Key Insights

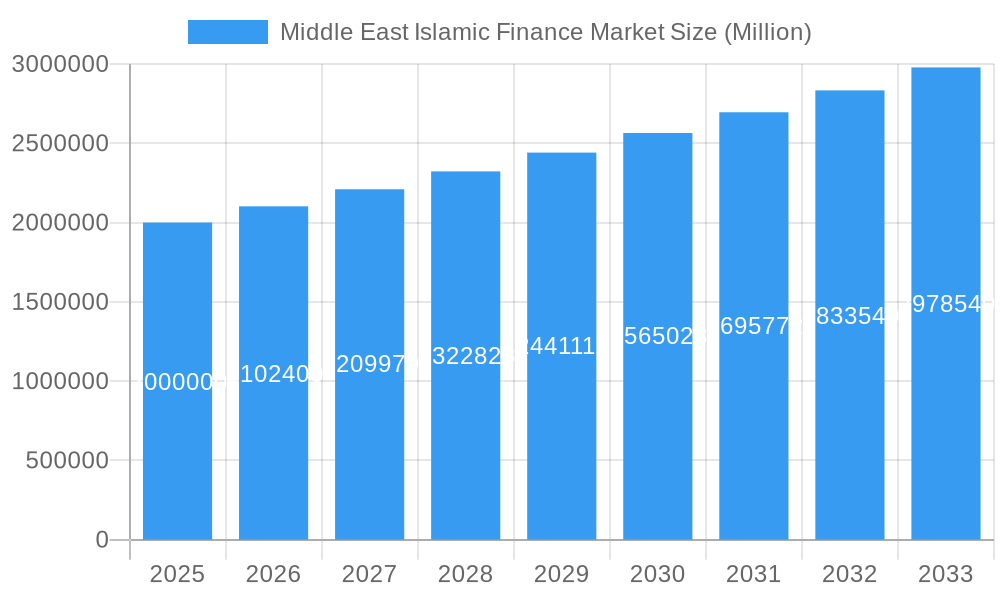

The Middle East Islamic finance market, valued at approximately $2 trillion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.12% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the region's predominantly Muslim population naturally aligns with Islamic finance principles, creating significant organic demand. Secondly, supportive government policies and regulations across various Middle Eastern countries are actively promoting the growth of this sector. Furthermore, increasing awareness and acceptance of Islamic financial instruments among both individuals and corporations are contributing to market expansion. Technological advancements, including the rise of fintech solutions tailored to Islamic finance, are also streamlining processes and attracting a wider range of participants. The market is segmented by various financial products and services, including Islamic banking, takaful (Islamic insurance), and sukuk (Islamic bonds). Leading players like Barwa Bank, Iraqi Islamic Bank of Investment & Development, Mellat Bank, and others are actively shaping market competition and innovation.

Middle East Islamic Finance Market Market Size (In Million)

However, the market faces certain challenges. Regulatory complexities and inconsistencies across different jurisdictions can hinder seamless cross-border transactions and investment. Additionally, a lack of standardized accounting and auditing practices specific to Islamic finance can pose challenges for transparency and investor confidence. Despite these restraints, the long-term outlook remains positive, driven by the region's economic growth, rising disposable incomes, and increasing demand for Sharia-compliant financial products and services. The increasing integration of Islamic finance into the global financial system further solidifies its potential for continued, substantial growth over the forecast period. The market is expected to significantly expand in both value and geographic reach across the Middle East during the next decade, leading to considerable opportunities for both existing and new market participants.

Middle East Islamic Finance Market Company Market Share

Middle East Islamic Finance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East Islamic finance market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this rapidly evolving sector. The report analyzes the parent market of Islamic finance and its child markets within the Middle East region, providing granular insights and detailed forecasts. Market size is presented in Million units.

Middle East Islamic Finance Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and M&A activities. The Middle East Islamic finance market exhibits a moderately concentrated structure, with a few major players commanding significant market share. However, the emergence of fintech companies and the increasing adoption of digital solutions are fostering competition. Regulatory frameworks, while supportive of Islamic finance, continue to evolve, influencing market dynamics.

- Market Concentration: xx% market share held by top 5 players in 2024.

- Technological Innovation: Rapid adoption of FinTech solutions, particularly in mobile banking and digital payment systems. Key barriers include legacy IT infrastructure and regulatory hurdles in some countries.

- Regulatory Frameworks: Varying regulatory environments across different countries in the Middle East create both opportunities and challenges. Harmonization efforts are ongoing.

- Competitive Product Substitutes: Conventional banking products still represent a competitive challenge, particularly for certain segments of the population.

- End-User Demographics: Growing young population and increasing financial literacy are key drivers of market growth.

- M&A Trends: xx M&A deals were recorded between 2019 and 2024, signaling consolidation and expansion within the sector.

Middle East Islamic Finance Market Growth Trends & Insights

The Middle East Islamic finance market has witnessed substantial growth over the past five years, driven by factors such as increasing religious observance, rising disposable incomes, and government support for the sector. The report provides a detailed analysis of market size evolution, adoption rates, and technological disruptions impacting growth trajectory. Specific metrics, including CAGR and market penetration rates, are included. Consumer behavior shifts towards digital platforms and greater financial inclusion are also analyzed. The projected CAGR for the forecast period (2025-2033) is xx%. Market penetration is estimated to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Middle East Islamic Finance Market

The Middle East Islamic finance market is experiencing robust growth, spearheaded by several key regions and countries. The United Arab Emirates (UAE) and Saudi Arabia remain dominant players, benefitting from well-established financial infrastructures, supportive regulatory frameworks, and substantial populations. However, significant untapped potential exists within other markets. Iran, despite sanctions-related challenges, possesses a large and potentially lucrative market. Similarly, Iraq's burgeoning economy presents opportunities for Islamic finance expansion. Market dominance analysis reveals the UAE and Saudi Arabia hold the largest market share, attributed to their proactive government policies, robust economic growth, and advanced financial technology adoption. Further analysis of regional variances reveals that growth rates are significantly influenced by factors such as economic stability, infrastructure development, and the effectiveness of regulatory frameworks in promoting investor confidence and facilitating market accessibility. This includes evaluating the availability of skilled professionals, access to capital, and the overall business environment in each region. Detailed analysis across various segments (e.g., retail banking, corporate finance, Takaful) reveals varying growth trajectories and market dynamics, providing valuable insights for strategic investments and market entry strategies.

- Key Drivers: Government initiatives promoting Islamic finance, including tax incentives and streamlined regulatory processes; robust economic growth in several key markets; favorable regulatory environments that encourage innovation and competition; increasing demand for ethical and Shariah-compliant financial products; and technological advancements fostering financial inclusion.

- Dominance Factors: Established financial infrastructure, including a robust network of Islamic banks and financial institutions; strong regulatory frameworks ensuring transparency, stability, and investor protection; a large and growing Muslim population representing a significant customer base; and successful integration of Islamic finance principles into the broader financial ecosystem.

Middle East Islamic Finance Market Product Landscape

The Middle East Islamic finance market showcases a diverse and expanding range of Shariah-compliant products and services. These include a wide array of financing solutions such as Murabaha, Ijara, and Sukuk, catering to both individuals and corporations. Investment products encompass a spectrum of options, from ethically-screened mutual funds to Shariah-compliant investment trusts and real estate investment trusts (REITs). The Takaful (Islamic insurance) sector also plays a significant role, offering insurance products adhering to Islamic principles of risk sharing and mutual support. The market has witnessed a surge in innovation, with a particular focus on leveraging digital platforms, mobile banking, and AI-driven services to enhance customer experience, improve operational efficiency, and expand market reach. These technologies enable greater accessibility, transparency, and convenience for customers, while simultaneously reducing costs for financial institutions. The unique selling proposition (USP) of these products is their unwavering alignment with Islamic principles, offering a compelling alternative to conventional finance for a growing segment of the population.

Key Drivers, Barriers & Challenges in Middle East Islamic Finance Market

Key Drivers:

- Increased religious observance and a corresponding rise in demand for Shariah-compliant financial services, reflecting a growing preference for ethical and socially responsible investment options.

- Government support and initiatives to promote Islamic finance, including policy reforms, regulatory enhancements, and the establishment of dedicated Islamic finance development bodies.

- Growing population and rising disposable incomes, leading to increased demand for a wider range of financial products and services.

- Technological advancements and innovation in financial services, enabling greater efficiency, accessibility, and product diversification within the Islamic finance sector.

- Growing awareness and understanding of the benefits of Islamic finance among both individuals and corporations.

Key Challenges:

- Regulatory inconsistencies across different jurisdictions in the region, creating fragmentation and potentially hindering cross-border transactions and investment flows.

- Competition from conventional banking institutions, necessitating continuous innovation and differentiation to maintain a competitive edge.

- Lack of awareness and understanding of Islamic financial products among certain population segments, requiring targeted education and outreach programs to promote broader adoption.

- Global economic uncertainties and their potential impact on investment flows, requiring robust risk management strategies and diversification to mitigate potential risks.

- The need for skilled professionals with expertise in both Islamic finance and modern financial technologies.

Emerging Opportunities in Middle East Islamic Finance Market

Emerging opportunities include the growth of fintech and Insurtech applications within the Islamic finance sector, the expansion of Islamic microfinance to serve underserved populations, and the development of innovative Shariah-compliant investment instruments catering to evolving investor preferences. Untapped potential lies in the expansion into less-developed markets within the Middle East and the growing interest in sustainable and ethical finance.

Growth Accelerators in the Middle East Islamic Finance Market Industry

Long-term growth in the Middle East Islamic finance market is expected to be driven by technological advancements such as blockchain and AI, strategic partnerships between Islamic banks and fintech firms, and market expansion into new geographical areas. Government initiatives and regulatory clarity play a significant role in shaping the sector's future trajectory.

Key Players Shaping the Middle East Islamic Finance Market Market

- Barwa Bank

- Iraqi Islamic Bank of Inv & Dev

- Mellat Bank

- Post Bank of Iran

- Bank Keshavarzi

- Abu Dhabi Islamic Bank (ADIB)

- Dubai Islamic Bank (DIB)

- Abu Dhabi Commercial Bank

- Saudi British Bank

- Riyad Bank

- Al Rajhi Bank

- Islamic Corporation for the Development of the Private Sector (ICD) (List Not Exhaustive)

Notable Milestones in Middle East Islamic Finance Market Sector

- September 2023: Abu Dhabi Securities Exchange (ADX) partnered with Sharjah Islamic Bank (SIB) to improve IPO access for investors, signifying increased market efficiency and investor participation.

- March 2023: Aafaq Islamic Finance's partnership with Rasmala broadened product offerings and enhanced advisory capabilities, indicating strategic collaborations driving product innovation.

In-Depth Middle East Islamic Finance Market Market Outlook

The Middle East Islamic finance market is projected to experience substantial growth over the next decade, driven by several interconnected factors. Supportive government policies, including the continued implementation of strategies promoting the sector, are creating a favourable environment for investment and growth. Rapid technological advancements, including the adoption of fintech solutions and digital banking platforms, are enhancing operational efficiency, expanding market reach, and improving customer experiences. The growing demand for Shariah-compliant financial services reflects a global shift towards ethical and responsible investments. This trend is further fueled by the rising awareness of the benefits of Islamic finance, including its focus on transparency, fairness, and social responsibility. Strategic opportunities abound for companies seeking to capitalize on this expanding market. Investment in cutting-edge technologies, diversification of product offerings to meet the evolving needs of a diverse customer base, and the development of innovative solutions to enhance customer experience are key strategies for success. The market's growing emphasis on sustainable and ethical finance further solidifies its long-term growth outlook, positioning it as a significant driver of economic development and social progress in the region. The focus on environmentally friendly and socially responsible investments is expected to further attract a wider range of investors.

Middle East Islamic Finance Market Segmentation

-

1. Financial Sector

- 1.1. Islamic Banking

- 1.2. Islamic Insurance 'Takaful'

- 1.3. Islamic Bonds 'Sukuk'

- 1.4. Other Fi

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. Qatar

- 2.3. Iraq

- 2.4. Iran

- 2.5. United Arab Emirates

- 2.6. Rest of Middle East

Middle East Islamic Finance Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Qatar

- 3. Iraq

- 4. Iran

- 5. United Arab Emirates

- 6. Rest of Middle East

Middle East Islamic Finance Market Regional Market Share

Geographic Coverage of Middle East Islamic Finance Market

Middle East Islamic Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Muslim Population is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Growing Muslim Population is Driving the Market

- 3.4. Market Trends

- 3.4.1. Growing Fintech Digital Sukuk

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 5.1.1. Islamic Banking

- 5.1.2. Islamic Insurance 'Takaful'

- 5.1.3. Islamic Bonds 'Sukuk'

- 5.1.4. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. Qatar

- 5.2.3. Iraq

- 5.2.4. Iran

- 5.2.5. United Arab Emirates

- 5.2.6. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Qatar

- 5.3.3. Iraq

- 5.3.4. Iran

- 5.3.5. United Arab Emirates

- 5.3.6. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6. Saudi Arabia Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6.1.1. Islamic Banking

- 6.1.2. Islamic Insurance 'Takaful'

- 6.1.3. Islamic Bonds 'Sukuk'

- 6.1.4. Other Fi

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. Qatar

- 6.2.3. Iraq

- 6.2.4. Iran

- 6.2.5. United Arab Emirates

- 6.2.6. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7. Qatar Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7.1.1. Islamic Banking

- 7.1.2. Islamic Insurance 'Takaful'

- 7.1.3. Islamic Bonds 'Sukuk'

- 7.1.4. Other Fi

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. Qatar

- 7.2.3. Iraq

- 7.2.4. Iran

- 7.2.5. United Arab Emirates

- 7.2.6. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8. Iraq Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8.1.1. Islamic Banking

- 8.1.2. Islamic Insurance 'Takaful'

- 8.1.3. Islamic Bonds 'Sukuk'

- 8.1.4. Other Fi

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. Qatar

- 8.2.3. Iraq

- 8.2.4. Iran

- 8.2.5. United Arab Emirates

- 8.2.6. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9. Iran Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9.1.1. Islamic Banking

- 9.1.2. Islamic Insurance 'Takaful'

- 9.1.3. Islamic Bonds 'Sukuk'

- 9.1.4. Other Fi

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. Qatar

- 9.2.3. Iraq

- 9.2.4. Iran

- 9.2.5. United Arab Emirates

- 9.2.6. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10. United Arab Emirates Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10.1.1. Islamic Banking

- 10.1.2. Islamic Insurance 'Takaful'

- 10.1.3. Islamic Bonds 'Sukuk'

- 10.1.4. Other Fi

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. Qatar

- 10.2.3. Iraq

- 10.2.4. Iran

- 10.2.5. United Arab Emirates

- 10.2.6. Rest of Middle East

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11. Rest of Middle East Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11.1.1. Islamic Banking

- 11.1.2. Islamic Insurance 'Takaful'

- 11.1.3. Islamic Bonds 'Sukuk'

- 11.1.4. Other Fi

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. Qatar

- 11.2.3. Iraq

- 11.2.4. Iran

- 11.2.5. United Arab Emirates

- 11.2.6. Rest of Middle East

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Barwa Bank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Iraqi Islamic Bank of Inv & Dev

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Mellat Bank

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Post Bank of Iran

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bank Keshavarzi

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Abu Dhabi Commercial Bank

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Saudi British Bank

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Riyad Bank**List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Barwa Bank

List of Figures

- Figure 1: Global Middle East Islamic Finance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Middle East Islamic Finance Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 4: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 5: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 6: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 7: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 8: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 9: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 11: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Qatar Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 16: Qatar Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 17: Qatar Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 18: Qatar Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 19: Qatar Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 20: Qatar Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 21: Qatar Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 22: Qatar Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 23: Qatar Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Qatar Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Qatar Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Qatar Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Iraq Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 28: Iraq Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 29: Iraq Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 30: Iraq Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 31: Iraq Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 32: Iraq Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 33: Iraq Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 34: Iraq Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 35: Iraq Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Iraq Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Iraq Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Iraq Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Iran Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 40: Iran Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 41: Iran Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 42: Iran Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 43: Iran Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: Iran Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 45: Iran Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Iran Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: Iran Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Iran Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Iran Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Iran Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 52: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 53: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 54: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 55: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 56: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 57: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 58: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 59: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 60: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 64: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 65: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 66: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 67: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 68: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 69: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 70: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 71: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 73: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 2: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 3: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 5: Global Middle East Islamic Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 8: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 9: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 11: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 14: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 15: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 17: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 20: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 21: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 23: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 26: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 27: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 29: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 32: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 33: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 35: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 38: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 39: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 40: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 41: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Islamic Finance Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Middle East Islamic Finance Market?

Key companies in the market include Barwa Bank, Iraqi Islamic Bank of Inv & Dev, Mellat Bank, Post Bank of Iran, Bank Keshavarzi, Abu Dhabi Commercial Bank, Saudi British Bank, Riyad Bank**List Not Exhaustive.

3. What are the main segments of the Middle East Islamic Finance Market?

The market segments include Financial Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Muslim Population is Driving the Market.

6. What are the notable trends driving market growth?

Growing Fintech Digital Sukuk.

7. Are there any restraints impacting market growth?

Growing Muslim Population is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Abu Dhabi Securities Exchange (ADX) collaborated with Sharjah Islamic Bank (SIB) to enhance and streamline access to Initial Public Offering (IPO) subscriptions for investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Islamic Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Islamic Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Islamic Finance Market?

To stay informed about further developments, trends, and reports in the Middle East Islamic Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence