Key Insights

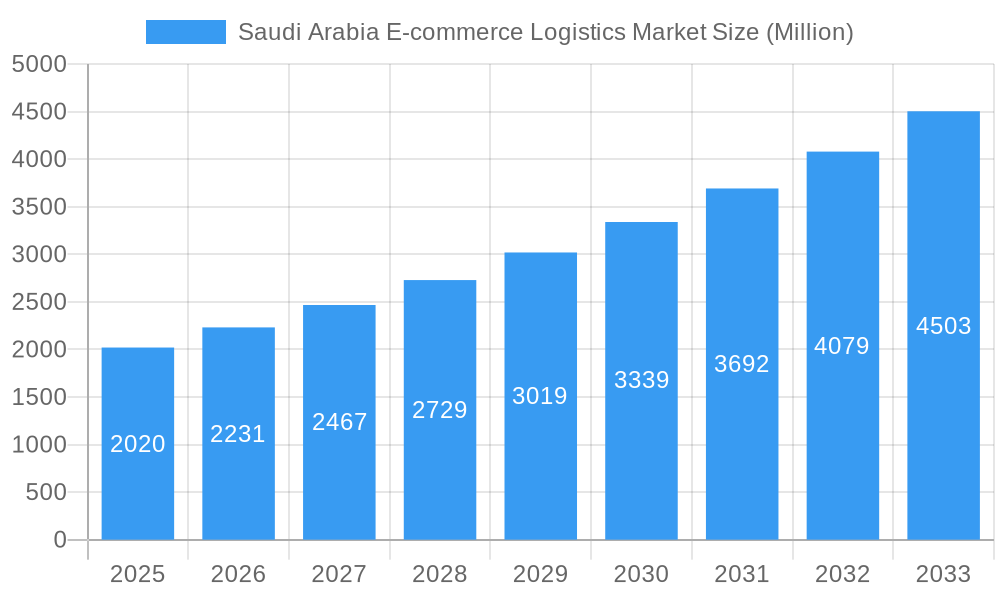

The Saudi Arabian e-commerce logistics market is experiencing robust growth, projected to reach \$2.02 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.94% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector within Saudi Arabia, driven by increasing internet and smartphone penetration, rising disposable incomes, and government initiatives promoting digital transformation, is a primary catalyst. Furthermore, the expansion of logistics infrastructure, including improved warehousing facilities and transportation networks, is enhancing efficiency and scalability. A shift towards convenient and faster delivery options, including same-day and next-day delivery services, further bolsters market growth. The market segmentation reveals a diverse landscape, with B2C e-commerce representing a larger share than B2B, indicating strong consumer adoption. Popular product categories include fashion and apparel, consumer electronics, home appliances, and beauty and personal care products, reflecting changing consumer preferences and spending patterns. The presence of both international players like DHL and UPS, alongside local logistics providers such as SMSA Express and Aramex, indicates a competitive market with opportunities for both established and emerging companies. The regional distribution across Saudi Arabia's central, eastern, western, and southern regions suggests a need for robust nationwide logistics networks to ensure efficient delivery across the country.

Saudi Arabia E-commerce Logistics Market Market Size (In Billion)

The market's restraints are primarily related to logistical challenges, including the vast distances within the country and the need for further improvements in last-mile delivery capabilities, particularly in remote areas. Despite these challenges, the ongoing investments in infrastructure development and technological advancements are expected to mitigate these constraints and pave the way for continued, significant market expansion. The strategic focus on enhancing customer experience, leveraging data analytics for improved operational efficiency, and implementing sustainable practices are expected to shape the future trajectory of the Saudi Arabian e-commerce logistics market. The increasing adoption of innovative technologies like automation, artificial intelligence, and big data analytics presents significant opportunities for growth within the industry.

Saudi Arabia E-commerce Logistics Market Company Market Share

Saudi Arabia E-commerce Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Saudi Arabia e-commerce logistics market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report segments the market by service (transportation, warehousing, inventory management, value-added services), business type (B2B, B2C), destination (domestic, international), and product type (fashion, electronics, home appliances, furniture, beauty, and others), offering a granular understanding of this rapidly evolving sector. The market size is presented in million units.

Saudi Arabia E-commerce Logistics Market Dynamics & Structure

The Saudi Arabian e-commerce logistics market is experiencing dynamic growth, driven by a surge in online shopping and government initiatives supporting digital transformation. Market concentration is moderate, with several major players and a number of smaller, specialized firms. Technological innovation, particularly in areas like automation, AI, and last-mile delivery solutions, is a key driver. The regulatory framework is evolving, with a focus on streamlining processes and promoting competition. The rise of e-commerce has led to increased demand for efficient logistics services, while substitutes like direct-to-consumer models are also emerging. M&A activity is expected to remain substantial as large players seek to consolidate their market share and enhance their service offerings.

- Market Concentration: Moderate, with a few dominant players controlling xx% of the market in 2024 (estimated).

- Technological Innovation: High adoption of automation, AI, and IoT in warehousing and transportation driving efficiency. Barriers include high initial investment costs and a skills gap in specialized technologies.

- Regulatory Framework: Government support for e-commerce and logistics, but challenges remain in streamlining regulations.

- Competitive Product Substitutes: Direct-to-consumer models and alternative delivery networks are posing challenges.

- End-User Demographics: Growing middle class and increased internet penetration fuel demand for e-commerce logistics.

- M&A Trends: Consolidation expected to continue, with a predicted xx M&A deals in the forecast period.

Saudi Arabia E-commerce Logistics Market Growth Trends & Insights

The Saudi Arabian e-commerce logistics market is experiencing an unprecedented surge, driven by a confluence of dynamic factors. A rapidly growing digitally-savvy population, coupled with escalating disposable incomes, is fueling a significant shift towards online purchasing. The Kingdom's ambitious Vision 2030 initiatives, which actively promote digital transformation and e-commerce adoption, are providing a robust framework for this expansion. Furthermore, widespread smartphone penetration and the proliferation of diverse e-commerce platforms are creating a fertile ground for logistics providers. The market, estimated at **[Insert Estimated Market Size in Units for 2024]** million units in 2024, is projected to burgeon to **[Insert Projected Market Size in Units for 2033]** million units by 2033, showcasing a compelling Compound Annual Growth Rate (CAGR) of **[Insert CAGR Percentage]%**. This upward trajectory is further accelerated by the integration of cutting-edge technologies, including AI-driven route optimization for enhanced efficiency and the exploration of drone delivery for swift last-mile solutions. Consumer preferences are evolving rapidly, with a strong inclination towards same-day and next-day delivery services, placing a premium on speed and convenience. The e-commerce logistics market penetration rate is anticipated to climb from **[Insert Penetration Rate for 2024]%** in 2024 to **[Insert Penetration Rate for 2033]%** by 2033, underscoring the growing importance of efficient logistics in the Kingdom's digital economy.

Dominant Regions, Countries, or Segments in Saudi Arabia E-commerce Logistics Market

The Saudi Arabian e-commerce logistics landscape is characterized by vibrant growth across multiple segments. Currently, the domestic Business-to-Consumer (B2C) segment, particularly within transportation services, is leading the charge. This dominance is further amplified by the strong performance of key product categories such as fashion and apparel and consumer electronics, which are experiencing the highest growth rates within the logistics ecosystem.

- By Service: Transportation services remain the largest segment, consistently outperforming warehousing and value-added services.

- By Business: The B2C segment holds a commanding position, representing approximately [Insert B2C Market Share Percentage for 2024]% of the total market share in 2024 (estimated).

- By Destination: The domestic logistics market significantly outweighs the international segment in terms of volume and activity.

- By Product: Fashion and apparel, consumer electronics, and home appliances are identified as high-growth product categories that are driving demand for specialized logistics solutions.

- Key Drivers: A supportive regulatory environment fostered by government initiatives aimed at bolstering e-commerce, coupled with continuous improvements in infrastructure and a robust increase in consumer spending, are the primary catalysts for this market's expansion.

Saudi Arabia E-commerce Logistics Market Product Landscape

The Saudi Arabian e-commerce logistics market displays a diverse product landscape encompassing a wide range of services. These include traditional transportation services complemented by cutting-edge technologies such as automated warehousing systems, real-time tracking solutions, and advanced analytics for inventory management. Value-added services like customized packaging and labelling cater to the specific needs of various e-commerce businesses. The focus is on enhancing speed, efficiency, and transparency across the entire supply chain. Innovative offerings include same-day and next-day delivery options, along with specialized services for handling temperature-sensitive goods.

Key Drivers, Barriers & Challenges in Saudi Arabia E-commerce Logistics Market

Key Drivers: The primary drivers include increasing e-commerce adoption, government initiatives promoting digitalization, infrastructure investments, and the growing middle class. Technological advancements like AI and automation further accelerate growth.

Key Challenges: Challenges include high operational costs, infrastructure limitations in certain regions, regulatory complexities, and competition from international players. Maintaining delivery speed and efficiency while controlling costs remains a significant obstacle. Supply chain disruptions, especially given global events, are also a concern. The lack of a unified logistics platform also presents a barrier.

Emerging Opportunities in Saudi Arabia E-commerce Logistics Market

The future of Saudi Arabia's e-commerce logistics market is brimming with untapped potential and innovative opportunities. The burgeoning adoption of advanced last-mile delivery solutions, including the integration of drones and autonomous vehicles, promises to revolutionize delivery times and efficiency. Furthermore, the growing demand for specialized logistics catering to temperature-sensitive products like pharmaceuticals and fresh produce, as well as the handling of high-value luxury goods and oversized items, presents significant growth avenues. The development and widespread adoption of integrated logistics platforms, designed to seamlessly connect all stakeholders across the supply chain, is poised to streamline operations and enhance transparency. Moreover, there exists substantial untapped potential in extending efficient and cost-effective logistics solutions to smaller cities and remote rural areas, thereby democratizing e-commerce access across the entire Kingdom.

Growth Accelerators in the Saudi Arabia E-commerce Logistics Market Industry

The Saudi Arabian e-commerce logistics market is poised for accelerated growth driven by substantial investments in infrastructure, including the development of advanced warehousing facilities and efficient transportation networks. Strategic partnerships between logistics providers and e-commerce platforms are creating synergistic opportunities to enhance the customer experience. Technological innovations, such as AI-powered route optimization and real-time tracking, are further streamlining operations and reducing costs. The expansion of e-commerce into previously underserved regions and the increasing adoption of omnichannel strategies create additional growth avenues.

Notable Milestones in Saudi Arabia E-commerce Logistics Market Sector

- February 2024: Naqel Express partners with Red Sea Global, utilizing biofueled and electric vehicles for sustainable logistics.

- February 2024: Aramco and DHL form a joint venture, ASMO, to create a modern procurement and logistics services hub.

In-Depth Saudi Arabia E-commerce Logistics Market Outlook

The Saudi Arabian e-commerce logistics market holds immense future potential. Continued government support for digital transformation, robust private sector investment, and ongoing technological advancements will fuel substantial growth. Strategic partnerships and the adoption of innovative solutions will further enhance efficiency and customer satisfaction. The market's future is bright, with significant opportunities for both established players and new entrants.

Saudi Arabia E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing Inventory Management

- 1.3. Value-added Services (Labelling, Packaging)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furnniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys. Food Products)

Saudi Arabia E-commerce Logistics Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia E-commerce Logistics Market Regional Market Share

Geographic Coverage of Saudi Arabia E-commerce Logistics Market

Saudi Arabia E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Poor Infrastructure and Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Growth in e-Commerce Sales is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing Inventory Management

- 5.1.3. Value-added Services (Labelling, Packaging)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furnniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys. Food Products)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SAB Express**List Not Exhaustive 7 3 Other Companie

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ESNAD Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zajil Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SMSA Express

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aramex

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ali Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alma Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saudi Post

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Saudi Arabia E-commerce Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia E-commerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Saudi Arabia E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-commerce Logistics Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the Saudi Arabia E-commerce Logistics Market?

Key companies in the market include DHL, UPS, SAB Express**List Not Exhaustive 7 3 Other Companie, ESNAD Express, Zajil Express, SMSA Express, Aramex, Ali Express, Alma Express, Saudi Post.

3. What are the main segments of the Saudi Arabia E-commerce Logistics Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Internet and Smart Phone Penetration; Urbanization and Lifestyle Changes; Government Initiatives.

6. What are the notable trends driving market growth?

Growth in e-Commerce Sales is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Poor Infrastructure and Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

February 2024: Naqel Express by SPL for Logistics Services announced a partnership with Red Sea Global. NAQEL Express, a fully owned subsidiary of Saudi Post Logistics, will operate all long-haul and local transportation services for The Red Sea and provide logistics equipment, labor, and supply chain technologies. As part of the partnership, Naqel Express will be using biofueled and electric vehicles. This aligns with RSG’s smart and sustainable mobility strategy, which prioritizes the use of hydrogen, electric, and biofueled vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence