Key Insights

Turkey's Courier, Express, and Parcel (CEP) market is experiencing significant expansion, driven by a booming e-commerce sector and increased international trade. The market, valued at 2.3 billion units in the base year 2024, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.3% from 2024 to 2033. This growth is primarily fueled by the escalating volume of online shopping in Turkey, necessitating efficient delivery networks, and the rise of cross-border e-commerce activities. Technological advancements, including automated sorting and real-time tracking, are enhancing operational efficiency and customer satisfaction, further stimulating market growth. The industry is segmented by destination (domestic/international), distribution channel (B2B/B2C), and end-user industry (e.g., BFSI, e-commerce, healthcare, manufacturing). The competitive landscape features global players like DHL, UPS, and TNT, alongside prominent domestic providers such as Turkon Logistic Group and Ekol Logistics, fostering innovation and competitive pricing.

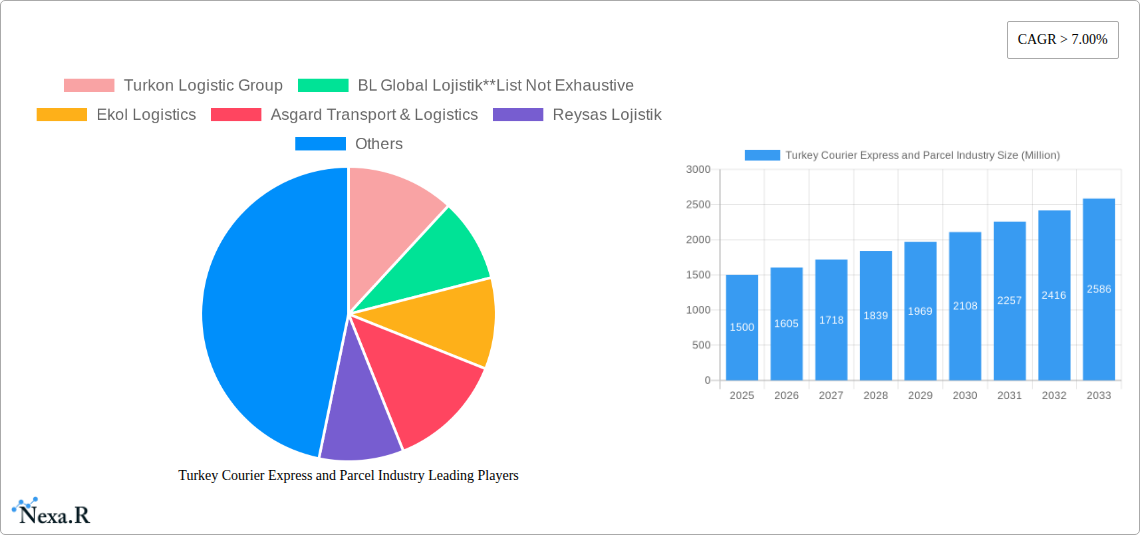

Turkey Courier Express and Parcel Industry Market Size (In Billion)

Despite a positive growth trajectory, the Turkish CEP industry navigates challenges including currency fluctuations and global economic uncertainties. Regional infrastructure limitations may also impact delivery efficiency. However, government initiatives focused on logistics infrastructure development and regulatory streamlining are expected to mitigate these issues and support sustained market expansion. The long-term outlook remains highly optimistic, supported by continued e-commerce growth and Turkey's increasing importance in global trade, with significant investments in technology and infrastructure poised to strengthen the sector's role in the national economy.

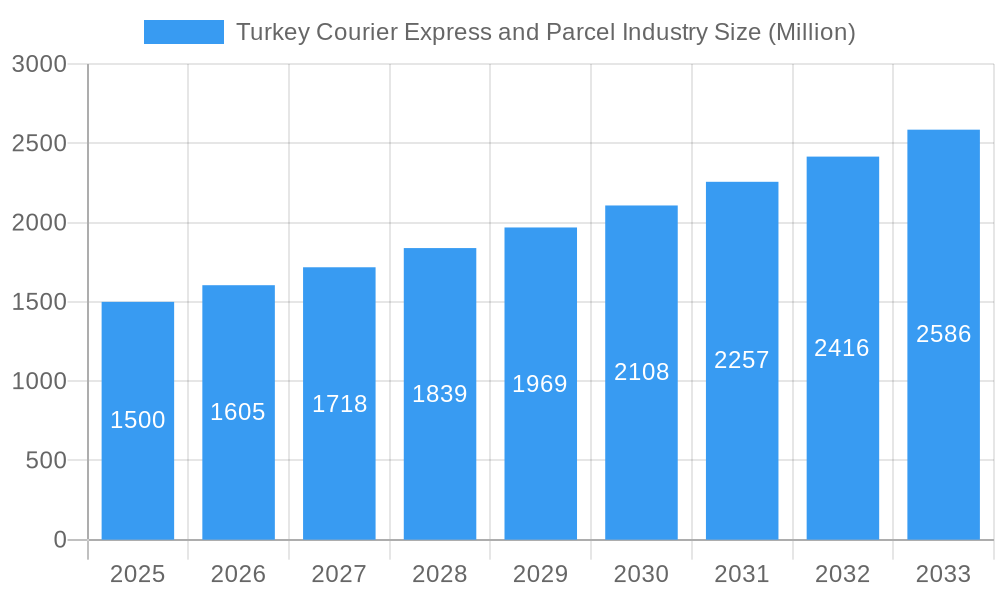

Turkey Courier Express and Parcel Industry Company Market Share

This report offers a comprehensive analysis of the Turkish CEP industry, providing critical insights for stakeholders. Spanning 2019-2033, with a focus on the base year 2024 and a forecast to 2033, the analysis covers domestic and international delivery, B2B and B2C channels, and various end-user segments. Key players, including Turkon Logistic Group, BL Global Lojistik, Ekol Logistics, and DHL Worldwide Express, are profiled to detail the competitive environment.

Turkey Courier Express and Parcel Industry Market Dynamics & Structure

This section analyzes the structure and dynamics of the Turkish CEP market, considering market concentration, technological advancements, regulatory influences, competitive substitutes, and end-user demographics. We explore the impact of mergers and acquisitions (M&A) activities on market consolidation.

Market Concentration: The Turkish CEP market exhibits a mix of large multinational players and smaller, regional operators. The top five players hold an estimated xx% market share in 2025, indicating a moderately concentrated market. Increased M&A activity is expected to further shape the competitive landscape.

Technological Innovation: The sector is witnessing rapid technological advancements, including automated sorting systems, advanced tracking technologies, and the rise of drone delivery. However, high initial investment costs pose a barrier for smaller players.

- Key Drivers: E-commerce boom, improved logistics infrastructure, and government initiatives.

- Challenges: Integration of new technologies, cybersecurity threats, and skills gap.

- M&A Activity: An estimated xx M&A deals were concluded between 2019 and 2024, with a projected increase in the forecast period.

Turkey Courier Express and Parcel Industry Growth Trends & Insights

This section provides a comprehensive analysis of the historical performance and future projections for the Turkish Courier, Express, and Parcel (CEP) market. We delve into the evolution of market size, the varying adoption rates across different industry segments, and the profound impact of rapid technological advancements and shifting consumer preferences.

The Turkish CEP market has witnessed remarkable expansion from 2019 to 2024, predominantly propelled by the phenomenal growth of the e-commerce sector and a persistent consumer demand for swifter and more dependable delivery solutions. The market size reached an estimated xx Million units in 2024, demonstrating a Compound Annual Growth Rate (CAGR) of xx% during this historical period. Projections indicate a continuation of this robust growth trajectory throughout the forecast period (2025-2033), with an anticipated CAGR of xx%, leading to a market size of xx Million units by 2033. This sustained expansion is underpinned by the ongoing digital commerce boom, escalating consumer expectations for service quality, and substantial investments in modern logistics infrastructure. Furthermore, technological innovations, including the widespread adoption of automated sorting systems and sophisticated real-time tracking technologies, are acting as significant catalysts for market acceleration. Evolving consumer behaviors, such as a pronounced preference for same-day and next-day delivery options, are also playing a pivotal role in shaping market dynamics.

Dominant Regions, Countries, or Segments in Turkey Courier Express and Parcel Industry

This section meticulously identifies the primary regions, countries, and market segments that are currently spearheading the growth of the Turkish CEP market. We undertake a detailed examination of the factors contributing to their prominence, encompassing market share, untapped growth potential, and the underlying economic and infrastructural foundations that support their leadership.

By Destination: The domestic segment currently holds the leading position, accounting for approximately xx% of the total market volume in 2025. However, the international segment is poised for more rapid expansion, largely fueled by the burgeoning cross-border e-commerce landscape and increasing global trade activities.

By Channel of Distribution: B2C (Business-to-Consumer) shipments represent the largest and most influential segment, a direct reflection of the unparalleled surge in online retail. The B2B (Business-to-Business) segment is also experiencing considerable momentum, driven by an increasing reliance on highly efficient and integrated logistics solutions by businesses across various sectors.

By End-User Industry: The Wholesale and Retail Trade (e-commerce) segment stands as the most significant end-user industry, driving substantial demand for CEP services. Following closely are the Industrial Manufacturing and Life Sciences/Healthcare sectors, which also contribute substantially to market volume.

- Key Catalysts for Market Expansion:

- Explosive E-commerce Growth: Turkey's dynamic and rapidly expanding e-commerce ecosystem serves as a primary engine, generating immense demand for comprehensive CEP services.

- Enhanced Infrastructure Development: Significant ongoing investments in transportation networks and advanced logistics infrastructure are continuously improving delivery speed, efficiency, and reliability.

- Supportive Regulatory Framework: Favorable government policies, strategic initiatives, and a conducive regulatory environment are actively facilitating and promoting industry expansion.

Turkey Courier Express and Parcel Industry Product Landscape

The Turkish CEP market is characterized by a diverse and sophisticated array of products and services designed to meet a wide spectrum of customer needs. This includes everything from standard parcel delivery solutions to highly specialized express services, and critical temperature-sensitive logistics crucial for the pharmaceutical and healthcare sectors. Continuous innovation remains a cornerstone, with a sharp focus on elevating speed, enhancing reliability, and improving tracking capabilities. The industry is actively integrating cutting-edge technologies such as real-time tracking systems, state-of-the-art automated sorting facilities, and intelligent delivery optimization software. Differentiating factors and unique selling propositions in the market include the availability of same-day delivery options, the development of bespoke solutions tailored for specific industry requirements, and the provision of advanced supply chain management tools.

Key Drivers, Barriers & Challenges in Turkey Courier Express and Parcel Industry

Key Drivers: The persistent and rapid expansion of the e-commerce sector, coupled with a growing consumer expectation for expedited and highly reliable delivery services, stands as a primary growth driver. Additionally, strategic government initiatives aimed at improving national logistics infrastructure, alongside a supportive and evolving regulatory environment, are significantly contributing to market momentum.

Challenges: The industry faces several significant hurdles. These include the increasing volatility of fuel costs, intensified competition among market players, and the fluctuating nature of currency exchange rates, all of which can impact operational costs and profitability. Furthermore, potential supply chain disruptions, whether global or domestic, and the possibility of unforeseen regulatory changes present substantial risks that require proactive management. The estimated cumulative impact of these identified challenges on overall market growth in 2025 is projected to be xx%.

Emerging Opportunities in Turkey Courier Express and Parcel Industry

Significant opportunities for growth and innovation abound within the Turkish CEP market. These include strategic expansion into currently underserved rural or remote areas, leveraging transformative technological advancements such as autonomous drone delivery for last-mile solutions, and developing specialized, high-value services tailored for niche industries like cold chain logistics and specialized medical deliveries. Further growth potential lies in the development and offering of advanced value-added services, such as sophisticated last-mile delivery optimization platforms and comprehensive, integrated supply chain management solutions that provide end-to-end visibility and control for businesses.

Growth Accelerators in the Turkey Courier Express and Parcel Industry Industry

Continued investment in technology, strategic partnerships between CEP providers and e-commerce platforms, and expansion into new markets (including rural areas) will accelerate growth. Development of sustainable and eco-friendly delivery solutions will also drive market expansion.

Key Players Shaping the Turkey Courier Express and Parcel Industry Market

- Turkon Logistic Group

- BL Global Lojistik

- Ekol Logistics

- Asgard Transport & Logistics

- Reysas Lojistik

- ATA Freight Line Limited

- UPS Hizli Kargo

- TNT International Express

- CEVA Logistik Limited

- ASE ASYA Afrika Hizli Kargo

- DHL Worldwide Express

- SkyNet Worldwide Express

- DSV

Notable Milestones in Turkey Courier Express and Parcel Industry Sector

- 2020: Introduction of nationwide drone delivery trials by a major CEP provider.

- 2022: Significant investment in automated sorting facilities by several key players.

- 2023: Merger of two regional CEP companies, resulting in increased market consolidation.

In-Depth Turkey Courier Express and Parcel Industry Market Outlook

The Turkish CEP market is poised for sustained growth over the forecast period, driven by the ongoing expansion of e-commerce and increasing demand for reliable delivery services. Strategic partnerships, technological advancements, and market expansion efforts will be crucial for success in this dynamic and competitive sector. The long-term outlook remains positive, with significant potential for both established players and new entrants.

Turkey Courier Express and Parcel Industry Segmentation

-

1. Destinaion

- 1.1. Domestic

- 1.2. International

-

2. Channel of Distribution

- 2.1. B2B (Business-to-Business)

- 2.2. B2C (Business-to-Consumer)

-

3. End-user Industry

- 3.1. BFSI (Ba

- 3.2. Wholesale and Retail Trade (E-commerce)

- 3.3. Life Sciences/Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End-user Industries

Turkey Courier Express and Parcel Industry Segmentation By Geography

- 1. Turkey

Turkey Courier Express and Parcel Industry Regional Market Share

Geographic Coverage of Turkey Courier Express and Parcel Industry

Turkey Courier Express and Parcel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. Government Initiatives to Develop Logistics Infrastructure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Courier Express and Parcel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destinaion

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. B2B (Business-to-Business)

- 5.2.2. B2C (Business-to-Consumer)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI (Ba

- 5.3.2. Wholesale and Retail Trade (E-commerce)

- 5.3.3. Life Sciences/Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Destinaion

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Turkon Logistic Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BL Global Lojistik**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ekol Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asgard Transport & Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reysas Lojistik

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATA Freight Line Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPS Hizli Kargo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TNT International Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CEVA Logistik Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ASE ASYA Afrika Hizli Kargo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DHL Worldwide Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SkyNet Worldwide Express

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DSV

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Turkon Logistic Group

List of Figures

- Figure 1: Turkey Courier Express and Parcel Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Turkey Courier Express and Parcel Industry Share (%) by Company 2025

List of Tables

- Table 1: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Destinaion 2020 & 2033

- Table 2: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Channel of Distribution 2020 & 2033

- Table 3: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Destinaion 2020 & 2033

- Table 6: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Channel of Distribution 2020 & 2033

- Table 7: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Turkey Courier Express and Parcel Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Courier Express and Parcel Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Turkey Courier Express and Parcel Industry?

Key companies in the market include Turkon Logistic Group, BL Global Lojistik**List Not Exhaustive, Ekol Logistics, Asgard Transport & Logistics, Reysas Lojistik, ATA Freight Line Limited, UPS Hizli Kargo, TNT International Express, CEVA Logistik Limited, ASE ASYA Afrika Hizli Kargo, DHL Worldwide Express, SkyNet Worldwide Express, DSV.

3. What are the main segments of the Turkey Courier Express and Parcel Industry?

The market segments include Destinaion, Channel of Distribution, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

Government Initiatives to Develop Logistics Infrastructure.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Courier Express and Parcel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Courier Express and Parcel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Courier Express and Parcel Industry?

To stay informed about further developments, trends, and reports in the Turkey Courier Express and Parcel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence