Key Insights

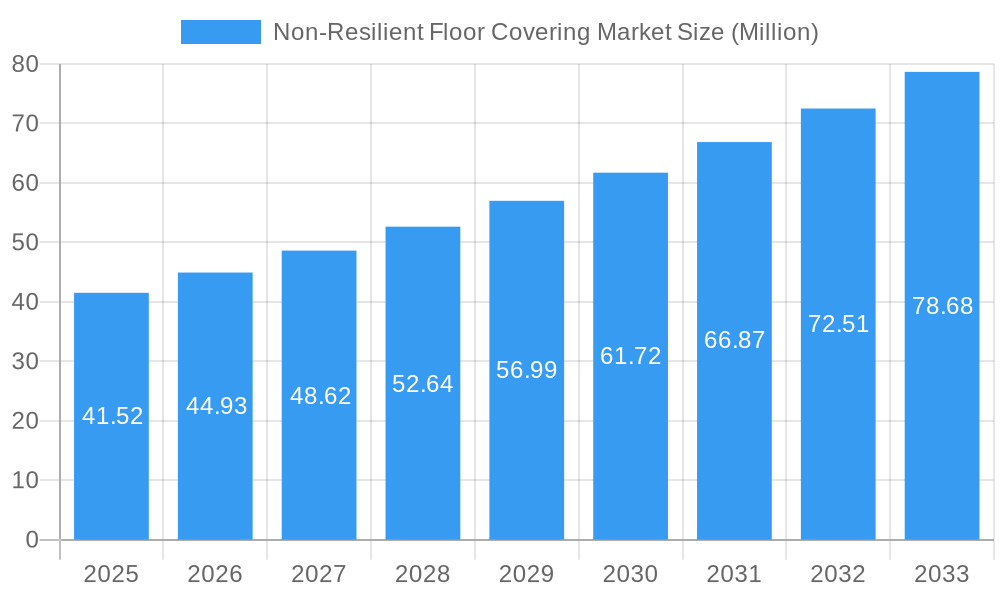

The global Non-Resilient Floor Covering Market is poised for robust expansion, with a projected market size of USD 41.52 Million in 2025, driven by an impressive CAGR of 8.17% throughout the forecast period of 2025-2033. This growth is primarily fueled by increasing urbanization, rising disposable incomes, and a growing demand for durable, aesthetically pleasing, and low-maintenance flooring solutions across both residential and commercial sectors. The "XXX" drivers, likely encompassing factors such as technological advancements in material science, innovative design patterns, and a heightened focus on sustainable and eco-friendly building materials, are expected to significantly propel market growth. Furthermore, evolving consumer preferences towards premium and sophisticated interior designs are encouraging the adoption of high-quality non-resilient flooring options.

Non-Resilient Floor Covering Market Market Size (In Million)

The market is segmented across various product types, with Ceramic Tiles Flooring and Stone Tiles Flooring likely dominating due to their inherent durability, aesthetic versatility, and widespread appeal in both modern and traditional settings. Laminate and Wood Tiles Flooring also represent significant segments, catering to specific design needs and budget considerations. Distribution channels are diverse, with Contract and Specialty Stores playing a crucial role in reaching commercial and discerning residential customers, while Home Centers serve a broader consumer base. The Residential sector is anticipated to be the largest end-user segment, followed closely by the Commercial sector, which includes hospitality, retail, and office spaces. Emerging economies in the Asia Pacific and Middle East & Africa regions are expected to witness substantial growth due to rapid infrastructure development and increasing construction activities.

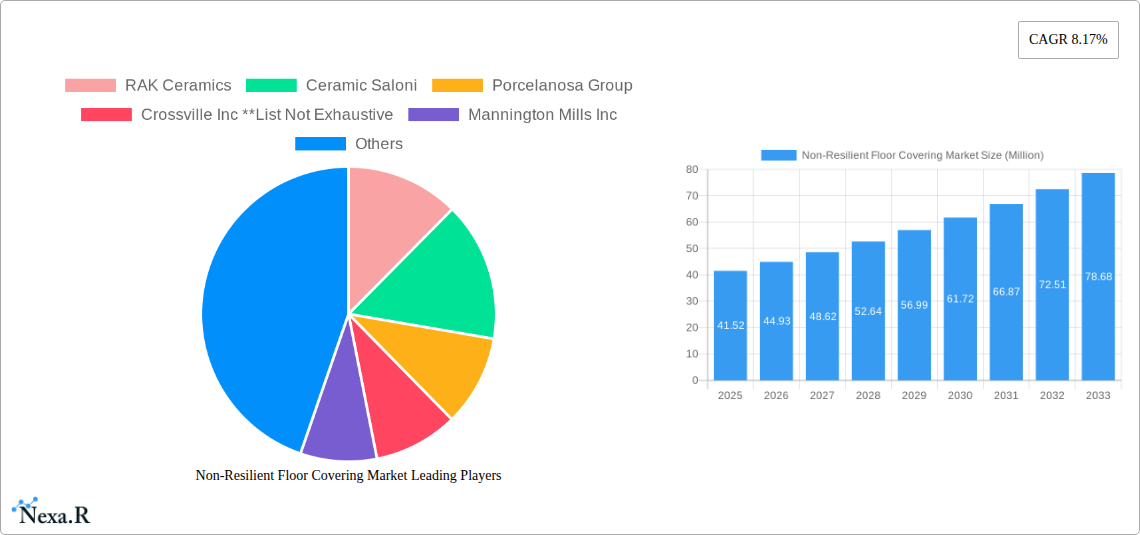

Non-Resilient Floor Covering Market Company Market Share

Non-Resilient Floor Covering Market Report: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global Non-Resilient Floor Covering Market, meticulously examining its dynamics, growth trends, and future potential. Spanning the historical period of 2019–2024, with a base and estimated year of 2025, and a comprehensive forecast period extending to 2033, this research offers unparalleled insights for stakeholders. We deliver precise market valuations in Million units to facilitate strategic decision-making.

Non-Resilient Floor Covering Market Market Dynamics & Structure

The Non-Resilient Floor Covering Market exhibits a moderately concentrated structure, characterized by a blend of large multinational corporations and specialized regional players. Technological innovation remains a pivotal driver, particularly in developing more durable, aesthetically pleasing, and environmentally sustainable ceramic tiles flooring, stone tiles flooring, and laminate tiles flooring options. Regulatory frameworks, focusing on building codes, material safety, and environmental impact, significantly influence product development and market entry strategies. Competitive product substitutes, while present, often fall short in offering the specific advantages of non-resilient floor coverings like enhanced water resistance and longevity, particularly for commercial and industry end-users. End-user demographics are shifting, with a growing demand for visually appealing and low-maintenance solutions in both residential and commercial sectors. Mergers and acquisitions (M&A) trends are moderately active, as key players seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the collaboration between Encina and Shaw Industries in March 2023, involving the recycling of over 2 million pounds of carpet waste annually, signifies a growing trend towards circular economy principles within the industry.

- Market Concentration: Moderately consolidated with a few key global players dominating market share.

- Technological Innovation: Driven by advancements in material science for enhanced durability, aesthetics, and sustainability.

- Regulatory Frameworks: Stringent building codes and environmental standards impact product certifications and material sourcing.

- Competitive Substitutes: Limited in matching the specific performance attributes of non-resilient options.

- End-User Demographics: Increasing demand for aesthetic and low-maintenance flooring solutions across sectors.

- M&A Trends: Strategic acquisitions and partnerships aimed at portfolio expansion and market penetration.

Non-Resilient Floor Covering Market Growth Trends & Insights

The Non-Resilient Floor Covering Market is poised for robust growth, driven by a confluence of economic recovery, urbanization, and evolving consumer preferences. Market size is projected to expand significantly as construction activities in both residential and commercial sectors gain momentum globally. Adoption rates for advanced ceramic tiles flooring and stone tiles flooring are escalating, fueled by their superior durability, water resistance, and diverse design possibilities, making them ideal for high-traffic areas and moisture-prone environments. Technological disruptions, such as advancements in digital printing for realistic wood and stone aesthetics on laminate and ceramic tiles, are revolutionizing product offerings. Consumer behavior shifts are also playing a crucial role, with a growing emphasis on hygiene, ease of cleaning, and long-term value. The Industry segment, particularly in sectors like healthcare and hospitality, is witnessing increased adoption due to the inherent hygienic properties and longevity of non-resilient options. The Contract distribution channel is anticipated to witness substantial growth, driven by large-scale construction projects and renovation initiatives. The overall market penetration of non-resilient floor coverings is expected to deepen as manufacturers continue to innovate and cater to niche demands. The market is estimated to reach XX Million units by 2025, with a projected Compound Annual Growth Rate (CAGR) of X.XX% from 2025 to 2033.

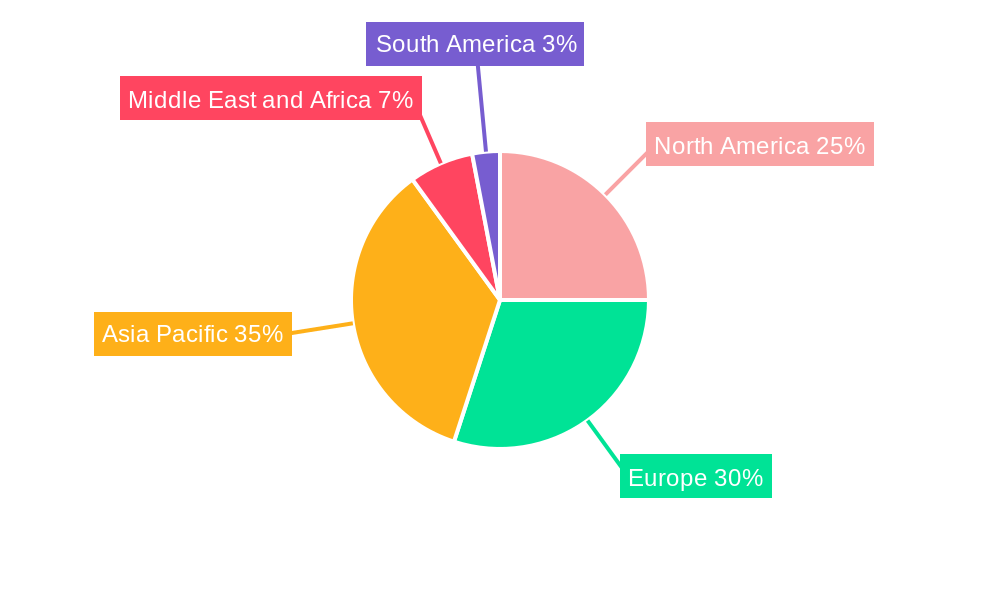

Dominant Regions, Countries, or Segments in Non-Resilient Floor Covering Market

The Asia Pacific region is emerging as a dominant force in the Non-Resilient Floor Covering Market, propelled by rapid urbanization, burgeoning construction industries, and a growing middle class with increasing disposable incomes. Within this region, China stands out as a leading country, driven by its massive manufacturing capabilities in ceramic tiles flooring and significant domestic demand across residential and commercial applications. The Ceramic Tiles Flooring segment, in particular, is a primary growth driver, accounting for a substantial market share due to its affordability, versatility, and aesthetic appeal. Key drivers supporting this dominance include supportive government policies promoting infrastructure development, significant investments in housing and commercial spaces, and a readily available skilled labor force. The Commercial end-user segment within Asia Pacific is experiencing robust expansion, fueled by the construction of shopping malls, office buildings, hotels, and healthcare facilities. The Contract distribution channel is also a major contributor, as large-scale projects increasingly rely on direct sourcing and installation services. Furthermore, the growing adoption of advanced manufacturing techniques and design innovations in stone tiles flooring and laminate tiles flooring is further solidifying the region's leading position.

- Dominant Region: Asia Pacific

- Leading Country: China

- Dominant Product Segment: Ceramic Tiles Flooring

- Key End-User Segment: Commercial

- Key Distribution Channel: Contract

- Key Drivers: Urbanization, infrastructure development, government support, manufacturing prowess, growing disposable income.

Non-Resilient Floor Covering Market Product Landscape

The product landscape of the Non-Resilient Floor Covering Market is dynamic and innovation-driven. Ceramic Tiles Flooring continues to dominate, with advancements in digital glazing techniques offering ultra-realistic wood, stone, and abstract patterns. Stone Tiles Flooring, including porcelain and natural stone variations, offers unparalleled durability and luxury, finding increased application in high-end commercial and residential projects. Laminate Tiles Flooring is evolving with enhanced water-resistant core technologies and embossed surface textures that mimic natural materials with remarkable fidelity. The "Others" category encompasses specialized products like PVC and luxury vinyl tiles (LVT), which are gaining traction due to their excellent performance characteristics in specific applications. Innovations focus on improved scratch resistance, stain repellency, and enhanced UV stability, ensuring longevity and aesthetic retention across diverse environments.

Key Drivers, Barriers & Challenges in Non-Resilient Floor Covering Market

Key Drivers:

- Growing Construction Sector: Robust expansion in residential and commercial building projects globally, particularly in emerging economies.

- Aesthetic Versatility & Durability: Increasing consumer and designer preference for visually appealing, long-lasting, and low-maintenance flooring solutions.

- Technological Advancements: Innovations in digital printing, material composition, and manufacturing processes leading to diverse designs and improved performance.

- Hygiene & Maintenance Benefits: Growing demand for easy-to-clean and antimicrobial surfaces in healthcare, hospitality, and educational institutions.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the cost of raw materials like clay, quartz, and resins can impact manufacturing costs and product pricing.

- Installation Complexity & Cost: Certain non-resilient floorings, especially large format tiles, can have higher installation costs and require specialized expertise.

- Environmental Concerns: Growing scrutiny over the environmental impact of manufacturing processes and end-of-life disposal of certain non-resilient materials.

- Intense Competition: A highly competitive market with numerous players, leading to price pressures and the need for continuous product differentiation.

- Supply Chain Disruptions: Global supply chain volatilities can affect the availability and cost of raw materials and finished goods.

Emerging Opportunities in Non-Resilient Floor Covering Market

Emerging opportunities lie in the development of sustainable and eco-friendly non-resilient floor coverings, utilizing recycled content and reducing manufacturing footprints. The expansion into developing markets with a growing middle class and increasing urbanization presents significant untapped potential. Innovative applications in niche sectors, such as high-performance flooring for industrial environments requiring chemical resistance or specialized acoustic properties, offer new avenues for growth. Evolving consumer preferences for personalized design solutions and smart flooring technologies (e.g., integrated heating or lighting) also present exciting prospects for product development.

Growth Accelerators in the Non-Resilient Floor Covering Market Industry

Long-term growth in the Non-Resilient Floor Covering Market will be significantly accelerated by continued investment in research and development for advanced material science, leading to more sustainable, durable, and aesthetically superior products. Strategic partnerships and collaborations between manufacturers, designers, and technology providers will foster innovation and unlock new market segments. Market expansion strategies targeting untapped geographical regions and specific end-user industries will be crucial. The increasing adoption of digitalization in manufacturing and sales, coupled with a focus on circular economy principles and product lifecycle management, will further bolster growth trajectories.

Key Players Shaping the Non-Resilient Floor Covering Market Market

- RAK Ceramics

- Ceramic Saloni

- Porcelanosa Group

- Crossville Inc

- Mannington Mills Inc

- Shaw Industries Inc

- Mohawk Industries Inc

- Dal Tiles

- China Ceramics

- Kajaria Ceramics

Notable Milestones in Non-Resilient Floor Covering Market Sector

- March 2023: Encina and Shaw Industries partnered with Carpet Waste Recycling. Under the agreement, Shaw will annually provide Encina with more than 2 million pounds of waste materials from its carpet manufacturing processes.

- February 2023: Daltile Announced new tile collections for spring 2023. These new Daltile assortments offer various fashionable products with exceptional performance features.

In-Depth Non-Resilient Floor Covering Market Market Outlook

The future outlook for the Non-Resilient Floor Covering Market is exceptionally positive, driven by sustained demand from the global construction industry and an escalating consumer preference for high-performance, aesthetically pleasing flooring. Continued innovation in material science, particularly in sustainability and digital printing technologies, will unlock new market segments and strengthen existing ones. Strategic collaborations and market expansion initiatives will be pivotal in capturing growth opportunities in both developed and emerging economies. The industry's commitment to environmental responsibility and the development of circular economy solutions will further enhance its long-term viability and market appeal, ensuring continued robust growth and profitability.

Non-Resilient Floor Covering Market Segmentation

-

1. Product

- 1.1. Ceramic Tiles Flooring

- 1.2. Stone Tiles Flooring

- 1.3. Laminate Tiles Flooring

- 1.4. Wood Tiles Flooring

- 1.5. Others

-

2. Distribution Channel

- 2.1. Contract

- 2.2. Specialty Stores

- 2.3. Home Centers

- 2.4. Others

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

Non-Resilient Floor Covering Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Italy

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Egypt

- 4.3. UAE

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Argentina

- 5.2. Colombia

- 5.3. Rest of South America

Non-Resilient Floor Covering Market Regional Market Share

Geographic Coverage of Non-Resilient Floor Covering Market

Non-Resilient Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Price Volatility of Raw Manufacturers; Economic Fluctuations and Consumer Purchasing Power

- 3.4. Market Trends

- 3.4.1. Ceramic Tile Segment Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Ceramic Tiles Flooring

- 5.1.2. Stone Tiles Flooring

- 5.1.3. Laminate Tiles Flooring

- 5.1.4. Wood Tiles Flooring

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Contract

- 5.2.2. Specialty Stores

- 5.2.3. Home Centers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Ceramic Tiles Flooring

- 6.1.2. Stone Tiles Flooring

- 6.1.3. Laminate Tiles Flooring

- 6.1.4. Wood Tiles Flooring

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Contract

- 6.2.2. Specialty Stores

- 6.2.3. Home Centers

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Ceramic Tiles Flooring

- 7.1.2. Stone Tiles Flooring

- 7.1.3. Laminate Tiles Flooring

- 7.1.4. Wood Tiles Flooring

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Contract

- 7.2.2. Specialty Stores

- 7.2.3. Home Centers

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Ceramic Tiles Flooring

- 8.1.2. Stone Tiles Flooring

- 8.1.3. Laminate Tiles Flooring

- 8.1.4. Wood Tiles Flooring

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Contract

- 8.2.2. Specialty Stores

- 8.2.3. Home Centers

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Ceramic Tiles Flooring

- 9.1.2. Stone Tiles Flooring

- 9.1.3. Laminate Tiles Flooring

- 9.1.4. Wood Tiles Flooring

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Contract

- 9.2.2. Specialty Stores

- 9.2.3. Home Centers

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Ceramic Tiles Flooring

- 10.1.2. Stone Tiles Flooring

- 10.1.3. Laminate Tiles Flooring

- 10.1.4. Wood Tiles Flooring

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Contract

- 10.2.2. Specialty Stores

- 10.2.3. Home Centers

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 RAK Ceramics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ceramic Saloni

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Porcelanosa Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Crossville Inc **List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mannington Mills Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shaw Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mohawk Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dal Tiles

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China Ceramics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kajaria Ceramics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 RAK Ceramics

List of Figures

- Figure 1: Global Non-Resilient Floor Covering Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Non-Resilient Floor Covering Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Non-Resilient Floor Covering Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Non-Resilient Floor Covering Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Non-Resilient Floor Covering Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Non-Resilient Floor Covering Market Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Non-Resilient Floor Covering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Non-Resilient Floor Covering Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Non-Resilient Floor Covering Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Non-Resilient Floor Covering Market Revenue (Million), by Product 2025 & 2033

- Figure 11: Europe Non-Resilient Floor Covering Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Non-Resilient Floor Covering Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 13: Europe Non-Resilient Floor Covering Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Europe Non-Resilient Floor Covering Market Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Non-Resilient Floor Covering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Non-Resilient Floor Covering Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Non-Resilient Floor Covering Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Non-Resilient Floor Covering Market Revenue (Million), by Product 2025 & 2033

- Figure 19: Asia Pacific Non-Resilient Floor Covering Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Non-Resilient Floor Covering Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 21: Asia Pacific Non-Resilient Floor Covering Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Asia Pacific Non-Resilient Floor Covering Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Non-Resilient Floor Covering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Non-Resilient Floor Covering Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Non-Resilient Floor Covering Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Non-Resilient Floor Covering Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Non-Resilient Floor Covering Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Non-Resilient Floor Covering Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Non-Resilient Floor Covering Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Non-Resilient Floor Covering Market Revenue (Million), by End-User 2025 & 2033

- Figure 31: Middle East and Africa Non-Resilient Floor Covering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East and Africa Non-Resilient Floor Covering Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Non-Resilient Floor Covering Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Non-Resilient Floor Covering Market Revenue (Million), by Product 2025 & 2033

- Figure 35: South America Non-Resilient Floor Covering Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Non-Resilient Floor Covering Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 37: South America Non-Resilient Floor Covering Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: South America Non-Resilient Floor Covering Market Revenue (Million), by End-User 2025 & 2033

- Figure 39: South America Non-Resilient Floor Covering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: South America Non-Resilient Floor Covering Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Non-Resilient Floor Covering Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: USA Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Product 2020 & 2033

- Table 22: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 24: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Product 2020 & 2033

- Table 32: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 33: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 34: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Egypt Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: UAE Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 42: Global Non-Resilient Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Argentina Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Colombia Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Non-Resilient Floor Covering Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-Resilient Floor Covering Market?

The projected CAGR is approximately 8.17%.

2. Which companies are prominent players in the Non-Resilient Floor Covering Market?

Key companies in the market include RAK Ceramics, Ceramic Saloni, Porcelanosa Group, Crossville Inc **List Not Exhaustive, Mannington Mills Inc, Shaw Industries Inc, Mohawk Industries Inc, Dal Tiles, China Ceramics, Kajaria Ceramics.

3. What are the main segments of the Non-Resilient Floor Covering Market?

The market segments include Product, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Ceramic Tile Segment Drives the Market.

7. Are there any restraints impacting market growth?

Price Volatility of Raw Manufacturers; Economic Fluctuations and Consumer Purchasing Power.

8. Can you provide examples of recent developments in the market?

March 2023: Encina and Shaw Industries partnered with Carpet Waste Recycling. Under the agreement, Shaw will annually provide Encina with more than 2 million pounds of waste materials from its carpet manufacturing processes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-Resilient Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-Resilient Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-Resilient Floor Covering Market?

To stay informed about further developments, trends, and reports in the Non-Resilient Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence