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Low-Density Polyethylene

- 6.3.2. Linear Low-Density Polyethylene

- 6.3.3. High-Density Polyethylene

- 6.3.4. Others

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Greenhouse

- 6.4.2. Silage

- 6.4.3. Mulching

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Agricultural Films Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Low-Density Polyethylene

- 7.1.2. Linear Low-Density Polyethylene

- 7.1.3. High-Density Polyethylene

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Greenhouse

- 7.2.2. Silage

- 7.2.3. Mulching

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Low-Density Polyethylene

- 7.3.2. Linear Low-Density Polyethylene

- 7.3.3. High-Density Polyethylene

- 7.3.4. Others

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Greenhouse

- 7.4.2. Silage

- 7.4.3. Mulching

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Agricultural Films Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Low-Density Polyethylene

- 8.1.2. Linear Low-Density Polyethylene

- 8.1.3. High-Density Polyethylene

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Greenhouse

- 8.2.2. Silage

- 8.2.3. Mulching

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Low-Density Polyethylene

- 8.3.2. Linear Low-Density Polyethylene

- 8.3.3. High-Density Polyethylene

- 8.3.4. Others

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Greenhouse

- 8.4.2. Silage

- 8.4.3. Mulching

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Spain Europe Agricultural Films Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Low-Density Polyethylene

- 9.1.2. Linear Low-Density Polyethylene

- 9.1.3. High-Density Polyethylene

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Greenhouse

- 9.2.2. Silage

- 9.2.3. Mulching

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Low-Density Polyethylene

- 9.3.2. Linear Low-Density Polyethylene

- 9.3.3. High-Density Polyethylene

- 9.3.4. Others

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Greenhouse

- 9.4.2. Silage

- 9.4.3. Mulching

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Agricultural Films Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Low-Density Polyethylene

- 10.1.2. Linear Low-Density Polyethylene

- 10.1.3. High-Density Polyethylene

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Greenhouse

- 10.2.2. Silage

- 10.2.3. Mulching

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Low-Density Polyethylene

- 10.3.2. Linear Low-Density Polyethylene

- 10.3.3. High-Density Polyethylene

- 10.3.4. Others

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Greenhouse

- 10.4.2. Silage

- 10.4.3. Mulching

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Europe Europe Agricultural Films Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Low-Density Polyethylene

- 11.1.2. Linear Low-Density Polyethylene

- 11.1.3. High-Density Polyethylene

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Greenhouse

- 11.2.2. Silage

- 11.2.3. Mulching

- 11.2.4. Others

- 11.3. Market Analysis, Insights and Forecast - by Type

- 11.3.1. Low-Density Polyethylene

- 11.3.2. Linear Low-Density Polyethylene

- 11.3.3. High-Density Polyethylene

- 11.3.4. Others

- 11.4. Market Analysis, Insights and Forecast - by Application

- 11.4.1. Greenhouse

- 11.4.2. Silage

- 11.4.3. Mulching

- 11.4.4. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Trioplast AB

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Barbier Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Polifilm GmbH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ab Rani Plast Oy

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 RKW Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BASF

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Berry Global

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Luigi Bandera Sp

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Duo Plast AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Trioplast AB

List of Figures

- Figure 1: Europe Agricultural Films Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Agricultural Films Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Europe Agricultural Films Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Europe Agricultural Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Europe Agricultural Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Europe Agricultural Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Europe Agricultural Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Europe Agricultural Films Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Europe Agricultural Films Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Europe Agricultural Films Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 35: Europe Agricultural Films Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Agricultural Films Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Europe Agricultural Films Industry?

Key companies in the market include Trioplast AB, Barbier Group, Polifilm GmbH, Ab Rani Plast Oy, RKW Group, BASF, Berry Global, Luigi Bandera Sp, Duo Plast AG.

3. What are the main segments of the Europe Agricultural Films Industry?

The market segments include Type, Application, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Horticulture Industry Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Agricultural Films Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Agricultural Films Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Agricultural Films Industry?

To stay informed about further developments, trends, and reports in the Europe Agricultural Films Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence