Key Insights

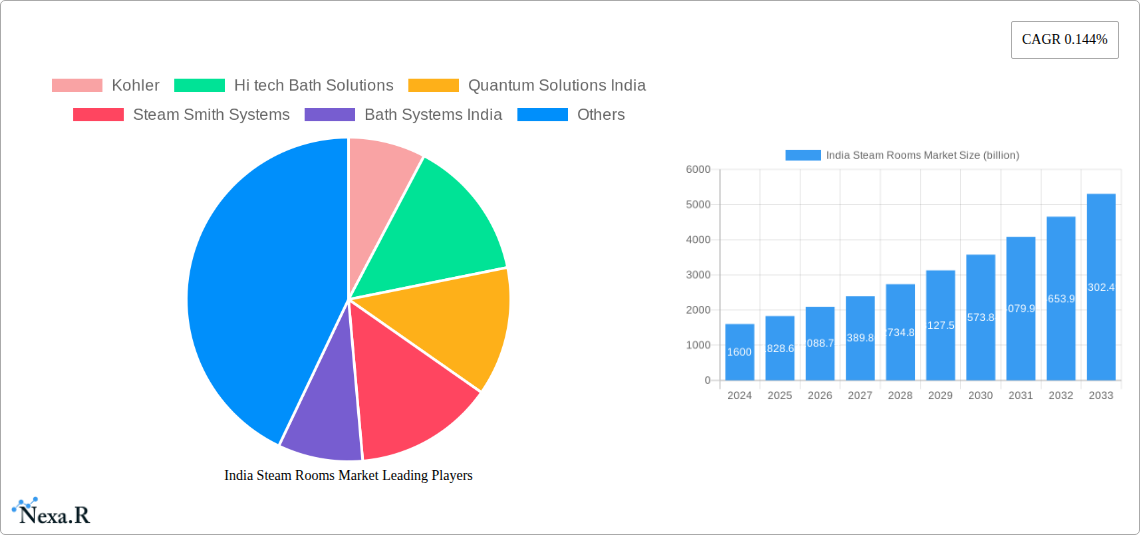

The Indian steam rooms market is poised for steady, albeit moderate, growth, driven by an increasing awareness of health and wellness benefits, a rising disposable income among the urban population, and a growing trend towards luxurious home spa experiences. With a current market size of an estimated USD 1.6 billion in 2024, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 14.4% during the forecast period of 2025-2033. This growth is underpinned by the increasing adoption of steam rooms in residential complexes, high-end hotels, and wellness centers across major metropolitan areas. The convenience and therapeutic advantages offered by steam rooms, such as stress relief, detoxification, and improved skin health, are becoming increasingly appealing to health-conscious consumers. Furthermore, technological advancements leading to more energy-efficient and feature-rich steam room solutions are also contributing to market expansion.

India Steam Rooms Market Market Size (In Billion)

The market's trajectory will be significantly shaped by evolving consumer preferences for personalized wellness solutions and the continued development of compact and aesthetically pleasing steam room designs suitable for modern living spaces. While the market is experiencing a healthy expansion, potential challenges may arise from the initial installation costs and the need for regular maintenance, which could temper demand among a broader consumer base. However, the sustained interest in self-care and the aspirational appeal of spa-like environments are expected to outweigh these restraints, ensuring a positive outlook for the Indian steam rooms market. Key players are focusing on innovation, offering smart features, and expanding their distribution networks to cater to the growing demand across various market segments.

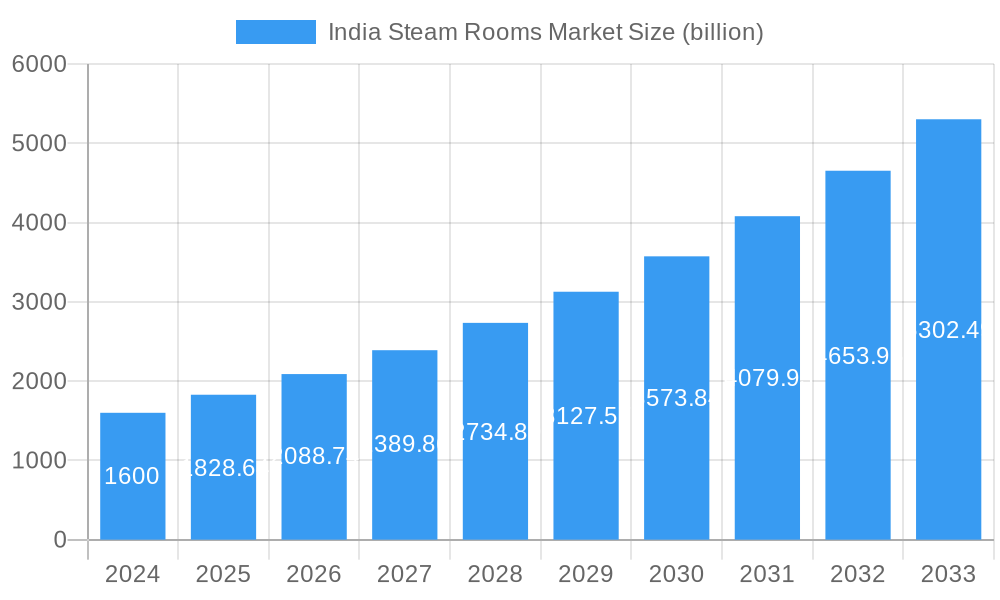

India Steam Rooms Market Company Market Share

Here is a compelling, SEO-optimized report description for the India Steam Rooms Market:

Gain unparalleled insights into the burgeoning India steam rooms market with our comprehensive market research report. This in-depth analysis covers the period from 2019 to 2033, with a dedicated base year of 2025 and a robust forecast period from 2025 to 2033. We delve into the intricate dynamics of the Indian spa and wellness market, exploring both the parent and child market segments to provide a holistic view. Discover market size, key growth drivers, emerging opportunities, and the competitive landscape shaped by industry leaders such as Kohler, Hi-tech Bath Solutions, Quantum Solutions India, Steam Smith Systems, Bath Systems India, Orion Bathing Concepts, Potent Water Care, Steamers India, Omega Bath Solutions, and Woven Gold India. This report is your essential guide to navigating the residential steam rooms, commercial steam rooms, and luxury spa solutions within India.

India Steam Rooms Market Market Dynamics & Structure

The India steam rooms market exhibits a dynamic and evolving structure characterized by increasing market concentration in select niches while fostering innovation across the board. Technological innovation is a primary driver, with manufacturers continuously introducing advanced features like smart controls, customizable programs, and energy-efficient designs to cater to a discerning clientele. Regulatory frameworks, though still developing, are beginning to influence product safety and installation standards, pushing for higher quality and reliability. Competitive product substitutes, ranging from traditional saunas to infrared cabins, present a challenge, but the unique health and wellness benefits of steam rooms continue to carve out a distinct market share. End-user demographics are shifting towards a younger, health-conscious population seeking premium home wellness solutions and enhanced spa experiences. Mergers and acquisitions (M&A) trends are nascent but expected to accelerate as larger players seek to consolidate their market position and expand their product portfolios.

- Market Concentration: Moderate to high concentration in premium and commercial segments, with fragmented presence in the residential space.

- Technological Innovation: Focus on smart controls, energy efficiency, and user customization.

- Regulatory Frameworks: Growing emphasis on safety and installation standards, influencing product development.

- Competitive Substitutes: Traditional saunas, infrared cabins, and basic bathing solutions.

- End-User Demographics: Growing demand from urban, affluent households and wellness-focused individuals.

- M&A Trends: Limited but growing interest from established players to acquire innovative smaller companies.

India Steam Rooms Market Growth Trends & Insights

The India steam rooms market is poised for significant expansion, driven by a confluence of evolving consumer preferences and a growing emphasis on health and wellness. Market size is projected to witness a healthy CAGR over the forecast period, fueled by increasing disposable incomes and a heightened awareness of the therapeutic benefits of steam therapy, including stress reduction, detoxification, and improved circulation. Adoption rates, particularly in urban and semi-urban areas, are steadily rising as steam rooms transition from a luxury amenity to a sought-after component of modern homes and commercial establishments. Technological disruptions are playing a crucial role, with manufacturers integrating smart technologies for seamless operation and personalized user experiences. Consumer behavior shifts towards prioritizing self-care and home-based wellness solutions are directly translating into increased demand for residential steam rooms. The penetration of steam rooms in hotels, resorts, and high-end gyms is also a major growth catalyst. Our analysis leverages extensive market data to provide precise figures on market evolution, adoption rates, and projected growth trajectories, offering valuable insights into the burgeoning home spa market and commercial spa solutions in India.

Dominant Regions, Countries, or Segments in India Steam Rooms Market

Within the India steam rooms market, North India is emerging as a dominant region driven by a confluence of economic prosperity, a growing health-conscious population, and a strong inclination towards luxury and wellness. This region exhibits robust growth across all analyzed segments: Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis.

- Production Analysis: Northern states, particularly those with established manufacturing hubs, are witnessing increased production activities, catering to both domestic and international demand. Economic policies encouraging local manufacturing and skilled labor availability contribute to this dominance.

- Consumption Analysis: A high concentration of affluent households, a growing middle class with rising disposable incomes, and a pronounced trend towards adopting healthy lifestyles make North India the largest consumer of steam rooms. The demand for residential steam rooms and luxury spa solutions is particularly strong.

- Import Market Analysis (Value & Volume): The import market in North India is substantial, driven by demand for specialized, high-end steam room components and finished products that may not be readily available or technologically advanced in the domestic market. Strong import volumes reflect the region's purchasing power.

- Export Market Analysis (Value & Volume): While still developing, North India is increasingly becoming a base for exporting steam rooms and related components, capitalizing on its production capabilities and competitive pricing for certain product categories.

- Price Trend Analysis: The price trends in North India are influenced by premium product offerings, brand positioning, and the overall demand for luxury wellness solutions. While premium segments command higher prices, there's a growing market for mid-range and affordable options as well, reflecting diverse consumer segments.

Key drivers for North India's dominance include favorable economic policies, significant investments in real estate and hospitality sectors, a well-developed retail infrastructure, and a cultural appreciation for wellness and rejuvenation. The region's market share is substantial, and its growth potential remains exceptionally high, setting the pace for the entire Indian steam rooms market.

India Steam Rooms Market Product Landscape

The product landscape of the India steam rooms market is characterized by continuous innovation and a focus on enhancing user experience. Manufacturers are differentiating their offerings through advanced features, materials, and designs. Key innovations include the integration of smart control panels allowing for personalized temperature, duration, and even aromatherapy settings. High-quality materials such as tempered glass, durable acrylics, and premium wood finishes are used to ensure longevity and aesthetic appeal. Performance metrics are driven by efficient steam generation, rapid heating times, and effective steam distribution for an immersive experience. Applications span across residential bathrooms, dedicated home spa rooms, and commercial settings like hotels, gyms, and wellness centers. The unique selling proposition of modern steam rooms lies in their therapeutic benefits, luxurious ambiance, and the ability to transform ordinary spaces into personal sanctuaries for relaxation and well-being.

Key Drivers, Barriers & Challenges in India Steam Rooms Market

Key Drivers:

- Rising Health and Wellness Consciousness: Increasing awareness of the health benefits of steam therapy, including stress relief, detoxification, and improved skin health, is a significant growth driver.

- Growing Disposable Income: A burgeoning middle class with higher disposable incomes is increasingly investing in luxury home amenities and wellness solutions.

- Urbanization and Lifestyle Changes: The fast-paced urban lifestyle fuels a demand for relaxation and rejuvenation, making steam rooms an attractive addition to homes and commercial spaces.

- Technological Advancements: Innovations in smart controls, energy efficiency, and customizable features are enhancing product appeal and functionality.

Barriers & Challenges:

- High Initial Cost: The upfront investment for steam room installation and maintenance can be a deterrent for a significant portion of the population.

- Limited Awareness of Benefits: Despite growing awareness, a segment of the population remains unaware of the specific advantages and functionalities of steam rooms compared to traditional bathing.

- Installation Complexity and Space Constraints: Installation often requires specialized plumbing and electrical work, and space availability in many Indian homes can be a constraint.

- Competition from Traditional and Alternative Wellness Solutions: The market faces competition from existing bathing solutions, traditional saunas, and other wellness trends.

- Supply Chain Disruptions: Global and domestic supply chain issues can impact the availability of components and the overall production timeline, leading to potential price fluctuations.

Emerging Opportunities in India Steam Rooms Market

Emerging opportunities in the India steam rooms market lie in the untapped potential of tier 2 and tier 3 cities, where the demand for wellness solutions is steadily growing. The development of more compact and affordable steam room models tailored for smaller living spaces presents a significant opportunity to broaden the consumer base. Furthermore, integrating steam rooms with smart home ecosystems and offering subscription-based maintenance and wellness programs can unlock new revenue streams. The increasing focus on holistic wellness by hotels and resorts also creates opportunities for customized commercial steam room solutions.

Growth Accelerators in the India Steam Rooms Market Industry

Growth accelerators for the India steam rooms market include significant technological breakthroughs in energy-efficient steam generation and smart control systems, making products more appealing and cost-effective. Strategic partnerships between steam room manufacturers and interior designers, architects, and real estate developers are crucial for integrating steam rooms into new constructions and renovations. Market expansion strategies targeting the growing hospitality sector, including boutique hotels and wellness retreats, will further fuel demand. Government initiatives promoting the wellness and healthcare industry can also indirectly boost the steam rooms market by fostering a culture of health and self-care.

Key Players Shaping the India Steam Rooms Market Market

- Kohler

- Hi-tech Bath Solutions

- Quantum Solutions India

- Steam Smith Systems

- Bath Systems India

- Orion Bathing Concepts

- Potent Water Care

- Steamers India

- Omega Bath Solutions

- Woven Gold India

Notable Milestones in India Steam Rooms Market Sector

- 2021: Hi-tech Bath Solutions launched a new indoor steam room model designed for corner placement, accommodating up to five individuals. This innovative product featured a blend of vertical and horizontal lines and offered pre-assembled panels, backrests, and benches for easy in-home assembly by two individuals.

In-Depth India Steam Rooms Market Market Outlook

The future outlook for the India steam rooms market is exceptionally bright, fueled by sustained growth accelerators such as continuous technological innovation and expanding market reach. The increasing integration of steam rooms into smart home ecosystems and the growing preference for personalized wellness experiences will drive demand for advanced, user-friendly products. Strategic collaborations with the hospitality and real estate sectors are anticipated to further bolster market penetration. As consumer awareness of the therapeutic and lifestyle benefits of steam therapy continues to rise, the market is poised for significant expansion, presenting lucrative opportunities for key players and new entrants alike in this dynamic segment of the Indian wellness industry.

India Steam Rooms Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Steam Rooms Market Segmentation By Geography

- 1. India

India Steam Rooms Market Regional Market Share

Geographic Coverage of India Steam Rooms Market

India Steam Rooms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.144% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Urbanization; Advancements in Kitchen Technology

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Growth in Tourism is Driving the Indian Steam Room Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Steam Rooms Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kohler

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hi tech Bath Solutions

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Quantum Solutions India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Steam Smith Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bath Systems India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Orion Bathing Concepts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Potent Water Care**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Steamers India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Omega Bath Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Woven Gold India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kohler

List of Figures

- Figure 1: India Steam Rooms Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Steam Rooms Market Share (%) by Company 2025

List of Tables

- Table 1: India Steam Rooms Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: India Steam Rooms Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Steam Rooms Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Steam Rooms Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Steam Rooms Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Steam Rooms Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: India Steam Rooms Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: India Steam Rooms Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Steam Rooms Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Steam Rooms Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Steam Rooms Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Steam Rooms Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Steam Rooms Market?

The projected CAGR is approximately 0.144%.

2. Which companies are prominent players in the India Steam Rooms Market?

Key companies in the market include Kohler, Hi tech Bath Solutions, Quantum Solutions India, Steam Smith Systems, Bath Systems India, Orion Bathing Concepts, Potent Water Care**List Not Exhaustive, Steamers India, Omega Bath Solutions, Woven Gold India.

3. What are the main segments of the India Steam Rooms Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Urbanization; Advancements in Kitchen Technology.

6. What are the notable trends driving market growth?

Growth in Tourism is Driving the Indian Steam Room Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In 2021, Hitech bath solutions launched a new steam room. It is an indoor model that seats up to five individuals. The entire sauna showcases a beautiful blending of vertical and horizontal lines and is designed for corner placement. The panels, backrests, and benches come pre-assembled for an easy, seamless in-home assembly by two individuals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Steam Rooms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Steam Rooms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Steam Rooms Market?

To stay informed about further developments, trends, and reports in the India Steam Rooms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence