Key Insights

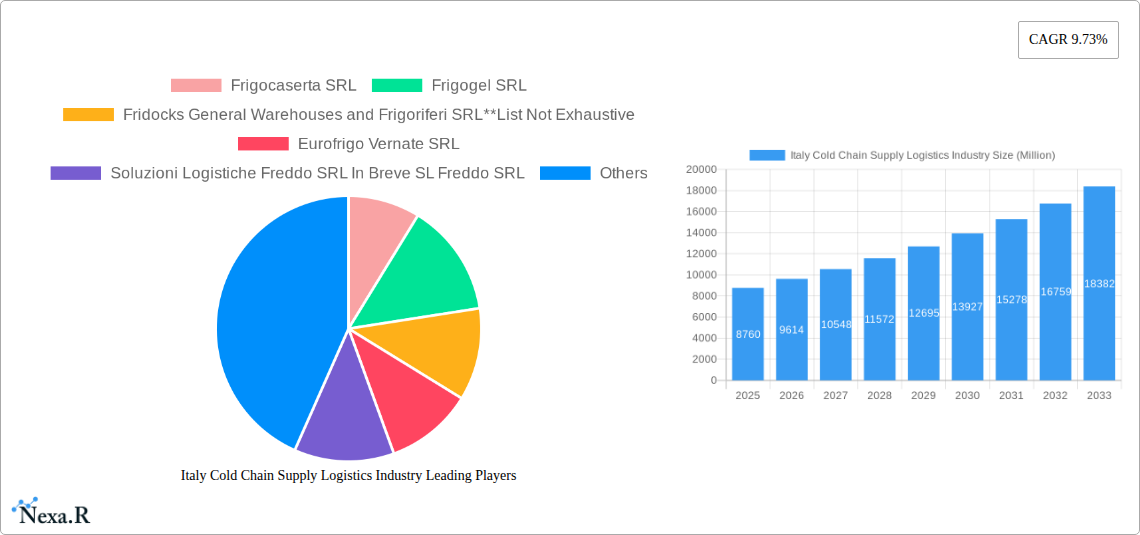

The Italian cold chain supply logistics market, valued at €8.76 billion in 2025, is projected to experience robust growth, driven by increasing demand for perishable goods, a rising consumer preference for fresh produce, and the expanding e-commerce sector. The market's Compound Annual Growth Rate (CAGR) of 9.73% from 2025 to 2033 signifies a significant expansion opportunity. Key growth drivers include investments in advanced cold storage technologies, improved transportation infrastructure, and stringent food safety regulations. The rising popularity of value-added services like blast freezing, labeling, and inventory management further enhances the market's potential. Segmentation reveals that the frozen segment dominates due to the long shelf life and preservation qualities it offers. Horticulture (fresh fruits and vegetables), dairy products, and meat and fish represent significant application segments. The increasing focus on traceability and transparency throughout the supply chain is another considerable force impacting the market's development. While data on specific market restraints is unavailable, potential challenges could include fluctuating energy prices, rising labor costs, and maintaining consistent cold chain integrity across the entire logistics network. Competition among established players like Frigocaserta SRL, Frigogel SRL, and Eurofrigo Vernate SRL, and emerging companies alike indicates a dynamic and competitive landscape. Future growth will depend on companies' ability to adapt to evolving consumer demands, technological advancements, and stringent regulatory requirements.

Italy Cold Chain Supply Logistics Industry Market Size (In Billion)

The Italian cold chain logistics industry is poised for considerable expansion, supported by a growing awareness of food safety, advancements in cold storage technologies, and a strengthening e-commerce sector fueling demand for efficient and reliable delivery of temperature-sensitive products. The diverse range of applications, from fresh produce to pharmaceuticals, ensures a broad customer base. Geographical expansion within Italy, driven by increasing demand in regions with high population density and significant agricultural activities, will contribute significantly to market growth. The market's success will be intricately linked to the adoption of digitalization strategies to optimize logistics, enhance visibility across the supply chain, and improve efficiency. This includes the use of advanced technologies like IoT sensors for real-time temperature monitoring and data analytics to enhance route optimization. Furthermore, sustainability initiatives focusing on reducing carbon emissions and minimizing environmental impact will become increasingly crucial for market leaders.

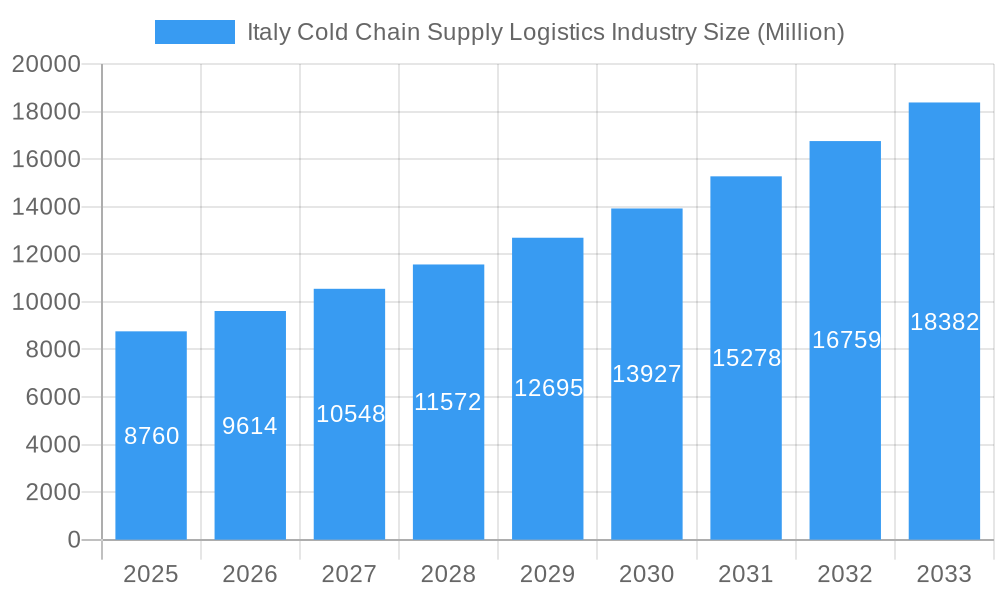

Italy Cold Chain Supply Logistics Industry Company Market Share

Italy Cold Chain Supply Logistics Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Italy cold chain supply logistics industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategic decision-makers seeking a thorough understanding of this vital sector. The report utilizes parent and child market segmentation for detailed insight.

Italy Cold Chain Supply Logistics Industry Market Dynamics & Structure

The Italian cold chain logistics market exhibits a moderately concentrated structure, a dynamic blend of established large-scale operators and a vibrant ecosystem of smaller, agile, and specialized firms. The market size for 2025 is projected to reach approximately €xx Million, reflecting significant economic activity. A primary catalyst for market evolution is continuous technological innovation, spurred by an escalating demand for highly efficient and exceptionally reliable temperature-controlled transportation and storage solutions. Furthermore, the industry operates within a robust and stringent regulatory landscape, particularly concerning the critical areas of food safety and pharmaceutical handling, which fundamentally shapes operational strategies and mandates significant investments. While technological advancements are paramount, competitive substitutes, such as sophisticated advancements in packaging materials and enhanced preservation techniques, also play a role in the market's competitive interplay. The end-user demographic is notably diverse, encompassing a broad spectrum of industries including food and beverage producers, pharmaceutical companies, and the retail sector, each with unique cold chain requirements.

- Market Concentration: The market is characterized by a high degree of concentration, estimated at xx%, although this is subject to significant regional variations across Italy.

- Technological Innovation: A key focus is on the integration and advancement of Internet of Things (IoT) devices, advanced automation, and sophisticated data analytics. These technologies are instrumental in enhancing real-time tracking, precision monitoring, and overall operational efficiency.

- Regulatory Framework: Stringent regulations, including the Hazard Analysis and Critical Control Points (HACCP) standards for food safety and Good Distribution Practices (GDP) for pharmaceuticals, are critical. These frameworks necessitate substantial investment in compliance-focused technology and meticulously designed operational procedures.

- M&A Activity: The period between 2019 and 2024 has witnessed moderate merger and acquisition activity, with approximately xx deals recorded. This trend indicates a strategic consolidation effort by larger entities to expand their market share and operational footprint.

Italy Cold Chain Supply Logistics Industry Growth Trends & Insights

The Italian cold chain logistics market demonstrated a pattern of steady and consistent growth throughout the historical period spanning 2019 to 2024. This upward trajectory was propelled by several key factors, including a rise in disposable incomes, evolving consumer preferences for fresh and high-quality products, and the burgeoning e-commerce sector. Projections indicate that the market is poised for substantial expansion, with an anticipated Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, culminating in an estimated market value of €xx Million by 2033. Technological disruptions are proving to be significant growth accelerators, particularly the implementation of blockchain technology for enhanced traceability and the widespread adoption of advanced cold chain monitoring systems. Shifting consumer behaviors, characterized by an increasing demand for fresh, healthy, and sustainably sourced products, are further intensifying market expansion. While the adoption rates of advanced technologies are notably higher in major urban centers, there remains a considerable opportunity for increased penetration in rural areas.

Dominant Regions, Countries, or Segments in Italy Cold Chain Supply Logistics Industry

The Northern region of Italy stands out as the dominant force in the cold chain logistics market. This prominence is largely attributable to its robust concentration of food processing industries and its highly developed logistical infrastructure. Analyzing by temperature type, the Frozen segment commands the largest market share at xx%, closely followed by the Chilled segment at xx%, with the Ambient segment representing xx%. In terms of services, Storage solutions currently hold the most significant portion of the market at xx%, with Transportation services following at xx%, and Value-Added Services contributing xx%. The primary applications driving this growth are the Pharma sector (xx%), Food Products (xx%), and Dairy Products (xx%).

- Key Growth Drivers:

- The strong and established presence of the agri-food sector, particularly concentrated in Northern Italy.

- The availability of advanced logistics infrastructure and networks within major urban areas.

- A rising demand for both imported and high-value product categories that necessitate stringent cold chain management.

- Supportive government initiatives aimed at promoting food safety standards, enhancing product quality, and fostering sustainable agricultural practices.

Italy Cold Chain Supply Logistics Industry Product Landscape

The product landscape within the Italian cold chain logistics market is characterized by a comprehensive array of specialized solutions. These include advanced temperature-controlled containers designed for optimal thermal stability, a diverse fleet of refrigerated trucks equipped with the latest refrigeration technology, and sophisticated warehousing systems. These warehousing solutions are increasingly integrated with IoT sensors for real-time temperature and humidity monitoring, as well as automated inventory management systems for enhanced efficiency and accuracy. The unique selling propositions within this market emphasize superior energy efficiency, advanced and robust tracking capabilities, and enhanced data analytics platforms that enable proactive risk management and predictive maintenance. Technological advancements are continuously focused on elevating the overall efficiency, unwavering reliability, and environmental sustainability of cold chain operations, aligning with global trends towards greener logistics.

Key Drivers, Barriers & Challenges in Italy Cold Chain Supply Logistics Industry

Key Drivers:

- Growing demand for fresh produce and chilled/frozen products.

- Expansion of e-commerce and online grocery delivery.

- Stringent regulations driving investment in cold chain infrastructure.

Key Challenges:

- High energy costs associated with maintaining cold chain temperatures.

- Infrastructure limitations in certain regions, particularly in rural areas.

- Intense competition and pressure on pricing. This leads to a xx% decrease in profit margins for small businesses.

Emerging Opportunities in Italy Cold Chain Supply Logistics Industry

- Expansion into niche markets, such as specialized pharmaceutical logistics.

- Adoption of sustainable and eco-friendly cold chain technologies.

- Development of integrated solutions combining transportation, storage, and value-added services.

Growth Accelerators in the Italy Cold Chain Supply Logistics Industry

The acceleration of market growth in Italy's cold chain supply logistics industry is intrinsically linked to significant technological breakthroughs. These advancements span across refrigeration technologies, innovative transportation solutions, and sophisticated tracking and monitoring systems, all of which promise to enhance efficiency and reduce operational costs. Furthermore, the forging of strategic partnerships between leading logistics providers, cutting-edge technology companies, and key players in the food and pharmaceutical sectors is expected to foster a collaborative environment that drives innovation and optimizes supply chain performance. The expansion of services into emerging markets within Italy and the proactive adoption of agile and flexible business models will also be critical drivers of future growth, enabling companies to adapt swiftly to evolving market demands and competitive pressures.

Key Players Shaping the Italy Cold Chain Supply Logistics Industry Market

- Frigocaserta SRL

- Frigogel SRL

- Fridocks General Warehouses and Frigoriferi SRL

- Eurofrigo Vernate SRL

- Soluzioni Logistiche Freddo SRL

- In Breve SL Freddo SRL

- DRS Depositi Regionali Surgelati SRL

- Sodele Magazzini Generali Frigoriferi SRL

- Safim Logistics

- Horigel SRL

- Frigoscandia SPA

Notable Milestones in Italy Cold Chain Supply Logistics Industry Sector

- April 2022: Bomi Group acquires Tendron Pharma, expanding its pharmaceutical logistics capabilities in France.

- May 2022: Bomi Group announces a new €15 Million logistics hub near Madrid, signifying expansion into the European healthcare sector.

In-Depth Italy Cold Chain Supply Logistics Industry Market Outlook

The Italian cold chain logistics market is poised for robust growth over the forecast period. Strategic investments in infrastructure, technology, and sustainable practices will be crucial for success. Companies that can effectively leverage innovation, optimize their operations, and build strong partnerships will be best positioned to capitalize on the significant opportunities within this dynamic market. The market is expected to expand significantly in the coming years, driven by continued economic growth, rising consumption of fresh food and pharmaceutical products, and increasing adoption of innovative cold chain solutions.

Italy Cold Chain Supply Logistics Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Ambient

- 2.2. Chilled

- 2.3. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats and Fish

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

Italy Cold Chain Supply Logistics Industry Segmentation By Geography

- 1. Italy

Italy Cold Chain Supply Logistics Industry Regional Market Share

Geographic Coverage of Italy Cold Chain Supply Logistics Industry

Italy Cold Chain Supply Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for customizable delivery solutions4.; Growing need for operational effciency

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of efficient transportation infrastructure4.; High cost of white glove services

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Dairy Products in the Country is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Cold Chain Supply Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Ambient

- 5.2.2. Chilled

- 5.2.3. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats and Fish

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Frigocaserta SRL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Frigogel SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fridocks General Warehouses and Frigoriferi SRL**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eurofrigo Vernate SRL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DRS Depositi Regionali Surgelati SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sodele Magazzini Generali Frigoriferi SRL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safim Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Horigel SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Frigoscandia SPA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Frigocaserta SRL

List of Figures

- Figure 1: Italy Cold Chain Supply Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Cold Chain Supply Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Cold Chain Supply Logistics Industry?

The projected CAGR is approximately 9.73%.

2. Which companies are prominent players in the Italy Cold Chain Supply Logistics Industry?

Key companies in the market include Frigocaserta SRL, Frigogel SRL, Fridocks General Warehouses and Frigoriferi SRL**List Not Exhaustive, Eurofrigo Vernate SRL, Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL, DRS Depositi Regionali Surgelati SRL, Sodele Magazzini Generali Frigoriferi SRL, Safim Logistics, Horigel SRL, Frigoscandia SPA.

3. What are the main segments of the Italy Cold Chain Supply Logistics Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.76 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for customizable delivery solutions4.; Growing need for operational effciency.

6. What are the notable trends driving market growth?

Increasing Usage of Dairy Products in the Country is Driving the Market.

7. Are there any restraints impacting market growth?

4.; Lack of efficient transportation infrastructure4.; High cost of white glove services.

8. Can you provide examples of recent developments in the market?

May 2022: Bomi Group, through the Picking Farma brand, announces the forthcoming opening of the new logistics hub near Madrid dedicated to the Healthcare sector. The warehouse, whose work has already begun, will involve an investment of 15 million euros and the creation of 150 jobs. The new logistics platform will join the seven already present in Spain, including one near Madrid, four in Catalonia, and two in the Canary Islands. This new logistics center will have an area of 25,000 m² and a capacity of 60,000 pallet places, making it one of the essential reference warehouses for the pharmaceutical sector in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Cold Chain Supply Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Cold Chain Supply Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Cold Chain Supply Logistics Industry?

To stay informed about further developments, trends, and reports in the Italy Cold Chain Supply Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence