Key Insights

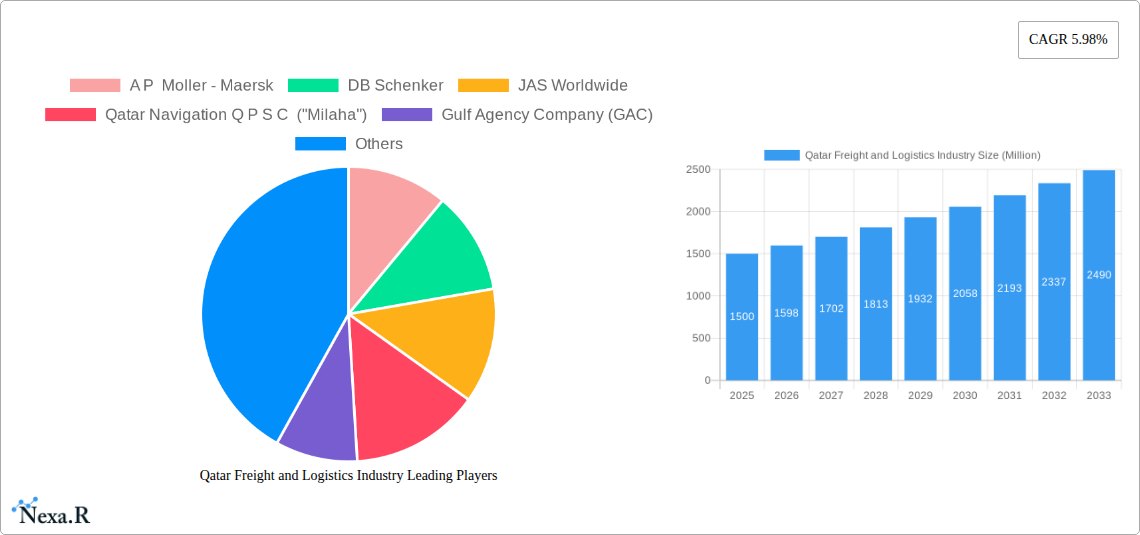

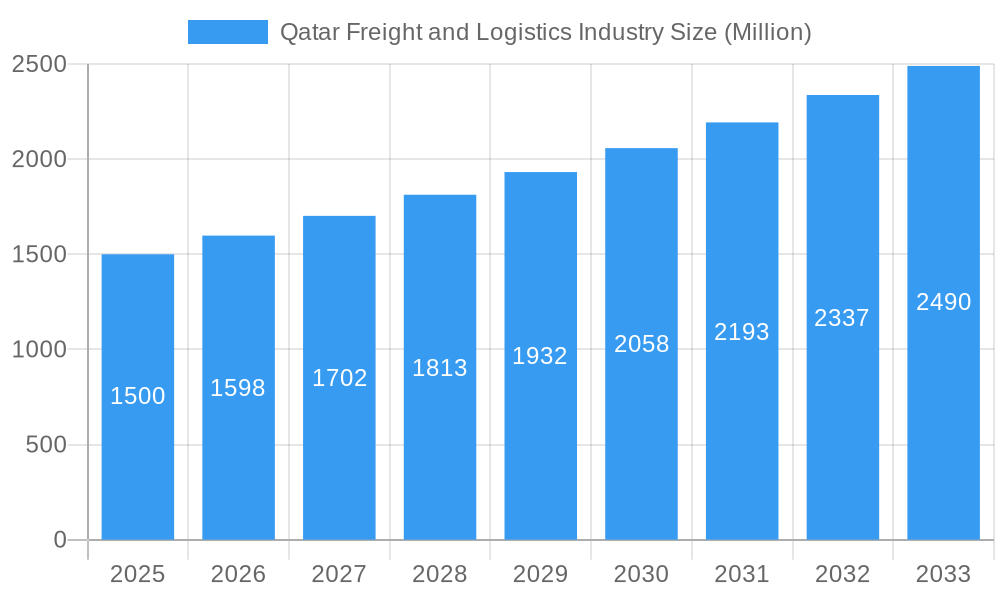

The Qatar freight and logistics industry, currently valued at approximately $XX million (estimated based on undisclosed market size and available data), is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. This expansion is fueled by several key drivers. Qatar's strategic geographic location, serving as a vital hub connecting Asia, Africa, and Europe, significantly contributes to its importance in global trade routes. Furthermore, substantial investments in infrastructure development, including port expansions and upgrades to transportation networks, are enhancing operational efficiency and capacity. The ongoing diversification of Qatar's economy, particularly in sectors like manufacturing and tourism, is also bolstering demand for freight and logistics services. Growth in e-commerce and the increasing reliance on temperature-controlled transportation for perishable goods further stimulate market expansion. While challenges exist, such as regional geopolitical instability and potential fluctuations in global energy prices, the overall outlook remains positive, driven by Qatar's commitment to becoming a leading logistics center in the region. The industry is segmented by end-user industry (Agriculture, Fishing & Forestry; Construction; Manufacturing; Oil & Gas; Mining & Quarrying; Wholesale & Retail Trade; Others) and logistics function (Courier, Express & Parcel (CEP); Temperature Controlled; Other Services), each exhibiting unique growth trajectories depending on the prevailing economic climate and infrastructural advancements. Key players, including international giants like Maersk and DHL alongside prominent regional companies such as Milaha and GWC, are actively shaping the industry's competitive landscape and adapting to evolving customer needs.

Qatar Freight and Logistics Industry Market Size (In Billion)

The substantial investments in Qatar's transportation infrastructure, such as Hamad International Airport's expansion and the development of New Doha Port, are creating a highly competitive and attractive environment for logistics companies. This leads to increased efficiency and capacity in handling diverse cargo types, including oversized and specialized freight. The continued growth of e-commerce and the expansion of online retail platforms further propel the demand for efficient last-mile delivery solutions within the country. The government's proactive initiatives to promote sustainable logistics practices also contribute to the sector's development. This includes focusing on improving supply chain visibility and optimizing transportation routes to minimize environmental impact. However, potential regulatory changes and competition from neighboring countries remain factors to consider for long-term industry performance. The market's success hinges on the continued implementation of innovative solutions, efficient management of resources, and adaptation to changing global economic dynamics.

Qatar Freight and Logistics Industry Company Market Share

Qatar Freight and Logistics Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Qatar freight and logistics industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child market segments, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 as the base and estimated year.

Qatar Freight and Logistics Industry Market Dynamics & Structure

The Qatari freight and logistics market, valued at xx Million in 2025, exhibits a moderately concentrated structure with several multinational and domestic players vying for market share. Technological innovation, driven by increasing automation and digitalization, is a significant driver, alongside robust governmental regulatory frameworks supporting infrastructure development. While traditional logistics services remain dominant, the emergence of specialized services like temperature-controlled transportation and e-commerce fulfillment is transforming the sector. Competitive substitutes, such as direct-to-consumer shipping models, are exerting pressure. End-user demographics, primarily driven by the energy sector and booming construction projects, significantly influence demand. M&A activity, while not overly prolific, demonstrates strategic consolidation within the market.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Strong focus on automation (e.g., robotics, AI), digitalization (e.g., blockchain, IoT), and sustainable solutions.

- Regulatory Framework: Supportive government policies promoting infrastructure development and logistics efficiency.

- Competitive Substitutes: Direct-to-consumer models and specialized niche players pose competitive pressure.

- End-User Demographics: Dominated by Oil & Gas, Construction, and Wholesale & Retail sectors.

- M&A Trends: Moderate level of mergers and acquisitions, driven by strategic expansion and service diversification. Total M&A deal value in 2024 estimated at xx Million.

Qatar Freight and Logistics Industry Growth Trends & Insights

The Qatari freight and logistics market exhibits robust growth, fueled by continuous infrastructure investments, expanding industrial activities, and a burgeoning e-commerce sector. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The adoption rate of advanced technologies, such as AI-powered route optimization and predictive maintenance, is accelerating, improving efficiency and reducing operational costs. Consumer behavior is shifting towards faster, more reliable, and transparent logistics solutions, driving the demand for advanced tracking and delivery management systems. The historical period (2019-2024) reflects a steady growth trajectory, setting the stage for further expansion.

Dominant Regions, Countries, or Segments in Qatar Freight and Logistics Industry

The Oil & Gas sector represents the largest end-user segment, accounting for xx% of the market in 2025, followed by Construction (xx%) and Wholesale & Retail Trade (xx%). Within logistics functions, "Other Services" holds a significant share (xx%), indicating diverse needs beyond core transportation. The dominance of these segments is driven by Qatar's economic structure and ongoing mega-projects. Growth potential lies in the diversification of the economy and the expansion of the e-commerce sector.

- Key Drivers for Oil & Gas Dominance: High value of goods transported, established infrastructure, and reliance on specialized logistics services.

- Key Drivers for Construction Sector Growth: Large-scale infrastructure projects, requiring extensive material movement and specialized transport.

- Key Drivers for Wholesale & Retail Growth: Expansion of e-commerce and increasing consumer demand for efficient delivery services.

- Infrastructure: Government investments in ports, roads, and airports significantly contribute to overall market growth.

Qatar Freight and Logistics Industry Product Landscape

The product landscape is characterized by a range of traditional and specialized logistics services. Key innovations include the integration of AI and IoT for improved supply chain visibility and predictive analytics, enhanced cold chain solutions for temperature-sensitive goods, and the adoption of sustainable practices to minimize environmental impact. Unique selling propositions focus on speed, reliability, transparency, and customization, catering to the specific requirements of various end-user industries.

Key Drivers, Barriers & Challenges in Qatar Freight and Logistics Industry

Key Drivers: Government investments in infrastructure, rising e-commerce activity, increasing demand for specialized logistics services (e.g., cold chain), and the growing need for efficient supply chain management.

Key Challenges: Competition from regional players, reliance on foreign labor, fluctuating oil prices (impacting related sectors), and the need for continuous technological adaptation. Regulatory complexities and bureaucratic procedures can also create bottlenecks. Estimated losses due to supply chain disruptions in 2024 amounted to xx Million.

Emerging Opportunities in Qatar Freight and Logistics Industry

Emerging opportunities reside in the growth of e-commerce logistics, specialized services for the healthcare sector, and the adoption of sustainable logistics solutions. Untapped market potential exists in niche sectors, including perishable goods transportation and the development of integrated logistics platforms for various industries.

Growth Accelerators in the Qatar Freight and Logistics Industry

Long-term growth is driven by continuous infrastructure development, the diversification of Qatar's economy beyond hydrocarbons, and the adoption of advanced technologies. Strategic partnerships between local and international logistics providers, coupled with a focus on sustainability and innovation, will be crucial for maintaining market momentum.

Key Players Shaping the Qatar Freight and Logistics Industry Market

- A P Moller - Maersk

- DB Schenker

- JAS Worldwide

- Qatar Navigation Q P S C ("Milaha")

- Gulf Agency Company (GAC)

- Bin Yousef Group of Companies W L L

- DHL Group

- Tokyo Freight Service

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- E2E Global Lines

- Gulf Warehousing Company (GWC)

- Qatar Post

- FedEx

- Target Logistics Qatar

- Al Faisal Holding

- Kuehne + Nagel

- BCC Logistics

- Aerofrt (Aero Freight Company Ltd)

- Mannai Corporation QPSC

- Nakilat

- Qatar Airways Group

- Aramex

- Ali Bin Ali Holding

- Rumaillah Group

Notable Milestones in Qatar Freight and Logistics Industry Sector

- March 2023: Maersk announced the divestment of Maersk Supply Service (MSS), focusing its strategy on integrated logistics.

- September 2023: Kuehne+Nagel and Capgemini partnered to create a supply chain orchestration service.

- January 2024: Kuehne + Nagel launched its Book & Claim insetting solution for electric vehicles.

In-Depth Qatar Freight and Logistics Industry Market Outlook

The future of the Qatari freight and logistics industry is bright, propelled by sustained economic growth, technological advancements, and ongoing infrastructure development. Strategic partnerships, investments in sustainable solutions, and a focus on digitalization will shape the market landscape in the coming years. The potential for market expansion lies in attracting foreign investment, fostering innovation, and creating a robust and efficient logistics ecosystem. The projected market size in 2033 presents significant opportunities for both established players and new entrants.

Qatar Freight and Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Qatar Freight and Logistics Industry Segmentation By Geography

- 1. Qatar

Qatar Freight and Logistics Industry Regional Market Share

Geographic Coverage of Qatar Freight and Logistics Industry

Qatar Freight and Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Freight and Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JAS Worldwide

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Qatar Navigation Q P S C ("Milaha")

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gulf Agency Company (GAC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bin Yousef Group of Companies W L L

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DHL Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tokyo Freight Service

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 E2E Global Lines

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gulf Warehousing Company (GWC)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Qatar Post

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 FedEx

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Target Logistics Qatar

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Al Faisal Holding

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Kuehne + Nagel

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 BCC Logistics

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Aerofrt (Aero Freight Company Ltd)

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Mannai Corporation QPSC

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Nakilat

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Qatar Airways Group

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Aramex

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Ali Bin Ali Holding

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Rumaillah Group

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Qatar Freight and Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Qatar Freight and Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Qatar Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 2: Qatar Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2020 & 2033

- Table 3: Qatar Freight and Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Qatar Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 5: Qatar Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2020 & 2033

- Table 6: Qatar Freight and Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Freight and Logistics Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Qatar Freight and Logistics Industry?

Key companies in the market include A P Moller - Maersk, DB Schenker, JAS Worldwide, Qatar Navigation Q P S C ("Milaha"), Gulf Agency Company (GAC), Bin Yousef Group of Companies W L L, DHL Group, Tokyo Freight Service, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), E2E Global Lines, Gulf Warehousing Company (GWC), Qatar Post, FedEx, Target Logistics Qatar, Al Faisal Holding, Kuehne + Nagel, BCC Logistics, Aerofrt (Aero Freight Company Ltd), Mannai Corporation QPSC, Nakilat, Qatar Airways Group, Aramex, Ali Bin Ali Holding, Rumaillah Group.

3. What are the main segments of the Qatar Freight and Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.September 2023: Kuehne+Nagel and Capgemini have entered into a strategic agreement to create a supply chain orchestration service offering to provide end-to-end services across the supply chain network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Freight and Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Freight and Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Freight and Logistics Industry?

To stay informed about further developments, trends, and reports in the Qatar Freight and Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence