Key Insights

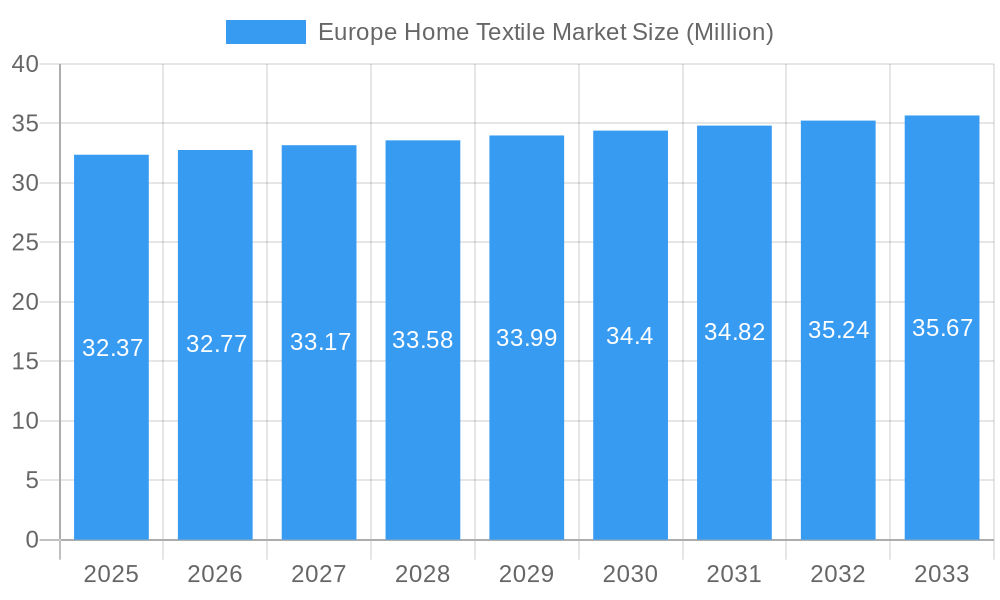

The European home textile market is poised for steady, albeit moderate, growth, with an estimated market size of 32.37 Million value units in 2025, projecting a Compound Annual Growth Rate (CAGR) of 1.23% through 2033. This growth is underpinned by evolving consumer preferences for home aesthetics, a rising demand for sustainable and eco-friendly products, and continuous innovation in textile technology. Key drivers include the increasing disposable incomes in several European nations, a growing trend towards home renovation and interior decoration, and the perceived value of home textiles as essential components of modern living. The market is segmenting into distinct areas such as production, consumption, imports, exports, and pricing, each offering unique insights into market dynamics. Production is likely influenced by advancements in manufacturing processes and material science, while consumption patterns are shaped by fashion trends and a growing awareness of product quality and durability. The import and export analyses will reveal the intricate trade relationships within the region and with international markets, indicating opportunities for market penetration and strategic partnerships. Price trends will reflect the interplay of raw material costs, production efficiencies, and consumer willingness to pay for premium and sustainable options.

Europe Home Textile Market Market Size (In Million)

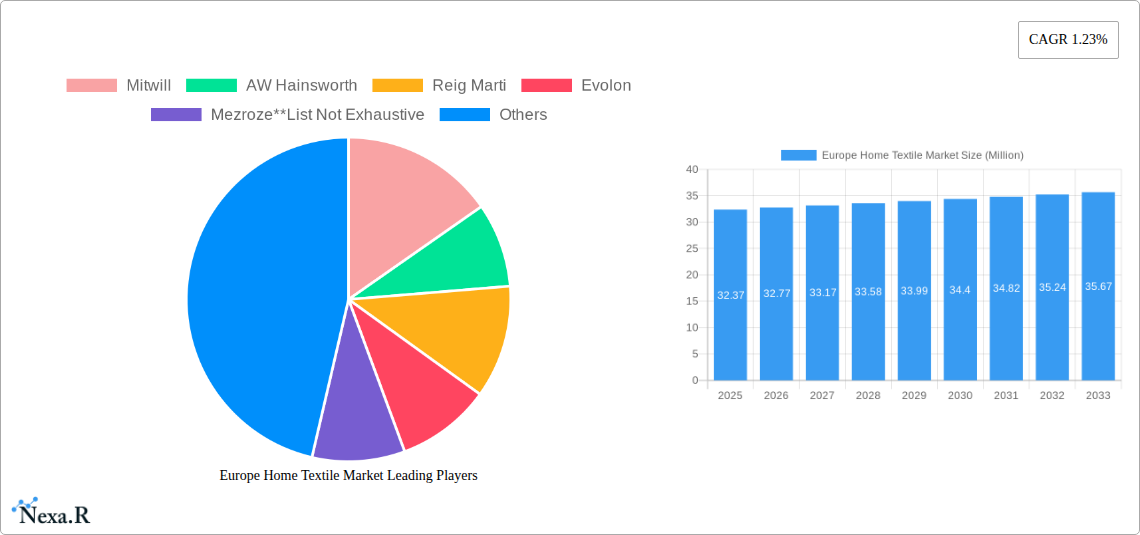

The European home textile landscape is characterized by a strong emphasis on quality, design, and increasingly, sustainability. Consumers are actively seeking products that not only enhance their living spaces but also align with their environmental values. This is fueling the demand for organic cotton, recycled materials, and ethically sourced textiles. Furthermore, technological advancements in textile production, such as antimicrobial treatments, stain-resistant finishes, and smart fabrics, are creating new avenues for product differentiation and premiumization. Key market restraints might include fluctuating raw material prices, intense competition from both established and emerging players, and the potential for economic downturns to impact discretionary spending on home goods. However, the resilience of the home furnishing sector, driven by the fundamental need for comfort and style, is expected to mitigate these challenges. Leading companies like Mitwill, AW Hainsworth, and Reig Marti are actively shaping the market through product innovation and strategic expansions, particularly within key regions like the United Kingdom, Germany, and France. The forecast period anticipates a gradual but consistent expansion, driven by these evolving consumer demands and industry advancements.

Europe Home Textile Market Company Market Share

Europe Home Textile Market Report: Navigating Sustainability, Innovation, and Growth (2019–2033)

This comprehensive report provides an in-depth analysis of the Europe home textile market, offering critical insights into market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, emerging opportunities, and strategic initiatives. With a study period spanning from 2019 to 2033, and a base and estimated year of 2025, this report delves into historical performance and forecasts future trajectories, presenting all values in million units. It meticulously examines both parent and child market segments, catering to the needs of industry professionals, manufacturers, suppliers, and investors seeking to understand the evolving landscape of home textiles in Europe.

Europe Home Textile Market Market Dynamics & Structure

The Europe home textile market is characterized by a moderate to high level of concentration, with a few dominant players holding significant market share. Technological innovation remains a key driver, particularly in the realm of sustainable materials, smart textiles, and advanced manufacturing processes. Regulatory frameworks, including environmental standards and consumer protection laws, play a crucial role in shaping market entry and product development. Competitive product substitutes, such as alternative furnishing materials and DIY solutions, exert pressure on traditional home textile offerings. End-user demographics are shifting, with a growing demand for premium, eco-friendly, and customizable products driven by an increasingly affluent and environmentally conscious consumer base. Mergers and acquisitions (M&A) are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Leading companies account for approximately 40-50% of the market value, with a gradual increase in M&A activity.

- Technological Innovation Drivers: Focus on organic cotton, recycled polyester, and biodegradable fibers. Development of smart home textiles with integrated technology.

- Regulatory Frameworks: Increasing stringency of REACH regulations and sustainability certifications (e.g., OEKO-TEX, GOTS).

- Competitive Product Substitutes: Growth in the market for natural alternatives like bamboo and linen, alongside innovative synthetic blends.

- End-User Demographics: Rising disposable incomes and a preference for personalized and ethically sourced home furnishings.

- M&A Trends: Acquisitions aimed at integrating sustainable technologies and expanding into niche markets. Deal volumes averaged around 5-7 major transactions annually during the historical period.

Europe Home Textile Market Growth Trends & Insights

The Europe home textile market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. This expansion is fueled by increasing disposable incomes, rising urbanization, and a growing emphasis on home décor and comfort. The adoption rate of sustainable and eco-friendly home textiles is accelerating, driven by heightened consumer awareness and regulatory support. Technological disruptions, such as the integration of smart functionalities into textiles (e.g., temperature regulation, self-cleaning properties) and advancements in digital printing and manufacturing, are reshaping product offerings and consumer experiences. Consumer behavior shifts towards online purchasing, personalized products, and a preference for brands with strong sustainability credentials are key influencing factors. The market penetration of premium and specialized home textile segments is on an upward trajectory.

The market size evolution demonstrates a consistent upward trend, from an estimated XX million units in 2019 to a projected XX million units by 2033. This growth is underpinned by a confluence of factors. Firstly, the increasing disposable income across major European economies translates directly into higher spending on home furnishings, including textiles. As consumers invest more in their living spaces, the demand for a wider array of home textiles—ranging from bedding and towels to curtains and upholstery—expands. Secondly, the ongoing trend of urbanization, coupled with smaller living spaces in many European cities, necessitates efficient and aesthetically pleasing home solutions. Home textiles play a pivotal role in defining the ambiance and functionality of these spaces.

Technological advancements are not merely incremental but transformative. The development of innovative materials, such as those offering enhanced durability, breathability, and stain resistance, directly impacts product value and consumer appeal. Furthermore, the integration of smart technologies, while still nascent, presents a significant future growth avenue. Imagine self-regulating duvets or curtains that adjust to natural light – these innovations promise to redefine the home textile experience. The rising consumer consciousness regarding environmental impact is perhaps the most potent growth accelerator. Consumers are actively seeking out products made from organic, recycled, or biodegradable materials. This demand is pushing manufacturers to adopt more sustainable production practices and to clearly communicate their environmental commitments.

Consumer behavior has undergone a significant metamorphosis. The digital revolution has empowered consumers with more information and purchasing options. Online retail channels have become indispensable, offering convenience and a wider selection. This shift also necessitates a strong online presence and effective digital marketing strategies for companies. Moreover, the desire for personalization is becoming paramount. Consumers are no longer content with one-size-fits-all solutions; they seek products that reflect their individual style and needs. This trend is driving the demand for customizable options in curtains, bedding, and upholstery. Finally, the growing emphasis on wellness and comfort within the home environment further fuels the demand for high-quality, tactile, and visually appealing home textiles. The "stay-at-home" culture, amplified by recent global events, has solidified the importance of creating comfortable and inviting living spaces.

- Market Size Evolution: Projected to grow from XX million units in 2019 to XX million units by 2033.

- CAGR: Estimated at 4.5% during the forecast period (2025–2033).

- Adoption Rates: High adoption of sustainable materials, with a 60% increase in demand for certified organic textiles in the last five years.

- Technological Disruptions: Increased investment in R&D for smart textiles and advanced dyeing technologies.

- Consumer Behavior Shifts: 30% growth in online sales of home textiles, and a 25% increase in demand for personalized products.

- Market Penetration: Premium segments like luxury bedding and high-performance technical textiles show accelerated penetration.

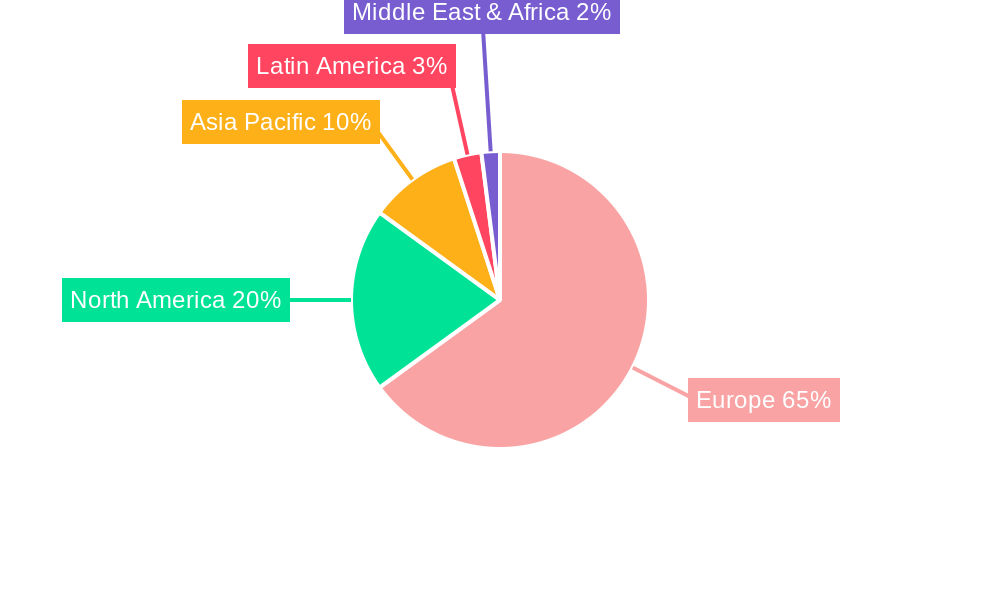

Dominant Regions, Countries, or Segments in Europe Home Textile Market

The Consumption Analysis segment is a dominant driver of growth within the Europe home textile market, with Germany and the United Kingdom emerging as leading consumer nations. This dominance is attributable to a combination of factors, including high disposable incomes, a well-established retail infrastructure, and a strong cultural appreciation for interior design and home comfort. These countries consistently exhibit high per capita spending on home furnishings, translating into substantial market volume for home textiles.

In terms of Production Analysis, countries like Italy, Turkey, and Poland are significant contributors. Italy's reputation for high-quality design and manufacturing, particularly in luxury segments, secures its position. Turkey, with its strong textile manufacturing base and competitive pricing, plays a crucial role in supplying a broad spectrum of home textile products to the European market. Poland is also emerging as a key production hub, benefiting from its strategic location and growing manufacturing capabilities.

The Import Market Analysis showcases the intricate trade flows within Europe. Germany, France, and the Netherlands are substantial importers, sourcing a wide variety of home textiles to meet domestic demand, often from outside the EU as well as from within. The value of imports is driven by premium products, while volume is often associated with more price-sensitive categories. The United Kingdom, despite Brexit, remains a significant importer, although trade dynamics are evolving.

Conversely, the Export Market Analysis highlights the prowess of countries like Turkey, which are major exporters to European nations. Within the EU, Italy and Portugal are notable for exporting high-value, design-led home textiles. The export volumes are influenced by factors such as product specialization, quality certifications, and established trade relationships.

The Price Trend Analysis reveals a bifurcated market. Premium segments, driven by sustainable materials, innovative designs, and high-performance features, command higher prices. Mass-market segments, particularly those influenced by global supply chains and competition, experience more price sensitivity. Inflationary pressures, raw material costs, and energy prices have impacted pricing across all segments during the historical period.

- Dominant Consumption Regions: Germany (XX million units), United Kingdom (XX million units), France (XX million units).

- Key Production Hubs: Italy (XX million units in high-value production), Turkey (XX million units in volume production), Poland (XX million units, growing segment).

- Major Import Markets (Volume): Germany (XX million units), Netherlands (XX million units), France (XX million units).

- Major Export Markets (Value): Italy (XX million units in luxury exports), Portugal (XX million units in specialized exports).

- Price Trend Drivers: Rise in organic and recycled material costs influencing premium pricing by an estimated 10-15%.

- Economic Policies & Infrastructure: Robust logistics networks in Western Europe facilitate high consumption; government support for textile manufacturing in Eastern Europe aids production.

- Market Share & Growth Potential: Germany and the UK represent the largest share of consumption, with Eastern European nations showing higher growth potential in production.

Europe Home Textile Market Product Landscape

The Europe home textile market is witnessing a surge in innovative product development, driven by a dual focus on sustainability and enhanced functionality. Product innovations range from bedding and bath linens made from organic cotton, bamboo, and recycled polyester to upholstery fabrics with enhanced stain resistance and antimicrobial properties. The application of smart textiles, though still in its early stages, is gaining traction, with products offering temperature regulation and improved comfort. Performance metrics are increasingly centered on durability, washability, and environmental impact. Unique selling propositions often revolve around certifications like OEKO-TEX and GOTS, as well as aesthetically pleasing designs that cater to evolving interior design trends. Technological advancements in dyeing and finishing processes are enabling a wider palette of colors and textures while minimizing environmental footprints.

Key Drivers, Barriers & Challenges in Europe Home Textile Market

Key Drivers:

- Growing Consumer Demand for Sustainable Products: Heightened environmental awareness is a significant catalyst, driving purchases of eco-friendly and ethically produced home textiles.

- Rising Disposable Incomes: Increased purchasing power across European nations translates into greater expenditure on home décor and furnishings.

- Technological Advancements: Innovations in materials science, textile manufacturing, and smart textile integration are creating new product categories and enhancing existing ones.

- Urbanization and Small-Space Living: The need for functional, aesthetically pleasing, and space-saving home solutions fuels demand for versatile home textiles.

- E-commerce Growth: The expansion of online retail channels provides wider accessibility and convenience for consumers, boosting sales volumes.

Barriers & Challenges:

- Supply Chain Volatility and Rising Raw Material Costs: Fluctuations in the prices of cotton, polyester, and energy impact production costs and final product pricing, creating unpredictability.

- Intense Competition and Price Sensitivity: The market faces significant competition from both domestic and international players, leading to price wars in certain segments.

- Stringent Environmental Regulations: Compliance with evolving environmental standards (e.g., REACH) and certifications adds to production costs and complexity.

- Counterfeiting and Intellectual Property Infringement: Protecting innovative designs and product quality from imitations remains a challenge.

- Skilled Labor Shortages: The textile industry faces challenges in attracting and retaining a skilled workforce, particularly for specialized manufacturing processes.

- Economic Uncertainty: Geopolitical events and economic downturns can impact consumer spending on non-essential items like home textiles.

Emerging Opportunities in Europe Home Textile Market

Emerging opportunities in the Europe home textile market lie in the growing demand for bio-based and biodegradable materials, offering a sustainable alternative to conventional options. The smart home textile segment presents significant untapped potential, with applications in health monitoring, comfort enhancement, and energy efficiency. Furthermore, there's a burgeoning interest in artisanal and handcrafted home textiles, catering to consumers seeking unique, high-quality, and ethically sourced products. The expansion of online customization platforms allows consumers to personalize their home textiles, creating a niche for tailored solutions. Additionally, the focus on circular economy principles, including textile recycling and upcycling initiatives, opens doors for innovative business models and product development.

Growth Accelerators in the Europe Home Textile Market Industry

Several catalysts are accelerating growth within the Europe home textile industry. Technological breakthroughs in areas like sustainable dyeing techniques and advanced fabric treatments are enhancing product performance and appeal. Strategic partnerships between raw material suppliers, manufacturers, and retailers are streamlining supply chains and fostering innovation. Market expansion strategies, including entering untapped geographical segments within Europe and developing product lines tailored to specific consumer needs (e.g., hypoallergenic textiles, pet-friendly fabrics), are proving highly effective. The increasing consumer preference for brands with strong ESG (Environmental, Social, and Governance) credentials acts as a significant growth accelerator, pushing companies to adopt more responsible practices.

Key Players Shaping the Europe Home Textile Market Market

- Mitwill

- AW Hainsworth

- Reig Marti

- Evolon

- Mezroze

- Tirotex

- Limaso

- Palmhive

- Lameirinho

- Lantex

- Tissery & Cie

Notable Milestones in Europe Home Textile Market Sector

- October 2022: AIMPLAS & its partners launched the CISUTAC project, a significant initiative focused on circular and sustainable textiles. This project, involving a consortium of 27 partners, aims to transition the textile sector towards greater sustainability by leveraging AIMPLAS's expertise in extraction technology for removing inks, dyes, and surface contaminants from textiles.

- February 2023: Archroma, a prominent player in sustainable specialty chemicals, completed the acquisition of Huntsman Corporation's Textile Effects business. This strategic move significantly expands Archroma's global footprint, adding 2,300 employees across 33 countries and 10 production sites, and bolstering its portfolio of solutions for the textile industry.

In-Depth Europe Home Textile Market Market Outlook

The Europe home textile market is on a trajectory of sustained growth, propelled by an unwavering consumer demand for sustainable, innovative, and personalized products. Future market potential is substantial, particularly in the niche segments of smart textiles and bio-based materials. Strategic opportunities lie in further integrating circular economy principles throughout the value chain, from sourcing to end-of-life management. Companies that prioritize transparency in their supply chains and actively invest in research and development for eco-friendly solutions will be best positioned to capitalize on the evolving consumer preferences and stringent regulatory landscape, ensuring long-term success in this dynamic market.

Europe Home Textile Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Home Textile Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Home Textile Market Regional Market Share

Geographic Coverage of Europe Home Textile Market

Europe Home Textile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Residential Space in Europe; Rising Urbanization Driving Demand of Home Textile

- 3.3. Market Restrains

- 3.3.1. Major Market Share Is Restricted To Bed Linen; Higher Price of Branded Textile Affecting their Sales

- 3.4. Market Trends

- 3.4.1. Germany Leading the European Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Home Textile Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitwill

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AW Hainsworth

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reig Marti

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Evolon

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mezroze**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tirotex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Limaso

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Palmhive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lameirinho

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lantex

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tissery & Cie

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Mitwill

List of Figures

- Figure 1: Europe Home Textile Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Home Textile Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Home Textile Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Home Textile Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Home Textile Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Europe Home Textile Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Home Textile Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Home Textile Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Home Textile Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Home Textile Market?

The projected CAGR is approximately 1.23%.

2. Which companies are prominent players in the Europe Home Textile Market?

Key companies in the market include Mitwill, AW Hainsworth, Reig Marti, Evolon, Mezroze**List Not Exhaustive, Tirotex, Limaso, Palmhive, Lameirinho, Lantex, Tissery & Cie.

3. What are the main segments of the Europe Home Textile Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Residential Space in Europe; Rising Urbanization Driving Demand of Home Textile.

6. What are the notable trends driving market growth?

Germany Leading the European Market.

7. Are there any restraints impacting market growth?

Major Market Share Is Restricted To Bed Linen; Higher Price of Branded Textile Affecting their Sales.

8. Can you provide examples of recent developments in the market?

October 2022: AIMPLAS & its partners launched the CISUTAC project based on circular and sustainable textiles. The project supported the transition to a circular and sustainable textile sector and is carried out by a consortium of 27 partners covering a major part of the textile sector. AIMPLAS has expertise in the extraction technology for removing inks, dyes, and other surface contaminants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Home Textile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Home Textile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Home Textile Market?

To stay informed about further developments, trends, and reports in the Europe Home Textile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence