Key Insights

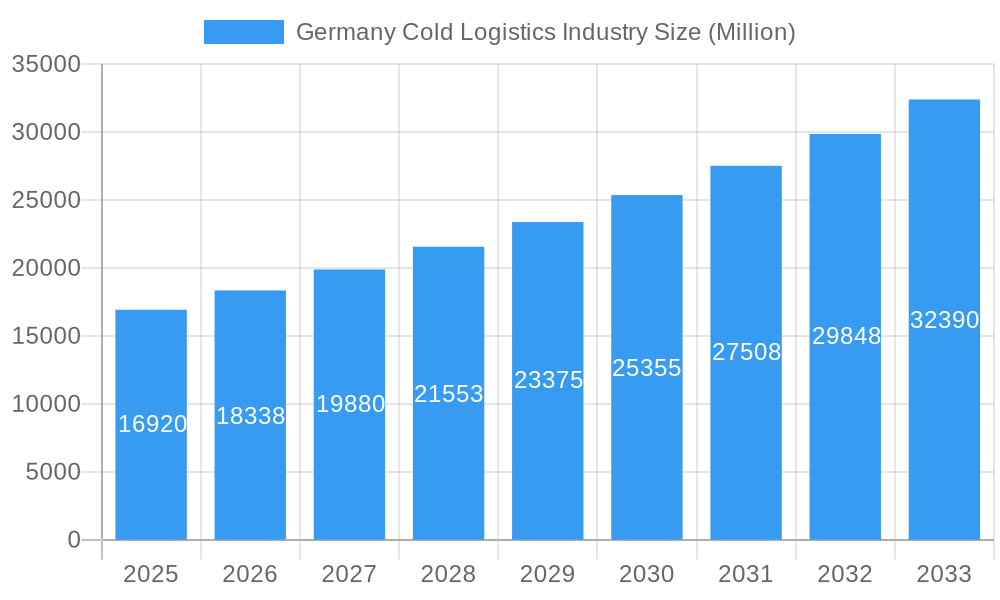

The German cold logistics market, valued at €16.92 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.50% from 2025 to 2033. This expansion is driven by several key factors. The rising demand for fresh produce, particularly fruits and vegetables, coupled with increasing consumer preference for chilled and frozen food products, fuels the need for efficient cold chain solutions. Furthermore, the growth of e-commerce and online grocery delivery services significantly contributes to the market's expansion, demanding sophisticated cold chain management to ensure product quality and safety. The pharmaceutical and life sciences sectors also contribute substantially, requiring stringent temperature-controlled logistics for sensitive medications and biological materials. Growth within Germany is particularly strong in regions like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse, reflecting high population densities and robust food and pharmaceutical industries. The market is segmented by service type (storage, transportation, value-added services like blast freezing and inventory management), temperature type (ambient, chilled, frozen), and application (horticulture, dairy, meat & seafood, processed food, pharmaceuticals, life sciences, and chemicals). Competition is intense, with major players like NewCold Advanced Logistics, A.P. Moller-Maersk, and DHL vying for market share. However, opportunities exist for smaller specialized firms to cater to niche sectors and specific regional needs.

Germany Cold Logistics Industry Market Size (In Billion)

The German cold logistics market’s future prospects remain positive, fueled by ongoing technological advancements, including automation and improved tracking systems. Increased sustainability concerns are driving the adoption of eco-friendly transportation methods and energy-efficient warehousing solutions. Government regulations focused on food safety and quality will continue to support market growth. However, challenges remain, including fluctuating energy costs, driver shortages, and the need for continuous infrastructure upgrades to accommodate the growing demand. The market's competitive landscape is expected to see consolidation and strategic partnerships as companies seek to enhance their service offerings and geographic reach within Germany and beyond. The consistent growth trajectory suggests significant investment opportunities within the sector.

Germany Cold Logistics Industry Company Market Share

Germany Cold Logistics Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the German cold logistics industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages extensive data analysis to deliver actionable insights for industry professionals, investors, and stakeholders. The report segments the market by services (storage, transportation, value-added services), temperature type (ambient, chilled, frozen), and application (horticulture, dairy, meat & seafood, processed food, pharmaceuticals, life sciences & chemicals, other).

Germany Cold Logistics Industry Market Dynamics & Structure

The German cold logistics market, a significant sub-sector of the fourth-largest logistics market globally, is characterized by a moderately concentrated structure with both large multinational corporations and specialized regional players. Market size in 2025 is estimated at XX Million. The industry is driven by technological innovations such as automated warehousing, IoT-enabled tracking, and advanced refrigeration technologies. Stringent regulatory frameworks concerning food safety and pharmaceutical handling significantly influence operational practices. Competitive product substitutes, primarily in transportation, are emerging, putting pressure on traditional players. The end-user demographics are diverse, ranging from large-scale retailers and food processors to smaller specialized businesses. Recent M&A activity highlights consolidation trends.

- Market Concentration: The top 5 players hold an estimated XX% market share in 2025.

- Technological Innovation: Investment in automation and digitalization is driving efficiency gains. Barriers include high initial capital expenditure and integration complexities.

- Regulatory Framework: Compliance with stringent food safety and pharmaceutical regulations is crucial.

- Competitive Substitutes: The rise of alternative transportation methods, particularly for smaller shipments, presents a challenge.

- M&A Trends: The recent acquisition of ETS Transport & Logistics by Scan Global Logistics exemplifies the industry's consolidation trend. The number of M&A deals between 2019 and 2024 was approximately XX.

Germany Cold Logistics Industry Growth Trends & Insights

The German cold logistics market experienced robust growth between 2019 and 2024, driven by rising consumer demand for fresh and processed food, growth in e-commerce, and increasing pharmaceutical shipments. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033), reaching an estimated XX Million by 2033. Technological disruptions, such as blockchain technology for enhanced traceability and AI for optimized route planning, are reshaping operational efficiencies. Consumer preferences toward healthier and more sustainably sourced products are further fueling market expansion. The market penetration of advanced cold chain solutions is gradually increasing.

Dominant Regions, Countries, or Segments in Germany Cold Logistics Industry

While the German cold logistics market is characterized by a relatively uniform geographic distribution of demand and infrastructure, specific segments are demonstrating significantly stronger growth trajectories and hold substantial future potential. The frozen food segment is poised to lead within the temperature type category, propelled by sustained and increasing consumer preference for a wide array of frozen food products. Concurrently, value-added services, encompassing specialized offerings such as blast freezing, precision labeling, and sophisticated inventory management, are experiencing a more rapid expansion than foundational storage and transportation services. The pharmaceutical and life sciences application segment represents a particularly high-growth opportunity, driven by the non-negotiable and increasingly stringent temperature control requirements essential for the integrity and efficacy of these sensitive products.

- Key Drivers: A strong and resilient domestic consumption base, the continued and accelerating expansion of e-commerce platforms, and a steadfast adherence to stringent quality and safety standards across all sectors.

- Frozen Segment Dominance: Fueled by growing consumer demand and evolving dietary habits favoring convenience and longevity in food products.

- High Growth in Value-Added Services: A direct response to the increasing need for tailored, customized solutions that go beyond basic logistics to meet specific product and customer requirements.

- Pharmaceutical & Life Sciences: The market is significantly propelled by stringent regulatory compliance, demanding precise temperature control and robust traceability throughout the supply chain.

Germany Cold Logistics Industry Product Landscape

The German cold logistics sector presents a dynamic and evolving product landscape, ranging from well-established refrigerated warehousing facilities to cutting-edge, highly automated installations. These advanced facilities are equipped with sophisticated, state-of-the-art temperature control systems, offering granular precision and real-time tracking capabilities for unparalleled oversight. Innovation within this sector is sharply focused on achieving enhanced operational efficiency, elevating safety standards to the highest levels, and minimizing the environmental footprint of logistics operations. Key unique selling propositions that differentiate providers in this competitive market include unparalleled speed of delivery, unwavering reliability, complete traceability from origin to destination, and a high degree of customization to meet diverse client needs. Technological advancements are at the forefront, with the integration of automated guided vehicles (AGVs), sophisticated robotic systems for handling and sorting, and advanced data analytics platforms enabling predictive maintenance and the optimization of logistical workflows.

Key Drivers, Barriers & Challenges in Germany Cold Logistics Industry

Key Drivers:

- A consistently rising demand for perishable goods, including fresh produce, dairy products, and critical pharmaceuticals, necessitating reliable cold chain solutions.

- The exponential growth of e-commerce, which is fundamentally reshaping retail and significantly increasing the demand for efficient and specialized last-mile delivery solutions for temperature-sensitive items.

- An increasing consumer and regulatory focus on food safety and quality control, driving the need for more robust and transparent cold chain management.

Challenges & Restraints:

- Volatile fluctuations in fuel prices, which directly impact transportation costs and introduce significant financial uncertainty. (Estimated impact on 2025 profits: XX Million EUR).

- A persistent shortage of qualified drivers, posing a substantial risk to transportation efficiency and potentially leading to delivery delays. (Estimated impact on delivery times in 2025: XX%).

- The complex and evolving landscape of stringent regulations across various sectors (e.g., food, pharmaceuticals), which often lead to increased operational costs and compliance burdens.

Emerging Opportunities in Germany Cold Logistics Industry

The German cold logistics industry is ripe with emerging opportunities, indicating a forward-looking and adaptive market. These include:

- A significant and growing demand for sustainable cold chain solutions, driven by environmental consciousness and regulatory pressures. This encompasses the adoption of electric vehicles for transportation fleets and the integration of renewable energy sources to power warehousing facilities.

- The strategic expansion of cold chain infrastructure into currently underserved rural areas, aiming to bridge logistical gaps and improve access to fresh and temperature-sensitive products nationwide.

- The accelerated adoption of advanced technologies like the Internet of Things (IoT) and Artificial Intelligence (AI). These technologies are revolutionizing supply chain visibility, enabling more accurate forecasting, proactive issue resolution, and enhanced overall operational efficiency.

Growth Accelerators in the Germany Cold Logistics Industry Industry

Long-term growth will be accelerated by technological advancements such as the adoption of autonomous vehicles, the use of AI and machine learning for predictive maintenance and optimization, and the development of more sustainable and eco-friendly cold chain solutions. Strategic partnerships between logistics providers and technology companies, combined with the expansion of cold chain infrastructure to support e-commerce growth, will further drive the market's expansion.

Key Players Shaping the Germany Cold Logistics Industry Market

- NewCold Advanced Logistics

- A P Moller-Maersk A/S

- Kloosterboer

- BLG Coldstore GmbH

- Frigolanda Cold Logistics

- Scan Global Logistics

- 7 Other Companies

- DHL Group

- Kuehne + Nagel International AG

- KLM Kuhl- und Lagerhaus Munsterland GmbH

- Heuer Logistics GmbH & Co KG

- Pfenning Logistics

- Eurofresh Logistics GmbH

Notable Milestones in Germany Cold Logistics Industry Sector

- June 2023: Scan Global Logistics significantly bolstered its presence in the German market with the strategic acquisition of ETS Transport & Logistics GmbH and ETS Fulfillment GmbH, expanding its service capabilities and geographical reach.

- March 2023: GEODIS solidified its position within the critical temperature-controlled pharmaceutical delivery segment through its acquisition of Trans-o-flex, enhancing its specialized logistics network for healthcare products.

In-Depth Germany Cold Logistics Industry Market Outlook

The German cold logistics market presents significant long-term growth potential, driven by sustained demand for perishable goods, technological innovation, and increasing e-commerce penetration. Strategic investments in sustainable cold chain solutions and the expansion of cold storage infrastructure will be critical for maximizing market opportunities. Further consolidation through mergers and acquisitions is expected, leading to a more concentrated market landscape. Companies that successfully embrace technological advancements and adapt to evolving consumer preferences will be best positioned to thrive in this dynamic market.

Germany Cold Logistics Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Ambient

- 2.2. Chilled

- 2.3. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meat and Seafood

- 3.4. Processed Food Products

- 3.5. Pharmaceuticals, Life Sciences, and Chemicals

- 3.6. Other Applications

Germany Cold Logistics Industry Segmentation By Geography

- 1. Germany

Germany Cold Logistics Industry Regional Market Share

Geographic Coverage of Germany Cold Logistics Industry

Germany Cold Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Perishable Products; Growth of Pharmaceutical Products

- 3.3. Market Restrains

- 3.3.1. High Initial Investment Costs; Labor Shortages and Skills Gap

- 3.4. Market Trends

- 3.4.1 The Number of Refrigerated Warehouses is Rising

- 3.4.2 Along With the Growing Pharmaceutical Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Cold Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Ambient

- 5.2.2. Chilled

- 5.2.3. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meat and Seafood

- 5.3.4. Processed Food Products

- 5.3.5. Pharmaceuticals, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NewCold Advanced Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 A P Moller-Maersk A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kloosterboer BLG Coldstore GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Frigolanda Cold Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Scan Global Logistics**List Not Exhaustive 7 3 Other Companie

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel International AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 KLM Kuhl- und Lagerhaus Munsterland GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heuer Logistics GmbH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pfenning Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eurofresh Logistics GmbH

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 NewCold Advanced Logistics

List of Figures

- Figure 1: Germany Cold Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Cold Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Cold Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Germany Cold Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Germany Cold Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Germany Cold Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Germany Cold Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Germany Cold Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Germany Cold Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Germany Cold Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Cold Logistics Industry?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Germany Cold Logistics Industry?

Key companies in the market include NewCold Advanced Logistics, A P Moller-Maersk A/S, Kloosterboer BLG Coldstore GmbH, Frigolanda Cold Logistics, Scan Global Logistics**List Not Exhaustive 7 3 Other Companie, DHL Group, Kuehne + Nagel International AG, KLM Kuhl- und Lagerhaus Munsterland GmbH, Heuer Logistics GmbH & Co KG, Pfenning Logistics, Eurofresh Logistics GmbH.

3. What are the main segments of the Germany Cold Logistics Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Perishable Products; Growth of Pharmaceutical Products.

6. What are the notable trends driving market growth?

The Number of Refrigerated Warehouses is Rising. Along With the Growing Pharmaceutical Industry.

7. Are there any restraints impacting market growth?

High Initial Investment Costs; Labor Shortages and Skills Gap.

8. Can you provide examples of recent developments in the market?

June 2023: Scan Global Logistics, a prominent global freight forwarder, disclosed its agreement to acquire ETS Transport & Logistics GmbH and ETS Fulfillment GmbH, both situated in Germany. This strategic move underscored Scan Global Logistics' commitment to bolstering its footprint in the German market, which is recognized as the fourth-largest logistics market globally and a key player in global trade partnerships.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Cold Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Cold Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Cold Logistics Industry?

To stay informed about further developments, trends, and reports in the Germany Cold Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence