Key Insights

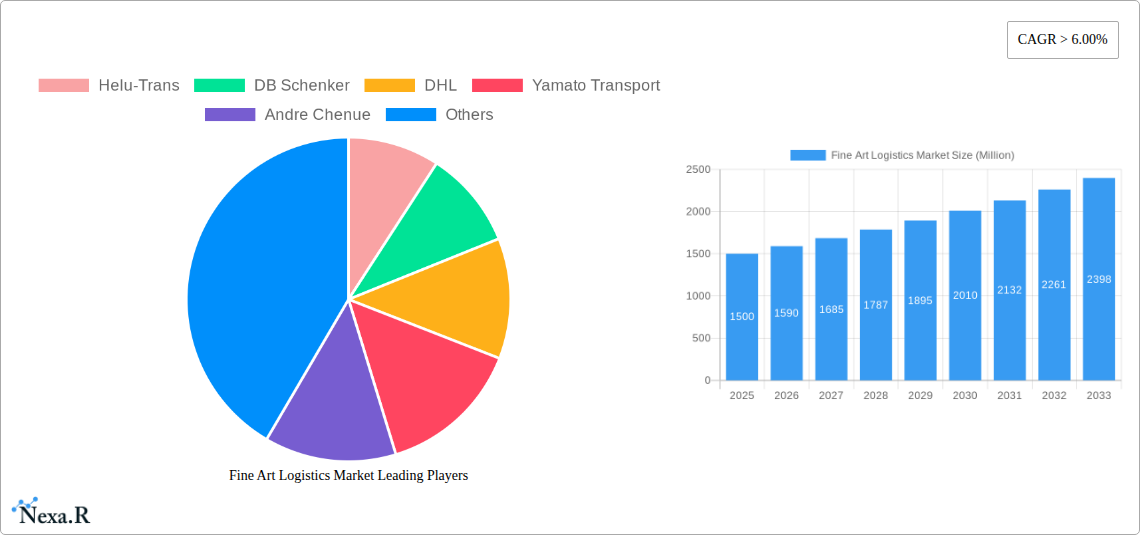

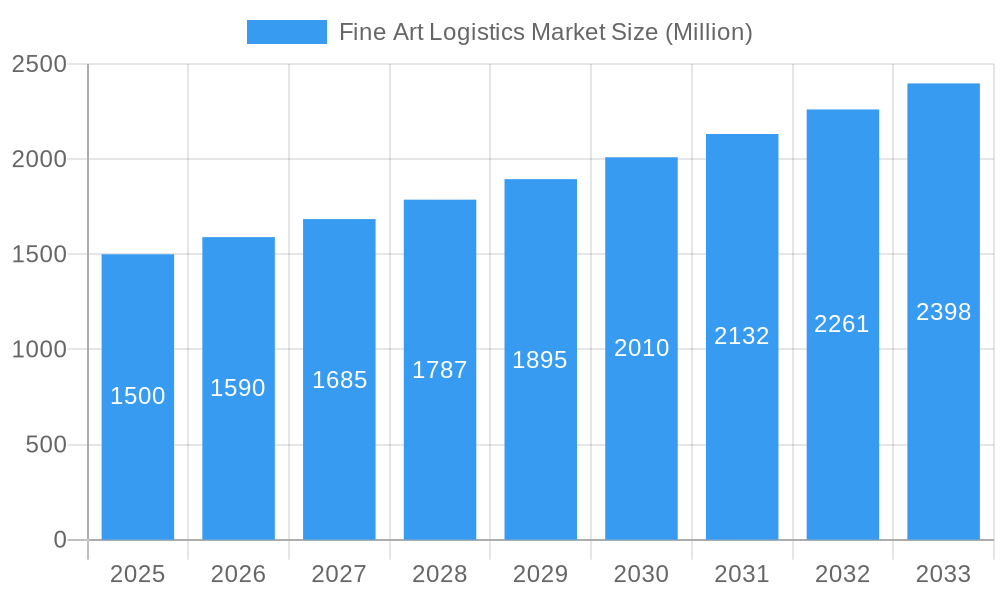

The global Fine Art Logistics market is poised for substantial expansion, with an estimated market size of $2.88 billion by 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 4.97% through 2033. This growth is attributed to several pivotal drivers. The escalating volume and value of global art transactions are directly increasing demand for specialized art handling, packing, and secure storage. A dynamic art market, encompassing galleries, auctions, and art fairs, requires dependable logistics capable of managing high-value, delicate pieces. Furthermore, growing environmental consciousness is fostering a demand for sustainable logistics solutions in artwork conservation. Advancements in tracking, monitoring, and insurance technologies are significantly improving industry security and operational efficiency, thereby boosting client trust. The market is segmented by application, including Art Dealers & Galleries, Auction Houses, Museums, and Art Fairs, alongside service types such as Transportation, Packing, and Storage, catering to the multifaceted needs of the art sector. Key industry players like Helu-Trans, DB Schenker, DHL, and Yamato Transport are strategically investing in infrastructure and technology to leverage these trends, while market maturity and regulatory landscapes influence regional dynamics.

Fine Art Logistics Market Market Size (In Billion)

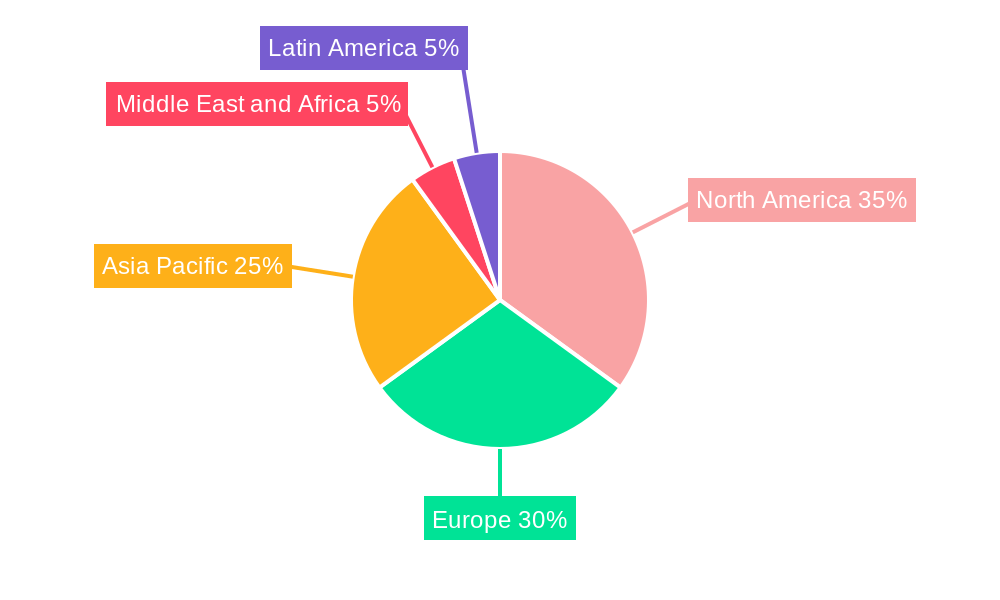

Geographically, the Fine Art Logistics market presents considerable opportunities in North America, Europe, and Asia-Pacific. North America, distinguished by its mature art market infrastructure and a high concentration of galleries and auction houses, currently dominates the market share. Europe, with its profound artistic legacy and vibrant art trade, remains a critical market. The Asia-Pacific region, propelled by robust economic growth and increased engagement in the global art market, is anticipated to experience notable growth. Market challenges include the elevated costs of specialized logistics, demanding regulatory compliance, and the inherent risks tied to transporting invaluable and fragile artworks. Nevertheless, innovative strategies and strategic alliances are effectively addressing these hurdles, supporting sustainable growth within the Fine Art Logistics sector. Companies are prioritizing bespoke solutions, reinforced security protocols, and advanced tracking systems to meet evolving client requirements.

Fine Art Logistics Market Company Market Share

Fine Art Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Fine Art Logistics Market, encompassing market size, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by application (Art Dealers and Galleries, Auction Houses, Museums, Art Fairs) and by type (Transportation, Packing, Storage), offering granular insights into this specialized sector. The report is crucial for investors, logistics providers, art institutions, and anyone seeking to understand and capitalize on the opportunities within the fine art logistics industry. The market value is projected to reach xx Million by 2033.

Fine Art Logistics Market Dynamics & Structure

The Fine Art Logistics market is characterized by a moderately concentrated structure with a few large global players and numerous smaller, specialized firms. Market concentration is estimated at xx%, with the top 5 players holding a combined market share of approximately xx%. Technological innovation, particularly in tracking, handling, and climate-controlled transportation, is a key driver. Stringent regulatory frameworks concerning the handling and transportation of valuable art significantly impact operational costs and procedures. Competition exists from general logistics providers diversifying into this niche, but specialized expertise remains a significant competitive advantage. The market also sees considerable M&A activity, with an average of xx deals annually over the past five years. Innovation barriers include high initial investment costs for specialized equipment and the need for highly skilled personnel.

- Market Concentration: xx% (estimated)

- Top 5 Player Market Share: xx% (estimated)

- Annual M&A Deals (2019-2024): xx (average)

- Key Innovation Barriers: High capital expenditure, skilled labor shortage

Fine Art Logistics Market Growth Trends & Insights

The Fine Art Logistics market experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by increased global art sales and the expansion of the art market in emerging economies. The market is expected to maintain a steady growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising demand for secure and specialized transportation services, advancements in climate-controlled storage technologies, and the increasing use of digital platforms for art transactions. Technological disruptions, such as real-time tracking and blockchain technology for provenance verification, are revolutionizing the industry, improving efficiency, and enhancing security. Shifts in consumer behavior, particularly the growth of online art auctions and sales, have expanded the market reach and further fueled demand. Market penetration of climate-controlled transportation, a crucial element for preserving art, is currently at xx% and projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Fine Art Logistics Market

North America currently dominates the Fine Art Logistics Market, holding the largest market share at xx%, followed by Europe at xx%. This dominance is driven by the presence of major auction houses, numerous art galleries, and established museum networks in these regions. The high concentration of high-net-worth individuals and a robust art market infrastructure further contribute to the regional dominance. The art dealers and galleries segment constitutes the largest application segment, representing xx% of the overall market, due to their consistent need for transportation, packing, and storage services. Rapid growth is anticipated in Asia-Pacific, particularly in China, driven by a growing affluent class, expanding art collector base, and increased participation in international art fairs.

- North America Market Share: xx%

- Europe Market Share: xx%

- Asia-Pacific Growth Drivers: Rising affluence, expanding art collector base

- Largest Application Segment: Art Dealers and Galleries (xx%)

- Fastest-Growing Segment: Asia-Pacific

Fine Art Logistics Market Product Landscape

The Fine Art Logistics market offers a diverse range of specialized services, including climate-controlled transportation using temperature- and humidity-controlled vehicles, custom crating and packaging solutions designed to protect delicate artworks, and secure warehousing facilities with environmental controls. Innovations focus on enhanced tracking systems leveraging GPS and IoT technologies, providing real-time visibility and reducing the risk of loss or damage. The use of AI-powered predictive analytics enhances operational efficiency by optimizing routes and anticipating potential disruptions. The unique selling propositions for providers lie in their specialized expertise, insurance coverage, and the meticulous handling of high-value and fragile items.

Key Drivers, Barriers & Challenges in Fine Art Logistics Market

Key Drivers:

- Growth of the global art market: Increased demand for art transportation and storage.

- Technological advancements: Real-time tracking, climate-controlled solutions.

- Government regulations: Stricter rules regarding art handling necessitate specialized services.

Key Challenges:

- High insurance costs: Protecting valuable artworks against damage or loss.

- Supply chain disruptions: Geopolitical events and global pandemics impact operations.

- Competition from general logistics providers: Pressure on pricing and margins.

Emerging Opportunities in Fine Art Logistics Market

Emerging opportunities include expanding into untapped markets, particularly in developing economies with growing art scenes. The development of specialized services for digital art and NFTs presents a significant growth area. Focus on sustainable and eco-friendly solutions for transportation and storage aligns with growing environmental concerns. Partnerships with art authentication platforms and digital asset management companies offer added value and create new revenue streams.

Growth Accelerators in the Fine Art Logistics Market Industry

Technological advancements, particularly in areas like blockchain technology for provenance verification and AI-driven route optimization, are key accelerators. Strategic partnerships between logistics providers, insurance companies, and art authentication experts enhance service offerings and increase customer trust. Market expansion into emerging economies and development of specialized services for niche art forms further drive market growth.

Key Players Shaping the Fine Art Logistics Market Market

- Helu-Trans

- DB Schenker

- DHL

- Yamato Transport

- Andre Chenue

- U S Art

- Gander & White

- Agility Logistics

- Hasenkamp

- Sinotrans

- LP ART

- 7 3 Other Companies

- Masterpiece International

Notable Milestones in Fine Art Logistics Market Sector

- November 2023: Masterpiece International opens a new full-service operation at Chicago Gateway, expanding its logistics capabilities.

- October 2023: DHL Supply Chain announces a EUR 350 million (USD 378 billion) investment in Southeast Asia to boost warehouse capacity, staff, and sustainability initiatives.

In-Depth Fine Art Logistics Market Market Outlook

The Fine Art Logistics market is poised for significant growth driven by sustained demand, technological innovation, and expansion into new markets. Strategic partnerships, acquisitions, and the development of specialized services tailored to evolving customer needs will shape the future market landscape. The focus on sustainable and digital solutions will be crucial for long-term success. The market presents strong opportunities for both established players and new entrants, particularly those offering innovative solutions that address the specific needs of the art world.

Fine Art Logistics Market Segmentation

-

1. Type

- 1.1. Transportation

- 1.2. Packing

- 1.3. Storage

-

2. application

- 2.1. Art Dealers and Galleries

- 2.2. Auction Houses

- 2.3. Museums

- 2.4. Art Fairs

Fine Art Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Spain

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Singapore

- 3.6. Malaysia

- 3.7. Thailand

- 3.8. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Qatar

- 4.3. United Arab Emirates

- 4.4. Egypt

- 4.5. Rest of Middle East and Africa

-

5. Latin Maerica

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of Latin America

Fine Art Logistics Market Regional Market Share

Geographic Coverage of Fine Art Logistics Market

Fine Art Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Demand for Secure Storage Facilities is Driven by the Increase in Art Collection Value; Specialized Expertise is the Key to Better Handling and Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Transportation Costs; Securing the Packaging and Transport of Fragile Goods is Difficult

- 3.4. Market Trends

- 3.4.1. A Growing Number of Collectors are Supporting the Growth of the Art Logistics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transportation

- 5.1.2. Packing

- 5.1.3. Storage

- 5.2. Market Analysis, Insights and Forecast - by application

- 5.2.1. Art Dealers and Galleries

- 5.2.2. Auction Houses

- 5.2.3. Museums

- 5.2.4. Art Fairs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin Maerica

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Transportation

- 6.1.2. Packing

- 6.1.3. Storage

- 6.2. Market Analysis, Insights and Forecast - by application

- 6.2.1. Art Dealers and Galleries

- 6.2.2. Auction Houses

- 6.2.3. Museums

- 6.2.4. Art Fairs

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Transportation

- 7.1.2. Packing

- 7.1.3. Storage

- 7.2. Market Analysis, Insights and Forecast - by application

- 7.2.1. Art Dealers and Galleries

- 7.2.2. Auction Houses

- 7.2.3. Museums

- 7.2.4. Art Fairs

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Transportation

- 8.1.2. Packing

- 8.1.3. Storage

- 8.2. Market Analysis, Insights and Forecast - by application

- 8.2.1. Art Dealers and Galleries

- 8.2.2. Auction Houses

- 8.2.3. Museums

- 8.2.4. Art Fairs

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Transportation

- 9.1.2. Packing

- 9.1.3. Storage

- 9.2. Market Analysis, Insights and Forecast - by application

- 9.2.1. Art Dealers and Galleries

- 9.2.2. Auction Houses

- 9.2.3. Museums

- 9.2.4. Art Fairs

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin Maerica Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Transportation

- 10.1.2. Packing

- 10.1.3. Storage

- 10.2. Market Analysis, Insights and Forecast - by application

- 10.2.1. Art Dealers and Galleries

- 10.2.2. Auction Houses

- 10.2.3. Museums

- 10.2.4. Art Fairs

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Helu-Trans

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DB Schenker

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yamato Transport

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Andre Chenue

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 U S Art

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gander & White

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Agility Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hasenkamp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sinotrans

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LP ART*List Not Exhaustive 7 3 Other Companie

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Masterpiece International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Helu-Trans

List of Figures

- Figure 1: Global Fine Art Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 5: North America Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 6: North America Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 11: Europe Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 12: Europe Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 17: Asia Pacific Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 18: Asia Pacific Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East and Africa Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 23: Middle East and Africa Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 24: Middle East and Africa Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin Maerica Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Latin Maerica Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin Maerica Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 29: Latin Maerica Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 30: Latin Maerica Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Latin Maerica Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 3: Global Fine Art Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 6: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 12: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 20: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: China Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Australia Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Singapore Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Malaysia Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Thailand Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 31: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Saudi Arabia Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Qatar Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Egypt Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 39: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Brazil Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Argentina Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Latin America Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fine Art Logistics Market?

The projected CAGR is approximately 4.97%.

2. Which companies are prominent players in the Fine Art Logistics Market?

Key companies in the market include Helu-Trans, DB Schenker, DHL, Yamato Transport, Andre Chenue, U S Art, Gander & White, Agility Logistics, Hasenkamp, Sinotrans, LP ART*List Not Exhaustive 7 3 Other Companie, Masterpiece International.

3. What are the main segments of the Fine Art Logistics Market?

The market segments include Type, application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.88 billion as of 2022.

5. What are some drivers contributing to market growth?

The Demand for Secure Storage Facilities is Driven by the Increase in Art Collection Value; Specialized Expertise is the Key to Better Handling and Market Growth.

6. What are the notable trends driving market growth?

A Growing Number of Collectors are Supporting the Growth of the Art Logistics Market.

7. Are there any restraints impacting market growth?

High Cost of Transportation Costs; Securing the Packaging and Transport of Fragile Goods is Difficult.

8. Can you provide examples of recent developments in the market?

November 2023: The opening of a new full-service operation at Chicago Gateway is a proud moment for Masterpiece International. The strategically located facility provides an enhanced and comprehensive set of logistics capabilities in the market. The company Masterpiece International, which has a state-of-the-art 75,000 sq f fulfillment center located at Chicago O'Hare Airport near some of the region's largest intermodal terminals, continues to invest in innovative supply chain innovation for aviation, energy, life sciences, and customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fine Art Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fine Art Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fine Art Logistics Market?

To stay informed about further developments, trends, and reports in the Fine Art Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence