Key Insights

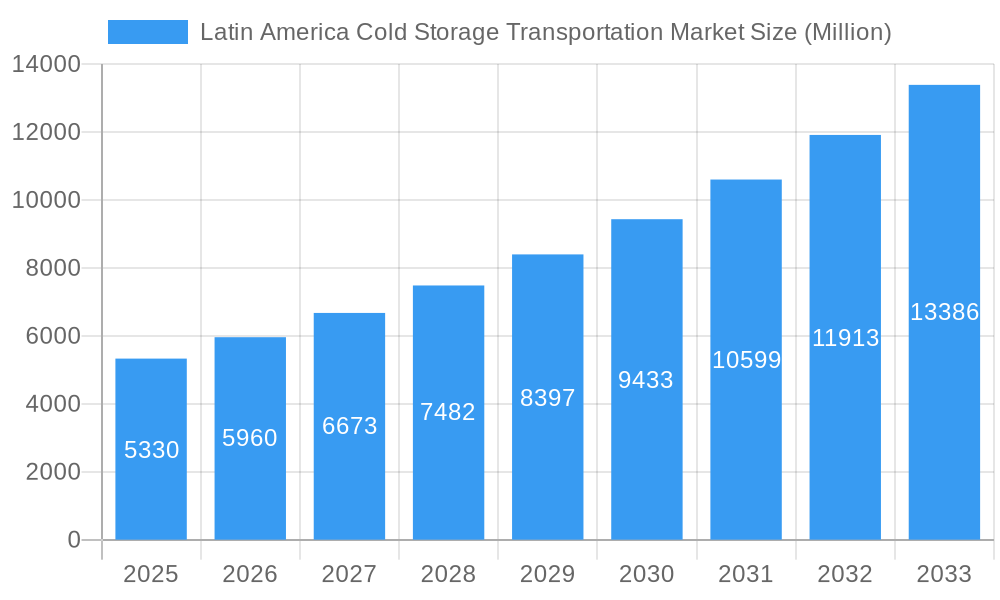

The Latin American cold storage and transportation market, valued at $5.33 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.60% from 2025 to 2033. This expansion is fueled by several key factors. The rising demand for perishable goods, including fruits, vegetables, dairy, and seafood, across the region is a significant driver. Increasing urbanization and a growing middle class with higher disposable incomes are boosting consumption of these products, necessitating efficient cold chain solutions. Furthermore, the expansion of the food processing and pharmaceutical industries in Latin America is creating further demand for reliable cold storage and transportation services. The growth of e-commerce and online grocery delivery platforms also plays a crucial role, necessitating sophisticated logistics networks to maintain product quality during delivery. While infrastructure limitations and fluctuating fuel prices present challenges, investments in modern cold storage facilities and technological advancements in transportation are mitigating these restraints. The market is segmented by service type (cold storage, refrigerated transport, value-added services), temperature range (chilled, frozen, ambient), end-user industry (food and beverage, pharmaceuticals), and country (Brazil, Mexico, Chile, Colombia, etc.), offering diverse investment and growth opportunities. Brazil and Mexico are expected to remain the largest markets due to their significant population sizes and robust economies.

Latin America Cold Storage Transportation Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational players and regional operators. Companies like Americold Logistics and Ransa Comercial SA compete alongside local players, indicating a dynamic market with opportunities for both established and emerging businesses. The increasing adoption of technology, such as temperature monitoring systems and GPS tracking, is enhancing efficiency and transparency within the cold chain, further supporting market growth. This trend is expected to continue, driving the need for skilled labor and specialized logistics expertise. The focus on sustainability and reduced carbon emissions is also gaining momentum within the industry, promoting investment in energy-efficient cold storage technologies and eco-friendly transportation solutions. Overall, the Latin American cold storage and transportation market presents a compelling investment opportunity with significant growth potential in the coming years.

Latin America Cold Storage Transportation Market Company Market Share

Latin America Cold Storage Transportation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America cold storage transportation market, covering market dynamics, growth trends, dominant segments, and key players. With a focus on the parent market (Cold Chain Logistics) and child market (Cold Storage Transportation), this report offers valuable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The market size is presented in million units.

Latin America Cold Storage Transportation Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and market trends, providing a comprehensive understanding of its structure and dynamics. The market is characterized by a mix of large multinational players and regional companies, resulting in a moderately consolidated structure. Market share is currently distributed as follows (2025 estimates): Top 5 players holding xx%, with the remaining xx% shared amongst other regional and smaller players.

- Market Concentration: Moderate, with key players holding significant market share but also allowing for the presence of numerous regional players.

- Technological Innovation: Driven by automation, IoT, and data analytics to enhance efficiency, traceability, and temperature control. However, high initial investment costs and lack of skilled workforce present barriers to adoption.

- Regulatory Framework: Varies across countries, influencing operational costs and compliance requirements. Harmonization efforts across Latin American nations present both opportunities and challenges.

- Competitive Product Substitutes: Limited direct substitutes; competition is mainly among providers offering different service levels, technological capabilities, and geographic reach.

- End-User Demographics: Driven by the growth of the food processing and pharmaceutical industries, coupled with rising consumer demand for fresh and high-quality products. This fuels demand for sophisticated cold chain solutions.

- M&A Trends: Significant M&A activity in recent years, with larger players consolidating their market presence through acquisitions of smaller regional operators. The estimated deal volume from 2019-2024 is xx deals, reflecting ongoing consolidation.

Latin America Cold Storage Transportation Market Growth Trends & Insights

The Latin American cold storage transportation market is experiencing robust growth driven by factors such as rising disposable incomes, changing consumer preferences for fresh and processed foods, and expansion of the food retail and e-commerce sectors. The market size experienced a CAGR of xx% from 2019 to 2024, reaching xx million units in 2024. This upward trend is projected to continue, with a projected CAGR of xx% from 2025 to 2033. Technological advancements, such as automated warehousing and GPS-enabled transportation, are further driving efficiency gains and contributing to market expansion. Consumer preference for convenience and premium products also contributes significantly to market demand. The market penetration is currently at xx% and expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Latin America Cold Storage Transportation Market

The Latin American cold storage transportation market is significantly shaped by the economic prowess and logistical capabilities of its leading nations. Brazil and Mexico stand out as the dominant players, propelled by their substantial populations, expanding economies, and deeply entrenched food and beverage industries. These factors create a consistent and substantial demand for efficient cold chain solutions. Within the market segments, Cold Storage/Refrigerated Warehousing commands the largest market share, reflecting the foundational need for secure and temperature-controlled storage facilities. This is closely followed by Refrigerated Transportation, which ensures the seamless movement of goods, and Value-added Services, which are increasingly crucial for optimizing the supply chain.

- By Service: Cold Storage/Refrigerated Warehousing (e.g., 55% market share), Refrigerated Transportation (e.g., 35%), Value-added Services (e.g., 10%).

- By Temperature: Frozen (e.g., 45%), Chilled (e.g., 40%), Ambient (e.g., 15%).

- By End User: Fruits and Vegetables (e.g., 30%), Dairy Products (e.g., 20%), Meat and Seafood (e.g., 25%), Processed Food (e.g., 15%), Pharmaceutical (e.g., 7%), Others (e.g., 3%).

- By Country: Brazil (e.g., 40%), Mexico (e.g., 35%), Chile (e.g., 8%), Colombia (e.g., 7%), Rest of Latin America (e.g., 10%).

Key drivers fueling growth across these dominant regions and segments include robust government initiatives supporting infrastructure development, an influx of foreign and domestic investment in modern logistics, and the accelerating pace of urbanization, which leads to greater consumer demand for perishable goods. The potential for significant growth is particularly evident in the realm of value-added services, addressing the escalating requirement for specialized handling, sophisticated inventory management, and tailored logistics solutions across the entire supply chain. Furthermore, the pharmaceutical sector presents a compelling growth avenue, driven by the increasing global and regional demand for temperature-sensitive medications, vaccines, and other healthcare products that necessitate stringent temperature control throughout their journey.

Latin America Cold Storage Transportation Market Product Landscape

The Latin American cold storage transportation market is characterized by a comprehensive suite of offerings designed to preserve the integrity and quality of temperature-sensitive goods. These services encompass state-of-the-art cold storage warehousing, efficient refrigerated transportation solutions, and an expanding array of value-added services. These value-added offerings include sophisticated order fulfillment, rapid blast freezing for product preservation, precise labeling for traceability, and advanced inventory management systems that optimize stock levels and minimize waste. Technological innovation is a cornerstone of this market, with the widespread adoption of advanced temperature monitoring systems providing real-time data, GPS tracking for enhanced logistical visibility, and integrated warehouse management systems (WMS) that streamline operations and improve efficiency. The core value propositions for market players revolve around demonstrably reducing product spoilage, significantly minimizing transit times, enhancing end-to-end supply chain transparency, and delivering highly customized, adaptable solutions to meet the diverse and specific product types and critical temperature requirements prevalent across the region.

Key Drivers, Barriers & Challenges in Latin America Cold Storage Transportation Market

Key Drivers:

- Increasing demand for fresh and processed foods.

- Growth of e-commerce and online grocery deliveries.

- Expansion of the food processing and pharmaceutical industries.

- Investments in cold chain infrastructure.

Key Challenges:

- High infrastructure costs in certain regions.

- Fluctuations in fuel prices impacting transportation costs.

- Lack of skilled labor in some areas.

- Regulatory inconsistencies across Latin American countries.

Emerging Opportunities in Latin America Cold Storage Transportation Market

- Expansion into less developed regions: Significant untapped potential exists in smaller cities and rural areas.

- Technological advancements: Adoption of automation, AI, and IoT offers opportunities for efficiency gains and cost reduction.

- Specialized services: Demand for specialized cold storage and transportation for pharmaceutical products and other temperature-sensitive goods is growing rapidly.

Growth Accelerators in the Latin America Cold Storage Transportation Market Industry

Strategic partnerships between logistics providers, technology companies, and cold storage equipment manufacturers are driving market growth. Technological innovations are accelerating efficiency gains and reducing costs, while expanding infrastructure projects are enhancing connectivity and logistics capabilities across the region. Government policies promoting food security and economic development are creating a favorable environment for market growth.

Key Players Shaping the Latin America Cold Storage Transportation Market Market

- Superfrio Armazens Gerais Ltda

- Ransa Comercial SA

- Americold Logistics

- Brasfrigo

- Comfrio Solucoes Logisticas

- Qualianz

- Frialsa Frigorificos SA

- Arfrio Armazens Gerais Frigorificos

- Friozem Armazens Frigorificos Ltda

- Localfrio

- Other Prominent Companies (e.g., key regional operators, logistics providers focusing on specific niches)

- Key Vendors and Suppliers (e.g., leading manufacturers of refrigeration equipment, advanced insulated truck bodies, temperature logging devices, and specialized cold chain software providers)

Notable Milestones in Latin America Cold Storage Transportation Market Sector

- June 2023: Canadian Pacific's strategic initiative to develop cold storage facilities in Kansas City, explicitly designed to bolster intermodal transport connectivity with Mexico. This development underscores a growing emphasis on enhanced cross-border logistics and the integration of value-added services within international trade routes.

- November 2022: Emergent Cold LatAm's strategic acquisition of a significant distribution facility located in Recife, Brazil. This expansion into the vital northeastern region of Brazil signifies a continued trend of market consolidation and strategic growth for major players seeking to broaden their operational footprint and service capabilities.

- October 2022: The successful expansion of a key temperature-controlled facility in Panama City, Panama, resulting in a substantial increase in operational capacity. This investment highlights the ongoing commitment to bolstering essential infrastructure in response to consistently rising market demand for cold chain solutions.

- Ongoing Developments: Increased investment in sustainable cold chain technologies, including energy-efficient refrigeration units and renewable energy integration within warehouse operations.

- Emerging Trends: Greater adoption of IoT-enabled cold chain solutions for enhanced real-time monitoring and predictive analytics, improving operational efficiency and reducing risks.

In-Depth Latin America Cold Storage Transportation Market Market Outlook

The Latin American cold storage transportation market is on a trajectory for robust and sustained growth throughout the foreseeable future. This optimistic outlook is primarily underpinned by substantial ongoing and planned investments in critical infrastructure, the widespread integration of cutting-edge technological advancements, and the continuous expansion of key end-user industries such as food and beverage, pharmaceuticals, and e-commerce. Strategic collaborations and alliances between market participants, coupled with ongoing innovation in cold chain technologies and the persistent expansion of high-growth sectors, are expected to unlock significant and diverse opportunities for all stakeholders. For companies aiming to thrive and capitalize on this dynamic market, a strategic focus on expanding operational reach into currently underserved geographical regions and a commitment to offering comprehensive, sophisticated value-added services will be paramount to achieving sustained success and market leadership.

Latin America Cold Storage Transportation Market Segmentation

-

1. Service

- 1.1. Cold Storage/Refrigerated Warehousing

- 1.2. Refrigerated Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Fruits and Vegetables

- 3.2. Dairy Pr

- 3.3. Fish, Meat, and Seafood

- 3.4. Processed Food

- 3.5. Pharmaceutical (Includes Biopharma)

- 3.6. Bakery and Confectionery

- 3.7. Other End Users

Latin America Cold Storage Transportation Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Cold Storage Transportation Market Regional Market Share

Geographic Coverage of Latin America Cold Storage Transportation Market

Latin America Cold Storage Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in E-commerce4.; Healthcare Sector is the market

- 3.3. Market Restrains

- 3.3.1. 4.; Supply Chain Disruptions4.; Lack of Temperature- Controlled Warehouses

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Demand for Perishable Goods the warehousing space is growing in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Cold Storage Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Cold Storage/Refrigerated Warehousing

- 5.1.2. Refrigerated Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Fruits and Vegetables

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat, and Seafood

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Includes Biopharma)

- 5.3.6. Bakery and Confectionery

- 5.3.7. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Superfrio Armazens Gerais Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ransa Comercial SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Americold Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brasfrigo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comfrio Solucoes Logisticas

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qualianz**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)6 4 Key Vendors and Suppliers (Cold Storage Equipment Manufacturers Carrier Manufacturers and Technology Providers for the Cold Chain Industry

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Frialsa Frigorificos SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arfrio Armazens Gerais Frigorificos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Friozem Armazens Frigorificos Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Localfrio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Superfrio Armazens Gerais Ltda

List of Figures

- Figure 1: Latin America Cold Storage Transportation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Cold Storage Transportation Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Latin America Cold Storage Transportation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Latin America Cold Storage Transportation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Cold Storage Transportation Market?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the Latin America Cold Storage Transportation Market?

Key companies in the market include Superfrio Armazens Gerais Ltda, Ransa Comercial SA, Americold Logistics, Brasfrigo, Comfrio Solucoes Logisticas, Qualianz**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)6 4 Key Vendors and Suppliers (Cold Storage Equipment Manufacturers Carrier Manufacturers and Technology Providers for the Cold Chain Industry, Frialsa Frigorificos SA, Arfrio Armazens Gerais Frigorificos, Friozem Armazens Frigorificos Ltda, Localfrio.

3. What are the main segments of the Latin America Cold Storage Transportation Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.33 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in E-commerce4.; Healthcare Sector is the market.

6. What are the notable trends driving market growth?

Increasing Consumer Demand for Perishable Goods the warehousing space is growing in the region.

7. Are there any restraints impacting market growth?

4.; Supply Chain Disruptions4.; Lack of Temperature- Controlled Warehouses.

8. Can you provide examples of recent developments in the market?

June 2023: Canadian Pacific announced a strategic partnership to co-host American warehouse facilities on Canadian Pacific's (CPKC) network. Supported by rail transportation, the goal is to construct the first facility on CPKC's network in Kansas City (Mo.), Kansas, to combine cold storage and added-value services with accelerated intermodal transport solutions connecting key markets in the U.S., Midwest, and Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Cold Storage Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Cold Storage Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Cold Storage Transportation Market?

To stay informed about further developments, trends, and reports in the Latin America Cold Storage Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence