Key Insights

The ASEAN Luxury Vinyl Tile (LVT) market is poised for significant expansion, driven by a projected Compound Annual Growth Rate (CAGR) of 4.7%. The market is estimated to reach 3298 million by 2025. Key growth factors include rising disposable incomes in major ASEAN economies, increasing demand for premium, durable, and aesthetically pleasing flooring solutions, and the robust expansion of the construction sector across residential and commercial segments. The inherent water resistance and ease of maintenance of LVT are particularly advantageous in the region's humid climate. The market is segmented by distribution channels, product types (rigid and flexible), and end-user applications (residential and commercial). Online retail channels are anticipated to experience substantial growth, mirroring the region's burgeoning e-commerce landscape. Growth will be primarily propelled by strong performance in Indonesia, Singapore, and Thailand.

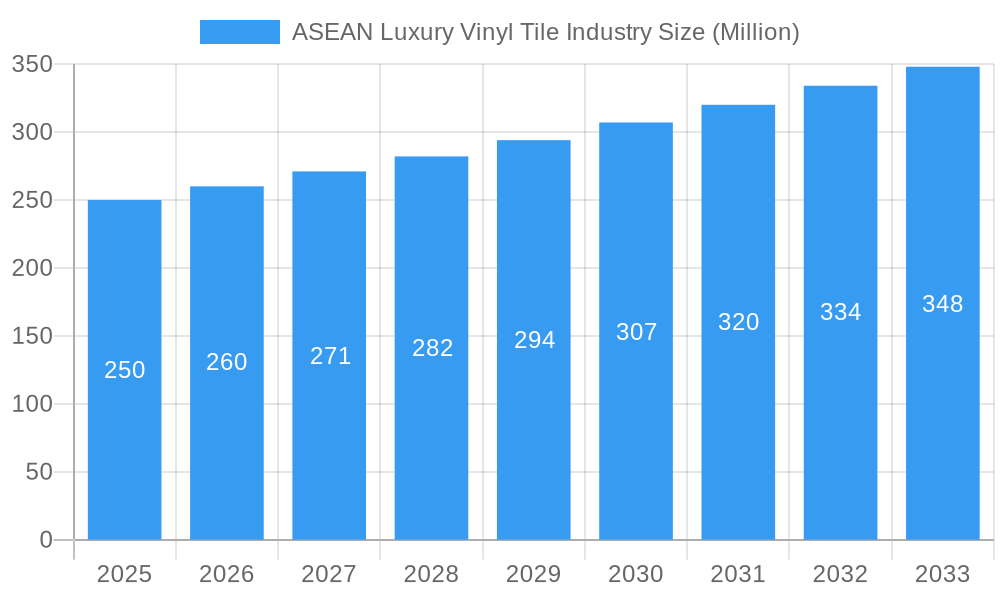

ASEAN Luxury Vinyl Tile Industry Market Size (In Billion)

The competitive environment features prominent international brands alongside agile regional players. Strategic success in this dynamic market will depend on catering to localized consumer preferences through diverse designs, establishing robust distribution networks, and implementing effective digital marketing strategies. The expanding middle class and supportive government infrastructure initiatives further bolster the positive market outlook. Companies prioritizing innovation, sustainability, and localized marketing efforts are best positioned to capitalize on the considerable growth potential within the ASEAN LVT market.

ASEAN Luxury Vinyl Tile Industry Company Market Share

ASEAN Luxury Vinyl Tile Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the ASEAN luxury vinyl tile (LVT) industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The report analyzes the parent market of flooring materials and the child market of luxury vinyl tiles within the ASEAN region. Market size is presented in Million units.

ASEAN Luxury Vinyl Tile Industry Market Dynamics & Structure

The ASEAN LVT market is characterized by a moderate level of concentration, with key players like The Horizon, Rumah Lantai Indonesia, Novelty Flooring Enterprise, APO Floors, Mannington Mills, Power Décor, Hanyo, Polyflor, and Inovar competing for market share. Technological innovation, particularly in product design and manufacturing processes, is a significant driver, alongside evolving consumer preferences and increasing demand for durable and aesthetically pleasing flooring solutions. Regulatory frameworks related to building codes and environmental standards also play a role, influencing material specifications and manufacturing processes. Competitive substitutes, such as ceramic tiles and engineered wood flooring, present ongoing challenges. The residential segment currently dominates, though commercial applications are exhibiting strong growth. M&A activity remains relatively limited, with xx deals recorded in the historical period (2019-2024), reflecting a market still in its growth phase.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on enhanced durability, realistic wood/stone designs, and click-lock installation systems.

- Regulatory Landscape: Varied across ASEAN nations, influencing material standards and compliance costs.

- Competitive Substitutes: Ceramic tiles, engineered wood, laminate flooring.

- End-User Demographics: Shifting preferences towards higher-end, aesthetically appealing flooring options in both residential and commercial segments.

- M&A Activity: Limited activity in the historical period (2019-2024), with xx deals recorded, indicating potential for future consolidation.

ASEAN Luxury Vinyl Tile Industry Growth Trends & Insights

The ASEAN LVT market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to factors such as rising disposable incomes, increasing urbanization, and a preference for low-maintenance, durable flooring solutions. The market is expected to maintain a healthy growth trajectory during the forecast period (2025-2033), driven by continued economic development, infrastructure investments, and expanding middle class. Technological advancements, such as the introduction of rigid core LVT, are further fueling adoption rates, offering superior water resistance and dimensional stability. Consumer behavior is shifting towards online purchasing channels, impacting distribution strategies and creating new opportunities. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in ASEAN Luxury Vinyl Tile Industry

Singapore, followed by Malaysia and Thailand, are currently the dominant markets for LVT in ASEAN, driven by higher disposable incomes and robust construction activities. The residential segment accounts for the largest share of the market, particularly in the flexible LVT product type. Speciality stores currently capture the largest portion of distribution channels, while online sales are rapidly expanding. Key drivers for growth include favourable government policies promoting housing and infrastructure development, and rising consumer preference for design-oriented flooring.

- Leading Region: Singapore, showcasing high consumer spending and a developed retail infrastructure.

- Leading Country: Singapore, driven by high per capita income and strong construction activity.

- Leading Segment (Distribution Channel): Speciality Stores, offering specialized expertise and wider product ranges.

- Leading Segment (Product Type): Flexible LVT, currently holding the largest market share due to cost-effectiveness.

- Leading Segment (End User): Residential sector, driven by growth in home construction and renovation.

ASEAN Luxury Vinyl Tile Industry Product Landscape

The ASEAN LVT market showcases a diverse range of products, with ongoing innovation focused on improving durability, aesthetics, and ease of installation. Rigid core LVT is gaining traction, offering superior water resistance and dimensional stability, while flexible LVT remains popular due to its cost-effectiveness. Manufacturers are continuously introducing new designs, textures, and finishes to cater to evolving consumer preferences, mirroring natural materials like wood and stone with high fidelity. Unique selling propositions often center around enhanced durability, ease of maintenance, and stylish aesthetics.

Key Drivers, Barriers & Challenges in ASEAN Luxury Vinyl Tile Industry

Key Drivers:

- Rising disposable incomes and urbanization in ASEAN nations.

- Increasing preference for low-maintenance and aesthetically pleasing flooring solutions.

- Technological advancements, particularly in rigid core LVT technology.

- Government initiatives and investments in infrastructure development.

Challenges:

- Fluctuations in raw material prices impacting manufacturing costs.

- Intense competition from established flooring materials like ceramic tiles and laminate.

- Limited awareness of LVT benefits in certain ASEAN markets.

- Supply chain disruptions and logistical challenges impacting product availability. This led to a xx% increase in prices in 2022.

Emerging Opportunities in ASEAN Luxury Vinyl Tile Industry

- Expansion into untapped markets within ASEAN, particularly in less developed regions.

- Development of eco-friendly and sustainable LVT products meeting growing environmental consciousness.

- Growing demand for customized and personalized LVT solutions to cater to individual preferences.

- Exploring new applications of LVT in commercial spaces, like healthcare and hospitality.

Growth Accelerators in the ASEAN Luxury Vinyl Tile Industry

Long-term growth will be fueled by technological breakthroughs, strategic partnerships between manufacturers and distributors, and expansion into new market segments and geographical areas. Collaborative efforts to promote LVT's benefits and overcome market awareness barriers are essential. Strategic investments in research and development to improve product performance, durability, and sustainability will play a crucial role.

Key Players Shaping the ASEAN Luxury Vinyl Tile Industry Market

- The Horizon

- Rumah Lantai Indonesia

- Novelty Flooring Enterprise

- APO Floors

- Mannington Mills

- Power Décor

- Hanyo

- Polyflor

- Inovar

Notable Milestones in ASEAN Luxury Vinyl Tile Industry Sector

- November 2020: Polyflor contributed to a unique surf center for those with disabilities, showcasing the versatility of LVT in specialized applications.

- 2018: Puyat Flooring Products Inc. (APO Floors) introduced innovative ancillary product lines ('APO Power Primer' and 'APO Power Self Leveling Compound (SLC)'), enhancing its product offerings and improving installation efficiency.

In-Depth ASEAN Luxury Vinyl Tile Industry Market Outlook

The ASEAN LVT market is poised for continued growth over the forecast period, driven by positive economic indicators, infrastructure development, and increasing consumer demand for high-quality flooring solutions. Strategic investments in research and development, alongside targeted marketing campaigns emphasizing the benefits of LVT, will further enhance market penetration. The focus on sustainable and eco-friendly products will be critical in shaping the future of the industry. The market is projected to reach xx million units by 2033.

ASEAN Luxury Vinyl Tile Industry Segmentation

-

1. Product Type

- 1.1. Rigid

- 1.2. Flexible

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Manufacturer Owned Stores

- 3.2. Speciality Stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. Indonesia

- 4.2. Malaysia

- 4.3. Philippines

- 4.4. Singapore

- 4.5. Thailand

- 4.6. Vietnam

- 4.7. Other Countries

ASEAN Luxury Vinyl Tile Industry Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Philippines

- 4. Singapore

- 5. Thailand

- 6. Vietnam

- 7. Other Countries

ASEAN Luxury Vinyl Tile Industry Regional Market Share

Geographic Coverage of ASEAN Luxury Vinyl Tile Industry

ASEAN Luxury Vinyl Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Domestic and Commercial Construction in the Market; Increase in Sales of Laminated Flooring Through Online Channels

- 3.3. Market Restrains

- 3.3.1. Major Share of Market is Concentrated in Urban Centres; Nascent Production Capacity of Domestic Manufaturers

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of LVT in the ASEAN Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid

- 5.1.2. Flexible

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Manufacturer Owned Stores

- 5.3.2. Speciality Stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Indonesia

- 5.4.2. Malaysia

- 5.4.3. Philippines

- 5.4.4. Singapore

- 5.4.5. Thailand

- 5.4.6. Vietnam

- 5.4.7. Other Countries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.5.2. Malaysia

- 5.5.3. Philippines

- 5.5.4. Singapore

- 5.5.5. Thailand

- 5.5.6. Vietnam

- 5.5.7. Other Countries

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Indonesia ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Rigid

- 6.1.2. Flexible

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Manufacturer Owned Stores

- 6.3.2. Speciality Stores

- 6.3.3. Online Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Indonesia

- 6.4.2. Malaysia

- 6.4.3. Philippines

- 6.4.4. Singapore

- 6.4.5. Thailand

- 6.4.6. Vietnam

- 6.4.7. Other Countries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Malaysia ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Rigid

- 7.1.2. Flexible

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Manufacturer Owned Stores

- 7.3.2. Speciality Stores

- 7.3.3. Online Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Indonesia

- 7.4.2. Malaysia

- 7.4.3. Philippines

- 7.4.4. Singapore

- 7.4.5. Thailand

- 7.4.6. Vietnam

- 7.4.7. Other Countries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Philippines ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Rigid

- 8.1.2. Flexible

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Manufacturer Owned Stores

- 8.3.2. Speciality Stores

- 8.3.3. Online Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Indonesia

- 8.4.2. Malaysia

- 8.4.3. Philippines

- 8.4.4. Singapore

- 8.4.5. Thailand

- 8.4.6. Vietnam

- 8.4.7. Other Countries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Singapore ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Rigid

- 9.1.2. Flexible

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Manufacturer Owned Stores

- 9.3.2. Speciality Stores

- 9.3.3. Online Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Indonesia

- 9.4.2. Malaysia

- 9.4.3. Philippines

- 9.4.4. Singapore

- 9.4.5. Thailand

- 9.4.6. Vietnam

- 9.4.7. Other Countries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Thailand ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Rigid

- 10.1.2. Flexible

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Manufacturer Owned Stores

- 10.3.2. Speciality Stores

- 10.3.3. Online Stores

- 10.3.4. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Indonesia

- 10.4.2. Malaysia

- 10.4.3. Philippines

- 10.4.4. Singapore

- 10.4.5. Thailand

- 10.4.6. Vietnam

- 10.4.7. Other Countries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Vietnam ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Rigid

- 11.1.2. Flexible

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Manufacturer Owned Stores

- 11.3.2. Speciality Stores

- 11.3.3. Online Stores

- 11.3.4. Other Distribution Channels

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Indonesia

- 11.4.2. Malaysia

- 11.4.3. Philippines

- 11.4.4. Singapore

- 11.4.5. Thailand

- 11.4.6. Vietnam

- 11.4.7. Other Countries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Other Countries ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Rigid

- 12.1.2. Flexible

- 12.2. Market Analysis, Insights and Forecast - by End User

- 12.2.1. Residential

- 12.2.2. Commercial

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Manufacturer Owned Stores

- 12.3.2. Speciality Stores

- 12.3.3. Online Stores

- 12.3.4. Other Distribution Channels

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. Indonesia

- 12.4.2. Malaysia

- 12.4.3. Philippines

- 12.4.4. Singapore

- 12.4.5. Thailand

- 12.4.6. Vietnam

- 12.4.7. Other Countries

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 The Horizon

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Rumah Lantai Indonesia

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Novelty Flooring Enterprise

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 APO Floors

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Mannington Mills

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Power Décor*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hanyo

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Polyflor

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Inovar

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 The Horizon

List of Figures

- Figure 1: Global ASEAN Luxury Vinyl Tile Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 5: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 9: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 11: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 13: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 15: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 17: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 19: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 21: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 23: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 25: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 26: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 27: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 29: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 33: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 35: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 39: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 43: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 45: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 47: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 49: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 51: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 52: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 53: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 55: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 56: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 57: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 59: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 61: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 63: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 64: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 65: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 66: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 67: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 68: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 69: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 70: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 71: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 3: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 5: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 8: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 11: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 12: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 13: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 15: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 17: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 18: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 21: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 23: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 25: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 26: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 27: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 28: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 31: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 32: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 33: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 35: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 37: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 38: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 40: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Luxury Vinyl Tile Industry?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the ASEAN Luxury Vinyl Tile Industry?

Key companies in the market include The Horizon, Rumah Lantai Indonesia, Novelty Flooring Enterprise, APO Floors, Mannington Mills, Power Décor*List Not Exhaustive, Hanyo, Polyflor, Inovar.

3. What are the main segments of the ASEAN Luxury Vinyl Tile Industry?

The market segments include Product Type, End User , Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3298 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Domestic and Commercial Construction in the Market; Increase in Sales of Laminated Flooring Through Online Channels.

6. What are the notable trends driving market growth?

Increasing Consumption of LVT in the ASEAN Region.

7. Are there any restraints impacting market growth?

Major Share of Market is Concentrated in Urban Centres; Nascent Production Capacity of Domestic Manufaturers.

8. Can you provide examples of recent developments in the market?

In November 2020, Polyflor contributed to a unique surf center for those with disabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Luxury Vinyl Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Luxury Vinyl Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Luxury Vinyl Tile Industry?

To stay informed about further developments, trends, and reports in the ASEAN Luxury Vinyl Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence