Key Insights

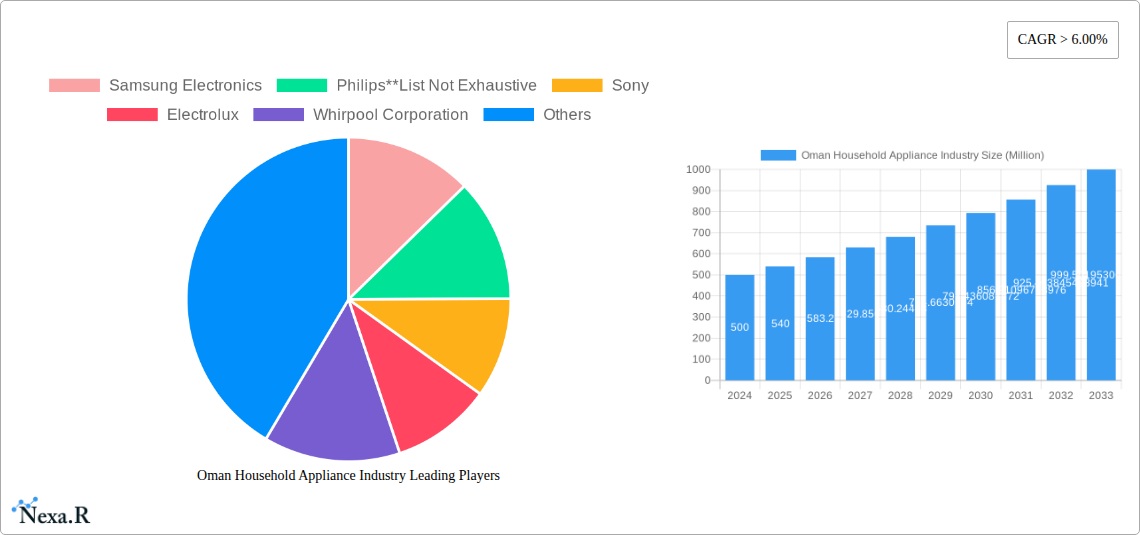

The Oman Household Appliance Industry is poised for substantial growth, projecting a market size of approximately $500 million in 2024. This expansion is fueled by a robust CAGR of 8% during the forecast period of 2025-2033. Several key drivers are propelling this surge. Rising disposable incomes and an increasing expatriate population are contributing to a greater demand for both essential and premium household appliances. Furthermore, the government's focus on housing development and infrastructure projects directly stimulates the need for new appliance installations in residential and commercial properties. The trend towards smart home technology and energy-efficient appliances is also gaining traction, with consumers increasingly seeking innovative and sustainable solutions. This shift is driven by greater environmental awareness and the long-term cost savings associated with reduced energy consumption.

Oman Household Appliance Industry Market Size (In Million)

The market segmentation reveals a strong performance across both major and small appliances. Within major appliances, refrigerators, air conditioners, and washing machines are expected to lead the demand due to their essential nature. In the small appliance category, coffee makers and vacuum cleaners are witnessing significant interest, reflecting changing lifestyle preferences and a desire for convenience. Distribution channels are also evolving, with online stores and multi-branded outlets emerging as dominant players, offering wider accessibility and competitive pricing. While the market is generally optimistic, potential restraints include fluctuating currency exchange rates and global supply chain disruptions, which could impact pricing and availability of imported goods. However, the underlying demand and positive economic outlook for Oman suggest these challenges are likely to be overcome by sustained growth.

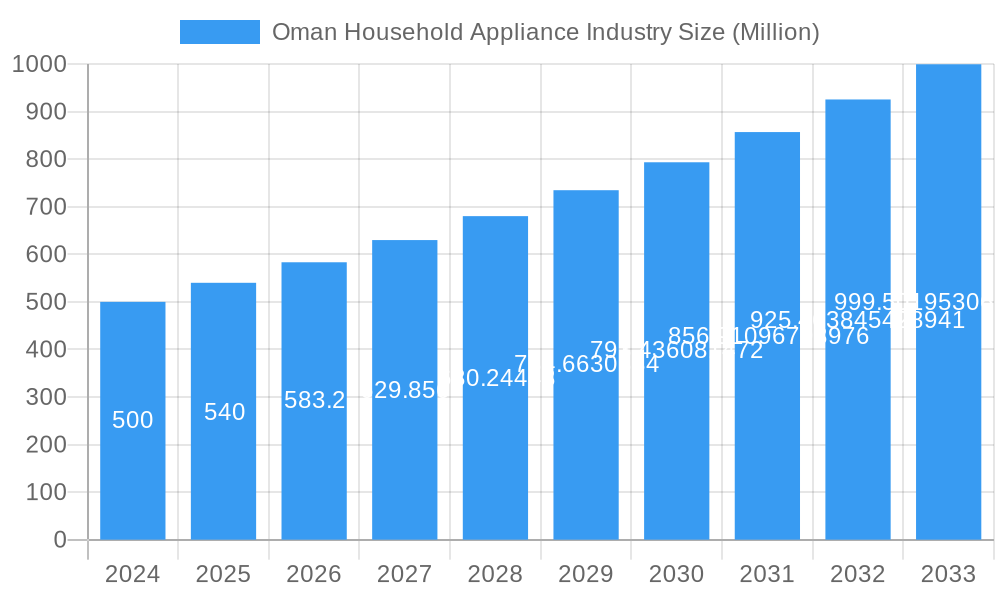

Oman Household Appliance Industry Company Market Share

This comprehensive report delves into the dynamic Oman household appliance industry, offering an in-depth analysis of its market structure, growth trajectories, and future potential. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research provides actionable insights for stakeholders seeking to capitalize on emerging opportunities in this burgeoning market. We explore the intricate parent and child market relationships, examining how shifts in one segment impact the other, thereby offering a holistic view of the industry. All unit values are presented in millions.

Oman Household Appliance Industry Market Dynamics & Structure

The Oman household appliance market is characterized by a moderately concentrated landscape, with global giants and established regional players vying for market share. Technological innovation serves as a primary driver, pushing manufacturers to develop energy-efficient, smart, and user-friendly appliances. Regulatory frameworks, while evolving, are increasingly focused on safety standards and energy efficiency ratings, influencing product design and consumer choices. Competitive product substitutes are abundant, particularly between major and small appliances, and within categories like kitchen gadgets. End-user demographics are shifting, with a growing middle class and an increasing demand for premium, feature-rich appliances. Merger and acquisition (M&A) trends are a significant aspect, consolidating market power and expanding product portfolios. The market is expected to see a volume of XX M&A deals in the forecast period, with a projected market share of XX% for the top 5 players. Barriers to innovation include high R&D costs and the need to adapt to local consumer preferences and environmental conditions.

- Market Concentration: Dominated by a mix of global brands and a growing presence of local distributors.

- Technological Innovation: Focus on smart home integration, energy efficiency (e.g., inverter technology), and enhanced user experience.

- Regulatory Frameworks: Adherence to GCC standardization, energy efficiency labeling, and import regulations.

- Competitive Product Substitutes: High substitutability between brands offering similar functionalities, driving competitive pricing and feature differentiation.

- End-User Demographics: Increasing disposable income, a younger population, and a growing expatriate community drive demand for diverse appliance types.

- M&A Trends: Strategic acquisitions aimed at expanding distribution networks and product offerings in key appliance categories.

Oman Household Appliance Industry Growth Trends & Insights

The Oman household appliance industry is poised for robust growth, driven by increasing disposable incomes, a burgeoning population, and a heightened awareness of modern living standards. The market size evolution indicates a steady upward trajectory, with adoption rates for both major and small appliances showing significant increases year-on-year. Technological disruptions, such as the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in home appliances, are fundamentally reshaping consumer behavior. Consumers are increasingly prioritizing convenience, energy efficiency, and smart functionalities, leading to a higher demand for advanced appliances. The shift towards online purchasing channels is also a prominent trend, complementing traditional retail. We project a Compound Annual Growth Rate (CAGR) of XX% for the overall market during the forecast period. Market penetration for key appliance categories like air conditioners and refrigerators is expected to reach XX% by 2033. Consumer behavior shifts are evident in the preference for durable, aesthetically pleasing, and feature-rich products that enhance lifestyle and reduce household chores.

- Market Size Evolution: Consistent growth driven by economic development and population expansion.

- Adoption Rates: Increasing uptake of both essential and discretionary household appliances.

- Technological Disruptions: Integration of smart technologies, AI, and energy-saving features becoming standard.

- Consumer Behavior Shifts: Growing demand for premiumization, sustainability, and connected home ecosystems.

- Market Penetration: High penetration for essential appliances, with significant room for growth in specialized and smart categories.

- CAGR: Anticipated XX% growth in market value between 2025 and 2033.

Dominant Regions, Countries, or Segments in Oman Household Appliance Industry

Within the Oman household appliance industry, Major Appliances represent the dominant segment, consistently driving market growth. This dominance stems from their essential nature in modern households and the continuous demand for upgrades and replacements. Within Major Appliances, Air Conditioners command a significant share due to Oman's hot climate, followed closely by Refrigerators and Washing Machines. The Distribution Channel of Multi Branded Stores remains the most dominant, offering consumers a wide selection and comparison of products. However, Online Stores are rapidly gaining traction, particularly among younger demographics and for smaller appliance purchases, indicating a significant growth potential. The dominance of these segments is fueled by several key drivers. Economic policies promoting consumer spending and infrastructure development facilitating logistics and retail expansion play a crucial role. Government initiatives aimed at improving living standards and housing development also contribute to the sustained demand for major appliances.

- Product Segment Dominance: Major Appliances, particularly Air Conditioners, Refrigerators, and Washing Machines.

- Distribution Channel Dominance: Multi Branded Stores, with increasing influence from Online Stores.

- Key Drivers for Major Appliances:

- Climate: High demand for energy-efficient air conditioners.

- Population Growth & Urbanization: Increased need for essential kitchen and laundry appliances.

- Disposable Income: Ability to invest in higher-end and more feature-rich major appliances.

- Housing Development: New residential projects spur demand for a full suite of appliances.

- Growth Potential for Online Stores:

- Convenience: Easy browsing, comparison, and home delivery.

- Digital Savvy Population: Growing comfort with e-commerce transactions.

- Promotional Offers: Attractive discounts and bundles often available online.

- Market Share: Major Appliances are estimated to hold approximately XX% of the total market value in 2025.

- Growth Potential: Online distribution channels are projected to grow at a CAGR of XX% during the forecast period.

Oman Household Appliance Industry Product Landscape

The Oman household appliance industry is witnessing a surge in product innovations focused on enhanced functionality, energy efficiency, and smart integration. Major appliances like refrigerators are now equipped with advanced cooling technologies, customizable compartments, and smart connectivity for remote monitoring and control. Washing machines are integrating AI for optimal fabric care and reduced water consumption. Small appliances are seeing advancements in convenience and multi-functionality, with coffee makers offering personalized brewing options and food processors boasting powerful yet compact designs. The unique selling propositions revolve around user convenience, sustainability, and aesthetic appeal, catering to the modern Omani household. Technological advancements are enabling appliances to become more intuitive, with voice control and app-based management becoming increasingly common.

Key Drivers, Barriers & Challenges in Oman Household Appliance Industry

Key Drivers: The Oman household appliance industry is propelled by a growing population, rising disposable incomes, and increasing urbanization, all contributing to a higher demand for modern amenities. Government initiatives promoting economic diversification and foreign investment also foster market expansion. Technological advancements, particularly in energy efficiency and smart home integration, are key drivers, aligning with consumer preferences for convenience and sustainability.

Barriers & Challenges: Significant barriers include intense competition from international brands, which can lead to price wars and squeezed profit margins. Fluctuations in currency exchange rates and the cost of imported components pose challenges for local assembly and manufacturing. Supply chain disruptions and logistical complexities in a geographically dispersed market can also impact availability and costs. Regulatory hurdles and the need for continuous adaptation to evolving consumer demands further test the resilience of industry players.

Emerging Opportunities in Oman Household Appliance Industry

Emerging opportunities lie in the growing demand for smart home appliances that offer enhanced connectivity and automation, catering to the tech-savvy Omani consumer. The increasing focus on sustainability presents a significant opportunity for energy-efficient and eco-friendly appliances, aligning with global trends and local environmental consciousness. Untapped markets within specific regions of Oman, as well as niche product categories like health and wellness appliances, offer further potential for growth. Evolving consumer preferences for premium and aesthetically pleasing designs also create avenues for brands that can deliver on both form and function.

Growth Accelerators in the Oman Household Appliance Industry Industry

Several catalysts are accelerating the long-term growth of the Oman household appliance industry. Technological breakthroughs in areas like advanced AI for appliance management and innovative materials for energy conservation will drive product development. Strategic partnerships between manufacturers, distributors, and technology providers are crucial for expanding market reach and enhancing product offerings. Market expansion strategies, including entering new geographical areas within Oman and targeting specific consumer segments with tailored products, will be key. The increasing adoption of e-commerce platforms and the development of robust after-sales service networks will further solidify market growth.

Key Players Shaping the Oman Household Appliance Industry Market

- Samsung Electronics

- Philips

- Sony

- Electrolux

- Whirlpool Corporation

- Haier

- Bosch

- Midea

- LG Electronics

- Panasonic Corporation

- Hitachi

Notable Milestones in Oman Household Appliance Industry Sector

- January 2023: The first exclusive brand store dedicated to Bosch home appliances was inaugurated at Oman Avenues Mall in Muscat, showcasing the brand's commitment to quality and innovation.

- May 2022: LG Electronics introduced its Smart Home Appliances portfolio, featuring products like InstaView Door-in-Door™ Refrigerators, AI Direct Drive Washing Machines, Puricare™ Wearable Air Purifier, VIRAAT Air Conditioners, UV+UF Water Purifiers, and charcoal microwaves, emphasizing refined designs and premium lifestyle integration.

In-Depth Oman Household Appliance Industry Market Outlook

The Oman household appliance industry presents a promising outlook characterized by sustained growth and evolving consumer demands. The market's trajectory will be significantly shaped by the continued integration of smart technologies, a stronger emphasis on energy efficiency, and the increasing preference for products that enhance convenience and well-being. Strategic initiatives by key players, focusing on innovation, expanding distribution networks, and building strong brand presence, will be crucial for capturing market share. The growing digital penetration will further propel online sales channels, while traditional retail will continue to play a vital role. Emerging opportunities in sustainability-focused appliances and niche product categories offer avenues for diversification and long-term profitability. The industry is well-positioned for continued expansion, driven by a dynamic consumer base and a supportive economic environment.

Oman Household Appliance Industry Segmentation

-

1. Product

-

1.1. Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Ovens

- 1.1.6. Air Conditioners

- 1.1.7. Other Major Appliances

-

1.2. Small Appliances

- 1.2.1. Coffee Makers

- 1.2.2. Food Processors

- 1.2.3. Grills and Roasters

- 1.2.4. Vacuum Cleaners

- 1.2.5. Other Small Appliances

-

1.1. Major Appliances

-

2. Distribution Channel

- 2.1. Multi Branded Stores

- 2.2. Specialty Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channel

Oman Household Appliance Industry Segmentation By Geography

- 1. Oman

Oman Household Appliance Industry Regional Market Share

Geographic Coverage of Oman Household Appliance Industry

Oman Household Appliance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Penetration of smart technology in Home Appliances; Increase in demand for Air Conditioner and Refrigerator

- 3.3. Market Restrains

- 3.3.1. Rise in Price level of Home Appliance; Fluctuation in consumer spending with rising Inflation

- 3.4. Market Trends

- 3.4.1. Digital sales trending for major appliances in Oman

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Household Appliance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Ovens

- 5.1.1.6. Air Conditioners

- 5.1.1.7. Other Major Appliances

- 5.1.2. Small Appliances

- 5.1.2.1. Coffee Makers

- 5.1.2.2. Food Processors

- 5.1.2.3. Grills and Roasters

- 5.1.2.4. Vacuum Cleaners

- 5.1.2.5. Other Small Appliances

- 5.1.1. Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi Branded Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsung Electronics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Philips**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sony

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Whirpool Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Midea

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LG Electronics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hitachi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Samsung Electronics

List of Figures

- Figure 1: Oman Household Appliance Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Oman Household Appliance Industry Share (%) by Company 2025

List of Tables

- Table 1: Oman Household Appliance Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Oman Household Appliance Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Oman Household Appliance Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Oman Household Appliance Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Oman Household Appliance Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Oman Household Appliance Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Household Appliance Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Oman Household Appliance Industry?

Key companies in the market include Samsung Electronics, Philips**List Not Exhaustive, Sony, Electrolux, Whirpool Corporation, Haier, Bosch, Midea, LG Electronics, Panasonic Corporation, Hitachi.

3. What are the main segments of the Oman Household Appliance Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Penetration of smart technology in Home Appliances; Increase in demand for Air Conditioner and Refrigerator.

6. What are the notable trends driving market growth?

Digital sales trending for major appliances in Oman.

7. Are there any restraints impacting market growth?

Rise in Price level of Home Appliance; Fluctuation in consumer spending with rising Inflation.

8. Can you provide examples of recent developments in the market?

On Janruary 2023, The first exclusive brand store dedicated to Bosch home appliances was inaugurated at Oman Avenues Mall in Muscat , showcasing an iconic German brand synonymous with quality, durability and inventive ingenuity. The store aims to kindle in customers an enthusiasm for Bosch products, for the unmatched quality bosch represent.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Household Appliance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Household Appliance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Household Appliance Industry?

To stay informed about further developments, trends, and reports in the Oman Household Appliance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence