Key Insights

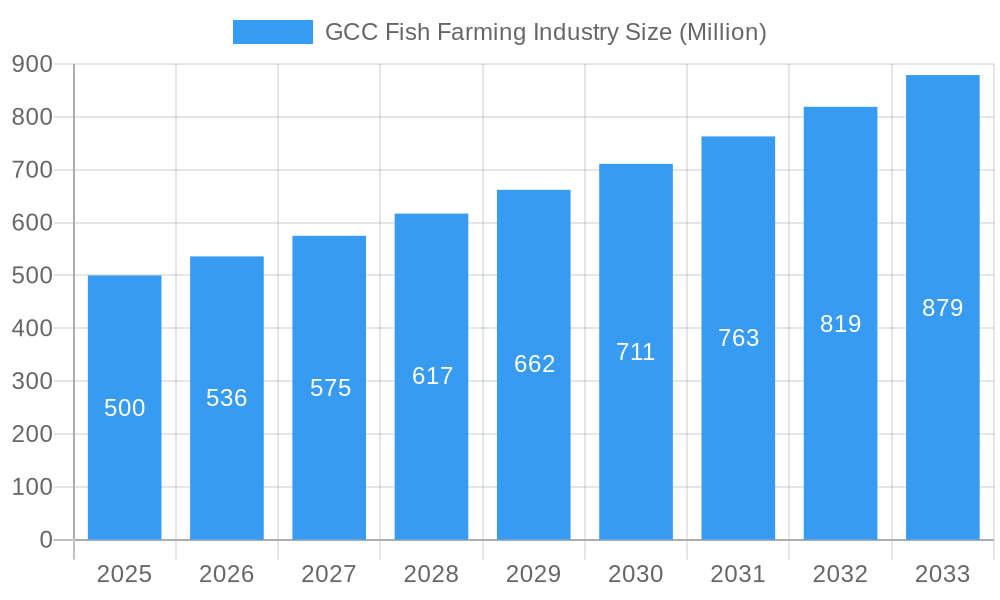

The GCC fish farming industry is experiencing robust growth, projected to reach a substantial market size driven by increasing seafood demand, government support for sustainable aquaculture, and a growing awareness of the health benefits of fish consumption. The 7.20% CAGR indicates a significant expansion over the forecast period (2025-2033), with the market value expected to surpass $XXX million by 2033 (estimation based on 2025 market size and CAGR). Key drivers include rising populations, increasing disposable incomes leading to higher seafood consumption, and government initiatives promoting food security and diversification away from traditional fishing. The industry's segmentation reveals a diverse market encompassing pelagic, demersal, and freshwater fish farming, along with crustaceans and other high-value seafood. This diversity offers opportunities for specialization and catering to various consumer preferences. Challenges include the high initial investment costs associated with establishing aquaculture farms, the need for advanced technology and skilled labor, and the potential environmental concerns related to unsustainable practices. However, the adoption of sustainable aquaculture techniques, coupled with governmental regulations and incentives, is mitigating these challenges.

GCC Fish Farming Industry Market Size (In Million)

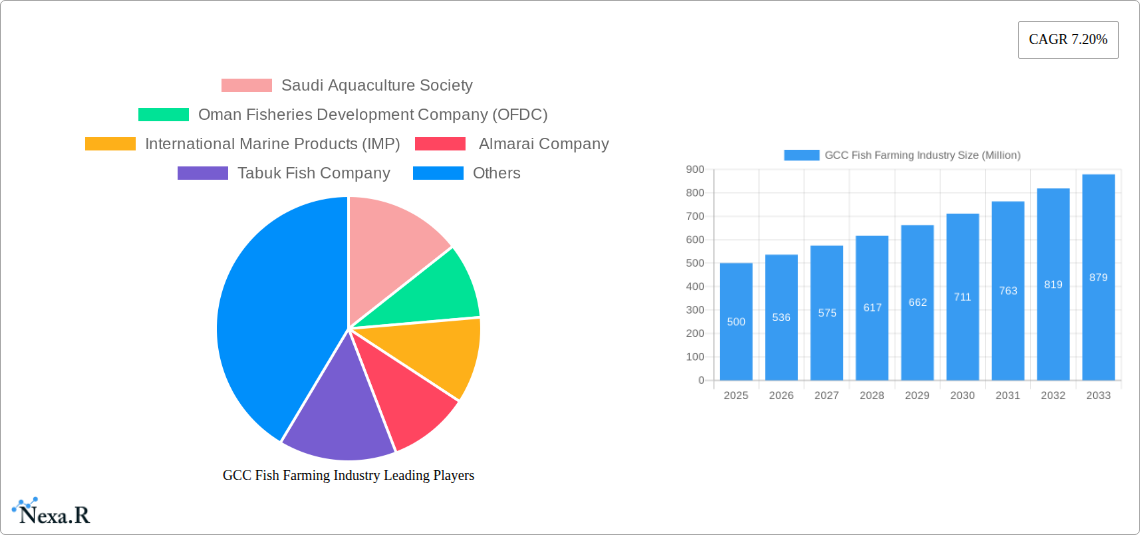

Major players like Saudi Aquaculture Society, Oman Fisheries Development Company (OFDC), International Marine Products (IMP), Almarai Company, and Tabuk Fish Company are key contributors to market growth, driving innovation and technological advancements. Their strategic investments in modern aquaculture facilities and efficient farming techniques contribute to increased production and improved product quality. Future growth will be significantly influenced by the successful implementation of sustainable farming practices, government policies promoting responsible aquaculture, and innovative approaches to market access and distribution. The diversification of species being farmed, including high-value products such as caviar, along with investments in research and development are likely to fuel future market expansion and enhance the overall resilience of the GCC fish farming sector.

GCC Fish Farming Industry Company Market Share

GCC Fish Farming Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report delivers an in-depth analysis of the GCC fish farming industry, providing crucial insights for investors, industry professionals, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a detailed understanding of the market's historical performance, current status, and future trajectory. The report covers key market segments, including Pelagic Fish, Demersal Fish (like Barracuda and Pomfret), Freshwater Fish (like Tilapia), and high-value species such as Scallop, Lobster, Shrimp, and Caviar.

GCC Fish Farming Industry Market Dynamics & Structure

The GCC fish farming market presents a dynamic landscape characterized by moderate market concentration, increasing technological innovation, evolving regulatory frameworks, and growing competition from imported seafood. The market is witnessing a rise in mergers and acquisitions (M&A) activity as larger players seek to consolidate their market share and expand their operations. While the exact market share percentages for individual companies are unavailable (xx), Saudi Aquaculture Society, Oman Fisheries Development Company (OFDC), International Marine Products (IMP), Almarai Company, and Tabuk Fish Company are key players. Innovation is driven by the need for sustainable and efficient farming practices, but barriers include high initial investment costs and access to advanced technologies.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Technological Innovation: Driven by automation, precision aquaculture, and disease management technologies. Barriers include high costs and skilled labor shortages.

- Regulatory Frameworks: Vary across GCC countries, impacting operational costs and sustainability.

- Competitive Product Substitutes: Imported seafood poses a significant competitive threat.

- End-User Demographics: Growing population and rising disposable incomes fuel demand.

- M&A Trends: Increasing consolidation driven by expansion strategies and economies of scale. (Estimated xx M&A deals in the last 5 years).

GCC Fish Farming Industry Growth Trends & Insights

The GCC fish farming industry is experiencing robust growth, driven by factors such as rising population, increasing consumer demand for seafood, government initiatives to promote aquaculture, and technological advancements enhancing production efficiency. The market size is expected to reach xx million in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Increased consumer awareness of the health benefits of fish and a growing preference for sustainably sourced seafood further contribute to market expansion. Technological disruptions, like automation and data-driven farming techniques, are improving yield and reducing operational costs. Consumer behavior shifts toward healthier, convenient food options also favor the growth of the sector. The market penetration rate is currently at xx% and is projected to increase to xx% by 2033.

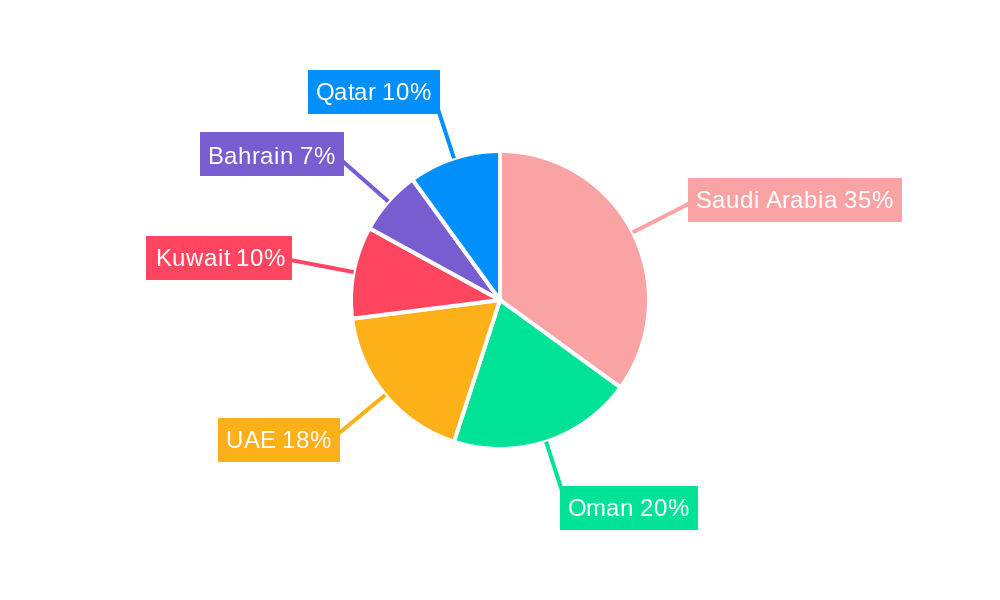

Dominant Regions, Countries, or Segments in GCC Fish Farming Industry

Saudi Arabia and Oman are currently the leading countries in the GCC fish farming industry, driven by significant government investments in aquaculture infrastructure and supportive regulatory frameworks. The Tilapia segment dominates the freshwater fish market due to high consumer preference and ease of farming. Among the high-value species, shrimp farming holds a significant market share owing to robust demand and attractive export opportunities. Pelagic fish farming is also seeing growth due to increasing demand.

- Key Drivers:

- Government subsidies and support for aquaculture development.

- Investments in research and development for improved farming techniques.

- Development of efficient processing and distribution networks.

- Growing consumer awareness of the health benefits of seafood.

- Dominance Factors: Saudi Arabia and Oman lead due to favorable government policies, extensive coastline, and substantial investments. Tilapia and Shrimp segments are dominant due to high consumer preference and export potential.

GCC Fish Farming Industry Product Landscape

The GCC fish farming industry offers a diverse range of products, encompassing various fish species, shellfish, and crustaceans. Product innovations focus on enhancing production efficiency, improving product quality, and catering to evolving consumer preferences. Technological advancements in areas like recirculating aquaculture systems (RAS) and automated feeding systems are improving yields and reducing operational costs. Unique selling propositions often center on sustainability certifications, traceability, and superior product quality.

Key Drivers, Barriers & Challenges in GCC Fish Farming Industry

Key Drivers:

- Increasing demand for seafood driven by population growth and changing dietary habits.

- Government support and initiatives to boost domestic seafood production.

- Technological advancements leading to higher yields and improved efficiency.

Challenges:

- High initial investment costs for establishing fish farms.

- Limited access to advanced technologies and skilled labor.

- Disease outbreaks and environmental concerns impacting production.

- Fluctuations in feed prices and global market dynamics. (Estimated xx% impact on profitability due to feed price volatility).

Emerging Opportunities in GCC Fish Farming Industry

Emerging opportunities include exploring new species, expanding into value-added products (e.g., processed seafood), developing sustainable aquaculture practices, leveraging technology to enhance efficiency and traceability, and targeting niche markets like organic and specialty seafood. Untapped potential lies in developing integrated aquaculture systems that minimize environmental impact and improve resource utilization.

Growth Accelerators in the GCC Fish Farming Industry

Long-term growth will be fueled by further technological advancements, including the adoption of precision aquaculture and AI-powered farming techniques. Strategic partnerships between government agencies, private companies, and research institutions will also play a crucial role. Expansion into new markets and the development of robust supply chains to ensure consistent product availability will also be key factors driving industry growth.

Key Players Shaping the GCC Fish Farming Industry Market

- Saudi Aquaculture Society

- Oman Fisheries Development Company (OFDC)

- International Marine Products (IMP)

- Almarai Company

- Tabuk Fish Company

Notable Milestones in GCC Fish Farming Industry Sector

- April 2021: NEOM's agreement with Tabuk Fish Company to build a 70 million fingerling capacity hatchery, the largest in MENA.

- September 2021: OFDC expands its value chain presence through fleet expansion and value-added processing.

- June 2022: Saudi Arabia joins the Network of Aquaculture Centres in Asia-Pacific (NACA), signifying commitment to sustainable aquaculture.

In-Depth GCC Fish Farming Industry Market Outlook

The GCC fish farming industry is poised for significant growth, driven by favorable government policies, rising consumer demand, and technological advancements. Strategic investments in sustainable aquaculture practices, technological innovation, and skilled workforce development will be essential for realizing the market’s full potential. Opportunities exist in expanding production capacity, developing value-added products, and strengthening regional and international market linkages. The market is projected to reach xx million by 2033, presenting substantial opportunities for investors and industry players alike.

GCC Fish Farming Industry Segmentation

-

1. Type

-

1.1. Pelagic Fish

- 1.1.1. Sardine

- 1.1.2. Mackerel

- 1.1.3. Tuna

- 1.1.4. Barracuda

-

1.2. Demersal Fish

- 1.2.1. Grouper

- 1.2.2. Trevally

- 1.2.3. Emperor

- 1.2.4. Pomfret

-

1.3. Freshwater Fish

- 1.3.1. Tilapia

- 1.4. Scallop

- 1.5. Lobster

- 1.6. Shrimp

- 1.7. Caviar

- 1.8. Other Types

-

1.1. Pelagic Fish

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Oman

- 2.4. Qatar

- 2.5. Bahrain

- 2.6. Kuwait

-

3. Type

-

3.1. Pelagic Fish

- 3.1.1. Sardine

- 3.1.2. Mackerel

- 3.1.3. Tuna

- 3.1.4. Barracuda

-

3.2. Demersal Fish

- 3.2.1. Grouper

- 3.2.2. Trevally

- 3.2.3. Emperor

- 3.2.4. Pomfret

-

3.3. Freshwater Fish

- 3.3.1. Tilapia

- 3.4. Scallop

- 3.5. Lobster

- 3.6. Shrimp

- 3.7. Caviar

- 3.8. Other Types

-

3.1. Pelagic Fish

GCC Fish Farming Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Oman

- 4. Qatar

- 5. Bahrain

- 6. Kuwait

GCC Fish Farming Industry Regional Market Share

Geographic Coverage of GCC Fish Farming Industry

GCC Fish Farming Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Government Initiatives for Sustainable Fish Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pelagic Fish

- 5.1.1.1. Sardine

- 5.1.1.2. Mackerel

- 5.1.1.3. Tuna

- 5.1.1.4. Barracuda

- 5.1.2. Demersal Fish

- 5.1.2.1. Grouper

- 5.1.2.2. Trevally

- 5.1.2.3. Emperor

- 5.1.2.4. Pomfret

- 5.1.3. Freshwater Fish

- 5.1.3.1. Tilapia

- 5.1.4. Scallop

- 5.1.5. Lobster

- 5.1.6. Shrimp

- 5.1.7. Caviar

- 5.1.8. Other Types

- 5.1.1. Pelagic Fish

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Oman

- 5.2.4. Qatar

- 5.2.5. Bahrain

- 5.2.6. Kuwait

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Pelagic Fish

- 5.3.1.1. Sardine

- 5.3.1.2. Mackerel

- 5.3.1.3. Tuna

- 5.3.1.4. Barracuda

- 5.3.2. Demersal Fish

- 5.3.2.1. Grouper

- 5.3.2.2. Trevally

- 5.3.2.3. Emperor

- 5.3.2.4. Pomfret

- 5.3.3. Freshwater Fish

- 5.3.3.1. Tilapia

- 5.3.4. Scallop

- 5.3.5. Lobster

- 5.3.6. Shrimp

- 5.3.7. Caviar

- 5.3.8. Other Types

- 5.3.1. Pelagic Fish

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Oman

- 5.4.4. Qatar

- 5.4.5. Bahrain

- 5.4.6. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pelagic Fish

- 6.1.1.1. Sardine

- 6.1.1.2. Mackerel

- 6.1.1.3. Tuna

- 6.1.1.4. Barracuda

- 6.1.2. Demersal Fish

- 6.1.2.1. Grouper

- 6.1.2.2. Trevally

- 6.1.2.3. Emperor

- 6.1.2.4. Pomfret

- 6.1.3. Freshwater Fish

- 6.1.3.1. Tilapia

- 6.1.4. Scallop

- 6.1.5. Lobster

- 6.1.6. Shrimp

- 6.1.7. Caviar

- 6.1.8. Other Types

- 6.1.1. Pelagic Fish

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Oman

- 6.2.4. Qatar

- 6.2.5. Bahrain

- 6.2.6. Kuwait

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Pelagic Fish

- 6.3.1.1. Sardine

- 6.3.1.2. Mackerel

- 6.3.1.3. Tuna

- 6.3.1.4. Barracuda

- 6.3.2. Demersal Fish

- 6.3.2.1. Grouper

- 6.3.2.2. Trevally

- 6.3.2.3. Emperor

- 6.3.2.4. Pomfret

- 6.3.3. Freshwater Fish

- 6.3.3.1. Tilapia

- 6.3.4. Scallop

- 6.3.5. Lobster

- 6.3.6. Shrimp

- 6.3.7. Caviar

- 6.3.8. Other Types

- 6.3.1. Pelagic Fish

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pelagic Fish

- 7.1.1.1. Sardine

- 7.1.1.2. Mackerel

- 7.1.1.3. Tuna

- 7.1.1.4. Barracuda

- 7.1.2. Demersal Fish

- 7.1.2.1. Grouper

- 7.1.2.2. Trevally

- 7.1.2.3. Emperor

- 7.1.2.4. Pomfret

- 7.1.3. Freshwater Fish

- 7.1.3.1. Tilapia

- 7.1.4. Scallop

- 7.1.5. Lobster

- 7.1.6. Shrimp

- 7.1.7. Caviar

- 7.1.8. Other Types

- 7.1.1. Pelagic Fish

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Oman

- 7.2.4. Qatar

- 7.2.5. Bahrain

- 7.2.6. Kuwait

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Pelagic Fish

- 7.3.1.1. Sardine

- 7.3.1.2. Mackerel

- 7.3.1.3. Tuna

- 7.3.1.4. Barracuda

- 7.3.2. Demersal Fish

- 7.3.2.1. Grouper

- 7.3.2.2. Trevally

- 7.3.2.3. Emperor

- 7.3.2.4. Pomfret

- 7.3.3. Freshwater Fish

- 7.3.3.1. Tilapia

- 7.3.4. Scallop

- 7.3.5. Lobster

- 7.3.6. Shrimp

- 7.3.7. Caviar

- 7.3.8. Other Types

- 7.3.1. Pelagic Fish

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Oman GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pelagic Fish

- 8.1.1.1. Sardine

- 8.1.1.2. Mackerel

- 8.1.1.3. Tuna

- 8.1.1.4. Barracuda

- 8.1.2. Demersal Fish

- 8.1.2.1. Grouper

- 8.1.2.2. Trevally

- 8.1.2.3. Emperor

- 8.1.2.4. Pomfret

- 8.1.3. Freshwater Fish

- 8.1.3.1. Tilapia

- 8.1.4. Scallop

- 8.1.5. Lobster

- 8.1.6. Shrimp

- 8.1.7. Caviar

- 8.1.8. Other Types

- 8.1.1. Pelagic Fish

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Oman

- 8.2.4. Qatar

- 8.2.5. Bahrain

- 8.2.6. Kuwait

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Pelagic Fish

- 8.3.1.1. Sardine

- 8.3.1.2. Mackerel

- 8.3.1.3. Tuna

- 8.3.1.4. Barracuda

- 8.3.2. Demersal Fish

- 8.3.2.1. Grouper

- 8.3.2.2. Trevally

- 8.3.2.3. Emperor

- 8.3.2.4. Pomfret

- 8.3.3. Freshwater Fish

- 8.3.3.1. Tilapia

- 8.3.4. Scallop

- 8.3.5. Lobster

- 8.3.6. Shrimp

- 8.3.7. Caviar

- 8.3.8. Other Types

- 8.3.1. Pelagic Fish

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Qatar GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pelagic Fish

- 9.1.1.1. Sardine

- 9.1.1.2. Mackerel

- 9.1.1.3. Tuna

- 9.1.1.4. Barracuda

- 9.1.2. Demersal Fish

- 9.1.2.1. Grouper

- 9.1.2.2. Trevally

- 9.1.2.3. Emperor

- 9.1.2.4. Pomfret

- 9.1.3. Freshwater Fish

- 9.1.3.1. Tilapia

- 9.1.4. Scallop

- 9.1.5. Lobster

- 9.1.6. Shrimp

- 9.1.7. Caviar

- 9.1.8. Other Types

- 9.1.1. Pelagic Fish

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. United Arab Emirates

- 9.2.3. Oman

- 9.2.4. Qatar

- 9.2.5. Bahrain

- 9.2.6. Kuwait

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Pelagic Fish

- 9.3.1.1. Sardine

- 9.3.1.2. Mackerel

- 9.3.1.3. Tuna

- 9.3.1.4. Barracuda

- 9.3.2. Demersal Fish

- 9.3.2.1. Grouper

- 9.3.2.2. Trevally

- 9.3.2.3. Emperor

- 9.3.2.4. Pomfret

- 9.3.3. Freshwater Fish

- 9.3.3.1. Tilapia

- 9.3.4. Scallop

- 9.3.5. Lobster

- 9.3.6. Shrimp

- 9.3.7. Caviar

- 9.3.8. Other Types

- 9.3.1. Pelagic Fish

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Bahrain GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pelagic Fish

- 10.1.1.1. Sardine

- 10.1.1.2. Mackerel

- 10.1.1.3. Tuna

- 10.1.1.4. Barracuda

- 10.1.2. Demersal Fish

- 10.1.2.1. Grouper

- 10.1.2.2. Trevally

- 10.1.2.3. Emperor

- 10.1.2.4. Pomfret

- 10.1.3. Freshwater Fish

- 10.1.3.1. Tilapia

- 10.1.4. Scallop

- 10.1.5. Lobster

- 10.1.6. Shrimp

- 10.1.7. Caviar

- 10.1.8. Other Types

- 10.1.1. Pelagic Fish

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. United Arab Emirates

- 10.2.3. Oman

- 10.2.4. Qatar

- 10.2.5. Bahrain

- 10.2.6. Kuwait

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Pelagic Fish

- 10.3.1.1. Sardine

- 10.3.1.2. Mackerel

- 10.3.1.3. Tuna

- 10.3.1.4. Barracuda

- 10.3.2. Demersal Fish

- 10.3.2.1. Grouper

- 10.3.2.2. Trevally

- 10.3.2.3. Emperor

- 10.3.2.4. Pomfret

- 10.3.3. Freshwater Fish

- 10.3.3.1. Tilapia

- 10.3.4. Scallop

- 10.3.5. Lobster

- 10.3.6. Shrimp

- 10.3.7. Caviar

- 10.3.8. Other Types

- 10.3.1. Pelagic Fish

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Kuwait GCC Fish Farming Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Pelagic Fish

- 11.1.1.1. Sardine

- 11.1.1.2. Mackerel

- 11.1.1.3. Tuna

- 11.1.1.4. Barracuda

- 11.1.2. Demersal Fish

- 11.1.2.1. Grouper

- 11.1.2.2. Trevally

- 11.1.2.3. Emperor

- 11.1.2.4. Pomfret

- 11.1.3. Freshwater Fish

- 11.1.3.1. Tilapia

- 11.1.4. Scallop

- 11.1.5. Lobster

- 11.1.6. Shrimp

- 11.1.7. Caviar

- 11.1.8. Other Types

- 11.1.1. Pelagic Fish

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. United Arab Emirates

- 11.2.3. Oman

- 11.2.4. Qatar

- 11.2.5. Bahrain

- 11.2.6. Kuwait

- 11.3. Market Analysis, Insights and Forecast - by Type

- 11.3.1. Pelagic Fish

- 11.3.1.1. Sardine

- 11.3.1.2. Mackerel

- 11.3.1.3. Tuna

- 11.3.1.4. Barracuda

- 11.3.2. Demersal Fish

- 11.3.2.1. Grouper

- 11.3.2.2. Trevally

- 11.3.2.3. Emperor

- 11.3.2.4. Pomfret

- 11.3.3. Freshwater Fish

- 11.3.3.1. Tilapia

- 11.3.4. Scallop

- 11.3.5. Lobster

- 11.3.6. Shrimp

- 11.3.7. Caviar

- 11.3.8. Other Types

- 11.3.1. Pelagic Fish

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Saudi Aquaculture Society

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Oman Fisheries Development Company (OFDC)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 International Marine Products (IMP)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Almarai Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Tabuk Fish Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.1 Saudi Aquaculture Society

List of Figures

- Figure 1: Global GCC Fish Farming Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global GCC Fish Farming Industry Volume Breakdown (Kiloton, %) by Region 2025 & 2033

- Figure 3: Saudi Arabia GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 5: Saudi Arabia GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Saudi Arabia GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Saudi Arabia GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 8: Saudi Arabia GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 9: Saudi Arabia GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 11: Saudi Arabia GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 12: Saudi Arabia GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 13: Saudi Arabia GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Saudi Arabia GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 15: Saudi Arabia GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: Saudi Arabia GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 17: Saudi Arabia GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Saudi Arabia GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: United Arab Emirates GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 20: United Arab Emirates GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 21: United Arab Emirates GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: United Arab Emirates GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: United Arab Emirates GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 24: United Arab Emirates GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 25: United Arab Emirates GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 26: United Arab Emirates GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 27: United Arab Emirates GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 28: United Arab Emirates GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 29: United Arab Emirates GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: United Arab Emirates GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: United Arab Emirates GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: United Arab Emirates GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 33: United Arab Emirates GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: United Arab Emirates GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Oman GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 36: Oman GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 37: Oman GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Oman GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 39: Oman GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 40: Oman GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 41: Oman GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 42: Oman GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 43: Oman GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 44: Oman GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 45: Oman GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: Oman GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 47: Oman GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Oman GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 49: Oman GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Oman GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Qatar GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 52: Qatar GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 53: Qatar GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Qatar GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Qatar GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 56: Qatar GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 57: Qatar GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 58: Qatar GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 59: Qatar GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 60: Qatar GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 61: Qatar GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 62: Qatar GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 63: Qatar GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Qatar GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 65: Qatar GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Qatar GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Bahrain GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 68: Bahrain GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 69: Bahrain GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 70: Bahrain GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 71: Bahrain GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 72: Bahrain GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 73: Bahrain GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 74: Bahrain GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 75: Bahrain GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 76: Bahrain GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 77: Bahrain GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 78: Bahrain GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 79: Bahrain GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: Bahrain GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 81: Bahrain GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Bahrain GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Kuwait GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 84: Kuwait GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 85: Kuwait GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 86: Kuwait GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 87: Kuwait GCC Fish Farming Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 88: Kuwait GCC Fish Farming Industry Volume (Kiloton), by Geography 2025 & 2033

- Figure 89: Kuwait GCC Fish Farming Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 90: Kuwait GCC Fish Farming Industry Volume Share (%), by Geography 2025 & 2033

- Figure 91: Kuwait GCC Fish Farming Industry Revenue (undefined), by Type 2025 & 2033

- Figure 92: Kuwait GCC Fish Farming Industry Volume (Kiloton), by Type 2025 & 2033

- Figure 93: Kuwait GCC Fish Farming Industry Revenue Share (%), by Type 2025 & 2033

- Figure 94: Kuwait GCC Fish Farming Industry Volume Share (%), by Type 2025 & 2033

- Figure 95: Kuwait GCC Fish Farming Industry Revenue (undefined), by Country 2025 & 2033

- Figure 96: Kuwait GCC Fish Farming Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 97: Kuwait GCC Fish Farming Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Kuwait GCC Fish Farming Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 3: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 5: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 7: Global GCC Fish Farming Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 9: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 11: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 13: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 15: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 17: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 19: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 21: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 23: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 27: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 29: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 31: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 33: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 35: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 36: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 37: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 39: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 41: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 42: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 43: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 44: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 45: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 46: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 47: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 49: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 50: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 51: Global GCC Fish Farming Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 52: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 53: Global GCC Fish Farming Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 54: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Type 2020 & 2033

- Table 55: Global GCC Fish Farming Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Global GCC Fish Farming Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Fish Farming Industry?

The projected CAGR is approximately 5.76%.

2. Which companies are prominent players in the GCC Fish Farming Industry?

Key companies in the market include Saudi Aquaculture Society , Oman Fisheries Development Company (OFDC) , International Marine Products (IMP), Almarai Company , Tabuk Fish Company .

3. What are the main segments of the GCC Fish Farming Industry?

The market segments include Type, Geography, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Government Initiatives for Sustainable Fish Farming.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

June 2022: The Ministry of Environment, Water, and Agriculture (MEWA) has decided to make the Kingdom of Saudi Arabia one of the first in the world in the aquaculture sector to be a member of the Network of Aquaculture Centres in Asia-Pacific (NACA).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Fish Farming Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Fish Farming Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Fish Farming Industry?

To stay informed about further developments, trends, and reports in the GCC Fish Farming Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence