Key Insights

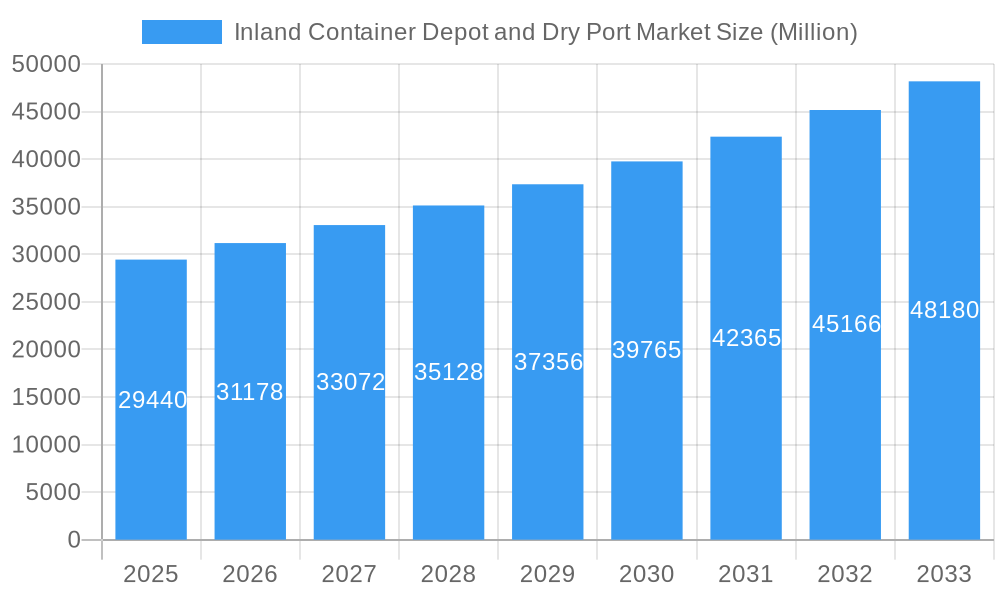

The Inland Container Depot (ICD) and Dry Port market is experiencing robust growth, projected to reach a market size of $29.44 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 5.45% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing global trade volume necessitates efficient logistics solutions, with ICDs and dry ports playing a crucial role in reducing congestion at major seaports and streamlining the movement of goods inland. Furthermore, government initiatives promoting infrastructure development and trade facilitation in many regions are significantly contributing to market growth. Technological advancements, such as improved container tracking systems and automated handling equipment, are enhancing operational efficiency and attracting further investment. The rising adoption of intermodal transportation, combining various modes like rail and road, is another factor boosting market demand. Competitive pressures among major players like Boasso Global, Maersk, and DP World are also driving innovation and cost optimization within the industry.

Inland Container Depot and Dry Port Market Market Size (In Billion)

However, certain restraints impact market growth. These include infrastructural limitations in some regions, particularly in developing economies, and the fluctuating costs of fuel and labor, which can affect operational profitability. Furthermore, regulatory complexities and bureaucratic hurdles in obtaining permits and licenses can delay project implementation. Despite these challenges, the long-term outlook for the ICD and dry port market remains positive, driven by continuous globalization and the increasing demand for seamless and efficient logistics solutions across the globe. Market segmentation, while not explicitly provided, likely includes various factors like port size, location (proximity to major industrial hubs or population centers), and service offerings (specialized handling, warehousing, etc.), all influencing the overall market dynamics. The forecast period (2025-2033) offers significant opportunities for expansion and investment in this growing sector.

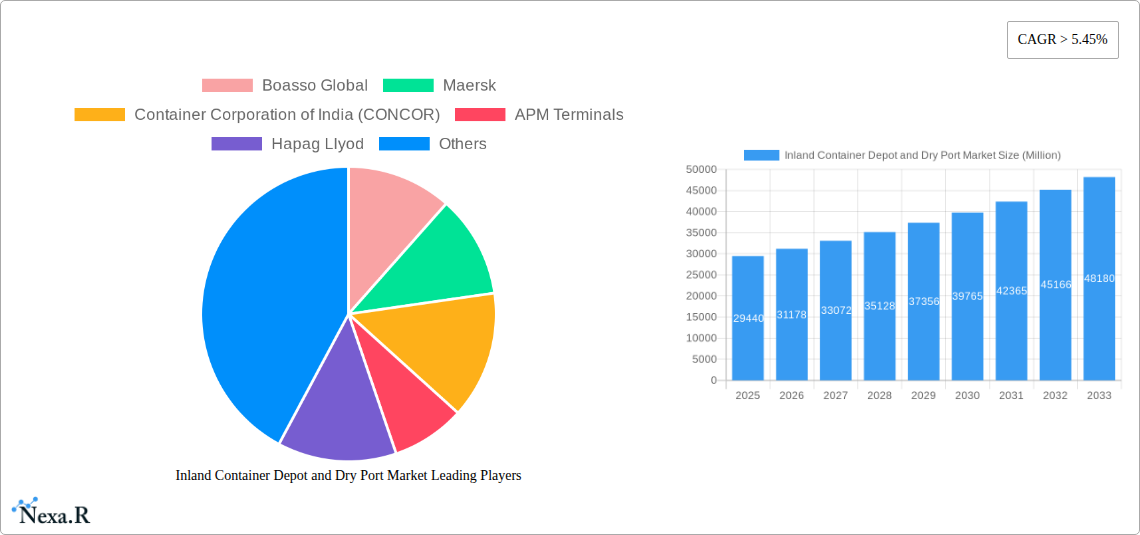

Inland Container Depot and Dry Port Market Company Market Share

Inland Container Depot and Dry Port Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Inland Container Depot and Dry Port market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The parent market is the logistics and transportation sector, while the child market is specifically inland container depots and dry ports.

Inland Container Depot and Dry Port Market Market Dynamics & Structure

The Inland Container Depot and Dry Port market is characterized by a moderately consolidated structure, featuring a mix of established global logistics giants and numerous regional and specialized operators. Key players such as Boasso Global, Maersk, Container Corporation of India (CONCOR), APM Terminals, Hapag-Lloyd, Hutchison Ports, GAC, DP World, Abu Dhabi Terminals, and Freightliner Group Ltd. command a significant portion of the market share. Despite this concentration, the presence of a substantial number of smaller, agile players creates a dynamic environment ripe for both organic expansion and strategic mergers and acquisitions (M&A). The market's trajectory is heavily influenced by a confluence of factors, including rapid technological innovation, evolving and often stringent regulatory frameworks governing trade and logistics, and the constant availability of competitive substitutes and alternative supply chain solutions.

Market Structure & Dynamics:

- Market Concentration: The market is moderately consolidated, with a discernible dominance of a few key players alongside a vibrant ecosystem of smaller operators. In 2024, it is estimated that the top 5 players collectively held approximately XX% of the market share, indicating a significant but not fully saturated concentration.

- Technological Innovation: The integration of cutting-edge technologies is a paramount driver of market evolution. This includes the widespread adoption of automation for efficient container handling, the digitization of operations through platforms like blockchain for enhanced tracking and transparency, and continuous investment in modernizing infrastructure. However, the substantial initial capital investment required for these advancements can pose a significant barrier to entry for smaller or emerging businesses.

- Regulatory Framework: Government policies play a pivotal role in shaping market dynamics. This encompasses trade facilitation initiatives, investments in critical logistics infrastructure, and increasingly, environmental regulations aimed at promoting sustainability. The heterogeneity of these regulations across different geographical regions adds a layer of complexity for international operators.

- Competitive Substitutes: While ICDs and dry ports offer distinct advantages, traditional warehousing and direct transportation methods remain viable alternatives for certain logistics needs. However, the efficiency, speed, and cost-effectiveness offered by modern ICDs and dry ports often render these substitutes less competitive in the broader supply chain context.

- End-User Demographics: The primary beneficiaries and users of ICD and dry port services are manufacturers, importers, exporters, and freight forwarders. The sustained growth of this market is intrinsically linked to the ebb and flow of global trade volumes, the expansion of e-commerce, and the increasing demand for efficient, integrated supply chain solutions.

- M&A Trends: The industry has witnessed notable consolidation activities, exemplified by the acquisition of MTC by Quala and Boasso Global in February 2024, underscoring the ongoing trend of strategic integration. Over the historical period from 2019 to 2024, an estimated XX M&A deals were completed, reflecting a strategic move towards larger, more integrated service offerings.

Inland Container Depot and Dry Port Market Growth Trends & Insights

The Inland Container Depot and Dry Port market demonstrated robust growth throughout the historical period spanning from 2019 to 2024. This expansion was primarily fueled by escalating global trade volumes, the accelerated growth of the e-commerce sector, and proactive government initiatives focused on developing and enhancing efficient logistics infrastructure. By 2024, the market size had reached an impressive valuation of approximately XX Million units. Projections indicate a sustained upward trajectory, with the market expected to maintain a healthy Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period from 2025 to 2033. This growth is anticipated to propel the market to an estimated XX Million units by 2033. Key drivers of this growth include accelerating technological disruptions, such as the widespread adoption of automation and advanced digitization techniques, which are significantly boosting operational efficiency and streamlining processes. Furthermore, evolving consumer behavior, characterized by an increasing demand for faster delivery times and greater supply chain transparency, is directly contributing to market expansion. A significant opportunity for market penetration lies within developing economies that are actively investing in and improving their logistical infrastructure.

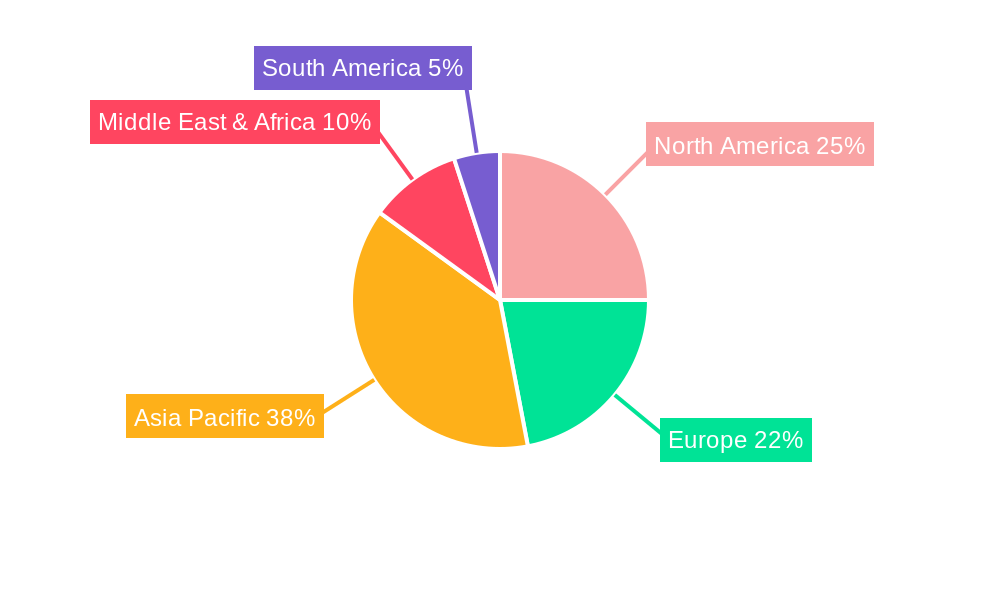

Dominant Regions, Countries, or Segments in Inland Container Depot and Dry Port Market

Asia, particularly China and India, currently dominate the Inland Container Depot and Dry Port market due to their substantial manufacturing base, high import/export volumes, and ongoing infrastructure investments. Europe and North America also hold significant market share, driven by robust industrial activity and efficient logistics networks. The rapid growth of e-commerce in developing economies is expected to significantly boost demand in these regions during the forecast period.

Key Drivers for Regional Dominance:

- Asia (China & India): Massive manufacturing hubs, substantial trade volumes, government support for infrastructure development.

- Europe: Well-established logistics networks, efficient transportation infrastructure, high concentration of manufacturing and trade activities.

- North America: Strong economies, well-developed transportation infrastructure, increasing focus on supply chain optimization.

Inland Container Depot and Dry Port Market Product Landscape

The product and service landscape within the Inland Container Depot and Dry Port market is comprehensive, offering a suite of essential services designed to optimize cargo movement and storage. These core services include secure container storage, efficient container handling, streamlined customs clearance procedures, and a growing array of value-added services. These enhanced offerings often encompass repackaging, labeling, kitting, and last-mile delivery coordination. Recent innovations are heavily focused on the integration of advanced automation for enhanced efficiency, the deployment of sophisticated real-time tracking systems for improved visibility, and the implementation of robust security features to safeguard cargo. The unique selling propositions that differentiate operators in this market revolve around speed of service, operational efficiency, cargo security, and overall cost-effectiveness. Crucially, technological advancements are pivotal in elevating supply chain visibility, reducing transit times, and thereby enhancing the overall effectiveness and reliability of logistical operations.

Key Drivers, Barriers & Challenges in Inland Container Depot and Dry Port Market

Key Drivers:

- Growing global trade volumes.

- Expansion of e-commerce and faster delivery expectations.

- Government initiatives promoting infrastructure development.

- Technological advancements leading to operational efficiencies.

Key Challenges & Restraints:

- High initial investment costs for infrastructure development.

- Regulatory complexities and bureaucratic hurdles.

- Intense competition among existing players.

- Supply chain disruptions (e.g., port congestion, geopolitical events) can negatively impact market growth. In 2022, supply chain disruptions reduced market growth by an estimated xx%.

Emerging Opportunities in Inland Container Depot and Dry Port Market

- Untapped Markets: Significant potential exists in emerging and developing economies where logistical infrastructure is still maturing and demand for efficient trade facilitation is rising.

- Technological Integration: The adoption and further integration of advanced technologies like Artificial Intelligence (AI) for predictive analytics and Internet of Things (IoT) for real-time asset tracking present opportunities for enhanced efficiency, predictive maintenance, and superior security.

- Sustainable Practices: With a growing global emphasis on environmental responsibility, there is a substantial opportunity for operators who prioritize and invest in sustainable practices, such as renewable energy sources, waste reduction programs, and eco-friendly logistics solutions.

- Value-Added Services: The demand for specialized services beyond basic storage and handling is increasing. Opportunities lie in expanding offerings such as comprehensive last-mile delivery solutions, specialized handling for temperature-sensitive or hazardous goods, and tailored supply chain management services.

Growth Accelerators in the Inland Container Depot and Dry Port Market Industry

Technological innovation, strategic partnerships between depot operators and logistics companies, and government investments in infrastructure development are key catalysts for long-term growth. Expanding into underserved markets and offering specialized services catering to niche industries will further accelerate market expansion.

Key Players Shaping the Inland Container Depot and Dry Port Market Market

- Boasso Global

- Maersk

- Container Corporation of India (CONCOR)

- APM Terminals

- Hapag-Lloyd

- Hutchison Ports

- GAC

- DP World

- Abu Dhabi Terminals

- Freightliner Group Ltd

- 73 Other Companies

Notable Milestones in Inland Container Depot and Dry Port Market Sector

- February 2024: Quala and Boasso Global acquire Mainport Tank Cleaning BV, significantly expanding their tank container depot services. This acquisition strengthened their market position and broadened their service offerings.

- January 2024: Maersk establishes a center of excellence at the East Midlands Gateway campus, integrating warehousing, rail, and container depot operations within a freeport. This strategic move enhances their logistics capabilities and market reach.

In-Depth Inland Container Depot and Dry Port Market Market Outlook

The Inland Container Depot and Dry Port market is poised for substantial and sustained growth in the coming years. This optimistic outlook is underpinned by several key factors, including the relentless march of globalization which continues to drive cross-border trade, ongoing technological advancements that are revolutionizing logistics operations, and an increasing corporate and governmental focus on optimizing supply chain efficiency. Success in this increasingly competitive landscape will hinge on strategic foresight, including the formation of strategic partnerships, significant investments in developing and maintaining sustainable and resilient infrastructure, and the agile expansion into new and promising markets. The long-term outlook for the Inland Container Depot and Dry Port market is overwhelmingly positive, offering ample opportunities for both well-established industry leaders and innovative new entrants to flourish and capture significant market share.

Inland Container Depot and Dry Port Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Handling

- 1.3. Maintenance and Repair

-

2. Type of Container

- 2.1. General

- 2.2. Refrigerated (Reefer)

Inland Container Depot and Dry Port Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Chile

-

5. Middle East

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

Inland Container Depot and Dry Port Market Regional Market Share

Geographic Coverage of Inland Container Depot and Dry Port Market

Inland Container Depot and Dry Port Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Multimodal Connectivity Boosts Demand for Inland Container Depots

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Handling

- 5.1.3. Maintenance and Repair

- 5.2. Market Analysis, Insights and Forecast - by Type of Container

- 5.2.1. General

- 5.2.2. Refrigerated (Reefer)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Storage

- 6.1.2. Handling

- 6.1.3. Maintenance and Repair

- 6.2. Market Analysis, Insights and Forecast - by Type of Container

- 6.2.1. General

- 6.2.2. Refrigerated (Reefer)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Storage

- 7.1.2. Handling

- 7.1.3. Maintenance and Repair

- 7.2. Market Analysis, Insights and Forecast - by Type of Container

- 7.2.1. General

- 7.2.2. Refrigerated (Reefer)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Storage

- 8.1.2. Handling

- 8.1.3. Maintenance and Repair

- 8.2. Market Analysis, Insights and Forecast - by Type of Container

- 8.2.1. General

- 8.2.2. Refrigerated (Reefer)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South America Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Storage

- 9.1.2. Handling

- 9.1.3. Maintenance and Repair

- 9.2. Market Analysis, Insights and Forecast - by Type of Container

- 9.2.1. General

- 9.2.2. Refrigerated (Reefer)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Storage

- 10.1.2. Handling

- 10.1.3. Maintenance and Repair

- 10.2. Market Analysis, Insights and Forecast - by Type of Container

- 10.2.1. General

- 10.2.2. Refrigerated (Reefer)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boasso Global

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Maersk

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Container Corporation of India (CONCOR)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 APM Terminals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hapag Llyod

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hutchison Ports

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GAC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DP World

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abu Dhabi Terminals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Freightliner Group Ltd**List Not Exhaustive 7 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Boasso Global

List of Figures

- Figure 1: Global Inland Container Depot and Dry Port Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Inland Container Depot and Dry Port Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 4: North America Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 5: North America Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 7: North America Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 8: North America Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 9: North America Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 10: North America Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 11: North America Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 16: Europe Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 17: Europe Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 19: Europe Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 20: Europe Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 21: Europe Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 22: Europe Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 23: Europe Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 28: Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 29: Asia Pacific Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 31: Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 32: Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 33: Asia Pacific Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 34: Asia Pacific Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 35: Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 40: South America Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 41: South America Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 42: South America Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 43: South America Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 44: South America Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 45: South America Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 46: South America Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 47: South America Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South America Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 52: Middle East Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 53: Middle East Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 54: Middle East Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 55: Middle East Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 56: Middle East Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 57: Middle East Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 58: Middle East Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 59: Middle East Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 3: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 4: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 5: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 9: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 10: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 11: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 19: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 20: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 21: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: Germany Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: UK Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: UK Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: France Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Spain Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 36: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 37: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 38: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 39: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: India Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: China Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Japan Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 50: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 51: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 52: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 53: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Brazil Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Brazil Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Chile Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Chile Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 60: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 61: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 62: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 63: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: United Arab Emirates Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: United Arab Emirates Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Saudi Arabia Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Saudi Arabia Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Rest of Middle East Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Middle East Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inland Container Depot and Dry Port Market?

The projected CAGR is approximately > 5.45%.

2. Which companies are prominent players in the Inland Container Depot and Dry Port Market?

Key companies in the market include Boasso Global, Maersk, Container Corporation of India (CONCOR), APM Terminals, Hapag Llyod, Hutchison Ports, GAC, DP World, Abu Dhabi Terminals, Freightliner Group Ltd**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Inland Container Depot and Dry Port Market?

The market segments include Service, Type of Container.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.44 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Multimodal Connectivity Boosts Demand for Inland Container Depots.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2024: Quala and Boasso Global, key players in the tank trailer and ISO tank container industry specializing in cleaning, maintenance, storage, and transportation services, completed the acquisition of Mainport Tank Cleaning BV, Mainport Tank Container Services Botlek BV, and Mainport Tank Container Services Moerdijk BV – collectively referred to as "MTC" – from Matrans Holding BV, headquartered in Rotterdam, Netherlands. MTC is renowned for its excellence in tank cleaning and ISO tank container depot services.January 2024: Maersk established a 'center of excellence' at the East Midlands Gateway campus. The campus, featuring a 695,000 sq ft warehouse, a rail terminal managed by Maritime, and a 14-acre container depot, all situated within a freeport, is well-positioned to champion this streamlined approach. Moreover, its strategic location, near major UK ports like Felixstowe, Liverpool, and Southampton, alongside easy access to the nation's rail, road network, and key airports, enhances its allure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inland Container Depot and Dry Port Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inland Container Depot and Dry Port Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inland Container Depot and Dry Port Market?

To stay informed about further developments, trends, and reports in the Inland Container Depot and Dry Port Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence