Key Insights

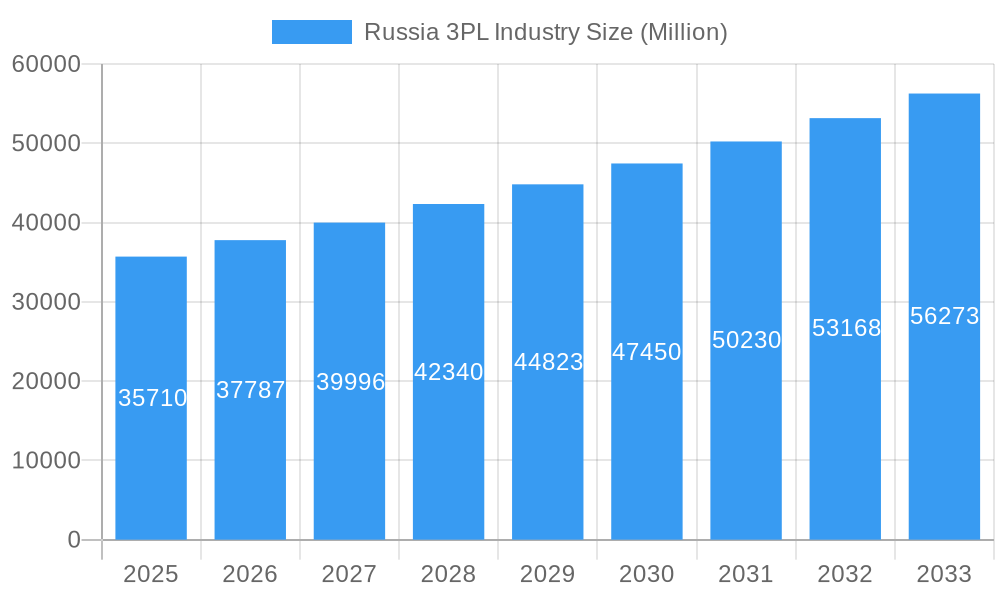

The Russian 3PL (Third-Party Logistics) industry, valued at $35.71 billion in 2025, is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.63% from 2025 to 2033. This robust growth is fueled by several key factors. The burgeoning e-commerce sector in Russia is driving demand for efficient warehousing and distribution solutions, particularly within the consumer and retail segment. Furthermore, the increasing complexity of global supply chains and the need for specialized logistics services within sectors like energy and chemicals, automotive manufacturing, and life sciences are contributing to the market expansion. Government initiatives aimed at improving infrastructure and streamlining logistics processes are also providing positive tailwinds. However, geopolitical uncertainties and economic fluctuations present challenges. Sanctions and trade restrictions can impact international transportation management, while domestic infrastructure limitations in certain regions, particularly Eastern Russia, could hinder overall growth. The competitive landscape is characterized by a mix of international players like DB Schenker, UPS, and Kuehne + Nagel, alongside established domestic providers such as RZD Logistics, Nienshants, and FM Logistics. This blend of global expertise and local knowledge shapes the market dynamics.

Russia 3PL Industry Market Size (In Billion)

The segmentation of the Russian 3PL market reveals valuable insights into its trajectory. Domestic transportation management remains a significant segment, reflecting the importance of efficient intra-country movement of goods. The growth of international transportation management will depend heavily on geopolitical stability and evolving trade relationships. Value-added warehousing and distribution services are gaining traction, particularly among companies seeking to optimize their supply chain efficiency and reduce operational costs. The end-user segment analysis indicates strong demand from the consumer and retail sector, driven by e-commerce growth, while the energy and chemicals, automotive manufacturing, and life sciences sectors also contribute significantly to market demand. Regional variations exist, with Western Russia exhibiting potentially higher growth rates due to better infrastructure and proximity to major economic centers. The forecast period of 2025-2033 promises continued expansion, provided macroeconomic conditions remain favorable and geopolitical factors stabilize.

Russia 3PL Industry Company Market Share

Russia 3PL Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Russia 3PL (Third-Party Logistics) industry, encompassing market dynamics, growth trends, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this evolving market. The report segments the market by type (Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution) and end-user (Consumer and Retail, Energy and Chemicals, Automotive and Manufacturing, Life sciences and Healthcare, Other End-Users). The total market size is projected to reach xx Million by 2033.

Russia 3PL Industry Market Dynamics & Structure

The Russian 3PL market is characterized by a moderate level of concentration, with several large multinational players and a number of domestic providers. Technological innovation, while present, faces challenges due to sanctions and geopolitical factors. Regulatory frameworks are complex and evolving, impacting operational efficiency. The market witnesses competition from smaller, specialized logistics providers. End-user demographics are diverse, reflecting Russia's vast geography and varied economic sectors. M&A activity has been impacted by recent geopolitical events, with some significant divestments observed.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Driven by automation in warehousing and digitalization of supply chain management, but hindered by sanctions and technological dependence.

- Regulatory Framework: Complex and subject to change, impacting operational costs and compliance.

- Competitive Substitutes: Smaller, specialized logistics providers and in-house logistics operations pose competition.

- M&A Trends: Recent geopolitical events led to a decrease in M&A activity, with some notable divestments. For example, Kuehne+Nagel's sale of its Russian operations in 2022.

Russia 3PL Industry Growth Trends & Insights

The Russian 3PL market experienced fluctuating growth during the historical period (2019-2024), significantly impacted by geopolitical events and sanctions. The market is expected to recover and exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the increased adoption of blockchain technology and AI-powered logistics solutions, are anticipated to drive efficiency and transparency. Consumer behavior shifts, such as the growing preference for e-commerce, are creating new opportunities for 3PL providers. Market penetration of 3PL services is expected to increase from xx% in 2024 to xx% by 2033. The market is seeing an increased demand for value-added services like customized warehousing and distribution solutions. Government initiatives promoting infrastructure development are expected to contribute to market growth.

Dominant Regions, Countries, or Segments in Russia 3PL Industry

The Moscow and St. Petersburg regions are currently the dominant areas for 3PL activities, due to high population density, economic activity, and infrastructure development. Within the segments, Domestic Transportation Management holds the largest market share, primarily due to the vast internal trade within Russia. The Consumer and Retail sector represents the largest end-user segment, driven by the expansion of e-commerce. However, the Energy and Chemicals sector is projected to experience the highest growth rate during the forecast period, given the country's resource-rich economy.

- Key Drivers:

- Strong economic growth in certain sectors (e.g., energy, manufacturing).

- Development of transportation infrastructure (roads, railways).

- Government initiatives to improve logistics efficiency.

- Dominance Factors: Geographic location, established infrastructure, and concentration of major industries.

- Growth Potential: High growth potential in less-developed regions and in niche sectors like life sciences and healthcare.

Russia 3PL Industry Product Landscape

The Russian 3PL market offers a range of services, from basic transportation and warehousing to advanced value-added services like inventory management, order fulfillment, and reverse logistics. Recent innovations include the integration of advanced technologies such as IoT sensors for real-time tracking, AI-powered route optimization, and blockchain for enhanced security and transparency. These technologies are aimed at improving efficiency, reducing costs, and enhancing the overall customer experience. Unique selling propositions often focus on regional expertise, specialized handling of certain goods, and tailored solutions to meet specific client needs.

Key Drivers, Barriers & Challenges in Russia 3PL Industry

Key Drivers: Increased e-commerce penetration, growth of manufacturing and retail sectors, government initiatives to modernize infrastructure, and the need for efficient supply chain management.

Challenges: Geopolitical instability, sanctions imposed on Russia, fluctuations in the ruble's exchange rate, outdated infrastructure in some regions, and a shortage of skilled labor. These challenges impact operational costs, lead times, and overall market growth. The impact of sanctions is estimated to have reduced the market size by xx Million in 2022.

Emerging Opportunities in Russia 3PL Industry

Emerging opportunities include the expansion of e-commerce in smaller cities and towns, the growing demand for cold chain logistics in the life sciences and food sectors, and the increasing need for specialized handling of hazardous materials. The development of sustainable and eco-friendly logistics solutions is also gaining traction. Untapped markets include the remote regions of Siberia and the Far East, where there is potential for growth in logistics services catering to resource extraction and transportation.

Growth Accelerators in the Russia 3PL Industry

Technological advancements, such as the implementation of AI and automation, will significantly boost efficiency and reduce costs within the 3PL sector. Strategic partnerships between 3PL providers and technology companies are crucial to accelerate this adoption. Expansion into underserved regions, especially those with developing infrastructure, promises considerable growth. Government policies supporting logistics modernization will further propel market expansion.

Key Players Shaping the Russia 3PL Industry Market

- DB Schenker

- UPS

- Kuehne Nagel

- RZD Logistics

- Nienshants

- FM Logistics

- Eurosib

- DHL Supply Chain

- DP World

- STS Logistics

Notable Milestones in Russia 3PL Industry Sector

- June 2022: Russian Railways and Eurosib-SPB Transport Systems signed a Memorandum of Understanding to develop multimodal transport solutions to/from the Middle East and APR. This signifies a push towards improved international connectivity.

- June 2022: Kuehne+Nagel sold its Russian operations to its local Managing Director. This reflects the impact of geopolitical factors on market consolidation.

In-Depth Russia 3PL Industry Market Outlook

The Russian 3PL market is poised for significant growth in the coming years, driven by technological advancements, infrastructure improvements, and increasing demand from key sectors. Strategic partnerships, investments in technology, and expansion into new regions will be crucial for success. The market presents significant opportunities for both domestic and international players to establish a strong presence and capitalize on the growth potential. However, geopolitical factors and regulatory changes will continue to shape the market's trajectory.

Russia 3PL Industry Segmentation

-

1. Type

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-Users

- 2.1. Consumer and Retail

- 2.2. Energy and Chemicals

- 2.3. Automotive and Manufacturing

- 2.4. Life sciences and Healthcare

- 2.5. Other End-Users

Russia 3PL Industry Segmentation By Geography

- 1. Russia

Russia 3PL Industry Regional Market Share

Geographic Coverage of Russia 3PL Industry

Russia 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics

- 3.3. Market Restrains

- 3.3.1. Damaged Goods; Increasing Transportation Cost

- 3.4. Market Trends

- 3.4.1. The Rise in the E-Commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-Users

- 5.2.1. Consumer and Retail

- 5.2.2. Energy and Chemicals

- 5.2.3. Automotive and Manufacturing

- 5.2.4. Life sciences and Healthcare

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPS**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuehne Nagel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RZD Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nienshants

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FM Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eurosib

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DHL Supply Chain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DP World

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 STS Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Russia 3PL Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Russia 3PL Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Russia 3PL Industry Revenue Million Forecast, by End-Users 2020 & 2033

- Table 3: Russia 3PL Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Russia 3PL Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Russia 3PL Industry Revenue Million Forecast, by End-Users 2020 & 2033

- Table 6: Russia 3PL Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia 3PL Industry?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the Russia 3PL Industry?

Key companies in the market include DB Schenker, UPS**List Not Exhaustive, Kuehne Nagel, RZD Logistics, Nienshants, FM Logistics, Eurosib, DHL Supply Chain, DP World, STS Logistics.

3. What are the main segments of the Russia 3PL Industry?

The market segments include Type, End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics.

6. What are the notable trends driving market growth?

The Rise in the E-Commerce Sector.

7. Are there any restraints impacting market growth?

Damaged Goods; Increasing Transportation Cost.

8. Can you provide examples of recent developments in the market?

June 2022: Russian Railways and Eurosib-SPB Transport Systems have signed a Memorandum of Understanding on cooperation in developing optimal multimodal solutions for international freight transportation to/from the Middle East and APR. The document was signed by Viktor Golomolzin, Chief of Oktyabrskaya Railway, and Dmitry Nikitin, President of Eurosib-SPB Transport Systems, at a conference in St. Petersburg. The Memorandum envisages cooperation in developing export and import freight transportation using the railway infrastructure of the Northwest region of Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia 3PL Industry?

To stay informed about further developments, trends, and reports in the Russia 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence